Beruflich Dokumente

Kultur Dokumente

United States:: Major World Indices With Their Locations

Hochgeladen von

Rajesh RanjanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

United States:: Major World Indices With Their Locations

Hochgeladen von

Rajesh RanjanCopyright:

Verfügbare Formate

Major World Indices with their locations: United States: S&P 100 INDEX:Standard and poor , loc-new york

NASDAQ composite:newyork Dow Jones industrial average, Dow Jones Composite Average:new york. AMERICAS:(not imp) MerVal:Argentina Bovespa:Brazil S&P TSX Composite: Toronto IPC: Mexico ASIA:

All Ordinaries: Australia Shanghai Composite:china Hang Seng: hong kong BSE 30: mumbai Jakarta Composite :indonesia KLSE Composite: kuala lumpur Nikkei 225: tokyo NZSE 50: new zealand Straits Times: singapore KOSPI: south korea Taiwan Weighted : taiwan

Europe:

ATX: Austrian Traded Index CAC 40: France DAX: Germany AEX General :Euronext amsterdam FTSE 100:imp london IGBM: Madrid S MICEX Index:moscow Athex Composite Share Price Index:Athens

Mergers and Accquistions:

Tata Chemicals buys British salt Reliance Power and Reliance Natural Resources merger Airtels acquisition of Zain in Africa Abbotts acquisition of Piramal healthcare solutions GTL Infrastructure acquisition of Aircel towers ICICI Bank buys Bank of Rajasthan JSW and Ispat Ki Kahani Reckitt Benckiser goes shopping Mahindra goes international Mahindra acquired a 70% controlling stake in troubled South Korea auto major Ssang Yong

The overseas investors came in the form of BP's $7.2 billion deal with Reliance Industries. It announced the acquisition of a 30 per cent stake in 23 Reliance oil and gas exploration blocks in February this year.

Vodafone Group Plc's purchase of a 33 per cent stake in Vodafone Essar Ltd, a deal valued at $5 billion, was soon followed by Siemens AG acquisition of a 19.82 per cent stake in Siemens Ltd for $1.35 billion.

iGateCorp's acquisition of a majority stake in Patni Computer Systems for $1.21 billion and Aditya Birla Group acquired US-based Columbian Chemicals Company for $875 million were some of the other big deals of the year.

Maharatna status

In 2009, the government established the Maharatna status, which raises a company's investment ceiling from Rs. 1,000 crore to Rs. 5,000 crore.[3] The Maharatna firms can now decide on investments of up to 15 per cent of their net worth in a project; the Navaratna companies could invest up to Rs 1,000 crore without explicit government approval. [edit] Criteria

The six criteria for eligibility as Maharatna are:

Having Navratna status. Listed on Indian stock exchange with minimum prescribed public shareholding under SEBI regulations. An average annual turnover of more than Rs. 20,000. [4]crore during the last 3 years. Earlier it was Rs 25,000 Crore. [5] An average annual net worth of more than Rs. 10,000[6] crore during the last 3 years. Earlier it was Rs. 15,000 crore. [7] An average annual net profit after tax of more than Rs. 2500 crore during the last 3 years. Earlier it was Rs. 5000 crore. [8] Should have significant global presence/international operations.[9]

List of Maharatna

Coal India Limited [10] Indian Oil Corporation Limited [11] NTPC Limited [12] Oil and Natural Gas Corporation Limited [13] Steel Authority of India Limited

Navratna status

Navratna was the title given originally to nine Public Sector Enterprises (PSEs), identified by the Government of India in 1997 as having comparative advantages, which allowed them greater autonomy to compete in the global market.[14] The number of PSEs having Navratna status has been raised to 16,[15] The government is likely to accord the coveted status to Engineers India Limited, which is under consideration.

List of Navratnas

Bharat Electronics Limited Bharat Heavy Electricals Limited Bharat Petroleum Corporation Limited GAIL (India) Limited Hindustan Aeronautics Limited Hindustan Petroleum Corporation Limited Mahanagar Telephone Nigam Limited

National Aluminium Company Limited National Mineral Development Corporation Limited Neyveli Lignite Corporation Limited Oil India Limited Power Finance Corporation Limited Power Grid Corporation of India Limited Rashtriya Ispat Nigam Limited Rural Electrification Corporation Limited Shipping Corporation of India Limited

Miniratna Status

In addition, the government created another category called Miniratna. Miniratnas can also enter into joint ventures, set subsidiary companies and overseas offices but with certain conditions. In 2002, there were 61 government enterprises that were awarded Miniratna status. However, at present, there are 66 government enterprises that were awarded Miniratna status. [edit] Category I

This designation applies to PSEs that have made profits continuously for the last three years or earned a net profit of Rs. 30 crore or more in one of the three years. These miniratnas granted certain autonomy like incurring capital expenditure without government approval up to Rs. 500 crore or equal to their net worth, whichever is lower.

1. Airports Authority of India 2. Antrix Corporation Limited 3. Balmer Lawrie & Co. Limited 4. Bharat Dynamics Limited 5. BEML Limited 6. Bharat Sanchar Nigam Limited 7. Bridge & Roof Company (India) Limited 8. Central Warehousing Corporation 9. Central Coalfields Limited 10. Chennai Petroleum Corporation Limited 11. Cochin Shipyard Limited 12. Container Corporation of India Limited 13. Dredging Corporation of India Limited 14. Engineers India

Limited 15. Ennore Port Limited 16. Garden Reach Shipbuilders & Engineers Limited 17. Goa Shipyard Limited 18. Hindustan Copper Limited 19. HLL Lifecare Limited 20. Hindustan Newsprint Limited 21. Hindustan Paper Corporation Limited 22. Housing and Urban Development Corporation 23. India Tourism Development Corporation 24. Indian Railway Catering and Tourism Corporation 25. IRCON International Limited 26. Kudremukh Iron Ore Company Limited. 27. Mazagaon Dock Limited 28. Mahanadi Coalfields Limited 29. Manganese Ore (India) Limited 30. Mangalore Refinery and Petrochemicals Limited 31. Mishra Dhatu Nigam Limited 32. Minerals and Metals Trading Corporation of India 33. MSTC Limited 34. National Fertilizers Limited 35. National Seeds Corporation Limited 36. NHPC Limited 37. Northern Coalfields Limited 38. Numaligarh Refinery Limited 39. ONGC Videsh Limited 40. Pawan Hans Helicopters 41. Rashtriya Chemicals & Fertilizers Limited 42. RITES Limited 43. Satluj Jal Vidyut Nigam 44. Security Printing and Minting Corporation of India Limited 45. South Eastern Coalfields Limited 46. State Trading Corporation of India Limited 47. Tehri Hydro Development Corporation Limited 48. Telecommunications Consultants (India) Limited 49. Western Coalfields Limited 50. Water & Power Consultancy (India) Limited [edit] Category II

This category include those PSEs which have made profits for the last three years continuously and should have a positive net worth. Category II miniratnas have autonomy to incurring the capital expenditure without government approval up to Rs. 250 crore or up to 50% of their net worth whichever is lower.

51. Bharat Pumps & Compressors Limited 52. Broadcast Engineering Consultants (I) Limited 53. Central Mine Planning & Design Institute Limited 54. Ed.CIL (India) Limited 5. Engineering Projects (India) Limited 56. FCI Aravali Gypsum & Minerals India Limited 57. Ferro Scrap Nigam Limited 58. HMT (International) Limited 59. HSCC (India) Limited

60. India Trade Promotion Organisation 61. Indian Medicines & Pharmaceuticals Corporation Limited 62. M E C O N Limited 63. National Film Development Corporation Limited 64. National Small Industries Corporation Limited 65. P E C Limited 66. Rajasthan Electronics & Instruments Limited

SEZs in India

Introduction India was one of the first in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model in promoting exports, with Asia's first EPZ set up in Kandla in 1965. In order to overcome the shortcomings experienced on account of the multiplicity of controls and clearances; absence of world-class infrastructure, and an unstable fiscal regime and with a view to attract larger foreign investments in India, the Special Economic Zones (SEZs) Policy was announced in April 2000.

The SEZ Act, 2005, was an important bill to be passed by the Government of India in order to instill confidence in investors and signal the Government's commitment to a stable SEZ policy regime and with a view to impart stability to the SEZ regime thereby generating greater economic activity and employment through their establishment, a comprehensive draft SEZ Bill prepared after extensive discussions with the stakeholders. A number of meetings were held in various parts of the country both by the Minister for Commerce and Industry as well as senior officials for this purpose. The Special Economic Zones Act, 2005, was passed by Parliament in May, 2005 which received Presidential assent on the 23rd of June, 2005. The draft SEZ Rules were widely discussed and put on the website of the Department of Commerce offering suggestions/comments. Around 800 suggestions were received on the draft rules. After extensive consultations, the SEZ Act, 2005, supported by SEZ Rules, came into effect on 10 February 2006, providing for drastic simplification of procedures and for single window clearance on matters relating to central as well as state governments.

The objectives of SEZs can be clearly explained as the following: (a) generation of additional economic activity (b) promotion of exports of goods and services; (c) promotion of investment from domestic and foreign sources; (d) creation of employment opportunities; (e) development of infrastructure facilities.

The major incentives and facilities available to SEZ developers include:-

Exemption from customs/excise duties for development of SEZs for authorized operations approved by the BOA. Income Tax exemption on income derived from the business of development of the SEZ in a block of 10 years in 15 years under Section 80IAB of the Income Tax Act. Exemption from minimum alternate tax under Section 115 JB of the Income Tax Act. Exemption from dividend distribution tax under Section 115O of the Income Tax Act. Exemption from Central Sales Tax (CST). Exemption from Service Tax (Section 7, 26 and Second Schedule of the SEZ Act). List of Special Economic Zones in India

Currently there are 114 SEZs (as of October 2010) operating throughout India in the following states[8]: Karnataka - 18; Kerala - 6; Chandigarh - 1; Gujarat 8; Haryana - 3; Maharashtra - 14; Rajasthan - 1; Tamil Nadu - 20; Uttar Pradesh - 4; West Bengal - 2: Orissa - 1.

Additionally, more than 500 SEZs are formally approved (as on October 2010) by the Government of India in the following states[9]: Andhra Pradesh - 109; Chandigarh - 2; Chattisgarh - 2; Dadra and Nagar Haveli - 4; Delhi - 3; Goa 7; Gujarat - 45; Haryana - 45; Jharkhand - 1; Karnataka - 56; Kerala - 28; Madhya Pradesh - 14; Maharashtra - 105; Nagaland - 1; Orissa - 11; Pondicherry - 1; Punjab - 8; Rajasthan - 8; Tamil Nadu - 70; Uttarkhand - 3; Uttar Pradesh - 33; West Bengal - 22. [10]

Das könnte Ihnen auch gefallen

- GroveGreen ImperialismDokument8 SeitenGroveGreen Imperialismdr_ardenNoch keine Bewertungen

- GailDokument6 SeitenGailPriyansa PanigrahiNoch keine Bewertungen

- Navratna: Navratna Was The Title Given Originally To NineDokument5 SeitenNavratna: Navratna Was The Title Given Originally To NineblokeshwaranNoch keine Bewertungen

- CRUXMaharatna Navratna and Miniratna CompaniesDokument6 SeitenCRUXMaharatna Navratna and Miniratna CompaniesSuman KumarNoch keine Bewertungen

- Public Sector Undertakings in IndiaDokument10 SeitenPublic Sector Undertakings in IndiaNisarg KhamarNoch keine Bewertungen

- The Maharatna, Navratna and MiniratnaDokument4 SeitenThe Maharatna, Navratna and Miniratnardx216Noch keine Bewertungen

- Navratna - Wikipedia, The F...Dokument6 SeitenNavratna - Wikipedia, The F...Vaasu RastogiNoch keine Bewertungen

- Public Sector Enterprises ReformsDokument28 SeitenPublic Sector Enterprises Reformsamit1234Noch keine Bewertungen

- (Richardson & Cruddas) - PrintDokument25 Seiten(Richardson & Cruddas) - PrintRuchika Keshri100% (1)

- Top Companies in IndiaDokument9 SeitenTop Companies in IndiaAamir AbbasNoch keine Bewertungen

- Eligibility Criteria For Grant of Maharatna StatusDokument3 SeitenEligibility Criteria For Grant of Maharatna StatusshaminibinoyNoch keine Bewertungen

- Analysis Oil and Gas SectorDokument37 SeitenAnalysis Oil and Gas SectorLakshay KalraNoch keine Bewertungen

- B C C India: LUE HIP Ompanies INDokument48 SeitenB C C India: LUE HIP Ompanies INmacandjaNoch keine Bewertungen

- Abhyaas Business Bulletin - March 1st, 2012Dokument4 SeitenAbhyaas Business Bulletin - March 1st, 2012Abhyaas Edu CorpNoch keine Bewertungen

- List of Companies of India Wikipedia The Free EncyclopediaDokument17 SeitenList of Companies of India Wikipedia The Free Encyclopediaanish18tambeNoch keine Bewertungen

- Fidelity Fund Management Private LimitedDokument28 SeitenFidelity Fund Management Private LimitedsubudaniNoch keine Bewertungen

- Portfolio Management Report - FEB Module-2 - Mikhlesh EkkaDokument18 SeitenPortfolio Management Report - FEB Module-2 - Mikhlesh EkkaSai PavanNoch keine Bewertungen

- D Isinvest Ment in Pub Lic Sector E N Terprises': National Institute of Financial ManagementDokument49 SeitenD Isinvest Ment in Pub Lic Sector E N Terprises': National Institute of Financial ManagementsangramdeyNoch keine Bewertungen

- BA II Final QBDokument13 SeitenBA II Final QBMonica MastiholimathNoch keine Bewertungen

- 0 - LIC Mutual Fund-WPS OfficeDokument47 Seiten0 - LIC Mutual Fund-WPS OfficePranay khandelwalNoch keine Bewertungen

- Portfolio Management Report - FEB Module-2 - Mikhlesh EkkaDokument18 SeitenPortfolio Management Report - FEB Module-2 - Mikhlesh EkkaSai PavanNoch keine Bewertungen

- Iadr Swot Analysis.Dokument7 SeitenIadr Swot Analysis.rakeshNoch keine Bewertungen

- 4 NavratnaDokument52 Seiten4 NavratnaSarath JoshyNoch keine Bewertungen

- SEZDokument23 SeitenSEZniharika-banga-2390Noch keine Bewertungen

- Economics Notes - III by Aman Srivastava: Industrialisation in IndiaDokument57 SeitenEconomics Notes - III by Aman Srivastava: Industrialisation in IndiaAshish LatherNoch keine Bewertungen

- Acc Cements: India's No. 1 Cement CompanyDokument26 SeitenAcc Cements: India's No. 1 Cement CompanyAmol PakhaleNoch keine Bewertungen

- Foreign Capital Inflow in India & It's Implication For Macro EconomyDokument8 SeitenForeign Capital Inflow in India & It's Implication For Macro EconomyAnimesh JainNoch keine Bewertungen

- Dashboard For SajidsfaDokument7 SeitenDashboard For SajidsfasajidsfaNoch keine Bewertungen

- Indian Oil (PBM)Dokument37 SeitenIndian Oil (PBM)AsraNoch keine Bewertungen

- Navratna: From Wikipedia, The Free EncyclopediaDokument5 SeitenNavratna: From Wikipedia, The Free EncyclopediapradanjainNoch keine Bewertungen

- Accounts AssignmentDokument15 SeitenAccounts AssignmentGagandeep SinghNoch keine Bewertungen

- Statistics ProjectDokument33 SeitenStatistics Projectsaraansh aryaNoch keine Bewertungen

- Inter-Connected Stock Exchange of India LTD: Easier Access Wider ReachDokument5 SeitenInter-Connected Stock Exchange of India LTD: Easier Access Wider ReachAmit GuptaNoch keine Bewertungen

- Eco TextDokument7 SeitenEco TextasdasdaNoch keine Bewertungen

- Public Sector Enterprises: TopicDokument9 SeitenPublic Sector Enterprises: TopicloveleenajeerhNoch keine Bewertungen

- Financial Ratios of Walmart For Year 05-06 and About The Tata Motors: A Term PaperDokument20 SeitenFinancial Ratios of Walmart For Year 05-06 and About The Tata Motors: A Term PaperRaj VardhanNoch keine Bewertungen

- Assignment On: Iocl Success Case Submmited To: D.R Govind Kumar Submitted By: Akesh Kumar RauniyarDokument7 SeitenAssignment On: Iocl Success Case Submmited To: D.R Govind Kumar Submitted By: Akesh Kumar RauniyarAkesh GuptaNoch keine Bewertungen

- Cse of BPCLDokument20 SeitenCse of BPCLRinkish KainthNoch keine Bewertungen

- Portfolio Management Report - FEB Module - II - Mikhlesh EkkaDokument18 SeitenPortfolio Management Report - FEB Module - II - Mikhlesh EkkaSai PavanNoch keine Bewertungen

- List of Maharatna, Navratna and MiniratnaDokument4 SeitenList of Maharatna, Navratna and Miniratnaవినోద్ కుమార్100% (1)

- Mou System: SPS Solanki AGM (CP)Dokument82 SeitenMou System: SPS Solanki AGM (CP)SamNoch keine Bewertungen

- Indian Oil Corporation LimitedDokument40 SeitenIndian Oil Corporation LimitedAnu Jindal100% (1)

- Navratna TwishwDokument7 SeitenNavratna TwishwThwisha ChananaNoch keine Bewertungen

- Portfolio Management Report - FEB Module - II - Mikhlesh EkkaDokument18 SeitenPortfolio Management Report - FEB Module - II - Mikhlesh EkkaSai PavanNoch keine Bewertungen

- Omax Ar 09Dokument80 SeitenOmax Ar 09jughead201985Noch keine Bewertungen

- Finance ServicesDokument17 SeitenFinance ServicesChit DesaiNoch keine Bewertungen

- 17 Jul CilDokument85 Seiten17 Jul CilPritam BasuNoch keine Bewertungen

- Industrial Output: Information Network, and Development / Strengthening of Infrastructure, Grading and StandardizationDokument5 SeitenIndustrial Output: Information Network, and Development / Strengthening of Infrastructure, Grading and StandardizationAsif AliNoch keine Bewertungen

- Top Ten PSUsDokument22 SeitenTop Ten PSUsAbhishek SangalNoch keine Bewertungen

- BUY BUY BUY BUY: Exide Industries LTDDokument13 SeitenBUY BUY BUY BUY: Exide Industries LTDcksharma68Noch keine Bewertungen

- Public Sector UndertakingsDokument4 SeitenPublic Sector UndertakingsShivaniNoch keine Bewertungen

- List of Maharatna Companies in IndiaDokument4 SeitenList of Maharatna Companies in IndiaJAI ROYALNoch keine Bewertungen

- KLJ Group - BBA Summer ReportDokument54 SeitenKLJ Group - BBA Summer ReportHardik SNoch keine Bewertungen

- 4.2 KSE 100 IndexDokument5 Seiten4.2 KSE 100 IndexbilawalrNoch keine Bewertungen

- Specification of Methods and Procedures For Acquiring The Information Needed.Dokument68 SeitenSpecification of Methods and Procedures For Acquiring The Information Needed.Vipul TandonNoch keine Bewertungen

- PSU Maharatna Etc Def PDFDokument7 SeitenPSU Maharatna Etc Def PDFSheshu BabuNoch keine Bewertungen

- "Petroleum Sector": A Comprehensive Project OnDokument46 Seiten"Petroleum Sector": A Comprehensive Project OnShah VrajNoch keine Bewertungen

- Business Marketing Report FinalDokument17 SeitenBusiness Marketing Report FinalAkanksha ChhabraNoch keine Bewertungen

- Economic Liberalization in India: Past Achievements and Future ChallengesDokument55 SeitenEconomic Liberalization in India: Past Achievements and Future ChallengesEr Arvind NagdaNoch keine Bewertungen

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportVon EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNoch keine Bewertungen

- QT StepByStepDokument6 SeitenQT StepByStepRajesh RanjanNoch keine Bewertungen

- HR DETAILS of Tata CumminsDokument6 SeitenHR DETAILS of Tata CumminsRajesh RanjanNoch keine Bewertungen

- Comparison of The Incentive Structures: SL - Area Earlier Plan CIPP Consequences Suggest IonDokument2 SeitenComparison of The Incentive Structures: SL - Area Earlier Plan CIPP Consequences Suggest IonRajesh RanjanNoch keine Bewertungen

- Fundamentals of Human Resource Management - Personal Learning PaperDokument1 SeiteFundamentals of Human Resource Management - Personal Learning PaperRajesh RanjanNoch keine Bewertungen

- Room Allocation 2016-18Dokument9 SeitenRoom Allocation 2016-18Rajesh RanjanNoch keine Bewertungen

- Assets: All Figures in '000 Cash 470.78 Inventory 24.046 Prepaid Rent 7 Total Current Assets 501.826Dokument4 SeitenAssets: All Figures in '000 Cash 470.78 Inventory 24.046 Prepaid Rent 7 Total Current Assets 501.826Rajesh RanjanNoch keine Bewertungen

- Basic Statements: 5DfhvDokument3 SeitenBasic Statements: 5DfhvRajesh RanjanNoch keine Bewertungen

- SOP For HR PartnerDokument10 SeitenSOP For HR PartnerRajesh RanjanNoch keine Bewertungen

- Motion in A Straight Line - Time, Speed and DistanceDokument7 SeitenMotion in A Straight Line - Time, Speed and DistanceRajesh RanjanNoch keine Bewertungen

- Solutions Are at The End of Question (S) in The Same FileDokument1 SeiteSolutions Are at The End of Question (S) in The Same FileRajesh RanjanNoch keine Bewertungen

- TNS Shortlist TimeslotsDokument2 SeitenTNS Shortlist TimeslotsRajesh RanjanNoch keine Bewertungen

- UserManual For EmployeeDokument5 SeitenUserManual For EmployeeRajesh RanjanNoch keine Bewertungen

- Profile of Management Trainee SalesDokument2 SeitenProfile of Management Trainee SalesRajesh RanjanNoch keine Bewertungen

- IcseDokument6 SeitenIcserishabh poniyaNoch keine Bewertungen

- Holiday Calendar 2016Dokument2 SeitenHoliday Calendar 2016Gvl KasturiNoch keine Bewertungen

- Government Housing Schemes in VijayawadaDokument30 SeitenGovernment Housing Schemes in VijayawadaPavani SingamsettyNoch keine Bewertungen

- UntitledDokument2 SeitenUntitledjot sandhuNoch keine Bewertungen

- Policy of Subsidiary AllianceDokument7 SeitenPolicy of Subsidiary AlliancePadma LhamoNoch keine Bewertungen

- TS & Ap Medical Colleges - 20-06-2023Dokument3 SeitenTS & Ap Medical Colleges - 20-06-2023Yaswanth JuturuNoch keine Bewertungen

- History and Development of The Constitution of IndiaDokument9 SeitenHistory and Development of The Constitution of IndiaAnonymous uxd1ydNoch keine Bewertungen

- The Simon Commission 1927Dokument11 SeitenThe Simon Commission 1927CH HamzaNoch keine Bewertungen

- Literature Beyond Borders-Word FormatDokument7 SeitenLiterature Beyond Borders-Word FormatKarthick RmNoch keine Bewertungen

- CV GRaghuram Mar2020Dokument40 SeitenCV GRaghuram Mar2020Raja Ram (Veera)Noch keine Bewertungen

- Static GKDokument25 SeitenStatic GKABHISHEK SinghNoch keine Bewertungen

- Reflection On Indian Civilization and Filipino CultureDokument2 SeitenReflection On Indian Civilization and Filipino Culturepatricia pillarNoch keine Bewertungen

- BA (H) HISTORY 5th SemesterDokument63 SeitenBA (H) HISTORY 5th SemesterGulrez MNoch keine Bewertungen

- Cause and EffectDokument6 SeitenCause and EffectMADHUSUDAN RAINoch keine Bewertungen

- Talk To Our ExpertsDokument41 SeitenTalk To Our ExpertsVishal FundingNoch keine Bewertungen

- CHO ResultDokument129 SeitenCHO ResultRohit VermaNoch keine Bewertungen

- YOGESH KUMAR SAXENA KAYASTHA RATNADATE of BIRTH 29th November Advocate High Court and Supreme Court Representative of World Parliament ExperimentDokument3 SeitenYOGESH KUMAR SAXENA KAYASTHA RATNADATE of BIRTH 29th November Advocate High Court and Supreme Court Representative of World Parliament Experimentyogesh saxenaNoch keine Bewertungen

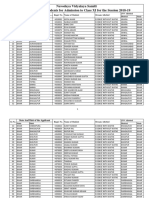

- Navodaya Vidyalaya Samiti List of Selected Students For Admission To Class XI For The Session 2018-19Dokument11 SeitenNavodaya Vidyalaya Samiti List of Selected Students For Admission To Class XI For The Session 2018-19Pijush SinhaNoch keine Bewertungen

- JanorpdfDokument86 SeitenJanorpdfanop_09Noch keine Bewertungen

- Hinduism Buddhism Jainism Sikhism: Perceptions of Indian CultureDokument5 SeitenHinduism Buddhism Jainism Sikhism: Perceptions of Indian CultureabdulhafizunawalaNoch keine Bewertungen

- Udc Additional ListDokument14 SeitenUdc Additional ListUma Maheswari SethuAravindNoch keine Bewertungen

- RatnaDokument2 SeitenRatnaeemaatacNoch keine Bewertungen

- Oms, 2018 - Cbse (X) - Reserve: Name Father's Name School/ College Name Bank Name Branch Name Account Number IFSC CodeDokument3 SeitenOms, 2018 - Cbse (X) - Reserve: Name Father's Name School/ College Name Bank Name Branch Name Account Number IFSC CodePratimNoch keine Bewertungen

- MBA Assignment QuestionDokument4 SeitenMBA Assignment QuestionPoorna SethuramanNoch keine Bewertungen

- Ancient IndiaDokument16 SeitenAncient Indiaakhmedova.2004Noch keine Bewertungen

- Biodiversity at Global LevelDokument23 SeitenBiodiversity at Global LevelShantanu Sharma67% (3)

- FDI and Impact On Indian EconomyDokument8 SeitenFDI and Impact On Indian EconomyOm PrakashNoch keine Bewertungen

- Civil Disobedience Movement in IndiaDokument18 SeitenCivil Disobedience Movement in IndiaAnantha PurushothamNoch keine Bewertungen