Beruflich Dokumente

Kultur Dokumente

Defining Risk and Uncertainty

Hochgeladen von

Dalton Erick Suyosa BaltazarOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Defining Risk and Uncertainty

Hochgeladen von

Dalton Erick Suyosa BaltazarCopyright:

Verfügbare Formate

Defining Risk and a Framework for Moving Towards Resilience In Agriculture

By: Dennis Kaan Colorado State University

Farmers and ranchers make decisions in a risky environment every day. The consequences of their decisions are generally not known when the decisions are made. Furthermore, the outcome may be better or worse than expected. Variability of prices and yield are the biggest sources of risk in agriculture. Technology changes, legal and social concerns, and the human factor itself also contribute to the risk environment for agriculture producers. The two situations that most concern agriculture producers are: 1) is there a high probability of adverse consequences and 2) would those adverse consequences significantly disrupt the business. uncertainty as imperfect knowledge and risk as uncertain consequences. If a person says I am uncertain about the weather tomorrow,: this would be a value-free statement implying imperfect knowledge about the future. If this same person says I am planning a picnic for tomorrow and there is a risk of rain, now he or she is indicating preference for an alternative consequence. Taking a risk can now be defined as exposing ones self to a significant chance of injury or loss. Risk management can then be defined as choosing among alternatives to reduce the effects of risk (Harwood, et al). This requires an evaluation of tradeoff between changes in risk, expected returns and entrepreneurial freedom among others. The focus must be on the risk that matters. This may involve the prospect of losing money, possible harm to human health, repercussions that affect resources or other events that affect a persons welfare. For an individual farmer, risk management involves finding the preferred combination of Page 1 of 4

Risk, Uncertainty and Risk Management Defined

Risk and uncertainty are two terms basic to any decision making framework. Risk can be defined as imperfect knowledge where the probabilities of the possible outcomes are known, and uncertainty exists when these probabilities are not known (Hardaker). A more common usage of these terms would state

Article 1.3

activities with uncertain outcomes and varying levels of expected returns (Harwood, et. al.). From this point of view, risk management can be defined as choosing among alternatives for reducing the effects of risk on the farm or ranch, which in turn effects the farm or ranchs welfare position. Risk management strategies can 1) reduce risk within the operation, such as product diversification, 2) transfer risk outside the operation, such as production contracting or 3) build the operations capacity to bear risk, such as maintaining liquid assets. Risk management cannot be viewed as a one size fits all action. Several key decisionmaking criteria that play into the risk management planning process include the goals established for the operation, the risk bearing ability of the farm or ranch, and the managers attitude towards risk. Each one of these items will be different for individual family members and each farm or ranch unit.

The composition of the management unit will determine the range of goals to be considered. For instance, a family farm operation will require personal, family and business goals. Each member of the family must determine their personal goals and share them with other family members. This process will identify common goals along with differences that must be dealt with. The keys for success here will be negotiation and compromise to determine the most important goals. With a common set of family goals set forth, business goals can be developed that will satisfy the family goals.

Risk Bearing Ability

It was discussed previously that agricultural producers are most concerned about the probability of an adverse outcome and would that outcome significantly disrupt the business. In short this directly relates to the firm's risk bearing ability. The firm's risk bearing ability is directly related to liquidity and solvency measures. Liquidity refers to the ability of a business to meet financial obligations as they come due without hurting the normal operations of the business (Kaan). It is a measure of a firms ability to repay current debts by converting current assets into cash. Liquidity is a short run concept since it deals with current assets and liabilities. In general, the more cash that is available to pay current debts, the more liquid the firm is said to be. Solvency is a measure of the firms risk bearing ability. Solvency measures provide an indication of the firms ability to repay all financial obligations if all assets are sold. It also can indicate the ability to continue as a viable business after a financial adversity strikes that would increase debt or reduce equity. Solvency is a long run concept since these measures deal with the ability of the business to survive in the future.

Establishing Goals

An old adage says, If you dont know where you are going, any road will get you there. The starting point in any planning process is to identify and specify goals. As a manager of a business venture, you need to know where you are going, how you intend to get there and when you plan an arriving. Answers to these questions come from your goals. Goals are your personal statements which reflect your values and beliefs, the resources available to you and the limitations you face (Hewlett). They represent visions of the future and also provide a basis for comparing and judging alternative plans. Goals should direct and guide management decisions since they represent your future hopes and ambitions. With a written set of goals, consideration can be given to activities and resources needed to achieve these goals.

Page 2 of 4

Article 1.3

Risk bearing ability is also affected by cash flow requirements. Cash flow requirements are the obligations for cash costs, taxes, loan repayment, and family living expenses that must be met each year. The higher these obligations as a percentage of total cash flow, the less able the farm is to assume risk.

Risk Attitudes

A managers attitude towards risk is not a reflection of him or her management ability. There are no right or wrong risk attitudes. For each operation and manager, circumstances factoring into any decision-making process are different. The emphasis needs to focus on knowing your risk attitude and using that information in decision-making. An improved understanding of risk attitudes can help in analyzing investments or business alternatives as well as making day-to day decisions. Risk attitudes can be divided into three types: risk averse, risk preferring and risk neutral (Boehlje). Risk overters, or avoiders, are characterized as more cautious individuals with preferences for less risky sources of income or investment. In general, this individual will sacrifice some level of expected return in order to reduce the possibility of a loss. A person who is considered risk averse likely will also have a low risk bearing ability. Their situation would be such that a large income loss would seriously disrupt or end the business. Risk preferring individuals are characterized as more adventuresome with a preference for more risky business ventures. Risk preferrers will select the alternative with some probability of a higher outcome. In order to get this higher income, this person must also accept a probability of a lower outcome compared to the risk averter. This person likely has a greater risk bearing ability and therefore is less concerned with the increased probability of a lower outcome and primarily focuses on the higher outcome potential.

The risk neutral person is the limiting case between the risk averse and risk preferring individuals. This person will select the alternative with the highest expected outcome, regardless of the probabilities associated with potential gains or losses. This person will have acceptable levels of risk bearing ability such that large losses are not of concern but at the same time, achieving the highest outcome is not the focus either. The primary concern is to achieve a sustainable outcome over time. Risk attitudes will change over time as goals, financial resources and a managers experience change over time. Along with these variables, the probability and size of a gain or loss will effect a managers risk attitude. The key is to be aware of your risk attitude and utilize it in the decision-making and planning process.

Business Planning

The document that ties all of these ideas and concepts together is a business plan. Development of a business plan will be guided by the goals set forth for the family and business. The risk bearing ability of the operation and the risk attitudes of the people involved will set the parameters to select alternative enterprises. The process of business planning will create opportunities for discussions between farm family members allowing each person the opportunity to share their thoughts and dreams for the future. As farm businesses continue to grow, more complex and producers interact with more individuals, the need for a formal business plan will also increase. Todays successful agricultural producers are businessmen first, and farmers second. This statement will become truer as we move into the new millenium. Continued success in this risk-laden world of agricultural production will be determined largely by the ability to anticipate and prepare for the future. The basic element that will guide producers in the

Article 1.3

Page 3 of 4

decision-making process is a business plan. It is a formalized thought process where producers assess their current situation, specify their goals, identify and implement alternatives for reaching their goals and monitoring progress towards the goals. The emphasis is on the longterm goals; five, ten, fifteen or more years in the future. A business plan will serve as a framework to develop short-term production and marketing plans. As such, it will be designed to be flexible as the environment surrounding the business changes. Another aspect is this is not a one-time process. The business plan will need to be reviewed and adjusted at regular intervals. Any number of the factors the original business plan was based on can and will change and so the plan also needs to change accordingly. Several positive results will come from a business planning process. First, a producer will thoroughly understand the business and can determine how a current decision will impact the long-term success of the operation. The process also encourages thought regarding 1) alternatives for the farm business, 2) risks inherent in available opportunities and 3) contingency plans to follow when obstacles arise. Secondly, a producer will remain focused on the overall purpose of the business. With long-term goals written out, a manager can always overcome current problems and not lose sight of the long-term goals of the business.

Harwood, J.R. Heifner, K. Coble, T. Perry, and A. Somwaru. Managing Risk in Farming: Concepts, Research and Analysis. Agricultural Economic Report No. 774. Market and Trade Economic Division and Resource Economics Division, Economic Research Service U.S. Department of Agriculture. March, 1999. Hewlett, J., K, Drake, G. Gade, A. Gray, F. Henderson, J. Jacobs, J. Jenkins, R. Weigel. Western Integrated Ranch/Farm Education. University of Wyoming Cooperative Extension Service, 1995. Kaan, D., Understanding Your Financial Situation. Managing for Todays Cattle Market and Beyond. University of Wyoming Cooperative Extension Service. Patrick, George F., Managing Risk in Agriculture. NCR-406. Cooperative Extension Service, Purdue University. May,1992.

References

Boehlje, Michael D., Vernon R. Euidman. Farm Management, New York: John Wiley and Sons, Inc. 1984. Hardaker, J. Brian, Raud B.M. Huirne, and Jock R. Anderson, Coping With Risk in Agriculture, New York: CAB International, 1997.

Page 4 of 4

Article 1.3

Das könnte Ihnen auch gefallen

- DHL Express Rate Transit Guide PH enDokument21 SeitenDHL Express Rate Transit Guide PH enDalton Erick Suyosa BaltazarNoch keine Bewertungen

- %Jfuboe/Vusjujpo (Vjef: "Qvcmjdbujpopguif6Ojufe0Tupnz"Ttpdjbujpotpg"Nfsjdb OdDokument21 Seiten%Jfuboe/Vusjujpo (Vjef: "Qvcmjdbujpopguif6Ojufe0Tupnz"Ttpdjbujpotpg"Nfsjdb OdArcoiris Que FloreceNoch keine Bewertungen

- Meycauayan BulacanDokument2 SeitenMeycauayan BulacanDalton Erick Suyosa BaltazarNoch keine Bewertungen

- Implementation of Hiwa-Hiwalay Na Basura Sa Barangay ProgramDokument3 SeitenImplementation of Hiwa-Hiwalay Na Basura Sa Barangay ProgramDalton Erick Suyosa BaltazarNoch keine Bewertungen

- National Solid Waste Management Status Report 2008 To 2014Dokument62 SeitenNational Solid Waste Management Status Report 2008 To 2014Dalton Erick Suyosa Baltazar0% (1)

- %Jfuboe/Vusjujpo (Vjef: "Qvcmjdbujpopguif6Ojufe0Tupnz"Ttpdjbujpotpg"Nfsjdb OdDokument21 Seiten%Jfuboe/Vusjujpo (Vjef: "Qvcmjdbujpopguif6Ojufe0Tupnz"Ttpdjbujpotpg"Nfsjdb OdArcoiris Que FloreceNoch keine Bewertungen

- Solid Waste ManagementDokument49 SeitenSolid Waste Managementmayaetbeguiras75% (16)

- 1 Introduction To Organic ChemistryDokument8 Seiten1 Introduction To Organic ChemistryDalton Erick Suyosa BaltazarNoch keine Bewertungen

- STELLA ModelsDokument60 SeitenSTELLA ModelsDalton Erick Suyosa BaltazarNoch keine Bewertungen

- Tes9e ch03Dokument74 SeitenTes9e ch03Dalton Erick Suyosa BaltazarNoch keine Bewertungen

- Measuring Ecosystem Service BenefitsDokument156 SeitenMeasuring Ecosystem Service BenefitsDalton Erick Suyosa BaltazarNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 20bsp1623 Project ReportDokument36 Seiten20bsp1623 Project ReportPRACHI DAS100% (1)

- MCQ - Behavioural EconomicsDokument12 SeitenMCQ - Behavioural EconomicsMelaku GemedaNoch keine Bewertungen

- Return and RiskDokument20 SeitenReturn and Riskdkriray100% (1)

- Chapter ThreeDokument27 SeitenChapter ThreeMinhaz Hossain OnikNoch keine Bewertungen

- Financial Literacy and Financial Risk Tolerance of Individual Investors: Multinomial Logistic Regression ApproachDokument11 SeitenFinancial Literacy and Financial Risk Tolerance of Individual Investors: Multinomial Logistic Regression ApproachlaluaNoch keine Bewertungen

- Principles of Managerial Finance Brief 8th Edition Zutter Solutions ManualDokument35 SeitenPrinciples of Managerial Finance Brief 8th Edition Zutter Solutions Manualbosomdegerml971yf100% (25)

- State Preference TheoryDokument24 SeitenState Preference TheoryPsyonaNoch keine Bewertungen

- Chapter Six: Capital Allocation To Risky AssetsDokument26 SeitenChapter Six: Capital Allocation To Risky AssetsjimmmmNoch keine Bewertungen

- Chapter 7: Capital Allocation Between The Risky Asset The Risk-Free AssetDokument9 SeitenChapter 7: Capital Allocation Between The Risky Asset The Risk-Free AssetjojoFRNoch keine Bewertungen

- 5.4. Risk and Return Trade-Off: Unit 5: Basic Long-Term Financial ConceptsDokument4 Seiten5.4. Risk and Return Trade-Off: Unit 5: Basic Long-Term Financial ConceptsTin CabosNoch keine Bewertungen

- Chap 1 - Portfolio Risk and Return Part1Dokument91 SeitenChap 1 - Portfolio Risk and Return Part1eya feguiriNoch keine Bewertungen

- Solved Suppose That A Researcher Is Trying To Determine Whether JoggingDokument1 SeiteSolved Suppose That A Researcher Is Trying To Determine Whether JoggingM Bilal SaleemNoch keine Bewertungen

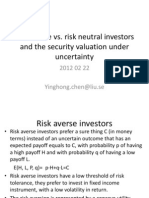

- Risk Averse Vs Risk Neutral InvestorsDokument9 SeitenRisk Averse Vs Risk Neutral InvestorsYinghong chenNoch keine Bewertungen

- Chap006 Text BankDokument14 SeitenChap006 Text BankAshraful AlamNoch keine Bewertungen

- Risk Return QuizDokument10 SeitenRisk Return QuizalyNoch keine Bewertungen

- Eliciting Expert Judgment: ENMG 698c: Special Topics - Project Risk Management - Dr. Rayan KhraibaniDokument36 SeitenEliciting Expert Judgment: ENMG 698c: Special Topics - Project Risk Management - Dr. Rayan KhraibaniJoli SmithNoch keine Bewertungen

- Rsik ManagementDokument221 SeitenRsik ManagementNirmal ShresthaNoch keine Bewertungen

- Rules of Differentiation & Taylor Series: 7.1 Review: Derivative and Derivative RulesDokument33 SeitenRules of Differentiation & Taylor Series: 7.1 Review: Derivative and Derivative Rulesranim najibNoch keine Bewertungen

- Modern Acturial Risk TheoryDokument318 SeitenModern Acturial Risk TheoryEzy Vo100% (1)

- Risk Aversion and Capital Allocation To Risky AssetsDokument16 SeitenRisk Aversion and Capital Allocation To Risky Assets777priyankaNoch keine Bewertungen

- Improving Optimization: Vijay Kumar ChopraDokument9 SeitenImproving Optimization: Vijay Kumar ChopraClaudio bastidasNoch keine Bewertungen

- Investor Behavior and Asset Allocation ProcessDokument19 SeitenInvestor Behavior and Asset Allocation ProcessAnjali Ajz77Noch keine Bewertungen

- Advanced Micro EconomicsDokument50 SeitenAdvanced Micro EconomicsSayemin Naheen100% (1)

- OkDokument4 SeitenOkAtrayee ChoudhuryNoch keine Bewertungen

- Lecture 8 - Risk AversionDokument7 SeitenLecture 8 - Risk AversionNikanon AvaNoch keine Bewertungen

- Insurance Decision-Making and Market Behavior - Kunreuther (2005)Dokument65 SeitenInsurance Decision-Making and Market Behavior - Kunreuther (2005)Jose CobianNoch keine Bewertungen

- Behavioral Finance - Investor StyleDokument15 SeitenBehavioral Finance - Investor StyleCarmen BejarNoch keine Bewertungen

- Profiling The Risk Tolerance of Higher Education Students in ZambiaDokument10 SeitenProfiling The Risk Tolerance of Higher Education Students in ZambiaThe IjbmtNoch keine Bewertungen

- DISC 321-Decision Analysis-Kamran Ali ChathaDokument9 SeitenDISC 321-Decision Analysis-Kamran Ali ChathaAdil AshrafNoch keine Bewertungen

- Decision Making Under UncertaintyDokument51 SeitenDecision Making Under UncertaintyRavneet SinghNoch keine Bewertungen