Beruflich Dokumente

Kultur Dokumente

2011 - ITR2 - r6

Hochgeladen von

Bathina Srinivasa RaoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011 - ITR2 - r6

Hochgeladen von

Bathina Srinivasa RaoCopyright:

Verfügbare Formate

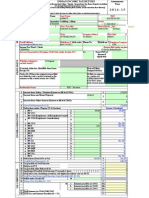

Select applicable sheets below by choosing Y/N and Click on Apply Click on the sheets below PART A - GENERAL

PARTB - TI - TTI HOUSE_PROPERTY CG-OS CYLA-BFLA CFL VIA SPI - SI EI IT TDS Schedules for filing Income Tax Return Personal Info., Filing Status PartB-TI,PartB-TTI,Verification,Schedule S Schedule HP Schedule CG, Schedule OS Schedule CYLA, Schedule BFLA ScheduleCFL Schedule VIA Schedule SPI, Schedule SI Schedule EI Schedule AIR, Schedule IT Schedule TDS1,Schedule TDS2

1 2 3 4 5 6 7 8 9 10 11

Y Y Y Y Y Y Y Y Y Y Y

Select sheets to print and click apply

Y Y Y Y Y Y Y Y Y Y Y

ScheduleName

GENERAL PART_B PART_B HOUSE_PROPERTY CG_OS CG_OS CYLA BFLA CYLA BFLA CFL VIA SPI - SI SPI - SI EI IT TDS TDS

PartA_Gen1 PartB-TI PartB-TTI ScheduleHP ScheduleCG ScheduleOS ScheduleCYLA ScheduleBFLA ScheduleCFL ScheduleVIA ScheduleSPI ScheduleSI ScheduleEI ScheduleIT ScheduleTDS1 ScheduleTDS2

Appli cable YN Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y

Description Click on applicable links to navigate to the respective sheet / schedule. Click on any of the links on this page to navigate to the respective schedules. Computation of total income Computation of tax liability on total income Details of Income from House Property Capital Gains Income from other sources Details of Income after set-off of current years losses Details of Income after Set off of Brought Forward Losses of earlier years Details of Losses to be carried forward to future Years Deductions under Chapter VI-A Income chargeable to Income tax at special rates IB [Please see instruction Number-9(iii) for section code and rate of tax] Income chargeable to Income tax at special rates IB [Please see instruction Number-9(iii) for section code and rate of tax] Details of Exempt Income (Income not to be included in Total Income) Details of Advance Tax and Self Assessment Tax Payments of Income-tax Details of Tax Deducted at Source on Income [As per Form 16 A issued by Deductor(s)] Details of Tax Collected at Source [As per Form 27D issued by the Collector(s)]

FORM

INDIAN INCOME TAX RETURN

Assessment Year 2011-12

ITR-2

First Name

[For Individuals and HUFs not having Income from Business or Profession] (Please see Rule 12 of the Income Tax-Rules,1962) (Also see attached Instructions) Middle Name Last Name PAN

PERSONAL INFORMATION

Flat / Door / Block No

Name of Premises / Building / Village

Status (I-Individual,H-HUF) I - Individual Date of birth (in case of individual) 00/00/0000

Road / Street / Post Office

Area / Locality

Town/City/District

State

Pin Code

Sex (Select) M-Male

Email Address

Mobile No

(Std code) Phone No

Designation of Assessing Officer (Ward / Circle) FILING STATUS Whether original or revised return? O-Original

Employer Category (if in employment) OTH Return filed under section (Refer 11 - u/s 139(1) Instruction 9(ii)

If revised, enter Receipt no and Date of Date filing original return (DD/MM/YYYY) (DD/MM/YYYY RES - Resident Residential Status Whether this return is being filed by a representative assessee? If yes, please furnish following information a Name of the representative b Address of the representative c Permanent Account Number (PAN) of the representative For Office Use Only For Office Use Only Receipt No Date

N-No

Seal and signature of receiving official

Computation of total income Part B - TI 1 Salaries (6 of Schedule S) 2 Income from house property (C of Schedule-HP) (Enter nil if loss) 3 Capital gains a Short term i Short-term (under section 111A) (A5 of Schedule - 3ai CG) ii Short-term (others) (A6 of Schedule-CG) 3aii iii Total short-term (3ai + 3aii) (A4 of Schedule CG) 3aii i b Long-term (B5 of Schedule-CG) 3b c Total capital gains (3aiii + 3b) Income from other sources a from sources other than from owning race horses (3 4a of Schedule OS) b from owning race horses (4c of Schedule OS) 4b c Total (a + b) Total (1 + 2 + 3 c+ 4c) Losses of current year set off against 5 (total of 2vi and 3vi of Schedule CYLA) Balance after set off current year losses (5-6) (also total of column 4 of Schedule CYLA) Brought forward losses set off against 7 (2vi of Schedule BFLA) Gross Total income (7-8) (also 3vii of Schedule BFLA) Deductions under Chapter VI-A (o of Schedule VIA) Total income (9 - 10) Net agricultural income/ any other income for rate purpose (4 of Schedule EI) Aggregate income (11 + 12) Losses of current year to be carried forward (total of xi of Schedule CFL)

1 2

0 0

0 0 0 0 3c 0 0 4c 5 6 7 8 9 10 11 12 13 14 0 0 0 0 0 0 0 0 0 0 0 0

TOTAL INCOME

5 6 7 8 9 10 11 12 13 14

TAXES PAID

Computation of tax liability on total income Part B - TTI 1 Tax payable on total income a Tax at normal rates 1a b Tax at special rates (11 of Schedule-SI) 1b c Rebate on Agricultural income 1c d Tax Payable on Total Income (1a + 1b-1c) 2 Education Cess, including secondary and higher education cess, on 1d 3 Gross tax liability (1d+ 2) 4 Tax relief a Section 89 4a b Section 90 4b c Section 91 4c d Total (4a + 4b + 4c) 5 Net tax liability (3 4d) 6 Interest payable a For default in furnishing the return (section 234A) 6a b For default in payment of advance tax (section 234B) 6b c For deferment of advance tax (section 234C) 6c d Total Interest Payable (6a+6b+6c) 7 Aggregate liability (5 + 6d) 8 Taxes Paid COMPUTATION OF TAX LIABILITY

0 0 0 1d 2 3 0 0 0

4d 5 0 0 0 6d 7

0 0

0 0

TAXES PAID

a Advance Tax (from Schedule-IT) b TDS (total of Schedule-TDS1 and Schedule-TDS2)

8a 8b

0 0

0 c Self Assessment Tax (from Schedule-IT) 8c d Total Taxes Paid (8a+8b+8c) 9 Amount payable (Enter if 7 is greater than 8d, else enter 0) 10 Refund (If 8d is greater than 7, also give Bank Account details below) 11 Enter your bank account number (mandatory ) Select Yes if you want your refund by direct deposit into your bank account, Select 12 No if you want refund by Cheque 13 In case of direct deposit to your bank account give additional details MICR Code Type of Account (Select)

REFUND

8d 9 10 11 12

0 0 0

NO

Date(DD/MM/YYYY) VERIFICATION I, (full name in block letters), son/ daughter of

solemnly declare that to the best of my knowledge and belief, the information given in the return and the schedules thereto is is correct and complete and that the amount of total income/ fringe benefits and other particulars shown therein are truly stated and are in accordance with the the provisions of the Income-tax Act, 1961, in respect of income and fringe benefits chargeable to Income-tax for the previous year relevant to the assessment year 2011-2012 Place (Date) PAN 14 If the return has been prepared by a Tax Return Preparer (TRP) give further details below: Counter Signature Identification No. of of TRP TRP Name of TRP If TRP is entitled for any reimbursement from the Government, 14 amount thereof Schedule S Details of Income from Salary (Fields marked in RED should not be left Blank) Name of Employer PAN of Employer (optional) Address of employer Town/City Pin code State 1 Salary (Excluding all allowances, perquisites & profit in lieu of salary).. 1 2 Allowances exempt under section 10 2 3 Allowances not exempt 3 4 Value of perquisites 4 0 5 Profits in lieu of salary 5 0 6 Income chargeable under the Head Salaries (1+3+4+5) 6 0 Total 0

Schedule HP Details of Income from House Property (Fields marked in RED must not be left Blank) Address of property Town/ City State PIN Code

a b c d e f g

h i

Is the property let out ? Name of Tenant Y Annual letable value/ rent received or receivable The amount of rent which cannot be realized Tax paid to local authorities Total (b + c) Balance (a d) 30% of e Interest payable on borrowed capital Cannot exceed 1.5 lacs if not let out Total (f + g) Income from house property (e h) Address of property Town/ City State

PAN of Tenant (optional) a b c d f g 0 0 0 e 0 0

b i PIN Code PAN of Tenant (optional) a b c d f g

0 0

Is the property let out ? a b c d e f g

Name of Tenant

h i

Annual letable value/ rent received or receivable The amount of rent which cannot be realized Tax paid to local authorities Total (b + c) Balance (a d) 30% of e Interest payable on borrowed capital Cannot exceed 1.5 lacs if not let out Total (f + g) Income from house property (e h) Address of property Town/ City State

0 e 0 0

b i PIN Code PAN of Tenant (optional) a

0 0

Is the property let out ? a b c d e f g

Name of Tenant

Annual letable value/ rent received or receivable The amount of rent which cannot be realized b Tax paid to local authorities c Total (b + c) d 0 Balance (a d) 30% of e f 0 Interest payable on borrowed capital Cannot exceed g 1.5 lacs if not let out h Total (f + g) i Income from house property (e h) Income under the head Income from house property A Rent of earlier years realized under section 25A/AA B Arrears of rent received during the year under section 25B after deducting 30% C Total (A + B + Total of (i) for all properties above)

b i A B C

0 0

Schedule CGCapital Gains A Short-term capital gain 1. From assets in case of non-resident to which first proviso to section 48 applicable 2. From other assets 2a a Full value of consideration b Deductions under section 48 i Cost of acquisition bi ii Cost of Improvement bii iii Expenditure on transfer biii iv Total ( i + ii + ii) biv 2c c Balance (2a 2biv) Loss, if any, to be ignored under section 94(7) or 94(8) d 2d (Enter positive values only) Exemption under section 54B/54D e 2e f Short-term capital gain (2c + 2d 2e) Amount deemed to be short term capital gains under sections 3. 54/54B/54D/54EC/54ED/54F 4. Total short term capital gain (1 + 2f +3) 5. Short term capital gain under section 111A included in 4 6. Short term capital gain other than referred to in section 111A (4 5) Long term capital gain 1. Asset in case of non-resident to which first proviso to section 48 applicable 2. Other assets for which option under proviso to section 112(1) not exercised a Full value of consideration 2a b Deductions under section 48 i Cost of acquisition after indexation bi ii Cost of improvement after indexation bii iii Expenditure on transfer biii iv Total (bi + bii +biii) biv c Balance (2a 2biv) 2c d Excemption under sections 54/54B/54D/54EC/54F 2d

1 0 0 0 0 0 0 0 0 2f 3 4 A5 A6 1

CAPITAL GAINS

0 0 0 0 0 0 2e

e Net balance (2c 2d) 3. Other assets for which option under proviso to section 112(1) exercised a Full value of consideration 3a b Deductions under section 48 i Cost of acquisition without indexation bi ii Cost of improvement without indexation bii iii Expenditure on transfer biii iv Total (bi + bii +biii) biv c Balance (3a biv) 3c d Excemption under sections 54/54B/54D/54EC/54F 3d

0 0 0 0 0 0 3e 4 B5 C

e Net balance (3c-3d) Amount deemed to be long term capital gains under sections 4. 54/54B/54D/54EC/54ED/54F 5 Total long term capital gain (1 + 2e + 3e + 4) Income chargeable under the head CAPITAL GAINS (A4 + B5)

Date i Up to 15/9 (i) ii 16/9 to 15/12 (ii) iii 16/12 to 15/3 (iii) iv 16/3 to 31/3 (iv)

STCG 111A 0 0 0 0

Date i Up to 15/9 (i) ii 16/9 to 15/12 (ii) iii 16/12 to 15/3 (iii) iv 16/3 to 31/3 (iv) Date i Up to 15/9 (i) ii 16/9 to 15/12 (ii) iii 16/12 to 15/3 (iii) iv 16/3 to 31/3 (iv)

LTCG PROVISO 0 0 0 0 Lottery 0 0 0 0

Schedule OS Income 1 Income other than from owning race horse(s):a Dividends, Gross 1a b Interest, Gross 1b c Rental income from machinery, plants, buildings, etc., 1c d Others, Gross (excluding income from owning race horses) 1d e Total (1a + 1b + 1c + 1d) f Deductions under section 57:i Expenses fi ii Depreciation fii iii Total fiii g Balance (1e fiii) 2 Winnings from lotteries, crossword puzzles, races, etc. 3 Income from other sources (other than from owning race horses) (1g + 2) 4 Income from owning and maintaining race horses a Receipts 4a b Deductions under section 57 in relation to (4) 4b c Balance (4a 4b) 5 Income chargeable under the head Income from other sources (3 + 4c) OTHER SOURCES

1e

0 0 1g 2 3

0 4c 5

NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head

0 0 0 0 0

0 0 0 0

STCG OTH 0 0 0 0

LTCG NO PROVISO 0 0 0 0

0 0

0 0

pecified persons referred to in Schedule SPI while computing the income under this head

Schedule CYLA

Sl.No

Head/ Source of Income

Details of Income after set-off of current years losses Other Income of sources loss current year House Current (other (Fill this property years than loss column only loss of the Income from race if income is current year remaining horses) of zero or set off after set off the current positive) year set off

CURRENT YEAR LOSS ADJUSTMENT

Total loss (C of Schedule HP) Loss to be adjusted 1 i Salaries ii House property iii Short-term capital gain iv Long term capital gain Other sources (incl profit from owning v race horses, winnings from lotteries added later) 0 0 0 0 2 0 0

Total loss (3 of ScheduleOS)

0 3 0 0 0 0 4=1-2-3 0 0 0 0

0 0

0 vi Total loss set-off Loss remaining after set-off vii

0 0 0

0 0 0

Schedule BFLA

BROUGHT FORWARD LOSS ADJUSTMENT

Sl. No.

Head/ Source of Income

i Salaries ii House property iii Short-term capital gain iv Long-term capital gain

Details of Income after Set off Brought Forward Losses of earlier years Income after set off, if any, of Current current Brought years years forward loss income losses as per set off remaining 4 of after set off Schedule CYLA) 1 2 3 0 0 0 0 0 0 0 0 0 0 0

BROUGHT FORWARD LO

Other sources v (including profit from owning race horses) 0 vi Total of brought forward loss set off Current years income remaining after set off vii Total (i3 +ii3 + iii3 + iv3+v3)

0 0

Note : Short Term Capital Loss Brought Forward will be adjusted against STCG and LTCG in the sequence of STCG Other than 111A, LTCG Non Proviso, STCG u/s 111A, LTCG Proviso to the extent of loss brought forward available for set off Please click on "Compute Set off" button on top to allow the utility to auto fill the Adjustment of Current Year Loss and Brought Forward Loss in the yellow fields above.

Schedule CFL Sl. No. i ii iii iv v vi vii viii ix

xi xii

Details of Losses to be carried forward to future Years Date of Assessmen House Short-term Long-term Filing t Year property loss capital loss Capital loss (DD/MM/ YYYY) 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 Total of earlier 0 0 year losses Adjustme nt of above 0 0 losses in ScheduleB FLA 2011-12 (Current 0 0 year losses) Total loss Carried 0 0 Forward to future

Other sources loss (other than loss from race horses)

Other sources loss (from owning race horses)

CARRY FORWARD OF LOSS

0 0

0 0

Schedule VI-A Deductions under Chapter VI-A a 80C b 80CCC c 80CCD d 80CCF e 80D f 80DD g 80DDB h 80E i 80G j 80GG k 80GGA l 80GGC m 80QQB n 80RRB o 80U p Total Deductions :

System Calculated a b c d e f g h i j k l m n o 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 p 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

TOTAL DEDUCTIONS

Schedule SPI Income of specified persons(spouse, minor child etc) includable in income of the assessee Sl No Name of person PAN of person (optional) Relationship Nature of Income Amount (Rs) 1 2 3 0

Please clilck on Recalculate initially, and also subsequently if Gender, Date of Birth , Residential Status or Assessee Status (Indl / HUF etc) is changed Income chargeable to Income tax at special rates IB [Please see instruction Schedule SI Number-9(iii) for section code and rate of tax] Section SPECI System code Sr nos 1 to 4 AL Taxable Income calculated are auto filled RATE Sl Special rate Income after adjusting for tax thereon from Sch CG. No (%) i Min Chargeable to Enter rates for Sl Tax no 5 and 6 manually) 1 21 20 0 0 0 2 1A 15 0 0 0 3 22 10 0 0 0 4 5BB 30 0 0 0 5 1 10 0 0 0 6 DTAA 1 0 0 0 7 4A1 30 0 0 8 5A1b2 20 0 0 0 9 7A 30 0 0 10 7A 30 0 0 11 Total (1ii to 10 ii) 0 0 0

Please Click on Compute Tax button in Part B TI to re calculate Tax at Normal Rate and Tax at Special Rate

Schedule EI Details of Exempt Income (Income not to be included in Total Income) 1 Interest income 2 Dividend income 3 Long-term capital gains on which Securities Transaction Tax is paid Net Agriculture income(other than income to be excluded under rule 7, 7A, 7B 4 or 8) 5 Others, (including exempt income of minor child) 6 Total (1+2+3+4+5)

EXEMPT INCOME

1 2 3 4 5 6

0 0 0 0 0 0

Schedule ITDetails of Advance Tax and Self Assessment Tax Payments TA X PA Sl Date of Deposit Serial Number BSR Code Amount (Rs) YM No (DD/MM/YYYY) of Challan EN TS 1 2 3 4 5 1 2 3 4 5 6 NOTE Enter the totals of Advance tax and Self Assessment tax in Sl No. 8a & 8c of PartB-TTI

Schedule TDS1

Details of Tax Deducted

Sl No 1 1 2 3

Tax Deduction Account Number (TAN) of the Deductor 2

Income Name of Deductor chargeable under Salaries 3 4

Total tax deducted 5

Schedule TDS2 Tax Deduction Account Number (TAN) of the Deductor 1 1 2 3 2

Details of Tax Deducted at Source on Income [As per Form 16 A issued by Deductor(s)] Amount out of (4) claimed for this year 5

Sl No

Name of Deductor

Total tax deducted 4

Instructions to fill up Excel Utility i ii iii iv v vi vii viii ix Overview Before you begin Structure of the utility for ITR2 Customisation of the utility Filling up the sections of the form using the utility Validating the sheets Generating the XML Printing Importing Configure the utility Fill up applicable schedules Validate each sheet Generate XML Validate Summary Upload the XML

Overview The excel utility can be used for creating the XML file for efiling of your returns. The excel utility provides all the sections and schedules required to be submitted as a part of the eFiling process. Once, the data to be submitted for filing your returns is entered into the utility, the Generate XML button will take you to a validation page. The validation page shows the error free entries that the utility will convert into XML format when the user clicks on Publish XML button. The XML file generated will be placed in the same folder as the Excel utility, and will carry a name ending with your PAN number followed by the file extension.

ii

Before you begin Read the general instructions for filling up the form. The ITR6 Excel Utility is an Excel Workbook that consists of a number of individual, integrated worksheets. Each of the sheets contains one or more schedules for data entry. Initially, all the sheets are visible to the user. A number of these sheets are optional. On customisation from the Home page, the taxpayer can decide which sheets are applicable to their case and accordingly select Y or N to hide or show the sheets. Similarly , by selecting the sheets which the taxpayer needs for printing, it is possible to control how many sheets should be printed, in case all sheets are not required to be printed. Later on, these settings can always be changed. The following elements are available on every sheet a) The navigate buttons for navigating to the various schedules. b) Home Button which allows a user to navigate to the customisation home page. c) Validate Sheet button , which allows the user to check for errors / omissions if any, per sheet. d) Generate XML button, which will be clicked by the user to generate the XML and validate all the sheets. The e) Print button which will print all the sheets selected for printing on the Customization page. f) Help button providing context specific help.

iii

Structure of the utility for ITR2 The various sheets and the schedules covered per sheet is as below. The name of each sheet displays in the tab at the bottom of the workbook.

Each sheet includes a number of distinct, titled sections / schedules. These titles are displayed in black color background with white text. Each sheet is identified by the sheet tabs located at the bottom of the Excel window. These tabs are labeled with abbreviation forms of the schedules of the sheet. You can move to a specific sheet by either choosing the sheet tab from the bottom, or by navigating to the required schedule (and sheet) using the right panel. iv Customisation of the utility by clicking on the Home button shown here ----> Depending on the various optional schedules that you need to leave out of the filing, you can customize the utility to show you only relevant sheets. To customize the utility, one needs to go to the Home page / Customization sheet by clicking on the Home button. This sheet has embedded in it the Version number, buttons to access the "General instructions to fill the utility and form". "Customize" button which when clicked will apply the customization inputs for hiding unnecessary sheets, to the utility. The print options are also stored on clicking Customize button. These options include user selected list of sheets that need to be printed. Note : If, on a sheet, there are more than one schedules, you should disable the sheet by selecting "N" only if all the schedules on that sheet are not relevant to you. v Filling up the sections of the form using the utility. Every section / schedule is color coded to facilitate the user to enter data. There are following different types of cells in the sheet. a) Data entry cells for mandatory fields which are required to be compulsorily entered by the user. These have a red font and a green background color. b) Data entry cells for mandatory fields which , if left empty by the user, will default to a predefined value. These have a red font and a green background color. c) Data entry cells for fields which may be mandatory based on the value of some other field. Ex : Only in the case of revised return are the dates of original return and receipt no to be filled in. Such labels are either partially red, or , if they ha d) Data entry cells for optional fields have a black font and a green background color. e) Formula fields where no data entry is done by the user but a value is calculated based on already available values. These have a blue font for the labels and a white background color. The formulas are not changeable by the user but are calculated by th f) Linked fields, where no data entry is done by the user, but a value is picked up from an existing cell elsewhere in the sheet. These have a blue font for the labels and a white background. All green cells are areas where the user input is expected. Refer to the navigation buttons shown on the left for Next, Previous and Index. The user can navigate the various sheets and schedules by either clicking on next or previous buttons to move to the next or the previous tab, or by clicking on Index to move Moving through the cells : After the user has reached the desired schedule, the user can click on the tab keyboard button. On clicking tab, the user is taken to the next green cell of the schedule. Adding more rows : Schedules such as Subsidiary Details, 10A, TDS2, TCS etc allow users to enter data in tabular format. The utility provides an option to add more rows in these schedules than provided in the base utility. IMPORTANT : To add more rows, the user must place the cursor in the last row that is already filled up in the schedule. Thereafter, the user can click on the button provided to add more rows. The user can enter a number greater than or equal to 1. On clicking enter, the desired number of rows will be increased. Warning : Rows once added, cannot be deleted. However, if rows are not filled up, they will not be reflected in the generated XML. Note while filling tabular data : When filling tabular data, ensure that all rows are filled one after another. Do not skip a row blank. Do not use 2 rows for entering value for a particular entry. Example : If address is longer than the available space, please continue typing in the provided space, and do not move to the next cell to complete the rest of the address. The cell will automatically expand and accept the full address in the same cell.

After filling a row in the table, do not skip a blank row before filling the next row. The utility will stop generating XML at the point it encounters a blank row. Also, every schedule has either red colored column headers, which must be filled up for a valid row to be accepted by the utility. To be sure that the data entered in such tables is being accepted by the utility, please check the count per table displayed when you click on the XML generate button. By clicking on the XML Generate button, you will be taken to the verification sheet wherein the utility will calculate the valid rows for each and every schedule and display the same for final verification before outputting the XML file for upload. Caution to ensure correct generation of XML as per expectations : For Schedules such as IT, FBT where the totals are being transferred to Part B, ensure that user does not enter data in the schedules which is incomplete. All rows where amounts are entered

vi

Validating the sheets : After the required schedules in a sheet are filled up, the user must click the Validate sheet button to confirm that the Generating the XML and Verification : Once all relevant sheets have been filled up, the user can then click on the "Generate XML" button. This will validate once again all the sheets, and direct the user to the confirmation page which shows the various schedules listed showing which have been The user can then confirm the same with their actual data, and if ok, click on Save XML option to finally save the generated XML to the file system. The system will prompt the user with the name and location of the file saved. This file can then be uploaded towards efiling your return and an acknowledgement can be hence generated. Printing. The filled up sheets can be printed. The user can decide which sheets to print by selecting from the homepage, the sheets desired to be printed from the last column. On clicking Print, the selected sheets will be printed out.

vii

viii

ix

Importing If a taxpayer has already filled up ITR2 on a previous version, the tax payer can transfer all of the data from the previous version to the current version by following the given steps. Step 1 : Ensure that the previous version is kept in a specific folder (any folder) and the taxpayer is aware of the location of this file. If this file is open, please close it / save and close before proceeding. Step 2 : Open the latest version of the ITR2 utility after downloading from the site, unzipping if the downloaded utility is in an archived (zip) format . Step 3 : Go to the General sheet and click on the import button on the top right. Follow the messages thereafter

1 GENERAL Most of the details to be filled out in Part-Gen of this form are self-explanatory. However, some of the details mentioned below ar to be filled out as explained hereunder:(a) e-mail address and phone number are optional;

PART_B PART B-TI-COMPUTATION OF TOTAL INCOME

PART B-TI-COMPUTATION OF TAX LIABILITY ON TOTAL INCOME

HOUSE_PROPERTY

BP CG_OS

CYLA BFLA CFL

VIA

SI

EI

AIR_IT

TDS

General Instructions for filling in the form Instructions for filling up ITR-2 are available in the PDF form

ubmitted as a part of the eFiling process.

utility, the Generate XML button will take you

ert into XML format when the user clicks on

tility, and will carry a name ending with your

of individual, integrated worksheets. Each of sheets are visible to the user. A number of payer can decide which sheets are applicable to larly , by selecting the sheets which the ould be printed, in case all sheets are not

issions if any, per sheet. he XML and validate all the sheets. The

k.

se titles are displayed in black color

cel window. These tabs are labeled with

he bottom, or by navigating to the required

of the filing, you can customize the utility to

ion sheet by clicking on the Home

"General instructions to fill the utility and tion inputs for hiding unnecessary sheets, to the

ptions include user selected list of sheets that

ble the sheet by selecting "N" only if all the

compulsorily entered by the user.

e user, will default to a lor. e value of some other field. Ex : nd receipt no to be filled in. Such

e is calculated based on already ackground color. The formulas

e is picked up from an existing d a white background.

and Index. The user can navigate uttons to move to the next or the

dule, the user can click on the tab of the schedule. , TCS etc allow users to enter data in tabular format. provided in the base utility. last row that is already filled up in the ore rows. The user can enter a number greater increased. t filled up, they will not be reflected in the

all rows are filled one after another. Do not ntry. Example : If address is longer than the t move to the next cell to complete the rest of ss in the same cell.

next row. The utility will stop generating XML d colored column headers, which must be filled ntered in such tables is being accepted by the XML generate button. By clicking on the XML utility will calculate the valid rows for each and ing the XML file for upload.

For Schedules such as IT, FBT where the totals e schedules which is incomplete. All rows

the Validate sheet button to confirm that the

he "Generate XML" button. This will validate hich shows the various schedules listed showing

k on Save XML option to finally save the the name and location of the file saved. wledgement can be hence generated.

print by selecting from the homepage, the

yer can transfer all of the data from the

folder) and the taxpayer is aware of the location ceeding.

m the site, unzipping if the downloaded utility

p right. Follow the messages thereafter

anatory. However, some of the details mentioned below are

Das könnte Ihnen auch gefallen

- EY AlpineValuation PDFDokument36 SeitenEY AlpineValuation PDFStuff NewsroomNoch keine Bewertungen

- Level 1 Assessment EY Financial Analysis ProdegreeDokument9 SeitenLevel 1 Assessment EY Financial Analysis ProdegreeSairam Govarthanan0% (2)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Von EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Bewertung: 3.5 von 5 Sternen3.5/5 (17)

- Mergers Workbook II-Electronic WorksheetsDokument11 SeitenMergers Workbook II-Electronic WorksheetsBathina Srinivasa RaoNoch keine Bewertungen

- Case 9-47 PDFDokument5 SeitenCase 9-47 PDFMicha Maalouly33% (3)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Commercial & Industrial Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryVon EverandCommercial & Industrial Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Royale Aspira New PDFDokument2 SeitenRoyale Aspira New PDFVikas SinghNoch keine Bewertungen

- Dialog English AccountingDokument2 SeitenDialog English AccountingPutri100% (2)

- Accounting II-Review Chapters12,13,14 (8thed)Dokument10 SeitenAccounting II-Review Chapters12,13,14 (8thed)JacKFrost1889Noch keine Bewertungen

- 14 - Audit Other Related ServicesDokument38 Seiten14 - Audit Other Related ServicesSyafiq AhmadNoch keine Bewertungen

- CHAPTER 2: Measuring The Macroeconomy: Multiple ChoiceDokument24 SeitenCHAPTER 2: Measuring The Macroeconomy: Multiple ChoicebbbbbNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument7 SeitenITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument7 SeitenITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996Noch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument8 SeitenITR-3 Indian Income Tax Return: Part A-GENRahul SharmaNoch keine Bewertungen

- ITR-2 Indian Income Tax Return: Part A-GENDokument10 SeitenITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument7 SeitenITR-3 Indian Income Tax Return: Part A-GENAvani GadaNoch keine Bewertungen

- Itr 2Dokument9 SeitenItr 2Arvind PaulNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument12 SeitenITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNoch keine Bewertungen

- Form ITR2 2012-2013Dokument9 SeitenForm ITR2 2012-2013N.PalaniappanNoch keine Bewertungen

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDokument7 SeitenItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraNoch keine Bewertungen

- Indian Numbering SystemDokument8 SeitenIndian Numbering SystemelangomduNoch keine Bewertungen

- ITR-2 Indian Income Tax Return: Part A-GENDokument12 SeitenITR-2 Indian Income Tax Return: Part A-GENMankamesachinNoch keine Bewertungen

- 2016 Itr4 PR3Dokument165 Seiten2016 Itr4 PR3TejasNoch keine Bewertungen

- Assessment Year Indian Income Tax Return: I - IndividualDokument6 SeitenAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNoch keine Bewertungen

- Income TaxDokument6 SeitenIncome TaxKuldeep HoodaNoch keine Bewertungen

- Indian Income Tax Return Assessment Year SahajDokument7 SeitenIndian Income Tax Return Assessment Year SahajSubrata BiswasNoch keine Bewertungen

- Assessment Year Indian Income Tax Return SahajDokument7 SeitenAssessment Year Indian Income Tax Return SahajallipraNoch keine Bewertungen

- 2011 Itr4 SpecificeDokument54 Seiten2011 Itr4 SpecificeAnand ThackerNoch keine Bewertungen

- Form 16, Tax Deduction at Source... Income Tax of IndiaDokument2 SeitenForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNoch keine Bewertungen

- Assessment Year Sahaj Indian Income Tax ReturnDokument7 SeitenAssessment Year Sahaj Indian Income Tax Returnrajshri58Noch keine Bewertungen

- Form ITR-1Dokument3 SeitenForm ITR-1Rajeev PuthuparambilNoch keine Bewertungen

- 2012 Itr1 Pr21Dokument5 Seiten2012 Itr1 Pr21MRLogan123Noch keine Bewertungen

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDokument11 SeitenITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNoch keine Bewertungen

- Form2FandInstructions 06062006Dokument11 SeitenForm2FandInstructions 06062006Mnaoj PatelNoch keine Bewertungen

- Monthly Value-Added Tax DeclarationDokument17 SeitenMonthly Value-Added Tax DeclarationMIRAHNELNoch keine Bewertungen

- Gross Total Income (1+2+3) 4: System CalculatedDokument8 SeitenGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNoch keine Bewertungen

- IT Return 2011 2012Dokument3 SeitenIT Return 2011 2012swapnil6121986Noch keine Bewertungen

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasDokument5 SeitenQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloNoch keine Bewertungen

- 82202BIR Form 1702-MXDokument9 Seiten82202BIR Form 1702-MXJp AlvarezNoch keine Bewertungen

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDokument4 SeitenMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesNoch keine Bewertungen

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Dokument3 SeitenSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarNoch keine Bewertungen

- 82202BIR Form 1702-MXDokument9 Seiten82202BIR Form 1702-MXRen A EleponioNoch keine Bewertungen

- Form No 16Dokument5 SeitenForm No 16Rabiul KhanNoch keine Bewertungen

- ITR Form 1Dokument7 SeitenITR Form 1gj29hereNoch keine Bewertungen

- 2013 Itr1 PR11Dokument9 Seiten2013 Itr1 PR11Akshay Kumar SahooNoch keine Bewertungen

- RecoverdDokument55 SeitenRecoverdcmtssikarNoch keine Bewertungen

- IT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Dokument7 SeitenIT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Amanat AhmedNoch keine Bewertungen

- ITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Dokument8 SeitenITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Modin HorakeriNoch keine Bewertungen

- Form3 2008 09Dokument9 SeitenForm3 2008 09api-3850174Noch keine Bewertungen

- Select Applicable Sheets Below by Choosing Y/N and Click On ApplyDokument69 SeitenSelect Applicable Sheets Below by Choosing Y/N and Click On ApplysreetomapaulNoch keine Bewertungen

- New Form 16 AY 11 12Dokument4 SeitenNew Form 16 AY 11 12Sushma Kaza DuggarajuNoch keine Bewertungen

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDokument4 SeitenForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424Noch keine Bewertungen

- Form 16Dokument2 SeitenForm 16orkid2100Noch keine Bewertungen

- Form No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDokument2 SeitenForm No. 16: Details of Salary Paid and Any Other Income and Tax DeductedSundaresan ChockalingamNoch keine Bewertungen

- Cit (TDS) : Emp CodeDokument3 SeitenCit (TDS) : Emp CodeMahaveer DhelariyaNoch keine Bewertungen

- Itr 62 Form 16Dokument4 SeitenItr 62 Form 16Hardik ShahNoch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- Air Brakes (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandAir Brakes (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- J.K. Lasser's Your Income Tax 2024, Professional EditionVon EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNoch keine Bewertungen

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnVon EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNoch keine Bewertungen

- Colour Sheet HouseDokument5 SeitenColour Sheet HouseBathina Srinivasa RaoNoch keine Bewertungen

- Ind-As 115 Education MaterialDokument146 SeitenInd-As 115 Education MaterialRanjan Rajourya100% (1)

- Colour Sheet HouseDokument5 SeitenColour Sheet HouseBathina Srinivasa RaoNoch keine Bewertungen

- Ap Book of Colours PDFDokument148 SeitenAp Book of Colours PDFsandeepNoch keine Bewertungen

- Zero-Based Budgeting Gets A Second LookDokument5 SeitenZero-Based Budgeting Gets A Second LookBathina Srinivasa RaoNoch keine Bewertungen

- Building A Better Partnership Between Finance and StrategyDokument4 SeitenBuilding A Better Partnership Between Finance and StrategyRaghvendra ToliaNoch keine Bewertungen

- Questions in GST - AKDokument2 SeitenQuestions in GST - AKBathina Srinivasa RaoNoch keine Bewertungen

- T Shape SkillsDokument3 SeitenT Shape SkillsBathina Srinivasa RaoNoch keine Bewertungen

- The CFOs Role in Helping Companies Navigate The Coronavirus CrisisDokument6 SeitenThe CFOs Role in Helping Companies Navigate The Coronavirus CrisisBathina Srinivasa RaoNoch keine Bewertungen

- Filing Procedure PDFDokument1 SeiteFiling Procedure PDFBathina Srinivasa RaoNoch keine Bewertungen

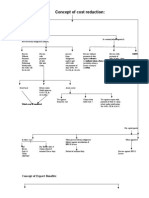

- Indirect TaxesDokument15 SeitenIndirect TaxesBathina Srinivasa RaoNoch keine Bewertungen

- Legal GuideDokument82 SeitenLegal GuideralgrigNoch keine Bewertungen

- Building A Better Partnership Between Finance and StrategyDokument4 SeitenBuilding A Better Partnership Between Finance and StrategyRaghvendra ToliaNoch keine Bewertungen

- 12 Physics Notes ch04 Moving Charges and Magnetism PDFDokument3 Seiten12 Physics Notes ch04 Moving Charges and Magnetism PDFBathina Srinivasa RaoNoch keine Bewertungen

- Contentious Issues in GST 11.10.2018Dokument24 SeitenContentious Issues in GST 11.10.2018Bathina Srinivasa RaoNoch keine Bewertungen

- Bhupendra ICAI Bglore GST - 12 Oct 2018 - FinalDokument10 SeitenBhupendra ICAI Bglore GST - 12 Oct 2018 - FinalBathina Srinivasa RaoNoch keine Bewertungen

- VBA Further v5.0Dokument61 SeitenVBA Further v5.0iwankurniaNoch keine Bewertungen

- Venkatramani Case Study On Input Tax Credit PDFDokument15 SeitenVenkatramani Case Study On Input Tax Credit PDFBathina Srinivasa RaoNoch keine Bewertungen

- Reclassification of Oci To P&L Example With EntriesDokument4 SeitenReclassification of Oci To P&L Example With EntriesBathina Srinivasa RaoNoch keine Bewertungen

- CPE Training Accountants Report by R Vikram PDFDokument45 SeitenCPE Training Accountants Report by R Vikram PDFBathina Srinivasa RaoNoch keine Bewertungen

- Important Treatments and Diclosures in IND As Collected From Different Balance Sheet of CompaniesDokument22 SeitenImportant Treatments and Diclosures in IND As Collected From Different Balance Sheet of CompaniesBathina Srinivasa RaoNoch keine Bewertungen

- Shipping For Duty DrawbackDokument12 SeitenShipping For Duty DrawbackshasvinaNoch keine Bewertungen

- Taxguru - In-Step Up To Ind As 101 First Time Adoption of Indian Accounting Standards IND-AsDokument6 SeitenTaxguru - In-Step Up To Ind As 101 First Time Adoption of Indian Accounting Standards IND-AsBathina Srinivasa RaoNoch keine Bewertungen

- Ebiz Steps PDFDokument59 SeitenEbiz Steps PDFBathina Srinivasa RaoNoch keine Bewertungen

- FEMA - NIRC ICSI - 07 Nov 2015 - Vijay Gupta - VKGN - FinalDokument88 SeitenFEMA - NIRC ICSI - 07 Nov 2015 - Vijay Gupta - VKGN - FinalBathina Srinivasa RaoNoch keine Bewertungen

- Full Book PP Sacm&Dd-2016Dokument377 SeitenFull Book PP Sacm&Dd-2016Bathina Srinivasa RaoNoch keine Bewertungen

- Roth Fee052912Dokument1 SeiteRoth Fee052912Bayu kristiantoNoch keine Bewertungen

- Retail Sector - GST GUIDEDokument13 SeitenRetail Sector - GST GUIDEBathina Srinivasa RaoNoch keine Bewertungen

- Testbanks FADokument7 SeitenTestbanks FAStela Marie CarandangNoch keine Bewertungen

- Loans and Advances (Mba Finance Internship Project)Dokument84 SeitenLoans and Advances (Mba Finance Internship Project)Niki niki83% (6)

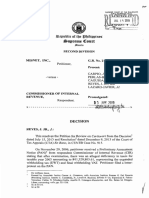

- Misnet Vs CIR PDFDokument9 SeitenMisnet Vs CIR PDFMiley LangNoch keine Bewertungen

- 2018 Integrated Report PDFDokument290 Seiten2018 Integrated Report PDFAndrea PalancaNoch keine Bewertungen

- Chapter 5Dokument15 SeitenChapter 5MisshtaCNoch keine Bewertungen

- Lesson 3 - Demand and SupplyDokument79 SeitenLesson 3 - Demand and SupplyRounak TiwariNoch keine Bewertungen

- Ratios For BCR Criteria 2011Dokument4 SeitenRatios For BCR Criteria 2011sherysameeNoch keine Bewertungen

- Palmetto Utilities, Inc. Petition To Increase Utility RatesDokument40 SeitenPalmetto Utilities, Inc. Petition To Increase Utility RatesKiana MillerNoch keine Bewertungen

- Determinants of Equity Share Prices in The Indian Corporate SectorDokument96 SeitenDeterminants of Equity Share Prices in The Indian Corporate SectorRikesh Daliya100% (2)

- Report On ADF FoodsDokument7 SeitenReport On ADF FoodsRadhakrishnan SrinivasanNoch keine Bewertungen

- Kids Space Center Business PlanDokument25 SeitenKids Space Center Business PlanDaily Hussle365Noch keine Bewertungen

- Profit and Loss Statement Template (Excel)Dokument1 SeiteProfit and Loss Statement Template (Excel)MicrosoftTemplates100% (7)

- Theory of Accounts Quiz 1Dokument3 SeitenTheory of Accounts Quiz 1Cris Tarrazona Casiple100% (1)

- Form 10C Guidelines SpecimenDokument8 SeitenForm 10C Guidelines SpecimenSandeep KumarNoch keine Bewertungen

- Conwi vs. CA (G.R. No. 48532 August 31, 1992) - 4Dokument8 SeitenConwi vs. CA (G.R. No. 48532 August 31, 1992) - 4Amir Nazri KaibingNoch keine Bewertungen

- Unit 1 TaxationDokument72 SeitenUnit 1 TaxationAnshul SinghNoch keine Bewertungen

- Drill Fs and Closing Entries 2Dokument2 SeitenDrill Fs and Closing Entries 2Kuroko TetsuyaNoch keine Bewertungen

- DSIJ3209Dokument84 SeitenDSIJ3209Navin ChandarNoch keine Bewertungen

- HCL Technologies Condensed Consolidated Interim Financial StatementsDokument47 SeitenHCL Technologies Condensed Consolidated Interim Financial StatementsraxenNoch keine Bewertungen

- Components of Director RemunerationDokument2 SeitenComponents of Director RemunerationusmancheemaNoch keine Bewertungen

- Robert Kiyosaki Michael MaloneyDokument5 SeitenRobert Kiyosaki Michael MaloneyOthman A. MughniNoch keine Bewertungen

- Final For Making FinalsDokument15 SeitenFinal For Making FinalsEmir AdemovicNoch keine Bewertungen

- HTTP - WWW - Aphref.aph - Gov.au House Committee Ewr Owk Report Chapter2Dokument22 SeitenHTTP - WWW - Aphref.aph - Gov.au House Committee Ewr Owk Report Chapter2edgartorno1Noch keine Bewertungen