Beruflich Dokumente

Kultur Dokumente

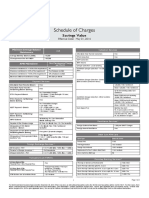

Annex 3 Prime Salary Account

Hochgeladen von

fr123Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Annex 3 Prime Salary Account

Hochgeladen von

fr123Copyright:

Verfügbare Formate

Schedule of Facilities (April 01,2011) ChargesExclusive of Service tax.Service tax of 10.

30% as on Feb 24,2009 is applicable over and above the charges indicated. Prime Salary Account (Incase the acct remains inactive for > 2 years it will be categorised as inoperative) Scheme Code : RSSLV Eligibility : Minimum no of employees required -10. The average salary credit to our bank should be > Rs 8000 per month Account requirement In case of non receipt of salary for 3 consecutive months the account shall be downgraded to regular Savings Account of Rs 5000 AQB requirement and the faciltiy shall be discontinued Gold debit card International Debit Cum ATM Card Free Annual Fee Free One/additional add-on card per account Free Replacement of damaged/lost/stolen card/ re - generation of Pin/ Copy retrieval Free Domestic/International all bank ATM transactions Cheque Book Free Local cheque/Personalised Multicity cheque book Account statements Free Passbook/Statement Free Monthly by email Free Duplicate Statement/passbook at the branch Free Hold mail facility Free Overseas mailing Free Request for duplicate statement through Phone banking & ATM Free Account closure charges Certificates Free Standing instructions Free Balance/Interest/Signature verification certificate/Banker's report Free Foreign inward remittance certificate Remittances Free Demand Drafts (Branch/Non Branch)/Payorder/ Payable at Par utilisation Free Foreign currency demand drafts / international money orders Free DD/ payorder cancellation (Domestic/Foreign Currency) Free RTGS/NEFT Any Branch Banking* Free Any branch cheque deposits and account to account transfers Any Branch Cash withdrawal(By self only) and Cash deposit Free The services allows you to operate your account from any IDBI bank branch across India. This service is not available for encashing FD, issuance of DD/PO and third party bearer cheque. Third party cash withdrawal is not allowed. Third party cash deposit is allowed to the maximum of Rs 1 lac per day per account. Cheque transaction charges Only other bank commission to be recovered Cheque collections (Branch/Non branch locations)/Speed Clearing Only other bank commission to be recovered Foreign Currency cheque collection Free Cheque stop payment instructions Free Old records / copies of paid cheques Alternate Channel Banking Internet/Mobile/Phone/ATM banking Free Charges ECS/ Cheque issued and returned Rs 200 Financial reasons Free Technical reasons Cheque deposited and returned Rs 53 Local cheque Rs 102 Outstation cheque Unarranged overdraft / Cheque Purchase (A + B) (Subject to approval) Per occasion (A) Rs.102 Interest (B) 19.75% * Joint Account allowed to be opened with the spouse/parents/Children. Declaration: I/We have read/ understood the terms and conditions as applicable to Account opening/ Scheme code upgrade or downgrade and other operational aspect. I/We understand that the terms and condition may be revised by the Bank from time to time and it will be agreeable to me/us. I/We also agree to pay charges as per the Bank Policy. I/We also agree that the special features shall be discontinued incase the account requirement is not met.

Signature of first holder

Signature of Second holder

Signature of Third holder

Das könnte Ihnen auch gefallen

- Account Opening Meezan BankDokument6 SeitenAccount Opening Meezan Banknarmirathka33% (3)

- The Feasibility of Establishing A Tax and Accounting Firm in Digos CityDokument2 SeitenThe Feasibility of Establishing A Tax and Accounting Firm in Digos Citylorren4jeanNoch keine Bewertungen

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountVon EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountBewertung: 2 von 5 Sternen2/5 (1)

- PrivateBanking Banking Transactions SOCDokument2 SeitenPrivateBanking Banking Transactions SOCMohamedYoussefNoch keine Bewertungen

- Du Bill 09305426 Aug 2011Dokument8 SeitenDu Bill 09305426 Aug 2011Syira Lola0% (1)

- Sector Analysis Architecture Building and Construction 2014Dokument9 SeitenSector Analysis Architecture Building and Construction 2014PritNoch keine Bewertungen

- MGMT611 Managing Littlefield TechDokument4 SeitenMGMT611 Managing Littlefield Techqiyang84Noch keine Bewertungen

- 21St Century Computer Solutions: A Manual Accounting SimulationVon Everand21St Century Computer Solutions: A Manual Accounting SimulationNoch keine Bewertungen

- Developing New Products: Isaa Ruth F. Lesma Marketing Management G14-0139Dokument16 SeitenDeveloping New Products: Isaa Ruth F. Lesma Marketing Management G14-0139Isaa Ruth FernandezNoch keine Bewertungen

- Advanced Accounting Test Bank Questions Chapter 8Dokument19 SeitenAdvanced Accounting Test Bank Questions Chapter 8Ahmed Al EkamNoch keine Bewertungen

- Save The ChildrenDokument2 SeitenSave The ChildrenPrakash SinghNoch keine Bewertungen

- Yes Bank Smart SalaryDokument2 SeitenYes Bank Smart SalaryVicky SinghNoch keine Bewertungen

- Valuation of Asset For The Purpose of InsuranceDokument13 SeitenValuation of Asset For The Purpose of InsuranceAhmedAli100% (1)

- Time Value of MoneyDokument18 SeitenTime Value of MoneyJunaid SubhaniNoch keine Bewertungen

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersVon EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersNoch keine Bewertungen

- Overview of Stock Transfer Configuration in SAP-WMDokument11 SeitenOverview of Stock Transfer Configuration in SAP-WMMiguel TalaricoNoch keine Bewertungen

- Catalog EnglezaDokument16 SeitenCatalog EnglezaCosty Trans100% (1)

- Casa PresentationDokument25 SeitenCasa PresentationGupta Bhawna GuptaNoch keine Bewertungen

- PersonalBanking SOC 26Dec13EnDokument1 SeitePersonalBanking SOC 26Dec13EnHasnain MuhammadNoch keine Bewertungen

- Akuntansi Keuangan Lanjutan 2Dokument6 SeitenAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNoch keine Bewertungen

- Savings Account DetailsDokument2 SeitenSavings Account Detailsmysto9Noch keine Bewertungen

- Sabka Basic Savings Account Complete KYC 10-10-2013Dokument2 SeitenSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNoch keine Bewertungen

- Annex 2 Super Savings AccountDokument2 SeitenAnnex 2 Super Savings AccountPhani BhupathirajuNoch keine Bewertungen

- Super Savings NewDokument2 SeitenSuper Savings NewwinnermeNoch keine Bewertungen

- "Being Me" Savings Account: W.E.F. 1st April 2014Dokument2 Seiten"Being Me" Savings Account: W.E.F. 1st April 2014praveenpersonelNoch keine Bewertungen

- Crown salary account benefitsDokument2 SeitenCrown salary account benefitsVikram IsgodNoch keine Bewertungen

- Schedule of Charges: Savings ValueDokument2 SeitenSchedule of Charges: Savings ValueNavjot SinghNoch keine Bewertungen

- Personal Banking Charges ScheduleDokument1 SeitePersonal Banking Charges ScheduleSaravanan ParamasivamNoch keine Bewertungen

- Select ChargesDokument1 SeiteSelect ChargesMd Imran ImuNoch keine Bewertungen

- CD PremiumDokument1 SeiteCD PremiumnelzonpouloseNoch keine Bewertungen

- Assignment 1 - Banking OperationDokument72 SeitenAssignment 1 - Banking OperationRAVI JAISWANI Student, Jaipuria IndoreNoch keine Bewertungen

- July 2013: Current, Call and Savings AccountsDokument1 SeiteJuly 2013: Current, Call and Savings AccountsBala MNoch keine Bewertungen

- HSBC Savings AccountDokument3 SeitenHSBC Savings AccountLavanya VitNoch keine Bewertungen

- Emirates NBD RatesDokument1 SeiteEmirates NBD Ratesmanish450inNoch keine Bewertungen

- Complete Guide On Service Tax For The District Cooperative Central Bank LTD.Dokument5 SeitenComplete Guide On Service Tax For The District Cooperative Central Bank LTD.ramprasadNoch keine Bewertungen

- Bank Alfalah Schedule of Islamic Banking ChargesDokument16 SeitenBank Alfalah Schedule of Islamic Banking Chargesfaisal_ahsan7919Noch keine Bewertungen

- Bank Alfalah Islamic Banking Schedule of Charges July-Dec 2013Dokument14 SeitenBank Alfalah Islamic Banking Schedule of Charges July-Dec 2013krishmasethiNoch keine Bewertungen

- CC Common MITCDokument6 SeitenCC Common MITCRamarao ChNoch keine Bewertungen

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Dokument2 SeitenParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNoch keine Bewertungen

- Schedule of Charges 2011-12Dokument28 SeitenSchedule of Charges 2011-12Aamir ShehzadNoch keine Bewertungen

- Most Important Terms & ConditionsDokument6 SeitenMost Important Terms & ConditionsshanmarsNoch keine Bewertungen

- Saadiq SOCDokument31 SeitenSaadiq SOCjoshmalikNoch keine Bewertungen

- SuperCard MITC PDFDokument47 SeitenSuperCard MITC PDFPrudhvi RajNoch keine Bewertungen

- SUPERCARD Most Important Terms and Conditions (MITC)Dokument14 SeitenSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNoch keine Bewertungen

- Key-Facts-Statement-Signature-Priority-Account UBLDokument4 SeitenKey-Facts-Statement-Signature-Priority-Account UBLMuhammadDanialNoch keine Bewertungen

- MITCs AND FEESDokument5 SeitenMITCs AND FEESLoesh WaranNoch keine Bewertungen

- Citi Banks Credit NormsDokument6 SeitenCiti Banks Credit NormsAshutosh TripathiNoch keine Bewertungen

- SAVE MONEY WITH BANK SAVINGS ACCOUNTSDokument11 SeitenSAVE MONEY WITH BANK SAVINGS ACCOUNTSপ্রিয়াঙ্কুর ধরNoch keine Bewertungen

- Schedule of Charges: Smart Salary ExclusiveDokument2 SeitenSchedule of Charges: Smart Salary ExclusivevedavakNoch keine Bewertungen

- RB Chapter 2 - Current DepositsDokument3 SeitenRB Chapter 2 - Current DepositsRohit KumarNoch keine Bewertungen

- Yes Bank - Schedule of Charges - Savings Select AccountDokument2 SeitenYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMENoch keine Bewertungen

- 120121023web Version Fees and Charges FinalDokument17 Seiten120121023web Version Fees and Charges Finalhelloooo5Noch keine Bewertungen

- Most Important Terms and ConditionsDokument5 SeitenMost Important Terms and ConditionsaavisNoch keine Bewertungen

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Dokument15 SeitenSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarNoch keine Bewertungen

- DCB Bank FeaturesDokument2 SeitenDCB Bank Featuresdileepreddy220Noch keine Bewertungen

- EastWest Bank Credit Card Application Requirements and Benefits in Davao CityDokument8 SeitenEastWest Bank Credit Card Application Requirements and Benefits in Davao CityAlfred LacandulaNoch keine Bewertungen

- Fees and Charges GuideDokument3 SeitenFees and Charges GuideShashank AgarwalNoch keine Bewertungen

- Schedule of Charges for No Frills Smart Salary AccountDokument2 SeitenSchedule of Charges for No Frills Smart Salary AccountRupali WaliaNoch keine Bewertungen

- Fees and Charges For Debit CardDokument2 SeitenFees and Charges For Debit CardAnandraojs JsNoch keine Bewertungen

- Barclays Business Loan ChargesDokument1 SeiteBarclays Business Loan Chargesk kaulNoch keine Bewertungen

- PDS Revision Eng & BM Online (Final)Dokument6 SeitenPDS Revision Eng & BM Online (Final)Faiziya BanuNoch keine Bewertungen

- Axis Bank savings account chargesDokument6 SeitenAxis Bank savings account chargesArnab Nandi100% (1)

- PAY YOUR CREDIT CARD BILL ON TIMEDokument75 SeitenPAY YOUR CREDIT CARD BILL ON TIMEjamin2020Noch keine Bewertungen

- Online Counseling Fee Payment Guide <40Dokument3 SeitenOnline Counseling Fee Payment Guide <40abhishekNoch keine Bewertungen

- September 2014: Current, Call and Savings AccountsDokument1 SeiteSeptember 2014: Current, Call and Savings AccountsAseForkliftRepairingNoch keine Bewertungen

- Most Important Terms & ConditionsDokument93 SeitenMost Important Terms & Conditionslancy_dsuzaNoch keine Bewertungen

- Iw01220137 25022012025852Dokument1 SeiteIw01220137 25022012025852ishanarya00761Noch keine Bewertungen

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Dokument4 SeitenSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377rahuljaiswal20097313Noch keine Bewertungen

- Chapter 1 IntroDokument10 SeitenChapter 1 IntrosanyakathuriaNoch keine Bewertungen

- Achieving Financial Stability in America, 4th ed. (2023-2024)Von EverandAchieving Financial Stability in America, 4th ed. (2023-2024)Noch keine Bewertungen

- Model Questions - Jaiib Principles of Banking - Module A & BDokument10 SeitenModel Questions - Jaiib Principles of Banking - Module A & Bapi-3808761Noch keine Bewertungen

- Jaiib Sample QuestionsDokument4 SeitenJaiib Sample Questionskubpyg100% (1)

- JAIIB LowDokument10 SeitenJAIIB LowVimal RamakrishnanNoch keine Bewertungen

- Industrial Relations & Labour Laws ConsolidatedDokument188 SeitenIndustrial Relations & Labour Laws ConsolidatedVikram SinghNoch keine Bewertungen

- (Physics) (Hindi and English Version)Dokument38 Seiten(Physics) (Hindi and English Version)mayankhardikarNoch keine Bewertungen

- PD March 2012Dokument195 SeitenPD March 2012fr123Noch keine Bewertungen

- Mba Finance 3rd-5Dokument62 SeitenMba Finance 3rd-5Pankaj SharmaNoch keine Bewertungen

- Future of IP Series: Is the Patent System Under AttackDokument15 SeitenFuture of IP Series: Is the Patent System Under Attackfr123Noch keine Bewertungen

- India - China, A Comparative Business StudiesDokument3 SeitenIndia - China, A Comparative Business Studiesfr123Noch keine Bewertungen

- Course CodeDokument4 SeitenCourse Codefr123Noch keine Bewertungen

- Future of IP Series: Is the Patent System Under AttackDokument15 SeitenFuture of IP Series: Is the Patent System Under Attackfr123Noch keine Bewertungen

- BILAX BrochureDokument8 SeitenBILAX BrochureJeremy GordonNoch keine Bewertungen

- WWW EconomicsdiscussionDokument12 SeitenWWW EconomicsdiscussionMorrison Omokiniovo Jessa SnrNoch keine Bewertungen

- Peace Corps FINANCIAL ASSISTANTDokument1 SeitePeace Corps FINANCIAL ASSISTANTAccessible Journal Media: Peace Corps DocumentsNoch keine Bewertungen

- gb10nb37lz 179Dokument10 Seitengb10nb37lz 179Jan RiskenNoch keine Bewertungen

- Personal Assignment Fraud Audit ReviewDokument8 SeitenPersonal Assignment Fraud Audit ReviewNimas KartikaNoch keine Bewertungen

- EFE Matrix For RevlonDokument4 SeitenEFE Matrix For RevlonPrateek SinglaNoch keine Bewertungen

- World Leasing GuideDokument5 SeitenWorld Leasing GuideLudmila DumbravaNoch keine Bewertungen

- Case StudyDokument16 SeitenCase Studysagrikakhandka100% (1)

- From Homeless To Multimillionaire: BusinessweekDokument2 SeitenFrom Homeless To Multimillionaire: BusinessweekSimply Debt SolutionsNoch keine Bewertungen

- Kisan Diwas - 2013Dokument9 SeitenKisan Diwas - 2013sumeetchhabriaNoch keine Bewertungen

- Airline Industry Metrics - MA - Summer 2017Dokument21 SeitenAirline Industry Metrics - MA - Summer 2017Yamna HasanNoch keine Bewertungen

- Answers To Second Midterm Summer 2011Dokument11 SeitenAnswers To Second Midterm Summer 2011ds3057Noch keine Bewertungen

- Auditor's Cup Questions-2Dokument8 SeitenAuditor's Cup Questions-2VtgNoch keine Bewertungen

- Garantias Copikon VenezuelaDokument3 SeitenGarantias Copikon VenezuelaMaria SanzNoch keine Bewertungen

- 7 Unemployment Mankiw9e Lecture Slides Chap14Dokument21 Seiten7 Unemployment Mankiw9e Lecture Slides Chap14Kwesi WiafeNoch keine Bewertungen

- Case Studies 1Dokument3 SeitenCase Studies 1Kenny Ang0% (2)

- Fashion Cycle - Steps of Fashion CyclesDokument3 SeitenFashion Cycle - Steps of Fashion CyclesSubrata Mahapatra100% (1)

- El Al.Dokument41 SeitenEl Al.Chapter 11 DocketsNoch keine Bewertungen