Beruflich Dokumente

Kultur Dokumente

7the Project of Siniors

Hochgeladen von

jeetucnluOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

7the Project of Siniors

Hochgeladen von

jeetucnluCopyright:

Verfügbare Formate

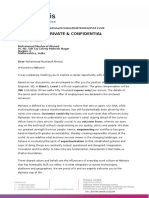

Project Topic for Seventh Semister

Roll

No.

Interpretation of

statutes

Environmenta

l Law

Intellectual

Property Law

Taxation

Corporate Law

- I

1

Sources oI law

Environment

and

Development-

International

perspective

Concept oI

Intellectual

Property: An

overview.

Fiscal policy

design in india.

LiIting and

piercing oI the

corporate veil.

2

Legislation

Sustainable

Development-

Indian

perspective

Commercial

exploitation oI

intellectual

property.

Ideologies in

diect taxes.

Cooperative

bussinesses as

companies.

3

Interpretation and

construction

Doctrine oI

public trust in

Environmental

protection

Product patent

V. Process

Patent.

Tax neutrality.

Position oI

secured creditor

on winding up.

4

Maxwell Rule oI

construction

Polluter pays

principle in

Environmental

protection

Subject matter

oI copy right.

Role oI Budget

in taxation.

NCLT- The

repute oI better

eIIicency: A

critical comment

5

Objects and purpose oI

Interpretation

Precautionary

principle in

Environmental

protection

Product patent

in relation to

drugs.

Constitutional

design oI

taxation in

India.

Prospectus.

7

Necessity to interpret

the provision

Sustainable

Development

international

perspective

WIPO copy

right treaty.

Central Board

oI direct taxes.

Stock exchanges

and their

importantce in

the expansion oI

trade.

8

Presumptions in

Interpretation

Bhopal Gas

case- A critical

study

WIPO and

India.

Commissioner

oI income tax.

Company

Meetings.

9

Supreme and sub-

ordinate legislation

Sri Ram`s

Case- A critical

study

Invention V.

innovation

under Patent

Law.

OIIences under

I.T. Act. 1961

Consequence oI

Ultra Vires

transactions.

10

Considerations in

Interpretation

Delhi pollution

cases

SpeciIication

under Patent

Law

Wealth Tax. Investigation.

11

Grammatical

interpretation

Ganga

pollution cases

Terms oI copy

right

GiIt Tax.

Corporate

Criminal

Liability.

12

Logical interpretation Ganga action Ownership oI Rights oI Holding company

plan and

environmental

protection

copy right taxpayers. and subsidiary :

A Note.

14

Rules oI statutory

interpretation

Taj Pollution

cases

Music Piracy in

India

Tax avoidance

and tax

evasion.

Sick industrial

company.

15

Golden rule oI

interpretation

Vellore citizens

welIare

Iorum`s case

Assignment oI

copy right

Residentiabilit

y oI taxation.

Directors's

Liabilities

towards share

holders

16

MischieI rule oI

interpretation

Stockholm

Declaration

India`s

response

Moral and

Economic rights

oI a copy right

owner.

Tax

assessment oI

public

charitable trust.

Doctrine oI

Indoor

Management.

17

Harmonious

construction

Rio

Declaration-

India`s

response

Relinquishment

oI copy right

Standard

deduction

under salary.

Corporate

governance oI

Indian company.

18

Strict and liberal

construction

Rio

Declaration-

International

response

Public and

Publication oI

work

Property

income not

chargeable to

tax.

Incorporation oI a

company.

19

Intention oI legislature

Marine

pollution

India`s

response

Live telecast

and copy right.

Basic

principles Ior

arriving at

bussiness

income.

Meetings under

the company

Law.

20

Application oI

principal oI Viscerivus

actus

Marine

pollution

International

perspective

PerIorming the

work in Public

Relevacly oI

method oI

accounting Ior

computing

business

income.

Incorporation

contract.

21

Application oI

principal oI utresmagis

valeat quauampereat

Public interest

litigation and

Indian

Environmental

law

Neighbouring

Rights.

Depreciation

allownces

under

bussiness

income.

Share capital.

22

Rule oI plain and

ordinary meaning

Environmental

protection

Supreme court

oI India ( water

pollution)

Copy right oI

Design.

Permissibility

oI double

deduction.

Other Managerial

personnel in

Company.

23

Legal Iiction

Environmental

protection

Concept oI

obviousness

Computation

oI income

Nature oI

corporate Iorm

Supreme court

oI India ( Air

pollution)

under patent

Law.

under capital

gain.

and advantages.

24

Rule oI last antecedent

Water pollution

High Courts

Licensing oI

trade Marks.

Capital gains

in the case oI

land and

building.

Alteration oI

articles oI

association.

25

Rule oI construction oI

general words

Air pollution

High Courts

InIringement oI

Trade Marks.

Deduction in

respect oI

medical

insurance

premia under

direct taxes.

Rights oI the

shareholders.

26

Application oI rule oI

reddendosingulasinguli

s

National Zoo

policy

Goodwill and

Law oI passing

oII under Trade

Mark Law.

Deduction in

respect oI

royalty on

patents.

Types oI

Companies.

27

Literal construction

Wild liIe

protection and

the law

InIringement,

threat and trade

libel.

Computation

oI taxable

income oI

Hindu

undivided

Iamily.

Corporate social

responsibility.

28

Heydons case

Silient Valley

case

Passing oII and

unIair trading.

The scheme oI

taxation oI

Iirms.

Duties oI

Directors.

29

Application oI the rule

oI Hormonious

construction- In India

Dehradun

Valley case

Trade Mark V.

Trade name

Tax liability oI

association oI

persons (AOP)

Articles oI

Association.

30

Strict construction-

Taxation statutes

Koyoto

protocol and

environmental

protection

Work oI Artistic

crabtmenship.

Relevance oI

diIIerent types

oI companies

Vis-A- Vis

taxation.

Requirements oI

meeting under the

companies

Act.1956.

31

Strict construction-

penal statutes

Atmospheric

pollution

Sound recording

and singers.

Charge oI tax.

Allotment oI

Shares.

32

Application oI

languages to

developments in

science and technology

Antarctic

pollution

Rights oI broad

casting

organisations.

Capital receipt

Vs. Rvenue

receipt.

Director's

liability under

corporate legal

system.

33

Liberal or beneIicent

construction

State

responsibility-

Environmental

protection

Rights oI

perIormers.

Taxable and

exenpted

capital gains.

Alteration oI

objects.

34

AIDS to construction Water Act- A Fair dealing Taxation oI Debentures.

critical study under Copyright

Law.

Dividend.

35

Internal AIDS to

construction

AIR Act- A

critical study

InIringement oI

cinematograph

Iilm.

Principles oI

Double

taxation.

Rights oI the

shareholders

under copmanies

Act.1956.

36

Construction oI a word

not deIined in the

statutes

EP Act- A

critical study

Version

recording and

Music industry.

Set oII and

carry Iorward

losses.

Winding up oI a

Company

through tribunal.

37

Headings

Climate

change-

International

response

Home taping oI

sound

recording.

Taxation oI

corporate

proIits.

Corporate

insolvency laws

in India.

38

Marginal notes

Climate

change- India`s

response

Anton piller

order.

Principles oI

service tax.

Promoters in

company Law.

39

Punctuation marks

International

Environmental

Law- Indian

Courts

international

copy right.

Deduction and

collection oI

tax at source.

Private

Companies.

40

Proviso

Environmental

pollution A

case study oI

AP

Copy right

Societies.

interest

payable by

assessce under

incom tax Act.

Doctrine oI Ultra

Vires.

41

Explanation

Environmental

pollution A

case study oI

UP

Copy right

Board.

ReIund oI

excess

payment.

Can one model Iit

all?

42

Schedules

Environmental

pollution A

case study oI

Gujarat

Protection oI

conIidentral

inIormation.

Appellate

authorities

under income

Tax Act.

Salomons Vs.

Salomon & Co.

Ltd.

43

External aids to

construction

Environmental

pollution A

case study oI

Jarkhand

Intergrated

circuit and

layout design.

Income tax

oIIicer.

A Comparative

study oI

prospectus under

Indian and U. K.

Law.

44

Parliamentary history-

Indian practice

Environmental

pollution A

case study oI

Orissa

Berne

convention oI

copy right.

Securities

transaction tax.

The majority

power and

minority rights.

45

Prliamentary history-

English practice

Environmental

pollution A

case study oI

West Bengal

Paris convention

oI Patent.

Fringe beneIit

Tax.

Form oI

Contracts.

46

Legislative bills

Environmental

pollution A

case study oI

North East

Geographicatica

l indications and

trips.

Banking cash

Transaction

Tax.

Dividend

47

Reports oI the

commissions

Environmental

pollution A

case study oI

Haryana

Plant breeders

Rights.

Cooperative

Societies and

income tax.

Remedies Ior

misrepresentation

.

48

General clauses Act

Environmental

pollution

Indian Tort

Law

Special rights oI

a copy right

owner.

Agriculture

income and its

tax treatment.

The meaning and

Evolution oI

corporate

governance: A

comparative

Study.

49

Historical Iacts and

surrounding

circumstances

Environmental

pollution

Constitution oI

India

Patents oI

addition.

Amalgamation

oI company

and income

tax.

The Volunary

winding up.

50

Dictionaries

Environmental

pollution A

case study oI

Uttaranchal

Surrender and

revolation oI

patent.

income

accrued or

arise in india.

Public

Compaines.

51

Statutes in parimateri

Environmental

pollution

Cases (2000-

2001)

Protection oI

Domain name.

Tax treatment

oI gratuity

income.

Memorandum od

Association.

52

Textbooks

Environmental

pollution

Cases (2001-

2002)

Compulsary

licensing under

Patent Law.

Educational

scholarship

and tax

treatment.

Progress in

pending

restructuring oI

the companies

Act.

53

Earlier statutes

Environmental

pollution

Cases (2002-

2003)

Patent oIIice

and patent

agent.

Income oI

local authority.

EIIects oI

conversion oI

share in to stock.

54

CodiIing and

consolidating statutes

Environmental

pollution

Cases (2003-

2004)

Piracy oI

Registered

design.

General

principles oI

taxation on

commodities.

Reduction oI

share capital.

55

Application oI

contemporaneaexpositi

o

Environmental

pollution

Cases (2004-

2005)

Registered and

Unregisterid

trade Marks.

Income oI

games

association.

Liebility oI

Trustee For

debenture holder.

56

Foreign decisions

Environmental

pollution

Use oI Trade

marks and

Collection

enIorcement.

Perpetual

Debenture.

Cases (2005-

2006)

registered users.

57

Temporary statutes

Environmental

pollution

Cases (2006-

2007)

Collective

Marks.

income oI

proIessional

institutions.

Registration oI

charges.

58

Perpetual statures

Environmental

pollution

Cases (2007-

2008)

protection oI

geographical

indications.

General

principles oI

taxations on

persons.

Annual General

Meeting.

59

Amending act and its

aIIects on principal

statute

Environmental

pollution

Cases (2008-

2009)

CertiIication

Trade Marks.

Income Ior

income tax.

Proxies.

60

Prospective operation

oI statutes

Environmental

pollution

Cases (2009)

Concept oI

Copy right.

Mode oI

assessment.

Prevention oI

management by

undesirable

person

61

Retrospective

operation oI statutes

Environmental

pollution

Cases

(Supreme court

on water

pollution)

Moral Rights oI

perIormers.

Tax treatment

oI minor's

income.

Insider Trading

62

Presumption against

Retrospectivity

Environmental

pollution

Cases (High

courts on Air

pollution)

Criminal

remedies under

copyright Laws

Concept oI

application oI

income.

EIIects oI Kumar

Mangalam Birla

Committee

Report

63

Operation oI various

kinds oI statutes

Mining policy

and the law

Civil remedies

under Patent

Law.

Income tax and

political Iund.

EIIects oI

NareshChandra

Committee

Report

64

Delegated legislation

World Summit

on Sustainable

Development

Patentable

subject matter.

tax on pension.

Sarbanes Oxley

Act 2002

65

Conditional legislation

Biological

diversity, IPR

and the law

Process patent

burden oI prooI.

Tax planning.

Role SEBI in

Regulalising the

Market

66

Interpretation oI

statutes aIIecting

jurisdiction oI courts

Biological

diversity and

the law-

International

response

Judicial

approach to the

concept oI

income.

Investigation oI

the aIIairs oI a

Company

67

Principles relating to Biological Uruguay Round Income Wholetime

jurisdiction oI courts diversity and

the law- India`s

response

oI GATT and

IPR.

exempted Irom

tax.

Director

68

AA Cotton vs Director

oI education

Ramsar

convention A

critical study

Industrial

Designs:

Requirement oI

protection.

Perquisities

under income

tax law.

Managing

Agents.

69

AK Goplan vs state oI

Madras

Trans boundary

pollution

International

response

Domain name

Dispute under

Trade Mark

Law.

Fully and

partially

exempted

income .

Prevention oI

oppression and

mismanagement

70

Article 143 oI the

constitution oI India,

inre

Trans boundary

pollution

India`s`

response

Amarnath

Sahgal V. Union

oI India. 2005

ProIessional

Tax.

OIIicial

Liquidator

71

BN Sinha vs Union oI

India

Environment

pollution A

case study oI

Sri Lanka

Trade Marks

and consumer

protection.

Tax treatment

oI provident

Iund.

Producer

Companies

72

Bangalore water

supply`s case

Environment

pollution A

case study oI

Pakistan

Designs Act.

2000. An over

view.

Income tax on

selI occupied

property.

Winding up oI

unregistered

Company

73

BeckIord vs wade

. Environment

pollution A

case study oI

Nepal

PerIormers

Rights and

Rome

convention.

Deduction

under national

saving scheme

and tax

treatment.

Listing and

delivery oI

Shares

74

Commissioner oI

income tax Madras vs

GR Karthikeyan

Environment

pollution A

case study oI

Bhutan

Protection oI

IPR throught

injunctions.

choice oI

accounting

method.

Sweat Equity

75

CrawIord vs spooner

Environment

pollution A

case study oI

Maldives

pormers Rights

under IPR

regime..

income Irom

house

peroperty.

Employees Stock

Option

76

D Saibaba vs Bar

council oI India

Bio-medical

waste and the

law-

International

perspective

ConIidentral

inIormation and

patent.

Income Irom

trust.

UnIair Trade

Practice relating

to Securities

77

K. Hashim vs state oI

Tamil nadu

Bio-medical

waste and the

law- Indian

perspective

Bio-Piracy.

Incidence oI

salary income.

Mutual Fund

78

M Ismail Iaruqqui vs

union oI India

Bio-medical

waste and the

Indian

Supreme court

Traditional

Knowledge

under IPR and

india.

Tax treatment

on equity link

saving scheme.

Buy Back OF

Securities

79

Interpretation oI the

preamnble

Bio-medical

waste and the

Indian High

courts

WIPO

perIormers and

phonograms

treaty 1996.

(WPPT)

Medical

insurance

premia and

Income Tax.

Venture Capital

Fund

80

Presence oI

nononbstante clause

Global

warming and

the

environmental

law

Patent

Cooperation

Treaty 1970.

Advance

payment oI

tax.

Collective

Investment

Schemes

80(a)

Purpose oI

interpretation

Environmental

ethics

Neem and

Termeric

controversy.

Locating the

taxpayer.

Foreign Direct

Investment

80(b

)

Process oI

interpretation

Environmental

education

Copy right in

inIormation

technology

regime.

Taxpayer's

complaince.

Stock Exchange

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Heirs of Gozo v. Pumc-SdaDokument1 SeiteHeirs of Gozo v. Pumc-SdaMikka MonesNoch keine Bewertungen

- Assignment No.4 Millennium Case StudyDokument6 SeitenAssignment No.4 Millennium Case StudyRitwik KumarNoch keine Bewertungen

- JBF Interlude V Quibi HoldingsDokument23 SeitenJBF Interlude V Quibi HoldingsTHROnlineNoch keine Bewertungen

- Shiva AyyaduraiDokument60 SeitenShiva AyyaduraiJoy Velu100% (2)

- Roche v. Bolar Pharmaceutical Co.Dokument9 SeitenRoche v. Bolar Pharmaceutical Co.José Luis GutiérrezNoch keine Bewertungen

- Bureau of Patents, Trademarks and Technology Transfer Internal Rules of ProcedureDokument30 SeitenBureau of Patents, Trademarks and Technology Transfer Internal Rules of ProcedurejoNoch keine Bewertungen

- Silicone Coating and Electrical Insulation: Marketing Bulletin Silanes - Coatings AdditivesDokument8 SeitenSilicone Coating and Electrical Insulation: Marketing Bulletin Silanes - Coatings AdditivesPratik MehtaNoch keine Bewertungen

- LL.M SyllabusDokument48 SeitenLL.M SyllabusSubramanijanki RaviNoch keine Bewertungen

- 20764C ENU TrainerHandbookDokument532 Seiten20764C ENU TrainerHandbookPatrizio Tardiolo100% (1)

- Homestead PatentsDokument11 SeitenHomestead PatentsRAFAEL FRANCESCO SAAR GONZALESNoch keine Bewertungen

- Draft HJRS Promtion Policy v2Dokument5 SeitenDraft HJRS Promtion Policy v2Arsalan SidikiNoch keine Bewertungen

- Private & Confidential: CIN: L3007KA1992PLC025294Dokument158 SeitenPrivate & Confidential: CIN: L3007KA1992PLC025294Oceans123Noch keine Bewertungen

- Intellectual Property Law (Core)Dokument9 SeitenIntellectual Property Law (Core)Tilak SahooNoch keine Bewertungen

- SysReg XML A Profile-2023-12Dokument6.170 SeitenSysReg XML A Profile-2023-12davidcosmin98Noch keine Bewertungen

- Simulated Environment Concept - SpaCapsule - Company ReportDokument11 SeitenSimulated Environment Concept - SpaCapsule - Company ReportSE ConceptsNoch keine Bewertungen

- Copyright NotesDokument12 SeitenCopyright Notesarmchairphilosopher100% (2)

- Transfer of Property Act ProjectDokument10 SeitenTransfer of Property Act ProjectUtkarsh LodhiNoch keine Bewertungen

- C-Thru Products, Inc. and Leon Laguerre v. Uniflex, Inc., 397 F.2d 952, 2d Cir. (1968)Dokument7 SeitenC-Thru Products, Inc. and Leon Laguerre v. Uniflex, Inc., 397 F.2d 952, 2d Cir. (1968)Scribd Government DocsNoch keine Bewertungen

- Course Outline IPLDokument3 SeitenCourse Outline IPLNElle SAn FullNoch keine Bewertungen

- Quest Licensing v. FactSet Research SystemsDokument3 SeitenQuest Licensing v. FactSet Research SystemsPatent LitigationNoch keine Bewertungen

- EN-Employment & Labour Law in AngolaDokument15 SeitenEN-Employment & Labour Law in AngolaAlex LiuNoch keine Bewertungen

- Managing The Security of InformationDokument22 SeitenManaging The Security of InformationGlen Joy GanancialNoch keine Bewertungen

- Ebook - CISSP - Domain - 01 - Security and Risk ManagementDokument202 SeitenEbook - CISSP - Domain - 01 - Security and Risk ManagementroyNoch keine Bewertungen

- Steel Span - National Steel Bridge Alliance PDFDokument12 SeitenSteel Span - National Steel Bridge Alliance PDFmjlazo0% (1)

- CMR - PatentsDokument5 SeitenCMR - PatentsChristian RoqueNoch keine Bewertungen

- Apple v. Samsung - Design Professionals Amicus BriefDokument53 SeitenApple v. Samsung - Design Professionals Amicus BriefSarah BursteinNoch keine Bewertungen

- Confidential Non Disclosure AgreementDokument3 SeitenConfidential Non Disclosure AgreementLian TranNoch keine Bewertungen

- Patent Portfolio ManagementDokument89 SeitenPatent Portfolio ManagementJohn Alexander Taquio YangaliNoch keine Bewertungen

- NPTEL Entrepreneurship and IP Strategy Preparation Notes - Data Driven by Jarvis IncDokument30 SeitenNPTEL Entrepreneurship and IP Strategy Preparation Notes - Data Driven by Jarvis Incநட்ராஜ் நாதன்Noch keine Bewertungen

- Ipasset ManagementDokument48 SeitenIpasset ManagementSiddharth GhorpadeNoch keine Bewertungen