Beruflich Dokumente

Kultur Dokumente

Citi To Exceed Targeted Capital Levels Pro Forma For Fourth Quarter 2007

Hochgeladen von

api-3836349Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Citi To Exceed Targeted Capital Levels Pro Forma For Fourth Quarter 2007

Hochgeladen von

api-3836349Copyright:

Verfügbare Formate

Citi to Exceed Targeted Capital Levels Pro Forma for Fourth Quarter 2007

Nearly $30 Billion of Capital Raised or Priced Over Last 2 Months

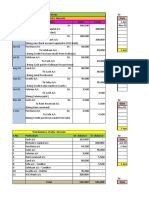

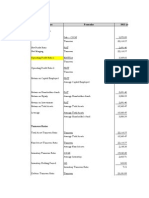

NEW YORK – Citi said today that it will exceed its announced targeted capital ratios on a pro

forma basis for the fourth quarter 2007.

Taking into account recent capital raising activities totaling almost $30 billion, Citi expects its

following key capital ratios to hit, on a pro forma basis for the fourth quarter: Tier One at

approximately 8.8% and TCE/RWMA capital ratio at approximately 6.9%.

“These levels meaningfully exceed our capital ratio targets,” said Vikram Pandit, Chief Executive

Officer, Citi. “We wanted to make sure that we can put capital to work for our clients and capture

market opportunities for our shareholders.”

Citi priced a series of equity issuances last week, including a $12.5 billion private placement of

Convertible Preferred securities, a $2.9 billion public offering of Convertible Preferred securities,

and a $3.25 billion public offering of Straight Preferred securities. The cumulative $18.65 billion

equity issuance has been priced as follows:

• $12.5 billion private placement of Convertible Preferred securities with a 7% non-

cumulative dividend and a $31.62 per share conversion price

• $2.9 billion public offering of Convertible Preferred securities with 6.5% non-cumulative

dividend and a conversion price of $33.73 per share

• $3.25 billion public offering of Straight Preferred securities with non-cumulative dividend

of 8.125%

These private and public Convertible Preferred securities offerings will settle and close on

January 23, 2008. The Straight Preferred securities offering will settle and close on January 25,

2008.

In December, Citi sold $7.5 billion of Upper DECS Equity Units in a private placement to the Abu

Dhabi Investment Authority. As a result of the pricing of the $12.5 billion private offering and as

contractually required, the maximum conversion price on the Upper DECS Equity Units will be

reduced to $31.83. All other features of the Upper DECS Equity Units will remain the same,

including the reference price of $31.83 and payment rate of 11%. The sale of the Upper DECS

Equity Units settled and closed on December 3.

On December 21, Citi closed and settled on $3.5 billion public offering of Enhanced Trups. These

securities bear an 8.30% coupon.

On November 27, 2007, Citi also closed and settled on a $787.5 million public offering of

Enhanced Trups. These securities bear a 7.875% coupon.

On January 18, 2008, Citi announced that Nikko Cordial Corporation shareholders will be entitled

to receive 0.602 shares of Citigroup Inc. common stock for each share of Nikko Cordial

Corporation common stock that they own under the previously agreed share exchange between

Citi and Nikko Cordial. The share exchange will settle on January 29, 2008.

Das könnte Ihnen auch gefallen

- Gati 250108Dokument7 SeitenGati 250108api-3836349Noch keine Bewertungen

- EagleEye Jan28 (E)Dokument5 SeitenEagleEye Jan28 (E)api-3836349Noch keine Bewertungen

- Rumours+ Truth+Dokument1 SeiteRumours+ Truth+api-3836349Noch keine Bewertungen

- Boi 250108Dokument5 SeitenBoi 250108api-3836349Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Project Report On OPTCLDokument63 SeitenProject Report On OPTCLKaranDevlikarNoch keine Bewertungen

- Onerous Contracts-Cost of Fulfilling A Contract Amendments To Ias 37Dokument6 SeitenOnerous Contracts-Cost of Fulfilling A Contract Amendments To Ias 37Suzy BaeNoch keine Bewertungen

- Investment Attitude QuestionnaireDokument6 SeitenInvestment Attitude QuestionnairerakeshmadNoch keine Bewertungen

- Date Date Particulars Debit CreditDokument13 SeitenDate Date Particulars Debit Creditswarna sNoch keine Bewertungen

- Financial Services Set 14Dokument5 SeitenFinancial Services Set 14Goel apurvaNoch keine Bewertungen

- Andito Na Tayo Sa Exciting PartDokument9 SeitenAndito Na Tayo Sa Exciting PartAnn GGNoch keine Bewertungen

- HUL RatiosDokument9 SeitenHUL RatiosChinmaya BeheraNoch keine Bewertungen

- Chapter 5 ActivityDokument2 SeitenChapter 5 ActivityMika MolinaNoch keine Bewertungen

- StatementDokument10 SeitenStatementTemidayo EmmanuelNoch keine Bewertungen

- Profit OR Loss PRE AND Post Incorporation: After Studying This Unit, You Will Be Able ToDokument29 SeitenProfit OR Loss PRE AND Post Incorporation: After Studying This Unit, You Will Be Able ToNitesh MattaNoch keine Bewertungen

- Project On Working Capital ManagementDokument16 SeitenProject On Working Capital ManagementVineeth VtNoch keine Bewertungen

- Stevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsDokument2 SeitenStevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsAmit PandeyNoch keine Bewertungen

- Business FinanceDokument21 SeitenBusiness Financechloe frostNoch keine Bewertungen

- 37 - Practice Questions (Corporate Finance-Working Capital Managament) - AnswersDokument5 Seiten37 - Practice Questions (Corporate Finance-Working Capital Managament) - AnswersSouradeep MondalNoch keine Bewertungen

- Ipsas 1 and Ipsas 2Dokument6 SeitenIpsas 1 and Ipsas 2Esther AkpanNoch keine Bewertungen

- Excercise Chapter 2Dokument2 SeitenExcercise Chapter 2Loan VũNoch keine Bewertungen

- Journal Entries: Example 1: Whole-Period Depreciation in The Period of PurchaseDokument2 SeitenJournal Entries: Example 1: Whole-Period Depreciation in The Period of PurchasemulualemNoch keine Bewertungen

- Partnership Deed Agreement 2023Dokument3 SeitenPartnership Deed Agreement 2023Subkabox UKNoch keine Bewertungen

- School of Accountancy & Management Accounting For Special Transaction Midterm ExaminationDokument11 SeitenSchool of Accountancy & Management Accounting For Special Transaction Midterm ExaminationTasha MarieNoch keine Bewertungen

- AFM 123 F16 - Lecture F12 (Learn)Dokument27 SeitenAFM 123 F16 - Lecture F12 (Learn)Cai ClaireNoch keine Bewertungen

- AssssDokument10 SeitenAssssshimelisNoch keine Bewertungen

- Auditing Investments 1Dokument2 SeitenAuditing Investments 1Sabel FordNoch keine Bewertungen

- Cost Calculation LaundryDokument11 SeitenCost Calculation LaundryFahmi RusyadiNoch keine Bewertungen

- Analysis of Autoline Industries Ltd.Dokument43 SeitenAnalysis of Autoline Industries Ltd.Umang Katta0% (1)

- Module 6 Investment PropertyDokument9 SeitenModule 6 Investment PropertyMonica mangobaNoch keine Bewertungen

- Trading SecuritiesDokument3 SeitenTrading SecuritiesFreddierick JuntillaNoch keine Bewertungen

- J R Mohapatra Co Chartered Accountants Hospital Road, Ranihat Cuttack - 753007Dokument1 SeiteJ R Mohapatra Co Chartered Accountants Hospital Road, Ranihat Cuttack - 753007amarnath ojhaNoch keine Bewertungen

- Types of SharesDokument3 SeitenTypes of SharespatsjitNoch keine Bewertungen

- Wacc and MMDokument2 SeitenWacc and MMThảo NguyễnNoch keine Bewertungen

- Marketing Metrics: Ts. Lê Thùy Hương Khoa MarketingDokument23 SeitenMarketing Metrics: Ts. Lê Thùy Hương Khoa MarketingDuy TrầnNoch keine Bewertungen