Beruflich Dokumente

Kultur Dokumente

Tax 2 Digests - Last Batch

Hochgeladen von

Cyris Aquino NgOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax 2 Digests - Last Batch

Hochgeladen von

Cyris Aquino NgCopyright:

Verfügbare Formate

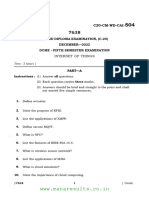

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

44. GUAGUA V. COLLECTOR (LIQUIGAN)

Facts:

Guagua Electric Light Plant Co. is a grantee of municipal franchises by

the municpal councils of Guagua and Sexmoan, Pampanga. It reported

a gross income of P1,133,003.44 for 1947 go 1956 and paid thereon a

franchise tax of P56,664.97 computed at 5% in accordance with

Section 259 of the Tax Code. Believing that it should pay a lower

franchise tax as provided by its franchises, it filed a claim for refund on

25 March 1957 for overpayment. The Commissioner denied the refund

of franchise tax for the period prior to the 4th quarter of 1951 on the

ground that the right to refund has prescribed. The Commissioner

allowed the refund of P16,593.87. Later however, due to the holding in

Hoa Hin Co. vs. David, the Commissioner assessed against the

company deficiency franchise tax subject to a 25% surcharge, and

thereby including the amount previously allowed by the Commissioner

to be refunded.

Issue:

Whether the tax "refunded erroneously should be imposed against the

company, or if the right to recover has prescribed.

Held: Right to assess has prescribed.

Guagua Electric would be paying the same deficiency tax for the period

of 1 January to 30 November

1956 if it is required to pay P16,593.87 in addition to the sum of

P19,938.12, the difference between the tax computed at 5% pursuant

to Section 259 of the Tax Code and the franchise tax paid at 1% and

2% under the franchise. Further, by insisting on the payment of

P16,593.87 (September 1951 to November 1956), the

Commissioner is trying to collect the same deficiency tax where the

right to assess the same, according to him, has been lost by

prescription. The demand on the taxpayer to pay the sum of

P16,593.87 is in effecct an assessment of deficiency franchise tax.

The Court of Tax Appeals however stated in its decision that Guagua

Electric did not raise the issue of prescription of the right of the

Government to assess and collect the sum of P16,593.87. This finding

of the lower court is not supported by the pleadings. In its letter dated

March 30, 1961 contesting the first assessment dated March 2, 1961

Guagua Electric assailed the right to assess and/or collect the tax on

grounds of prescription. In paragraph 20 of its petition for review

(C.T.A. Rec. p. 4), it raised the defense of prescription of the

Commissioner's right to assess and collect the tax.

Anent the contention of the Commissioner of Internal Revenue that

Guagua Electric failed to adduce evidence to prove prescription of his

right to assess and collect the P16.593.87, suffice it to state that in

paragraph 10 of the Commissioner's answer he admitted the

allegations in paragraph 13 of the petition for review. Paragraph 13

alleged the facts, supported by annexes, constituting prescription.

There was therefore no need for the taxpayer to present further

evidence in the point.

The Commissioner of Internal Revenue further maintains that the

prescription of his right to recover the amount of P16,593.87 is

governed by Article 1145(2) in relation to Articles 1154 and 1155 of

the Civil Code. Hence, prescription will set in only after the expiration

of six years from 1957 and 1959, the dates refunds were granted.

Since the petition for review and answer thereto were filed in the Court

of Tax Appeals on February 14, and May 4, 1962, he concludes that

the prescriptive period of six years has not expired.1wph1.t

As stated above, the demand on the taxpayer to pay the sum of

P16,593.87 is in effect an assessment for deficiency franchise tax. And

being so, the right to assess or collect the same is governed by

Section 331 of the Tax Code

5

rather than by Article 1145 of the Civil

Code. A special law (Tax Code) shall prevail over a general law (Civil

Code)

Guagua electric is absolved from paying P16,593.87.

45. CIR V. SUYOC (FUSTER)

46. REPUBLIC V. LOPEZ (CABAL)

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f2

Doctrine: Where a taxpayer demands a reinvestigation, the time

employed in reinvestigation should be deducted from the total period

of limitation.

Facts: In 1950, Lopez filed his income tax return. In 1952, BIR issued

an assessment and demanded payment of deficiency income tax;

Lopez requested for reconsideration only to be denied.

In 1953, Lopez reiterated his petition. On 29 May 1954, giving due

course to the petition, BIR issued a revised assessment reducing the

imposed amount.

On 16 January 1956, Lopez prayed for reinvestigation which was again

acceded to by the BIR. On 23 March 1960, the BIR issued an

assessment demanding payment additional deficiency income tax,

increasing his total amount of deficiency income tax. On 22 April 1960,

this last reinvestigation became decided and concluded but still

without payment from Lopez. Thus, a collection suit was filed on 13

August 1960. Lopez moved to dismiss the complaint which the court

sustained.

Issue: Whether the action has prescribed

Held: No. In the case at bar, if the time employed in reinvestigation

(ie. the time for deciding taxpayers last reinvestigation which was

from 16 January 1956 to 22 April 1960) is deducted from the total

period of limitation (ie. the time between the first revised assessment

on 29 May 1954 and the filing of the complaint on 13 August 1960), it

will be seen that less than 5 years can be counted against the

Government.

Between 29 May 1954 and 13 August 1960, the total period of

limitation was for six (6) years, two (2) months, and fifteen (15)

days]. Between 16 January 1956 and 22 April 1960, the interrupted

period was for 4 years, 3 months, and 6 days. Deducting the latter

from the former interval, the computation results to only one (1) year,

three (3) months, and six (6) days counted against the government.

47. COMMISSIONER V. SISON (DELA CRUZ)

48. BISAYA LAND TRANSPO V. COLLECTOR (TANHUECO)

Petitioner Bisaya Land transport acquired equipment from United

States Commercial Co. which it used in the operation of its busses,

without paying the corresponding taxes. On investigation of its books

by the revenue agents, it was discovered that its gross receipts of the

transportation business from 1946 to 1951 were not declared for

taxation. It was also found that petitioner issued freight receipts but

the corresponding documentary stamps were not affixed thereto. A

deficiency additional residence tax was also determined. The CIR

assess the petitioner. The petitioner company alleged that the Court of

Tax Appeals erred in not holding that the claim for compensating tax

and residence tax has already prescribed.

Issue: W/N the claim for tax has already prescribed

Held: No it has not prescribed.

Ratio: (I really dunno how this is pertinent)

Petitioners pretense that the period of prescription, in relation to the

compensating tax should be computed from the filing of the income

tax returns is without merit. To being with, said income tax returns

have not been introduced in evidence and therefore, there was no

means to determine what data were included in said return to appraise

the BIR that the company should pay the compensating tax. Secondly,

income tax returns contain a statement of the taxpayers income for a

given year. The taxpayer is not supposed to declare in said returns

what he has purchased or received "from without the Philippines

commodities or merchandise that are subject to the compensating tax.

Generally, such purchasers are not "income and hence, have no place

in income tax returns.

49. BUTUAN SAWMILL V. CTA (DE LA TORRE)

An income tax return cannot be considered as a return for

compensating tax for purposes of computing the period of prescription

under Section 331 of the Tax Code, and that the taxpayer must file a

return for the particular tax required by law in order to avail himself of

the benefits of Section 331 of the Tax Code; otherwise, if he does not

file a return, an assessment may be made within the time stated in

Section 332(a) of the same Code.

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

FACTS

Butuan Sawmill sold logs to Japanese firms from January 1951 to June

1953. The FOB prices included costs of loading, wharfage stevedoring

and other costs in the Philippines. Also, the quality, quantity and

measurement specifications of the logs were certified by the Bureau of

Forestry. The freight was paid by the Japanese buyers and the

payments of the logs were effected by means of irrevocable letters of

credit in favor of Butuan and payable through the PNB or any other

bank named by it.

Upon investigation by the BIR, it was ascertained that no sales tax

return was filed by the Butuan and neither did it pay the corresponding

tax on the sales. It assessed Butuan Sawmill deficiency sales taxes.

Butuan Sawmills reconsiderations having been denied, it filed a

petition for review with the CTA.

ISSUES

1. Whether petitioner is liable to pay the 5% sales tax on

its sales of logs to the Japanese buyers - YES.

2. Whether the assessment thereof was made within the

prescriptive period provided by law therefore - YES.

RATIO

Butuan insists that the transaction was consummated in Japan, but it

is clear that said export sales had been consummated in the

Philippines and were, accordingly, subject to sales tax therein.

On the second issue, Butuan avers that the filing of its income tax

returns, wherein the proceeds of the disputed sales were declared, is

substantial compliance with the requirement of filing a sales tax

return, and, if there should be deemed a return filed, Section 331, and

not Section 332(a), of the Tax Code providing for a 5-year prescriptive

period within which to make an assessment and collection of the tax in

question from the time the return was deemed filed, should be applied

to the case at bar. Since Butuan filed its income tax returns for the

years 1951, 1952 and 1953, and the assessment was made in 1957

only, it further contends that the assessment of the sales tax

corresponding to the years 1951 and 1952 has already prescribed for

having been made outside the five-year period prescribed in Section

331 of the Tax Code and should, therefore, be deducted from the

assessment of the deficiency sales tax made by respondent.

The above contention has already been raised and rejected as not

meritorious in a previous case decided by this Court. Thus, an income

tax return cannot be considered as a return for compensating tax for

purposes of computing the period of prescription under Section 331 of

the Tax Code, and that the taxpayer must file a return for the

particular tax required by law in order to avail himself of the benefits

of Section 331 of the Tax Code; otherwise, if he does not file a return,

an assessment may be made within the time stated in Section 332(a)

of the same Code.

It being undisputed that Butuan failed to file a return for the

disputed sales corresponding to the years 1951, 1952 and

1953, and this omission was discovered only on September 17,

1957, and that under Section 332(a) of the Tax Code

assessment thereof may be made within ten (10) years from

and after the discovery of the omission to file the return, it is

evident that the lower court correctly held that the assessment

and collection of the sales tax in question has not yet

prescribed.

50. CIR V. AYALA SECURITIES (MANLICLIC)

- internal revenue taxes shall be assessed within 5 years after the

return was filed, and no proceeding in court without assessment for

the collection of such taxes shall be begun after the expiration of such

period

Ayala Securities Corporation filed its income tax returns with BIR for

its fiscal year. Attached to its income tax return was the audited

financial statements. The income tax due on the return of Ayala

Securities was duly paid for within the time prescribed by law.

CIR advised Ayala of the assessment of P758k on its accumulated

surplus reflected on its income tax return for the fiscal year. Ayala, on

the other hand, protested against the assessment on its retained and

accumulated surplus pertaining to the taxable year and sought

reconsideration thereof one of the reasons being, that the said

assessment was issued beyond the 5-year prescriptive period. CIR

responded by asking them to execute a waiver which Ayala did not do.

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

Manila Examiners of the CIR requested for the payment of the said

amount within 5 days from receipt of the said letter and so the

corporation filed with the CTA a Petition for Review of the assessment.

The Petition for Review alleges that the assessment made by CIR is

illegal and invalid considering that (1) the assessment in question,

having been issued only on February 21, 1961, and received by the

respondent corporation on March 22, 1961, the same was issued

beyond the five-year period from the date of the filing of respondent

corporations income tax return petitioner's right to make the

assessment has already prescribed, pursuant to the provision. CTA

ruled in favor of the corporation.

ISSUE

Whether the applicable provision in this case is Section 331 of

the NIRC which provides for a 5-year period of prescription of

assessment from the filing of the return, or Section 332(a) of

the which provides for a 10-year period of limitation for the

same purpose - SECTION 331

RATIO

On the issue of whether Sec. 331 or See. 332(a) of the National

Internal Revenue Code should apply to this case, there is no iota of

evidence presented by the petitioner as to any fraud or falsity on the

return with intent to evade payment of tax, not even in the income tax

nor in the letter-decision of February 18, 1963, nor in his answer to

the petition for review. Petitioner merely relies on the provisions of Sec

25 of the National Internal Revenue Code, violation of which, according

to Petitioner, presupposes the existence of fraud. But this is begging

the question and We do not subscribe to the view of the petitioner.

The applicable provision of law in this case is Section 331 of the

National Internal Revenue Code, to wit:

SEC. 331. !eriod of limitation upon assessment and collection.

- Except as provided in the succeeding section, internal

revenue taxes shall be assessed within five years after the

return was filed, and no proceeding in court without

assessment for the collection of such taxes shall be begun

after the expiration of such period. For the purposes of this

section, a return filed before the last day prescribed by law for

the filing thereof shall be considered as filed on such last day:

Provided, That this limitation shall not apply to cases already

investigated prior to the approval of this Code.

The Ayala Securities Corporation could, therefore, file its income tax

returns on or before January 15, 1956. The assessment by the

Commissioner of Internal Revenue shall be made within five (5) years

from January 15, 1956, or not later than January 15, 1961, in

accordance with Section 331 of the National Internal Revenue Code

herein above-quoted. As the assessment issued on February 21, 1961,

which was received by the Ayala Securities Corporation on March 22,

1961, was made beyond the five-year period prescribed under Section

331 of said Code, the same was made after the prescriptive period had

expired and, therefore, was no longer binding on the Ayala Securities

Corporation

51. AZNAR V. CA (same as first batch, see BACANI)

52. CIR V. JAVIER (BAHJIN)

Doctrine: Fraud is never imputed and the courts never sustain

findings of fraud upon circumstances which, at most, create only

suspicion and the mere understatement of a tax is not itself proof of

fraud for the purpose of tax evasion.

Facts: Javier erroneously received US$1,000,000.00 instead of only

US$1,000.00 as remittance from his US-based sister-in-law, through a

clerical error by Mellon Bank. A complaint was filed by Mellon Bank

against Javier to return the excess amount. Also, an information was

filed by the city fiscal against Javier for the crime of estafa, alleging

that he has already misappropriated and converted to his own

personal use said excess amount received. While both cases were

pending, Javier filed his ITR for taxable year 1977, showing a net

income of P48,053.88 and stating in the footnote of the return that

"Taxpayer was recipient of some money received from abroad which

he presumed to be a gift but turned out to be an error and is now

subject of litigation." He was subsequently assessed for deficiency

taxes. He protested and denied that he had any undeclared income in

1977, and requested that the assessment be made to await final court

decision on the cases filed against him. The Commissioner maintained

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

otherwise, and furthermore imposed a 50% fraud penalty in addition

to the assessed deficiency taxes.

Issue: Whether a taxpayer who merely states as a footnote in his ITR

that a sum of money that he erroneously received and already spent is

the subject of a pending litigation, and there did not declare it as

income, is liable to pay the 50% penalty for filing a fraudulent return?

Held: NO FRAUD.

Under the then Section 72 of the Tax Code (now Section 248), a

taxpayer who files a fraudulent return is liable to pay the fraud penalty

of 50% of the tax due from him or of the deficiency tax, in case

payment has been made on the basis of the return filed before the

discovery of the falsity or fraud.

Fraud is never imputed and the courts never sustain findings of fraud

upon circumstances which, at most, create only suspicion and the

mere understatement of a tax is not itself proof of fraud for the

purpose of tax evasion.

In the case at bar, there was no actual and intentional fraud through

willful and deliberate misleading of the BIR. The government was not

induced to give up some legal right and place itself at a disadvantage

so as to prevent its lawful agents from proper assessment of tax

liabilities, because Javier did not conceal anything. He in fact "laid his

cards on the table" and gave the BIR an opportunity to examine the

subject erroneously remitted amount when he stated the same as his

footnote in the ITR. Error or mistake of law is not fraud. The

petitioner's zealousness to collect taxes from the unearned windfall to

Javier is highly commendable. Unfortunately, the imposition of the

fraud penalty in this case is not justified by the extant facts. Javier

may be guilty of swindling charges, perhaps even for greed by

spending most of the money he received, but the records lack a clear

showing of fraud committed because he did not conceal the fact that

he had received an amount of money although it was a "subject of

litigation." As such, the 50% surcharge imposed as fraud penalty by

the petitioner against the private respondent in the deficiency

assessment should be deleted.

53. REPUBLIC V. ACEBEDO (BRIONES)

DOCTRINE: Mere request of reinvestigation does not suspend the

running of the prescriptive period. Waiver of statute of limitations

must be in writing and must be executed before the expiration of

the original prescriptive period.

FACTS: This is a complaint for collection of deficiency income tax

for the year 1948. The corresponding assessment was issued on

September 24, 1949. The complaint was filed on December 27,

1961. After Acebedo filed his answer but before trial started, he

moved to dismiss the case on the ground of prescription. The trial

court dismissed the case; hence the CIR appealed this dismissal.

ISSUE: Whether the collection suit has already prescribed.

RULIG: YES. The present suit was not begun within the five years

after the assessment of the tax, which was 1949. The waiver of

the statute of limitations presented by the Cir was ineffective

because it was executed beyond the original five-year limitation.

The CIR contends, however, that period of prescription was

suspended by the Acebedos various requests for reinvestigation or

reconsideration of the tax assessment. The trial court correctly

rejected this contention since mere request for reinvestigation or

reconsideration of an assessment does not have the effect of such

suspension. The ruling is logical, otherwise there would be no point

to the legal requirement that the extension of the original period

must be agreed upon in writing.

In the case at bar, the defendant, after receiving the

assessment notice of September 24, 1949, asked for a

reinvestigation thereof on October 11, 1949 There is no evidence

that this request was considered or acted upon. Consequently, the

request for reinvestigation did not suspend the running of the

period for filing an action for collection. On October 6, 1951, again,

defendant requested a reinvestigation of his tax liability. Nothing

came of this request either. Then on February 9, 1954, the

defendant's lawyers wrote the Collector of Internal Revenue

informing him that the books of their client were ready at their

office for examination. After more than a year, CIR required that

the defendants specify his objections to the assessment and

execute "the enclosed forms for waiver, of the statute of

limitations." The last part of the letter was a warning that unless

the waiver "was accomplished and submitted within 10 days the

collection of the deficiency taxes would be enforced by means of

the remedies provided for by law."

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

It will be noted that up to October 4, 1955 the delay in

collection could not be attributed to the defendant at all. His

requests in fact had been unheeded until then, and there was

nothing to impede enforcement of the tax liability by any of the

means provided by law. By October 4, 1955, more than five years

had elapsed since assessment in question was made, and hence

prescription had already set in, making subsequent events in

connection with the said assessment entirely immaterial. Even the

written waiver of the statute signed by the defendant on December

17, 1959 could no longer revive the right of action, for under the

law such waiver must be executed within the original five-year

period within which suit could be commenced.

54. SINFOROSA ALCA V. CA (ALDANA)

Doctrine: A waiver of the prescriptive period signed at a date after the

expiration of the period is a valid agreement. It is not just an

extension, therefore, of the period of limitation, but a renunciation of

her right to invoke the defense of prescription which was then already

available to her. There is nothing unlawful nor immoral about this kind

of waiver; just like any other right, the right to avail of the defense of

prescription is waivable.

Facts:

O Sinforosa Alca is the owner and operator of Pacific Industrial

Manufacturing (Phil.) engaged in manufacturing rubbing

alcohol

O Sept 1960 - CIR assessed Alca for P43k by way of specific tax

on rubbing alcohol produced in and removed from the factory

between June 1953 and Aug 1960, plus compromise penalty

of P1,000.00.

O Alca protested arguing that specially denatured alcohol is

exempt from tax and assuming he is liable to pay the specific

tax on the denatured alcohol, the assessment of the tax on

September 1960 was made beyond the 5-year period.

O CTA ruled that the 10-year prescriptive period is applicable in

this case because the official transcript sheets submitted by

the taxpayer are not returns for purposes of the prescriptive

law. Therefore, no return is actually filed.

Issue: WON the period to assess has prescribed

Held: NO

Ratio: It is not disputed that the taxpayer did not file any returns for

purposes of paying the specific tax due on the manufactured products

with denatured alcohol as chief ingredient. However, even assuming

that the official transcript sheets are to be considered as valid returns,

the assessment in question shall still remain valid. For while it is true

that the demand for payment of the specific tax accruing from June

1953 to Aug 1960 was only made on Sept 1960 and, therefore, as far

as the taxes due from June 1953 to Sept 1955 are concerned, the

demand therefor had been made beyond the required 5-year period, it

appears that on December 9, 1959, petitioner taxpayer had signed a

waiver to the running of the prescriptive period beginning January 20,

1956 ... but not after December 31, 1966."

But then, it is argued that for a written agreement extending the

prescriptive period to be valid, it is necessary that the same be made

before the period to be extended has expired. The rule would not apply

in this case. Note that petitioner's waiver was of the period of

prescription beginning January 20, 1956. It is not just an extension,

therefore, of the period of limitation, but a renunciation of her right to

invoke the defense of prescription which was then already available to

her. There is nothing unlawful nor immoral about this kind of waiver;

just like any other right, the right to avail of the defense of

prescription is waivable. (Note: Case was however remanded for

recomputation of tax based on error by agents of the government in

collecting the wrong tax for the period June 1953 to Aug 1956).

55. RP V. KIM DE YU (LAVADIA)

Doctrine:

Section 331 (old Tax Code) gives the Government five years from

filing of the return (which is not false or fraudulent) within which to

assess the tax due. Collection then may be effected within five years

after assessment or within the "period for collection agreed upon in

writing by the Commissioner of Internal Revenue and the taxpayer

before the expiration of such five-year period."

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

Facts:

Respondent filed her ITR from 1948 through 1953. The BIR assessed

the taxes due, and respondent paid (back then, di pa uso ang self-

assessment). On July 17, 1956 the BIR issued to her deficiency income

tax assessments for the years 1945 to 1953. She protested the

assessments and requested a reinvestigation. On August 30, 1956,

she signed a "waiver" as condition to the reinvestigation requested. On

July 18, 1958, the BIR issued assessment notices for the years 1948

to 1953. This last assessment, like the one issued in 1956, covered not

only the basic deficiency income taxes, but also 50% thereof as

surcharge (for fraud). Upon her failure to pay, an action for collection

was filed against her in the RTC on May 11, 1959. Taxpayer contends

that the period of assessment has already prescribed.

Issue:

Whether the assessment has already prescribed

Held:

Counting from July 17, 1956, assessments for tax years 1948-1950

has already prescribed, while assessments for tax years 1951-1952 it

has not prescribed.

While fraud is alleged by the BIR, the same has not been established.

On three different occasions it arrived at three highly different

computations. The right to assess or collect the income taxes for the

years 1948 to 1950 had already prescribed, therefore, when the

Bureau of Internal Revenue issued the deficiency income tax

assessments on July 17, 1956.

The tax years 1948 to 1950 cannot be deemed included in the "waiver

of the statute of limitations under the National Internal Revenue Code"

executed by appellee on August 30, 1956. The five-year period for

assessment, counted from the date the return is filed, may be

extended upon agreement of the Commissioner and the taxpayer, but

such agreement must be made before, not after, the expiration of the

original period. The clear import of the provision is that it does not

authorize extension once prescription has attached.

The waiver validly covers only the tax years 1951 and 1952, with

respect to which the five-year period had not yet elapsed when the

said waiver was executed. With respect to the tax year 1953, as to

which the return was filed by appellee on March 1, 1954, the waiver

was not necessary for the effectivity of the assessment made on July

18, 1958, since such assessment was well within the original five-year

period provided by law. After the assessment on July 18, 1958, BIR

had five years within which to file suit for collection.

56. CIR V. BF GOODRICH (SALAZAR)

Doctrine: The law on prescription, being a remedial measure, should

be liberally construed in order to afford protection and safeguard

taxpayers from any unreasonable examination, investigation, or

assessment. As a corollary, the exceptions to the law on prescription

must be strictly construed.

Facts: Respondent BF Goodrich Phils., Inc. (now Sime Darby

International Tire Co. Inc.), was an American-owned and controlled

corporation. As a condition for approving the manufacture by private

BF Goodrich of tires and other rubber products, the Central Bank of

the Philippines required it to develop a rubber plantation. In

compliance with this requirement, it purchased a certain parcels of

land in Tumajubong, Basilan, and there developed a rubber plantation.

The justice secretary rendered an opinion stating that, upon the

expiration of the Parity Amendment, the ownership rights of Americans

over public agricultural lands, including the right to dispose or sell their

real estate, would be lost. On the basis of this Opinion, Bf Goodrich

sold to Siltown Realty Philippines, Inc. (Siltown) on January 21, 1974,

its Basilan landholding for P500,000 payable in installments. In accord

with the terms of the sale, Siltown leased the said parcels of land back

to BF Goodrich for a period of 25 years, with an extension of another

25 years at the latters option.

On 23 April 1975, an assessment for deficiency income tax was issued

against BF Goodrich and the same was paid.

Subsequently, on 10 October 1980, the BIR issued against BF

Goodrich an assessment for deficiency in donors tax in the amount of

P1,020,850, in relation to the previously mentioned sale of its Basilan

landholdings to Siltown. The BIR deemed the consideration for the sale

insufficient, and the difference between the FMV and the actual

purchase price a taxable donation.

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

Private respondent contested this assessment. On April 9, 1981, it

received another assessment dated March 16, 1981, which increased

to P1,092,949 the amount demanded for the alleged deficiency donors

tax.

BF Goodrich appealed the correctness and the legality of these last two

assessments (1980 & 1981 assessments) to the CTA. CTA rendered its

decision modifying the assessment, increasing the tax liability to

P1,311,179.01 plus 10% surcharge and 20% annual interest.

Bf Goodrich elevated the matter to the CA which reversed the CTA. It

ruled that what is involved here is not a first assessment; nor is it one

within the 5-year period stated in Section 331 above. Since what is

involved in this case is a multiple assessment beyond the five-year

period, the assessment must be based on the grounds provided in

Section 337, and not on Section 15 of the 1974 Tax Code. Section 337

utilizes the very specific terms fraud, irregularity, and mistake. Falsity

does not appear to be included in this enumeration. Falsity suffices for

an assessment, which is a first assessment made within the five-year

period. When it is a subsequent assessment made beyond the five-

year period, then, it may be validly justified only by fraud, irregularity

and mistake on the part of the taxpayer.

Issue: Whether CIRs right to assess deficiency donors tax has

prescribed as ruled by CA.

Held: Yes. Section 331 of the NIRC provides that internal revenue

taxes must be assessed within five years after the return was filed.

Applying this provision of law to the facts at hand, it is clear that the

October 16, 1980 and the March 1981 assessments were issued by the

BIR beyond the five-year statute of limitations. The Court found no

basis to disregard the five-year period of prescription.

The subsequent assessment made by the CIR on October 10, 1980,

modified by that of March 16, 1981, violates the law. Involved in this

petition is the income of the petitioner for the year 1974, the returns

for which were required to be filed on or before April 15 of the

succeeding year. The returns for the year 1974 were duly filed by the

petitioner, and assessment of taxes due for such year -- including that

on the transfer of properties on June 21, 1974 -- was made on April

13, 1975 and acknowledged by Letter of Confirmation No. 101155

terminating the examination on this subject. The subsequent

assessment of October 10, 1980 modified, by that of March 16, 1981,

was made beyond the period expressly set in Section 331 of the NIRC

Petitioner BIR claims that it merely followed the provision of Section

15 of the NIRC (now, Section 16) which provides for assessment of the

proper tax on the best evidence obtainable where there is reason to

believe that a report of a taxpayer is false, incomplete or erroneous.

They claim that the present case falls within this section, because the

return filed was false, since the land had a value of P2.6 Million pesos,

but BF Goodrich sold the same for only P500,000.

However, Section 15 does not provide an exception to the statute of

limitations on the issuance of an assessment, by allowing the initial

assessment to be made on the basis of the best evidence available.

Having made its initial assessment in the manner prescribed, the

commissioner could not have been authorized to issue, beyond the

five-year prescriptive period, the second and the third assessments

under consideration before us.

Nor is petitioners claim of falsity sufficient to take the questioned

assessments out of the ambit of the statute of limitations.

SEC. 332. xceptions as to period of limitation of assessment and

collection of taxes. -- (a) In the case of a false or fraudulent return

with intent to evade a tax or of a failure to file a return, the tax may

be assessed, or a proceeding in court for the collection of such tax

may be begun without assessment, at any time within ten years after

the discovery of the falsity, fraud, or omission

Petitioner insists that private respondent committed falsity when it

sold the property for a price lesser than its declared FMV. This fact

alone did not constitute a false return which contains wrong

information due to mistake, carelessness or ignorance. It is possible

that real property may be sold for less than adequate consideration for

a bona fide business purpose; in such event, the sale remains an arms

length transaction. In the present case, the BF Goodrich was

compelled to sell the property even at a price less than its market

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

value, because it would have lost all ownership rights over it upon the

expiration of the parity amendment. In other words, BF Goodrich was

attempting to minimize its losses. At the same time, it was able to

lease the property for 25 years, renewable for another 25. This can be

regarded as another consideration on the price.

Furthermore, the fact that it sold its real property for a price less than

its declared FMV did not by itself justify a finding of false return.

Indeed, private respondent declared the sale in its 1974 return

submitted to the BIR. Within the five-year prescriptive period, the BIR

could have issued the questioned assessment, because the declared

fair market value of said property was of public record. This it did not

do, however, during all those five years. Moreover, the BIR failed to

prove that respondent's 1974 return had been filed fraudulently with

intent to evade the payment of the correct amount of tax.

The law on prescription, being a remedial measure, should be liberally

construed in order to afford protection and safeguard taxpayers from

any unreasonable examination, investigation, or assessment. As a

corollary, the exceptions to the law on prescription must be strictly

construed.

57. BOISE CASCADE V. CIR (CHAN)

Doctrine: Prescription of Right to Assess

Facts: Boise is a domestic corporation engaged in the manufacturing

and selling of all kinds of paper products. It is a subsidiary of Boise

Internaltional. Bataan Pulp & Paper Mills (Bataan) and Zamboanga

Wood Products Inc. (Zamboanga) which are also engaged in the same

business Boise, sought the financial aid of Boise as both are in the

verge of bankruptcy. Boise obtained 3 loans from Boise Intl. The first

loan was in the amount of Php. 1,920,200 with interest of 12% per

annum. The second loan amounted to Php 600k with interest of 12%

per annum, which was subsequently given to Bataan. Lastly, a loan

amounting to Php 11.4 million with interest of 3/4% per annum was

obtained and given to Zamboanga. Pursuant to the existing Central

Bank Rules & Regulations, the 3 loans were accepted and approved for

registration as foreign loans. All these amounts loaned and the

interests that accrued or were due were reflected in its books of

account and financial statements.

On January 12, 1967, Boise filed its amended income tax return for

the year 1966. CIR assessed Boise for deficiency income and

withholding taxes covering fiscal years June 30, 1966 and June 30,

1967 as well as calendar year ended December 31, 1967. CIR in

another letter dated September 15, 1972, assessed Boise for the year

1968 holding the latter liable for deficiency withholding income tax in

the total amount of P451,976.86. The assessment issued by CIR was

based on the disallowed item of interest expenses claimed by Boise on

the ground that the aforesaid interest expenses were considered

disguised dividend distributions. The withholding tax deficiency

assessment was based on the ground that the duty to withhold and

pay the tax arises upon accrual of the income in the books of accounts

of petitioner and not at the time of actual payment or remittance. In a

letter dated May 5, 1972, which was received by CIR on May 8, 1972,

Boise filed a letter of protest. On January 25, 1977, CIR denied Boise's

letters of protest and reiterated the payment of the said deficiency

assessments.

Boise contends that the amended income tax return for 1966 was filed

by it on January 12, 1967. However, the demand or assessment letter

which was dated April 3, 1972 was released by CIR on April 12, 1972

which date of release of the assessment is five years and three months

counted from the date of filing of the Boise's Income tax return for

1966. Therefore, Boise concluded that the right of CIR to assess

deficiency income tax for said year 1966 has already prescribed

pursuant to Section 331 of the 1972 Tax Code and there was no valid

waiver of the statute of limitation signed by the Commissioner of

Internal Revenue which may suspend the running of the period of

prescription. On the other hand, CIR contends that the assessment in

question was filed within the prescribed period because Boise had

executed and signed a waiver of statute of limitation under Section

332 (b) of the National Internal Revenue Code and said waiver was

signed by the Revenue District Officer of Makati. Hence, on February

22, 1977, petitioner appealed to this Court.

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

Issue: Whether there was a valid waiver of the statute of limitation

and CIR's right to assess petitioner for the fiscal year ended June 30,

1966 has not prescribed.

Held: No valid waiver was executed and as such CIR's right to assess

has prescribed. CIR decision reversed.

Ratio: There was no proper filing of a valid waiver of the statute of

limitation which was actually signed by Boise and Revenue District

Officer of Makati. The law is clear and explicit that a valid waiver of the

statute of limitation must be in writing and must be both signed by the

Commissioner of Internal Revenue and the taxpayer. A close scrutiny

of the aforesaid waiver of the statute of limitation shows that Revenue

District Officer Sixto J. Javier had merely attested the aforesaid

waiver; that aforesaid officer did not sign the waiver either for or by

virtue of the authority of the Commissioner of Internal Revenue.

Clearly, for all legal intents and purposes of the above law, Section

332 of the National Internal Revenue Code, there was no valid waiver

executed by herein Commissioner of Internal Revenue and Boise to

stop the running of the period within which to validly assess the tax.

In the instant case, the language of said statute of limitation being

plain and unambiguous, it conveys a clear and definite meaning, and

said statute must simply be applied and never to be interpreted. It is

only the Commissioner of Internal Revenue, who is specially named by

said provision of Section 332(b) of the Tax Code, as the one who can

sign the waiver of the statute of limitation, and since the

Commissioner has not signed the waiver, there is, therefore, no

consummated or valid waiver which may suspend the running of the

period within which to assess the tax in question. Consequently, CIR's

assessment which was made more than five years from the filing of

Boise's amended income tax return on January 12, 1967 for the

taxable year 1966 has prescribed.

*very long case and numerous issues; other held:

The transaction is a loan as approved by the Central Bank. As such,

accrued interest are valid and legal and are deductible. Withholding

taxes assessed has been paid. The obligation to withhold and pay

taxes at source should be on the date of actual remittances. The 25%

surcharge, interests and compromise penalty are not imposable.

58. CARNATION PHILS V. CIR (BACANI)

Doctrine:

Although the period of prescription is waivable by agreement, there

must exist, however, two essential requisites for the waiver to

be valid: first, the waiver must be entered into before

expiration of the time prescribed for making an assessment;

and second, the Commissioner and the taxpayer must have

consented thereto in writing.

Facts:

Petitioner comes before this Court praying for the nulling and voiding

of the assessments covering its alleged deficiency income and sales for

the taxable year ending September 30, 1981, in the total amount of

P19.5M.

Petitioner, through its Senior Vice President Jaime O. Lardizabal, and

in consideration of the approval by the CIR of petitioner's request for

reinvestigation and/or reconsideration of its internal revenue case

involving the assessments for the fiscal year 1981 which were pending

at the time, signed three separate waivers

Neither waiver was signed by respondent Commissioner or any

of his agents.

Petitioner filed a basic protest with the BIR therein disputing the

assessments. These protests were denied by respondent in a letter,

stating:

"In view thereof, it is requested that the aforesaid tax liabilities of your

client (petitioner herein) be paid immediately, inclusive of the

penalties incident to late payment.

"This is our final decision. If you are not amenable thereto, you may

appeal to the Court of Tax Appeals within thirty (30) days after

receipt of this letter, otherwise, your client's assessments shall

become final, executory and unappealable."

Petitioner contends that the deficiency assessments subject of the

instant petition are barred by prescription, since they were issued

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

beyond five years from the filing of the returns covering the internal

revenue taxes assessed therein.

Issue: whether or not the deficiency assessments subject of the

instant petition are barred by prescription, since they were issued

beyond five years from the filing of the returns?

Held:

Yes, barred by prescription.

However, although the period of prescription is waivable by

agreement, there must exist, however, two essential requisites

for the waiver to be valid: first, the waiver must be entered into

before expiration of the time prescribed for making an

assessment; and second, the Commissioner and the taxpayer

must have consented thereto in writing.

We agree with petitioner, and find that the subject

assessments were issued beyond the five-year prescriptive

period allowed by the Tax Code.

59. MARCOS V. CA (same as first batch, see PARAS)

60. CIR V. PASCOR (same a first and second batch, see

ADVINCULA and LOVERIA)

61. TUPAZ V. ULEP (same as first batch, see FRANCISCO)

62. CIR V. SISON (same as above, see DE LA CRUZ)

63. REPUBLIC V. ABLAZA (LEYNES)

Doctrine: The law on prescription being a remedial measure should be

interpreted in a way conducive to bringing about the beneficient

purpose of affording protection to the taxpayer within the

contemplation of the Commission which recommend the approval of

the law.

Facts: On October 3, 1951, the Collector of Internal Revenue (CIR)

assessed income taxes for the years 1945, 1946, 1947 and 1948 on

the income tax returns of defendant-appellee Luis G. Ablaza. The

assessments total P5,254.70 . On October 16, 1951, the accountants

for Ablaza requested a reinvestigation of Ablaza's tax liability, on the

ground that (1) the assessment is based on third-party information

and (3) neither the taxpayer nor his accountants were permitted to

appear in person. The petition for reinvestigation was granted in a

letter of the CIR, dated October 17, 1951. On October 30, 1951, the

accountants for Ablaza again sent another letter to the CIR submitting

a copy of their own computation. On October 23, 1952, said

accountants again submitted a supplemental memorandum.On March

10, 1954, the accountants for Ablaza sent a letter to the examiner of

accounts and collections of the Bureau of Internal Revenue requesting

a copy of the detailed computation of the alleged tax liability as soon

as the reinvestigation is terminated.

On February 11, 1957, after the reinvestigation, the CIR made a final

assessment of the income taxes of Ablaza, fixing said income taxes for

the years already mentioned at P2,066.56. Notice of the said

assessment was sent and upon receipt thereof the accountants of

Ablaza sent a letter to the CIR, dated May 8, 1957, protesting the

assessments, on the ground that the income taxes are no longer

collectible for the reason that they have already prescribed. As the

Collector did not agree to the alleged claim of prescription, action was

instituted by him in the Court of First Instance to recover the amount

assessed. The Court of First Instance upheld the contention of Ablaza

that the action to collect the said income taxes had prescribed.

Issue: Whether or not the Governments right to collect taxes has

prescribed?

Held: Yes, The law prescribing a limitation of actions for the collection

of the income tax is beneficial both to the Government and to its

citizens; to the Government because tax officers would be obliged to

act promptly in the making of assessment, and to citizens because

after the lapse of the period of prescription citizens would have a

feeling of security against unscrupulous tax agents who will always

find an excuse to inspect the books of taxpayers, not to determine the

latter's real liability, but to take advantage of every opportunity to

molest peaceful, law-abiding citizens. Without such legal defense

taxpayers would furthermore be under obligation to always keep their

books and keep them open for inspection subject to harassment by

unscrupulous tax agents. The law on prescription being a remedial

measure should be interpreted in a way conducive to bringing about

the beneficient purpose of affording protection to the taxpayer within

the contemplation of the Commission which recommend the approval

of the law.

The question in the case at bar boils down to the interpretation of the

letter, dated March 10, 1954, quoted above. If said letter be

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f2

interpreted as a request for further investigation or a new

investigation, different and distinct from the investigation demanded

or prayed for in Ablaza's first letter, then the period of prescription

would continue to be suspended thereby. But if the letter in question

does not ask for another investigation, the result would be just the

opposite. In our opinion the letter dated March 10, 1954 , does not ask

for another investigation. Its first paragraph quoted above shows that

the reinvestigation then being conducted was by virtue of its request

of October 16, 1951. All that the letter asks is that the taxpayer be

furnished a copy of the computation. The request may be explained in

this manner: As the reinvestigation was allowed on October 1, 1951

and on October 16, 1951, the taxpayer supposed or expected that at

the time, March, 1954 the reinvestigation was about to be finished and

he wanted a copy of the re-assessment in order to be prepared to

admit or contest it. Nowhere does the letter imply a demand or

request for a ready requested and, therefore, the said letter may not

be interpreted to authorize or justify the continuance of the suspension

of the period of limitations.

64. CIR V. CAPITOL (MANGAHAS)

Doctrine: Period of prescription is suspended by taxpayers request

for reconsideration or review of the assessment and by reiteration of

said request.

Facts:

Capitol filed its income tax returns for the years 1948, 1949, 1950,

and 1951 and promptly paid the amounts assessed thereon. In an

investigation conducted by an examiner, Capitol was found liable for

deficiency income taxes for the said years for a total of P27, 212.88.

April 8, 1953- CIR sent income tax assessment notices requesting

payment of the aforesaid amounts due and collectible, the said taxes

being based on disallowed deductions, and over-claimed depreciations.

May 30, 1953- Capitol requested for the breakdown of the amounts

reflected in the said notices.

June 21, 1955- CIR sent Capitol circular letters inquiring as to whether

payment was already made.

July 1, 1955- Capitol in reply to above circular letters reiterated its

request of the breakdown.

September 20, 1955- CIR reiterated his demand for payment of the

income tax assessment for the years concerned.

October 15, 1955- Capitol wrote to CIR and explained the disallowed

items and requested for re-investigation.

October 26, 1955- CIR after investigation released a memorandum

report and submitted to the Acting Provincial Revenue Officer

reiterating his findings and recommended that the previous

assessments be affirmed.

September 2, 1959- CIR demanded from Capitol the payment of the

said deficiency income taxes.

September 16, 1959- Capitol asked the CIR for the cancellation of the

assessment in a letter. Upon its denial, said respondent initiated the

instant proceeding in the Court of Tax Appeals.

CTA ruled that that the right of respondent Commissioner to collect

said deficiencies has already prescribed, The deficiency assessments in

question were made on April 8, 1953 and the CIR's answer to the

instant petition for review, which is tantamount to a judicial action for

collection was filed on December 29, 1959, or 6 years, 8 months and

21 days thereafter, it follows that the right of respondent CIR to collect

said deficiencies has already prescribed. (This is also the contention of

Capitol)

Issue:

Whether CIRs right to collect Capitol's deficiency income tax

assessments in question has already prescribed under Section 332 (c)

of the National Internal Revenue Code?

Held/ Ratio: No. The period was suspended twice- first, by

request for itemized information on the disallowed items on

May 30, 1953; second, by reiteration of the request for

breakdown on July 1, 1955.

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

The period commenced to run on April 8, 1953 when the assessment

was made. But the same was interrupted when the respondent

taxpayer, by letter of May 30, 1953, requested for itemized

information on the disallowed items. While the said letter did not

specifically use the words "review" or "reconsideration," the request

itself for an explanation of the disallowances made in the assessment

in effect was an exception to the correctness thereof. The request was

denied when CIR demanded for payment of the alleged deficiency tax

on June 21, 1955. The period for collection then started to run

again, but it was tolled when the taxpayer reiterated its

request for explanation of the disallowances on July 1, 1955 or

after 10 days.

Clearly, although the assessment was sent on April 8, 1953, by

respondent taxpayer's own requests for review or reconsideration of

the disputed assessment, the period for collection thereof had been

interrupted. Therefore, deducting from the total period from April 8,

1953 (date of the deficiency assessment) to December 29, 1959 (date

of answer which is tantamount to a judicial action), or a total of 6

years, 8 months and 21 days, the period of interruption from May 30,

1953 (when respondent filed its petition for clarification amounting to

reconsideration or review of the assessment) to June 21, 1955 (when

the petitioner in effect denied the petition by reiterating its demand for

payment), or a total of 2 years and 21 days, there is left a period of

4 years and 8 months within which judicial collection may be

effected. Since the law allows 5 years for such purpose, the collection

sought by the CIR is still timely.

65. PALANCA V. CIR (FRANCISCO)

Doctrines:

O "It is not essential that the warrant of distraint and levy be

fully executed in order that it may have the effect of

suspending the running of the statute of limitation upon

collection of the tax; it is enough that the proceeding be

validly begun or commenced and that its execution has not

been suspended by reason of the voluntary desistance of the

respondent (government).

O "While the law provides that said warrant should be served

upon the taxpayer except when he is absent from the

Philippines when it may be served upon his agent or upon an

occupant of the property, there is nothing therein that would

prevent the service to be made upon his authorized

representative

Facts:

O In 1947, Diluangco died and testate proceedings were filed

O On March 27, 1951, Atty. San Jose, the executor and counsel

for the heirs, belatedly filed the estate and inheritance tax

return

O On August 18, 1952, the deficiency estate taxes were finally

assessed in the amount of P10,437.56

O In June 1955, a warrant of distraint and levy was issued to

San Jose since the tax was yet to be paid

O Instead of paying the tax, San Jose requested that the heirs

be informed of the taxes respectively due from each of them

O In a letter dated April 28, 1956, the BIR explained the

breakdown of the amounts due from the heirs

O San Jose requested for a reconsideration which was denied

O In September 1957, the heirs requested for a revaluation of

the estate

O Before said request could be acted upon, the heirs claimed

that the right of the government to collect the tax had

prescribed since 1) the warrant was not executed within 5

years from the final assessment; and 2) the warrant was not

served upon the proper parties which were the heirs who were

present in the Philippines and therefore ineffective

Issue:

O Whether the right to collect the tax had already prescribed.

NO

Ratio:

O The NIRC then provided: "Where the assessment of any

internal revenue tax has been made within the period of

limitation above prescribed, such tax may be collected by

distraint or levy by the proceeding in court, but only if begun

(1) within five years after the assessment of the tax..."

O (Insert 1

st

doctrine)

O Since the warrant was issued in 1955, the tax collection was

begun within 5 years from August 1952 when the final

assessment was made

O The delay in the execution of the warrant was clearly because

of the acts of the taxpayer, not by reason of the voluntary

desistance of the government

O The warrant was indeed served upon the proper party

O (Insert 2

nd

doctrine)

O The warrant was served upon San Jose, the duly authorized

representative of the estate and of the heirs

O There being a valid service, the warrant effectively suspended

the prescriptive period for the collection of the tax

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

66. REPUBLIC V. KER (DE LEON)

The running of the prescriptive period to collect the tax shall be

suspended for the period during which the Commissioner of Internal

Revenue is prohibited from beginning a distraint and levy or instituting

a proceeding in court, and for sixty days thereafter.

Facts

In 1953 the Bureau of Internal Revenue examined and audited Ker &

Co., Ltd.'s returns and books of accounts and subsequently issued the

following assessments for deficiency income tax:

On March 1, 1956 Ker & Co., Ltd. filed with the Court of Tax Appeals a

petition for review with preliminary injunction. No preliminary

injunction was issued, for said court dismissed the appeal for having

been instituted beyond the 30-day period provided for in Section 11 of

Republic Act 1125.

On March 15, 1962, the Bureau of Internal Revenue demanded

payment of the aforesaid assessments together with a surcharge of

5% for late payment and interest at the rate of 1% monthly. Ker &

Co., Ltd. refused to pay, instead in its letters dated March 28, 1962

and April 10, 1962 it set up the defense of prescription of the

Commissioner's right to collect the tax.

Issue

Did the filing of a petition for review by the taxpayer in the Court of

Tax Appeals suspend the running of the statute of limitations to collect

the deficiency income for the years 1948, 1949 and 1950?

Held

Yes

Ratio

Under Section 333 of the Tax Code, quoted hereunder:

SEC. 333. Suspension of running of statute.-The running of the

statute of limitations provided in Section 331 or three hundred thirty-

two on the making of assessments and the beginning, of distraint or

levy or a proceeding in court for collection, in respect of any

deficiency, shall be suspended for the period during which the

Collector of Internal Revenue is prohibited from making the

assessment or beginning distraint or levy or a proceeding in court, and

for sixty days thereafter.

the running of the prescriptive period to collect the tax shall be

suspended for the period during which the Commissioner of Internal

Revenue is prohibited from beginning a distraint and levy or instituting

a proceeding in court, and for sixty days thereafter.

From March 1, 1956 when Ker & Co., Ltd. filed a petition for review in

the Court of Tax Appeals contesting the legality of the assessments in

question, until the termination of its appeal in the Supreme Court, the

Commissioner of Internal Revenue was prevented, as recognized in

this Court's ruling in Ledesma, et al. v. Court of Tax Appeals, from

filing an ordinary action in the Court of First Instance to collect the tax.

Besides, to do so would be to violate the judicial policy of avoiding

multiplicity of suits and the rule on lis pendens.

Thus, did the taxpayer produce the effect of temporarily staying the

hands of the Commissioner of Internal Revenue simply through a

choice of remedy. And, if We were to sustain the taxpayer's stand, We

would be encouraging taxpayers to delay the payment of taxes in the

hope of ultimately avoiding the same.

67. CIR V. ALGUE (REGIS)

68. CIR V. WYETH (RIGETS)

Doctrine: The prescriptive period provided by law to make a collection

by distraint or levy or by a proceeding in court is interrupted once a

taxpayer requests for reinvestigation or reconsideration of the

assessment.

Facts: Wyeth Suaco Laboratories, Inc. is a domestic corporation

engaged in the manufacture and sale of assorted pharmaceutical and

nutritional products.

By virtue of a Letter of Authority, a Revenue Examiner conducted an

investigation and examination of the books of accounts of Wyeth

Suaco. The report disclosed that Wyeth allegedly failed to remit

withholding tax at source on accrued royalties, remuneration for

technical services and cash dividends, resulting in a deficiency

withholding tax.

The Bureau of Internal Revenue assessed Wyeth Suaco on the

aforesaid tax liabilities in two (2) notices. Wyeth protested the

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

assessments and requested their cancellation or withdrawal on the

ground that said assessments lacked factual or legal basis.

Wyeth Suaco filed a petition for review in Court of Tax Appeals praying

that petitioner be enjoined from enforcing the assessments by reason

of prescription and that the assessments be declared null and void for

lack of legal and factual basis.

Petitioner issued a warrant of distraint of personal property and

warrant of levy of real property to enforce collection of the deficiency

taxes. However, collection of the deficiency taxes by virtue of warrants

of distraint and levy was enjoined by the CTA.

CTA rendered its decision in favor of Wyeth that the deficiency

assessment may not be collected due to prescription.

Issue: Whether or not petitioner's right to collect deficiency

withholding tax at source and sales tax liabilities from Wyeth is barred

by prescription.

Held: No. The main thrust of the BIR is that the five-year prescriptive

period provided by law to make a collection by distraint or levy or by a

proceeding in court has not yet prescribed. Although he admits that

more than five years have already lapsed from the time the

assessment notices were received by Wyeth up to the time the

warrants of distraint and levy were served, he avers that the running

of the prescriptive period was stayed or interrupted when Wyeth Suaco

protested the assessments. BIR argues that the protest letters sent by

SGV & Co. in behalf of Wyeth Suaco requesting for withdrawal and

cancellation of the assessments were actually requests for

reinvestigation or reconsideration, which could interrupt the running of

the five-year prescriptive period.

Wyeth Suaco, on the other hand, maintains the position that it never

asked for a reinvestigation nor reconsideration of the assessments.

What it requested was the cancellation and withdrawal of the

assessments for lack of legal and factual basis.

Thus, it did not interrupt the running of the period.

After carefully examining the records of the case, the Court finds that

Wyeth Suaco admitted that it was seeking reconsideration of the tax

assessments. Wyeth's claim that it did not seek reinvestigation or

reconsideration of the assessments is belied by the subsequent

correspondence or letters written by its officers. These letters of Wyeth

Suaco interrupted the running of the five-year prescriptive period to

collect the deficiency taxes. Verily, the original assessments were both

received by Wyeth Suaco. However, when Wyeth Suaco protested the

assessments and sought its reconsideration, the prescriptive period

was interrupted. This period started to run again when the Bureau of

Internal Revenue served the final assessment to Wyeth Suaco.

69. CIR V. UNION SHIPPING (same as first batch, see

SALAZAR)

70. DELTA MOTORS V. CIR (BARRIENTOS)

Doctrine: The burden of proof is on the taxpayer contesting the

validity or correctness of an assessment to prove not only that the

Commissioner of Internal Revenue is wrong but that he (taxpayer) is

right. And if the taxpayer fails to present evidence or proof in support

of his allegations in his petition for review, or to prosecute his action,

as in this case, conformably to the doctrine of the presumption in favor

of the correctness of the tax assessment, the CTA will merely sustain

the assessment against the taxpayer.

(Personal Note: The case did not mention anything about remedies

before payment of the tax. The case probably tells us that the

taxpayer has the remedy of protesting to the appellate division of the

BIR and the CTA.)

Facts: Delta Motors is engaged in the business of manufacture and

sale of passenger cars and commercial vehicles. For the years 1975,

1976, 1977 and the first semester of 1978, Delta Motors filed the

required business tax returns for trucks and automobiles and paid the

taxes due thereon. However, CIR denies that the taxes were paid.

CIR assessed and demanded from Delta Motors payment of 35M as

deficiency percentage tax for 1975 and 1976. Delta Motors contested

the assessment and requested administrative hearing of the case.

While the case is still pending resolution, the CIR issued another letter

of demand urging Delta Motors to pay 42M as deficiency percentage

taxes for 1977 and the first semester of 1978. Delta Motors protested

the two (35M and 42M) assessments and requested that a "conference

hearing" be held in the appellate division of the BIR. CIR denied Delta

Motors protest and modified the original assessments by adding 11M

as additional deficiency percentage taxes for the periods involved.

Total tax assessed is 88M.

Delta Motors appealed from this decision with the CTA. For repeated

failure of Delta Motors to appear or to prosecute its action by

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

presenting evidence at the scheduled hearings, the case was

submitted for decision by CIR on the basis of the pleadings and the

records of the BIR.

Issue: Whether the assessment is valid

Held: YES. Delta Motors is ordered to pay the tax assessed. The

records of the BIR show that Delta Motors failed to pay the correct

amount of: (1) sales tax as manufacturer of cars and commercial

vehicles; (2) sales tax as manufacturer of electric fans, refrigerators,

air conditioners, television sets, stereo sets; (3) percentage tax as

contractor engaged in the servicing of the motor vehicles and

appliances sold by it; and (4) advance sales tax due on its imported

raw materials for air conditioners.

There is no showing in the pleadings or in the records that Delta

Motors questioned the computations of the deficiency taxes assessed

against it by the CIR. While Delta Motors prays in its petition for

review filed with this Court that the assessments are null and void

which should be withdrawn and cancelled, Delta Motors either failed to

appear or to present evidence at the scheduled hearings to

substantiate the nullity and illegality of the assessments.

Since no evidence was presented by Delta Motors to substantiate the

errors that are claimed to have been committed by the CIR in making

the assessments in question, this Court has no other alternative than

to resort to the legal truism that "all presumptions are in favor of the

correctness of tax assessments." The burden of proof is on the

taxpayer to show the contrary. This action finds support in the

following authorities:

"All presumptions are in favor of the correctness of tax

assessments. The good faith of tax assessors and the

validity of their actions are presumed. They will be

presumed to have taken into consideration all the facts to

which their attention was called. No presumption can be

indulged that all of the public officials of the state in the

various countries who have to do with the assessment of

property for taxation will knowingly violate the duties

imposed upon them by law.

"When an importer challenges by legal steps the

correctness of the assessment of a duty by the Collector

of Customs, the question to be decided is not whether the

Collector was wrong but whether the importer was right,

the burden being on the latter to establish the correctness

of his own contention.

Even more, under section 3 of Rule 17, Rules of Court, if plaintiff

(petitioner herein) fails to appear at the time of the trial, or to

prosecute his action for an unreasonable length of time, which actually

happened in this case, the action may be dismissed upon motion of

the defendant (respondent) or upon the court's own motion. This

dismissal shall have the effect of an adjudication upon the merits,

unless otherwise provided by court. Parenthetically, it may be stated

that the general rules provided in the Rules of Court govern

proceedings in the Court of Tax Appeals. The rules promulgated by the

Court of Tax Appeals are merely supplementary.

71. REPUBLIC V. BASA (PARAS)

Doctrine: Deficiency assessments may be made within ten years after

the discovery of the falsity or omission. The court action should be

instituted within five years after the assessment but this period is

suspended during the time that the Commission is prohibited from

instituting a court action.

FACTS:

In a demand letter dated August 31, 1967, the Commissioner of

Internal Revenue assessed against Augusto Basa deficiency income

taxes for 1957 to 1960 totalling P16,353.12. Deficiencies were based

on the taxpayer's failure to report in full his capital gains on the sales

of land. This omission or underdeclaration of income justified the

imposition of 50% surcharge. The taxpayer did not contest the

assessments in the Tax Court. The Commissioner's letter-decision on

the case was dated ecember 6, 1974. On the assumption that the

assessments had become final and incontestable, the Commissioner on

September 3, 1975 sued the taxpayer in the Manila Court of First

Instance for the collection of said amount.

The trial court in a decision dated April 20, 1976 affirmed the

assessments and ordered Basa to pay P16,353.12 plus 5% surcharge

and one percent monthly interest from August 31, 1967 to August 31,

1970. Instead of appealing to this Court directly under Republic Act

No. 5440, in relation to Rules 41 and 45 of the Rules of Court, since no

factual issues are involved, Basa tried to appeal to the Court of

Appeals. He did not perfect his appeal within the reglamentary period.

The trial court dismissed it in its order dated October 1, 1976. On

December 23, 1976 Basa filed the instant special civil action of

certiorari wherein he assailed the trial court's decision.

1Ak 2 (kLMLDILS) CLASS DIGLS1 LAS1 8A1Cn

A11 GCN2ALL2

9f

ISSUE: Whether the decision of the Court of First Instance of Manila

(not the Tax Court) in an income tax case is reviewable by the

Appellate Court or by this Court.

HELD: NO. The petition is devoid of merit. The trial court acted within

its jurisdiction in rendering its decision and dismissing Basa's appeal.

He should have appealed to this Court. His failure to do so rendered

the decision final and executory. He has no cause of action for

certiorari.

RATIO:

If he wanted to contest the assessments, he should have appealed to

the Tax Court. Not having done so, he could not contest the same in

the Court of First Instance. The issue of prescription raised by him is

baseless. The assessments were predicated on the fact that his income

tax returns, if not fraudulent, were false because he underdeclared his

income. In such a case, the deficiency assessments may be made

within ten years after the discovery of the falsity or omission.

The court action should be instituted within five years after the

assessment but this period is suspended during the time that

the Commission is prohibited from instituting a court action.**

Basa's requests for reinvestigation tolled the prescriptive period of five

years within which court action may be brought.

72. MARCOS V. CA (see PARAS digest)

73. AGUINALDO V. CIR (ADVINCULA)

DOCTRINE:

FACTS: Aguinaldo Industries is engaged in the manufacture of fishing

nets (a tax exempt industry), which is handled by its Fish Nets

Division. It is also engaged in the manufacture of furniture which is

operated by its Furniture Division. Each division is provided with

separate books of accounts. The income from the Fish Nets Division,

miscellaneous income of the FIsh Nets Division, and and the income

from the Furniture Division are computed individually.

Petitioner acquired a parcel of land in Muntinglupa Rizal as site

for its fishing net factory. The transaction was entered in the books of

the Fish Nets Division. The company then found another parcel of land

in Marikina Heights, which was more suitable. They then sold the

Muntinglupa property and the profit derived from the sale was entered

in the books of the Fish Nets Division as miscellaneous income to

separate it from its tax exempt income.

For 1957, petitioner filed 2 separate ITRs (one for Fish Nets

and one for Furniture). After investigation, BIR examiners found that

the Fish Nets Div deducted from its gross income PhP 61k as additional