Beruflich Dokumente

Kultur Dokumente

CSE 16-2011 - Dialog Axiata PLC - Q3 2011 Financial Statements

Hochgeladen von

LBTodayCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CSE 16-2011 - Dialog Axiata PLC - Q3 2011 Financial Statements

Hochgeladen von

LBTodayCopyright:

Verfügbare Formate

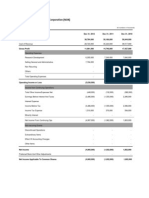

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

CONSOLIDATED INTERIM FINANCIAL

INFORMATION FOR THE NINE MONTHS ENDED

30 SEPTEMBER 2011

Page 2

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Balance sheet

(all amounts in Sri Lanka Rupees Thousands)

30 September 2011

Group

Company

ASSETS

Non-current assets

Property, plant and equipment

Intangible assets

Investments in subsidiaries

Investment in associate

Other investment

Amount due from subsidiaries

31 December 2010

Group

Company

51,584,001

3,993,255

Nil

34,057

30,596

Nil

55,641,909

43,131,481

1,719,631

10,326,010

27,742

30,596

9,254,822

64,490,282

53,014,351

3,757,193

Nil

Nil

30,596

Nil

56,802,140

44,348,523

1,397,140

10,326,010

Nil

30,596

8,771,992

64,874,261

389,904

10,060,682

10,010,208

20,460,794

385,202

8,721,685

9,494,357

18,601,244

271,184

9,628,718

5,433,770

15,333,672

266,159

8,071,307

5,079,135

13,416,601

76,102,703

83,091,526

72,135,812

78,290,862

29,306,113

(1,990,921)

291,782

129,225

4,834,680

32,570,879

32,570,879

29,306,113

(1,990,921)

291,782

94,503

13,636,567

41,338,044

41,338,044

30,556,113

(1,990,921)

260,067

131,713

2,656,318

31,613,290

31,613,290

30,556,113

(1,990,921)

260,067

96,820

10,744,469

39,666,548

39,666,548

17,932,680

1,923,985

450,229

642,520

1,103,522

22,052,936

17,932,680

1,923,985

411,134

629,710

1,103,522

22,001,031

20,122,753

1,612,510

390,635

619,876

285,766

23,031,540

20,122,753

1,612,510

358,854

607,794

285,766

22,987,677

Total liabilities

Total equity and liabilities

13,364,527

54,440

8,059,921

21,478,888

43,531,824

76,102,703

11,879,111

50,820

7,822,520

19,752,451

41,753,482

83,091,526

12,094,208

14,151

5,382,623

17,490,982

40,522,522

72,135,812

10,443,631

10,898

5,182,108

15,636,637

38,624,314

78,290,862

Net assets per share (Rs.)

3.85

4.92

3.57

4.56

Current assets

Inventories

Trade and other receivables

Cash and cash equivalents

Total assets

EQUITY

Capital and reserves attributable to equity

holders of the Company

Stated capital

ESOS Trust shares

Dividend reserve - ESOS

Revaluation reserve

Retained earnings

Total equity

LIABILITIES

Non-current liabilities

Borrowings

Deferred income tax liabilities

Retirement benefit obligations

Provision for other liabilities

Deferred revenue

Current liabilities

Trade and other payables

Current income tax liabilities

Borrowings

I certify that these financial statements have been prepared in compliance with the requirements of the Companies Act, No. 07 of

2007.

Signed

Group Chief Financial Officer

Date : 28 October 2011

The Board of Directors is responsible for the preparation and presentation of these financial statements.

Approved and signed for and on behalf of the Board of Directors:

Signed

Director

Date : 28 October 2011

The notes on page 8 to 12 form an integral part of these financial statements.

Signed

Director

Date : 28 October 2011

Page 3

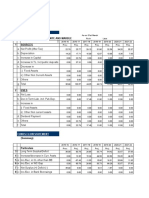

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Income statement

(all amounts in Sri Lanka Rupees Thousands)

Nine months ended

30 September 2011

Group

Company

Revenue

Direct costs

Gross margin

Other operating income

33,663,914

30,853,735

(18,592,777) (16,693,108)

Nine months ended

30 September 2010

Group

Company

30,668,744

28,068,421

(17,350,683)

(15,221,131)

15,071,137

14,160,627

13,318,061

12,847,290

55,975

53,414

79,603

63,333

Administrative costs

(6,087,298)

(4,811,804)

(4,993,823)

(3,875,265)

Distribution costs

(4,857,845)

(4,503,915)

(4,273,387)

(3,811,404)

4,181,969

4,898,322

4,130,454

5,223,954

155,623

154,346

6,638

Nil

Nil

Nil

4,344,230

5,052,668

4,095,407

5,315,548

Operating profit

Finance income/ (costs )- net

Share of profit of associate

Profit before tax

(408,803)

Tax

Profit for the period

(403,334)

(35,047)

(323,262)

91,594

(325,101)

3,935,427

4,649,334

3,772,145

4,990,447

3,935,427

4,649,334

3,772,145

4,990,447

- Basic

0.72

0.85

0.44

0.59

- Diluted

0.72

0.85

0.44

0.59

Attributable to:

Equity holders of the Company

Earnings per share on profit attributable to the equity holders of

the Company during the period (expressed in Rs per share)

The notes on page 8 to 12 form an integral part of these financial statements.

Page 4

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Income statement

(all amounts in Sri Lanka Rupees Thousands)

Three months ended

30 September 2011

Group

Company

Three months ended

30 September 2010

Group

Company

Revenue

11,648,028

10,676,925

10,557,453

9,671,291

Direct costs

(6,074,750)

(5,511,966)

(5,913,567)

(5,222,958)

5,573,278

5,164,959

4,643,886

4,448,333

2,657

2,295

19,248

17,440

Gross margin

Other operating income

Administrative costs

(2,113,384)

(1,580,940)

(1,595,280)

(1,291,952)

Distribution costs

(1,729,151)

(1,580,488)

(1,408,559)

(1,312,473)

1,733,400

2,005,826

1,659,295

1,861,348

120,537

125,854

Operating profit

Finance (costs)/income - net

Share of profit of associate

Profit before tax

(85,573)

4,329

Nil

Nil

Nil

1,652,156

1,919,292

1,779,832

1,987,202

(259,701)

Tax

Profit for the period

(86,534)

(256,678)

(86,894)

(86,552)

1,392,455

1,662,614

1,692,938

1,900,650

1,392,455

1,662,614

1,692,938

1,900,650

- Basic

0.26

0.31

0.20

0.23

- Diluted

0.26

0.31

0.20

0.23

Attributable to:

Equity holders of the Company

Earnings per share on profit attributable to the equity holders of

the Company during the period (expressed in Rs per share)

The notes on page 8 to 12 form an integral part of these financial statements.

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Page 5

Statement of changes in equity

(all amounts in Sri Lanka Rupees Thousands)

Group

Stated

capital

Shares in

ESOS trust

Dividend

reserve

- ESOS

Revaluation

reserve

Retained

earnings

Total

Balance at 1 January 2010

31,806,113

(1,990,921)

260,067

136,471

(2,102,401)

28,109,329

Net profit

Dividend to rated cumulative redeemable preference shares

Redemption of rated cumulative redeemable preference shares

Deferred tax attributable to revaluation surplus

Depreciation transfer

Balance as at 30 September 2010

Nil

Nil

(1,250,000)

Nil

Nil

30,556,113

Nil

Nil

Nil

Nil

Nil

(1,990,921)

Nil

Nil

Nil

Nil

Nil

260,067

Nil

Nil

Nil

(1,050)

(3,015)

132,406

3,772,145

(257,025)

Nil

Nil

3,015

1,415,734

3,772,145

(257,025)

(1,250,000)

(1,050)

Nil

30,373,399

Balance at 1 October 2010

30,556,113

(1,990,921)

260,067

132,406

1,415,734

30,373,399

Net profit

Dividend to rated cumulative redeemable preference shares

Depreciation transfer

Deferred tax attributable to revaluation surplus

Balance at 31 December 2010

Nil

Nil

Nil

Nil

30,556,113

Nil

Nil

Nil

Nil

(1,990,921)

Nil

Nil

Nil

Nil

260,067

Nil

Nil

(1,037)

344

131,713

1,275,296

(35,749)

1,037

Nil

2,656,318

1,275,296

(35,749)

Nil

344

31,613,290

Balance at 1 January 2011

30,556,113

(1,990,921)

260,067

131,713

2,656,318

31,613,290

Net profit

Dividend to rated cumulative redeemable preference shares

Depreciation transfer

Dividend received ESOS

Deferred tax attributable to revaluation surplus

Dividend to ordinary shares

Redemption of rated cumulative redeemable preference shares

Balance as at 30 September 2011

Nil

Nil

Nil

Nil

Nil

Nil

(1,250,000)

29,306,113

Nil

Nil

Nil

Nil

Nil

Nil

Nil

(1,990,921)

Nil

Nil

Nil

31,715

Nil

Nil

Nil

291,782

Nil

Nil

(3,035)

Nil

547

Nil

Nil

129,225

3,935,427

(131,344)

3,035

Nil

Nil

(1,628,756)

Nil

4,834,680

3,935,427

(131,344)

Nil

31,715

547

(1,628,756)

(1,250,000)

32,570,879

The notes on page 8 to 12 form an integral part of these financial statements.

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Page 6

Statement of changes in equity

(all amounts in Sri Lanka Rupees Thousands)

Company

Stated

capital

Shares in

ESOS trust

Dividend

reserve

- ESOS

Balance at 1 January 2010

31,806,113

(1,990,921)

260,067

Net profit

Deferred tax attributable to revaluation surplus

Redemption of rated cumulative redeemable preference shares

Depreciation transfer

Dividend to rated cumulative redeemable preference shares

Balance as at 30 September 2010

Nil

Nil

(1,250,000)

Nil

Nil

30,556,113

Nil

Nil

Nil

Nil

Nil

(1,990,921)

Nil

Nil

Nil

Nil

Nil

260,067

Balance at 1 October 2010

30,556,113

(1,990,921)

Net profit

Deferred tax attributable to revaluation surplus

Depreciation transfer

Dividend to rated cumulative redeemable preference shares

Balance at 31 December 2010

Nil

Nil

Nil

Nil

30,556,113

Balance at 1 January 2011

Net profit

Redemption of rated cumulative redeemable preference shares

Dividend to ordinary shares

Dividend to rated cumulative redeemable preference shares

Dividend received ESOS

Depreciation transfer

Deferred tax attributable to revaluation surplus

Balance as at 30 September 2011

Revaluation

reserve

Total

4,481,458

34,658,075

Nil

(1,050)

Nil

(2,850)

Nil

97,458

4,990,447

Nil

Nil

2,850

(257,025)

9,217,730

4,990,447

(1,050)

(1,250,000)

Nil

(257,025)

38,140,447

260,067

97,458

9,217,730

38,140,447

Nil

Nil

Nil

Nil

(1,990,921)

Nil

Nil

Nil

Nil

260,067

Nil

344

(982)

Nil

96,820

1,561,506

Nil

982

(35,749)

10,744,469

1,561,506

344

Nil

(35,749)

39,666,548

30,556,113

(1,990,921)

260,067

96,820

10,744,469

39,666,548

Nil

(1,250,000)

Nil

Nil

Nil

Nil

Nil

29,306,113

Nil

Nil

Nil

Nil

Nil

Nil

Nil

(1,990,921)

Nil

Nil

Nil

Nil

31,715

Nil

Nil

291,782

Nil

Nil

Nil

Nil

Nil

(2,864)

547

94,503

4,649,334

Nil

(1,628,756)

(131,344)

Nil

2,864

Nil

13,636,567

4,649,334

(1,250,000)

(1,628,756)

(131,344)

31,715

Nil

547

41,338,044

The notes on page 8 to 12 form an integral part of these financial statements.

101,358

Retained

earnings

Page 7

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Cash Flow Statement

(all amounts in Sri Lanka Rupees Thousands)

Nine months ended

30 September 2011

Group

Company

Nine months ended

30 September 2010

Group

Company

Cash flows from operating activities

Cash generated from operations

Interest received

TDC refund received

Interest paid

Tax / SRL/ ESC paid

Retirement benefit obligations paid

Net cash generated from operating activities

11,988,747

152,454

1,646,941

(166,199)

(86,693)

(10,180)

13,525,070

11,338,084

146,198

1,646,941

(166,135)

(82,112)

(9,998)

12,872,978

10,470,862

45,207

210,260

(575,788)

(69,268)

(36,076)

10,045,197

9,891,928

43,758

210,260

(434,048)

(69,255)

(31,078)

9,611,565

Cash flows from investing activities

Purchases of property, plant and equipment (PPE)

Purchases of intangible assets

Amount given to subsidiaries

Investment in associate

Proceeds from sale of investment

Expenditure incurred on capital work-in-progress

Proceeds from sale of PPE

Net cash used in investing activities

(4,957)

(384,614)

Nil

(11,440)

69,190

(6,278,733)

2,781

(6,607,773)

(4,969)

(384,614)

(847,456)

(11,440)

69,190

(4,901,320)

2,363

(6,078,246)

(65,549)

(28,134)

Nil

Nil

Nil

(3,880,934)

46,785

(3,927,832)

(62,938)

(12,642)

(2,712,424)

Nil

Nil

(2,548,872)

36,409

(5,300,467)

Cash flows from financing activities

Repayment of finance leases

Repayment of borrowings

Proceeds from borrowings

Redemption of rated cumulative redeemable preference shares

Dividend - Ordinary shares

Dividend - rated cumulative redeemable preference shares

Dividend received -ESOS

(5,755)

(3,401,222)

4,276,441

(1,250,000)

(1,628,756)

(124,023)

31,714

Nil

(3,401,222)

4,276,441

(1,250,000)

(1,628,756)

(124,023)

31,714

(19,638)

(6,609,526)

2,112,243

(1,250,000)

Nil

(222,185)

Nil

(5,247)

(5,125,892)

2,081,563

(1,250,000)

Nil

(222,185)

Nil

Net cash used in financing activities

(2,101,601)

(2,095,846)

(5,989,106)

(4,521,761)

Net increase/(decrease) in cash and cash

equivalents

4,815,696

4,698,886

128,259

(210,663)

Movement in cash and cash equivalents

At start of year

Increase/(decrease)

Exchange losses on cash and bank overdrafts

At end of period

4,475,861

4,815,696

(4,585)

9,286,972

4,314,219

4,698,886

(4,585)

9,008,520

3,019,449

128,259

(32,571)

3,115,137

3,175,076

(210,663)

(32,571)

2,931,842

The notes on page 8 to 12 form an integral part of these financial statements.

Page 8

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Notes to the financial statements

(in the notes all amounts in Sri Lanka Rupees thousands unless otherwise stated)

General information

Dialog Axiata PLC (the Company) and its subsidiaries (together the Group) provide Communication (Mobile, Internet,

International, Data and Backbone, Fixed wireless and Transmission infrastructure) and Media related services.

Dialog Axiata PLC (the Company) is a public limited liability company incorporated and domiciled in Sri Lanka and listed

on the Colombo Stock Exchange. The registered office of the Company is located at 475, Union Place, Colombo 2.

Issued ordinary shares of the Company have been listed on the Colombo Stock Exchange since 28 July 2005.

Basis of preparation

The condensed interim consolidated financial information of Dialog Axiata PLC (the Company) for the period ended 30

September 2011 has been prepared in accordance with Sri Lanka Accounting Standard 35 Interim Financial Reporting.

The interim consolidated financial information should be read in conjunction with the annual financial statements for the

year ended 31 December 2010.

Accounting policies

Accounting policies adopted are consistent with those of the annual financial statements for the year ended 31 December

2010.

Segment information

The segmental reporting presentation is revised to represent more appropriate business segments of the group.

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Page 9

Notes to the financial statements (Contd)

Segment information (Contd)

Primary reporting format - business segments

o

The segment results for the period ended 30 September 2011 are as follows:

Mobile

operations

Total segmental revenue

Inter-segment revenue

Revenue from external customers

Operating profit/(loss) / segment results

Fixed

broadband

operations

Television

operations

Other

30,853,735

(333,915)

30,519,820

1,771,983

(338,372)

1,433,611

1,722,348

(12,263)

1,710,085

39,784

(39,386)

398

4,898,322

(657,175)

(19,563)

(1,242)

Elimination

/adjustment

Nil

Nil

Nil

(38,373)

Finance income - net

Share of profit of associate

Profit before income tax

Income tax expense

Profit for the period

o

34,387,850

(723,936)

33,663,914

4,181,969

155,623

6,638

4,344,230

(408,803)

3,935,427

Other segment items included in the income statement are as follows:

Mobile

operations

Depreciation, amortisation and impairment

Group

6,037,107

Fixed

broadband

operation

1,115,199

Television

operations

396,549

Elimination

/adjustment

Other

1,758

37,715

Group

7,588,328

The segment assets and liabilities at 30 September 2011 and capital expenditure for the period then ended are as follows:

Mobile

operations

Fixed

broadband

operations

Television

operations

Elimination

/adjustment

Assets

Inter -segment assets

Total assets

83,091,526

(9,246,646)

8,314,114

(14,848)

3,269,939

(1,060)

Liabilities

Inter- segment liabilities

Total liability

41,753,482

(114,157)

8,913,856

(8,093,421)

2,542,161

(1,470,097)

Nil

Nil

53,209,499

(9,677,675)

43,531,824

5,290,903

1,094,126

283,275

Nil

6,668,304

Capital expenditure

(9,310,322)

Nil

Group

85,365,257

(9,262,554)

76,102,703

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Page 10

Notes to the financial statements (Contd)

Segment information (Contd)

o

The segment results for the period ended 30 September 2010 are as follows:

Mobile

operations

Total segmental revenue

Inter-segment revenue

Revenue from external customers

Operating profit / (loss) / segment results

Fixed

broadband

operations

Television

operations

28,068,421

(414,613)

27,653,808

1,770,947

(267,424)

1,503,523

1,520,109

(8,696)

1,511,413

5,223,954

(838,853)

(216,230)

Elimination

/adjustment

Nil

Nil

Nil

(38,417)

Finance costs - net

Share of profit of associate

Profit before income tax

Income tax expense

Profit for the period

31,359,477

(690,733)

30,668,744

4,130,454

(35,047)

Nil

4,095,407

(323,262)

3,772,145

Mobile

operations

Depreciation, amortisation and impairment

Group

5,730,576

Fixed

broadband

operations

1,016,982

Television

operations

354,269

Elimination

/adjustment

37,715

Group

7,139,542

The segment assets and liabilities at 31 December 2010 and capital expenditure for the year then ended are as follows:

Mobile

operations

Fixed

broadband

operations

Television

operations

Assets

Inter -segment assets

Total assets

78,290,862

(8,769,992)

8,487,674

(8,278)

3,408,441

(291)

Liabilities

Inter- segment liabilities

Total liability

38,624,314

(23,146)

8,429,555

(7,583,078)

2,657,593

(1,582,716)

5,029,817

2,201,115

Capital expenditure

701,490

Elimination

/adjustment

(9,272,604)

Nil

Group

80,914,373

(8,778,561)

72,135,812

Nil

Nil

49,711,462

(9,188,940)

40,522,522

Nil

7,932,422

Page 11

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Notes to the financial statements (Contd)

5

Stated capital

Stated Capital of the Company consist of 8,143,778,405 ordinary shares and 1,250,000,000 rated cumulative

redeemable preference shares.

Comparatives

Where necessary, comparative figures have been adjusted to conform with changes in presentation in the current period.

Market price per share

For the three months ended 30 September

-

11.00

7.80

8.40

2010

12.70

9.25

12.60

20 largest shareholders of the Company

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

Highest

Lowest

Last traded

2011

Name of Shareholder

No. of Shares

% Holding

Axiata Investments (Labuan) Limited

HSBC - BBH - Genesis Smaller Companies

Dialog Telekom Employees ESOS Trust

Employees Provident Fund

Sri Lanka Insurance Corporation Ltd-Life Fund

HSBC-SSBT- South Asia Portfolio

HSBC-International Finance Corporation

HSBC-BBH-Genesis Emerging Markets Opportunities Fund

HSBC-JPMLU-Morgan Stanley Asset Management

Browns Investments (Pvt) Ltd

BNY-CF Ruffer Investment Funds

Northen Trust Co s/a Northern Trust Fiduciary Services (Ireland)

as Trustee to Baring Asean Frontiers Fund

HSBC-JPMCB-Scottish Orl Sml TR GTI 6018

Pemberton Asian Opportunities Fund

Sri Lanka Insurance Corporation Ltd-General Fund

Associated Electrical Corporation Ltd

HSBC-SSBT-Morgan Stanley Frontier Emerging Markets Fund Inc

Seylan Bank PLC. - A/C No. 3

CB London s/a RBS as DEP of FS India Sub/Cont FD Aa s/f of First State

Invest ICVC

Mercantile Investments Limited

6,785,252,765

191,221,640

158,572,462

124,461,289

74,585,920

68,161,980

64,086,800

55,345,900

54,985,167

44,990,600

44,314,300

38,938,000

83.32%

2.35%

1.95%

1.53%

0.92%

0.84%

0.79%

0.68%

0.68%

0.55%

0.54%

0.48%

32,207,500

23,000,000

22,320,360

18,450,600

18,347,188

17,459,100

0.40%

0.28%

0.27%

0.23%

0.23%

0.21%

17,240,000

11,000,000

0.21%

0.14%

Public shareholding

The percentage of public shareholding as at 30 September 2011 was 14.73% (14.73% as at 31 December 2010),

calculated as per the listing rules of the Colombo Stock Exchange.

Page 12

DIALOG AXIATA PLC AND ITS SUBSIDIARIES

Notes to the financial statements (Contd)

10

Directors shareholdings

The details of shares held by the Directors and their spouses as at 30 September 2011 are as follows:

Dr. Shridhir Sariputta Hansa Wijayasuriya

Mr. Moksevi Rasingh Prelis

Mr. Mohamed Vazir Muhsin

42,570

18,480

18,040

None of the Directors other than those disclosed above hold any shares in the Company.

11

Contingencies

There has not been a significant change in the nature of the contingent liabilities, which were disclosed in the Annual

Report for the year ended 31 December 2010.

12

Events after the balance sheet date

No circumstances have arisen since the balance sheet date, which would require adjustments to or disclosure in the

financial statements.

Das könnte Ihnen auch gefallen

- Paper Accounts SPL (Con) - Sep-2011Dokument4 SeitenPaper Accounts SPL (Con) - Sep-2011Shafiul MuznabinNoch keine Bewertungen

- Third Quarter Ended 31 December 2011Dokument19 SeitenThird Quarter Ended 31 December 2011Norliza YusofNoch keine Bewertungen

- HCL Technologies LTD 170112Dokument3 SeitenHCL Technologies LTD 170112Raji_r30Noch keine Bewertungen

- Balance Sheet: As at June 30,2011Dokument108 SeitenBalance Sheet: As at June 30,2011Asfandyar NazirNoch keine Bewertungen

- 3B36C062-4ACD-428C-A2C5-A960A40E32B7Dokument173 Seiten3B36C062-4ACD-428C-A2C5-A960A40E32B7belalangkupukupukupuNoch keine Bewertungen

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Dokument9 SeitenICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunNoch keine Bewertungen

- MDRX10 Q 2Dokument63 SeitenMDRX10 Q 2mrjohnseNoch keine Bewertungen

- Financial Statements Year Ended Dec 2010Dokument24 SeitenFinancial Statements Year Ended Dec 2010Eric FongNoch keine Bewertungen

- MMH SGXnet 03 12 FinalDokument16 SeitenMMH SGXnet 03 12 FinalJosephine ChewNoch keine Bewertungen

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Dokument10 SeitenNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNoch keine Bewertungen

- CHEM Audited Results For FY Ended 31 Oct 13Dokument5 SeitenCHEM Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNoch keine Bewertungen

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDokument14 SeitenASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)Noch keine Bewertungen

- Financial Report Financial ReportDokument16 SeitenFinancial Report Financial Report8001800Noch keine Bewertungen

- Weida 2011's 4th QTR Return - 31032011Dokument23 SeitenWeida 2011's 4th QTR Return - 31032011Kai Sheng RooraNoch keine Bewertungen

- Analisis Laporan Keuangan PT XL AXIATA TBKDokument9 SeitenAnalisis Laporan Keuangan PT XL AXIATA TBKmueltumorang0% (1)

- Symc (2011 2Q) PDFDokument59 SeitenSymc (2011 2Q) PDFNitesh ChauhanNoch keine Bewertungen

- 1st QTR 30 Sep 11Dokument18 Seiten1st QTR 30 Sep 11m__saleemNoch keine Bewertungen

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Dokument1 SeiteUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNoch keine Bewertungen

- Income Statement: Assets Non-Current AssetsDokument213 SeitenIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNoch keine Bewertungen

- Annual Report OfRPG Life ScienceDokument8 SeitenAnnual Report OfRPG Life ScienceRajesh KumarNoch keine Bewertungen

- HUL MQ 12 Results Statement - tcm114-286728Dokument3 SeitenHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNoch keine Bewertungen

- TCS Ifrs Q3 13 Usd PDFDokument23 SeitenTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNoch keine Bewertungen

- Statement of Financial Position As at 31 December 2013: Renata Limited 2013Dokument2 SeitenStatement of Financial Position As at 31 December 2013: Renata Limited 2013SouravAgarwalNoch keine Bewertungen

- ICI Pakistan Limited: Balance SheetDokument28 SeitenICI Pakistan Limited: Balance SheetArsalan KhanNoch keine Bewertungen

- Quarterly Acc 3rd 2011 12Dokument10 SeitenQuarterly Acc 3rd 2011 12Asif Al AminNoch keine Bewertungen

- Consolidated Accounts June-2011Dokument17 SeitenConsolidated Accounts June-2011Syed Aoun MuhammadNoch keine Bewertungen

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Dokument18 SeitenSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNoch keine Bewertungen

- SP Setia Annual Report 2005Dokument13 SeitenSP Setia Annual Report 2005Xavier YeohNoch keine Bewertungen

- Bata Shoe Company (Bangladesh) Limited Statement of Financial Position (Un-Audited) As at 30 June 2011Dokument5 SeitenBata Shoe Company (Bangladesh) Limited Statement of Financial Position (Un-Audited) As at 30 June 2011Mohammad NaserNoch keine Bewertungen

- Shell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011Dokument19 SeitenShell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011roker_m3Noch keine Bewertungen

- Pak Elektron Limited: Condensed Interim FinancialDokument16 SeitenPak Elektron Limited: Condensed Interim FinancialImran ArshadNoch keine Bewertungen

- First Quarter Ended March 31 2012Dokument24 SeitenFirst Quarter Ended March 31 2012Wai HOngNoch keine Bewertungen

- MSSL Results Quarter Ended 31st December 2011Dokument4 SeitenMSSL Results Quarter Ended 31st December 2011kpatil.kp3750Noch keine Bewertungen

- PCC - Financial Stahtements 2013 - Final by RashidDokument56 SeitenPCC - Financial Stahtements 2013 - Final by RashidFahad ChaudryNoch keine Bewertungen

- FLBHD 2015 Q2 Financial ReportDokument4 SeitenFLBHD 2015 Q2 Financial ReportYan KhaiNoch keine Bewertungen

- Consolidated AFR 31mar2011Dokument1 SeiteConsolidated AFR 31mar20115vipulsNoch keine Bewertungen

- Integrated Micro-Electronics: Q2 Results (Press Release)Dokument17 SeitenIntegrated Micro-Electronics: Q2 Results (Press Release)BusinessWorldNoch keine Bewertungen

- Padaeng FS Dec2011Dokument35 SeitenPadaeng FS Dec2011reine1987Noch keine Bewertungen

- PEL 2009 FinancialsDokument7 SeitenPEL 2009 FinancialssaqibaliraoNoch keine Bewertungen

- Finan StatDokument11 SeitenFinan StatMd. Abu Yousuf NoshedNoch keine Bewertungen

- Central Industries PLC: (Company Reg - No. PQ 121)Dokument10 SeitenCentral Industries PLC: (Company Reg - No. PQ 121)wasantha12Noch keine Bewertungen

- Wipro Financial StatementsDokument37 SeitenWipro Financial StatementssumitpankajNoch keine Bewertungen

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Dokument58 SeitenCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3ch0% (1)

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Dokument71 SeitenCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3chNoch keine Bewertungen

- United States Securities and Exchange Commission FORM 10-QDokument71 SeitenUnited States Securities and Exchange Commission FORM 10-QWai LonnNoch keine Bewertungen

- Ebix, Inc.: FORM 10-QDokument39 SeitenEbix, Inc.: FORM 10-QalexandercuongNoch keine Bewertungen

- Consol FY11 Annual Fin StatementDokument13 SeitenConsol FY11 Annual Fin StatementLalith RajuNoch keine Bewertungen

- Financial Statement SolutionDokument21 SeitenFinancial Statement SolutionYousaf BhuttaNoch keine Bewertungen

- Report Arutmin Indonesia September 2011Dokument56 SeitenReport Arutmin Indonesia September 2011Fredy Milson SimbolonNoch keine Bewertungen

- Results For The Year Ended 30 September 2010Dokument19 SeitenResults For The Year Ended 30 September 2010Sissi ChiangNoch keine Bewertungen

- Assignment Ratio - A4 SizeDokument4 SeitenAssignment Ratio - A4 SizekakurehmanNoch keine Bewertungen

- Balance Sheet: As at June 30, 2011Dokument45 SeitenBalance Sheet: As at June 30, 2011Rana HaiderNoch keine Bewertungen

- Nokia Financial StatementsDokument5 SeitenNokia Financial StatementsSaleh RehmanNoch keine Bewertungen

- Consolidated First Page To 11.2 Property and EquipmentDokument18 SeitenConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564Noch keine Bewertungen

- PHN 17Q Sep2011Dokument74 SeitenPHN 17Q Sep2011Ryan Samuel C. CervasNoch keine Bewertungen

- PT Asiaplast Industries TBK: Laporan Keuangan 31 DESEMBER 2011 DAN 2010 Dan/And Laporan Auditor IndependenDokument70 SeitenPT Asiaplast Industries TBK: Laporan Keuangan 31 DESEMBER 2011 DAN 2010 Dan/And Laporan Auditor IndependenElven StoresNoch keine Bewertungen

- 494.Hk 2011 AnnReportDokument29 Seiten494.Hk 2011 AnnReportHenry KwongNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- Agricultural Implements World Summary: Market Values & Financials by CountryVon EverandAgricultural Implements World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Budget Speech 2012Dokument74 SeitenBudget Speech 2012yusufariffNoch keine Bewertungen

- Galle HotelDokument3 SeitenGalle HotelLBTodayNoch keine Bewertungen

- NDB 2012 Budget Proposal HighlightsDokument9 SeitenNDB 2012 Budget Proposal HighlightsLBTodayNoch keine Bewertungen

- FitchDokument6 SeitenFitchLBTodayNoch keine Bewertungen

- Onsite WTM Industry Report 2011Dokument60 SeitenOnsite WTM Industry Report 2011LBTodayNoch keine Bewertungen

- FitchDokument6 SeitenFitchLBTodayNoch keine Bewertungen

- NDB 2qfy11Dokument14 SeitenNDB 2qfy11LBTodayNoch keine Bewertungen

- Index Charts October 10thDokument8 SeitenIndex Charts October 10thLBTodayNoch keine Bewertungen

- Daily Exchange Rates-20092011Dokument1 SeiteDaily Exchange Rates-20092011LBTodayNoch keine Bewertungen

- Index Charts October 10thDokument8 SeitenIndex Charts October 10thLBTodayNoch keine Bewertungen

- Brs-Ipo Document Peoples Leasing Company LimitedDokument13 SeitenBrs-Ipo Document Peoples Leasing Company LimitedLBTodayNoch keine Bewertungen

- Peoples Leasing Co. IPODokument18 SeitenPeoples Leasing Co. IPOLBTodayNoch keine Bewertungen

- Capital Alliance PLC The Biggest Where Size MattersDokument31 SeitenCapital Alliance PLC The Biggest Where Size MattersLBTodayNoch keine Bewertungen

- Capital Trust Research 249 Peoples Leasing Company LTD IpoDokument11 SeitenCapital Trust Research 249 Peoples Leasing Company LTD IpoLBTodayNoch keine Bewertungen

- DNH Sri Lanka Weekly 24 Oct - 28 OctDokument11 SeitenDNH Sri Lanka Weekly 24 Oct - 28 OctLBTodayNoch keine Bewertungen

- Index Charts October 10thDokument8 SeitenIndex Charts October 10thLBTodayNoch keine Bewertungen

- Focus: Colombo Stock ExchangeDokument24 SeitenFocus: Colombo Stock ExchangeLBTodayNoch keine Bewertungen

- Oil 14.09Dokument1 SeiteOil 14.09LBTodayNoch keine Bewertungen

- Sri Lanka Inter Bank Offered Rates-1Dokument1 SeiteSri Lanka Inter Bank Offered Rates-1LBTodayNoch keine Bewertungen

- NDB Daily Market Update 27.10.11Dokument1 SeiteNDB Daily Market Update 27.10.11LBTodayNoch keine Bewertungen

- Call & Market 14.10Dokument2 SeitenCall & Market 14.10LBTodayNoch keine Bewertungen

- Call & Market 14.10Dokument2 SeitenCall & Market 14.10LBTodayNoch keine Bewertungen

- Price List 1Dokument4 SeitenPrice List 1LBTodayNoch keine Bewertungen

- Index Charts October 10thDokument8 SeitenIndex Charts October 10thLBTodayNoch keine Bewertungen

- Sri Lanka Inter Bank Offered Rates-1Dokument1 SeiteSri Lanka Inter Bank Offered Rates-1LBTodayNoch keine Bewertungen

- DNH Market Watch Daily 27.10.2011Dokument1 SeiteDNH Market Watch Daily 27.10.2011LBTodayNoch keine Bewertungen

- Daily Exchange Rates-20092011Dokument1 SeiteDaily Exchange Rates-20092011LBTodayNoch keine Bewertungen

- Asia Wealth 27th Oct '11Dokument8 SeitenAsia Wealth 27th Oct '11LBTodayNoch keine Bewertungen

- Current T Bill Press Release 25-03-2013Dokument1 SeiteCurrent T Bill Press Release 25-03-2013Randora LkNoch keine Bewertungen

- Installment MethodDokument4 SeitenInstallment Methodjessica amorosoNoch keine Bewertungen

- Tanco - Annual Report 2020 (Part 2)Dokument130 SeitenTanco - Annual Report 2020 (Part 2)Yu Wen LaiNoch keine Bewertungen

- Assignment #4 Magic Timber & SteelDokument12 SeitenAssignment #4 Magic Timber & SteelASAD ULLAH36% (14)

- Cost of FinanceDokument6 SeitenCost of Financeblue benzNoch keine Bewertungen

- Ifrs Framework PDFDokument23 SeitenIfrs Framework PDFMohammad Delowar HossainNoch keine Bewertungen

- Marginal CostingDokument15 SeitenMarginal CostingShri VidhyaNoch keine Bewertungen

- Solutions: D SC - Ordinary Share Premium Retained Earnings Treasury SharesDokument2 SeitenSolutions: D SC - Ordinary Share Premium Retained Earnings Treasury SharesQueen ValleNoch keine Bewertungen

- Management Accounting: Amity Business SchoolDokument24 SeitenManagement Accounting: Amity Business Schoolprateek agalNoch keine Bewertungen

- Chapter 2: Manufacturing Cost: Concept and ComponentsDokument5 SeitenChapter 2: Manufacturing Cost: Concept and ComponentsNur Batrisyia KhiriNoch keine Bewertungen

- Case: Riyadh SportsDokument4 SeitenCase: Riyadh SportslackylukNoch keine Bewertungen

- Prelim NotesDokument164 SeitenPrelim NotesShaina Monique RangasanNoch keine Bewertungen

- Merger &acquisitionDokument150 SeitenMerger &acquisitionMadhvendra BhardwajNoch keine Bewertungen

- 04 ABSORPTION AND VARIABLE COSTING - Rev23 24Dokument4 Seiten04 ABSORPTION AND VARIABLE COSTING - Rev23 24Kyn RusselNoch keine Bewertungen

- CH 7a BEPDokument12 SeitenCH 7a BEPNovhendraNoch keine Bewertungen

- Shree Shyam Granite Cma Data - Xls FINALDokument45 SeitenShree Shyam Granite Cma Data - Xls FINALSURANA1973100% (1)

- Classroom Exercises On Consolidation With Intercompany Sale of InventoryDokument7 SeitenClassroom Exercises On Consolidation With Intercompany Sale of InventoryRedNoch keine Bewertungen

- Financial Asset at Fair ValueDokument4 SeitenFinancial Asset at Fair ValueDianna DayawonNoch keine Bewertungen

- AP-03 Audit of Intangible AssetsDokument11 SeitenAP-03 Audit of Intangible AssetsMitch MinglanaNoch keine Bewertungen

- Orignal Internal Test Ac OneDokument6 SeitenOrignal Internal Test Ac OnePankaj PandagaleNoch keine Bewertungen

- 2ndlecture-Corporate LiquidationDokument6 Seiten2ndlecture-Corporate LiquidationRechelle DalusungNoch keine Bewertungen

- International Accounting Standard 36 (IAS 36), Impairment of AssetsDokument10 SeitenInternational Accounting Standard 36 (IAS 36), Impairment of AssetsMadina SabayevaNoch keine Bewertungen

- What Is The Overall Weighted Average Cost of Capital (WACC) ?Dokument3 SeitenWhat Is The Overall Weighted Average Cost of Capital (WACC) ?JIAXUAN WANGNoch keine Bewertungen

- Advanced Accounting ProblemsDokument4 SeitenAdvanced Accounting ProblemsAjay Sharma0% (1)

- Financial ModelingDokument5 SeitenFinancial ModelingQuang Hữu TrầnNoch keine Bewertungen

- Financial WorksheetDokument6 SeitenFinancial WorksheetCelyn DeañoNoch keine Bewertungen

- 9 - Bonds and Their ValuationDokument1 Seite9 - Bonds and Their Valuationjasminn_2Noch keine Bewertungen

- Advanced Financial Accounting-Part 2Dokument4 SeitenAdvanced Financial Accounting-Part 2gundapola83% (6)

- Andritz Financial Report 2019 en DataDokument173 SeitenAndritz Financial Report 2019 en DatamNoch keine Bewertungen

- Workingcapitalmanagement-Lecture (Student)Dokument19 SeitenWorkingcapitalmanagement-Lecture (Student)Christoper SalvinoNoch keine Bewertungen

- Baru Baru - PT X - Study Case 5Dokument98 SeitenBaru Baru - PT X - Study Case 5Kojiro FuumaNoch keine Bewertungen