Beruflich Dokumente

Kultur Dokumente

266gray 121203

Hochgeladen von

Ankur SharmaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

266gray 121203

Hochgeladen von

Ankur SharmaCopyright:

Verfügbare Formate

NOTE NUMBER 266

privatesector

Exchange Rate Risk

Philip Gray and Timothy Irwin

P U B L I C

P O L I C Y

F O R

T H E

DECEMBER 2003

Allocating Exchange Rate Risk in Private Infrastructure Projects

E a c h ye a r d eve l o p i n g c o u n t r i e s s e e k b i l l i o n s o f d o l l a r s o f i nve s t m e n t i n t h e i r i n f r a s t r u c t u re , a n d p r i vat e i nve s t o r s , m o s t l y i n r i c h c o u n t r i e s , s e e k p l a c e s t o i nve s t t r i l l i o n s o f d o l l a r s o f n ew s av i n g s . P r i vat e f o re i g n i nve s t m e n t i n t h e i n f r a s t r u c t u re o f d eve l o p i n g c o u n t r i e s wo u l d s e e m t o h o l d g re at p ro m i s e . B u t f o re i g n i nve s t o r s m u s t c o p e w i t h vo l at i l e d eve l o p i n g c o u n t r y c u r re n c i e s . M a ny at t e m p t s t o d o s o h ave c re at e d a s m a ny p ro bl e m s a s t h ey h ave s o l ve d . T h i s N o t e p ro p o s e s t h at i nve s t o r s t a ke o n a l l f i n a n c i n g - re l at e d ex c h a n g e r at e r i s k , eve n t h o u g h t h i s m ay m e a n h i g h e r t a r i f f s f o r c o n s u m e r s a s a p re m i u m f o r b e a r i n g t h at r i s k .

The standard advice on allocating riskto assign it to the party best able to manage ithas controversial implications for the allocation of exchange rate risk in a private infrastructure project. Three parties can bear the risk of exchange rate movements in the first instance: the private investors (whether foreign or local equity-holders or creditors), the host country government (ultimately, its taxpayers), and customers of the service. Some argue that investors or at least their ultimate shareholders should bear the risk because they can diversify away country-specific exchange rate risk. Others argue that the government should bear the risk because it is responsible for macroeconomic policies that strongly influence the exchange rate. Still others argue that customers should bear it because they must ultimately pay for the cost of the service and the risk can be shared widely to lessen the impact. The allocation of exchange rate risk is often done through tariff adjustment formulas that implicitly share risk through the way they adjust the tariff over time. If indexation is allowed, tariffs can reflect the exchange rate in several ways: Allowed prices or revenue can be fully or partially indexed to the exchange rate. Input costs that depend on the exchange rate can be treated as a pass-through, so that customers pay the actual costs of the inputs. The contract can provide for a renegotiation of allowed prices or revenue if the exchange rate moves outside a specified band. At one extreme of the risk sharing spectrum, Argentina effectively indexed 100 percent of costs to the dollar. The implications of this are

Philip Gray (pgray@ worldbank.org) is a senior private sector development

T H E W O R L D B A N K G R O U P PRIVATE SECTOR DEVELOPMENT VICE PRESIDENCY

specialist, and Timothy Irwin (tirwin@worldbank. org) a senior economist, at the World Bank. This Note is a companion to Philip Gray and Timothy Irwin, Exchange Rate Risk: Reviewing the Record for Private Infrastructure Contracts, Viewpoint 262 (World Bank, Private Sector and Infrastructure Network, Washington, D.C., 2003).

E X C H A N G E R A T E R I S K ALLOCATING EXCHANGE RATE RISK IN PRIVATE INFRASTRUCTURE PROJECTS

now being fought out by the investors and the Argentine government, which has prevented significant tariff increases since the devaluation of the Argentine peso. Most countries use a hybrid approach to tariff adjustment. Part of the tariff is indexed to local inflation, part is indexed to dollar inflation, and some costs are straight pass-throughs. But there is still much debate about what share of the cost base should be indexed to local inflation and what share to international costs. And tariff adjustment mechanisms are not the only approach: governments sometimes provide exchange rate guarantees to cover repayment of foreign currency debt.

Nature and sources of exchange rate risk

To shed more light on the debate requires first looking more closely at the nature and sources of the risk. Exchange rate risk, as defined here, is variability in the value of a project, or of an interest in the project, that results from unpredictable variation in the exchange rate. There are two types of exchange rate risk: project and financing related. Project exchange rate risk arises when the value of a projects inputs or outputs depends on the exchange rate. Typical infrastructure projects sell their outputs domestically, so, valued in local currency, revenues usually are not subject to exchange rate risk. But any input that is tradable, even if it is not imported, will have a world price, so its cost, measured in local currency, will vary inversely with the exchange rate. The cost of fuel, for example, creates exchange rate risk for a thermal electricity generator. Financing choices affect the amount of exchange rate risk borne by different participants in the project (shareholders, creditors, customers, taxpayers). In particular, loans requiring repayment in foreign currency expose shareholders to exchange rate risk. As a result, shareholders may seek to shape the contractual arrangements to pass on some or all of the risk to the government or customers (through exchange rate guarantees or indexation of the tariff to the exchange rate).

Optimal allocation of exchange rate risk

Parties can manage exchange rate risk in three ways:

They can influence the underlying source of the risk. Governments, for example, can reduce the rate of depreciation and the volatility of the exchange rate by keeping budget deficits small and inflation low. They can influence the sensitivity of the value of a project or of their interest in it to the risk. Project sponsors, for example, can reduce the sensitivity of the value of their shareholding to the exchange rate by reducing the projects reliance on foreign currency debt. They can hedge or diversify away the risk. Hedging exchange rate risks is possible in only a few developing countries. But most of the ultimate foreign shareholders of the project companyindividuals with savings in mutual funds, pension plans, and life insurancecan diversify their savings, limiting their exposure to any one countrys exchange rate risk (as defined). The principle of optimal allocation can therefore be restated as follows: Exchange rate risk should be allocated according to the parties ability and incentives to influence the exchange rate, change the sensitivity of the value of the project (or of their interest in it) to the exchange rate, and hedge or diversify away the risk. Because the principle involves three types of management, its implications are not clear cut (table 1). The governments influence over the exchange rate is one factor that, other things equal, argues in favor of allocating project and financing-related exchange rate risk to the government. But this argument should not carry too much weight. Allocating the risk to the government is unlikely to improve the quality of its decisions affecting the exchange rateboth because the relationship between the exchange rate and the governments financial position is affected in complex ways by many factors unrelated to the project and because governments do not respond to financial incentives in the same way as firms and individuals do. If the government does not assume the exchange rate risk, the risk must be shared between customers and investors (shareholders). Neither can influence the exchange rate, so the choice turns on the other two factors. Consider first project exchange rate risk. Customers can sometimes influence the sensi-

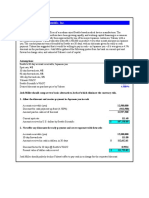

Table

Ability of customers, shareholders, and government to manage exchange rate risk

Customers Shareholders Government

Project risk Influence over exchange rate Influence over sensitivity of project to exchange rate

Ability to cope with risk by hedging or diversification Financing-related risk Influence over exchange rate Influence over sensitivity of value of investors interest in company to exchange rate Ability to cope with risk by hedging or diversification

None Limited, but can change consumption in response to changes in the cost of tradable inputs Little

None Limited, but can sometimes change inputs in response to changes in the cost of tradable inputs Great (through diversification)

Great Little

Little

None None Little

None Great (through choice of financial structure) Great (through diversification)

Great None Little

tivity of a projects value to the exchange rate by changing their consumption levels in response to changes in the cost of tradable inputs. When the cost of fuel rises as the exchange rate depreciates, customers may be able to mitigate the adverse effect on a power projects value by cutting their electricity consumption. In other cases investors may be better placed to mitigate project exchange rate risk. For example, they may be able to change the mix of inputs (using more hydro and less thermal power) to soften the effect of depreciation. Shareholders are also better placed than customers to diversify away or hedge exchange rate riskbecause of their ability to diversify risk in equity markets and, in a few developing countries, to hedge risk using exchange rate derivatives. This suggests that project exchange rate risk should be shared between investors and customers according to their ability to respond in value-enhancing ways to changes in the exchange rateerring toward investors, given their greater ability to hedge or diversify away the risk. For many infrastructure projects, however, project exchange rate risk is small. Financing-related exchange rate risk tends to loom much larger. Should investors or customers bear this risk? Customers are in a poor position to manage the risk because they have no influence over the sensitivity of the value of shareholders interest in

the project to the exchange rate (they have no control over whether the investors decide to use financing that creates exchange rate risk). Moreover, most customers have no good natural hedges against the risk of currency fluctuations and in most developing countries no realistic opportunities to acquire hedges or diversify away the risk. Indeed, because exchange rates tend to fall during macroeconomic crises, their ability to pay higher tariffs is likely to be lowest just when the exchange rate has fallen. Investors, however, choose financing and thus control the extent of financing-related exchange rate risk. And their ultimate shareholders are well placed to diversify away much of the risk they choose to take on.

Implications for prices and financing

Although investors should generally face some project and all financing-related exchange rate risk, they still need to be able to recoup their costs and make a return that is reasonable given the risks they take. Not protecting investors from exchange rate risk may well imply higher tariffs. Moreover, if tariffs are not linked to the exchange rate, they need to be linked to an index of local inflation, possibly adjusted to more closely reflect the cost of inputs (for example, an electricity utilitys tariffs might be linked to an index in which the price of fuel has greater

E X C H A N G E R A T E R I S K ALLOCATING EXCHANGE RATE RISK IN PRIVATE INFRASTRUCTURE PROJECTS

weight than in the consumer price index). Over the long term the effect on prices will be similar whether tariffs are linked to local inflation or to the exchange rate (see the companion Note). But with a link to local inflation, currency crises will tend not to cause such immediate, politically perilous price increases. What are the implications for financing if neither the host country government nor customers protect foreign investors from financing-related exchange rate risk? Unless the government provides explicit subsidies in place of the implicit subsidies in having taxpayers or customers bear the exchange rate risk: Projects may be able to raise less financing, with shorter terms and higher initial rates. Traditional project finance deals, with dollardenominated debt financing a large share of the project cost, may be less feasible, leading to greater use of local currency debt and local and foreign equity and therefore higher initial rates of return and higher project prices. In East Asian and other countries with high savings rates, the prospects for raising more local equity and debt for infrastructure seem promising. Elsewhere, progress will take longer. But governments can help by facilitating the development of local capital markets and contractual savings institutions such as pension funds and insurance companiesincluding by ensuring that tariff formulas do not implicitly discourage local currency financing. While foreign debt financing will be scarcer, innovative financing structures offer solutions. The Tiet project in Brazil illustrates one approach to mitigating investors exposure to financing-related exchange rate risk. To finance the generating facilities, AES (the U.S. parent company of the operator, AES Tiet) issued US$300 million in U.S. dollar bonds with an average maturity of 10 years, at rates less than those paid by the Brazilian government for debt of an equivalent maturity. The project sells power at prices indexed to local inflation with no provision for changes in the exchange rate. If the exchange rate declines substantially and AES Tiet has insufficient cash to pay its debt service, however, it may draw on a US$30 million liquidity facility (revolving loan) provided by the U.S. Overseas Private Investment Corporation. Once local inflation has

caught up with the exchange rate reduction, AES Tiet will repay the advances from cash that would otherwise have gone to shareholders.

Conclusion

Despite the drawbacks of high levels of foreign currency debt, the argument for foreign capital remains. Developing countries need investment in infrastructure, and local debt and equity investors may well be unable to meet all the costs of the investment efficiently. The problem with many deals is the mix of foreign capital: many projects have too much dollar-denominated debt, which drives the demand for allocating exchange rate risk to governments and consumers. While allocating the risk this way keeps the initial financing costs low, it risks a blowup in the longer term. Reducing reliance on foreign debt may mean that the volumes of private finance mobilized in the 1990s for greenfield projects and privatizations in developing countries will not be forthcoming and that the initial costs of finance will be higher. But the benefits may be longer-lived and more robust investments that can weather the vagaries of emerging markets.

viewpoint

is an open forum to encourage dissemination of public policy innovations for private sectorled and market-based solutions for development. The views published are those of the authors and should not be attributed to the World Bank or any other affiliated organizations. Nor do any of the conclusions represent official policy of the World Bank or of its Executive Directors or the countries they represent.

To order additional copies contact Suzanne Smith, managing editor, Room I9-009,

Note

For different perspectives on the issue, see Ignacio Mas, Managing Exchange Rate and Interest RateRelated Project Exposure: Are Guarantees Worth the Risk? in Timothy Irwin, Michael Klein, Guillermo E. Perry, and Mateen Thobani, eds., Dealing with Public Risk in Private Infrastructure, Latin American and Caribbean Studies Viewpoint (Washington, D.C.: World Bank, 1997); and Joe Wright, Tomoko Matsukawa, and Robert Sheppard, Foreign Exchange Risk Mitigation for Power and Water Projects in Developing Countries, Energy and Mining and Water and Sanitation Sector Boards Discussion Paper (World Bank, Washington, D.C., 2003).

The World Bank, 1818 H Street, NW, Washington, DC 20433.

Telephone: 001 202 458 7281 Fax: 001 202 522 3480 Email: ssmith7@worldbank.org

Produced by Communications Development Inc.

Printed on recycled paper

This Note is available online: http://rru.worldbank.org/Viewpoint/index.asp

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- International Finance NoteDokument35 SeitenInternational Finance Noteademoji00Noch keine Bewertungen

- Anson - AF5362 Outline 2019S Wed - Revised2Dokument11 SeitenAnson - AF5362 Outline 2019S Wed - Revised2kerenkangNoch keine Bewertungen

- AFM Study Support Guide: Plan Prepare PassDokument26 SeitenAFM Study Support Guide: Plan Prepare PassSarah SeeNoch keine Bewertungen

- Danila 1Dokument16 SeitenDanila 1Chan Hui YanNoch keine Bewertungen

- Risk and GovernanceDokument9 SeitenRisk and GovernanceAyeesha K.s.Noch keine Bewertungen

- Internship Report On: Financial Analysis of KDS Accessories LimitedDokument50 SeitenInternship Report On: Financial Analysis of KDS Accessories Limitedshohagh kumar ghoshNoch keine Bewertungen

- Chapter 11Dokument2 SeitenChapter 11atuanaini0% (1)

- Chapter 08 Management of TRDokument90 SeitenChapter 08 Management of TRLiaNoch keine Bewertungen

- SBM Nov 17 Exam PaperDokument16 SeitenSBM Nov 17 Exam PaperIsavic AlsinaNoch keine Bewertungen

- IFM Course FileDokument22 SeitenIFM Course FileHOD MBA HOD MBANoch keine Bewertungen

- Chapter 12 Accounting For Foreign Currency Transactions and Hedging Foreign Exchange RiskDokument31 SeitenChapter 12 Accounting For Foreign Currency Transactions and Hedging Foreign Exchange RiskMuhammad Za'far SiddiqNoch keine Bewertungen

- Investment & Gambling: Asst - Prof .Seena Alappatt Dept of Management StudiesDokument24 SeitenInvestment & Gambling: Asst - Prof .Seena Alappatt Dept of Management Studiesseena15Noch keine Bewertungen

- Risk and Refinements in Capital BudgetingDokument75 SeitenRisk and Refinements in Capital BudgetingdhfbbbbbbbbbbbbbbbbbhNoch keine Bewertungen

- International Economics, 7e (Husted/Melvin) Chapter 13 The Foreign Exchange MarketDokument19 SeitenInternational Economics, 7e (Husted/Melvin) Chapter 13 The Foreign Exchange MarketAli AlshehhiNoch keine Bewertungen

- Assignment Unit 4 Fernando LichuchaDokument29 SeitenAssignment Unit 4 Fernando LichuchaflichuchaNoch keine Bewertungen

- Economic ExposureDokument36 SeitenEconomic Exposurebuffon100% (1)

- Multiple Choice Questions: Top of FormDokument96 SeitenMultiple Choice Questions: Top of Formchanfa3851Noch keine Bewertungen

- Shapiro Chapter 14 SolutionsDokument11 SeitenShapiro Chapter 14 SolutionsRuiting ChenNoch keine Bewertungen

- Analyzing Forex Exposure of Infosys: CIA-1 OF International Financial ManagementDokument12 SeitenAnalyzing Forex Exposure of Infosys: CIA-1 OF International Financial ManagementNehal SharmaNoch keine Bewertungen

- Trichy Full PaperDokument13 SeitenTrichy Full PaperSwetha Sree RajagopalNoch keine Bewertungen

- Sample ChapterDokument25 SeitenSample ChapterYimei DengNoch keine Bewertungen

- Multinational Financial Management: An OverviewDokument25 SeitenMultinational Financial Management: An OverviewRazib AliNoch keine Bewertungen

- FinmanDokument3 SeitenFinmanKaren LaccayNoch keine Bewertungen

- IE Lecture 1Dokument58 SeitenIE Lecture 1EnjoyNoch keine Bewertungen

- DERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYDokument21 SeitenDERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYsunthatburns00Noch keine Bewertungen

- AQR 2023 Alternative Thinking Capital Market AssumptionsDokument19 SeitenAQR 2023 Alternative Thinking Capital Market AssumptionsABAD GERONIMO RAMOS CORDOVANoch keine Bewertungen

- Ni Hsin - Annual Report 2019Dokument116 SeitenNi Hsin - Annual Report 2019Goh Zai PengNoch keine Bewertungen

- Financial Institutions Management A Risk Management Approach 9Th Edition Saunders Test Bank Full Chapter PDFDokument50 SeitenFinancial Institutions Management A Risk Management Approach 9Th Edition Saunders Test Bank Full Chapter PDFclubhandbranwq8100% (11)

- Familytex BD LTD ProspectusDokument102 SeitenFamilytex BD LTD ProspectusMonoarul IslamNoch keine Bewertungen