Beruflich Dokumente

Kultur Dokumente

Boi 250108

Hochgeladen von

api-3836349Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Boi 250108

Hochgeladen von

api-3836349Copyright:

Verfügbare Formate

Bank of India

Another superlative quarter

January 23, 2008 Profits way above estimates: BoI's Q3FY08 net profit grew by 100% YoY

Q3FY08 Result Update

at Rs5.2bn, which was significantly above our estimates by 43% of

Rs3.6bn. NII growth was in line with expectations, while high other

Rating BUY income growth and lower than expected operating expenses mainly

Price Rs408 resulted in such a strong out performance.

Target Price Rs520 NII growth in line with expectations: NII (gross of amortisation

Implied Upside 27.5% expenses) grew by 24% YoY to Rs11.4bn. Margins improved by 17bps YoY

and 10bps QoQ. On sequential basis, margins have mainly improved due

Sensex 17,594

to decline in cost of funds as asset yields have more or less remained

(Prices as on January 23, 2008)

stable.

Other income continues to be robust: Other income (net of

Trading Data

amortisation costs) grew by 87% YoY and 6% QoQ to Rs4.9bn, of which

fee income grew by 42% YoY and treasury by 110% YoY to Rs1.2bn.

Market Cap. (Rs bn) 199.2

Shares o/s (m) 488.1 Strong operating performance: Operating profit was up 76% YoY and

16% QoQ driven by strong 38% YoY net income growth and muted

Free Float 30.5%

operating expenses growth of 5.5% YoY.

Avg. Daily Vol (‘000) 515.4

Factoring QIP issue at Rs450 per share: We have factored in a dilution

Avg. Daily Value (Rs m) 191.9

of 7.8% of BoI’s existing equity base at Rs450 per share, which would

help it raise around Rs17bn. The current BV is Rs138 per share, thus the

issue would be significantly BV accretive; post issue tier-I ratio is likely

to be at 8.2%.

Major Shareholders

Valuation: At the CMP, the stock is quoting at 7.5x FY10E EPS, 1.7x

Promoters 69.5%

FY10E BV and 1.7x FY10E ABV. We expect its earnings to grow at a CAGR

Foreign 17.1% of 37% in FY07-10E with improvement in asset quality. We maintain a

Domestic Inst. 6.4% BUY on the stock with a 15-month forward price target of Rs520.

Public & Others 7.0%

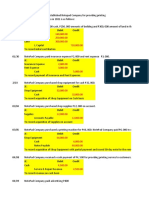

Key financials (Rs m) FY07 FY08E FY09E FY10E

Net interest income* 36,841 44,901 54,400 64,778

Growth (%) 28.1 21.9 21.2 19.1

Stock Performance

Operating profit 23,945 35,913 44,658 55,158

(%) 1M 6M 12M PAT 11,232 17,973 22,909 28,778

Absolute 16.3 56.8 108.0 EPS (Rs) 23.0 34.2 43.6 54.7

Growth (%) 60.2 48.5 27.5 25.6

Relative 24.5 44.9 82.7

Net DPS (Rs) 4.0 6.8 8.7 10.9

Source: Company Data; PL Research * Gross of amortisation expenses

Price Performance (RIC: BOI.BO, BB: BOI IN) Profitability & valuation FY07 FY08E FY09E FY10E

(Rs) NIM (%)* 2.9 2.9 2.9 2.9

470 RoAE (%) 21.2 23.9 23.6 24.6

420 RoAA (%) 0.9 1.1 1.2 1.3

370 P / BV (x) 3.5 2.4 2.0 1.7

320 P / ABV (x) 3.9 2.5 2.1 1.7

270 PE (x) 17.7 11.9 9.4 7.5

220 Net dividend yield (%) 4.0 6.8 8.7 10.9

170 Source: Company Data; PL Research * Gross of amortisation expenses

120

Mar-07

Jan-07

Jan-08

May-07

Jul-07

Nov-07

Sep-07

Abhijit Majumder Bharat Gorasiya

AbhijitMajumder@PLIndia.com BharatGorasiya@PLIndia.com

Source: Bloomberg

+91-22-6632 2236 +91-22-6632 2242

Bank of India

Highlights

Margins continue to show improvement unlike peers

BOI is perhaps the only PSU bank which is unscathed from the high deposit

cost pressure on margins for most other PSU banks. CASA ratio remains

healthy at 37%, stable on QoQ basis but down by 400bps YoY. Despite the fall

in CASA, a broad industry phenomenon, the bank has managed well to

improve its margins and maintain steady business growth.

Trend in NIM

3.2

3.2

3.1

3.1

3.0

3.0

2.9

2.9

2.8

2.8

2.7

Q3FY07 Q4FY07 Q1FY08 Q2FY08 Q3FY08

Source: Company Data, PL Research

Responsible business growth has been the key

The bank, unlike its peers, had not relied on bulk deposits to fund its

advances growth. Rather, bulk deposit comprises of only 10% of its total

deposits. This responsible business growth, with more focus on quality, has

helped BOI to improve margins and also its asset quality. A rare feat not

displayed by most other PSU banks.

Trend in advances and deposit growth

32.0 Advances Deposits

30.0

28.0

26.0

24.0

22.0

20.0

Q3FY07 Q4FY07 Q1FY08 Q2FY08 Q3FY08

Source: Company Data, PL Research

January 23, 2008 2

Bank of India

AS-15 expenses already provided for FY08

The bank estimates its transitional liability of Rs5bn to be spread over five

years, of which Rs1bn has already been provided for this year.

Asset quality likely to improve further

There is little stress on the bank’s asset quality as GNPAs (at 1.9% vs. 2.7%

QoQ) and NNPAs (at 0.6% vs. 0.8% QoQ) are both down on sequential basis in

percentage and absolute terms. The innovative recovery methods (providing

incentives to employees) adopted by the management is yielding good

results. The bank plans to increase provision coverage to 85% by March 2008

from 78% at present thus improving the asset quality further.

Trend in GNPA and NNPA

25.0 GNPA (Rs bn) NNPA (Rs bn) NNPA (%) - (RHS) 1.0

0.9

20.0 0.8

0.7

15.0 0.6

0.5

10.0 0.4

0.3

5.0 0.2

0.1

0.0 0.0

Q3FY07 Q4FY07 Q1FY08 Q2FY08 Q3FY08

Source: Company Data, PL Research

Outlook

BOI has been the best performing PSU bank for the last six quarters. It is

prudently utilising treasury gains to increase its provision coverage. We

expect the QIP placement to be at a much higher price than the SEBI floor

price of Rs359 per share (our assumption Rs450). With a RoE of 24%, FII

headroom still available and improving asset quality, BOI continues to remain

among our top picks.

Valuation

At the CMP, the stock is quoting at 7.5x FY10E EPS, 1.7x FY10E BV and 1.7x

FY10E ABV. We expect its earnings to grow at a CAGR of 37% in FY07-10E

with improvement in asset quality. We maintain a BUY on the stock with a

15-month forward price target of Rs520.

January 23, 2008 3

Bank of India

Q3FY08 result overview (Rs m)

Y/e March Q3FY08 Q3FY07 YoY gr. (%) Q2FY08 9MFY08 9MFY07 YoY gr. (%)

Total interest earned 32,161 23,181 38.7 30,412 90,476 65,642 37.8

Total non interest income* 4,890 2,614 87.1 4,630 12,700 8,062 57.5

Total income 37,051 25,795 43.6 35,042 103,176 73,704 40.0

Int. expended 20,717 13,984 48.1 19,895 58,412 39,115 49.3

Net int. income** 11,445 9,198 24.4 10,517 32,065 26,527 20.9

Net total income 16,335 11,811 38.3 15,147 44,765 34,589 29.4

Op. expenses 6,622 6,279 5.5 6,744 19,871 19,589 1.4

Op. profit 9,713 5,532 75.6 8,403 24,893 15,000 66.0

Core op. profit 7,553 4,789 57.7 6,373 21,823 13,425 62.6

Provisions 2,314 2,286 1.2 3,000 7,294 5,556 31.3

PBT 7,399 3,246 127.9 5,403 17,599 9,443 86.4

Prov. for taxes 2,281 697 227.4 1,153 5,067 2,683 88.8

Net profit 5,118 2,549 100.8 4,251 12,532 6,760 85.4

CAR (%) 12.5 11.8 12.6 12.5 11.8

EPS (Rs) 10.5 5.2 100.8 8.7 25.7 13.9 85.4

Gross NPA 19,693 21,860 (9.9) 19,837 19,693 21,860 (9.9)

Net NPA 6,335 7,480 (15.3) 7,137 6,335 7,480 (15.3)

% of gross NPAs 1.9 2.7 2.1 1.9 2.7

% of net NPAs 0.6 1.0 0.8 0.6 1.0

Deposits 1,358,350 1,066,120 27.4 1,295,910 1,358,350 1,066,120 27.4

Advances 1,036,570 798,180 29.9 958,160 1,036,570 798,180 29.9

* Net of amortisation expenses ** Gross of amortisation expenses

January 23, 2008 4

Bank of India

Prabhudas Lilladher Pvt. Ltd.

3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India.

Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209

PL’s Recommendation Nomenclature

BUY : > 15% Outperformance to BSE Sensex Outperformer (OP) : 5 to 15% Outperformance to Sensex

Market Performer (MP) : -5 to 5% of Sensex Movement Underperformer (UP) : -5 to -15% of Underperformace to Sensex

Sell : <-15% Relative to Sensex

Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly

This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information

and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken

as an offer to sell or a solicitation to buy or sell any security.

The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or

completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information,

statements and opinion given, made available or expressed herein or for any omission therein.

Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The

suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent

expert/advisor.

Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or

engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication.

We may from time to time solicit or perform investment banking or other services for any company mentioned in this document.

January 23, 2008 5

Das könnte Ihnen auch gefallen

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsVon EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNoch keine Bewertungen

- Centrum Suryoday Small Finance Bank Q3FY23 Result UpdateDokument10 SeitenCentrum Suryoday Small Finance Bank Q3FY23 Result UpdateDivy JainNoch keine Bewertungen

- ABG+Shipyard 11-6-08 PLDokument3 SeitenABG+Shipyard 11-6-08 PLapi-3862995Noch keine Bewertungen

- Infosys (Q1 FY23) - YES SecuritiesDokument8 SeitenInfosys (Q1 FY23) - YES SecuritiesRojalin SwainNoch keine Bewertungen

- PC - Engineers India 4Q21Dokument8 SeitenPC - Engineers India 4Q21Sandesh ShettyNoch keine Bewertungen

- Motilal Oswal Financial Services 3Dokument11 SeitenMotilal Oswal Financial Services 3gunesh somayaNoch keine Bewertungen

- HDFC Bank: Performance HighlightsDokument4 SeitenHDFC Bank: Performance HighlightsAditi TyagiNoch keine Bewertungen

- Nocil LTD.: Margins Have Bottomed Out, Import Substitution in PlayDokument8 SeitenNocil LTD.: Margins Have Bottomed Out, Import Substitution in PlaySadiq SadiqNoch keine Bewertungen

- NRB Bearing ILFSDokument3 SeitenNRB Bearing ILFSapi-3775500Noch keine Bewertungen

- Ultratech Cement: CMP: Inr6,485 TP: Inr8,050 (+24%) Market Share Gains Con Nue BuyDokument10 SeitenUltratech Cement: CMP: Inr6,485 TP: Inr8,050 (+24%) Market Share Gains Con Nue BuyLive NIftyNoch keine Bewertungen

- Apollo TyreDokument12 SeitenApollo TyrePriyanshu GuptaNoch keine Bewertungen

- State Bank of India (SBI) : Decent Performance in Q4Dokument5 SeitenState Bank of India (SBI) : Decent Performance in Q4deveshNoch keine Bewertungen

- Shriram City Union Finance 27042018 1Dokument14 SeitenShriram City Union Finance 27042018 1saran21Noch keine Bewertungen

- PTPP Uob 15 Mar 2022Dokument5 SeitenPTPP Uob 15 Mar 2022Githa Adhi Pramana I GDNoch keine Bewertungen

- Apollo Hospitals Enterprise Companyname: Sets The Stage For ExpansionDokument13 SeitenApollo Hospitals Enterprise Companyname: Sets The Stage For Expansionakumar4uNoch keine Bewertungen

- HDFCDokument2 SeitenHDFCshankyagarNoch keine Bewertungen

- ZEE Research Report BNP ParibasDokument5 SeitenZEE Research Report BNP ParibasArpit JhanwarNoch keine Bewertungen

- Kpit TechnologiesDokument7 SeitenKpit TechnologiesRanjan BeheraNoch keine Bewertungen

- Cyient: Poor Quarter Recovery Likely in The Current QuarterDokument9 SeitenCyient: Poor Quarter Recovery Likely in The Current QuarterADNoch keine Bewertungen

- Aarti Industries - 3QFY20 Result - RsecDokument7 SeitenAarti Industries - 3QFY20 Result - RsecdarshanmaldeNoch keine Bewertungen

- Peninsula+Land 10-6-08 PLDokument3 SeitenPeninsula+Land 10-6-08 PLapi-3862995Noch keine Bewertungen

- Q1FY22 Result Update City Union Bank LTD: Beat On Operational Front Due To Lower Credit CostDokument12 SeitenQ1FY22 Result Update City Union Bank LTD: Beat On Operational Front Due To Lower Credit Costforgi mistyNoch keine Bewertungen

- Bhushan Steel: Transformation Continues Maintain BuyDokument6 SeitenBhushan Steel: Transformation Continues Maintain BuyRudra GoudNoch keine Bewertungen

- IDBI Capital Century Plyboards Q1FY23 Result ReviewDokument10 SeitenIDBI Capital Century Plyboards Q1FY23 Result ReviewTai TranNoch keine Bewertungen

- ITC 21 08 2023 EmkayDokument15 SeitenITC 21 08 2023 Emkayvikram112in20002445Noch keine Bewertungen

- CDSL 10 02 2021 HDFCDokument2 SeitenCDSL 10 02 2021 HDFCJessy PadalaNoch keine Bewertungen

- Voltas Fy07Dokument7 SeitenVoltas Fy07hh.deepakNoch keine Bewertungen

- Voltamp Transformers 26112019Dokument5 SeitenVoltamp Transformers 26112019anjugaduNoch keine Bewertungen

- 2020-09-02-SHJ - AX-Moelis Australia Sec-SHINE CORPORATE - Back in Growth Mode-89665112Dokument5 Seiten2020-09-02-SHJ - AX-Moelis Australia Sec-SHINE CORPORATE - Back in Growth Mode-89665112ssdebNoch keine Bewertungen

- CYIENT Kotak 22102018Dokument6 SeitenCYIENT Kotak 22102018ADNoch keine Bewertungen

- Infosys (INFO IN) : Q1FY22 Result UpdateDokument13 SeitenInfosys (INFO IN) : Q1FY22 Result UpdatePrahladNoch keine Bewertungen

- Angel One: Revenue Misses Estimates Expenses in LineDokument14 SeitenAngel One: Revenue Misses Estimates Expenses in LineRam JaneNoch keine Bewertungen

- 1 31 2008 (Edelweiss) Page Industries-Result Up - Edw02410Dokument4 Seiten1 31 2008 (Edelweiss) Page Industries-Result Up - Edw02410api-3740729Noch keine Bewertungen

- Ashok Leyland: Performance HighlightsDokument9 SeitenAshok Leyland: Performance HighlightsSandeep ManglikNoch keine Bewertungen

- Hindustan Unilever: Decent Beat in Challenging Quarter Scale Benefits and GSK Drive Margin BeatDokument14 SeitenHindustan Unilever: Decent Beat in Challenging Quarter Scale Benefits and GSK Drive Margin BeatUTSAVNoch keine Bewertungen

- Aarti Industries: All Round Growth ImminentDokument13 SeitenAarti Industries: All Round Growth ImminentPratik ChhedaNoch keine Bewertungen

- IDFC Bank: CMP: Inr63 TP: INR68 (8%)Dokument8 SeitenIDFC Bank: CMP: Inr63 TP: INR68 (8%)Devendra SarafNoch keine Bewertungen

- Equity Research BritaniaDokument8 SeitenEquity Research BritaniaVaibhav BajpaiNoch keine Bewertungen

- INFY - NoDokument12 SeitenINFY - NoSrNoch keine Bewertungen

- Gati 250108Dokument7 SeitenGati 250108api-3836349Noch keine Bewertungen

- Ganesha Ecosphere 3QFY20 Result Update - 200211 PDFDokument4 SeitenGanesha Ecosphere 3QFY20 Result Update - 200211 PDFdarshanmadeNoch keine Bewertungen

- Bajaj Auto EdelweissDokument10 SeitenBajaj Auto Edelweiss251219811Noch keine Bewertungen

- Vinati Organics: AccumulateDokument7 SeitenVinati Organics: AccumulateBhaveek OstwalNoch keine Bewertungen

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDokument17 SeitenQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyNoch keine Bewertungen

- Bharat Forge: Performance HighlightsDokument13 SeitenBharat Forge: Performance HighlightsarikuldeepNoch keine Bewertungen

- Motilal Oswal Financial Services2Dokument9 SeitenMotilal Oswal Financial Services2Bhav Bhagwan HaiNoch keine Bewertungen

- Infosys (INFO IN) : Q1FY21 Result UpdateDokument14 SeitenInfosys (INFO IN) : Q1FY21 Result UpdatewhitenagarNoch keine Bewertungen

- Teamlease: Near Term Impact To Be ManageableDokument8 SeitenTeamlease: Near Term Impact To Be ManageableAnand KNoch keine Bewertungen

- Pfizer: Margins Expansion Helps Net Earnings Growth Despite Revenue DeclineDokument6 SeitenPfizer: Margins Expansion Helps Net Earnings Growth Despite Revenue DeclineGuarachandar ChandNoch keine Bewertungen

- Raymond-Q2FY22-RU LKPDokument9 SeitenRaymond-Q2FY22-RU LKP56 AA Prathamesh WarangNoch keine Bewertungen

- ITC 020822 MotiDokument12 SeitenITC 020822 Motinitin sonareNoch keine Bewertungen

- Aditya Birla Fashion and Retail - Result Update-Aug-18-EDEL PDFDokument14 SeitenAditya Birla Fashion and Retail - Result Update-Aug-18-EDEL PDFDeepak SharmaNoch keine Bewertungen

- Dabur India: Strong Domestic Volume Growth Lifts RevenuesDokument9 SeitenDabur India: Strong Domestic Volume Growth Lifts RevenuesRaghavendra Pratap SinghNoch keine Bewertungen

- Asian Paints JefferiesDokument12 SeitenAsian Paints JefferiesRajeev GargNoch keine Bewertungen

- Vascon Engineers - Kotak PCG PDFDokument7 SeitenVascon Engineers - Kotak PCG PDFdarshanmadeNoch keine Bewertungen

- Bajaj Finance 29072019Dokument7 SeitenBajaj Finance 29072019Pranav VarmaNoch keine Bewertungen

- Tvs Motor PincDokument6 SeitenTvs Motor Pincrajarun85Noch keine Bewertungen

- Himatsingka Seide - 1QFY20 Result - EdelDokument12 SeitenHimatsingka Seide - 1QFY20 Result - EdeldarshanmadeNoch keine Bewertungen

- Bhel (Bhel In) : Q4FY19 Result UpdateDokument6 SeitenBhel (Bhel In) : Q4FY19 Result Updatesaran21Noch keine Bewertungen

- Blue Star (BLSTR In) 2QFY20 Result Update - RsecDokument9 SeitenBlue Star (BLSTR In) 2QFY20 Result Update - RsecHardik ShahNoch keine Bewertungen

- Branch AccountingDokument38 SeitenBranch AccountingAshutosh shriwasNoch keine Bewertungen

- Problem A. PORT HYIR Manufacturing Company Using Process Costing To Account For ItsDokument3 SeitenProblem A. PORT HYIR Manufacturing Company Using Process Costing To Account For ItsMay RamosNoch keine Bewertungen

- Final Submission Fyp Muhammad Safwan Bin Mohd Sobri (2017201252)Dokument115 SeitenFinal Submission Fyp Muhammad Safwan Bin Mohd Sobri (2017201252)Safwan SobriNoch keine Bewertungen

- General Accounting 3 - Express Handling and DeliveryDokument9 SeitenGeneral Accounting 3 - Express Handling and DeliveryRheu ReyesNoch keine Bewertungen

- Cost Accounting de Leon Chapter 3 SolutionsDokument9 SeitenCost Accounting de Leon Chapter 3 SolutionsRichelle SangatananNoch keine Bewertungen

- CH 21 FroyenDokument24 SeitenCH 21 FroyenRamadhan Der ErobererNoch keine Bewertungen

- Financial Accounting and Reporting Lesson 1 2 3Dokument12 SeitenFinancial Accounting and Reporting Lesson 1 2 3kim fernandoNoch keine Bewertungen

- Economics PYQ SSCDokument48 SeitenEconomics PYQ SSCNitin Vishwakarma100% (1)

- Comprehensive Problem-Analysis of TransactionDokument43 SeitenComprehensive Problem-Analysis of TransactionJoanna DandasanNoch keine Bewertungen

- Investment in Debt SecuritiesDokument21 SeitenInvestment in Debt SecuritiesAlarich CatayocNoch keine Bewertungen

- Chapter One 1.0 1.1 Background of StudyDokument42 SeitenChapter One 1.0 1.1 Background of StudyOko IsaacNoch keine Bewertungen

- Acctg 112 Reviewer Pas 1 8Dokument26 SeitenAcctg 112 Reviewer Pas 1 8surbanshanrilNoch keine Bewertungen

- Intercompany Inventory Transactions: Mcgraw-Hill/IrwinDokument123 SeitenIntercompany Inventory Transactions: Mcgraw-Hill/IrwinsresaNoch keine Bewertungen

- Rishi Saurout 10001Dokument3 SeitenRishi Saurout 10001tarunNoch keine Bewertungen

- Name: Jenylou Dapiton Semi Finals TopicDokument3 SeitenName: Jenylou Dapiton Semi Finals TopicJenylou Maputol DapitonNoch keine Bewertungen

- Income From House PropertyDokument27 SeitenIncome From House PropertyJames Anderson0% (1)

- Transfer To Benefit of Unborn Child Section 13-20: Submitted To: D.R. Nisha JindalDokument25 SeitenTransfer To Benefit of Unborn Child Section 13-20: Submitted To: D.R. Nisha JindalriyaNoch keine Bewertungen

- Longoria Inez (115) $999.25 Wed Oct 28 19 08 00 EDT 2020Dokument1 SeiteLongoria Inez (115) $999.25 Wed Oct 28 19 08 00 EDT 2020nelson menaNoch keine Bewertungen

- Case Study - Destin Brass Products CoDokument6 SeitenCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNoch keine Bewertungen

- Conceptual Framework Module 5Dokument3 SeitenConceptual Framework Module 5Jaime LaronaNoch keine Bewertungen

- UAS Muhammad Misbahul HudaDokument6 SeitenUAS Muhammad Misbahul Hudawhite shadowNoch keine Bewertungen

- CH 15Dokument56 SeitenCH 15Quỳnh Anh Bùi ThịNoch keine Bewertungen

- DXC Q1FY24 Earnings DeckDokument47 SeitenDXC Q1FY24 Earnings Decky.belausavaNoch keine Bewertungen

- Chapter 5 - Teori AkuntansiDokument34 SeitenChapter 5 - Teori AkuntansiCut Riezka SakinahNoch keine Bewertungen

- Mind Map of Accounting ElementsDokument4 SeitenMind Map of Accounting ElementsSapphire Au MartinNoch keine Bewertungen

- CONCORRENTES - Iber King 56107Dokument16 SeitenCONCORRENTES - Iber King 56107caetano nunesNoch keine Bewertungen

- Yordanos Sisay Final Thesis@smu, 2022 CommentDokument65 SeitenYordanos Sisay Final Thesis@smu, 2022 CommentTesfahun GetachewNoch keine Bewertungen

- Computation of Gross ProfitDokument21 SeitenComputation of Gross ProfitedreleneNoch keine Bewertungen

- Tafesse YuaDokument11 SeitenTafesse Yuaalemayehu tarikuNoch keine Bewertungen

- TaxationDokument8 SeitenTaxationArlyn VicenteNoch keine Bewertungen

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusVon EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusBewertung: 3.5 von 5 Sternen3.5/5 (10)

- Preclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Von EverandPreclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Bewertung: 5 von 5 Sternen5/5 (1)

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresVon EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Drilling Supervisor: Passbooks Study GuideVon EverandDrilling Supervisor: Passbooks Study GuideNoch keine Bewertungen

- The Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Von EverandThe Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Bewertung: 4 von 5 Sternen4/5 (1)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessVon EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Clinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2Von EverandClinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2Bewertung: 3 von 5 Sternen3/5 (1)

- Master the Boards USMLE Step 3 7th Ed.Von EverandMaster the Boards USMLE Step 3 7th Ed.Bewertung: 4.5 von 5 Sternen4.5/5 (6)

- Check Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreVon EverandCheck Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreBewertung: 5 von 5 Sternen5/5 (1)

- CUNY Proficiency Examination (CPE): Passbooks Study GuideVon EverandCUNY Proficiency Examination (CPE): Passbooks Study GuideNoch keine Bewertungen

- Medical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldVon EverandMedical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldBewertung: 4.5 von 5 Sternen4.5/5 (2)

- ASVAB Flashcards, Fourth Edition: Up-to-date PracticeVon EverandASVAB Flashcards, Fourth Edition: Up-to-date PracticeNoch keine Bewertungen

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Von Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Noch keine Bewertungen

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeVon EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeBewertung: 3.5 von 5 Sternen3.5/5 (3)

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsVon EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsNoch keine Bewertungen

- Certified Professional Coder (CPC): Passbooks Study GuideVon EverandCertified Professional Coder (CPC): Passbooks Study GuideBewertung: 5 von 5 Sternen5/5 (1)

- Pilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CVon EverandPilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CNoch keine Bewertungen

- PTCE: Pharmacy Technician Certification Exam Premium: 4 Practice Tests + Comprehensive Review + Online PracticeVon EverandPTCE: Pharmacy Technician Certification Exam Premium: 4 Practice Tests + Comprehensive Review + Online PracticeNoch keine Bewertungen

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsVon EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsNoch keine Bewertungen

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASVon EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASNoch keine Bewertungen

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsVon EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsBewertung: 4.5 von 5 Sternen4.5/5 (77)

- LMSW Passing Score: Your Comprehensive Guide to the ASWB Social Work Licensing ExamVon EverandLMSW Passing Score: Your Comprehensive Guide to the ASWB Social Work Licensing ExamBewertung: 5 von 5 Sternen5/5 (1)