Beruflich Dokumente

Kultur Dokumente

Ratio Analysis of Square Pharmaceuticals LTD

Hochgeladen von

md_waleedaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ratio Analysis of Square Pharmaceuticals LTD

Hochgeladen von

md_waleedaCopyright:

Verfügbare Formate

Ratio Analysis of Square Pharmaceuticals Ltd

BRIEF HISTORY

Square Pharmaceuticals Ltd. is a renowned company in Bangladesh. It is a flagship company in the pharmaceutical industry which has reached this mountain of success by fighting many potential competitors like BEXIMCO Pharma, INCEPTA, ACME, RENETA, OPSONIN, SK+F, SANOFI-AVENTIS etc. It initially started as a Partnership in 1958. It was incorporated as a Private Ltd. Company in 1964 and converted into Public Limited Company in 1991. Its initial public offering started in Dhaka and Chittagong stock exchange simultaneously in 1995. Their mission is to produce and provide quality & innovative healthcare relief for people, maintain stringently ethical standard in business operation also ensuring benefit to the shareholders, stakeholders and the society at large. RATIO ANALYSIS Financial ratios are useful indicators of a firm's performance and financial situation. Financial ratios can be used to analyze trends and to compare the firm's financials to those of other firms. Financial ratios can be classified according to the information they provide. The following types of ratios frequently are used: 1. Liquidity ratios 2. Asset management ratios 3. Debt management ratios 4. Profitability ratios 5. Market value ratios LIQUIDITY RATIOS Liquidity ratios are the first ones to come in the picture. These ratios actually show the relationship of a firms cash and other current assets to its current liabilities. Two ratios are discussed under Liquidity ratios. They are: 1. Current ratio 2. Quick/ Acid Test ratio. 1. Current ratio: This ratio indicates the extent to which current liabilities are covered by those assets expected to be converted to cash in the near future. Current assets normally include cash, marketable securities, accounts receivables, and inventories. Current

liabilities consist of accounts payable, short-term notes payable, current maturities of long-term debt, accrued taxes, and other accrued expenses (principally wages). Current Ratio=Current Assets/Current Liabilities Following table shows the Current ratios of Square Pharmaceuticals in different years: Year Current ratio 2005-06 1.78 times 2004-05 1.66 times 2003-04 1.62 times

Analysis of this ratio speaks in a same language as current ratio. In 2003-04, the quick ratio was .98 times which increased very silently just like current ratio and resulted as 1.19 times in 2005-06. Both of these ratios portray the idea that square has so far an almost constant liquidity position which is good at some point, but at the same token it can be said that they have not been able to improve them-selves. Standing at this point, we can make an assumption that may be their profit margin was not so high that they can make some investments paying off the liabilities that could result in an increase in assets and decrease in liabilities to make the liquidity position far better. This assumption can only be proved as we go on analyzing their financial statement and calculate the profitability ratios. FINANCIAL LEVERAGE (DEBT) RATIOS Debt to Equity ratio: The ratio of total debt to total shareholders equity is a debt ratio, that tells us about how much the creditors provide of financing for each $1 being provided by shareholders. Debt ratio = Total Debt / Shareholders equity Following table shows the Debt ratios of Square Pharmaceuticals in different years: Year Debt ratio 2005-06 1.47 2004-05 1.61 2003-04

Debt to Asset ratio: The ratio of total debt to total assets, generally called the debt ratio, measures the percentage of funds provided by the creditors.

Debt ratio = Total Debt / Total Assets Following table shows the Debt ratios of Square Pharmaceuticals in different years: Year Debt ratio 2005-06 31% 2004-05 46% 2003-04 37%

Calculating the debt ratio, we came to see that this company is not that highly leveraged one. In 2003-04, it was 37%, in 2004-05, it suddenly went up to 46%, and than again in 2005-06, it climbed down to 31%. A little bit of fluctuation is seen here in debt management, which is actually nothing but their strategic move. The reason behind such fluctuation is better understandable form the balance sheet. In 2004-05, the company has issued long-term loan, which happens to be BTD 389,193,080 that is way too high than the previous years loan, which is BDT 36,544,158 that actually increased the total debt thus resulting in a high debt ratio. Again, in the following year they paid off the loans and have not made any huge financing from outside which decreased. COVERAGE RATIO Times-Interest-Earned (TIE) ratio: This ratio measures the extent to which operating income can decline before the firm is unable to meet its annual interest cost. TIE ratio = EBIT / Interest Charges Following table shows the times-interest-earned (TIE) ratios of Square Pharmaceuticals in different years: Year TIE ratio 2005-06 11.30 times 2004-05 14.92 times 2003-04 11.12 times

We can see from this ratio analysis that, this company has covered their interest expenses 11 times in 2003-04, 15 times in 2004-05 and 11 times in 2005-06. It means they have performed pretty much same in 2003-04 and 2005-06 but has taken a different look in 2004-05. As in 2004-05 they issued a little high number of long-term loans and does not have good liquidity position, their EBIT became high thus making TIE a little high as well. ACTIVITY RATIOS Receivables Turnover Ratio: This Receivables Turnover Ratio provides insight into the quality of the firms receivables and how successful the firm is in its collections.

Receivable Turnover = Annual Net Credit Sales/Receivables Following table shows the Receivables Turnover(RT) ratios of Square Pharmaceuticals in different years: Year RT ratio 2005-06 12.45 2004-05 31.24 2003-04

NB: The Raito is calculateds basing on Total Annual sales. Average Collection Period: Average Collection Period(days) = Days in the year/Receivable Turnover Year RTD 2005-06 11.68 2004-05 29.32 2003-04

Inventory Turnover Ratio: To help determine how effectively the firm is managing inventory and also to gain an indication of the liquidity of inventory this ratio is calculated. Inventory Turnover Ratio(IT) = Costs of Goods sold/Inventory

Das könnte Ihnen auch gefallen

- Ratio AnalysisDokument11 SeitenRatio AnalysispalowanNoch keine Bewertungen

- Financial Ratio AnalysisDokument4 SeitenFinancial Ratio AnalysisJennineNoch keine Bewertungen

- Financial and Accounting Digital Assignment-2Dokument22 SeitenFinancial and Accounting Digital Assignment-2Vignesh ShanmugamNoch keine Bewertungen

- Thesis FinallDokument29 SeitenThesis FinallBasharat JamilNoch keine Bewertungen

- Mba Project ReportDokument15 SeitenMba Project ReportPreet GillNoch keine Bewertungen

- Ratio Analysis of Life Insurance - IBADokument116 SeitenRatio Analysis of Life Insurance - IBANusrat Saragin NovaNoch keine Bewertungen

- Sources of Finance and Impact On Financial Statements Finance EssayDokument12 SeitenSources of Finance and Impact On Financial Statements Finance EssayHND Assignment Help50% (2)

- Integrated Case 4-26Dokument6 SeitenIntegrated Case 4-26Cayden BrookeNoch keine Bewertungen

- Financial Statement Analysis - HulDokument15 SeitenFinancial Statement Analysis - HulNupur SinghalNoch keine Bewertungen

- Ratio AnalysisDokument9 SeitenRatio Analysisbharti gupta100% (1)

- Ratio Analysis Note Acc 321-2Dokument20 SeitenRatio Analysis Note Acc 321-2Adedeji MichaelNoch keine Bewertungen

- Concept Questions:: Net WorthDokument30 SeitenConcept Questions:: Net WorthRutuja KhotNoch keine Bewertungen

- Management Accounting Assignment Topic:Ratio Analysis: Room 34Dokument18 SeitenManagement Accounting Assignment Topic:Ratio Analysis: Room 34nuttynehal17100% (1)

- Pepsi and Coke Financial ManagementDokument11 SeitenPepsi and Coke Financial ManagementNazish Sohail100% (1)

- Ratio Analysis of Beximco Pharmaceuticals LimitedDokument12 SeitenRatio Analysis of Beximco Pharmaceuticals Limitedapi-3707335100% (4)

- Accounting Ratio TablesDokument18 SeitenAccounting Ratio TablesSanjeed Ahamed SajeebNoch keine Bewertungen

- Liquidity RatiosDokument7 SeitenLiquidity RatiosChirrelyn Necesario SunioNoch keine Bewertungen

- Ratio Analysis For NTPC LTDDokument73 SeitenRatio Analysis For NTPC LTDNani BhupalamNoch keine Bewertungen

- Data Analysis and InterpretationDokument15 SeitenData Analysis and InterpretationMukesh KarunakaranNoch keine Bewertungen

- Managerial Focus On Ratios & ImportanceDokument9 SeitenManagerial Focus On Ratios & ImportanceMahima BharathiNoch keine Bewertungen

- Ratio AnaalysisDokument10 SeitenRatio AnaalysisMark K. EapenNoch keine Bewertungen

- Chapter-1-Ratio AnalysisDokument8 SeitenChapter-1-Ratio AnalysisRG RAJNoch keine Bewertungen

- What Is Ratio AnalysisDokument2 SeitenWhat Is Ratio AnalysisDarlene SarcinoNoch keine Bewertungen

- "Financial Analysis of Kilburn Chemicals": Case Study OnDokument20 Seiten"Financial Analysis of Kilburn Chemicals": Case Study Onshraddha mehtaNoch keine Bewertungen

- Executive SummaryDokument21 SeitenExecutive SummarykhandakeralihossainNoch keine Bewertungen

- Synopsis Ratio AnalysisDokument3 SeitenSynopsis Ratio Analysisaks_swamiNoch keine Bewertungen

- Ratio Analysis and Risk Estimation: Submitted To MR - Sheheryar MalikDokument11 SeitenRatio Analysis and Risk Estimation: Submitted To MR - Sheheryar MalikHaani ArNoch keine Bewertungen

- Ratio Analysis: We Will First Explain Why We Are Discussing Ratios?Dokument15 SeitenRatio Analysis: We Will First Explain Why We Are Discussing Ratios?Avneet Kaur Bedi100% (1)

- 4b - Chapter 4 Financial Management-OkDokument49 Seiten4b - Chapter 4 Financial Management-OkIni IchiiiNoch keine Bewertungen

- Financial Statements Analysis and Evaluation Veritas PDFDokument16 SeitenFinancial Statements Analysis and Evaluation Veritas PDFEuniceNoch keine Bewertungen

- Brand Awairness Cocacola ProjectDokument70 SeitenBrand Awairness Cocacola Projectthella deva prasadNoch keine Bewertungen

- Transcritption - Determining Liquidity and SolvencyDokument6 SeitenTranscritption - Determining Liquidity and Solvencymanoj reddyNoch keine Bewertungen

- BHEL FinanceDokument44 SeitenBHEL FinanceJayanth C VNoch keine Bewertungen

- Class 12 AccountDokument9 SeitenClass 12 AccountChandan ChaudharyNoch keine Bewertungen

- FM - Lesson 4 - Fin. Analysis - RatiosDokument8 SeitenFM - Lesson 4 - Fin. Analysis - RatiosRena MabinseNoch keine Bewertungen

- Analysis of Financial StatementDokument4 SeitenAnalysis of Financial StatementShardautdNoch keine Bewertungen

- Reliance IndustriesDokument16 SeitenReliance IndustriesDarshan RNoch keine Bewertungen

- Analyzing With RatiosDokument25 SeitenAnalyzing With Ratiosemily passanhaNoch keine Bewertungen

- Proj 3.0 2Dokument26 SeitenProj 3.0 2Shivam KharuleNoch keine Bewertungen

- Modified 15ratiosDokument24 SeitenModified 15ratiosSahifa MisbahNoch keine Bewertungen

- Chapter 2 - Analysis of Financial StatementDokument34 SeitenChapter 2 - Analysis of Financial StatementAikal HakimNoch keine Bewertungen

- 4 Reasons Why Ratios and Proportions Are So ImportantDokument8 Seiten4 Reasons Why Ratios and Proportions Are So ImportantShaheer MehkariNoch keine Bewertungen

- Financial Report Analysis UtsDokument14 SeitenFinancial Report Analysis UtsRahma Yulia PrastiwiNoch keine Bewertungen

- Financial Management Chapter 03 IM 10th EdDokument38 SeitenFinancial Management Chapter 03 IM 10th EdDr Rushen SinghNoch keine Bewertungen

- Fin Financial Statement AnalysisDokument8 SeitenFin Financial Statement AnalysisshajiNoch keine Bewertungen

- Effect of Financial Performance On Stock PriceDokument14 SeitenEffect of Financial Performance On Stock PriceMuhammad Yasir YaqoobNoch keine Bewertungen

- 59 Ratio AnlysisDokument21 Seiten59 Ratio Anlysissaurabhbakshi89Noch keine Bewertungen

- Financial Ratio IntrepretationDokument47 SeitenFinancial Ratio IntrepretationRavi Singla100% (1)

- MGT - Accounting - Imp (1 Unit 3 and 1Dokument12 SeitenMGT - Accounting - Imp (1 Unit 3 and 1Vansh TharejaNoch keine Bewertungen

- Fundamental Equity AnalysisDokument2 SeitenFundamental Equity AnalysisEllaine Pearl AlmillaNoch keine Bewertungen

- Nilutpul SirDokument11 SeitenNilutpul SirTarekNoch keine Bewertungen

- Revised Chapter 2 Financial Statements and Corporate FinanceDokument17 SeitenRevised Chapter 2 Financial Statements and Corporate FinanceLegend Game100% (1)

- Financial AnalysisDokument14 SeitenFinancial AnalysisTusharNoch keine Bewertungen

- Financial Analysis AssignmentDokument12 SeitenFinancial Analysis AssignmentDushan Chamidu50% (2)

- Financial Statements (Ratios) - 061850Dokument4 SeitenFinancial Statements (Ratios) - 061850Rajabu HatibuNoch keine Bewertungen

- Financials RatiosDokument25 SeitenFinancials RatiosSayan DattaNoch keine Bewertungen

- Cost of Goods Sold: 1. Gross Profit MarginDokument10 SeitenCost of Goods Sold: 1. Gross Profit MarginYuga ShiniNoch keine Bewertungen

- 1ratio Analysis of Automobile Sector For InvestmentDokument29 Seiten1ratio Analysis of Automobile Sector For Investmentpranab_nandaNoch keine Bewertungen

- Mady CFDokument11 SeitenMady CFannanaqviNoch keine Bewertungen

- Capital BudgetingDokument6 SeitenCapital BudgetingJaylin DizonNoch keine Bewertungen

- Investment Management Analysis PDFDokument138 SeitenInvestment Management Analysis PDFAngelee Manuel-AmigoNoch keine Bewertungen

- Question No 02: Calculate Market Value of Equity For A 100% Equity Firm, Using Following Information Extracted From ItsDokument7 SeitenQuestion No 02: Calculate Market Value of Equity For A 100% Equity Firm, Using Following Information Extracted From ItsrafianazNoch keine Bewertungen

- Clean Securities Syllabus-1Dokument10 SeitenClean Securities Syllabus-1Aron MenguitoNoch keine Bewertungen

- Cash and Receivables - 6Dokument52 SeitenCash and Receivables - 6natiNoch keine Bewertungen

- TradecraftDokument450 SeitenTradecraftSonu KumarNoch keine Bewertungen

- Summary of Disciplinary Action For Mercer Hicks IIIDokument35 SeitenSummary of Disciplinary Action For Mercer Hicks IIIJaymie BaxleyNoch keine Bewertungen

- Atlantic ComputerDokument39 SeitenAtlantic ComputerAbhijan Carter BiswasNoch keine Bewertungen

- Chapter 12Dokument67 SeitenChapter 12siddiquekhankhan14Noch keine Bewertungen

- Dessertation Final ReportDokument94 SeitenDessertation Final ReportDeep ChoudharyNoch keine Bewertungen

- Updated SCM and Finance Timetable 2019 BatchDokument3 SeitenUpdated SCM and Finance Timetable 2019 Batchomkar sanapNoch keine Bewertungen

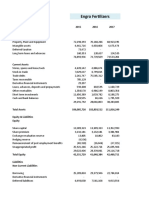

- Engro FertilizerDokument9 SeitenEngro FertilizerAbdullah Sohail100% (1)

- Risk Spectrum For BanksDokument5 SeitenRisk Spectrum For BanksLý Minh TânNoch keine Bewertungen

- CH 03Dokument56 SeitenCH 03Zelalem GirmaNoch keine Bewertungen

- Commercial ValuationDokument40 SeitenCommercial ValuationBulbul SahuNoch keine Bewertungen

- Fair Value ModelDokument2 SeitenFair Value ModelZes ONoch keine Bewertungen

- Group4 Cityu8b Assignment Corporate FinanceDokument16 SeitenGroup4 Cityu8b Assignment Corporate Financeđức nguyên anhNoch keine Bewertungen

- Investment&Portfolio 260214Dokument285 SeitenInvestment&Portfolio 260214Yonas Tsegaye HaileNoch keine Bewertungen

- Annual Return: Form No. Mgt-7Dokument19 SeitenAnnual Return: Form No. Mgt-7Shivani KelvalkarNoch keine Bewertungen

- Moneylife 26 October 2017Dokument68 SeitenMoneylife 26 October 2017ADNoch keine Bewertungen

- 3 Signs of Stock Market CrashDokument16 Seiten3 Signs of Stock Market Crashmicha100% (2)

- Audited Financial Statements Airlines 2021Dokument60 SeitenAudited Financial Statements Airlines 2021VENICE OMOLONNoch keine Bewertungen

- Pension Calculation Sheet Sample-SignedDokument2 SeitenPension Calculation Sheet Sample-SignedThirukumaran VenugopalNoch keine Bewertungen

- 0cc49 A Comparative Study of Nepal Bank LimitedDokument47 Seiten0cc49 A Comparative Study of Nepal Bank LimitedAnonymous ab3pW73tt0Noch keine Bewertungen

- Financial Management - SmuDokument0 SeitenFinancial Management - SmusirajrNoch keine Bewertungen

- Assessment On Accounting For Shareholders' Equity: Problem Solving RequirementsDokument4 SeitenAssessment On Accounting For Shareholders' Equity: Problem Solving RequirementsErika Mae LegaspiNoch keine Bewertungen

- UGBA 120B Discussion Section 7 10 12 12Dokument18 SeitenUGBA 120B Discussion Section 7 10 12 12jennyz365Noch keine Bewertungen

- Studocudocument 2Dokument17 SeitenStudocudocument 2Kathleen J. GonzalesNoch keine Bewertungen

- Ebook Corporate Finance 12Th Edition Ross Test Bank Full Chapter PDFDokument59 SeitenEbook Corporate Finance 12Th Edition Ross Test Bank Full Chapter PDFpaullanb7nch100% (9)

- Introduction To Money Payment System-2Dokument42 SeitenIntroduction To Money Payment System-2lawwrrance chanNoch keine Bewertungen

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursVon EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursBewertung: 4.5 von 5 Sternen4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetVon EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetBewertung: 5 von 5 Sternen5/5 (2)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamVon EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNoch keine Bewertungen

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Financial Risk Management: A Simple IntroductionVon EverandFinancial Risk Management: A Simple IntroductionBewertung: 4.5 von 5 Sternen4.5/5 (7)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistVon EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistBewertung: 4 von 5 Sternen4/5 (32)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Von EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsVon EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsBewertung: 5 von 5 Sternen5/5 (1)

- Joy of Agility: How to Solve Problems and Succeed SoonerVon EverandJoy of Agility: How to Solve Problems and Succeed SoonerBewertung: 4 von 5 Sternen4/5 (1)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionVon EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionBewertung: 5 von 5 Sternen5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsVon EverandCreating Shareholder Value: A Guide For Managers And InvestorsBewertung: 4.5 von 5 Sternen4.5/5 (8)

- How to Measure Anything: Finding the Value of Intangibles in BusinessVon EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessBewertung: 3.5 von 5 Sternen3.5/5 (4)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursVon EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursBewertung: 4.5 von 5 Sternen4.5/5 (34)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityVon EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Other People's Money: The Real Business of FinanceVon EverandOther People's Money: The Real Business of FinanceBewertung: 4 von 5 Sternen4/5 (34)