Beruflich Dokumente

Kultur Dokumente

Serivce Tax-showcause-Cenvat Credit - CS

Hochgeladen von

api-38223960 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten1 SeiteShow cause notice dated 04 / 04 / 2006 sought to recover 2,040 / - as Service Tax and Education Cess for wrongly utilizing cenvat credit on the Company Secretary service. We would like to submit as follows: 1) it has been alleged in the show cause notice that service of Company Secretary appears to be not used directly in providing services as Chartered Accountant. If any service is used indirectly in relation to providing output service, it would not qualify to be an "input service"

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenShow cause notice dated 04 / 04 / 2006 sought to recover 2,040 / - as Service Tax and Education Cess for wrongly utilizing cenvat credit on the Company Secretary service. We would like to submit as follows: 1) it has been alleged in the show cause notice that service of Company Secretary appears to be not used directly in providing services as Chartered Accountant. If any service is used indirectly in relation to providing output service, it would not qualify to be an "input service"

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten1 SeiteSerivce Tax-showcause-Cenvat Credit - CS

Hochgeladen von

api-3822396Show cause notice dated 04 / 04 / 2006 sought to recover 2,040 / - as Service Tax and Education Cess for wrongly utilizing cenvat credit on the Company Secretary service. We would like to submit as follows: 1) it has been alleged in the show cause notice that service of Company Secretary appears to be not used directly in providing services as Chartered Accountant. If any service is used indirectly in relation to providing output service, it would not qualify to be an "input service"

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

The Assistant Commissioner of Service Tax, 24th April, 2006

Division - I, 39 Rabindra Sarani,

Mody Building, 3rd Floor,

Kolkata – 700 073.

Sir,

Please refer to your show cause notice no. C.NO.V(12) 115/RAC/SCN/R-1/D-

I/Kol/06/267 dated 04/04/2006 wherein you have sought to recover 2,040/- as Service

Tax and Education Cess for wrongly utilizing cenvat credit on the Company Secretary

Service and also sought to recover interest and impose penalty upon us.

In this regard we would like submit as follows:-

1) It has been alleged in the show cause notice that service of company secretary

appears to be not used directly in providing services as Chartered Accountant.

However nothing has been stated in the show cause notice regarding the basis of

allegation that we have not directly utilised the services of Company Secretary in

the course of provision of our service. Your allegation is based merely on

conjectures and surmises and as such without any material or evidence in your

record. We would like to bring to your kind attention the fact that in the course of

rendering of our professional services as a Chartered Accountant, we are required

to avail the services of other professionals like Company Secretaries, Advocates

etc., which are directly used for the provision of our service.

2) It has been further stated in your show cause notice, while analyzing the Cenvat

Credit Rules, 2004, that if any service is used indirectly in relation to providing

output service, it would not qualify to be an “input service”. However, even

though as stated above we are directly utilizing the services of Company Services

in providing our services, we would like to point out that as per Rule 2(l) of the

Cenvat Credit Rules, 2004, “input service” means any service used by a service

provider for providing an output service. The connotation used while defining

“input service” is “any service”, hence it should be deemed to be inclusive of both

direct and indirect services. In the interpretation of statute, an interpretation which

unduly restricts the scope of a beneficial provision should be avoided. This

principle was upheld by the Honorable Apex Court in the case of Union Of India

Versus Suksha International & Nutan Gems & Anr. - 1989 (39) E.L.T. 503 (S.C.)

Hence we would request you to kindly drop any further proceedings against us.

We further request you to kindly give us an opportunity to be heard in person before

making any adverse adjudication against us.

Thanking You,

Yours Faithfully,

For Rajneesh Agarwal & co.

Proprietor

Das könnte Ihnen auch gefallen

- Transfer PricingDokument1 SeiteTransfer Pricingapi-3822396Noch keine Bewertungen

- VinayShraff CVDokument2 SeitenVinayShraff CVapi-3822396Noch keine Bewertungen

- Valuation Under Central ExciseDokument3 SeitenValuation Under Central Exciseapi-3822396100% (1)

- Vinay Shraff CVDokument4 SeitenVinay Shraff CVapi-3822396Noch keine Bewertungen

- Value Added TaxationDokument6 SeitenValue Added Taxationapi-3822396Noch keine Bewertungen

- VinayShraff ProfileDokument4 SeitenVinayShraff Profileapi-3822396Noch keine Bewertungen

- Securitization 2002Dokument26 SeitenSecuritization 2002api-3822396Noch keine Bewertungen

- Show Cause Mandatory Requirement For Raising DemandDokument5 SeitenShow Cause Mandatory Requirement For Raising Demandapi-3822396Noch keine Bewertungen

- SSI BenefitDokument3 SeitenSSI Benefitapi-3822396Noch keine Bewertungen

- Service TaxDokument3 SeitenService Taxapi-3822396Noch keine Bewertungen

- Service Tax - 2003Dokument13 SeitenService Tax - 2003api-3822396Noch keine Bewertungen

- Why VATDokument10 SeitenWhy VATapi-3822396Noch keine Bewertungen

- Tax Planning - CEDokument10 SeitenTax Planning - CEapi-3822396Noch keine Bewertungen

- Securitization ACTDokument9 SeitenSecuritization ACTapi-3822396100% (1)

- Central Excise ScopeDokument2 SeitenCentral Excise Scopeapi-3822396100% (3)

- Production of Additional EvidenceDokument2 SeitenProduction of Additional Evidenceapi-3822396Noch keine Bewertungen

- Professional Opportunities in Central ExciseDokument8 SeitenProfessional Opportunities in Central Exciseapi-3822396100% (1)

- Financial Due DiligenceDokument10 SeitenFinancial Due Diligenceapi-3822396100% (6)

- Incentives - New Industrial UnitDokument3 SeitenIncentives - New Industrial Unitapi-3822396Noch keine Bewertungen

- Music 3d-VeDokument4 SeitenMusic 3d-Veapi-3822396100% (3)

- Capital Gain - Land or Building or BothDokument4 SeitenCapital Gain - Land or Building or Bothapi-3822396Noch keine Bewertungen

- Budget 2004-05 UpdateDokument5 SeitenBudget 2004-05 Updateapi-3822396Noch keine Bewertungen

- Benefit Sales TaxDokument3 SeitenBenefit Sales Taxapi-3822396Noch keine Bewertungen

- NRI InvestmentDokument9 SeitenNRI Investmentapi-3822396100% (2)

- Fema-17 1Dokument43 SeitenFema-17 1api-3822396Noch keine Bewertungen

- Transfer PricingDokument3 SeitenTransfer Pricingapi-3822396Noch keine Bewertungen

- Applicability of ST On ISPDokument3 SeitenApplicability of ST On ISPapi-3822396Noch keine Bewertungen

- Partition Deed (Huf)Dokument3 SeitenPartition Deed (Huf)api-382239685% (13)

- Taxation BelanisDokument3 SeitenTaxation Belanisapi-3822396Noch keine Bewertungen

- Tax Holiday Provisions in Respect of Newly Established Hundred Percent Export Oriented UndertakingsDokument1 SeiteTax Holiday Provisions in Respect of Newly Established Hundred Percent Export Oriented Undertakingsapi-3822396Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Actions Required For Building A Strong Startup Ecosystem in ManipurDokument3 SeitenActions Required For Building A Strong Startup Ecosystem in ManipuryibungoNoch keine Bewertungen

- Article 10 - Headquarters or Regions Who Leads Growth in EMDokument4 SeitenArticle 10 - Headquarters or Regions Who Leads Growth in EMRNoch keine Bewertungen

- NCRMP Alibaug UGC Work Action PlanDokument14 SeitenNCRMP Alibaug UGC Work Action PlanKULDEEP KUMAR50% (2)

- Iran Letter JCPOA Compliance 090617Dokument1 SeiteIran Letter JCPOA Compliance 090617The Iran ProjectNoch keine Bewertungen

- Policy Brief - Food Insecurity in AfghanistanDokument3 SeitenPolicy Brief - Food Insecurity in AfghanistanAPPROCenterNoch keine Bewertungen

- Company Profile ManmulDokument3 SeitenCompany Profile ManmulAston Rahul Pinto50% (2)

- Human Resources-WPS Office PDFDokument14 SeitenHuman Resources-WPS Office PDFArun KarthikNoch keine Bewertungen

- Adobe Scan Apr 18, 2023Dokument6 SeitenAdobe Scan Apr 18, 2023Yan PaingNoch keine Bewertungen

- Unconventional MatterialsDokument4 SeitenUnconventional MatterialsAlex GunăNoch keine Bewertungen

- Economic ResourcesDokument12 SeitenEconomic ResourcesMarianne Hilario0% (2)

- Indian Real Estate SectorDokument8 SeitenIndian Real Estate SectorSumit VrmaNoch keine Bewertungen

- Oceangoing Ships 2007 PDFDokument102 SeitenOceangoing Ships 2007 PDFaleventNoch keine Bewertungen

- Price Summary Owner: PT Nadayu Marsar Indonesia Project: Epc of Transmart & Ibis Hotel Pekan BaruDokument8 SeitenPrice Summary Owner: PT Nadayu Marsar Indonesia Project: Epc of Transmart & Ibis Hotel Pekan BaruBandono JnrNoch keine Bewertungen

- Grade 11 Daily Lesson Log: ObjectivesDokument2 SeitenGrade 11 Daily Lesson Log: ObjectivesKarla BangFerNoch keine Bewertungen

- 6 Zimbabwean DollarDokument32 Seiten6 Zimbabwean DollarArjun Nayak100% (1)

- Guide To Buying A Wooden SunglassesDokument2 SeitenGuide To Buying A Wooden SunglassesBrendan LuoNoch keine Bewertungen

- Event Managment Project MbaDokument26 SeitenEvent Managment Project Mbasuruchi100% (1)

- Chapter 6 MoodleDokument36 SeitenChapter 6 MoodleMichael TheodricNoch keine Bewertungen

- 1 Priciples of Engineering EconomyDokument32 Seiten1 Priciples of Engineering EconomyMaricar AlgabreNoch keine Bewertungen

- Test Bank For Principles of Macroeconomics 5th Edition N Gregory MankiwDokument3 SeitenTest Bank For Principles of Macroeconomics 5th Edition N Gregory MankiwMarlys Campbell100% (29)

- A Study On Impact of Foregin Stock Markets On Indian Stock MarketDokument20 SeitenA Study On Impact of Foregin Stock Markets On Indian Stock MarketRaj KumarNoch keine Bewertungen

- EV Infrastructure Solutions DEA-524Dokument8 SeitenEV Infrastructure Solutions DEA-524tommyctechNoch keine Bewertungen

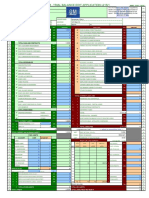

- GM OEM Financials Dgi9ja-2Dokument1 SeiteGM OEM Financials Dgi9ja-2Dananjaya GokhaleNoch keine Bewertungen

- Indian Economic Development: DAV Fertilizer Public School, BabralaDokument96 SeitenIndian Economic Development: DAV Fertilizer Public School, Babralakavin sNoch keine Bewertungen

- Ballina TT A4 LFDokument3 SeitenBallina TT A4 LFdyani davisonNoch keine Bewertungen

- Business Economics - Neil Harris - Summary Chapter 3Dokument2 SeitenBusiness Economics - Neil Harris - Summary Chapter 3Nabila HuwaidaNoch keine Bewertungen

- CRN 7075614092Dokument3 SeitenCRN 7075614092Prasad BoniNoch keine Bewertungen

- EcoTourism Unit 8Dokument20 SeitenEcoTourism Unit 8Mark Angelo PanisNoch keine Bewertungen

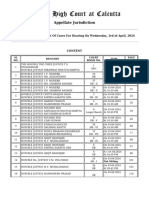

- Notice 11120 02 Apr 2024Dokument669 SeitenNotice 11120 02 Apr 2024bhattacharya.devangana2Noch keine Bewertungen

- L 1Dokument5 SeitenL 1Elizabeth Espinosa ManilagNoch keine Bewertungen