Beruflich Dokumente

Kultur Dokumente

Powers of The BIR The BIR Has The Power and Duty:: Design V CIR)

Hochgeladen von

Alexandra Castro-SamsonOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Powers of The BIR The BIR Has The Power and Duty:: Design V CIR)

Hochgeladen von

Alexandra Castro-SamsonCopyright:

Verfügbare Formate

Powers of the BIR The BIR has the power and duty: o to assess and collect all taxes,

fees and charges,

to enforce all forfeitures, penalties and fines in connection therewith (including execution of judgments cases decided in its favor)

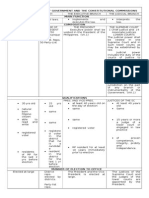

The Commissioner is authorized by law to do a lot more things: o ascertaining the correctness of any return, or o making a return when none has been made, or o collecting any such liability, or o evaluating tax compliance, or o determining the liability of any person for tax. The law allows the BIR access to all relevant or material records and data of the taxpayer. The BIR can even accept documents which cannot be admitted in a judicial proceeding where the Rules of Court are strictly observed. (Fitness by Design v CIR) best evidence obtainable applies when a tax report is required by law for the purpose of assessment and it is not available or when the tax report is incomplete or fraudulent. (Sy Po v CTA) The failure of the taxpayers to present their books of accounts for examination is a reason for the CIR to resort to his powers. The CIR may delegate the power to assess taxes to his subordinates. (Republic v Hizon) But he cannot delegate the power:

To compromise or abate any tax liability (but if P500,000 or less, he can delegate) To assign or reassign officers to establishments where excise tax articles are produced or kept. Tax Assessment - is an official action by an administrative officer to determine the tax due of the taxpayer. It consists of: o computation of the amount of tax that must be paid by the taxpayer, coupled with, o demand to pay the tax within a specified period of time. There are two kinds of assessment:

To recommend the promulgation of rules and regulations by the Sec of Finance, To issue rulings of first impression or to reverse, revoke or modify any existing ruling of the bureau,

1. 2. 1. 2. 3. 4.

Self-assessment (Section 56 (A)) - This is when the taxpayer files his return and pays Deficiency assessment (Section 56 (B) - upon discovery of the BIR that the self-assessment was either deficient, or when no return was made by the taxpayer

Tax assessment by tax examiners are presumed correct and made in good faith. The taxpayer has the duty to prove otherwise. (Sy Po v CTA) However, assessments cannot be based on mere presumptions on the part of the government. There must be a minimum effort on the government before the presumption of correctness sets in. (CIR v Benipayo, wherein the Court said that a charge of fraud against a taxpayer is a serious one and must be supported by clear and convincing proof). Mandamus does not lie to compel the CIR to impose a tax assessment not found by him to be proper. (Meralco Securities v Savellano, a case where an informer wanted his reward) The assessment must always be addressed to the proper party.

What is the procedure? (RR 12-99, Reyes)

1. 2. 3.

1st step in any assessment is service of a Letter of Authority [NOTE: pursuant to RMO 69-10 eLA are now sent] by the BIR. After which the authorized revenue officer can examine the books and records of the taxpayer. After examination, the BIR will inform the taxpayer of the discrepancies and if there are points of clarification required, a Notice of Informal Conference shall be provided.

a.

Taxpayer has 15 days from receipt of the notice to respond. If he doesnt, default

If there is sufficient basis for an assessment/ if no agreement was reached in the conference, the BIR will issue a pre-assessment notice (PAN) stating the facts, laws, rules, regulations, and jurisprudence on which the proposed assessment is based.

4. 5.

a.

Taxpayer has 15 days from receipt of the PAN to respond with a Position Paper. If he doesnt, default.

If the taxpayer is in DEFAULT or his response is NOT meritorious, the BIR will issue a formal letter of demand and assessment. It too will state the facts, laws, etc etc. The taxpayer must file a letter of protest within 30 days thereof. He too should state the laws, facts, etc.

a. c.

For issues which he did not raise, a collection letter shall be issue telling the taxpayer to pay. b. For issues protested, the prescriptive period on assessment and collection will be suspended. If the taxpayer failed to file a valid protest within the period, the assessment will become final, executory and demandable, and

6. 7.

The taxpayer must submit supporting documents within 60 days from filing his letter of protest. If he doesnt, Final. If the protest is denied in whole or in part, appeal to the CTA within 30 days from date of receipt of decision

a. b.

But if the denial was by an agent of the Commissioner, protest first to the Commissioner within 30 days. If the commissioner or his agent fails to act on the taxpayers protest within 180 days from the submission of documents, the taxpayer has to appeal to the CTA within 30 days from the lapse of the 180 day period. If not, FINAL.

8.

Within 15 days from receipt of the decision of the CTA, appeal it to the CTA En Banc.

When is the PAN not needed? (Formal Assessment enough) [M-TAE-T]

1. 2. 3. 4. 5.

Any deficiency tax is the result of Mathematical error in the computation of the tax evident on the face of the return Discrepancy between the Tax withheld and the amount actually remitted by the withholding agent Taxpayer opted to claim a refund or tax credit for excess creditable withholding tax carried it over and automatically Applied the amount claimed against the estimated tax liabilities for the taxable quarter of the succeeding taxable year Excise tax due on excisable articles has not been paid When an article locally purchase or imported by an exempt person has been sold, traded or Transferred to non-exempt person

Q: Until when can a taxpayer amend its Tax Returns? Sec. 6(A) of the Tax Code provides that any return, statement or declaration filed in any office authorized to receive the same shall NOT be withdrawn, provided that within 3 years from the date of such filing, the same may be modified, changed or amended, o provided NO notice for audit or investigation of such return, statement or declaration has, in the meantime, been actually served on the taxpayer. REMEDIES GOVERNMENT REMEDIES The government has the following tax remedies for its tax collection and tax enforcement: 1. Compromise and abatement 2. Tax lien 3. Distraint and levy 4. Forfeiture 5. Civil penalties and interests 6. Civil action 7. Criminal action 1. Compromise The grounds for compromise are: 1. Doubtful validity of the claim against the taxpayer, or 2. Financial incapacity of the taxpayer The BIR would rather compromise than go to court because there is a chance that if brought to court, they might not collect because of some rabbit that the taxpayer might pull out of his hat. A compromise in extra-judicial settlement of the taxpayers criminal liability for his violation is consensual in character, hence, may not be imposed on the taxpayer without his consent. (RR 12-99) Cases which may be compromised: 1. Delinquent accounts 2. Pending admin cases under admin protest after issuance of final assessment notice to the taxpayer

3. 4. 5.

Civil tax cases being disputed before the courts Collection cases filed in courts Criminal violations o EXCEPT if 1) already filed in court or 2) involving criminal tax fraud Cases which CANNOT be compromised: 1. Withholding tax cases, unless the applicant-taxpayer invokes provisions of law that cast doubt on the taxpayers obligation to withhold. 2. Criminal tax fraud cases confirmed as such by the Commissioner or his duly authorized representative 3. Criminal violations already filed in court;

4. 5.

6.

Delinquent accounts with duly approved schedule of installment payments Cases where final reports of reinvestigation or reconsideration have been issued resulting to reduction in the original assessment and the taxpayer was agreeable to such decision by signing the required agreement form for the purpose. Cases which become final and executory after final judgment of a court, where compromise is requested on the ground of doubtful validity of the assessment Estate tax cases where compromise is requested on the ground of financial incapacity of the heirs.

7. 1.

2.

Examples for doubtful validity: Delinquent account/disputed assessment resulted from a jeopardy assessment called jeopardy because the tax is in jeopardy of not being collected at all. The assessment seems to be: a. Arbitrary,

a. b. b.

c.

An assessment without the benefit of complete or partial audit by an authorized revenue officer

3.

Based on presumptions, and There is reason to believe that is lacking in legal/factual basis to file an admin protest because of alleged failure to receive notice of assessment, or to file a request for reinvestigation reconsideration within 30 days from receipt of final assessment notice, or

There is reason to believe that the assessment is lacking in legal and factual basis and taxpayer failed:

4. 5.

to elevate to the Court of Tax Appeals (CTA) an adverse decision of the Commissioner, or his authorized representative, in some cases, within 30 days from receipt thereof. Assessments made based on the Best Evidence Obtainable Rule and there is reason to believe that the same can be disputed by sufficient and competent evidence The assessment was:

a. b. c.

a. b.

c.

issued within the period extended by the taxpayers execution of Waiver of Statute of Limitations and the waivers authenticity is being questioned and there is strong reason to believe and evidence to prove that it is not authentic.

What are examples of financial incapacity?

1.

2.

3. 4. 5.

Corporation ceased or dissolved (but the tax liabilities for the assets distributed to the stockholders as return of capital can not be compromised) Taxpayer has a surplus deficit resulting to capital impairment by at least 50% a. Provided taxpayer has no sufficient liquid asset to satisfy liability a. Provided that amounts payable or due to stockholders other than business-related transactions which are properly includible in the regular accounts payable are by fiction of law considered as part of capital and not liability Net Worth deficit (for corps), and for an individual, if he has no other leviable properties except his family home Taxpayer is a compensation earner and he has no more leviable assets except his family home Taxpayer declared to be bankrupt by any court/tribunal/authority/body/government agency Minimum Compromise Rates Based on financial incapacity Based on doubtful validity 10% of the basic assessed tax 40% of the basic assessed tax

Where the basic tax involved exceeds P1m or where the settlement offered is less than the prescribed minimum rates, the compromise shall be subject to the approval of the Evaluation Board. Abatement and Cancellation of Tax Liability Abatement of the penalties and/or interest is allowed when: 1. The taxes or any portion thereof appears to be unjustly or excessively assessed, or 2. The administration and collection costs do not justify the collection of the amount due. When is there an unjust or excessive assessment? 1. Filing of the return/payment was made at the wrong venue

2.

3. 4. 5. 6.

Taxpayers mistake in payment of tax was due to erroneous written advice of a revenue officer Taxpayers non-compliance is due to a difficult interpretation of said law Failure to pay on time because of substantial losses from prolonged labor disputes, force majeure, legitimate business reverses Failure to pay because of circumstances beyond his control In 4 & 5, the abatement will only cover the surcharge and the compromise penalty, not the interest. Late payment of tax under meritorious circumstances like:

One-day late filing in the bank Use of wrong tax form but correct amount of tax was remitted

Filing an amended return under meritorious circumstances (here, only penalties are abated, not interest) Surcharge erroneously imposed Late filing due to unresolved issue on classification/valuation of real property (for capital gains) Offsetting of taxes of the same kind Offsetting of one kind of withholding against the underpayment of another kind Late remittance of withholding tax on compensation of expats Wrong use of the Tax Credit Certificate Analogous cases NOTE: abatement of the surcharge and compromise will only be allowed upon written application by the taxpayer that he is signifying his willingness to pay the basic tax and interest or just the basic tax (depending on the circumstances) 2. Tax Liens

When a taxpayer neglects or refuses to pay his internal revenue tax liability after demand, the amount demanded shall be a lien in favor of the government from the time the assessment was made by the CIR until paid with interest, penalties, and costs that may accrue in addition thereto upon all property and rights to property belonging to the taxpayer However, the lien shall not be valid against any mortgagee, purchaser or judgment creditor until notice of such lien is registered in the office of the RD. Well-settled that the claim of the government predicated on a tax lien is superior to the claim of a private litigant predicted on a judgment. (CIR v NLRC) 3. Distraint and Levy- Distraint and levy are known as summary, extrajudicial or administrative enforcement remedies. o They are distinguished from remedies of collection by civil and criminal actions, where are judicial in nature. However, distraint and levy, as well as collection by civil and criminal action may by be pursued singly or independently of each other or all of them simultaneously. Distraint is enforced on personal property. Levy is enforced on real property. There are two kinds of distraint: o ACTUAL distraint, wherein actual delinquency in tax payment is necessary; and o CONSTRUCTIVE distraint, wherein no actual delinquency is necessary. It is a preventive remedy of the Government which aims at forestalling possible dissipation of the taxpayers assets. Instances when constructive distraint may be availed of; the CIR believes the taxpayer: o Is Retiring from any business subject to tax,

o o o o

Intends to Leave the Philippines Intends to Remove his property from the Philippines Intends to Hide or conceal his property Performs any Act tending to obstruct the proceedings for collecting the tax due.

How is constructive distraint effected? o The taxpayer will be required to sign a receipt covering the property distrained and obligate himself to: Preserve it intact and unaltered, and Not dispose of it in any manner, without express authority of the CIR o If the taxpayer refuses, the officer will prepare a list of the properties distrained and will leave a copy thereof in the premises, in the presence of 2 witnesses. Procedure for actual distraint: 1. Commencement of distraint proceedings 2. Service of warrant of distraint 3. Notice of sale of distrained property 4. Release of distrained property, prior to sale 5. Sale of property distrained 6. Purchase by Government at sale upon distraint Procedure for levy of real property: 1. Commencement of levy proceedings 2. Service of warrant of levy 3. Advertisement for sale 4. Public sale of the property under levy 5. Redemption of property sold 6. Forfeiture to the Government for want of bidder 7. Resale of real estate taken for taxes 8. Further distraint and levy

4. Forfeiture The difference between distraint/levy (or collectively, seizure) and forfeiture is: o In seizure, the residue after deducting tax liability and expenses shall go to the taxpayer. o In forfeiture, all the proceeds of the sale will go to the government. 5. Civil Penalties and Interest Penalties and interests apply to ALL taxes, fees and charges imposed by the NIRC. Theyre intended to hasten tax payments by punishing evasions or neglect of duty in respect thereof. It is mandatory to collect penalty and interest at the stated rate in case of delinquency. (PRC v CA) A penalty of 25% on the amount due will be imposed in the following cases: 1. Failure to file any return AND pay the tax due

2.

3. 4.

Filing a return with an internal revenue officer other than those with whom the return is required to be filed Failure to pay the deficiency tax within the time prescribed in the notice of assessment Failure to pay the full or part of the amount of tax stated in the return (or full amount when no return is required) on or before the date prescribed for its payment Note: There is NO 25% surcharge when you file on time, pay the full amount stated in the return, but subsequently find out that the return filed and the amount paid was erroneous.

A penalty of 50% of the deficiency tax will be imposed in the following cases: 1. Willful neglect to file a return within the period prescribed by law 2. False or fraudulent return is willfully made

a.

Prima facie evidence of a false and fraudulent return when substantial underdeclaration of taxable income or substantial overstatement of deductions (failure to declare an amount exceeding 30% for taxable income or actual deductions)

willful neglect: if the taxpayer voluntarily files the return, without notice from the BIR, only 25% surcharge shall be imposed for late filing and late payment of the tax. But if the taxpayer files the return only after prior notice in writing from the BIR, the 50% surcharge will be imposed. Jurisprudence:

The 25% surcharge for non-payment of the sales tax is not imposable where such non-payment arose from a legitimate dispute on whether an article is subject or not to the sales tax. (CIR v Republic Cement, wherein the original stand of the BIR that cement was a mineral product subject to ad valorem, and not sales tax. CIR should have abated the surcharge.) Where imposition of a tax statute was controversial, taxpayer may not be held liable to pay surcharge and interest. It should be liable only for tax proper and should not be held liable for the surcharge and interest. (Cagayan Electric v CIR) Willful neglect to file the required tax return or the fraudulent intent to evade the payment of taxes, considering that the same is accompanied by legal consequences, cannot be presumed. (CIR v Air India) The fraud contemplated by law is actual and not constructive. It must be intentional fraud, consisting of deception willfully and deliberately done or resorted to in order to induce another to give up some legal right. Negligence, whether slight or gross, is not equivalent to the fraud with intent to give up some legal right. (Aznar v CTA) Interest There are four kinds of interest:

1. 2. 3.

For General Interest, the interest on unpaid taxes is 20% per annum on any unpaid amount of tax from the date prescribed for payment until the amount is fully paid. For deficiency interest, the rate is 20% per annum on any deficiency in the tax due from the date prescribed for its payment until full payment For delinquency interest, 20% per annum on the unpaid amount in case of failure to pay: o Amount of tax due on any return required to be filed, or o Amount of tax due for which no return is required, or o Deficiency tax, or any surcharge or interest thereon on the due date appearing in the notice and demand of the CIR. For interest on extended payment, the rate is 20% per annum. o This is imposed when a taxpayer is qualified and elects to pay the tax on installment, but fails to pay the tax or any installment thereof, or pays it beyond the period of payment; or o CIR has authorized an extension of time within which pay a tax or a deficiency tax or any part thereof. Illustration Rocky forgot to file on April 15. He filed on June 30 after he woke up and realized his error. Result: Pay the tax due + penalties Rocky paid on April 15, but he paid to the wrong agent bank. Result: Pay the surcharge (no need to pay the tax due) Rocky didnt file on April 15. He didnt care until a demand letter was sent to him by the BIR to pay by June 30. He paid on June 30. Result: Pay tax + penalties Penalties 25% surcharge for late filing and late payment 20% general interest from date due up to time paid 25% surcharge ONLY No interest charge because he paid on time, just at the wrong place 50% surcharge 20% general interest from date due (not from demand) up to time paid

4.

Scenario Late filing and late payment of the tax; no BIR intervention/demand Tax return filed on time, but filed through an internal revenue officer other than with whom the return is required to be filed. (Paid in the wrong venue) Late filing and late payment due to taxpayers willful neglect; i.e. did not file, then BIR notified him to pay by a certain time, and only then did he file and pay his tax.

Penalty or penalties for deficiency tax As a rule, no surcharge is imposed on deficiency tax and on the basic tax. However, if the amount due inclusive of penalties is not paid on or before the due date stated on the demand letter, the corresponding surcharge will be imposed. Scenario Illustration Penalties

Paid on time, error in computation resulting to deficiency tax.

Paid on time, BIR disallowed deductions resulting to deficiency tax.

Paid on time, but return found to be false and fraudulent resulting to deficiency tax.

Late payment of deficiency tax assessed (In general, the deficiency tax assessed shall be paid within the time prescribed in the notice and demand, otherwise, payer shall be liable for civil penalties incident to the late payment.)

Rocky filed his income tax return on time (April 15) and paid P100,000. Upon pre-audit, it was discovered that there was an error in computation. The correct amount due was P120,000. He was assessed for deficiency income tax in a letter of demand and assessment noticed, telling him to pay by June 30. He did. Safari, Inc filed its return and paid on time tax amounting to P100,000. BIR disallowed its deductions, so their taxable income went back up. They were sent a PAN stating that the correct amount due was P170,000. They failed to protest. BIR sent them a formal demand telling them to pay by June 30. They did. McJonalds, Inc filed its return on time in April 15 and paid P175,000 for its income tax (it declared a P500,000 net taxable income). However, the BIR discovered that it did not report a taxable income of another P500,000 a clear case of false and fraudulent return. Amounted to a deficiency of another P175,000. They were informed by a PAN, but they failed to protest. A formal letter of demand and assessment notice was issued to them on May 31 demanding payment by June 30. They paid. Using the above example, the amount due (the deficiency assessed plus the penalties) imposed on McJonalds was P304,771.67. The corporation did not pay on June 30, the deadline for the payment of the assessment. As such, the corporation shall be considered late in payment of the assessment. They pay on July 31.

20% deficiency interest imposed on the deficiency tax from date due up to time paid No surcharge (Note here that the there are no grounds for the imposition of the 25% surcharge)

20% deficiency interest imposed on deficiency tax from date due up to time paid No surcharge (No statutory basis for imposition of the 25% surcharge)

50% surcharge (deficiency tax is the base) 20% deficiency interest imposed on deficiency tax from date due up to time paid

25% surcharge on the P304,771.67 (unpaid amount supposed to be paid on June 30) 20% delinquency interest imposed on the P304, 771.67 (total unpaid amount due June 30), from the day after the payment was due until time of actual payment.

First, a 50% surcharge was imposed on him for his fraudulent return, to be computed from the deficiency assessed by the BIR. Second, 20% deficiency interest was also imposed on the deficiency assessed by the BIR. Third, because of his late payment of the deficiency tax and the corresponding penalties, a 25% surcharge is now imposed on him based on the total unpaid amount he was supposed to pay. (Statutory basis? Sec 248 (A)3) Fourth, 20% delinquency interest is imposed on the total unpaid amount he was supposed to pay on June 30. Note the difference of the base of the two interest impositions: The deficiency interest imposition, computed from April 15 to June 30, is computed based on the deficiency tax. The delinquency interest imposition, computed from July 1 to July 31, is computed based on the total unpaid amount assessed in the May 31 demand, i.e. the deficiency tax plus the penalties Computation of 20% interest per annum in case of partial or installment payment of a tax liability. (Sec 249) If a taxpayer requests to pay his income tax liability in installment and the request is approved, no 25% surcharge shall be imposed for the late payment of the tax since its deadline for payment has been duly extended. However, 20% interest per annum for the extended payment shall be imposed, computed based on the diminishing balance of the unpaid amount, pursuant to Section 249 (D). If the taxpayers request for extension of the period within which to pay is made on or before the deadline prescribed for payment of the tax due, no 25% surcharge. But if the request is made after the deadline prescribed for payment, the taxpayer is already late in payment, in which case, the 25% surcharge shall be imposed, even if payment of the delinquency be allowed in partial amortization. Actual Liability: P10m On April 15 , paid: 1. Late, but unilaterally pays the balance A 5m No surcharge 20% interest Basis B 0 25% surcharge 20% interest Basis

Filed on time, but error in computation,

Late filing, late payment, no BIR demand.

2. BIR demands to pay on June 30, paid on June 30

No surcharge 20% deficiency interest

3. BIR demands to pay on June 30, but paid on July 31

25% surcharge on unpaid amount 20% delinquency interest on unpaid amount

no BIR demand. Still filed on time and error in computation. BIR demands, but paid on time required by BIR, so 248(A3) no application. BIR demands but does NOT pay on time required by BIR, 248 (A3) applies.

25% surcharge 20% deficiency interest

Late filing, late payment. BIR demands, but paid on time required by BIR, so 248 (A3) no application. BIR demands but does NOT pay on time required by BIR, 248 (A3) applies.

25% surcharge on unpaid amount 20% delinquency interest on unpaid amount

Analyzing the chart, if you compare situation 1 and situation 2, they are identical, there is no additional violation. Why? o Because surcharge is imposed on deficiency tax (plus penalties), only when it is NOT paid by the date indicated on the demand period. o So, if you pay within the period in the demand letter, you will not incur the additional 25% surcharge on the unpaid deficiency tax (plus penalties). Also note that there is no 25% surcharge when you file and pay on time but its subsequently discovered that there was an error. Only the interest will be imposed in that case (Situation 1 above) 5. Civil Action Basic principle: No civil (or criminal action) for the recovery of taxes shall be filed without the approval of the CIR. The government can collect when the assessment has become final and unappealable. This occurs when: o The taxpayer fails to file an administrative protest with the BIR within 30 days from receipt of assessment o The administrative protest is denied (or not acted upon within 180 days), and he fails to file an appeal with the CTA within 30 days from the receipt of the decision, or from the lapse of the 180 day period Collection in cases where the assessment is final an unappealable a. When there is no valid protest, the assessment shall become final and unappealable, and thus the tax shall be collectible. o To be a valid protest, the claim against the assessment must be substantiated. Jurisprudence

The requirement for the Commissioner to rule on disputed assessments before bringing an action for collection is applicable only in cases where the assessment was actually disputed, adducing reasons in support thereto. (Dayrit v Cruz, wherein the petitioners did not actually contest the assessments by stating the basis they did not submit the required position paper.) Failure to question the assessments will cause the said assessment to lapse into finality. (Marcos v CA, wherein the Marcoses not only failed to file the required estate tax return, but they also never questioned the assessments served upon them.) Once the assessment is final and executory, an action to collect the tax assessed is akin to an action to enforce a judgment. Hence, there can no longer be any inquiry on merits of the original case. Thus, raising the defense of prescription in the case for collection is of no merit. (Mambulao Lumber v Republic) The taxpayers failure to appeal to the CTA in due time made the assessment in question final, executory and demandable. Thus, when the present action for collection was instituted, said taxpayer was already barred from disputing the correctness of the assessment or invoking any defense that would reopen the question of its tax liability on the merits. (Republic v Lim Tian Teng) A taxpayer who fails to contest the BIR assessment in the CTA cannot contest the same in action to collect. (Basa v Republic) The RTC can acquire jurisdiction over a claim for collection of deficiency taxes only after the assessment made by the CIR has become final and unappealable; not where there is still a pending CTA case. (Yabes v Flojo, wherein the Court ruled that the RTC did not have jurisdiction and thus, must dismiss the case, because there was an appeal to the CTA of the disputed assessment) There is no requirment that the CIR must first rule on the taxpayers request for reinvestigation before going to court for the purpose of collecting the tax assessed. (Rep v Lim Tian)

Criminal action Again, no criminal action for the recovery of taxes shall be filed without the approval of the CIR. The judgment in the criminal case shall not only impose the penalty, but shall also order payment of the taxes subject of the criminal case as finally decided by the Commissioner. Acquittal of taxpayer in a criminal case does not exonerate him from tax liability. His legal duty to pay taxes cannot be affected by his attempt to evade payment. Said obligation is not a consequence of the felonious acts charged in the criminal

proceeding, nor is it a mere civil liability arising from a crime that could be wiped out by the judicial declaration of nonexistence of the criminal acts charged. (Republic v Patanao) o Civil liability to pay taxes arises from the fact that, for instance, one has engaged himself in business. His civil liability to pay taxes arises not because of any flony but upon the taxpayers failure to pay taxes. o The criminal liability arises upon failure of the debtor to satisfy his civil obligation. Computation and assessment of deficiency taxes is not a pre-requisite for criminal prosecution under the NIRC. Hence, protesting an assessment cannot stop criminal prosecution under the NIRC. (Ungab v Cusi) o A criminal complaint is instituted not to demand payment, but to penalize the taxpayer for violation of the Tax Code. (CIR v Pascor) o A crime is complete when the violator has knowingly and willfully filed a fraudulent return, with intent to evade and defeat the tax. The perpetration of the crime is grounded upon knowledge on the part of the taxpayer that he has made an inaccurate return, and the governments failure to discover the error and promptly to assess has no connections with the commission of the crime. (Adamson v CA) Prescription of the Governments Right to Assess & Collect An assessment contains not only a computation of tax liabilities, but also a demand for payment within a prescribed period. The ultimate purpose of assessment is to ascertain the amount that each taxpayer is to pay. It is a notice to the effect that the amount stated is due as tax and a demand for payment thereof. Assessments made beyond the prescriptive period would not be binding on the taxpayer. (Tupaz v Ulep) General Rule: The right to assess must be done 3 years from: o The day the return was actually filed, or o From the last day for filing the return (if the return was filed before the last day prescribed by law),

Exceptions: 1. False or fraudulent return with intent to evade taxes within 10 years from discovery of the falsity or fraud 2. Failure or omission to file a return within 10 years after discovery of failure or omission to file the return 3. Waiver of statute of limitations in writing, which must be made before the expiration of the 3 year period of assessment of taxes period agreed upon Our tax law provides a statute of limitations in the collection of taxes to safeguard taxpayers from any unreasonable examination, investigation or assessment. Thus, it should be liberally construed in order to afford protection to the taxpayers. Exceptions to the law on prescription should perforce be strictly construed. (CIR v BF Goodrich, wherein the Court said that the negligence or oversight on the part of the BIR with regard to make timely assessments cannot prejudice taxpayers, considering that the prescriptive period was precisely intended to give them peace of mind.) NOTE: the important date to remember is the date when the demand letter or notice is released, mailed or sent by the CIR to the taxpayer. (Basilan Estates v CIR) o Provided the release was effected before prescription sets in, the assessment is deemed made on time even if the taxpayer actually receives it after the prescriptive period. o However, the fact that the assessment notice was mailed before prescription period sets in must be proved with substantial evidence by the CIR. The presumption that a letter duly directed and mailed was received in the regular course of mail cannot be applied if there is no substantial evidence to prove that the notice was indeed sent.

whichever is later - to benefit the government, so they have more time to make the assessment on the taxpayer.

Deficiency income tax assessments cannot be enforced where the tax collector cannot prove that said assessments were served on the taxpayer. (Nava v CIR)

Moreso, if the taxpayer makes a direct denial of receipt of a mailed demand letter, such denial shifts the burden to the Government to prove that such letter was indeed received by the taxpayer. (Republic v CA, 1987). If the date on which the assessment is due to prescribe falls on a Saturday, the following day being a Sunday, it is understood that the Government has until the next succeeding business day or Monday within which to assess the tax. (CIR v Western Pacific, ruling probably also applies to dates falling on a national non-working holiday)

Jurisprudence on the filing of returns

In order that the filing of a return may serve as the starting point of the period for the making of an assessment, the return must be as substantially complete as to include the needed details on which the full assessment may be made. (Republic v Marsman, wherein Marsman failed to show when the returns were actually made, and assuming that they did file a return, they also failed to show that the return was substantially complete. Hence, the Court ruled that the 10-year period would apply, as there was a failure to file a return.)

If the taxpayer files an amended return which is substantially different from the original return, the period of prescription of the right to issue the deficiency assessment should be counted from the filing of the amended return, and not the original return. (CIR v Phoenix) If the taxpayer files the wrong return, it is as though he filed no return at all. This is true even if all the necessary information was reflected in the erroneous return. In situations like this, the 10-year prescriptive period will apply. (Butuan Sawmill v CA, wherein Butuan filed an income tax return for sales tax purposes). It is incumbent upon a taxpayer who wants to avail of the defense of prescription to prove that he indeed submitted a return. If he fails to do so, the conclusion should be that no such return was filed, in which case the Government ahs 10 years within which to make the corresponding assessments. (Taligaman v CIR)

Jurisprudence on fraud, falsity, and the imposition of the 10-year period Fraud is a question of fact and the circumstances constituting fraud must be alleged and proved in the court. Fraud is never lightly to be presumed because it is a serious charge. Hence, if fraud is not proven, the Government can not use the 10-year period to make the assessment. (CIR v Ayala) It is not enough that fraud is alleged in the complaint, it must be established. (Republic v Lim De Yu, wherein the BIR was not even sure of the net income of the taxpayer) o Claiming fictitious expenses as deductions is a proof of falsity or fraud in the income tax return. (Tan Guan v CTA) o There is a difference between false return and fraudulent return. (Aznar v CTA) False return merely implies deviation from the truth. Its usually due to mistake, carelessness or ignorance. Fraudulent return implies intentional or deceitful entry with intent to evade the taxes due. Actual fraud, not constructive fraud, is subject to the 50% penalty surcharge. For the surcharge to apply, it must be intentional fraud, consisting of deception willfully and deliberately done or resorted to in order to induce another to give up some legal right. - Negligence, whether slight or gross, is not equivalent to the fraud with intent to evade the tax contemplated by law. - The legal implications of the case are the following: Just because the 10-year period kicks in, it doesnt necessarily mean that the taxpayer will be slapped with the penalty surcharge. This is what happened in Aznar the taxpayer was adjudged to have filed a false return, but not a fraudulent one. So, the 10-year period applies, but he wasnt slapped with the penalty surcharge. If you were the government and you want to use the 10-year period, it will be easier to impute falsity in the part of the taxpayer. Falsity is easier to prove than fraud. The 30% threshold we learned in surcharges doesnt necessarily apply when it comes to prescription purposes, as it merely raises a presumption of fraud which must in the end be proven by the government. NOTE: the case of CIR v Ayala Securities teaches that collection of surtax on excess profits does not prescribe there being no law providing a prescriptive period therefore. Prescription with collection General rule: The prescriptive period to collect the taxes due is 5 years from the date of assessment. Exceptions: 1. False or fraudulent return with intent to evade taxes within 10 years from discovery without need for prior assessment. The government may file a proceeding in court. 2. Failure or omission to file a return within 10 years from discovery without need for assessment. 3. Waiver in writing executed before the 5-year period expires period agreed upon. The prescriptive period to assess or collect deficiency tax is governed by the NIRC (a special law) and not the Civil Code (a general law). (Guagua v CIR). The same can be said between the NIRC and the Rules of Court. Hence, claims for taxes may be collected even after the distribution of the decedents estate. Claims for estate taxes are exempted from the application of statute of non-claims. (Vera v Fernandez) For prescriptive period purposes, the tax is deemed collected if: 1. If collection is thru summary remedies (distraint and levy), when the government avails of a distraint and levy procedure prescribed under the Code 2. If collection is thru judicial remedies (civil or criminal), when the government files the complaint with the proper court.

A judicial action for the collection of a tax may be initiated by filing of a complain with the proper regular trial court, or where the assessment is appealed to the CTA, by filing an answer to the taxpayers petition for review wherein payment of the tax is prayed for. (PNOC v CA) General rule: is that there must be an assessment made before collection is resorted to by the government. Exception: 222 (A) of the NIRC wherein judicial action to collect the tax liability is permitted without an assessment when the taxpayer files a false or fraudulent return with intent to evade the tax or fails to file a return. Collection must be done within 10 years after the discovery. However, if an assessment is made against the taxpayer, the government cannot avail of Section 222 (A). In Republic v Ret, the Court stated that an assessment against the taxpayer takes the case out of Section 222 (A) and places it under Section 222 (C) or 5 years from the assessment made. The period for collecting a tax through a judicial proceeding, in case no return has been filed, is 10 years from the discovery of the omission. - A letter by the CIR demanding the amount of a rubber-check previously paid by a taxpayer, should be deemed to be an assessment if it declares and fixes the tax payable against the party thereo and demands the settlement thereof. Hence, the five-year period for collection of the tax due should commence anew from the time said letter of demand was sent to the taxpayer. (Republic v Limaco)

Normal Tax Return Assessment: 3 years Collection: 5 years from assessment NOT POSSIBLE

False, Fraudulent or Failure to file Return Assessment: 10 years, from discovery Collection: 5 years, from assessment Collection ONLY: If government does not make an assessment, they can collect within 10 years from discovery.

They are, however, limited to purely judicial remedies. (Section 222(A) Waiver of Statute of Limitations The taxpayer and the government may extend by mutual agreement in writing the prescriptive period for the assessment and collection of taxes. A waiver of the statute of limitations under the NIRC, to a certain extent, is a derogation of the taxpayers right to security against prolonged and unscrupulous investigations and must therefore be carefully and strictly construed. (Philippine Journalists v CIR) Essential conditions for a waiver to be valid: o It must be executed by the parties before the lapse of the 3 year prescriptive period for assessment of taxes (Republic v Acebedo). o They must be signed by the CIR or any of his agents. If it isnt, the waivers are not valid and binding. (CIR v CA, wherein the Court ruled that the waiver is not a unilateral act on the part of the taxpayer.) o It must contain a definite expiration date. (Philippine Journalists v CIR)

It must also contain the date when the waiver was executed (determines if waiver was signed within prescriptive period).

These have been embodied in RMO 20-90, below: [FSN-BP3] 1. The waiver must be in proper form prescribed by RMO 20-90. The phrase but not after_____19__ which indicates the expiry date of the period agreed upon to assess/collect the tax after the regular three-year period of prescription, should be filled up; 2. The waiver must be signed by the taxpayer himself or his duly authorized representative; 3. The waiver must be duly notarized; 4. The Commissioner of Internal Revenue or the revenue official authorized by him must sign the waiver indicating the BIRs acceptance and agreement to the waiver. The date of such acceptance by the BIR should be indicated; 5. Both the date of execution by the taxpayer and the date of acceptance by the BIR should be prior to the expiration of the period of prescription or before the lapse of the period agreed upon in case a subsequent agreement is executed; and 6. The waiver must be in three copies: the original copy to be attached to the docket of the case, the second copy for the taxpayer, and the third copy for the Office accepting the waiver. o Additionally, the waiver must not reduce the prescriptive period to less than that granted by law to the detriment of the state. It should not diminish the opportunity of the State to collect the taxes due it. (Republic v Lopez). o The taxpayers waiver of statute of limitations does not cover taxes already prescribed. (Republic v Lim De Yu) Suspension of Running of Statute of Limitations The running of the prescriptive period can be suspended in the following situations: [PC-WOCR] When the CIR is prohibited from making an assessment or beginning distraint and levy or a proceeding in court and for 60 days thereafter The periods for assessment and collection are suspended.

1.

2. 3. 4. 5. 6.

The filing of a petition for review in the CTA from the decision of the CIR on a protested assessment interrupts the running of the prescriptive period for collection. The pendency of the taxpayers appeal in the CTA and in the SC had the effect of temporarily staying the hands of the CIR from collecting. (Republic v Ker)

When the taxpayer cannot be located in the address given by him in the return filed, unless he informs the CIR of the change of address [BOTH the periods for assessment and collection are suspended] When the warrant of distraint/levy is duly served and no property could be located [ONLY period for collection suspended] When the taxpayer is out of the Philippines Period for assessment and collection is suspended Those under the CTA law The taxpayer requests for reinvestigation which is granted by the CIR The collection is suspended (the assessment has already been done at this point, so only period to collect is suspended).

There is a difference between a request for reconsideration and a request for reinvestigation. (BPI v CIR) o Reconsideration refers to a plea for a re-evaluation of an assessment on the basis of existing records without need of additional evidence. This is basically a mere re-evaluation of existing records. (CIR v Philippine Global) o Reinvestigation refers to a plea for re-evaluation on the basis of newly-discovered or additional evidence that a taxpayer intends to present in the reinvestigation. o NOTEL suspension of the period only occurs when the taxpayer requests for a reinvestigation, granted by the CIR.

A mere request for reinvestigation WITHOUT corresponding action on the part of the CIR will not interrupt the running of the period. The request must be granted by the CIR, which means that the government acted upon the request, as seen in Republic v Arache

The taxpayer is barred from invoking the defense of prescription because the delay was due to his repeated requests for reinvestigation and for extensions of time to pay, which the government acted upon. (Republic v Arache) However, in certain instances, the taxpayer may still be held in estoppel and be prevented from setting up the defense of prescription on collection when, by his own repeated requests or positive acts, the Government had been, for good reasons, persuaded to postpone collection to make the taxpayer feel that the demand is not unreasonable or that no harassment or injustice is meant by the Government.

10

EFFECTS OF REINVESTIGATION vs. REVISED ASSESSMENT

May 16 Dec. 1 2011 2016

June 1

December 1 2011

May 1 2016

Nov. 1

Reinvestigate pd. of reinvestigation added to the 5y prescriptive period. Revision IF revision on this date Fresh Period of 5y

In computing whether the collection was done within the period prescribed by law, do this: o (Date of Collection) (Date of Assessment) (Period of Reinvestigation) </= 5 years o The period starts to run again when the said request is denied, i.e. the BIR acted upon the request but did not find it meritorious afterwards (CIR v Capitol)

There is also an important difference between a revised assessment and a ruling on a reinvestigation. o When the assessment has been revised, the period to collect begins from the time of the revision. In other words, the period is reset.

Prescription in Criminal Cases - The prescriptive period for criminal cases is 5 years. When it begins to run depends on the nature of the violation of the taxpayer: o If failure or refusal to pay taxes due from the service of final notice and demand for payment of the deficiency taxes upon the taxpayer. o If filing of false or fraudulent returns from the institution of judicial proceedings for its investigation and punishment.

In the latter case, isnt this one-sided in favor of the Government? Yes, it is. It would seem that cases of fraudulent/false returns are practically imprescriptible for as long as the period from the discovery and institution of judicial proceedings for its investigation and punishment, up to the filing of the information in court does not exceed 5 years. But, thats what the law says. (Lim Sr v CA) TAXPAYERS REMEDIES

The taxpayer is given two remedies:

1. 2.

Protest or dispute the assessment, or Refund or recovery of erroneously or illegally collected taxes The remedies are mutually exclusive.

o o

In protest, the tax has not yet been paid, what is being contested is the governments claim that tax is underpaid. Protesting is the proper remedy when a FAN has been issued. You protest the assessment and appeal it to the CTA, when proper. In refund, the tax has already been paid by the taxpayer and the claim of the taxpayer is that the tax is overpaid. Refund is proper when the taxpayer has paid the tax pursuant to a self-assessment.

1. Some additional stuff on protest: o The FAN can be issued by the CIRs duly authorized representative. o The FAN (like the PAN) must state the facts, the law, rules and regulations, or jurisprudence on which the assessment is based, otherwise the FAN is void. It must also be written. o The FAN must be sent via registered mail or personal delivery.

If you protest the PAN, youre only protesting the declaration of default. This is not the protest contemplated after a final assessment. If you dont protest the FAN within 30 days, the assessment becomes final. You cant raise it to the CTA anymore. If the protest is denied, in whole or in part, by the Commissioner, the taxpayer may appeal to the CTA within 30 days from date of receipt of the said decision, otherwise, the assessment shall become final, executory and demandable. Provided, however, that if the taxpayer elevates his protest to the Commissioner within 30 days from date of receipt of the final decision of the Commissioners duly authorized representative, the latters decision shall not be considered final, executory and demandable, and the protest shall be decided by the Commissioner. If the Commissioner or his duly authorized represntative fails to act on the taxpayers protest within 180 days from date of submission, by the taxpayer, of the required documents in support of his protest, the taxpayer may appeal to the CTA within 30 days from the lapse of the said 180-day period, otherwise, the assessment shall become final, executory and demandable. 2. Tax Refunds and Tax Credit o In a tax refund, there is actual reimbursement.

In a tax credit, a tax certificate or tax credit memo is issued to the taxpayer, and may be applied against any sum

11

due and collectible from the taxpayer, except withholding taxes. The requirements for a tax credit or refund are:

1. 2.

Written claim for credit or refund filed with the CIR (a return filed showing overpayment- considered a written claim), whether or not the tax has been paid under protest, and Filed within 2 years after the actual payment of the tax or penalty, regardless of the existence of any supervening cause after payment

Common elements in all refund cases: o Filed within the period o Substantive basis in law o Documents to support or substantiate your claim Why such stringent requirements?

Because a claim for a refund/credit partakes of the nature of an exemption and is strictly construed against the claimant. He needs to establish the legal basis for the refund and substantiate it. (CIR v Tokyo Shipping) This was also reiterated in Philex Mining Corporation v CIR, where the refund awarded to the taxpayer was based on the specific tax deemed paid, and not on the increased rates actually paid. The Court stated that the refund privileges must be strictly construed. The following are the instances when a claim for refund may be done:

1. 2. 3.

Erroneously or illegally assessed or collected internal revenue taxes, Penalties imposed without authority, or Any sum alleged to have been excessive or in any manner wrongfully collected

Taxes are erroneously paid when a taxpayer pays under a mistake of fact, like when he is not aware of an existing exemption in his favor at the time he pays. Taxes are illegally collected when payments are made under duress. The government is not liable to pay interest on the taxes it refunds to the taxpayer, given that there is no provision in law requiring such. (CIR v Sweeney) The written claim for credit or refund filed with the CIR is a mandatory requirement. o It is a condition precedent. If the taxpayer fails to comply with the same, any action on his part in recovering that tax will necessarily fail. If a judicial action is brought for recovery, it will be dismissed. (Vda de Aguinaldo v CIR) o But can the CIR refund or claim any tax without a written claim?

Yes. But only when on the face of the return upon which payment was made, such payment appears clearly to have been erroneously paid.

On the two year prescriptive period General rule: is that the 2-year prescriptive period runs from the payment of the tax. BUT in the following cases: o Overpaid quarterly corporate income tax, the 2-year period to claim refunds commences to run ONLY from the time the refund is ascertained, determined after a final adjustment return is accomplished. So, For Corporations, the 2-year period begins when they file the final adjustment return. (CIR v Phil Am Life) o The 2-year period should be computed from the time of actual filing of the adjusted return or annual income tax return, not the last day allowed by law to file. So if you file earlier than the last day for filing, the period is counted from the date of actual filing. (CIR v CA and BPI, 1999) For example, the last day to file is on April 15 and you file your income tax return on April 4, the 2-year period will start on April 4. NOTE: Quarterly VAT Returns are FINAL returns, so the 2-year period to file the claim for refund is counted from the date of actual filing.

o o

For overpaid withholding taxes, the period is counted from the end of the taxable year. (Gibbs v CIR, 1965 Gibbs claimed he overpaid the taxes he withheld for some foreigner) But for claiming a refund for creditable withholding taxes, the period is counted from the filing of the taxpayers final adjustment tax return. (ACCRAIn v CA ACCRAIn claimed that they didnt have taxes due to credit the taxes withheld by their withholding agents.)

General Rule: the 2-year prescriptive period is mandatory, and after the lapse of the 2-year period, there can no longer be proceedings for refund. [Unlike in local government tax, this is regardless of any supervening event] (i.e. The 2-year period cannot be extended by the BIR by a mere revenue memorandum. (PBCOM v CIR) Exception: [WAM]

1. 2.

When the taxpayer and the government agree to wait for the outcome of a case which is on all fours with the instant case When the payment of tax was not due because of error or wrongful collection, but because of a patriotic duty to help the cause of the nation (CIR v PNB, wherein the PNB made an advanced payment of its taxes, which was recognized as such by the BIR themselves)

12

3.

When the taxpayer was made to believe that the refund was going to be allowed by the government NOTE: With respect to the CTA, the 2-year period is not jurisdictional and may be suspended for reasons of equity and other special circumstances. ELEVATING the claim to the CTA

The taxpayer need not wait for the action of the CIR on the claim for refund before taking his claim to the CTA. Both the claim for refund and the appeal to the CTA must be done within the 2-year period. o So if the period is about to expire, and the CIR has not acted upon the claim, the taxpayer may file and appeal with the CTA, without waiting for the CIR. o The suit or proceeding must be started in the CTA before the end of the 2-year period without awaiting the decision of the CIR. (Gibbs v CIR 1960) The taxpayers failure to comply with requirement regarding the institution of the action or proceeding in court within 2 years after the payment of the taxes bars him from recovery of the same, irrespective of whether a claim for the refund of such taxes filed with the CIR is still pending action on the latter. (CIR v. Sweeney) Illustration: on April 15, 2008, you filed an ITR. On April 10, 2010, you realized you overpaid your taxes. You have 5 days before the prescriptive period lapses. What do you do? a. Claim for a refund with the BIR on April 10, 2010 b. File an appeal with the CTA on April 15, 2010 c. Cry d. Both A & B The prudent thing to do is exhaust all administrative remedies before going to Court. But since youre last day is on April 15, then you have no other choice but to file an appeal with the CTA. The claim must be filed with the court which has proper jurisdiction over the refund. NOTE: the claim must not be in a mere supplemental petition in another case pending before the CTA, as its admission is merely discretionary. A petition for review must be filed instead. (FEBTC v CIR) THE CHOICE between a refund and a credit There are 3 options to a taxable corporation whose total quarterly income tax payments in a given taxable year exceeds its total income due:

1. 2. 3.

Filing for a tax refund, or Availing of a tax credit, or Carry-over the excess credit against the estimated income tax liabilities of the succeeding quarters.

These are alternative in nature. You choose one and thats it. If you choose the carry-over option, its considered irrevocable for that taxable period, and no application for a tax refund or issuance of a tax credit certificate shall then be allowed. (Phil Am v CIR) The taxpayer must choose by marking the corresponding option box provided in the FAT. While a taxpayer is required to mark its choice in the form provided by the BIR, this requirement is only for the purpose of facilitating tax collection. Failure to signify ones intention in the FAR does not mean outright barring of a valid request for a refund, should one still choose this option later on. In the case, PhilAm did not make the appropriate marking in the BIR form, but the Supreme Court said that the despite the failure to do so, the filing of its written claim effectively serves as an expression of its choice to request a tax refund, instead of a tax credit. To assert that any future claim for a tax refund will be instantly hindered by a failure to signify ones intention in the FAT is to render nugatory the clear provision that allows for a 2-year prescriptive period. Moreover, PhilAm did not perform any act indicating that it chose a tax credit. o In the same case, however, the Court, ruling on a different taxable period, stated that the subsequent acts of Phil Am revealed that it had effectively chosen the carry-over option despite not marking the carry-over option box. The act which indicated such was that they filled out the portion prior years excess credits in the FAR. Filling this portion was not mandatory if they indeed chose a refund, they shouldnt have just left this blank. A Tax Credit Certificate acquired through the DOF One Stop Shop Inter-Agency Tax Credit and Duty Drawback Center, which is run by the DOF, BIR, BOC and BOI, is immediately valid and effective after issuance. (Pilipinas Shell v CIR) o Their validity is not subject or dependent on the outcome of any post-audit. o A transferee in good faith and for value of a TCC who has relied on the Centers representation of the genuineness and validity of the TCC transferred to it may not be legally required to pay again the tax covered by the TCC which has been belatedly declared null and void, that is, after the TCCs have been fully utilized through settlement of internal revenue tax liabilities. A tax credit generally refers to an amount that may be subtracted directly from ones total tax liability. o It is an allowance against the tax itself or a deduction from what is owed by a taxpayer to the government. o It is the amount due to a taxpayer due to overpayment of a tax liability or erroneous payment of a tax due.

It is transferable in accordance with pertinent laws, rules and regulations.

A TCC is a certification, duly issued to the taxpayer, by the CIR, acknowledging that the taxpayer named is legally entitled to a tax credit, the money value of which may be used in payment of any of his internal revenue tax liability (except those excluded), or may be converted as a cash refund. ON ASSESSMENTS The taxpayers shall be informed in writing of the law and the facts on which the assessment is made; otherwise, the

13

assessment shall be void.

The advice of tax deficiency, given by the CIR to an employee of Enron, as well as the preliminary 5-day letter, are not valid substitutes for the mandatory notice in writing of the legal and factual bases of the assessment. (CIR v Enron) o The law requires that the legal and factual bases of the assessment be stated in the formal letter of demand and assessment notice. o The alleged factual bases in the advice, preliminary letter and audit working papers did not suffice. o Even if Enron made an intelligent protest, the CIR still has no ground to stand on, given that the law states that the assessment without legal and factual basis is void, not even voidable. The authority to make tax assessments may be delegated to subordinate officers. (Oceanic v CIR) Distinction between prescriptive periods of assessment and refund - In both cases, the prescriptive periods for making assessment and claiming a refund are made in favor of the government. o For making an assessment, the period starts from either the day the return was actually filed, OR the day when the return was supposed to be filed, whichever is later. o For claiming a refund, the period starts from the day the return was actually filed, even if it were earlier than the day it was supposed to be filed.

The only situation where the government is not given this benefit is when the return was filed after the date prescribed by law. The period for refund is counted from that date, and not from the date prescribed by law. Why? The law on refund states that the period starts from the time of payment. 2011 April Paid EARLY 02 Paid ON TIME 15 LATE 20 Assessment Filed this date, period starts 4/15 Filed this date, period starts this date Filed this date, period starts this date Refund Filed this date, period starts this day too Filed this date, period starts this day too But if filed this date, period starts this day too (not in favor of the government!)

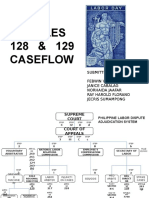

COURT OF TAX APPEALS (RA 9282 AND REVISED RULES OF COURT OF THE CTA) Exclusive Appellate Jurisdiction to Review by Appeal: [DIRC-CaTI] Decisions of CIR, involving disputed assessments, refunds or other matters arising under NIRC or other laws administered by the BIR Inaction by the CIR, involving disputed assessments, refunds or other matters arising under NIRC or other laws administered by the BIR, when the NIRC provides a specific period of action, in which case the inaction shall be deemed a denial Decisions, orders or resolutions of RTCs on local tax cases originally decided or resolved by them Decisions of the Commissioner of Customs (COC) involving matters arising under the Customs Law or other laws administered by the BOC Decisions of the Central Board of Assessment Appeals (CBAA) involving the assessment and taxation of real property originally decided by the provincial or city board of assessment appeals Decisions of the Secretary of Finance on customs case elevated to him automatically for review from decisions of the COC which are adverse to the Government Decisions of the Secretary of Trade and Industry (nonagricultural products, commodities or articles), and the Secretary of Agriculture (for agricultural products, commodities, or articles), involving dumping and countervailing duties under Section 301 or 302 of the Tariff and Customs Code, and safeguard measures under RA 8800, where either party may appeal the decision to impose or not to impose said duties. Exclusive ORIGINAL jurisdiction all criminal offenses arising from violations of NIRC or Customs and Tariff Code and other laws administered by the BIR or BOC, where the principal amount of tax claimed is worth P1m or more NOTE: If less than P1M or no specified amount claimed, appellate jurisdiction. Tax collection cases involving final and executory assessments for taxes, fees, charges and penalties, where amount claimed is P1M or more NOTE: If less than P1M or no specified amount claimed, appellate jurisdiction. Exclusive APPELLATE jurisdiction Appeals from the RTC in tax cases originally decided by them. Petitions for review from RTC in the exercise of their appellate jurisdiction over tax cases originally decided by the MTCs Appeals from the RTC in tax cases originally decided by them. Petitions for review from RTC in the exercise of their appellate jurisdiction over tax cases originally decided by the MTCs

1. 2. 3. 4. 5. 6. 7.

Jurisdiction over cases involving Criminal offenses:

Jurisdiction over Tax Collection cases

14

Composition Presiding justice and eight (8) associate justices appointed by the President of the Phils. The court shall sit:

a. b.

En banc, or In three (3) Divisions of three (3) justices each, - Including the presiding justice, who shall be the Chairperson of the First Division and the two (2) most Senior Associate Justices shall be served as Chairpersons of the Second Divisions, respectively.

The presiding justice or, the most senior justice in attendance shall preside over the sessions of the Court en banc. Quorum for its session en banc - five (5) justices of the Court. o 5 affirmative votes needed to reverse a decision of a division o Simple majority to promulgate a resolution or decision in all cases NOTE: Where the necessary majority vote cannot be had the petition shall be dismissed. In appealed cases judgment or order appealed from stands affirmed. Division quorum - 2 o 2 affirmative votes needed to pronounce a judgment Procedure Appeal within 30 days from receipt of decision or period of inaction of the CIR, COC, Secretary of Finance, Secretary of Trade & Industry or Secretary of Agriculture, or the CBAA or the RTC.

1.

2. 3. 4.

General rule: Appeal to a CTA DIVISION by a petition for review under Rule 42 Exception: If decisions of the CBAA or RTC in the exercise of its appellate jurisdiction, appeal to EN BANC by a petition for review under Rule 43 File an MR with the same division within 15 days from notice thereof, [in criminal cases, apply rules applicable to regular courts] File a petition for review with the CTA en banc under Rule 43

In case the decision of the Division was adverse:

In case the resolution of the Division on the MR is still adverse: In case the decision of the CTA en banc is still adverse File a review on certiorari with the SC under Rule 4 Suspension of Collection General rule: No injunction to restrain collection of taxes. Exception: Suspension is allowed when the following conditions concur:

1. 2. 3.

There is an appeal to the CTA, and In the opinion of the court, the collection by the government agencies may jeopardize the interest of the Government and/or the taxpayer, and Taxpayer either to deposit the amount claimed or to file a surety bond for not more than the double the amount with the Court.

Related Jurisprudence:

The jurisdiction of the CTA is to review by appeal decisions of the CIR on disputed assessments. When a taxpayer does not protest an assessment, and appeals the assessment itself to the CTA, his appeal is premature. (CIR v Villa) A final demand letter for payment of delinquent taxes may be considered a decision on a disputed or protested assessment. Thus, the taxpayer can file an appeal with the CTA. (CIR v Isabela Cultural) o Demand letter of the CIR - which states a warning that in the event the taxpayer fails to pay, collection will be enforced - constitutes the order appealable to the CTA. (Surigao Electric v CIR) o The BIR should always indicate to the taxpayer in clear and unequivocal language what constitutes final action on a disputed assessment. The object is to avoid repeated requests for reconsideration by the taxpayer, thereby delaying the finality of the assessment, and consequently, the collection of the taxes due.

Since the power to make an assessment may be delegated to subordinate officers, the act of issuance of the demand letter by a subordinate officer is an order that is appealable to the CTA. (Oceanic v CIR, wherein the taxpayer failed to appeal to the CTA within 30 days of receipt of the demand letter made by the Chief of the Accounts Receivable and Billing Division of the BIR. In this case, the investigation was started and concluded by the same division.)

Q: what if the CIR himself starts the investigation, and then delegates it to his deputy, do you appeal it to the CIR or straight to the CTA?

CTA jurisdiction has been expanded to include not only decisions or rulings but inaction as well of the CIR. (RCBC v CIR) In case the CIR fails to act on the disputed assessment within the 180-day period from date of submission of documents, a taxpayer can either:

1. 2.

File a petition for review with the CTA within 30 days after the expiration of the 180-day period, or Await the final decision of the Commissioner or the disputed assessments and appeal such final decision to the CTA within 30 days after receipt of a copy of such decision.

However, these options are mutually exclusive, and resort to one bars the application of the other. After availing the first option, but filing it out of time, a taxpayer can not successfully resort to the second option (awaiting the final decision of the CIR and appealing the same to the CTA, on the pretext that there

15

is yet no final decision on the disputed assessment because of the CIRs inaction). Remember that when a taxpayer protests an assessment, he is given 60 days to submit supporting documents. From the time he submits the documents, the 180-day period for the CIR to act on the protest starts. But what if the taxpayer submits all the documents with the protest? (CIR v First Express Pawnshop) o In that case, the CIR was contending that First Express did not submit the relevant documents. However, given that First Express submitted their documents along with their protest, the Court said that the BIR can not demand what type of supporting documents should be submitted. Otherwise, a taxpayer will be at the mercy of the BIR, which may require the production of documents that a taxpayer cannot submit. o So it appears that the 60-day period is given for the benefit of the taxpayer. He can take up the entire 60 days or not. The taxpayer has a choice of not utilizing the period, by immediately submitting the documents, effectively starting the 180-day period of the BIR to act much earlier. o The legal implication: is when the taxpayer appeals to the CTA because of the expiration of the 180-day period, the taxpayer must allege that the supporting documents were submitted along with the protest. If not, the CTA may dismiss the case because it was filed still within the 180-day period, and thus, prematurely filed. But how does the taxpayer know if the documents are in fact, complete? What if the BIR asks him to submit additional documents to substantiate his claim?

If he doesnt submit any more documents, then the 180-day period should start from the time he submitted the initial documents, the BIR cant demand for the kind of specific documents. If he does submit more documents within the 60-day period, then the 180-day period should start from the time he submitted the additional documents, since the 60-day period is given for the benefit of the taxpayer, and it is his choice whether or not to use the whole period or not. Filing a motion for reconsideration of a decision of the CIR denying a protest does not toll or suspend the period to appeal to the CTA. The 30-day period to appeal to the CTA is still reckoned from the date the taxpayer is notified of the denial of the CIR. (Fishwealth Canning Corp v CIR) Compared to asking for a reinvestigation and it being granted by the CIR.

In that case, what is being tolled is the time for the CIR to collect, not the period to appeal to the CTA. But can the period to appeal to the CTA be extended? Yes. In City of Manila v Coca-Cola (2009), the Court stated that in appeals to the CTA, the Rules of Court are applicable. Since in the Rules of Court, Rule 42 allows extensions to file petitions for review to be filed with Court of Appeals, the same should be applicable in petitions for review with the CTA.

16

Das könnte Ihnen auch gefallen

- GROUP 1 Tax RemediesDokument6 SeitenGROUP 1 Tax RemediesEunice Kalaw VargasNoch keine Bewertungen

- The Three Branches of GovernmentDokument7 SeitenThe Three Branches of GovernmentExistentialist5aldayNoch keine Bewertungen

- Republic Act No 10151Dokument16 SeitenRepublic Act No 10151Ashley CandiceNoch keine Bewertungen

- REMEDIES by J. DimaampaoDokument2 SeitenREMEDIES by J. DimaampaoJeninah Arriola CalimlimNoch keine Bewertungen

- 1 DOCUMENTARY REQUIREMENTS PresentationDokument70 Seiten1 DOCUMENTARY REQUIREMENTS PresentationSelyun E OnnajNoch keine Bewertungen

- Tax Cases'RemediesDokument137 SeitenTax Cases'RemediesDigna Burac-CollantesNoch keine Bewertungen

- Usufruct CasesDokument24 SeitenUsufruct CasesMay AnascoNoch keine Bewertungen

- 2017 RaccsDokument112 Seiten2017 RaccsBfp Car TublayNoch keine Bewertungen

- PDS - Work-Experience-SheetDokument3 SeitenPDS - Work-Experience-SheetKaren Ann Dato-on Salas100% (1)

- Tax Lectures TranscribeDokument29 SeitenTax Lectures TranscribeNeri DelfinNoch keine Bewertungen

- CTA JurisdictionDokument11 SeitenCTA JurisdictionShekinah GalunaNoch keine Bewertungen

- Labor HierarchyDokument12 SeitenLabor HierarchyfebwinNoch keine Bewertungen

- Pro-Life Phil vs. Office of The PresidentDokument81 SeitenPro-Life Phil vs. Office of The PresidentproliferakoNoch keine Bewertungen

- Writ of Continuing Mandamus - A.M. No. 09-6-8-SCDokument6 SeitenWrit of Continuing Mandamus - A.M. No. 09-6-8-SCVictor GalangNoch keine Bewertungen

- Considered Notice of AssessmentDokument7 SeitenConsidered Notice of AssessmentKyla Ellen CalelaoNoch keine Bewertungen

- SECTION 1.02.03 - Building PermitsDokument2 SeitenSECTION 1.02.03 - Building PermitsArcon Solite BarbanidaNoch keine Bewertungen

- CSC Gacayan Security of TenureDokument62 SeitenCSC Gacayan Security of TenureVictor FernandezNoch keine Bewertungen

- Writ of Amparo: Questions and Answers: 18shareDokument6 SeitenWrit of Amparo: Questions and Answers: 18shareaaron_cris891Noch keine Bewertungen

- NotarialDokument9 SeitenNotarialMarbie Ann Simbahan100% (1)

- Comelec Resolution 9640Dokument36 SeitenComelec Resolution 9640Ýel ÄcedilloNoch keine Bewertungen

- 98) Aldovino Vs COMELECDokument2 Seiten98) Aldovino Vs COMELECAlexandraSoledadNoch keine Bewertungen

- VSD Realty & Development v. Uniwide Sales, Inc.Dokument1 SeiteVSD Realty & Development v. Uniwide Sales, Inc.Marion KhoNoch keine Bewertungen

- Work Hours LACE 3.28.12Dokument43 SeitenWork Hours LACE 3.28.12bienvenido.tamondong TamondongNoch keine Bewertungen

- Legal Ethics HW1Dokument3 SeitenLegal Ethics HW1Julius Robert JuicoNoch keine Bewertungen

- M 24Dokument4 SeitenM 24Gilbert Aldana GalopeNoch keine Bewertungen

- Part Vi-Viii Case DigestsDokument70 SeitenPart Vi-Viii Case Digestskim dahyunNoch keine Bewertungen

- Invitation LetterDokument1 SeiteInvitation LetterMohibur RahmanNoch keine Bewertungen

- Requirement For Provisional RemedyDokument5 SeitenRequirement For Provisional RemedyEdsel Ian S. FuentesNoch keine Bewertungen

- AOM No. 2013-06-01 LDimalinaoDokument6 SeitenAOM No. 2013-06-01 LDimalinaoJuan Luis LusongNoch keine Bewertungen

- 012 Santos Santiago V NkiDokument3 Seiten012 Santos Santiago V NkiRose FortalejoNoch keine Bewertungen

- Revenue Memorandum Order No. 40-94: Claims For Value-Added Tax Credit/RefundDokument17 SeitenRevenue Memorandum Order No. 40-94: Claims For Value-Added Tax Credit/RefundjohnnayelNoch keine Bewertungen

- Admission Essay UP Gonzales Ann MargaretteDokument1 SeiteAdmission Essay UP Gonzales Ann MargaretteAnn Margarette GonzalesNoch keine Bewertungen

- Case Cebu United Enterprises v. Gallofin, 106 Phil 491 (1959)Dokument6 SeitenCase Cebu United Enterprises v. Gallofin, 106 Phil 491 (1959)Clarice Joy SjNoch keine Bewertungen

- Donor's Tax-2Dokument36 SeitenDonor's Tax-2Razel Mhin MendozaNoch keine Bewertungen

- Remedies Under The LGC - Movido OutlineDokument20 SeitenRemedies Under The LGC - Movido Outlinecmv mendoza100% (1)

- Registration of LandDokument15 SeitenRegistration of LandCharmila Siplon100% (1)

- 14-Suspension of Payments & RehabilitationDokument28 Seiten14-Suspension of Payments & RehabilitationEuna GallardoNoch keine Bewertungen

- MC-005-2018 - Ed GSIS ClearanceDokument3 SeitenMC-005-2018 - Ed GSIS ClearanceBeverly MananguiteNoch keine Bewertungen

- Banco de Oro Unibank V VLT Realty DigestDokument2 SeitenBanco de Oro Unibank V VLT Realty DigestJuralexNoch keine Bewertungen

- Tax AmnestyDokument25 SeitenTax AmnestyCali Shandy H.Noch keine Bewertungen

- Madamba v. Lara (2009)Dokument1 SeiteMadamba v. Lara (2009)neneneneneNoch keine Bewertungen

- Circular 97-002 - Utilization of Cash Advances.Dokument13 SeitenCircular 97-002 - Utilization of Cash Advances.JOHAYNIENoch keine Bewertungen

- Work Instruction: Bicol Medical CenterDokument6 SeitenWork Instruction: Bicol Medical CenterStib BrionesNoch keine Bewertungen

- Public International Law: By: Atty. CandelariaDokument2 SeitenPublic International Law: By: Atty. CandelariaEan PaladanNoch keine Bewertungen