Beruflich Dokumente

Kultur Dokumente

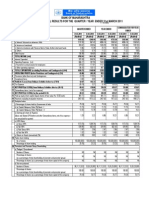

Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 Audited

Hochgeladen von

Dhanya R KarthaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 Audited

Hochgeladen von

Dhanya R KarthaCopyright:

Verfügbare Formate

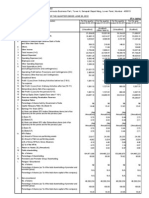

FINANCIAL RESULTS FOR THE THREE MONTHS/YEAR ENDED 31ST MARCH 2009 [Rs.

in Lakhs] Particulars 3 months ended 31.03.2009 47300 34491 9868 2941 3 months Year Ended Year Ended ended 31.03.2009 31.03.2008 31.03.2008 Audited Audited 35804 168692 129124 27307 7748 749 127090 35881 5721 96057 27271 5796

1. Interest earned (a) + (b) +(c) +(d) (a) Interest/discount on advances/bills (b) Income on investments (c) Interest on balances with Reserve Bank of India and other inter-bank funds (d) Others 2. Other Income 3. Total income (1+2) 4. Interest expended 5. Operating Expenses (i) + (ii) (i) Employees cost (ii) Other operating expenses 6. Total expenditure (4)+ (5) excluding provisions & contingencies 7. Operating Profit before provisions and contingencies (3) - (6) 8.Provisions (other than tax) and contingencies 9.Exceptional Items 10. Profit from Ordinary Activities before tax (7)-(8)-(9)

4429 51729 32496 9616 6951 2665 42112

3249 39053 25324 5329 3123 2206 30653

16427 185119 116404 32848 21418 11430 149252

14258 143382 91510 24537 14635 9902 116047

9617

8400

35867

27335

1445 8172

1635 6765

5730 30137

3890 270 23175

11.Tax expense - Current Tax - Deferred Tax - Fringe Benefit Tax 12.Net Profit from Ordinary Activities after tax (10)-(11) 13. Extra ordinary items (Net of Tax Expense) 14. Net Profit for the period (12+13) 15. Paid up equity share capital (Face Value Rs.10) 16. Reserves excluding revaluation reserves 17. Analytical Ratios i)Percentage of shares held by Goverment of India ii) Capital Adequacy Ratio (%) a) BASEL I b) BASEL II iii)Earning Per Share (EPS) (a) Basic & Diluted EPS - before extraordinary items (Not annualised) (Rs.) @ (b) Basic & Diluted EPS - after extraordinary items (Not annualised) (Rs.) @ iv) NPA Ratios (a) Gross NPA Net NPA (b) % of Gross NPA % of Net NPA (c) Return on Assets 18. Public Shareholding - No.of Shares (in lakhs) - Percentage of shareholding

1290 1828 27 5027 5027 11301

267 2014 0 4484 4484 9041

8856 1731 75 19475 19475 11301 117259

4730 3243 40 15162 15162 9041 105181

Nil 13.89 14.76 4.45 *

Nil 13.80 NA 3.97 *

Nil 13.89 14.76 17.23

Nil 13.80 NA 15.02 #

4.45 *

3.97 *

17.23

15.02 #

26056 13431 2.18 1.13 0.26 *

18848 3397 1.78 0.33 0.29 *

26056 13431 2.18 1.13 1.09

18848 3397 1.78 0.33 1.01

1130 100%

904 100%

1130 100%

904 100%

19. Promoters and promoter group shareholding (a) Pledged/ Encumbered - Number of shares - Percentage of shares[as a % of the total shareholding of promoter and promoter group] - Percentage of shares [as a % of the total share capital of the company] (b) Non Encumbered -Number of shares - Percentage of shares[as a % of the total shareholding of promoter and promoter group] - Percentage of shares [as a % of the total share capital of the company] NIL NIL NIL NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

# weighted average * Not annualised for three months period @ After considering Bonus Issue of shares in the ratio 1:4 Notes: 1. The above financial results for the year ended March 31, 2009 reviewed by the Audit Committee of the Board have been taken on record by the Board of Directors at their meeting held on April 30, 2009. The Board has recommended a dividend @ Rs. 3 per share of face value Rs.10/2. The working results have been arrived at after providing for Standard/Non performing assets as per RBI norms, provision for taxes and other necessary provisions. 3. Pending finalisation of industry level settlement of wage revision, a sum of Rs. 375 lakhs has been provided on an estimated basis during the three months [Rs. 2125 lakhs during the year] towards arrears and included under Employees' Cost. 4. Details of Investor complaints received and disposed off:

Pending at the beginning of the Quarter Received during the Quarter Redressed during the Quarter Pending at the end of the Quarter

Number 0 7 7 0

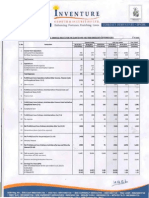

5. Previous period's/year's figures have been regrouped, wherever necessary to conform to the current period's classification. Segmentwise Results [Rs. in Lakhs] 3 months ended 31.03.2009 1. Segment Revenue a) Treasury b) Corporate/ Wholesale Banking c) Retail Banking d) Other Banking Operations Total Less : Inter segment -Revenue Income from Operations 2. Segment Results Profit(+)/Loss(-) before tax and after interest from each segment a) Treasury b) Corporate/ Wholesale Banking c) Retail Banking d) Other Banking Operations Total Less: unallocated expenditure 1420 51729 -51729 39053 441 39053 -185119 2697 185119 -143382 788 143382 13933 15861 20515 3 months ended 31.03.2008 9816 -753 29549 Year Ended 31.03.2009 Audited 46886 50119 85417 Year Ended 31.03.2008 Audited 38562 22431 81601

-2473 3394 7087 1164 9172 1000

-584 -1654 8635 368 6765 0

-2759 4534 27144 2218 31137 1000

3020 -6621 26125 651 23175 0

Profit Before Tax 3.Capital Employed a) Treasury b) Corporate/ Wholesale Banking c) Retail Banking d) Other Banking Operations Total

8172 607520 544989 640298 -1792807 --

6765 467672 395630 650045 -1513347

30137 607520 544989 640298 -1792807

23175 467672 395630 650045 1513347

By order of the Board DR. V. A. JOSEPH (MD & CEO) Thrissur April 30,2009

Das könnte Ihnen auch gefallen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersVon EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNoch keine Bewertungen

- Karnataka Bank Results Sep12Dokument6 SeitenKarnataka Bank Results Sep12Naveen SkNoch keine Bewertungen

- MRF PNL BalanaceDokument2 SeitenMRF PNL BalanaceRupesh DhindeNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2015 (Company Update)Dokument7 SeitenFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Sebi MillionsDokument2 SeitenSebi MillionsNitish GargNoch keine Bewertungen

- Userfiles Financial 6fDokument2 SeitenUserfiles Financial 6fTejaswini SkumarNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- IFCI Dec09Dokument3 SeitenIFCI Dec09nitin2khNoch keine Bewertungen

- Dabur Balance SheetDokument30 SeitenDabur Balance SheetKrishan TiwariNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument6 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- SIDBI Financial Result DEC 2010 EnglishDokument2 SeitenSIDBI Financial Result DEC 2010 EnglishSunil GuptaNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Result Q-1-11 For PrintDokument1 SeiteResult Q-1-11 For PrintSagar KadamNoch keine Bewertungen

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Dokument1 SeitePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaNoch keine Bewertungen

- Financial Results For June 30, 2013 (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Avt Naturals (Qtly 2012 12 31)Dokument1 SeiteAvt Naturals (Qtly 2012 12 31)Karl_23Noch keine Bewertungen

- Sebi MillionsDokument3 SeitenSebi MillionsShubham TrivediNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For March 31, 2015 (Result)Dokument5 SeitenFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Dokument11 SeitenStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Sebi Million Q3 1213 PDFDokument2 SeitenSebi Million Q3 1213 PDFGino SunnyNoch keine Bewertungen

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Dokument1 SeiteIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNoch keine Bewertungen

- Bil Quarter 2 ResultsDokument2 SeitenBil Quarter 2 Resultspvenkatesh19779434Noch keine Bewertungen

- BHL Fin Res 2011 12 q1 MillionDokument2 SeitenBHL Fin Res 2011 12 q1 Millionacrule07Noch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For The Quarter Ended 30 June 2012Dokument2 SeitenFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNoch keine Bewertungen

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Dokument3 SeitenReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Segment Reporting (Rs. in Crore)Dokument8 SeitenSegment Reporting (Rs. in Crore)Tushar PanhaleNoch keine Bewertungen

- New Listing For PublicationDokument2 SeitenNew Listing For PublicationAathira VenadNoch keine Bewertungen

- Ref: Code No. 530427: Encl: As AboveDokument3 SeitenRef: Code No. 530427: Encl: As AboveShyam SunderNoch keine Bewertungen

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokument7 SeitenAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument6 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results MARCH2011Dokument4 SeitenFinancial Results MARCH2011Rajat KukretiNoch keine Bewertungen

- Balance Sheet As at 31 March, 2011: ST STDokument14 SeitenBalance Sheet As at 31 March, 2011: ST STLambourghiniNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Dokument11 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Audited Financial 2011Dokument1 SeiteAudited Financial 2011gayatri9324814475Noch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Result)Dokument5 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Q2 Fy2011-12 PDFDokument2 SeitenQ2 Fy2011-12 PDFTushar PatelNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Consolidated Financial StatementsDokument28 SeitenConsolidated Financial Statementsswissbank333Noch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PressAdd 230509Dokument1 SeitePressAdd 230509Rekha BaiNoch keine Bewertungen

- Danish RAPDokument40 SeitenDanish RAPsalman0737100% (6)

- Brand ArchitectureDokument26 SeitenBrand ArchitectureNikhil Pal100% (1)

- Strategic Planning For Emerging Growth CompaniesDokument73 SeitenStrategic Planning For Emerging Growth CompaniesrmdecaNoch keine Bewertungen

- Venture Capital Q2 2016Dokument1 SeiteVenture Capital Q2 2016BayAreaNewsGroup100% (2)

- Sinco Vs Longa & Tevez 1928 (Guardianship) Facts:: Specpro Digest - MidtermDokument2 SeitenSinco Vs Longa & Tevez 1928 (Guardianship) Facts:: Specpro Digest - MidtermAngelic ArcherNoch keine Bewertungen

- Ibm Cognos ProspectingDokument3 SeitenIbm Cognos ProspectingtasvirkhaliliNoch keine Bewertungen

- Staff Paper: IASB Agenda RefDokument15 SeitenStaff Paper: IASB Agenda RefJesús David Izquierdo DíazNoch keine Bewertungen

- Dan Zanger Trading Rules PDFDokument4 SeitenDan Zanger Trading Rules PDFljhreNoch keine Bewertungen

- 2017 12 07 - APU Draft02 SignedDokument49 Seiten2017 12 07 - APU Draft02 SignedAnonymous pWVSQ1oIG6Noch keine Bewertungen

- Blaine Kitchenware Inc. Written Case AnalysisDokument1 SeiteBlaine Kitchenware Inc. Written Case AnalysisomirNoch keine Bewertungen

- Challenges Facing Implimentation of CRB Regulations in Kenya Commercial Banks in Kakamega TownshipDokument10 SeitenChallenges Facing Implimentation of CRB Regulations in Kenya Commercial Banks in Kakamega TownshipAlexander DeckerNoch keine Bewertungen

- Struktur OrganisasiDokument27 SeitenStruktur OrganisasiCipta DimensiaNoch keine Bewertungen

- Problem 8-19: Answer: C. 9,000,000Dokument2 SeitenProblem 8-19: Answer: C. 9,000,000Kien Alwyn Timola57% (7)

- Sarlaft Persona Natural PDFDokument3 SeitenSarlaft Persona Natural PDFPauline GamaNoch keine Bewertungen

- FileDokument75 SeitenFileAarti Ladda SarafNoch keine Bewertungen

- Meaning and Importance of Liquidity: Financial AccountingDokument3 SeitenMeaning and Importance of Liquidity: Financial AccountingrakeshgantiNoch keine Bewertungen

- The Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Dokument104 SeitenThe Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Surya G.C.Noch keine Bewertungen

- B215 AC08 Mochi Kochi 6th Presentation 19 June 2009Dokument46 SeitenB215 AC08 Mochi Kochi 6th Presentation 19 June 2009tohqinzhiNoch keine Bewertungen

- Ba Case Analysis FinalsDokument3 SeitenBa Case Analysis FinalsPaul Ryndel67% (3)

- How Maths Killed Lehman Brothers: by Horatio BoedihardjoDokument5 SeitenHow Maths Killed Lehman Brothers: by Horatio Boedihardjosaadz2007Noch keine Bewertungen

- Company Profile Allstate Consultants BackgroundDokument6 SeitenCompany Profile Allstate Consultants BackgroundClifton Gachagua100% (2)

- Working Capital Management at BEMLDokument20 SeitenWorking Capital Management at BEMLadharav malikNoch keine Bewertungen

- Captial Structure Trend in Indian Steel IndustryDokument76 SeitenCaptial Structure Trend in Indian Steel Industryjitendra jaushik50% (2)

- Bonds and Their Valuation ExerciseDokument42 SeitenBonds and Their Valuation ExerciseLee Wong100% (1)

- J JDokument4 SeitenJ JShani KhanNoch keine Bewertungen

- Case DigestsDokument889 SeitenCase Digestsjan jan100% (6)

- Epgpx01 Term Iii End Term Examination: Indian Institute of Management RohtakDokument3 SeitenEpgpx01 Term Iii End Term Examination: Indian Institute of Management Rohtakkaushal dhapareNoch keine Bewertungen

- Ascot Partners, L.P.: A Delaware Limited PartnershipDokument60 SeitenAscot Partners, L.P.: A Delaware Limited PartnershipAlan JohnsonNoch keine Bewertungen

- Post Contract ManagementDokument19 SeitenPost Contract ManagementRajanRanjanNoch keine Bewertungen

- Chapter 16: Hybrid and Derivative SecuritiesDokument70 SeitenChapter 16: Hybrid and Derivative SecuritiesJoreseNoch keine Bewertungen