Beruflich Dokumente

Kultur Dokumente

CF Fiunal Report - 2

Hochgeladen von

Himanshu KanaujiaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CF Fiunal Report - 2

Hochgeladen von

Himanshu KanaujiaCopyright:

Verfügbare Formate

SUBMITTED TO:Ms.

SANDHYA PRAKASH SUBMITTED BY:Anoop Singh Anamika Rai Sandeep arya Shipra Bhargava Suchita Sood Vineet Singh SECTION- F

ACKNOWLEDGEMENT

On the completion of this project we would like to thank large number of individuals who contributed to this project. As quotation goes: No single mole can move the mountain First of all we would like to give our gratitude and sincere regards to Ms. Shandhya prakash for giving us this opportunity and for her valuable guidance and support without which completion of this report would not be possible. We thank our classmates and group members for their support and valuable suggestions for the completion of this report.

BACKGROUND OF THE COMPANY

Siemens was founded in Berlin by Werner von Siemens in 1847. As an extraordinary inventor, engineer and entrepreneur, Werner von Siemens made the world's first pointer telegraph and electric dynamo, inventions that helped put the spin in the industrial revolution. He was the man behind one of the most fascinating success stories of all time - by turning a humble little workshop into one of the world's largest enterprises. As Werner had envisioned, the company he started grew from strength to strength in every field of electrical engineering. From constructing the world's first electric railway to laying the first telegraph line linking Britain and India, Siemens was responsible for building much of the modern world's infrastructure. Siemens is today a technology giant in more than 190 countries, employing some 440,000 people worldwide. Our work in the fields of energy, industry, communications, information, transportation, healthcare, components and lighting has become essential parts of everyday life. While Werner was a tireless inventor during his days, Siemens today remains a relentless innovator. With innovations averaging 18 a day, it seems like the revolution Werner started is still going strong.

Siemens Company Profile

SIEMENS AG is a global powerhouse in electronics and electrical engineering, operating in the industry, energy and healthcare sectors. For over 160 years, the company has stood for technical achievements, innovation, quality, reliability and internationality. SIEMENS is the world's biggest provider of ecofriendly technologies.The Siemens Group in india has emerged as a leading inventor, innovator and implementer of leading-edge technology operating in the core business segments of Industry, Engery and Healthcare. The Siemens Group In over 17,000 persons. The company has 18 manufacturing plants, a wide network of Sales and Service offices across the country and 500 channel partners.

SIEMENS encourages all its investors and stakeholders to maintain good relations with utmost transparency. SIEMENS business philosphy-Giving back graciously to society a piece of our success.

Directors Report:The Board of Directors wishes to express its sincere appreciation for the excellent support and co-operation extended By Siemens AG - the parent company, members, customers, suppliers, bankers and other business associates. 1. Financial Performance:(Rs . in Million) 2008-09 2007-08 Growth 2007-08 Growth % Gross Profit before Interest, Depreciation and Exceptional Income 8,349.78 56.84 Less: Interest 40.54 Depreciation 637.34 Profit before Tax and Exceptional Income 7,671.90 59.79 Add: Exceptional Income Profit on sale of Investments in Subsidiaries Profit on sale of SBT Division 10.64 Profit on sale of SVDO Division 1,235.15 Profit before Tax 8,917.69 60.56 14,318.59 2,059.46 2008-09

13,095.69 58.77 777.79 12,259.13

Less: Tax 3,493.16 Deferred Tax (629.04) Fringe Benefit Tax 120.30 Net Profit after Tax 5,933.27 76.10 Amount available for appropriation 5,933.27 Appropriations: General Reserve 4,577.24 Net deficit on account of amalgamation of erstwhile Siemens Industrial Turbo machinery Services Private Ltd. 172.64 Proposed Dividend 1,011.48 Dividend Distribution Tax 171.90

4,007.46 (208.88) 71.50

10,448.51 10,448.51

8,476.21

1,685.80 286.50

3. Dividend: The Board of Directors recommends a Dividend of Rs.5 per Equity Share of Rs.2 each. This Dividend is subject to the approval of the Members at the forthcoming 52nd Annual General Meeting to be held on 29th January, 2010. In the previous year, the Company paid a Dividend of Rs.3 per Equity Share of Rs.2 each. 4. Managements Discussion and Analysis: A detailed review of the operations, about the performance and future outlook of the Company and its businesses is given in the Managements Discussion and Analysis. 10. Corporate Governance To the principles of Corporate Governance mandated by the Securities and Exchange Board of India and have implemented all the prescribed stipulations. As required by Clause 49 VI of the Listing Agreement, a detailed report on Corporate Governance forms part of this Report. The Auditors Certificate on compliance with Corporate Governance requirements by the Company is attached to the Corporate Governance Report.

Managements Discussions and Analysis:General Performance Review

The fiscal year 2008-09 began amidst financial slowdown, which decelerated the economic growth of India to 6.7%.This depicted a decline of 2.1% from the average growth rate of 8.8% recorded in the previous five years. While the GDP growth in the first two quarters was above 7.5%, it fell sharply in the third and fourth quarter to 5.8% as compared to GDP growth rate of 9.3% and 8.6% recorded in Q3 and Q4 of 2007-08. The moderation in growth for 2008-09 is mainly attributed to steep slowdown in growth in industry to 3.9 per cent from 8.1 per cent in 2007-08. Within industry, the manufacturing, electricity, gas and water supply and construction activities declined sharply, while growth in mining and quarrying sector showed a marginal growth.The growth was led by an estimated 7% growth in the industrial sector, as compared to 5% in the first quarter. While, the industry as well as services sector were on recovery track, the performance of the agriculture sector remained a cause of concern. Considering the overall market conditions during the last fiscal of the company (October September 2009), Siemens continued to achieve stable performance. Further reviews on each of Siemens sector businesses are given separately in the following paragraphs:

Corporate Governance

The Companys philosophy on Corporate Governance is to observe the highest level of ethics in all its dealings, to ensure the efficient conduct of the affairs of the Company to achieve its goal of maximizing value for all its stakeholders. Book Closure The Companys Register of Members and Share Transfer Books will remain closed from Thursday, 21st January, 2010 to Friday, 29th January, 2010 (both days inclusive). Dividend Dividend will be paid on or before Wednesday, 24th February, 2010.

Siemens Limited (Annual Report) for The year ended 30 September 2009.

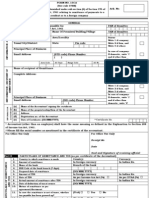

Balance sheet as at 30 September 2009 (Currency: Indian rupees thousands)

Schedule 2009 2008 SOURCES OF FUNDS Shareholders' funds Share capital 674,320 Reserves and surplus 20,016,524 6,207 20,690,844 5 6 674,320 28,491,887 29,16

Loan funds Unsecured loans 10,614 20,701,458 APPLICATION OF FUNDS Fixed assets Gross block 9,910,985 Accumulated depreciation/ amortization (5,052,761) (4,339,333) Net block 5,571,652 Capital work-in-progress including capital advances 870,136 352,031 6,441,788 9 5,236,464 10 6,295,013 1,057,018 7, Investments 4,769,723 8 11,347,774 7 5,906 29,172,113

Deferred tax asset, net 1,119,126 910,247 Current assets, loans and advances Inventories 9,721,971 11 7,621,143 12 13 14

Sundry debtors 34,583,115 34,327,991 Cash and bank balances 14,449,022 9,130,895 Loans and advances 10,457,640 6,312,513 ,211,748 57,392,542 Current liabilities and provisions Current liabilities (40,585,370) (42,663,570) Provisions (12,695,145) (6,616,013)

69

15 16 (53,

280,515) (49,279,583)

Net current assets 15,931,233 8,112,959 29, 172,113 20,701,458

Profit and loss account for the year ended 30 September 2009 (Currency: Indian rupees thousands)

2009 INCOME Sales and services (gross) 85,588,746 Excise duty (3,085,118) Sales and services (net) 82,503,628 Commission income 451,826 87,745 Interest income 471,937 Other operating income, net 621,790 Other income 67,214 49,154 EXPENDITURE Cost of sales and services 67,730,513 Personnel costs 4,475,751 Depreciation/amortisation 637,344 Interest Expense 40,535 Other costs, net 3,560,352 190,020 76,444,495 22 20 21 8 63,976,912 5,498,989 777,794 58,772 4,877,553 75, Profit before tax before exceptional income 12,259,134 7,671,900 Exceptional income: 84,116,395 82,955,454 17 18 19 85,554,114 (2,186,779) 83,367,335 2008 Schedule

520,410 83,8

523,002 697,219 2,341,188 87,4

- Profit on sale of investments in subsidiaries - Profit on sale of Building Technologies division 10,635 - Profit on sale of Automotive division 1,235,151 Profit before tax 14,318,593 8,917,686 Consists of: - Discontinued operations 8,232 - Continuing operations 14,318,593 8,909,454

2,059,459 -

14,318,593

8,917,686

Provision for tax Current tax (4,007,464) (3,493,161) Deferred tax credit/(charge) 208,879 629,037 Fringe benefit tax (71,500) (120,296) Profit after tax 10,448,508 5,933,266 Consists of: - Discontinued operations 5,434 - Continuing operations 10,448,508 5,927,832 Profit available for appropriation 10,448,508 5,933,266 Appropriations: Proposed dividend 1,685,801 1,011,481 Tax on proposed dividend 286,502 171,901 Net defi cit on account of amalgamation of erstwhile 172,640 Transfer to general reserve 8,476,205 4,577,244 10,448,508 5,933,266 2 4 -

Earnings per share ('EPS') (Equity share of face value Rs 2 each) - Basic and diluted 30.99 17.60

34

Cash flow statement for the year ended 30 September 2009

(Currency : Indian rupees thousands)

2009 2008 Schedule

Cash flow from operating activities Profit before tax 14,318,593 8,917,686 Adjustments for: Interest expense 58,772 40,535 Bad debts 246,216 22 34,943 22 8 18

Provision for doubtful debts/advances, net (121,563) 311,643 Depreciation and amortization 777,794 637,344 Profit on sale of fixed assets, net (238,276) (259,256) Profit on sale of long term investment (equity shares in Siemens Information Systems Ltd.) (1,942,882) Profit on sale of long term investment (equity shares in Siemens Information Processing Systems Ltd.) (116,577) Profit on sale of Building Technologies division (10,635) Profit on sale of Automotive division (1,235,151) Sale of lease rights (78,000) Profit on sale of Electronics Assembly Division (30,307) Unrealised exchange gain, net (1,027,379) (232,046) Interest income (523,002) (471,937) Dividend income (2,232,881) (67,214)

4 4

17 19

Operating profit before working capital changes 9,090,508 7,665,912 Increase in inventories (2,100,828) (396,396) Increase in sundry debtors and other receivables (1,261,079) (10,521,707) Increase in sundry creditors and other current liabilities (1,862,579) 11,000,201 Increase in provisions 5,233,690 1,138,892 Net change in working capital 9,204 1,220,990 Cash generated from operations 9,099,712 8,886,902 Direct taxes paid, net (5,631,333) (3,969,992) Net cash provided by operating activities 3,468,379 4,916,910

of which discontinued operations (104,951) of which continuing operations 5,021,861 Cash flow from investing activities Purchase of fixed assets (1,946,909) Proceeds from sale of fixed assets 290,309 Purchase of investments - In subsidiary companies (total consideration is in cash or cash equivalent) (250,000) - In mutual funds (962,215) Sale of investments - In subsidiary company (total consideration is in cash or cash equivalent) - In mutual funds 744,889 Dividend received - From subsidiary company - From mutual funds 67,214 Interest received 482,513 Inter corporate deposits placed (10,845,000) (750,000) Inter corporate deposits received back 325,000 Sale of Automotive division (total consideration is in cash or cash equivalent) 1,700,000 Sale of lease rights (total consideration is in cash or cash equivalent) Sale of EA business (total consideration is in cash or cash equivalent) Cash generated from investing activities 2,140,005 (299,199) of which discontinued operations (42,358) of which continuing operations 2,140,005 (256,841) Cash flow from financing activities Interest paid (2,251) (20,535) Dividend paid (including tax thereon) (1,180,526) (945,555) Repayment of long term borrowings (4,708) (4,709) Net cash used in financing activities (1,187,485) (970,799) of which discontinued operations of which continuing operations (1,187,485) (970,799) Net increase in cash and cash equivalents 4,420,899 3,646,912

3,468,379

(1,708,871) 258,268

(1,700,999) 3,021,459 1,205,740 19 19 2,229,459 3,422 520,377

9,050,000 4 78,000 28,150

Cash and cash equivalents at beginning of the year 9,130,895 4,636,219 Cash and cash equivalents acquired on merger of SITS 114,609 Cash and cash equivalents on demerger of the Automotive division 76,492 Effect of exchange gain/(loss) on cash and cash equivalents 897,228 656,663 Cash and cash equivalents at the end of the year 14,449,022 9,130,895 13 2 4

Note: (Cash and cash equivalents at the end of the period include current account balances with banks of Rs- 13,863 (2008: Rs- 11,007) which are restricted in use).

CAPITAL STRUCTURE ANALYSIS

Capital Structure consists Equity Share, Preference Share, Debenture, Secured and Unsecured loan. Company can raise capital from any of the following means. SIEMENS has authorized capital of Rs. 1000,000,000 equity share of Rs. 2 each. In 2008, company raised 338,024,465 equity share of Rs. 2 each out of which 337,160,200 equity share are fully paid up. In the same year company issued bonus share 55,500,000 of Rs. 2 each. In 2009 number shares were issue. Reserve and surplus of company increase from Rs. 20,016,524 to Rs. 28,491,887 as the amount is transferred to General Reserve. SIEMENS has not even raised any secured or unsecured loan in 2009 rather the payment of Interest Free Loan is done by the amount of Rs. 4708.

COST OF CAPITAL

COST OF DEBT = Interest rate (1-tax rate) Interest rate= 2.02% Corporate tax= 15.07% Cost of Debt= 2.02% * (1-0.1507) Cost of Debt = 1.71% COST OF EQUITY = (D/p0) +G D=Dividend=13% P0=Current share price=120.49 Growth= (1-dividend payout rate)*(return on equity)

Dividend payout rate=20% Return on equity=23.6% Growth= (1-.20)*(23.6) Growth rate=18.88% Cost of equity=18.88+ (13/120.49) Cost of equity=19.09%

Das könnte Ihnen auch gefallen

- Course ManualDokument5 SeitenCourse ManualSoumya BhattacharjeeNoch keine Bewertungen

- Ghaziabad Development Authority Vs Balbir SinghDokument2 SeitenGhaziabad Development Authority Vs Balbir SinghHimanshu KanaujiaNoch keine Bewertungen

- FA Course Manual 10-12-1Dokument15 SeitenFA Course Manual 10-12-1Himanshu Kanaujia100% (1)

- Blue Chip StocksDokument2 SeitenBlue Chip StocksHimanshu KanaujiaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Rick's Cabaret BMC 092711 FDokument15 SeitenRick's Cabaret BMC 092711 FAndre TerrellNoch keine Bewertungen

- Michael C. Robinson QualificationsDokument3 SeitenMichael C. Robinson QualificationsIsland Packet and Beaufort GazetteNoch keine Bewertungen

- SEO University Presentation 2012 (For Presenting) FINAL PDFDokument42 SeitenSEO University Presentation 2012 (For Presenting) FINAL PDFNaveen KarkiNoch keine Bewertungen

- Robo-Signing Gems IIDokument64 SeitenRobo-Signing Gems IIizraul hidashiNoch keine Bewertungen

- Toll Brothers 2007Dokument14 SeitenToll Brothers 2007Eesha Ü CaravanaNoch keine Bewertungen

- Investment BankingDokument85 SeitenInvestment BankingJoshuva DanielNoch keine Bewertungen

- Microfinance ProductsDokument3 SeitenMicrofinance Productsshyam patidarNoch keine Bewertungen

- A Study On Financial Performance Analysis of Bharti Airtel LimitedDokument6 SeitenA Study On Financial Performance Analysis of Bharti Airtel LimitedInternational Journal of Business Marketing and ManagementNoch keine Bewertungen

- Best Online Test Series in India For Bank PO, Clerk, JAIIB, CAIIB, InsuranceDokument18 SeitenBest Online Test Series in India For Bank PO, Clerk, JAIIB, CAIIB, InsuranceAnujVermaNoch keine Bewertungen

- Online Banking in BangladeshDokument8 SeitenOnline Banking in BangladeshAbul Hasnat100% (3)

- Invoice PDFDokument3 SeitenInvoice PDFHarish MaharNoch keine Bewertungen

- Grafic Rate Credit NegociateDokument6 SeitenGrafic Rate Credit NegociateCatalin PicNoch keine Bewertungen

- S 340Dokument2 SeitenS 340John Son GohNoch keine Bewertungen

- Formal and Informal Activities Ems Grade 7Dokument14 SeitenFormal and Informal Activities Ems Grade 7Stacey NefdtNoch keine Bewertungen

- 15CADokument2 Seiten15CAShant NagChaudhuriNoch keine Bewertungen

- Corporate Social Responsibility of Banking Sector in BangladeshDokument8 SeitenCorporate Social Responsibility of Banking Sector in BangladeshShamim RahmanNoch keine Bewertungen

- 601imguf CarryOverExaminationSchedule (B.Tech.,BCA)Dokument2 Seiten601imguf CarryOverExaminationSchedule (B.Tech.,BCA)Utkarsha SinghNoch keine Bewertungen

- Practical Investment BankingDokument30 SeitenPractical Investment Bankingw_fibNoch keine Bewertungen

- Topic 5 Working Capital and Current Asset ManagementDokument65 SeitenTopic 5 Working Capital and Current Asset ManagementbriogeliqueNoch keine Bewertungen

- Why Service StinksDokument6 SeitenWhy Service StinksNabeel Ahmed KhanNoch keine Bewertungen

- Banks in Country United KingdomDokument9 SeitenBanks in Country United KingdomGill ParamNoch keine Bewertungen

- Debt InstrumentsDokument204 SeitenDebt InstrumentsSitaKumariNoch keine Bewertungen

- Tokopandai - Digital Cash Pick Up and Store MonitoringDokument19 SeitenTokopandai - Digital Cash Pick Up and Store MonitoringiamsolusiNoch keine Bewertungen

- Lucknow Unoiversity Syllabus of BBA-302 & BBA-503Dokument2 SeitenLucknow Unoiversity Syllabus of BBA-302 & BBA-503shailesh tandonNoch keine Bewertungen

- XBRL Amdt RulesDokument2 SeitenXBRL Amdt RulesKolachina Udaya Bhaskar KumarNoch keine Bewertungen

- Banking OmbudsmanDokument4 SeitenBanking OmbudsmanAshok SutharNoch keine Bewertungen

- The 5 C's of BankingDokument5 SeitenThe 5 C's of BankingEman SultanNoch keine Bewertungen

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Dokument22 Seiten2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelNoch keine Bewertungen

- Lounge List For Priority Debit Cards 31 Dec 21Dokument6 SeitenLounge List For Priority Debit Cards 31 Dec 21Yashasvi GuptaNoch keine Bewertungen

- The Ant and The GrasshopperDokument3 SeitenThe Ant and The GrasshopperEmii IturriaNoch keine Bewertungen