Beruflich Dokumente

Kultur Dokumente

What Does Working Capital Management Mean

Hochgeladen von

mrinalsen69Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

What Does Working Capital Management Mean

Hochgeladen von

mrinalsen69Copyright:

Verfügbare Formate

Significance of Working Capital Management u u u u u In a typical manufacturing firm, current assets exceed one-half of total assets.

Excessive levels can result in a substandard Return on Investment (ROI). Current liabilities are the principal source of external financing for small firms. Requires continuous, day-to-day managerial supervision. Working capital management affects the companys risk, return, and share price.

Significance of Receivables Management

Significance of Cash Management cash flows into and out of the firm, cash flows within the firm, and cash balances held by the firm at a point of time by financing deficit or investing surplus cash

What Does Working Capital Management Mean?

A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets and current liabilities, in respect to each other. Working capital management ensures a company has sufficient cash flow in order to meet its short-term debt obligations and operating expenses.

http://www.investopedia.com/terms/w/workingcapitalmanagement.asp#axzz1cF0Kaqsu

What Does Cash Management Mean? The corporate process of collecting, managing and (short-term) investing cash. A key component of ensuring a company's financial stability and solvency. Frequently corporate treasurers or a business manager is responsible for overall cash management. Successful cash management involves not only avoiding insolvency (and therefore bankruptcy), but also reducing days in account receivables (AR), increasing collection rates, selecting appropriate short-term investment vehicles, and increasing days cash on hand all in order to improve a company's overall financial profitability. http://www.investopedia.com/terms/c/cash-management.asp#axzz1cF0Kaqsu What Does Accounts Receivable - AR Mean? Money owed by customers (individuals or corporations) to another entity in exchange for goods or services that have been delivered or used, but not yet paid for. Receivables usually come in the form of operating lines of credit and are usually due within a relatively short time period, ranging from a few days to a year. On a public company's balance sheet, accounts receivable is often recorded as an asset because this represents a legal obligation for the customer to remit cash for its short-term debts http://www.investopedia.com/terms/a/accountsreceivable.asp#axzz1cF0Kaqsu

Objectives of Working Capital Management:

- Deciding Optimum Level of Investment in various WC Assets - Decide Optimal Mix of Short Term and Long Term Capital - Decide Appropriate means of Short Term Financing

1) To make Payment According to Payment Schedule:-

Firm needs cash to meet its routine expenses including wages, salary, taxes etc. Following are main advantages of adequate cash-

1. 2. 3. 4.

To prevent firm from being insolvent. The relation of firm with bank does not deteriorate. Contingencies can be met easily. It helps firm to maintain good relations with suppliers.

(2) To minimise Cash Balance:The second objective of cash management is to minimise cash balance. Excessive amount of cash balance helps in quicker payments, but excessive cash may remain unused & reduces profitability of business. Contrarily, when cash available with firm is less, firm is unable to pay its liabilities in time. Therefore optimum level of cash should be maintain. http://www.mbanotesworld.in/2009/01/objective-of-cash-management.html Objectives of Receivables management Creating, presenting and collecting accounting receivables Establish and communicate the credit policies Evaluation of customers and setting credit limits Ensure prompt and accurate billing Maintaining up-to-date records Initiate collection procedures on overdue accounts

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Stanley F. Allen F.C.A. (Aust.) - The Pirates of Finance (1947)Dokument69 SeitenStanley F. Allen F.C.A. (Aust.) - The Pirates of Finance (1947)bookbenderNoch keine Bewertungen

- Ias 2Dokument4 SeitenIas 2mnhammadNoch keine Bewertungen

- Two MillionDokument19 SeitenTwo MillionFazal Ahmed100% (1)

- Video Production Quote TemplateDokument2 SeitenVideo Production Quote TemplateJosé Carlos Godinez VasquezNoch keine Bewertungen

- 92611902-KrugmanMacro SM Ch19 PDFDokument6 Seiten92611902-KrugmanMacro SM Ch19 PDFAlejandro Fernandez RodriguezNoch keine Bewertungen

- Fall FIN 254.10 Mid QuestionsDokument2 SeitenFall FIN 254.10 Mid QuestionsShariar NehalNoch keine Bewertungen

- Northern Arc Capital Raises $25 Million Debt From FMODokument10 SeitenNorthern Arc Capital Raises $25 Million Debt From FMOBSA3Tagum MariletNoch keine Bewertungen

- Resilience and Climate Resources, Reference DocumentDokument39 SeitenResilience and Climate Resources, Reference DocumentGOKUL GNoch keine Bewertungen

- 4 1ComparingAlternativesDokument59 Seiten4 1ComparingAlternativestouhidNoch keine Bewertungen

- Introduction On HDFC BankDokument3 SeitenIntroduction On HDFC BankAditya Batra50% (2)

- Statement 1688358203630Dokument3 SeitenStatement 1688358203630Chinmay RajNoch keine Bewertungen

- Central Banking and Financial RegulationsDokument9 SeitenCentral Banking and Financial RegulationsHasibul IslamNoch keine Bewertungen

- GloPAC Program 16 11 2023Dokument10 SeitenGloPAC Program 16 11 2023ElvisPresliiNoch keine Bewertungen

- Prudential Bank vs. Don A. Alviar & Georgia B. AlviarDokument3 SeitenPrudential Bank vs. Don A. Alviar & Georgia B. AlviarJenine QuiambaoNoch keine Bewertungen

- B1 How To Deal With Money LIU006: WWW - English-Practice - atDokument1 SeiteB1 How To Deal With Money LIU006: WWW - English-Practice - atIoana-Daniela PîrvuNoch keine Bewertungen

- Rental Agreement TemplateDokument2 SeitenRental Agreement TemplateytrdfghjjhgfdxcfghNoch keine Bewertungen

- S4H 966 Sample Configuration TrackerDokument129 SeitenS4H 966 Sample Configuration TrackerCleber CardosoNoch keine Bewertungen

- 11.25.2017 Accounting For Income TaxDokument5 Seiten11.25.2017 Accounting For Income TaxPatOcampo0% (1)

- Contract of AntichresisDokument2 SeitenContract of Antichresisjoshboracay100% (9)

- ITR 1 - AY 2023-24 - V1.3.xlsmDokument18 SeitenITR 1 - AY 2023-24 - V1.3.xlsmsrinukkNoch keine Bewertungen

- Living Faith Church Proforma InvoiceDokument1 SeiteLiving Faith Church Proforma InvoiceADEMILUYI SAMUEL TOLULOPENoch keine Bewertungen

- Country Wide Litigation Database 01072007Dokument15 SeitenCountry Wide Litigation Database 01072007Carrieonic100% (1)

- Question Bank 1. A and B Are Partners Sharing Profits in The Ratio of 3: 2 With Capitals of Rs. 50,000 and Rs. 30,000Dokument2 SeitenQuestion Bank 1. A and B Are Partners Sharing Profits in The Ratio of 3: 2 With Capitals of Rs. 50,000 and Rs. 30,000navin_raghuNoch keine Bewertungen

- CFAS Handout 01 - Corporation - Updated 01.21.2020Dokument23 SeitenCFAS Handout 01 - Corporation - Updated 01.21.2020VanessaNoch keine Bewertungen

- 2011 - UOL - Monetary EconsDokument15 Seiten2011 - UOL - Monetary EconsAaron ChiaNoch keine Bewertungen

- Cash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelDokument5 SeitenCash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelnarayanNoch keine Bewertungen

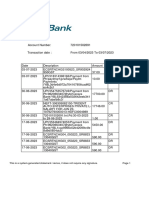

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument2 SeitenAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVara Prasad AvulaNoch keine Bewertungen

- Loan and Security Agreement 10Dokument170 SeitenLoan and Security Agreement 10befaj44984Noch keine Bewertungen

- Midterm I 2022 KEYDokument17 SeitenMidterm I 2022 KEYkuo zoeNoch keine Bewertungen

- Cover Letter Finance ManagerDokument1 SeiteCover Letter Finance ManagerhungdahoangNoch keine Bewertungen