Beruflich Dokumente

Kultur Dokumente

Allahabad Bank Result Updated

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Allahabad Bank Result Updated

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

2QFY2012 Result Update | Banking

November 2, 2011

Allahabad Bank

Performance Highlights

Particulars (` cr) NII Pre-prov. profit PAT

Source: Company, Angel Research

ACCUMULATE

CMP Target Price

% chg (qoq) 12.1 6.7 16.7 2QFY11 969 782 403 % chg (yoy) 36.0 21.5 21.2

`161 `169

12 months

2QFY12 1,318 949 488

1QFY12 1,176 890 418

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Banking 7,669 1.0 271/139 105,118 10 17,465 5,258 ALBK.BO ALBK@IN

For 2QFY2012, Allahabad Bank reported 21.2% yoy growth in its net profit to `488cr, well ahead of our estimates due to a lower-than-expected effective tax rate. On the PBT level, results were largely in-line with our estimates. NIM surprised positively despite a drop in CD ratio. Slippages rose due to the completion of switchover to system-based NPA recognition platform. We upgrade the stock to Accumulate (from Neutral) on attractive valuations. NIM surprises positively; slippages rise on switchover: After the healthy 5.5% qoq growth in advances in the seasonally lean first quarter, the banks advances came off by 3.1% qoq (up 16.6% yoy) during 2QFY2012. Deposits growth remained healthy at 6.1% qoq and 25.0% yoy. Consequently, the CD ratio dipped by 640bp qoq to 67.4%. CASA deposits growth was moderate at 10.3% yoy (with saving deposits registering relatively better growth of 15.8% yoy), leading to a sharp 409bp yoy reduction in calculated share of CASA to 30.6%. Despite the fall in CASA proportion and a lower CD ratio, the bank managed to expand its reported NIM by 28bp qoq to 3.7% on the back of a sharp 98bp qoq surge in yield on advances (partly due to faster growth in the high-yielding SME segments advances and conscious reduction in the share of short-term loans in the loan book) vis--vis just an 11bp qoq rise in cost of deposits. Slippages for the quarter rose as the bank completed the migration to system-based NPA recognition platform. The annualized slippage ratio increased to 2.2% from 0.6% registered in 1QFY2012. Management attributed around half of the slippages arising to the switchover exercise. Overall asset quality was within manageable levels with gross and net NPAs rising by 6.9% qoq and 12.8% qoq, respectively. Provision coverage ratio, including technical write-offs, was stable sequentially at 79.6%. Outlook and valuation: We had turned Neutral on the stock in our last result update on concerns over asset quality and since then the stock has fallen by 26%. Taking into account the banks reasonably healthy retail deposits base, especially in the eastern hinterland, the prospects of lower technically incremental slippages on completion of the switchover and attractive valuations (0.7x FY201E ABV), we upgrade the stock to Accumulate with a target price of `169. Key financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 58.0 17.3 13.0 11.7

Abs. (%) Sensex

Allahabad Bank

3m (3.6) (18.8)

1yr (14.2) (37.7)

3yr 78.4 230.7

FY2010 2,650 22.8 1,206 57.0 2.5 27.0 6.0 1.2 1.1 22.2

FY2011 4,022 51.8 1,423 18.0 3.0 29.9 5.4 1.0 1.0 21.0

FY2012E 5,192 29.1 1,752 23.1 3.3 36.8 4.4 0.9 1.1 21.0

FY2013E 5,607 8.0 1,790 2.2 3.1 37.6 4.3 0.7 1.0 18.4

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Allahabad Bank | 2QFY2012 Result Update

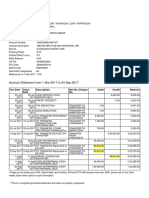

Exhibit 1: 2QFY2012 performance

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income Other income excl. treasury - Fee Income - Treasury Income - Recoveries from written-off a/cs - Others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies - Provisions for NPAs - Provisions for Investments - Other Provisions PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

2QFY12 1QFY12 % chg (qoq) 2QFY11 % chg (yoy) 3,893 2,961 907 20 5 2,575 1,318 309 302 257 7 23 22 1,627 678 467 211 949 412 302 82 28 538 50 488 9.2 3,550 2,699 834 16 0 2,374 1,176 286 260 207 26 65 (12) 1,461 572 382 190 890 320 166 113 41 570 152 418 26.6 9.7 9.7 8.8 24.9 8.5 12.1 8.1 16.3 24.2 (73.1) (63.8) 11.4 18.6 22.3 11.1 6.7 28.8 82.2 (27.0) (32.8) (5.7) (67.3) 16.7 (1,741)bp 2,637 1,984 631 14 8 1,668 969 345 308 213 37 76 19 1,314 532 350 182 782 271 225 4 43 510 108 403 21.1 47.6 49.3 43.8 40.7 (41.0) 54.4 36.0 (10.3) (1.8) 20.7 (81.1) (69.1) 16.0 23.9 27.4 33.4 15.7 21.5 51.7 34.0 2,214.3 (35.4) 5.4 (53.9) 21.2 (1,185)bp

Exhibit 2: 2QFY2012 Actual vs. estimates

Particulars (` cr) Net interest income Other income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 1,318 309 1,627 678 949 412 538 50 488

Estimates 1,175 305 1,480 594 887 368 518 155 363

Var. (%) 12.2 1.3 9.9 14.2 7.1 11.7 3.7 (68.1) 34.5

November 2, 2011

Allahabad Bank | 2QFY2012 Result Update

Exhibit 3: 2QFY2012 performance analysis

Particulars (` cr) Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) Current deposits (` cr) Saving deposits (` cr) CASA deposits (` cr) CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Cost of deposits Yield on advances Yield on investments Yield on funds Cost of funds Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision coverage ratio (%) Annualized slippage ratio (%) NPA prov. to avg. assets (%)

Source: Company, Angel Research

2QFY12 1QFY12 % chg (qoq) 2QFY11 % chg (yoy) 95,717 67.4 7,609 35,875 43,484 30.6 13.0 8.9 7.1 12.6 7.6 10.9 7.1 3.7 41.7 1,715 1.8 664 0.7 79.6 2.2 0.8 98,740 73.8 8,055 34,800 42,855 32.0 12.8 8.6 7.0 11.6 7.6 10.3 6.9 3.4 39.1 1,604 1.6 589 0.6 79.9 0.6 0.4 (3.1) (640)bp (5.5) 3.1 1.5 (141)bp 24bp 38bp 11bp 98bp 0bp 60bp 24bp 28bp 254bp 6.9 15bp 12.8 9bp (32)bp 158bp 33bp 82,088 72.2 8,448 30,982 39,430 34.7 13.5 8.4 5.7 10.4 6.9 9.0 5.8 3.3 40.5 1,470 1.8 457 0.6 81.0 2.5 0.7 16.6 25.0 (485)bp (9.9) 15.8 10.3 (409)bp (50)bp 52bp 138bp 221bp 64bp 182bp 133bp 34bp 115bp 16.7 0bp 45.5 13bp (144)bp (31)bp 6bp 142,043 133,818 6.1 113,633

Advances decline qoq; deposits accretion picks up

After healthy 5.5% qoq growth in advances in the seasonally lean first quarter, the banks advances came off by 3.1% qoq (up 16.6% yoy) in 2QFY2012. Sequentially, only the retail segments loans managed to post growth (up 4.9% qoq and 20.4% yoy). Given the seasonal nature of agri loans, they fell by 7.0% qoq. On a yoy basis, growth in SME advances remained healthy at over 45%.

Exhibit 4: CD ratio comes off sharply

Adv. qoq chg (%) 10.0 7.5 5.0 72.2 71.8 Dep. qoq chg (%) 73.8 71.0 CDR (%, RHS) 75.0 67.4 70.0 65.0

Exhibit 5: Deterioration of CASA ratio continues

CASA ratio 36.0 34.0 32.0 26.1 21.6 20.7 15.6 10.3 10.0 20.0 CASA yoy growth (%, RHS) 30.0

8.4 4.9

5.8 6.4

7.8 9.0

(3.1)

(2.5) (5.0)

5.5 1.5

2.5

6.1

34.7

33.3

33.5

32.0

55.0 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

28.0 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

Source: Company, Angel Research

30.6

60.0

30.0

Source: Company, Angel Research

November 2, 2011

Allahabad Bank | 2QFY2012 Result Update

On the deposits side, growth was faster at 6.1% qoq and 25.0% yoy. CASA deposits growth was moderate at 10.3% yoy (with saving deposits registering relatively better growth of 15.8% yoy), leading to a sharp 409bp yoy reduction in calculated share of CASA to 30.6%. Volatile current account deposits declined by 9.9% yoy (5.5% qoq); however, saving account deposits growth was relatively better at 15.8% yoy. Consequently, the credit-to-deposit ratio dipped by 640bp qoq and 485bp yoy to 67.4%. With the widening differential between fixed deposit interest rates and savings account interest rates, the pace of growth in CASA deposits moderated further to 15.6% yoy from 20.7% in 1QFY2012. CASA ratio came off by ~150bp qoq to 32.0% as the bank had lower flows from government-related businesses. Recently, the bank has secured a mandate from the West Bengal State Government for opening accounts for disbursal of salaries. The bank has also launched a campaign to open ~15 lakh saving accounts by 3QFY2012. These initiatives are expected to at least sustain the CASA ratio at current levels.

NIM surprises positively

Despite the decline in CASA proportion and a lower CD ratio, the bank managed to expand its reported NIM by 28bp qoq to 3.7% on the back of a sharp 98bp qoq surge in yield on advances (partly due to faster growth in the high-yielding SME segments advances and conscious reduction in share of short-term loans in the loan book) vis--vis just an 11bp qoq rise in cost of deposits.

Exhibit 6: Higher yield on advances...

(%) 13.0 12.0 11.0 10.0 9.0 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 10.6 10.7 11.6 10.4 12.6

Exhibit 7: ...leads to strong surge in reported NIM

(%) 3.9 3.6 3.3 3.3 3.0 2.7 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3.4 3.5 3.7 3.4

Source: Company, Angel Research

Source: Company, Angel Research

Slippages rise as expected; but overall asset quality well within manageable levels

Slippages for the quarter rose, in-line with expectations, as the bank completed the migration to system-based NPA recognition platform. The annualized slippage ratio increased to 2.2% from 0.6% registered in 1QFY2012. Management attributed around half of the slippages arising to the switchover exercise. The rise in gross NPAs was contained through stronger recoveries and upgrades as well as write-off of `250cr. During 1HFY2012, the bank has recovered `443cr from gross NPAs, including written-off accounts, in-line with its target of achieving recovery of `1,000cr in FY2012.

November 2, 2011

Allahabad Bank | 2QFY2012 Result Update

Overall asset quality was within manageable levels with gross and net NPAs rising by 6.9% qoq and 12.8% qoq, respectively. Gross and net NPA ratios increased marginally to 1.8% and 0.7%, respectively. Provision coverage ratio, including technical write-offs, was stable sequentially at 79.6% (81.0% in 2QFY2011). The bank restructured loans of ~`270cr during 2QFY2012, which pertained to a chunky corporate account. Cumulatively, the bank has restructured loans of `2,942cr, of which `220cr has slipped into NPAs. Going forward, management does not expect a sharp rise in restructuring.

Exhibit 8: Asset quality largely maintained

Gross NPAs (%) 2.0 1.5 1.0 0.5 81.0 80.2 75.7 Net NPAs (%) 79.9 PCR (%, RHS) 79.6 85.0 80.0 75.0 70.0

Exhibit 9: Slippages rise on switchover exercise

Slippages (%) 5.0 4.0 3.0 2.0 1.0 2.5 2.0 4.5 0.6 2.2 0.7 0.5 0.4 0.9 Credit cost (%, RHS) 1.0 0.8 0.8 0.6 0.4 0.2 -

1.8 0.6

1.8 0.6

1.7 0.8

1.6 0.6

2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

1.8 0.7

65.0 60.0

2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

Source: Company, Angel Research

Source: Company, Angel Research; Note: PCR incl. technical write-offs

Provisioning expenses for the quarter rose sharply by 51.7% yoy, mainly on account of provisions for MTM losses on investments of `82cr as compared to just `4cr in 2QFY2011. The bank also had to provide `302cr towards NPA provisions as compared to `166cr in 1QFY2012 and `225cr in 2QFY2011.

Opex to remain high on employee benefits-related provisions; branch expansion likely to be back-ended

Staff expenses continued the sharp rising trend, increasing by 33.4%. Even, overall operating expenses rose considerably by 27.4% yoy. Consequently, the cost-toincome ratio increased to 41.7% from 39.1% registered in 1QFY2012 and the opex-to-average assets ratio increased to 1.7% from 1.5% in 1QFY2012.

Exhibit 10: Branch expansion picks up a bit

2,500 2,450 2,400 2,350 2,300 2,250 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 2,402 2,364 2,441 2,415 2,416

Exhibit 11: Cost ratios rise but remain well under control

Cost-to-income ratio (%) 60.0 45.0 30.0 1.7 1.5 2.3 1.7 Opex to average assets (%, RHS) 2.5 1.5 2.0 1.5 1.0

40.5

39.8

51.9

39.1

41.7

15.0 -

0.5 -

2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

Source: Company, Angel Research

Source: Company, Angel Research

November 2, 2011

Allahabad Bank | 2QFY2012 Result Update

The bank added 25 branches in 2QFY2012. The bank plans to open 155 branches in FY2012, which is likely to be back-ended, in economically stronger states such as Gujarat, Maharashtra (particularly Mumbai), Haryana, Karnataka and Andhra Pradesh. This will also enable the bank to geographically establish a wider branch network, as it is hardly present in these states.

Investment arguments

Healthy retail deposit base and moderate fee income

Allahabad Bank has strong 41% of its branches in the CASA deposit-rich rural areas, which ensure relatively higher sustainability of the low-cost deposits reservoir, also reflected in the strong 24.0% CAGR in its saving account deposits over FY200911. Although the banks CASA market share reduced by 16bp over FY200610 to 2.4%, the decline in market share has been one of the lowest in its peer group. Also, the bank has a relatively lower share of wholesale deposits and CDs at 12.1%. Recently, the bank has secured a mandate from the West Bengal State Government for opening accounts for disbursal of salaries. The bank has also launched a campaign to open ~15 lakh saving accounts by 3QFY2012. These initiatives are expected to at least sustain the CASA ratio at current levels. The bank is now planning to diversify its branch network by expanding in the economically vibrant states of Gujarat, Maharashtra (particularly Mumbai), Haryana, Karnataka and Andhra Pradesh. The banks relatively better CASA ratio, of 3233%, is also likely to help in moderating the expected NIM pressures. As compared to peers such as IOB, OBC, Corporation Bank and UCO Bank, the bank has a higher structural CASA share. Also, growth in fee income (other income excluding treasury income) has been strong at a 45.8% CAGR over FY200911 (0.9% of average assets for FY2011). However, we have factored in lower growth in fee income than peers, as a large part of the banks high fee income was driven by above-average recoveries from written-off accounts (0.24% of average assets for FY2011), which could decline going forward.

Outlook and valuation

Management indicated that it had paid ~`300cr extra for income tax in FY2011, which is likely to be refunded in 2HFY2012. The effective tax rate for FY2012 is expected to be on the lower side at 21-22% on account of taking benefits of various exemptions. We had turned Neutral on the stock in our last result update on concerns over asset quality and since then the stock has fallen by 26%. Taking into account the banks reasonably healthy retail deposits base, especially in the eastern hinterland, the prospects of lower technically incremental slippages on completion of the switchover and attractive valuations (0.7x FY201E ABV), we upgrade the stock to Accumulate with a target price of `169.

November 2, 2011

Allahabad Bank | 2QFY2012 Result Update

Exhibit 12: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Treasury gain/(loss) (% of investments)

Source: Angel Research

Earlier estimates FY2012 21.0 19.0 32.6 2.9 (1.0) 14.0 2.4 0.1 FY2013 19.0 17.0 32.2 2.6 14.2 15.0 15.0 2.4 0.1

Revised estimates FY2012 16.0 12.0 34.7 3.3 (4.3) 12.0 15.0 2.5 0.1 FY2013 18.0 18.0 34.0 3.1 13.5 10.0 12.0 2.9 0.1

Exhibit 13: Change in estimates

Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

Earlier estimates

4,656 1,357 6,013 2,448 3,566 1,316 2,250 675 1,575

FY2012 FY2013 Revised Revised Earlier Var. (%) Var. (%) estimates estimates estimates

5,192 1,311 6,503 2,642 3,861 1,460 2,401 648 1,752 11.5 (3.4) 8.1 8.0 8.3 11.0 6.7 (4.0) 11.3 5,019 1,550 6,569 2,815 3,754 1,258 2,497 810 1,687 5,607 1,488 7,095 2,925 4,171 1,521 2,650 860 1,790 11.7 (4.0) 8.0 3.9 11.1 20.9 6.2 6.2 6.2

Exhibit 14: P/ABV band

Price (`) 350 300 250 200 150 100 50 0 0.3x 0.6x 0.9x 1.2x 1.5x

Dec-10

Apr-06

Aug-08

Mar-09

Oct-09

Jul-11

Nov-06

Source: Company, Angel Research

November 2, 2011

May-10

Feb-12

Jun-07

Jan-08

Allahabad Bank | 2QFY2012 Result Update

Exhibit 15: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI BOM CanBk CentBk CorpBk DenaBk IDBI IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk

#

Reco. Buy Accumulate Neutral Buy Neutral Buy Accumulate Neutral Accumulate Accumulate Accumulate Accumulate Neutral Buy Neutral Neutral Neutral Accumulate Neutral Accumulate Accumulate Buy Buy Neutral Accumulate Buy Neutral

CMP (`) 1,128 412 483 887 23 308 161 118 800 333 50 482 101 428 82 115 215 100 823 286 979 1,909 107 74 225 71 60

Tgt. price (`) 1,414 444 1,114 355 169 881 362 55 510 498 107 301 1,106 2,239 123 238 82 -

Upside (%) 25.4 7.9 25.6 15.4 5.2 10.1 8.7 10.9 5.9 16.3 7.3 5.3 13.0 17.3 15.3 5.8 15.2 -

FY2013E P/ABV (x) 1.8 1.1 3.3 1.6 1.1 1.9 0.7 0.8 1.1 0.9 0.7 0.9 0.7 0.7 0.6 0.7 0.9 0.6 0.9 0.7 1.1 1.4 0.7 0.9 0.9 0.6 0.8

FY2013E Tgt P/ABV (x) 2.3 1.2 2.0 2.3 0.8 1.2 1.0 0.7 1.0 0.8 0.7 0.7 1.3 1.7 0.8 0.9 0.7 -

FY2013E P/E (x) 9.9 8.4 16.8 13.0 6.8 10.2 4.3 5.3 5.7 5.5 4.3 5.6 5.2 4.4 3.9 5.4 5.5 4.0 5.2 5.0 5.8 7.3 4.7 4.4 5.1 4.2 7.3

FY2011-13E EPS CAGR (%) 17.7 19.5 30.5 23.3 15.6 19.9 12.2 (0.9) 14.2 15.2 38.1 (3.0) (16.1) 1.5 7.5 12.3 0.2 20.0 12.0 5.1 9.9 41.4 11.8 15.9 5.2 13.4 (3.2)

FY2013E RoA (%) 1.5 1.2 1.7 1.4 1.0 1.3 1.0 0.9 1.2 0.7 0.6 0.9 0.5 0.8 0.8 0.7 1.1 0.6 1.3 0.8 1.1 1.0 0.7 0.7 0.8 0.6 0.4

FY2013E RoE (%) 20.0 14.0 20.9 15.4 18.2 20.8 18.4 15.8 20.7 17.1 16.5 17.2 13.9 16.6 16.4 14.0 17.4 15.9 17.8 14.1 20.6 21.9 16.3 16.7 17.0 14.1 10.5

IndBk

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF

November 2, 2011

Allahabad Bank | 2QFY2012 Result Update

Income statement

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY07 1,751 11.0 376 (22.0) 2,127 3.3 1,027 (0.8) 1,100 7.4 265 (17.2) 835 18.5 85 10.2 750 6.2 FY08 1,672 (4.5) 965 156.3 2,637 24.0 1,158 12.7 1,480 34.5 357 35.1 1,122 34.3 147 13.1 975 29.9 FY09 2,159 29.1 1,142 18.4 3,301 25.2 1,399 20.9 1,901 28.5 825 131.0 1,076 (4.1) 307 28.6 769 (21.1) FY10 2,650 22.8 1,516 32.7 4,166 26.2 1,618 15.6 2,549 34.1 777 (5.9) 1,772 64.7 565 31.9 1,206 57.0 FY11 4,022 51.8 1,370 (9.6) 5,393 29.4 2,338 44.5 3,055 19.9 1,124 44.7 1,931 9.0 508 26.3 1,423 18.0 FY12E 5,192 29.1 1,311 (4.3) 6,503 20.6 2,642 13.0 3,861 26.4 1,460 29.9 2,401 24.3 648 27.0 1,752 23.1 FY13E 5,607 8.0 1,488 13.5 7,095 9.1 2,925 10.7 4,171 8.0 1,521 4.1 2,650 10.4 860 32.4 1,790 2.2

Balance sheet

Y/E March (` cr) Share Capital Reserves & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash Balances Bank Balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY07 447 4,030 22.8 257 1,582 1,804 4,068 874 FY08 447 4,774 20.3 1,792 1,862 2,448 6,289 753 FY09 447 5,405 18.6 937 2,912 2,975 5,115 1,521 29,651 58,802 18.3 1,110 1,449 17.7 FY10 447 6,306 24.8 1,424 4,012 3,455 7,184 1,984 38,429 71,605 21.8 1,118 1,379 24.6 FY11 476 8,031 24.4 3,006 3,912 3,974 7,901 3,126 43,247 93,625 30.8 1,148 2,239 24.3 FY12E 476 9,396 12.0 3,378 4,538 4,480 9,601 3,400 44,608 16.0 1,251 2,515 12.4 FY13E 476 10,799 18.0 3,979 5,355 5,321 11,330 4,005 52,351 18.0 1,430 2,963 17.8

59,544 71,616

84,972 106,056 131,887

147,714 174,302

67,664 82,939

97,648 121,699 151,286

169,981 200,232

18,746 23,400 41,290 49,720 41.7 1,056 1,629 22.4 20.4 1,071 1,705 22.6

108,605 128,154

67,664 82,939

97,648 121,699 151,286

169,981 200,232

November 2, 2011

Allahabad Bank | 2QFY2012 Result Update

Ratio analysis

Y/E March Profitability ratios (%) NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov./Avg. Assets Provision Coverage Per Share Data (`) EPS ABVPS DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis (%) NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage (x) RoE

FY07 3.0 48.3 1.2 22.6 38.0 69.3 12.5 8.1 2.6 1.1 1.9 0.1 57.0 16.8 76.0 3.0 9.6 2.1 1.9 2.8 0.4 2.4 (0.1) 2.4 0.7 3.0 1.7 1.4 0.1 1.2 18.5 22.6

FY08 2.3 43.9 1.3 24.6 36.0 69.4 12.0 7.7 2.0 0.8 1.5 0.4 58.6 21.8 93.5 3.5 7.4 1.7 2.2 2.2 0.5 1.7 0.6 2.4 0.7 3.0 1.5 1.5 0.2 1.3 19.0 24.6

FY09 2.5 42.4 0.9 16.5 34.6 69.2 12.2 7.5 1.8 0.7 1.7 0.3 59.5 17.2 107.7 2.5 9.4 1.5 1.6 2.4 0.9 1.5 0.6 2.1 0.6 2.7 1.5 1.2 0.3 0.9 19.4 16.5

FY10 2.5 38.8 1.1 22.2 34.5 67.5 12.7 7.6 1.7 0.7 2.1 0.8 61.5 27.0 131.7 5.5 6.0 1.2 3.4 2.4 0.7 1.7 0.5 2.2 0.9 3.1 1.5 1.6 0.5 1.1 20.2 22.2

FY11 3.0 43.4 1.0 21.0 33.5 71.0 12.0 8.0 1.7 0.8 2.4 0.6 52.4 29.9 160.5 6.0 5.4 1.0 3.7 2.9 0.8 2.1 0.1 2.2 0.9 3.1 1.7 1.4 0.4 1.0 20.2 21.0

FY12E 3.3 40.6 1.1 21.0 34.7 73.5 12.4 8.2 2.9 0.9 2.5 0.8 80.0 36.8 189.2 7.0 4.4 0.9 4.3 3.2 0.9 2.3 0.0 2.3 0.8 3.1 1.6 1.5 0.4 1.1 19.3 21.0

FY13E 3.1 41.2 1.0 18.4 34.0 73.5 12.3 8.1 4.2 1.3 2.9 0.7 75.0 37.6 218.6 7.0 4.3 0.7 4.3 3.0 0.8 2.2 0.0 2.2 0.8 3.0 1.6 1.4 0.5 1.0 19.1 18.4

November 2, 2011

10

Allahabad Bank | 2QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Allahabad Bank No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

November 2, 2011

11

Das könnte Ihnen auch gefallen

- IDBI Bank: Performance HighlightsDokument13 SeitenIDBI Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Axis Bank: Performance HighlightsDokument13 SeitenAxis Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Canara Bank Result UpdatedDokument11 SeitenCanara Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Indian Overseas BankDokument11 SeitenIndian Overseas BankAngel BrokingNoch keine Bewertungen

- Axis Bank Result UpdatedDokument13 SeitenAxis Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Union Bank of India Result UpdatedDokument11 SeitenUnion Bank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Oriental Bank, 1Q FY 2014Dokument11 SeitenOriental Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Dena Bank, 1Q FY 2014Dokument11 SeitenDena Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Bank of Maharashtra Result UpdatedDokument11 SeitenBank of Maharashtra Result UpdatedAngel BrokingNoch keine Bewertungen

- Corporation Bank Result UpdatedDokument11 SeitenCorporation Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Yes Bank: Performance HighlightsDokument12 SeitenYes Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- ICICI Bank Result UpdatedDokument15 SeitenICICI Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- IDBI Bank Result UpdatedDokument13 SeitenIDBI Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Canara Bank, 12th February 2013Dokument11 SeitenCanara Bank, 12th February 2013Angel BrokingNoch keine Bewertungen

- Oriental Bank of Commerce: Performance HighlightsDokument11 SeitenOriental Bank of Commerce: Performance HighlightsAngel BrokingNoch keine Bewertungen

- United Bank of India Result UpdatedDokument12 SeitenUnited Bank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Jammu and Kashmir Bank Result UpdatedDokument10 SeitenJammu and Kashmir Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Jammu and Kashmir Bank: Performance HighlightsDokument10 SeitenJammu and Kashmir Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- IDBI Bank: Performance HighlightsDokument13 SeitenIDBI Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Bank of Baroda, 7th February, 2013Dokument12 SeitenBank of Baroda, 7th February, 2013Angel BrokingNoch keine Bewertungen

- Syndicate Bank: Performance HighlightsDokument11 SeitenSyndicate Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Bank of India Result UpdatedDokument12 SeitenBank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Yes Bank: Performance HighlightsDokument12 SeitenYes Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Canara Bank Result UpdatedDokument11 SeitenCanara Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Indian Overseas Bank: Performance HighlightsDokument11 SeitenIndian Overseas Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- South Indian Bank Result UpdatedDokument13 SeitenSouth Indian Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Bank of India Result UpdatedDokument12 SeitenBank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Bank of Baroda Result UpdatedDokument12 SeitenBank of Baroda Result UpdatedAngel BrokingNoch keine Bewertungen

- Andhra Bank: Performance HighlightsDokument11 SeitenAndhra Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Union Bank of India: Performance HighlightsDokument11 SeitenUnion Bank of India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Bank of BarodaDokument12 SeitenBank of BarodaAngel BrokingNoch keine Bewertungen

- Central Bank, 4th February, 2013Dokument10 SeitenCentral Bank, 4th February, 2013Angel BrokingNoch keine Bewertungen

- Canara Bank Result UpdatedDokument11 SeitenCanara Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Central Bank of India Result UpdatedDokument10 SeitenCentral Bank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Central Bank of India Result UpdatedDokument10 SeitenCentral Bank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Allahabad Bank Result UpdatedDokument11 SeitenAllahabad Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- State Bank of India: Performance HighlightsDokument14 SeitenState Bank of India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Corporation Bank 4Q FY 2013Dokument11 SeitenCorporation Bank 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Hexaware Result UpdatedDokument13 SeitenHexaware Result UpdatedAngel BrokingNoch keine Bewertungen

- Indian Bank: Performance HighlightsDokument11 SeitenIndian Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Vijaya Bank Result UpdatedDokument11 SeitenVijaya Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Bank of Maharashtra Result UpdatedDokument11 SeitenBank of Maharashtra Result UpdatedAngel BrokingNoch keine Bewertungen

- Axis Bank: Performance HighlightsDokument13 SeitenAxis Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Union Bank of India Result UpdatedDokument11 SeitenUnion Bank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Indian Bank, 12th February 2013Dokument11 SeitenIndian Bank, 12th February 2013Angel BrokingNoch keine Bewertungen

- Bank of Maharashtra Result UpdatedDokument11 SeitenBank of Maharashtra Result UpdatedAngel BrokingNoch keine Bewertungen

- Punjab National Bank Result UpdatedDokument12 SeitenPunjab National Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- State Bank of IndiaDokument16 SeitenState Bank of IndiaAngel BrokingNoch keine Bewertungen

- Bank of Maharashtra: Performance HighlightsDokument11 SeitenBank of Maharashtra: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Syndicate Bank Result UpdatedDokument11 SeitenSyndicate Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- UCO Bank: Performance HighlightsDokument11 SeitenUCO Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- ICICI Bank Result UpdatedDokument15 SeitenICICI Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Andhra Bank: Performance HighlightsDokument10 SeitenAndhra Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Federal Bank, 1Q FY 2014Dokument11 SeitenFederal Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Vijaya Bank, 1Q FY 2014Dokument11 SeitenVijaya Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Dena Bank Result UpdatedDokument10 SeitenDena Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Syndicate Bank 4Q FY 2013Dokument11 SeitenSyndicate Bank 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Union Bank 4Q FY 2013Dokument11 SeitenUnion Bank 4Q FY 2013Angel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Chapter 29 Procedures and Reports On Special Purpose Audit EngagementsDokument30 SeitenChapter 29 Procedures and Reports On Special Purpose Audit EngagementsClar Aaron BautistaNoch keine Bewertungen

- Bus Law Mcqs 2016Dokument6 SeitenBus Law Mcqs 2016Anonymous 03JIPKRkNoch keine Bewertungen

- List of Top 400 Bad Loan AccountsDokument22 SeitenList of Top 400 Bad Loan AccountsMoneylife FoundationNoch keine Bewertungen

- Your Accounts at A Glance: Your Balances On 22 Feb 2022Dokument4 SeitenYour Accounts at A Glance: Your Balances On 22 Feb 2022mohamed elmakhzniNoch keine Bewertungen

- Private & Confidential: CREDIT INTEREST 881006851585Dokument5 SeitenPrivate & Confidential: CREDIT INTEREST 881006851585dr_rajatjainNoch keine Bewertungen

- Ingenico Ict220 Users Manual 120304Dokument40 SeitenIngenico Ict220 Users Manual 120304dermordNoch keine Bewertungen

- City BankDokument3 SeitenCity BankChong ShanNoch keine Bewertungen

- Functional DocumentDokument16 SeitenFunctional DocumentKotresh NerkiNoch keine Bewertungen

- Bank Letter For Fixed Deposit - SampleDokument1 SeiteBank Letter For Fixed Deposit - Sampletvaprasad75% (4)

- Vidya Lakshmi Common Education Loan Application FormDokument3 SeitenVidya Lakshmi Common Education Loan Application FormGagandeep SinghNoch keine Bewertungen

- Financial StatemnetDokument23 SeitenFinancial Statemnetmelaniekudo100% (1)

- LoanDokument2 SeitenLoanpratheeshNoch keine Bewertungen

- Westpac Feb4Dokument2 SeitenWestpac Feb4რაქსშ საჰა100% (1)

- Performance Evaluation of Mutual FundsDokument84 SeitenPerformance Evaluation of Mutual Fundsmansee_861398Noch keine Bewertungen

- Osman Ali Yousif: Job DescriptionDokument7 SeitenOsman Ali Yousif: Job DescriptionAnonymous K8uhurNoch keine Bewertungen

- En 20120404Dokument24 SeitenEn 20120404Hai Hoang ThanhNoch keine Bewertungen

- Open Letter To Bank Regulators On Mortgage Securitization and Servicing PracticesDokument5 SeitenOpen Letter To Bank Regulators On Mortgage Securitization and Servicing PracticesForeclosure FraudNoch keine Bewertungen

- Bos 28432 CP 14Dokument53 SeitenBos 28432 CP 14Basant Ojha100% (1)

- Ent117 Reflection PaperDokument4 SeitenEnt117 Reflection PaperKimberlyNoch keine Bewertungen

- HsDokument8 SeitenHsBhavya KothariNoch keine Bewertungen

- Airtel PDFDokument2 SeitenAirtel PDFNoorNoch keine Bewertungen

- Capital, Property, and FundsDokument5 SeitenCapital, Property, and FundsRichard Lee Gines100% (1)

- Bank Alfalah AssignmentDokument84 SeitenBank Alfalah AssignmentEhsan AsgharNoch keine Bewertungen

- Sample Complaint Letter Bank Fees IIDokument2 SeitenSample Complaint Letter Bank Fees IIRoshan Khan100% (1)

- Environmental AnalysisDokument7 SeitenEnvironmental Analysisprantik420Noch keine Bewertungen

- Chapter 11 AISDokument4 SeitenChapter 11 AISMyka ManalotoNoch keine Bewertungen

- Central BankingDokument29 SeitenCentral BankingMarcy ViernesGalasinao MaguigadCabacunganNoch keine Bewertungen

- Chapter 1-5Dokument46 SeitenChapter 1-5Mohammed Abu ShaibuNoch keine Bewertungen

- Campus Transfer FormDokument3 SeitenCampus Transfer FormgauriwastNoch keine Bewertungen