Beruflich Dokumente

Kultur Dokumente

HMMM October 23 2011

Hochgeladen von

George AdcockOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HMMM October 23 2011

Hochgeladen von

George AdcockCopyright:

Verfügbare Formate

Hmmm

A walk around the fringes of finance

THINGS THAT MAKE YOU GO

To Subscribe to Things That Make You Go Hmmm..... click HERE

Everyone needs the ECB to step up to the plate. The ECB has no excuse not to act. In trying to keep its monetary virginity intact, the bank threatens to destroy the Euro Zone. If that happens, nobody will be able to profit from its virginity.

PAUL DE GRAUWE

320

340

0 30

28 0

260

20 Simple Math: The total overall cap [of the ESM] is 500 billion Euros 160 billion Euros has been spent 340NW Euros remains billion 340 billion Euros + zero Euros = 940 billion Euros

40

Mike Shedlock, on the latest European Masterplan to merge the EFSF + ESM

NE

60

240

SW

Abraham Lincoln

220

The trouble with quotes on the internet is that its difficult SE to determine whether or not they are genuine

E

0 12

80

10 0

23 OctOber 2011

140

16 0

180

20

THINGS THAT MAKE YOU GO

Hmmm...

2.

ee Richmond, meet everybody. Everybody? Meet Lee Richmond.

Its difficult to put an exact number on the number of games of professional baseball that have been played since 1900 most estimates seem to be clustered around the high 300,000s though. For the purposes of this exercise, I am going to take the number provided in no-nonsense fashion by Wiki answers: 390,536. In amongst those 390,536 games were home runs, walks, steals, strikeouts and singles, doubles and triples too numerous to keep track of; or rather, just too numerous for anyone but the most die-hard of stat geeks to even contemplate tallying. (at this point, I should apologise to any non-baseball fans amongst you for whom the terms used above have induced a frantic bout of head-scratching and a desire to skip ahead stick with me for a while longer and the fog will clear I promise). Part of the innate beauty of baseball to me is the fact that (certainly in the modern era), game by game, season by season every aspect of it is measured, quantified and evaluated and the myriad ways the numbers can be dissected enables you to drill down into any part of it and gain a real understanding, through those numbers, of exactly what is going on. You cant fudge the numbers. The Oakland Athletics Billy Beane showed the power of this approach, which was documented so brilliantly in Michael Lewis Moneyball But lets get back to Lee Richmond.

In 1880 Richmond became the first of only 20 men in baseball history to pitch a perfect game when he pitched the Worcester Ruby Legs to a 1-0 victory over the Cleveland Blues at the Worcester Agricultural Fairgrounds on June 12. Think about that for a second. Over 130 years. 390,536 games. 2 teams in each contest. Thats 781,072 opportunities for a perfect game to be pitched or, to put it another way, the odds on a perfect game being pitched are 39,053:1 and rising. In fact, more people have orbited the moon than have pitched a MLB perfect game and NOBODY has done it more than once. (At this point I will again attempt to keep the non-baseball aficionados with us by the use of this short explanation of a perfect game: A perfect game is defined by Major League Baseball as a game in which a pitcher (or combination of pitchers) pitches a victory that lasts a minimum of nine innings and in which no opposing player reaches base. Thus, the pitcher (or pitchers) cannot allow any hits, walks, hit batsmen, or any opposing player to reach base safely for any other reasonin short, 27 up, 27 down) Interestingly enough, although it is technically possible for multiple pitchers to combine for a perfect game, to date, every major league perfect game has been thrown by a single pitcher. That record needs to change. And fast.

R

23 OctOber 2011

fractured and faltering alliance are sending pitcher after pitcher to the mound (sometimes in groups of two or three) trying to combine for the perfect game that they NEED in order to escape the debt trap they have backed themselves into.

ight now, the team comprising the ECB, EU and the various parliaments that make up that

THINGS THAT MAKE YOU GO

Hmmm...

3.

Being in a situation where you lose unless you can pull something off against odds of multiple-thousands to one and pitch a perfect game is a ridiculous spot in which to find yourself, but as this month has rolled by, it has become ever-more apparent that that is precisely where the Brussels Eurocrats now find themselves. It appears as though, as the pressure has ratcheted up this week, we are now in the ninth inning. Personally, my own belief (as regular readers are by now well aware) is that the very best the Eurocrats can hope for is to extend the game by an inning or two, but their arms are tired, their bullpen is empty and, at some point, we are going to see an absolute avalanche of runs scored against them as the whole thing finally topples under its own weight. This past week has been nothing short of farcical as the tension has built towards a crescendo that seemed at first to be willfully engendered in order to generate just enough sense of impending crisis to enable a resolution to be forced through in a similar fashion to that which preceded Henry Paulson and Ben Bernankes now-infamous closed-doors fright-fest (hyphenation alert!) that led to the passing of the TARP in late 2008.

any and all capitulation towards outright bailouts (or QEU) must at least be seen to be against the will of the Germans and that proviso goes a long way towards explaining the raft of headlines that have flooded the reuters and Bloomberg screens of investors all around the world this week. We have seen misdirection, scaremongering, u-turns and abject incompetence as well as the kinds of leaks that are, frankly, laughable the prime example being the leaked draft copy of the Euro Summit statement which was printed, in its entirety, in the Daily Telegraph on Thursday coincidentally at the precise moment when things were starting to come unglued as it became clear that this Sundays Summit would NOT produce the magic bullet required. The statement itself is priceless. It begins with a bit of back-slapping for the passing of the EFSF (after no less than six months of wrangling and an eleventh-hour drama in Slovakia): The strategy we have put into place encompasses determined efforts to ensure fiscal consolidation as well as growth, support to countries in difficulty, and a strengthening of euro area governance. At our 21 July meeting we took a set of major decisions. The ratification by all 17 Member States of the euro area of the measures related to the EFSF significantly strengthen our capacity to react to the crisis. The agreement on a strong legislative package within the EU structures on better economic governance represents another major achievement. The euro continues to rest on solid fundamentals

bviously

It then moves on to more familiar ground; an agreement to display their strong determination to fix things. Nothing concrete, of course, but they sure as hell are determined: The crisis is, however, far from over, as shown by the volatility of sovereign and corporate debt markets. Further action is needed to restore confidence. That is why today we agree on additional measures reflecting our strong determination to do whatever is required to overcome the present difficulties. The rest of the text, should you want to read it, is here, but allow me to summarise it through a few select phrases that will save you the trouble of doing so: blah, blah, blah All Member States are determined, blah, blah, blah We want to reiterate our determination, blah, blah, blah We reaffirm clearly our unequivocal commitment that, blah,

23 OctOber 2011

THINGS THAT MAKE YOU GO

Hmmm...

4.

blah, blah All other euro area Member States solemnly reaffirm their inflexible determination, blah, blah, blah The euro area Heads of State or Government fully support this determination, blah, blah, blah All tools available will be used in an effective way to ensure financial stability in the euro area, blah, blah, blah We fully support the ECB, blah, blah, blah See. I told you they were determined. But, buried deep in the draft are (amazingly enough) some specific measures that will surely help solve the crisis: There will be regular Euro Summit meetings bringing together the Heads of State or government (HoSG) of the euro area and the President of the Commission. These meetings will take place at least twice a year The President of the Euro Summit will be designated by the HoSG of the euro area at the same time the European Council elects its President The President of the Euro summit will keep the non euro area Member States closely informed of the preparation and outcome of the Summits As is presently the case, the Eurogroup will ensure ever closer coordination of the economic policies and promoting financial stability. The President of the Euro Summit will be consulted on the Eurogroup work plan and may invite the President of the Eurogroup to convene a meeting of the Eurogroup, notably to prepare Euro Summits or to follow up on its orientations Work at the preparatory level will continue to be carried out by the Eurogroup Working Group(EWG) The EWG will be chaired by a full-time Brussels-based President. He/she should preferably also chair the Economic and Financial Committee Clear rules and mechanisms will be set up to improve communication and ensure more consistent messages.

and my personal favourite:

Its at this point that the non-Europeans amongst you are possibly finally beginning to get the joke that anybody caught in the tractor beam of ineptitude that is Europe (and by Europe I mean the bureaucratic construct rather than the land mass) has understood for years. THIS IS HOW EUROPEAN BUREAUCRACY WORKS, PEOPLE!!!! Millions of Euros spent on days of talks to come up with solutions that fail to address any REAL problems. Dont believe me? Article 47 of the Common Fisheries Policy will ensure that every fish caught by an angler is notified to Brussels so that it can be counted against that countries quota. If you go out for a days fishing and catch a couple of cod or mackerel you will now be required to notify the authorities or face a heavy fine. There are EU regulations on the greenness of the person on the pedestrian crossing lights.

23 OctOber 2011

THINGS THAT MAKE YOU GO

Hmmm...

5.

There are 3 separate EU directives on the loudness of lawnmowers. Regulation (EC) 2257/94 a great read, by the way stated that bananas must be free from malformation or abnormal curvature of the fingers. It also contained stipulations about the grade, i.e. the measurement, in millimetres, of the thickness of a transverse section of the fruit between the lateral faces and the middle, perpendicularly to the longitudinal axis ... And then there are cucumbers: Under regulation (EEC) No 1677/88 cucumbers are only allowed a bend of 10mm for every 10cm of length. Do you think any of those were drawn up in 10 minutes on a single piece of paper? No. (Actually, in fairness to Europe, they dont have a monopoly on silly legislation: there IS a law in Alaska that makes it illegal to push a moose out of a moving aircraft.) The Brussels bureaucracy has always been something of a laughing stock amongst the people of Europe - since long before the final creation of the EU, in fact. Way back in 1955, with a European union freshly on the drawing board ten years after the end of WWII, Russell Bretherton, an English Civil Servant was dispatched to Brussels to inform European ministers what Britain thought of plans for an ambitious new European treaty. Upon arrival, he had these words of wisdom for those assembled: Gentlemen, youre trying to negotiate something you will never be able to negotiate. If negotiated, it will not be ratified. And if ratified, it will not work. Three years later, the Treaty of Rome was signed, establishing the European Economic Community and from that day to this, the degree of meddling, interference and sheer bureaucracy has increased year after year until we find ourselves here. is broken and the people charged with trying to fix it are clearly not up to the job. There are way too many vested interests, too many national peccadillos and way too many good, old-fashioned egos in play for it to come down to anything but a last-ditch solution when they are forced into it - and that solution WILL be the printing of money in some shape or form which will help to magically inflate the debt away. The other alternatives are either just too painful (default/ forgiveness) or plain unworkable (growth). A look at a selection of newsflashes that hit screens this week shows just how ridiculous things have become as everybody involved in trying to sort out the mess that is Europe attempts to get themselves in front of a microphone in order to let the world know just how important they are. Some of these appearances, it would seem, are stage-managed for maximum effect on markets - others are simply self-important politicians who just cant bring themselves to utter the words no comment: *GERMAN COALITION SOURCES: MERKEL SAYS LEVERAGING EFSF VIA ECB IS RULED OUT *MERKEL TOLD LAWMAKERS MOVING FORWARD MILLIMETER BY MILLIMETER *ECB TRICHET: CANT USE MONPOL TO CORRECT FAILURES OF GOVERNMENTS *ECB NEVER ACTS AS A SUBSTITUTE FOR GOVERNMENTS: NEWSPAPER INTERVIEW *FINANCIAL STABILITY IS THE RESPONSIBILITY OF GOVERNMENTS *EMU HAS PRICE STABILITY TODAY; INFLATION EXPECTATIONS FIRMLY ANCHORED

urope

23 OctOber 2011

THINGS THAT MAKE YOU GO

Hmmm...

6.

*TRICHET REJECTS ASSERTION THAT ECB HAS OVERSTEPPED ITS LIMITS *TRICHET: EURO WILL EXIST IN 10 YEARS *SEIBERT SAYS `DREAMS OF SWIFT EURO SOLUTION WONT MATERIALIZE *GERMAN COALITION SOURCES: MERKEL SAYS LEVERAGING EFSF VIA ECB IS RULED OUT *DJN-DJ REPORT EFSF FIREPOWER TO REACH EUR2T TOTALLY WRONG-SOURCE *MERKEL SAYS NEXT EU SUMMIT IS `NOT THE END POINT FOR CRISIS *DJ GERMAN GOVERNMENT DOESNT EXCLUDE DELAYING OCT. 23 SUMMIT *MERKEL CANCELS FRIDAY SUMMIT ON LACK OF EFSF DETAILS *MERKEL CANCELS EFSF SPEECH ON DEADLOCK ON LEVERAGING: LAWMAKERS *FRANCE, GERMANY SEE NEED FOR GLOBAL, AMBITIOUS CRISIS RESPONSE And the piece de resistance: *MERKEL SAYS EUROZONE TALKS STUCK. FLIES TO FRANCE: REUTERS *SARKOZY SAYS EUROZONE TALKS STUCK, FLIES TO GERMANY: REUTERS Amidst this barrage of headlines, Nicolas Sarkozy was quoted in two articles which outlined his own fears for Europe: Allowing the destruction of the euro is to take the risk of the destruction of Europe. Those who destroy Europe and the euro will bear responsibility for resurgence of conflict and division on our continent. And... If there isnt a solution by Sunday, everything is going to collapse, Theres something eerily familiar about that last sentence. Lets see what Google Translate makes of the original French version, shall we?: If money isnt loosened up, this sucker could go down, Those words were uttered by another President on September 26, 2008 - a few days before TARP was passed into law.

a EuroTARP. The ECB have a brand new, never-been-used printing press just sitting there in a locked room waiting to be called into action. The only problem is; the Germans have the key to the door. How long they continue to try to do the right thing before capitulating is pretty much the only unknown quantity right now.

o matter how long this charade continues, it seems impossible to see how it doesnt end in

Having backed themselves into a hopeless corner early last week with promises of a solution come the end of this weekends summit, the Eurocrats have now postponed the decision until next Wednesday. On hearing this, the markets were eerily calm, as the UK Guardian noted: (UK Guardian): Investors thinking seems to be that the adoption of a new deadline - Wednesday, at the latest, according to last nights communiqu - could be construed as good news, or at least

23 OctOber 2011

THINGS THAT MAKE YOU GO

Hmmm...

7.

neutral from the point of view of share prices and bond prices. This theory says that more time to reach agreement makes a watertight plan more likely to happen. Really? The notion sounds like a triumph of hope over experience. Okay, last nights statement still promised a global, ambitious response to the crisis currently facing the eurozone but it seems just as likely that more time will simply entrench disagreements between Germany and France. As the clock ticks, the definition of ambitious could simply be watered down. But is this sense of calm justified? Well, in a word, no. the latest leaks out of the ongoing Crisis Summit paint an ugly picture about what happens next and, if the leaks are anything to go by, we are in for anything BUT a period of calm: (UK Daily Telegraph): Europes leaders are threatening to trigger a formal default on Greek debt and risk a credit event if banks refuse to accept losses of up to 140bn (120bn) on their holdings. Hardline eurozone members, backed by the International Monetary Fund (IMF), delivered the ultimatum this weekend after an official report found that in a worst-case scenario Greece could need a second bail-out of 450bn twice the current package and more than the entire 440bn in the eurozones rescue fund. Vittorio Grilli, a senior EU official, travelled to Rome yesterday to present the take it or leave it deal to the Institute of International Finance, which is leading the negotiations for the banks. The only voluntary element for the banks now is to take a 50pc haircut or face a credit event, a default, said an EU diplomat. Apparently, even a once-taboo idea of a centralized Treasury is also now on the table: (UK Daily Telegraph): European Union chiefs are drawing up plans for a single Treasury to oversee tax and spending across the 17 eurozone nations. The proposal, put forward by Herman Van Rompuy, the European Council president, would be the clearest sign yet of a new United States of Europe with Britain left on the sidelines. The plan comes as European governments desperately trying to save the euro from collapse last night faced a new bombshell, with sources at the International Monetary Fund saying it would not pay for a second Greek bail-out. Or how about an EFSF SPV that will attract money from our old friends the Sovereign Wealth Funds (surely, by now, even THEY are starting to understand the folly of investing in these things?): (UK Guardian): Finance ministers from the 17 eurozone countries are discussing the option of creating a special purpose vehicle for the European Financial Stability Facility (EFSF) in order to boost its current 440bn (383bn) lending capacity. The idea, according to sources, would be to attract further money from official and private investors, with the sovereign wealth funds of countries such as China, Singapore or Qatar a prime target. Some of these already invest in European banks such as Barclays and UBS. So here we are.

vernight,

23 OctOber 2011

THINGS THAT MAKE YOU GO

Hmmm...

8.

Europe are as mixed as ever, despite the clear need for a solution (which has been perhaps the only consistent communique for about two years now). Sadly for the Eurocrats, the time when they have to stop telling us how important a solution IS and actually devise one that WORKS is now at hand. Any more prevaricating and the markets will give them their solution whether they like it or not. The chances are that we will see another photo-op featuring the regions finance ministers this week as they unveil their latest plan that will fix everything. There will be a communique issued which lays out exactly how determined they are to solve everything and quantifies all the important steps they have so far taken as well as the improvements they are seeing in the finances of the PIIGS. There may be some criticism of the banks for forcing them to this point, and there will most likely be certain promises made about how they aim to extract retribution for their forced largesse, but they will take one more swing at a solution - one that stops short of the massive steps they need to take to shore things up once and for all. Then the markets will have their say. Ultimately, the only realistic way to fix Europes problems is to shovel money into the gaping hole that is the regions finances. Which means that the REAL question that has to be answered is fairly simple: Where is that money going to come from? Growth? Nope. Inflation? Not quickly enough. Forgiveness or default? Not if you dont want M. Sarkozys prediction coming true. The ECBs printing press? Only if you can change German minds. Until German minds are harder to change than the immutable laws of mathematics, I suspect we have our answer.

ts Sunday morning in Asia as I finish writing this weeks missive and the messages coming out of

The year was 1956, the pitcher that day was Don Larsen and, as the 27th opposing batter was finally struck out, Larsen leapt into the arms of a man whose words of wisdom have graced the cover of Things That Make You Go Hmmm..... on several occasions: Yogi Berra. The latest European Crisis Summit? Well, as Yogi would probably have said, its dja-vu all over again.

O S

nly one Perfect Game has been thrown in a World Series game - when it REALLY counted.

warnings of a French downgrade from top economists, warnings of a downgrade blitz across the EMU from S&P and a warning for Mario Draghi as he prepares to take the crown from Jean-Claude Trichets greying head in a little over a week. Morgan Stanley explain Europes Triangle of Terror, we hear how the EU is mulling over a $1.3 trillion fund and little Belarus is doing its bit to show that austerity is the way forward by heading to eBay.

o what do we have for you this week? Well, naturally, theres a whole lotta Europe including

23 OctOber 2011

THINGS THAT MAKE YOU GO

Hmmm...

9.

Amidst Bostons own Occupation we find some of the most delicious irony of the year, the next wave of mortgage-backed lawsuits is set to traumatize Wall Street yet again, Peter Tchir imagines the EFSF as a hedge fund and we investigate the mysterious China International Fund and its activities in Africa. Gillian Tett examines the possibility that there is a shadowy plot behind gold, we look at common equity to total asset ratios that are downright scary, examine Libyas population pyramid and examine the implications for other Arab nations and see how the cost of oil extraction and the yields on Italian government debt are both heading in the same direction. Finally, we put the price of gold in Weimar Republic Marks in stark perspective and hear from Rick Santelli, Doug Casey and Paul Brodsky who all have something important to say and do a damn fine job of saying it. Thats all for me for another week.

lay Ball!

As a result of my role at Vulpes Investment Management, it falls upon me to disclose that, from time-to-time, the views I express and/or the commentary I write in the pages of Things That Make You Go Hmmm..... may reflect the positioning of one or all of the Vulpes funds - though I will not be making any specific recommendations in this publication.

Grant

www.vulpesinvest.com

23 OctOber 2011

THINGS THAT MAKE YOU GO

Hmmm...

10.

Contents

Belarus Central Bank Seeks $16,000 Selling Cups, Suitcases, TV Top Economists Warn of France Downgrade S&P sees downgrade blitz in EMU recession, threatening crisis strategy Is there a shadowy plot behind gold? Raymond Flynn to Occupy Boston: Time to pack up... and leave EU Said to Weigh Combined $1.3 Trillion Fund African Safari: CIFs Grab for Oil and Minerals The Truth Behind Europes (1.7 Trillion) Triangle Of Terror The EFSF As A Hedge Fund Ready for the ruck? Charts That Make You Go Hmmm..... Words That Make You Go Hmmm..... And Finally.....

23 October 2011

Wall Streets New Nightmare: The Next Wave Of Mortgage-Backed Securities Claims

The Gonnie, Gonnie Banks

# 81 82 83 84 Bank Old Harbor Bank, Clearwater, FL Decatur First Bank, Decatur, GA Community Capital Bank, Jonesboro, GA Community Banks of Colorado, Greenwood, CO Total Cost to FDIC Deposit Insurance Fund Assets ($m) 215.9 191.5 181.2 1380.0 Deposits ($m) 217.8 179.2 166.2 1330.0 Cost ($m) 39.3 32.6 62.0 224.9 359.8

23 OctOber 2011

10

THINGS THAT MAKE YOU GO

Hmmm...

11.

Now, backed by bond giants Pimco and BlackRock, Texas lawyer Kathy Patrick is gearing up for a new legal assault on the financial industry.

er $8.5 billion Bank of America settlement over bad mortgage deals was just the beginning.

The biggest private legal settlement in the history of Wall Street was a few sentences away from death. In early June a little-known Texas lawyer named Kathy Patrick was putting the final touches on her carefully crafted $8.5 billion deal with Bank of America over so-called mortgage put-backs, when she got a last-minute demand from the other side. Sitting in her Houston office, Patrick learned that BofA wanted her clientsa clutch of the worlds most important investment firms, including BlackRock and Pimcoto promise they would not go after the bank with separate claims over the same mortgage pools.

...Its not every day that you write a letter to someone, the 51-year-old says, and tell them to take their $8.5 billion and shove it.

No way, she answered. As far as Patrick was concerned, she had made clear such a release was not on the table. Some of her clients had already filed securities claims against Bank of America. Its not every day that you write a letter to someone, the 51-year-old says, and tell them to take their $8.5 billion and shove it.

Bank of Americas gambit turned out to be a bluff. On June 29 the nations largest bank announced it had struck the second-biggest legal settlement in American history, trailing only the 1998 tobacco master settlement. Three weeks later BofA reported an $8.8 billion quarterly loss, the start of a long and difficult summer in Charlotte. Rather than celebrate a career-capping victory, Patrick viewed it a different way: round one. And that has Wall Street terrified right now. Publicly the financial industry and the White House are dancing around a potential $20 billion settlement being forced on the nations biggest banks by state attorneys general over improper foreclosure practices. Quietly and without fanfare, Patrick and her 23 bondholding giantsone of the most powerful investor groups ever assembled for litigationare gearing up for something equally big: a painful new reckoning for the mortgage-lending debacle, with most of Wall Streets big banks in her crosshairs. This group did not come together just to deal with Bank of America. They came together because they wanted a comprehensive industrywide strategy and an industrywide solution, Patrick tells FORBES. They started with Bank of America because they thought they could achieve a template that they could extend to other institutions.

O O O

FORBES.COM / LINK

it prints, is seeking to raise $16,000 selling office supplies and household items from coffee cups and suitcases to a used television and stereo. The Natsionalnyi Bank Respubliki Belarus is offering more than 500 items ranging in price from 480 rubles (8 cents at the official exchange rate) for a cardboard box to 37.2 million rubles for a tapestry featuring the medieval city of Pinsk, the bank said in a statement on the Minsk City Councils website. Unused items put up for sale include a pack of 30 paper bags for 1,295 rubles, a sugar bowl for 4,270 rubles and two suitcases for 44,928 rubles apiece. Used items include an Aiwa dictaphone for 591,429 rubles, a Horisont television for 417,958 rubles and 10 safes ranging from 8.8 million rubles to 11.2 million rubles.

elaruss central bank, which charges a world-leading 35 percent interest rate on the money

23 OctOber 2011

11

THINGS THAT MAKE YOU GO

Hmmm...

12.

This doesnt have anything to do with the situation with the countrys economy or the central banks financial wellbeing, said Aleksander Timoshenko, a central bank spokesman, by phone from Minsk today. The bank is simply selling things it doesnt need. People interested in buying the items on offer had between Oct. 11 and Oct. 16 to apply, said Maksim Matrunchik, the official who organized the sale. He declined to say how much money was raised. Belarus raised its benchmark refinancing rate on Oct. 14 for the 10th time this year, to 35 percent, to help stem a loss of foreign currency reserves. The former Soviet republic needed $3.5 billion in emergency funding from the International Monetary Fund in 2009 and is seeking another $7 billion from the IMF now, First Deputy Finance Minister Vladimir Amarin said Oct. 3, according to the state-run Belta news service. President Aleksandr Lukashenkos government is facing some serious problems with the economy, though theres little chance of a default on the countrys sovereign debt, said Chris Jarvis, the head of the IMF mission in Minsk, yesterday. Belaruss key rate is more than double Vietnams 15 percent, the second highest in the world.

O O O

BUSINESSWEEK / LINK

ditional measures become necessary to prop up indebted euro-zone members or to save ailing banks. With debt relief for Greece under discussion, it may be a question of when, not if.

op German economists are warning that Frances AAA rating could be in danger should ad-

Ever since Europes common currency crisis began erupting in earnest last year, two countries have been largely responsible for preventing a complete collapse of the euro zone: France and Germany. Without their support, Greece, Portugal and Ireland would have long since declared insolvency. This year, though, with the euro crisis going from bad to worse, it is looking increasingly likely that France may not be able to emerge unscathed. Indeed, leading German economists on Monday told the website of financial dailyHandelsblatt that French debt is likely to be downgraded in the months to come. A new bailout package for debt-stricken countries in the southern part of the currency union will also strain French state finances, Jrg Krmer, chief economist for the German banking giant Commerzbank, told the website. In the coming year, the country could lose its top AAA rating. Thorsten Polleit, chief economist of Barclays Capital Deutschland, agrees. The problems of their domestic banks could result in significant additional pressure for the financial situation of the French state, he told the Handelsblatt website.

CLICK TO ENLARGE

Increased concern about Frances ability to shoulder additional bailout burdens come as European leaders prepare to gather in Brussels this weekend to consult on the ongoing common currency crisis. Whereas European Union leaders agreed in July to a second bailout package for Greece, including a debt haircut of 21 percent, most now say that the new package -- worth 109 billion ($150 billion)

SOURCE: DER SPIEGEL

23 OctOber 2011

12

THINGS THAT MAKE YOU GO

Hmmm...

13.

-- is nowhere near enough. Many think that Greek debt could be slashed by as much as 50 percent or even more. With French banks holding significant quantities of Greek debt on their books, however, an already heavily indebted Paris would likely have to plunge even further into the red to recapitalize its banks. Highlighting the problem, the ratings agency Fitch placed several French financial institutions on its watch list last week while Standard & Poors downgraded BNP Paribas on Friday. Furthermore, France has been battling budget deficit problems of its own in recent years. Just a few weeks ago, Paris announced an austerity program aimed at bringing its deficit, which is projected to be 5.7 percent of gross domestic product this year, to below the EU-mandated ceiling of 3 percent by 2013. Its overall debt stands at 85.5 percent of annual GDP, well above the EU limit of 60 percent. Any additional expenditures relating to bank bailouts -- or even additional euro-zone bailouts -- would slow the countrys return to fiscal health. The current state of French finances, Polleit told Handelsblatt, is anything but reassuring. French banks, though, do not represent Frances only Achilles heel. Europe just recently boosted the bailout fund known as the European Financial Stability Facility (EFSF) to increase its lending capacity to 440 billion.

O O O

DER SPIEGEL / LINK

& Poors (S&P) is to warn that a double-dip recession in Europe would imperil Frances AAA rating and set off a string of downgrades across Southern Europe, undermining the EUs debt crisis strategy. The EU-IMF bail-out machinery would require an extra 250bn or more to stabilize eurozone debt markets, forcing Germany and EUs creditor states to vastly increase rescue commitments.

tandard

... a lead to a downgrade of one or two notches for France, Spain, Italy, Ireland and Portugal,

The report, due Friday, said a double-dip recession would lead to a downgrade of one or two notches for France, Spain, Italy, Ireland and Portugal, both because of tumdouble-dip recession would bling tax revenues and the extra costs of propping up banks. The scenario looks increasingly likely after Germany slashed its growth forecast from 1.8pc to 1pc for 2012. Greece and Portugal are contracting at alarming speeds. Italy and Spain are already in industrial recession.

Confidence surveys have fallen off a cliff over past three months, said Marchel Alexandrovich from Jefferies Fixed Income. The lagged effects of fiscal and monetary tightening are still working their way through the system so it looks highly likely that we are in recession now. Drastic loan shrinkage as banks rush to meet new capital requirements before next June risk intensifying the downturn, and may lead to a credit crunch. Alberto Gallo from RBS said deleveraging by Europes lenders could reach 5.1 trillion over coming years, partly through asset sales and run-offs. The S&P warning comes at an explosive moment as German lawmakers balk at French demands for yet bigger bail-out pledges. The French want more money from Germany than we are prepared to take on our shoulders, said Otto Fricke, Bundestag leader of the Free Demoracts (FDP) in Chancellor Angela Merkels coalition. A French-led group of states want a full mobilization of the European Central Bank (ECB) to back-stop

23 OctOber 2011

13

THINGS THAT MAKE YOU GO

Hmmm...

14.

the system and halt the vicious cycle, perhaps by allowing the EUs 440bn rescue fund (EFSF) to borrow from the ECB credit window. The proposal - backed by Washington and key financial players worldwide - was shot down by German finance minister Wolfgang Schauble on Thursday as a breach of EU Treaty law. Germany will not accept this: it is not even open to discussion, he said.

O O O

UK DAILY TELEGRAPH / LINK

there in the world today, a cabal of western central bankers is secretly determined to manipulate the worlds markets. They are doing this not via interest rates, but by rigging gold prices. More specifically, they have kept bullion prices artificially low in recent decades to ensure that our so-called fiat currency system that is, money created by central banks continues to work. For if the public ever knew the real price of gold, we would finally understand that our currencies, such as the dollar, are a sham hence the need for that central bank plot. Does this sound like the ranting of a Tea Party activist? A Hollywood screenplay? Or could there be a grain of truth in it? The question has been provoking hot debate among a small tribe of investors in America for many years, particularly those owning gold mining stocks. Right now it is also leaching into the more mainstream American political world. As Republican candidates jostle ahead of the 2012 election, the question of whether Americas central bank has been debasing its currency and how that is (or is not) linked to the value of gold is cropping up with new force. Herman Cain, the former pizza executive who is now a popular Republican contender, hinted last month that he would like to return to a world where a dollar is a dollar and added that yes, we do need a gold standard for that. More recently, Newt Gingrich has voiced the same idea. Ron Paul, an outside Republican contender, has been lambasting the Federal Reserve for years over its easy money policies. He is now darkly warning of plots. A group called American Principles in Action created a Gold Standard 2012 platform last year and is now fighting to make these issues an election issue next year. And on the extremes of the Republican party and more libertarian circles of American life a flock of theories about gold are now circling around, and taking root in the fertile soil of the internet. I attended a dinner last week where Chris Powell, the treasurer of the Gold Anti-Trust Action Committee (Gata), was talking. Powell, an investigative journalist based in Connecticut, co-established Gata with a former commodities trader two decades ago, and he is convinced that the American government has long been manipulating gold prices as a matter of national policy. Gold is a currency that competes with government currencies and has a powerful influence on interest rates and the value of government bonds, Powell explains. This is why central banks have tried to control usually suppress the price of gold. This rigging continues even today, he adds. Never mind the fact that the gold price has soared by 22 per cent in a year: to Gata it remains far below the proper non-manipulated price. Thus, when the gold price tumbled last month, Powell blamed this on central banks, who meant to knock down the gold price at a crucial moment. (Check out www.gata.org for the arguments in full.)

ut

23 OctOber 2011

14

THINGS THAT MAKE YOU GO

Hmmm...

15.

Unsurprisingly, central bankers vehemently reject this plot idea. Indeed, when I pressed some of them on it, they laughed. I never heard anything about any plots during my time at the Fed we barely talked about gold at all, splutters one former Fed vice-chairman, who points out that the Fed does not actually own any gold itself. Or as a European banker says: How could we have secret deals for years, but nothing ever leaked? High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. For my money, though, I think there are at least two reasons why it would be foolish simply to deride or ignore Gata...

O O O

GILLIAN TETT / LINK

to a Boston police report, a disgruntled homeless man got into an argument at 6:15 p.m. with Occupiers because he had nowhere to stay. The man urinated on a tent and then allegedly pulled a knife on a group of 10 shocked protesters. No one was stabbed but several protesters later told cops they felt threatened by the incident. Cops assigned to the site grabbed the man, searched him and found a hypodermic needle and a knife. The blade was seized, but the alleged victims would not provide their names to police, so the man was not arrested, police said.

ccording

... They come in here and theyre looking at it as a way of getting a free meal and a place to crash, which is totally fine, but they dont bring anything to the table at all. It gets really frustrating.

Vigilant officers intervened in the situation and quickly de-escalated it, Boston police spokeswoman Elaine Driscoll said. Menino yesterday downplayed the problems, repeating that the demonstrators can stay as long as they are peaceful. He said hes not concerned about police costs. It is not right now a drain on resources, he said.

The incident highlights an emerging rift between the Occupiers and homeless, who have moved into the tent city to feast on freebies. Occupy protesters and a law enforcement source said cellphones, laptops and other items have been swiped from tents, but Driscoll said the department has received no reports of robberies. The homeless people are down there lurking around, a law-enforcement source told the Herald. Some of them are mentally ill and criminally insane. The potential is there for problems. Demonstrator Andrew Warner, 36, said homeless people are hijacking tents, getting drunk, passing out and stealing. Its turning into us against them, Warner said. They come in here and theyre looking at it as a way of getting a free meal and a place to crash, which is totally fine, but they dont bring anything to the table at all. It gets really frustrating. Jackson Bush, manning the Occupy information tent yesterday, said some homeless people have been hoarding free items, including donated coats. We do have homeless people and people addicted to drugs who need to steal things, Bush said. Theyre getting more than they need and trading it off. What we noticed is all the new jackets are disappearing quickly.

O O O

BOSTON HERALD (THANKS MB) / LINK

23 OctOber 2011

15

THINGS THAT MAKE YOU GO

Hmmm...

16.

debt crisis by combining the temporary and planned permanent rescue funds, two people familiar with the discussions said. Negotiations over pairing the two funds as of mid-2012 accelerated this week after efforts to leverage the temporary fund ran into European Central Bank opposition and provoked a clash between Germany and France, said the people, who declined to be identified because a decision rests with political leaders. Disclosure of the dual-use option helped reverse declines in U.S. stocks and the euro on speculation it could help break the deadlock among European leaders. Their wrangling led to the scheduling of a summit three days after an Oct. 23 gathering. Incrementalism is better than holding pat, said Marc Chandler, chief currency strategist at Brown Brothers Harriman & Co., in a telephone interview from London. This is incrementalism.

uropean governments may unleash as much as 940 billion euros ($1.3 trillion) to fight the

... Officials have discussed scrapping Article 34 of the ESM treaty, which sets the combined lending cap

The 440 billion-euro European Financial Stability Facility has already spent or committed about 160 billion euros, including loans to Greece that will run for up to 30 years. It is slated to be replaced by the European Stability Mechanism, which will hold 500 billion euros, in mid-2013.

A consensus is emerging to start the permanent fund in mid-2012, the people said. During the transition between the two funds, euro-area governments originally agreed to cap overall lending at 500 billion euros, a figure deemed sufficient when Greece, Ireland and Portugal were the primary victims of the debt crisis. Widening bond spreads in Italy, Spain, Belgium and France have thrown off those calculations, with multiple uses --primary and secondary market bond purchases, credit lines and bank aid in addition to loans to governments -- now planned for the rescue instruments. Officials have discussed scrapping Article 34 of the ESM treaty, which sets the combined lending cap, the people said. A revised treaty is due to be signed by the end of November and requires approval by the 17 euro-area governments, usually in parliamentary votes.

O O O

BLOOMBERG / LINK

frica has become one of Chinas most important energy sources. Nowhere on the continent is

this more evident than in Angola, Chinas second-largest oil supplier, trailing only Saudi Arabia.

According to Chinese customs data, Angolas oil exports to China increased to 40 million tons last year from 16.2 million tons in 2004. Chinas state-run oil companies, mainly Sinopec Group, have won a number of drilling concessions. The countrys oil fields now account for 16 percent of all foreign crude shipped to Chinese refineries. In exchange, China writes loans and builds infrastructure. Chinese enterprises have undertaken infrastructure projects ranging from highways and railroads, to airports and public housing. NonChinese media outlets say about 70,000 Chinese laborers have worked at Angolan construction sites. Lubricating deals between China and Angola is a small group of deal brokers headed by Hong Kong-based Sam Pa and Lo Fong Hung. Theyre at the core of concerns called China International Fund (CIF) and China Sonangol, CIFs joint venture with Angolas state oil company Sonangol. In

23 OctOber 2011

16

THINGS THAT MAKE YOU GO

Hmmm...

17.

these capacities, theyve demonstrated unparalleled power. CIFs activities have attracted critical attention from various researchers. In 2009, British foreign policy think tank Chatham House and the U.S.-China Economic & Security Review Commission began in-depth studies of the Pa and Los dealings to clarify CIFs mysterious background and vast influence. An August 2010 report in the Economist magazine gave the CIF-Angola connection wide exposure. Reporters at Columbia Universitys Toni Stabile Center for Investigative Journalism started looking into CIF and its various business ventures around the world last year. They recently completed the probe, and the center has given Caixin exclusive permission to publish the investigative teams justcompleted report in this edition. Meanwhile, Caixin reporters conducted and completed a parallel probe in Beijing and Hong Kong that traced CIFs controversial activities in Angola, as well as its links to the Chinese government. Portions of this report, which likewise appears in this edition, were based on a previously undisclosed Ministry of Commerce study with surprising conclusions. He was an outgoing Hong Kong businessman with a toothbrush moustache, multiple aliases, and his friends say, a fondness for women and fast cars. She was an older Chinese matron who liked to tell friends and business associates that she was once Deng Xiaopings translator.

... the CIF network acquired shares in a dozen Angolan oil blocks and diamond concessions in Zimbabwe. It also got a lucrative mining contract in Guinea, which has the worlds richest iron ore and bauxite deposits

Eight years ago, the two of them formed a business to sell oil and minerals to China. It didnt matter that Sam Pa and his partner Lo Fong Hung had little money and no experience in the oil business. They had good timing and high-level connections.

When they formed the China International Fund (CIF) in Hong Kong in 2003, China had just begun looking toward Africa as a source of oil. At the same time, oil-rich Angola had just emerged from 27 years of civil war and desperately needed to rebuild its devastated infrastructure. The International Monetary Fund, however, was reluctant to lend money unless Sonangol, the national oil company, cleaned up its accounts, published its audit reports and the government cracked down on corruption. A 2006 IMF report cited concerns regarding Sonangols deep-rooted governance and corruption issues. In 2005, CIF announced a US$ 2.9 billion line of credit to rebuild infrastructure in Angola. The same year, China Sonangol, CIFs Hong Kong-registered joint venture with Sonangol, became the broker of oil sales to China from Angola, which has since become Chinas No. 1 source of oil. In the years that followed, the CIF network acquired shares in a dozen Angolan oil blocks and diamond concessions in Zimbabwe. It also got a lucrative mining contract in Guinea, which has the worlds richest iron ore and bauxite deposits. In 2008, it took over what was once the most famous address in American finance: 23 Wall Street, the headquarters of the worlds first billion-dollar corporation, JP Morgan Co. Today CIF is the center of a transnational network of over 60 interlocking companies in the investor friendly regimes of Singapore and Hong Kong and the offshore havens of Bermuda, the British Virgin Islands and the Cayman Islands.

O O O

CAIXIN / LINK

23 OctOber 2011

17

THINGS THAT MAKE YOU GO

Hmmm...

18.

time to forget about Europes headlines for 15 minutes and refresh what is really going on in Europe, and why European leaders are scrambling day to day to come up with a solution to what is ultimately an intractable problem. Technically, the problem, as explained below, is manifested in three distinct symptoms, which exist in a self-referencing feedback loop that amplifies good input signals when times are good (and incremental debt is ample) and vice versa, or become a toxic spiral where one problem is amplified in the other two, when the system is caught in a deflationary spiral, until the entire system is threatened by collapse. The three problems are summarized best in a chart by Morgan Stanleys Huw Van Steenis (see below) in what we have dubbed the Triangle of Terror - these are i) Bank Solvency, ii) Sovereign Stress, and iii) Bank Funding Stress. At the end of September, Europe found itself in a perfect storm, in which concerns about all three hit peak levels. Since then, fears have subsided somewhat, following ECB intervention and rumors of bank recaps, not to mention an attempt to control sovereign solvency via a naked CDS ban, yet the festering question of overall Sovereign Stress remains. And what is worse, in a replica of a game of financial communicating vessels, any time there is an improvement in one or two, it is the third that gets beaten down. This explains why while banks have seen a boost in confidence expressed by rising stock prices, now that Europe is addressing Bank Solvency and Bank Funding Stress via actions of the ECB and SOURCE: MORGAN STANLEY CLICK TO ENLARGE the EFSF (the fact that the EFSF is even needed, when the Fed could address both issues at the same time, shows how woefully incapable the ECB is to deal alone with Europes problems), sovereign spreads have exploded, and OAT-Bund spreads hit all time wides overnight. All that said, the core problem at the very heart of European instability, is nothing more than, you guessed it, excess debt, 1.7 trillion worth of it to be precise: this is how much debt has to be rolled over the next 3 years, and also explains the magical 2 trillion number needed for the EFSF as only something that big can i) backstop the debt roll and ii) insure the needed bank recap, which in reality needs more like 400 billion but that is the topic of a different post. And without the abovementioned support pillars of bank solvency, funding and sovereign stress being address and fixed, in a credible manner and at the same time, this debt will not be able to roll, and effectively lead to systemic European insolvency. And that, in a nutshell, is what the issues facing Europe are. Everything else is headlines, smoke and mirrors.

O O O

ts

ZEROHEDGE / LINK

EFSF walks into a meeting with a potential investor. EFSF is looking to raise some additional capacity so needs to borrow some money.

with a decent analysis. In the meantime, here is something to think about.

here are still so many alternatives on the table and each is so confusing it is hard to come up

23 OctOber 2011

18

THINGS THAT MAKE YOU GO

Hmmm...

19.

The meeting starts off great. The investor is told that EFSF has 780 billion of capital. That is amazing, says the investor, not many people walk through the door with that much capital at launch. The investor is curious as to when the fund will get the funding. For the first time, EFSF looks a bit uncomfortable and has to explain it doesnt really have funding, it just has some guarantees. The investor is a bit confused about this since they would rather have money than guarantees, but decides that if the guarantors are good enough, maybe its okay. The EFSF instantly replies that the guarantors are great, they are all highly rated. Well, some of them are at least. Well, actually a few are so weak that they wont actually ever provide the guarantees, they just let us include them in the pitchbook so we could have a bigger number. The Investor is getting a little nervous at this time, but still intrigued, so wants to know how much from the good guarantors? They are reasonably happy that the answer is 726 billion. Still very impressive, but at least a little confused why they bother with the 780 billion. Their experience as investors tells them that when someone lies a little, they tend to lie a lot. The next obvious question is what are they going to do with the investors money, that doesnt have cash below it, just has some guarantees that would take losses before them. The EFSF proudly announces that it is going to pay as much as possible to prop up weak banks and countries throughout the Eurozone. The investors sit there with stunned looks on their face. The EFSF fully enjoying how awestruck the potential investors are, explain that there are many countries and some banks that cannot receive the financing that they need because they are having cash flow problems, are over leveraged, and quite simply are in deep trouble unless someone is will to buy their bonds at aggressive prices. As the investors finally regain their composure, they are sure they must have misunderstood. So, your business plan is to go and buy stuff that no one wants, that is unlikely to ever be in position to repay the debt, and you arent even price sensitive? The EFSF guys are getting very excited, they can tell this investor is on the hook, and now all they have to do is reel them in. They explain that it is even better than that. A couple of the big guarantors are in trouble themselves, but by buying their bonds we help ensure that they dont default...

O O O

PETER TCHIR (VIA ZEROHEDGE) / LINK

the end of October, after eight years in the top job, Jean-Claude Trichet will pass the presidency of the European Central Bank (ECB) to Mario Draghi. Italys leading central banker thus takes his place in the front row of the fight to push back the euro crisis, bearing every bit as heavy a responsibility as chancellors and presidents. Whatever plans Europes political leaders draw up at their summit on October 23rd, the ECBs new head will be a vital part of their successor failure. Mr Draghi has much in common with the Frenchman he is following. Both have had long careers in public life, including stints at their finance ministries and heading their national central banks. As chairman of the Financial Stability Board, Mr Draghi has been leading international efforts to remedy the ills of global banking. Besides his strong credentials for the job, Mr Draghi shares with Mr Trichet a pragmatic streak, a desirable characteristic when confrontSOURCE: ECB/ECONOMIST

23 OctOber 2011

19

THINGS THAT MAKE YOU GO

Hmmm...

20.

ing a challenge as grave as the euro crisis. Not all of Mr Draghis background works in his favour. His brief excursion into the private sector, working at Goldman Sachs between 2002 and 2005, might in some circles be seen as betokening welcome breadth in a central banker, but it has made others suspicious that he might be overly lenient towards banks. And then there is the matter of his nationality. Nationality is not supposed to count at the supranational ECB; but it always does. Until the start of this year it looked likely that Axel Weber, then the head of the German Bundesbank, would take over the ECB: a popular prospect with the German public and other onlookers who doubt the anti-inflationary zeal of the non-teutonic. But Mr Weber could not stomach some of the measures the ECB was taking in response to the euro crisis and bowed out of the race. German public opinion was sceptical of Mr DraghiMamma mia!, the newspaper Bild imaginatively began an article on the horror of his candidacy. But the Italian has seduced his critics by endorsing Germanys tough line on inflation (Bild now says hes an honorary German). Given the horrendous mess being bequeathed to him, he must be wondering whether the wooing was worth it...

O O O

ECONOMIST / LINK

23 OctOber 2011

20

CHARTS THAT MAKE YOU GO

Hmmm...

21.

other chart illustrates the vulnerability of European banks than the following. We use the simple common equity to total asset ratio, which excludes the risk weighting of assets and tiering of capital. It may be too simplistic and distort cross-country comparisons, but it is certainly revealing, if not shocking. The bank recapitalization in Europe will be a difficult task and its no wonder they need more time to reveal the plan. Stay tuned.

O O O

BARRY RITHOLTZ / LINK

CLICK TO ENLARGE

SOURCE: MILKEN INSTITUTE/MACROMON

the US and Europe have remained fixated on the simmering sovereign debt crisis in Euroland, the Arab world has been experiencing waves of demonstrations, protests and civil wars that have seen the fall of three major regimes thus far in 2011, with several others struggling to find equilibrium.

hile

The underlying forces beSOURCE: DSHORT hind the Arab Spring are complex and vary from country to country. But a key factor is demographics, as a glance at the population pyramids below suggests. A common denominator of the three is an aging ruling party unable to control a population bulge of young adults afflicted by high unemployment, food inflation, corruption, an absence of political freedoms and generally poor living conditions.

O O O

DOUG SHORT / LINK

23 OctOber 2011

21

CHARTS THAT MAKE YOU GO

Hmmm...

22.

next time you hear someone asserting that oil extraction was always difficult and expensiveas a way to refute the very high cost now of the marginal barrelyoull know theyre spinning a folk tale. A helpful chart from the just released EIA Annual Energy Review shows that the capital required to add an additional barrel of oil to reserves experienced a step change starting last decade. The chart uses the COE unit (crude oil equivalent) which is a way to measure the cost of adding 5.8 million btu regardless of whether the resource is oil, natural gas, or natural gas liquids.

he

CLICK TO ENLARGE

Two points are relative here. Firstly, the spike is concurrent with the six year peak in global oil production, which began in 2005. This should be rather obvious, if not expected. Secondly, however, there is another cost associated with our attempt to obtain the next barrel of liquid fossil fuels in our new, resource-constrained era. These resources are difficult to access and extract precisely because a more aggressive disturbance of the earth must be undertaken to secure them.

O O O

SOURCE: GREGOR.US

GREGOR / LINK

10 year surges over 7% (the so-called breaking point for their fiscal situation), then the whole game gets kicked to a new level. The ECB can intervene as they did back in August, but the market will continue to push the envelope as they realize the ECB is only a loose buyer of the bonds. A 7% 10 year on Italian bonds might just be the trigger point for E-bonds? Either way, its hard for me to imagine that were not going to see a situation in the coming months where the markets dont force Europe into some sort of fiscal action on the sovereigns themselves.

O O O

s Ive mentioned on several past occasions, this is the indicator to keep an eye on. If the Italian

CULLEN ROCHE / LINK

CLICK TO ENLARGE

SOURCE: REUTERS/PRAGCAP

23 OctOber 2011

22

CHARTS THAT MAKE YOU GO

Hmmm...

23.

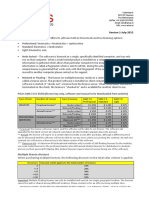

Date

January 1919 September 1919 January 1920 September 1920 January 1921 September 1921 January 1922 September 1922 January 1923 September 1923 October 2 1923 October 9 1923 October 16 1923 October 23 1923 October 30 1923 November 5 1923 November 30 1923

German Marks Needed To Buy One Ounce Of Gold

170.00 499.00 1,340.00 1,201.00 1,349.00 2,175.00 3,976.00 30,381.00 372,477.00 269,439,000.00 6,631,749,000.00 24,868,950,000.00 84,969,072,000.00 1,160,552,882,000.00 1,347,070,000,000.00 8,700,000,000,000.00 87,000,000,000,000.00

13 weeks

1919 - 1923 Weimar Republic

The reason for Germanys strident lack of any inclination to relent and print money...

Note: Brief Period Of DEflation

10

1918 1919 1920 1921

1922 1923

23 OctOber 2011

23

WORDS THAT MAKE YOU GO

Hmmm...

24.

first chance to hear him speaking. In this great interview with Chris Martenson, he discusses how The Seeds of Our Destruction Were - And Still Are - Sown in the Bond Markets. Paul and his partner Lee Quaintance are two of the brightest minds in the business so take this opportunity to gain their valuable perspective:

aul Brodsky is a frequent visitor to these pages but this is our

All the way through 2006 a monetary aggregate called M-3, which was the only aggregate that included repurchase agreements (which is the process by which banks fund themselves with each other) grew almost 12% a year. It is an enormous amount and that basically tells you that this overnight lending among banks provided the fuel from which all of the term credit, the 30-year mortgages, auto loans, and CLICK TO LISTEN revolving consumer credit came - which of course has never been paid down from whence it came. So in effect, we knew that the system became highly susceptible to any hiccup. So the system is levered at least 20 to 1 and there is effectively 20 times more debt than money with which to repay it... If it looks like a ponzi scheme and smells like a ponzi scheme.....

Santelli talks to Eric King about the Fed, the Occupy Wall Street movement, global inflation, the current crisis in Europe and much more...

ick

CLICK TO LISTEN

Caseys words regularly grace the pages of Things That Make You Go Hmmm..... and today we get to watch him being interviewed by Tommy Humphreys in an interview that Doug himself feels is one of the best hes given...

oug

CLICK TO WATCH

23 OctOber 2011

24

and finally

Thanks AR!

Hmmm

SUBSCRIBE UNSUBSCRIBE

GRANT WILLIAMS 2011

COMMENTS

23 OctOber 2011

25

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- HMMM Jan 08 2012Dokument28 SeitenHMMM Jan 08 2012George AdcockNoch keine Bewertungen

- Economic Outlook: Knife's Edge: Harvey RosenblumDokument19 SeitenEconomic Outlook: Knife's Edge: Harvey RosenblumGeorge AdcockNoch keine Bewertungen

- "Acta Est Fabula, Plaudite!": Things That Make You GoDokument27 Seiten"Acta Est Fabula, Plaudite!": Things That Make You GoGeorge AdcockNoch keine Bewertungen

- Cebr World Economic League Table Press Release 26 December 2011Dokument3 SeitenCebr World Economic League Table Press Release 26 December 2011fbonciuNoch keine Bewertungen

- HMMM November 20 2011Dokument27 SeitenHMMM November 20 2011George AdcockNoch keine Bewertungen

- To Subscribe To Things That Make You Go Hmmm..... ClickDokument26 SeitenTo Subscribe To Things That Make You Go Hmmm..... ClickGeorge AdcockNoch keine Bewertungen

- HMMM TDDokument3 SeitenHMMM TDGeorge AdcockNoch keine Bewertungen

- To Subscribe To Things That Make You Go Hmmm..... ClickDokument26 SeitenTo Subscribe To Things That Make You Go Hmmm..... ClickGeorge AdcockNoch keine Bewertungen

- Pimco Io Nov Global - FinalDokument4 SeitenPimco Io Nov Global - FinalGeorge AdcockNoch keine Bewertungen

- Are We Reaching "Limits To Growth"?Dokument7 SeitenAre We Reaching "Limits To Growth"?George AdcockNoch keine Bewertungen

- Speech: Economic Activity and Housing Finance in SwedenDokument5 SeitenSpeech: Economic Activity and Housing Finance in SwedenGeorge AdcockNoch keine Bewertungen

- Impact of Short Selling Bans in EuropeDokument5 SeitenImpact of Short Selling Bans in EuropeGeorge AdcockNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Your Risk ManagementDokument8 SeitenYour Risk ManagementBen FranklinNoch keine Bewertungen

- Lecture Engineering Economics FE Review ProblemsDokument23 SeitenLecture Engineering Economics FE Review ProblemsLee Song HanNoch keine Bewertungen

- Revenue GenerationDokument25 SeitenRevenue GenerationRon HudsonNoch keine Bewertungen

- ECOFIN Finland S Position PapersDokument6 SeitenECOFIN Finland S Position PapersAnyela NietoNoch keine Bewertungen

- Frog's LeapDokument4 SeitenFrog's LeapMireille KirstenNoch keine Bewertungen

- 09304079.pdf New Foreign PDFDokument44 Seiten09304079.pdf New Foreign PDFJannatul FerdousNoch keine Bewertungen

- Erste Bank Research Euro 2012Dokument10 SeitenErste Bank Research Euro 2012Wito NadaszkiewiczNoch keine Bewertungen

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDokument15 SeitenQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RINoch keine Bewertungen

- Chap001-Globalization N International LinkagesDokument45 SeitenChap001-Globalization N International LinkagesCindy XFNoch keine Bewertungen

- 038-Palting vs. San Jose Petroleum Inc. 18 Scra 924 (1966)Dokument10 Seiten038-Palting vs. San Jose Petroleum Inc. 18 Scra 924 (1966)wewNoch keine Bewertungen

- Europa April2009europaDokument19 SeitenEuropa April2009europanishadjp9Noch keine Bewertungen

- Tinderbox - Bernstein - 2015 - Actions and DashboardsDokument67 SeitenTinderbox - Bernstein - 2015 - Actions and Dashboardsmiki7555Noch keine Bewertungen

- AP Exam Past Exam PaperDokument3 SeitenAP Exam Past Exam PaperAnnaLuxeNoch keine Bewertungen

- Tallinn Real Estate Market Review September 2010Dokument11 SeitenTallinn Real Estate Market Review September 2010TallinnPropertyNoch keine Bewertungen

- Suffolk County BudgetDokument527 SeitenSuffolk County BudgetTimesreviewNoch keine Bewertungen

- Nedbank Se Rentekoers-Barometer November 2016Dokument4 SeitenNedbank Se Rentekoers-Barometer November 2016Netwerk24SakeNoch keine Bewertungen

- Greenwald Class Notes 5 - Liz Claiborne & Valuing GrowthDokument17 SeitenGreenwald Class Notes 5 - Liz Claiborne & Valuing GrowthJohn Aldridge Chew100% (2)

- Disadvantages of Eu EnlargementDokument12 SeitenDisadvantages of Eu Enlargementapi-7859327Noch keine Bewertungen

- The Home DepotDokument30 SeitenThe Home DepotAnoop SrivastavaNoch keine Bewertungen

- ECON 201 12/9/2003 Prof. Gordon: Final ExamDokument23 SeitenECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanNoch keine Bewertungen

- SAM 7.0 PricingDokument2 SeitenSAM 7.0 PricingFabianNoch keine Bewertungen

- Make Money Magazine #1 - Alex Forex Millionaire and Playboy!Dokument19 SeitenMake Money Magazine #1 - Alex Forex Millionaire and Playboy!ForexAlex71% (7)

- International Finance Multiple Choice ExamplesDokument6 SeitenInternational Finance Multiple Choice ExamplesRəşad SəttarlıNoch keine Bewertungen

- Pimco Corp. Opp Fund (Pty)Dokument46 SeitenPimco Corp. Opp Fund (Pty)ArvinLedesmaChiongNoch keine Bewertungen

- Leather Research PDFDokument162 SeitenLeather Research PDFVishnuGundaNoch keine Bewertungen

- Toyota'S European Operating Exposure: Summary of Mini-CaseDokument3 SeitenToyota'S European Operating Exposure: Summary of Mini-CaseCuongNoch keine Bewertungen

- Test Bank - TVM1Dokument34 SeitenTest Bank - TVM1Evan HochmanNoch keine Bewertungen

- RaykowskiA UsingAHP JK 2021Dokument50 SeitenRaykowskiA UsingAHP JK 2021MezbahNoch keine Bewertungen

- CHAPTER 14 Macroeconomics in An Open EconomyDokument7 SeitenCHAPTER 14 Macroeconomics in An Open EconomyAdel HassanNoch keine Bewertungen