Beruflich Dokumente

Kultur Dokumente

New Notes For Fiscal, International Trade Policy 2

Hochgeladen von

carendleonOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

New Notes For Fiscal, International Trade Policy 2

Hochgeladen von

carendleonCopyright:

Verfügbare Formate

MONETARY, FISCAL, and INTERNATIONAL TRADE POLICY With Taxation and Agrarian Reform MONETARY POLICY

Money is a very important means used in the conduct of economic activities. The primary concern of the government is to maintain a strong and growing economy. The Significance of Money Before money was invented, barter was the method used in exchanging a good with another good. Under the barter system, the family produces the various goods it needs. Barter was not successful because: 1. The goods offered for barter may not be the ones desired. 2. The parties may find it hard to agree on what quantity of goods to be offered in exchange that will approximate the value of the desired good. The introduction of money eliminated the disadvantages of the barter system. With money, the exchange of goods became faster, and as a result, the people were provided with the right environment to specialize. The Disadvantage of Using Objects as Money 1. Objects are perishable. 2. Objects are indivisible. 3.Objects are not easily portable. MONEY * Is anything that is generally accepted as payment for goods and services. (Hyman) * Anything used to make payment, for a good, a service or a debt obligation. (Cargill) * A generally acceptable medium of exchange. (Kidwell and Peterson) Money Supply Is a vehicle of economic activities when in circulation. It consists of the following: 1. Coins and Bills in circulation 2. Demand Deposits in Banks 3. Quasi-Money (Savings Deposits, Time Deposits) 4. Deposit Substitutes (deposits in savings banks, savings and loans associations, and credit unions) Sources of Money Supply 1. Lending operations of the banking system determines the volume of money checks a bank creates. 2. Foreign currency inflows (mostly dollars) are sold to the Central Bank for pesos through commercial banks based on a fixed exchange rate prescribed by the Central Bank. 3. Taxes also change the level of money supply as leakages from the circular flow. These are foregone conclusions and savings which could otherwise be part of currency in circulation and reserves which enable banks to create money checks. 4. The government prints money for circulation when there a depression in the economy. Money serves the following functions:

1. as a unit of account when people

used engage in barter, the exercise was not always easy to execute. With the coming in of money as the basic means of trade, people were able to determine the relative worth or value of the goods being traded.

2. as a medium of exchange with the

use money, exchange can take place even if there are no coincidences of wants. As exchanges are facilitated with the use of money, trade expansion is expected.

3. as a store of wealth the use of money

gives the person the luxury of time. Electronic Money: A New Form of Money Money evolves as the requirement for its use become more sophisticated. Advances in technology in technology made possible the introduction of newer forms of money. The first to be developed is electronic money which simply means money stored electronically, and which is also known as EMoney. Electronic money comes in four forms: (1) debit cards, (2) stored value cards, (3) electronic cash, and (4) electronic checks. The Goals of Monetary Policy 1. High employment the resources of the monetary authorities can be channeled toward the creation of more jobs. The financial system can give liberal financing terms to laborintensive companies. 2. Economic growth refers to the steady process of increasing productive capacity of the economy, and hence of increasing national income. 3. Stable prices When prices of commodities rise, they bring uncertainty in the economy, and economic growth is placed at a standstill. 4. Interest Rate Stability - This is a desirable feature of a growing economy. When interest rates fluctuate, they create uncertainty among decision-makers, and these people find It hard to decide on which move to make. 5. Stability of financial markets One of the important goals is the promotion of a more

stable financial system in which financial crises are avoided. 6. Stability in Foreign Exchange Markets When the value of the peso goes down in relation to other currencies, the prices of commodities tend to increase. Conversely, when the value of the peso rises against foreign currencies, the prices of commodities tend to go down. BANKO SENTRAL NG PILIPINAS - The BSP is the countrys central monetary authority. It was established on July 3, 1993 by virtue of Sec.2 RA 7653, better known as The New Central Bank Act. - It has an authorized capitalization of P50 billion pesos. - The BSP took over from the Central Bank of the Philippines which was established on January 2, 1949. As an Organization The Monetary Board is the policymaking body of the Bank. It formulates and reviews monetary and banking policies. Its chairman is the BSP Governor, with 5 full-time members from the private sector and one member from the Cabinet. A deputy governor heads each of the Banks three major operating sectors, that includes 44 departments and offices, 18 of which are offices and branches in the region. 3 Sectors of BSP 1. Banking Services Sector serves the banking needs of all banks such as accepting their deposits, servicing their withdrawals and extending them credit through the rediscounting facility. 2.Supervision and Examination Sector enforces and monitors compliance to banking laws to promote a sound and healthy banking system. 3. Resource and Management Sector serves the human, financial and physical resource needs of the BSP. ROLES of BSP 1. The Supplier of Money Only BSP can issue the Philippine currency, the peso. The paper notes and coins we use in our economic transactions are fully guaranteed by the government. 2. A Money Manager The BSP sees to it that there is just enough money to meet the financial needs of the economy. 3. The Supervisor of All Banks The BSP regularly monitors and examines the operations of banks, as well as their compliance with banking rules and regulations. 4. The Bank of Banks The BSP does not deal directly with the public. It can only accept deposits from, and grant loans to, banks. 5. The Main Bank of the Government The BSP is the official depository of the government. Some of the tax collections, proceeds of the sale

of government securities and foreign loans are deposited with the BSP. Likewise, when the government needs to repay its foreign debts or disburse money to pay expenses, it withdraws its funds from the BSP. Amando Tetangco Jr. - BSP Governor and Chairman, Monetary Board

THE GOVERNMENT, FISCAL POLICY AND TAXATION

Definition of terms: INVESTMENT - an amount of money invested in something for the purpose of making a profit. EXPENDITURE - - an amount of money spent, as a whole or on a particular thing FISCAL POLICY Takes off to influence income and consumption and lead the economy toward growth and development where monetary policy left off. As a tool utilizes government spending and taxation as means to control the economy. - Cannot be easily manipulated; goes hand in hand with monetary policy. GOVERNMENT

Very important sector of the economy

Makes up for the private sectors deficiency. - Big spender and big borrower Sources and Uses of Public Funds TAXES - biggest source of government funds. 2 Tax Collecting Agencies: *Bureau of Internal Revenue *Bureau of Customs a. Taxes collected includes: *Income taxes of individuals & businesses *Property taxes *Import taxes *Inheritance taxes *Gift taxes *And other specific taxes b. Non-Tax Revenues Governments also earns income from. Ex. Collection of fines and fees Licenses and registration charges Profits earned by government-operated and controlled corporations (GOCC) Borrowing - Government resorts to when revenues are insufficient to finance growing budget. Public Debt - Consist of all claims against our government which may have resulted from loans or advances extended to the government or as

payment for goods and services rendered to it, for which the existence of indebtedness has been acknowledged by the government. A government tends to borrow for 3 reasons: 1. Due to political reluctance to raise taxes 2. A sense that some government sponsored capital improvements should be paid for gradually over the life of the investment by those who will be taxpayers while the improvements are providing benefits. 3. A deliberate use of the budget to stimulate the economy Government borrowing may be undertaken from internal sources such as the Central Bank, or from external sources such as foreign governments. Government Expenditures occupies the top position among the various government expenses. Consists of spending connected with the maintenance of the different government subdivisions and instrumentalities Ex. Salaries of government officials and employees. 2 Types of Budget 1. Deficit Budget Is being adopted by the government in instances where the private sector is hesitant to spend and the economy needs a boost - Has an expansionary effect since it increases the flow of money into the economy as a result of an increase in government spending, the excess spending being derived from sources other than taxes. 2. Surplus Budget Is being adopted by the government at times when private spending is excessive and threatens to be inflationary. Has a contracting effect since not all the taxes collected from the people are channeled back into the economic stream. Depress economy Increasing Aggregate Demand - The effect when there is an increase in government purchases or cutting tax rates. Decrease Aggregate Demand

flow of money into the economy as a result of increase in government spending. Such excess spending are being derived from public borrowing other than taxes. Income spent by the government are derived from tax collections. So the excess amount spent are derived from public borrowing. - The surplus budget has a contracting effect since not all tax collections are spent and channeled back into the economy. TAXATION The act of collecting taxes. This power is vested in the government, whether local or national. TAXES are compulsory payments associated with income, consumption, or holding of property that individuals and corporations are required to make each year to governments. THE NEED FOR TAXATION 1. As funds to maintain the various functions of the government, and the different activities it deems important. 2. To sustain viability of the government in providing the necessary services for the people. REQUISITES OF A VALID TAXATION 1. The tax should be for a public purpose if the funds generated through it is used to support the government, like when it is used to pay for the construction of public buildings. 2. The rule of taxation shall be uniform all taxable articles or kinds of property belonging to the same class or category are taxed at the same rate. 3. The person or property taxed shall be within the jurisdiction of the government levying (imposing) the tax when the state collects taxes on persons, properties, or transactions where it has jurisdiction. 4. The assessment and collection of certain kinds of taxes must provide guarantees against injustices to individuals if there is sufficient notice and opportunity for hearing is provided to individual subjects of taxation. OBJECTIVES OF TAXATION 1. to raise funds taxation is the chief means for raising funds to support the government 2. to redistribute wealth some individuals amass great wealth during their lifetime, and taxation is one way of redistributing these wealth to the people. Examples are taxes relating to estate and inheritance. 3. to regulate consumption consumption of some goods sometimes reach level that become harmful to the society, so to limit the sale of these goods, taxes are imposed. 4. to protect local industries imported goods sometimes enter our local markets to the detriment (harm, disadvantage) of local producers. If imported goods are sold locally at lower process, the government may impose taxes that will raise its selling price, and in effect,

The effect when there is reduced government demand or increasing tax rates. *A change in the tax rates or in government spending is purely discretionary. Effects of Budget: A deficit and balanced budget have an expansionary effect because they increase the

imported goods will be less attractive to domestic consumers. CLASSES OF TAXES a. According to Subject personal, property, or excise Personal tax one imposed on individuals residing within a specific territory, regardless of property or occupation. Example: Community tax levied by the barangay to its residents. Property tax one levied on property Excise tax one imposed upon goods consumed, sold, or manufactured within a nation. Example: excise tax levied on alcohol and cigarettes b. According to purpose revenue or regulatory Revenue tax is imposed to collect revenues for the general purposes of the government. Example: income tax and sales tax. Regulatory tax is imposed for a special purpose like the protection of local industries from foreign competition. c. According to Authority Imposing Tax national and local taxes National tax one imposed by the national government. Example: income taxes and customs duties Local tax one levied in the municipal, provincial, or barangay governments. Example: real property tax d. According to Determination of Amount specific or ad valorem Specific tax one assessed on the basis of a tax per unit. Ad valorem assessment is based on a percentage of the value of the iteme. According to Who Bears the Burden direct or indirect Direct when the person on whom the tax is imposed absorbs the burden. Example: income tax Indirect when the amount is paid by the person other than the one whom it is legally imposed. Example: VAT paid by the seller but passed on to the buyer of the selling price. f. According to Graduation Rate proportional, progressive or regressive Proportional if it is based on a fixed percentage of the amount of property, income, or other factors. Examples: sales tax and real property tax Progressive when the rate increases as the tax base increases. Example: income tax Regressive when the effective rate decreases as the tax base increases. REQUISITES FOR AN IDEAL TAX SYSTEM 1. Adequate adequate to raise money to support the activities of the government 2. Equitable tax system must be fair. It must not benefit some groups or individual at the expense of others.

3. Economically efficient a tax system must be able to support strong, stable economic growth, rather than becoming an impediment (hindrance) to investment and a barrier to economic development. 4. Simple TAX ON INDIVIDUALS Individuals, as income taxpayers, fall into two general categories of citizens and aliens. A citizen may be a resident citizen or a nonresident citizen. Alien individuals are classified into resident aliens, and non-resident aliens are in turn classified into those engaged in trade or business or practice of profession, in the Philippines and those not engaged in trade or business, or practice of profession, in the Philippines. An individual is a citizen of the Philippines by definition of the Constitution of the Philippines. Under the Constitution, an individual may be a citizen of the Philippines at birth (i.e. one whose father or mother is a citizen of the Philippines), or may become a citizen of the Philippines sometime after birth (i.e. one who is naturalized in accordance with law). Philippine citizenship may be lost or required in the manner provided by law. Who is a non-resident citizen? He is a citizen who: a. establishes to the satisfaction of the Commissioner of Internal Revenue the fact of his physical presence abroad with a definite intention to reside therein; or b. leaves the Philippines during the taxable year to reside abroad; as an immigrant; or for employment on a permanent basis; or 3. for work and derives income from abroad and whose employment thereat requires him to be physically abroad most of the time during the taxable year; or c. was previously a non-resident citizen and who arrives in the Philippines at any time during the taxable year to reside permanently in the Philippines. He shall be considered a nonresident citizen for the taxable year in which he arrives in the Philippines with respect to his income derived from sources abroad until the date of his arrival in the Philippines. A citizen of the Philippines who shall have stayed outside the Philippines for 183 days or more by the end of the year is a nonresident citizen for the year. PERSONAL EXEMPTIONS OF CITIZENS AND RESIDENT ALIENS a. Married person: If only one spouse is deriving taxable income, only said spouse may claim the personal

exemption. If a married person is not legally separated from his spouse, his basic personal exemption is P32,000. If legally separated from the spouse, without any dependent, his basic personal exemption is P20,000. If legally separated from the spouse with a dependent, he may qualify as head of the family, with a basic personal exemption of P25,000 and with an additional exemption of P8,000, if the dependent is a child. b. Head of the Family: Under the National Internal Revenue Code, the term head of the family means an unmarried or legally separated man or woman with one or both parents, or both parents, or with one or more brothers or sisters, or with one or more legitimate, recognized natural or legally adopted children, living with and dependent upon him or her for their chief support, where such brothers, sisters or children are not more than twenty-one years of age, unmarried, and not gainfully employed, or where such brothers, sisters or children, regardless of age, are incapable of self-support because of mental or physical defect. The term chief support means more than onehalf of the requirements for support. Thus, if two children contribute equal amounts for the support of a parent, neither one of them may qualify as head of the family. A parent, brother, or sister may qualify the taxpayer as head of the family, entitled to the basic personal exemption of P25,000, but not entitled to additional exemption. c. Dependent A dependent, for whom a head of family or a married person may claim an additional exemption of P8,000, is a legitimate, illegitimate or legally adopted child, chiefly dependent upon and living with the taxpayer, if such dependent is not more than twenty-one years of age, unmarried and not gainfully employed, or if such dependent, regardless of age, is incapable of self-support because of mental or physical defect d. Single individual, widow/widower or married individual judicially decreed as legally separated with no qualified dependent has a basic personal exemption of P20,000. * Marginal Income Earner refers to individuals not deriving compensation as an employee under an employer-employee relationship but who are self-employed and deriving gross sales/receipts not exceeding P100,000 during any 12-month period. They shall file this return reflecting herein the net income from business. When to File

The Returns of the taxpayers shall be filed on or before the 15th day of April of each year covering income for the proceeding year.

Agrarian Reform Program

Events that paved the Way for Agrarian Reform Land one of the factors of production * When one wants to engage in production, he must find some land, apply the necessary materials and labor inputs, and wait for the outputs to start pouring in, if he wants to be of Service to the nation (and to himself). * Securing land for production purposes constitutes the BIGGEST barrier to economic growth. * Prior to 1963, big land estates were owned by a small % of the population. * hacienderos - landlords made decisions on what to do with their lands. * 1946-50s rebellion of the poor peasant farmers of Central Luzon. - Rebellion, however is economically disruptive because the production of goods and services is hampered by hostile actions between the landlords and the tenant-rebels. - Rebellion is the effect of concentration of land ownership in the hands of a few. The dispersal of land ownership has therefore become an important issue; even Gen. Douglas Mac Arthur recognized land reform as an important requisite for economic development. THE COMPREHENSIVE AGRARIAN REFORM PROGRAM - otherwise known as R.A. 6657 - was signed by Pres. Corazon Aquino on June 10, 1988 - In its declaration of Principles and Policies, the program stated that it is the policy of the state to pursue CARP. - The welfare of the Landless Farmers and Farm Workers will receive the Highest consideration: 1. To promote Social Justice 2. To move the nation toward Sound Rural Development and Industrialization 3. Establishment of Owner Cultivatorship of Economic-sized farms as a basis of Philippine agriculture. * turning over 26, 000 hectares of farmland to some 20, 000 Mindanao farmers. Farmlandsformerly owned by MNCs were given to the workers cooperatives of DOLE Phils., Del Monte and the National Development Corporation. What is LAND REFORM? Limiting ownership of land by the landlords.

HISTORICAL BACKGROUND: Land Reform has been with us for thousands of years. Rome is acknowledged as one of the worlds greatest empires, but still its rulers found it necessary to pass a law that limited the amount of land one person could hold. But even with such a law, the aristocrats (or the patricians) gained control of public lands. This made it necessary for Tiberius and Gaius Gracchus to secure new but short-lived laws for land reform during the 2nd century B.C. During the middle ages, feudalism became the norm. the feudal lords owned the lands worked by the serfs who were provided with food and protection. This arrangement made the life of the serfs, and later of the tenants, miserable throughout the centuries and way up to the 1900s. The feudal lords were able to own huge estates that became too large for efficiency. The tenants relationship with the feudal lord was not permanent, and profits derived from tilling the land were not shared with the tenants. Because of this, the tenants were not motivated to exert their utmost efforts to make the lands productive. On the other hand, the landowners were not also motivated to invest in the lands because they were not sure that the tenants will make good use of them. As such, society was pressed for a solution that will make the lands more productive. The problem, of course, was how to motivate the tillers of the soil. By the 1800s, there were several measures adapted in Europe and in the United States to make land reform a factor for economic growth. In the community economy of prehistoric Philippines, land ownership was not much of a problem because unsettled land belonged to the individual who planted it with coconut, fruit trees, and abaca. When a community settles in a place, the land is divided among its members. Every family is, thus, provided with a plot of land to cultivate. The coming of the Spaniards changed many aspects of the economic life of the early inhabitants of the Philippines. The Spaniards brought with them the system of feudalism. The conquerors divided among themselves all available lands, turning these into large encomiendas. This condition continued for more than three centuries of hardship for farmers who were allowed to till the land of the encomenderos. These big landholdings were later converted into haciendas. The end of the Spanish rule in the Philippines also marked the beginning of some attempts at land reform. These are as follows: 1. the confiscation of friar lands by General Emilio Aguinaldo during the Phil. Revolution of 1896; 2. the institution of systematic land registration and public land

disposition during the American occupation; 3. the social justice program of Pres. Quezon during the commonwealth period; 4. the land-for-the-landless program of Pres. Ramon Magsaysay during his term; and 5. the land reform pilot projects during the administration of Pres. Diosdado Macapagal. These attempts were considered limited in scope, and for one reason or another, were not able to improve the lot of the masses and eliminate feudalism. A more radical measure was the enactment of Pres. Decree No. 27, otherwise known as the Tenants Emancipation Act. This decree emancipated the tenants from the bondage of the soil, transferred to them the ownership of the land they till and provided the instruments and mechanisms to support its objectives. CARP (Comprehensive Agrarian Reform Program) - this was a more ambitious means of improving the life of many Filipino - it is embodied in the Comprehensive Agrarian Reform Law (R.A. no. 6657, approved June 10, 1988) - this is an act that was instituted to promote social justice and industrialization, providing the mechanism for its implementation and for other purposes. The CARPs Program of Implementation The three phases of implementation are as follows: PHASE 1 (1988-1992) a. rice and corn lands covered by P.D. no. 27, b. all idle or abandoned lands c. all private lands voluntarily offered by owners for agrarian reform, d. all lands foreclosed by government financial institutions, e. all lands acquired by the Presidential Commission on Good Governance, f. Lands operated by multinational companies, and g. All other lands owned by the government devoted to or suitable for agricultural purposes PHASE 2 (1988-1992) a. all alienable and disposable public agricultural lands, b. all arable public agricultural lands under agri-forest, pasture and agricultural leases already cultivated and planted to crops in accordance

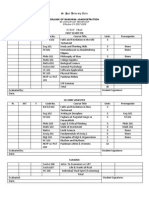

with Sec. 6, Art, VIII, 1987 Constitution c. all public lands which are to be opened for new development and resettlement, and d. all private agricultural lands in excess of fifty hectares PHASE 3 a. landholdings above twenty four hectares up to fifty hectares (19921995) b. landholdings with areas between 5.1 and 24 hectares (1994-1998) Coverage of the Program: 1. Public Health Programs 2. Family Planning 3. Education and training of farmers 4. Reorganization of land reform agencies 5. application of labor laws to agricultural workers 6. construction of infrastructure facilities as feeder roads, irrigation system and establishment of rural electrification 7. organization of different types of voluntary association 8. providing employment opportunities 9. other services of community development Reasons for the Failure of the Program in the early stages of Implementation 1. Program stopped at land distribution. 2. The farmers were not prepared to take over the responsibilities given them. 3. The haphazard planning on the part of the government. 4. The tenants squatting on the land. Not over P 10,000 over P 10,000 over P 30,000 over P 70,000 over P 140,000 over P 250,000 over P 500,000 5% but not over P 30,000 but not over P 70,000 but not over P 140,000 but not over P 250,000 but not over P 500,000

P 500 P 2,500 P 8,500 P 22,500 P50,000 P 125,000

+ 10% of the excess over P10,000 + 15% of the excess over P 30,000 + 20% of the excess over P 70,000 + 25% of the excess over P 140,000 + 30% of the excess over P 250,000 + 34% of the excess over P500,000

Mr. Robert de Castro Individual Income Tax Return December 31, 2025 Gross Compensation Income Less: Exemptions: a. Married 32,000 b. children 4x8000 32,000 Taxable Income Tax Due a. Basic Rate b. Excess (311,000 250,000) 61,000 x 30% Tax Due Less: Tax withheld 50,000.00 18,300.00 68,300.00 68,300.00 P 375,000.00 64,000.00 P 311,000.00 =========

Tax refundable/payable

-----0-----

* If the tax withheld is equal to the tax due. Mr. Robert de Castro Individual Income Tax Return December 31, 2025 Gross Compensation Income Less: Exemptions: a. Married 32,000 b. children 4x8000 32,000 Taxable Income Tax Due a. Basic Rate b. Excess (311,000 250,000) 61,000 x 30% Tax Due Less: Tax withheld Tax refundable 50,000.00 P 375,000.00 64,000.00 P 311,000.00 ========

18,300.00 68,300.00 110,000.00 (41,300.00) ======= * If the tax withheld is greater than the tax due, you have a refund

INTERNATIONAL TRADE

- The Phoenicians pioneered in the seagoing trade, followed later by the Greeks and the Romans. - Some Traders went as far as India and China. - 13th century, Italian cities of Genoa, Pisa and Venice dominated international trade. - Period of discovery, feats of explorers like Columbus and Magellan led to the further development in international trade involving Spain, Portugal, France, and England. These nations became the centers of trading influence around the world. Reasons for International trade: Globalization Export and Import Basis for International Trade: a. Specialization b. absolute advantage a country that can produce a good with fewer resources than can other countries. c. comparative advantage a country that can produce a product or service at lower opportunity costs than another country. International Trade Barriers: A. tariffs a tax to be paid for importing or exporting goods. a. Export tariff one that is collected by the exporting country b. Transit tariff one that is collected by the country

through which the goods have passed c. Import tariff one that is collected by the importing country. A tariff may be assessed as follows: 1. specific duty assessment on the basis of a tax per unit. 2. ad valorem duty assessment as percentage of the value of the item 3. compound duty a combination of specific and ad valorem duties. Import tariffs are imposed for the following purposes: 1. for raising revenues; 2. to reduce the overall level of imports by making them more expensive than the locally produced substitute, with the aim of eliminating a balance of payments deficit; 3. to counter dumping by raising the price of the dumped commodity; 4. to retaliate against restrictive measures imposed by other countries; 5. to protect an infant industry until it has grown and is able to compete with the more developed industries of other countries; and 6. to protect vital industries such as agriculture. B. Non-tariff barriers

1. Direct Price Influences - One way

of controlling trade is to influence the price of commodities that are imported or exported. a. Subsidies are direct or indirect governmental assistance to companies, to make their goods more competitive with imports. b. Customs valuation refers to the authority granted to custom officials in determining the value of an imported commodity. c. Other direct price influences i. Special fees ii. Requiring the advanced placement of customs deposit before shipment is made iii. Requiring minimum selling prices of goods after customs clearance have been made

2. Quantity Controls another was

of controlling trade is the use of some means of effectively limit the quantity of goods trades between countries. a. Quotas are limits placed on the quantity of specified products allowed to be imported into or exported out of a country. b. Buy-local legislations are those designed by the government to give preference to the locally made goods. c. Standards refers to classifications, labeling, and testing set by a country. d. Specific permission requirements- are forms controlling trade whereby the country requires permission from the government before engaging in foreign trade e. Administrative delays f. Reciprocal arrangements require exporters to accept merchandise as payment for the exported goods. g. Restriction on services refer to arrangements whereby an importer or exporter is required to use services of domestic companies in moving goods from one country to another.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Ountry Iving Tyle: Designed Exclusively ForDokument20 SeitenOuntry Iving Tyle: Designed Exclusively ForcarendleonNoch keine Bewertungen

- The Family and Right To WorkDokument15 SeitenThe Family and Right To WorkcarendleonNoch keine Bewertungen

- Rel Ed Yr 4 - Lesson 4 Intro To Human DignityDokument18 SeitenRel Ed Yr 4 - Lesson 4 Intro To Human DignitycarendleonNoch keine Bewertungen

- Rel Ed Yr 4 - Lesson 5human DignityDokument14 SeitenRel Ed Yr 4 - Lesson 5human DignitycarendleonNoch keine Bewertungen

- Template 2Dokument16 SeitenTemplate 2carendleonNoch keine Bewertungen

- Rel Ed Yr 4 - Lesson 6 Dignity of WorkDokument48 SeitenRel Ed Yr 4 - Lesson 6 Dignity of WorkcarendleonNoch keine Bewertungen

- Summary On The Book of History From PeopleDokument2 SeitenSummary On The Book of History From PeoplecarendleonNoch keine Bewertungen

- Prospectus For The School Year 2013-2014Dokument4 SeitenProspectus For The School Year 2013-2014carendleonNoch keine Bewertungen

- Floral Oval FillableDokument1 SeiteFloral Oval FillableSaira MubeenNoch keine Bewertungen

- BSBA ObjectivesDokument3 SeitenBSBA ObjectivescarendleonNoch keine Bewertungen

- Business Trip Evaluation FormDokument2 SeitenBusiness Trip Evaluation FormcarendleonNoch keine Bewertungen

- St. Paul University Iloilo (SPUI) Is A Catholic University ThatDokument53 SeitenSt. Paul University Iloilo (SPUI) Is A Catholic University ThatcarendleonNoch keine Bewertungen

- BSBA ObjectivesDokument3 SeitenBSBA ObjectivescarendleonNoch keine Bewertungen

- Rel. Ed. 105 Homework - Aug 28Dokument3 SeitenRel. Ed. 105 Homework - Aug 28carendleonNoch keine Bewertungen

- Mock StudyDokument4 SeitenMock StudycarendleonNoch keine Bewertungen

- Monetary, Fiscal, and International Trade Policy With Taxation and Agrarian Reform Monetary PolicyDokument38 SeitenMonetary, Fiscal, and International Trade Policy With Taxation and Agrarian Reform Monetary PolicycarendleonNoch keine Bewertungen

- The Government, Fiscal Policy and TaxationDokument35 SeitenThe Government, Fiscal Policy and TaxationcarendleonNoch keine Bewertungen

- Statistics DescriptionDokument4 SeitenStatistics DescriptioncarendleonNoch keine Bewertungen

- Celebrating My WomanhoodDokument2 SeitenCelebrating My WomanhoodcarendleonNoch keine Bewertungen

- Product and Service Strategies - EditedDokument26 SeitenProduct and Service Strategies - EditedcarendleonNoch keine Bewertungen

- Deed of Absolute SaleDokument1 SeiteDeed of Absolute SalecarendleonNoch keine Bewertungen

- AP and ResumeDokument2 SeitenAP and ResumecarendleonNoch keine Bewertungen

- Statistics 2Dokument1 SeiteStatistics 2carendleonNoch keine Bewertungen

- Income TaxDokument25 SeitenIncome TaxcarendleonNoch keine Bewertungen

- 6 - Respecting TruthDokument15 Seiten6 - Respecting Truthcarendleon100% (4)

- 5 - Building JusticeDokument20 Seiten5 - Building JusticecarendleonNoch keine Bewertungen

- 4 - Respecting Human SexualityDokument15 Seiten4 - Respecting Human Sexualitycarendleon100% (1)

- 2 - Love The Lord Your GodDokument13 Seiten2 - Love The Lord Your GodcarendleonNoch keine Bewertungen

- 3 - Respecting God's Gift of LifeDokument13 Seiten3 - Respecting God's Gift of LifecarendleonNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Monetary Policy-Presentation SlidesDokument12 SeitenMonetary Policy-Presentation SlidesMuhammad Talha Khan100% (2)

- Chapter 4 The Monetary System. What It Is and How It WorksDokument6 SeitenChapter 4 The Monetary System. What It Is and How It WorksJoana Marie CalderonNoch keine Bewertungen

- Lecture 11 - International Finance by Krugman 11th EditionDokument23 SeitenLecture 11 - International Finance by Krugman 11th EditionWuZiFankoalaNoch keine Bewertungen

- Monetary and Fiscal PolicyDokument29 SeitenMonetary and Fiscal PolicyPrince AgrawalNoch keine Bewertungen

- Sybaf FC CH-1Dokument40 SeitenSybaf FC CH-1Chirag KararaNoch keine Bewertungen

- Fiscal Policy TutorialDokument44 SeitenFiscal Policy TutorialKing DariusNoch keine Bewertungen

- Banking Principles and PracticesDokument68 SeitenBanking Principles and Practicesmolla fentayeNoch keine Bewertungen

- Bus 420 International Monetary SystemDokument7 SeitenBus 420 International Monetary SystemYomi BrainNoch keine Bewertungen

- CH - 11Dokument16 SeitenCH - 11faliyarahulNoch keine Bewertungen

- IBP SyllabusDokument12 SeitenIBP Syllabuscyrex33100% (1)

- Master Your FinancesDokument15 SeitenMaster Your FinancesBrendan GirdwoodNoch keine Bewertungen

- IB Economics - Real World Examples: Terms in This SetDokument21 SeitenIB Economics - Real World Examples: Terms in This SetjoebidenyyzNoch keine Bewertungen

- How Credit-Money Shapes The Economy - The United States in A Global System (Robert Guttmann 1994)Dokument588 SeitenHow Credit-Money Shapes The Economy - The United States in A Global System (Robert Guttmann 1994)MarcoKreNoch keine Bewertungen

- UntitledDokument21 SeitenUntitledNalini PersaudNoch keine Bewertungen

- PROJECT Proposal ON INFLATIONDokument46 SeitenPROJECT Proposal ON INFLATIONNjoguNoch keine Bewertungen

- ECO211 Written ReportDokument12 SeitenECO211 Written ReportSITI RASHIDAH BAHAMANNoch keine Bewertungen

- Lec and Excer On Exchange Rate DeterminationDokument20 SeitenLec and Excer On Exchange Rate DeterminationFaysal HossainNoch keine Bewertungen

- Obstfeld and Rogoff 1995 The Mirage of Fixed Exchange RatesDokument42 SeitenObstfeld and Rogoff 1995 The Mirage of Fixed Exchange RatesJéssicaNoch keine Bewertungen

- Translation For Individuel AssignementDokument42 SeitenTranslation For Individuel AssignementZewen HENoch keine Bewertungen

- Mrunal - Economic Survey IndiaDokument156 SeitenMrunal - Economic Survey IndiaakashsinglaNoch keine Bewertungen

- Money Market and Capital MarketDokument3 SeitenMoney Market and Capital MarketThiên TrangNoch keine Bewertungen

- KazBuild 2016 - StrategyDokument34 SeitenKazBuild 2016 - StrategyFARANoch keine Bewertungen

- Finance Research TopicsDokument19 SeitenFinance Research TopicsSamiuddin KhanNoch keine Bewertungen

- (9781589061620 - International Monetary Fund Annual Report 2002) International Monetary Fund Annual Report 2002Dokument233 Seiten(9781589061620 - International Monetary Fund Annual Report 2002) International Monetary Fund Annual Report 2002Juasadf IesafNoch keine Bewertungen

- European Central BankDokument21 SeitenEuropean Central BankMariana PopaNoch keine Bewertungen

- Continuous Improvements in Communicating Monetary Policy Speech by Gertjan VliegheDokument25 SeitenContinuous Improvements in Communicating Monetary Policy Speech by Gertjan VliegheHao WangNoch keine Bewertungen

- Fundamental Analysis of Banking SectorDokument37 SeitenFundamental Analysis of Banking SectorNavya100% (1)

- Business Environment-Monetary & Fiscal PolicyDokument10 SeitenBusiness Environment-Monetary & Fiscal Policymanavazhagan0% (1)

- T2 - Economía Internacional - Lopez Cayao Liz EvelynDokument5 SeitenT2 - Economía Internacional - Lopez Cayao Liz EvelynBrany George Marquez OrdoñezNoch keine Bewertungen

- The Art of Tehnical AnalisisDokument87 SeitenThe Art of Tehnical AnalisisBursa ValutaraNoch keine Bewertungen