Beruflich Dokumente

Kultur Dokumente

Idfcresult 2

Hochgeladen von

Shashikant KumarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Idfcresult 2

Hochgeladen von

Shashikant KumarCopyright:

Verfügbare Formate

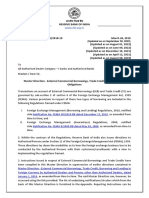

IDFC Long Term Infrastructure Bonds - Tranche 2

ALLOTMENT ADVICE NOT NEGOTIABLE

Infrastructure Development Finance Company Limited

Registered Office: KRM Tower, 8th Floor, No. 1, Harrington Road, Chetpet, Chennai - 600 031 Tel: (91 44 ) 4564 4000; Fax: (91 44) 2854 7597 Corporate Office: Naman Chambers, C-32, G-Block, Bandra-Kurla Complex, Bandra (East), Mumbai 400 051 Tel: (91 22) 4222 2000; Fax: (9122) 2654 0354 RL No. 207737 Ref No. 1150961

Date:February 21,2011

Application No.

42487622

SHASHI KANT KUMAR D-1477,REFINERY TOWNSHIP PANIPAT REFINERY PANIPAT-132140

Dear Bondholder(s) Public Issue by Infrastructure Development Finance Company Limited (the "Company") of long term infrastructure bonds-Tranche 2 of face value of Rs. 5,000 each, in the nature of secured, redeemable, non-convertible debentures, having benefits under Section 80CCF of the Income Tax Act, 1961 (the "Bonds"), not exceeding Rs.29,289.64 million for the financial year 2010-11 (the "Issue"). We thank you for your application for the Bonds. The Committee for Issue of Infrastructure Bonds (being duly authorised committee of the Board of Directors), is pleased to allot the below mentioned Bond(s) in accordance with the terms of (i) the Prospectus Tranche -2 dated January 4, 2011 (ii) the Memorandum and Articles of Association of the Company, (iii) the Basis of Allotment finalized in consultation with National Stock Exchange of India Limited, being the designated stock exchange for the Issue, (iv) the Application Form, (v) the Companies Act, 1956 and other applicable laws, and (vi) the terms mentioned herein. Details of the Bonds Alloted to you are as under:

Beneficiary Account No.

IDB0349255

Series Frequency of Interest Payment Face value per Bond ( ) Rate of Interest Yield on Maturity Whether Buyback Option facility opted Buyback Date Buyback Amount per Bond ( ) Maturity Date Amount payable on Maturity per Bond ( ) No. of Bonds applied for No. of Bonds alloted Certificate No. Distinctive No. (s) From To

1 Annual 5000/8%p.a 8% February 22,2016 5,000/February 21,2021 5,000/-

2 Cumulative 5000/N.A. 8% compounded annually YES February 22,2016 7,350/February 21,2021 10,800/4 4 349255 970336 970339

Please note that the Bonds shall be locked-in for a period of five years from the Deemed Date of Allotment i.e. February 21, 2011 and should not be traded until the expiry of the lock-in period i.e up to February 20,2016 The dispatch of this Allotment Advice forms an irrevocable, valid, binding, non-negotiable and non-transferable obligation on you to acquire the Bonds allocated to you. You will not be entitled to withdraw or cancel or terminate your Application Form. If you had opted for subscribing to the Bonds in physical mode: (i)The Consolidated Bond Certificate is enclosed along with this Allotment Advice.

If you had opted for subscribing to the Bonds in electronic mode: (i)The Bonds allotted to you are being credited to your Beneficiary Account as per the details given above. (ii)Nominee details, if any, of the Depository Account shall be applicable. In case you desire to change the name of the nominee you may please approach your Depository Participant and give necessary instruction for changes to be carried out

All the Bondholders and each of the subsequent tranferees of the Bonds are deemed to have knowledge of the contents of the Prospectus- Tranche 2 and the Debenture Trust Deed an by accepting delivery of the Bonds are deemed to have made the representations, agreemnts and acknowledements set forth in the Shelf Prospectus ,the Prospectus-Tranche 2 and Application Form. This Allotment advice is the being issued to you on the basis of your acceptence of the terms of the Issue as detailed in the shelf Prospectus,the Prospectus-Tranche 2,and the Application Form. All capitalized terms used in this Allotment Advice and not specifically defined shall have themeanings ascribed to such terms in the shelf Prospectus and the Prospectus-Tranche-2

List of Enclosure(s) - (if applicable) 1. Bond Certificate(s) All future communication in connection to these Bonds should be sent to under mentioned address, quoting Bondholder's Folio Number. Karvy Computershare Private Limited, Unit: IDFC Bonds - Tranche 2 Plot no. 17-24, Vithalrao Nagar, Madhapur, Hyderabad 500 081 Tel: (91 40) 2342 0815 - 24 Fax: (91 40) 2343 1551Email: idfc_infra@karvy.com

Das könnte Ihnen auch gefallen

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportVon EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNoch keine Bewertungen

- Jagadamb Idfcresult2Dokument1 SeiteJagadamb Idfcresult2Chandra Dutt SharmaNoch keine Bewertungen

- RL NO. 334856 REF NO. 2590020 Vipin Bansal Flat No 805 Diamond Tower Sec 30 Paras Apartment Ballabgarh 2 Faridabad HARYANA, INDIA - 121003Dokument1 SeiteRL NO. 334856 REF NO. 2590020 Vipin Bansal Flat No 805 Diamond Tower Sec 30 Paras Apartment Ballabgarh 2 Faridabad HARYANA, INDIA - 121003Varun BansalNoch keine Bewertungen

- 51977069Dokument1 Seite51977069Beginner RanaNoch keine Bewertungen

- NKDokument1 SeiteNKRachit GoyalNoch keine Bewertungen

- L&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Dokument8 SeitenL&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalNoch keine Bewertungen

- RamgyanDokument8 SeitenRamgyanRamgyan PrajapatiNoch keine Bewertungen

- IDFC Long Term Infrastructure Bond Tranche 2 Application Form 2012Dokument8 SeitenIDFC Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalNoch keine Bewertungen

- L&T Long Term Infrastructure Bond Tranche 1 Application FormDokument8 SeitenL&T Long Term Infrastructure Bond Tranche 1 Application FormPrajna CapitalNoch keine Bewertungen

- LNT Bond FormDokument8 SeitenLNT Bond FormsunajbaniNoch keine Bewertungen

- IDFC Application Form12!8!2011 - NEHADokument8 SeitenIDFC Application Form12!8!2011 - NEHAAjay KamatNoch keine Bewertungen

- 12345Dokument8 Seiten12345induchellamNoch keine Bewertungen

- 2011B Buyback NoticeDokument4 Seiten2011B Buyback NoticeJai Prakash JingarNoch keine Bewertungen

- 2012a Buyback NoticeDokument4 Seiten2012a Buyback Noticekv chandrasekerNoch keine Bewertungen

- FAQs Redemption of Tranche 2 LTIBsDokument7 SeitenFAQs Redemption of Tranche 2 LTIBsKaran KaranNoch keine Bewertungen

- Letter of Offer For Buyback of L T Infra Long Term Infrastructure BondsDokument4 SeitenLetter of Offer For Buyback of L T Infra Long Term Infrastructure BondsShamit Bugalia100% (1)

- L& T Buy BackDokument4 SeitenL& T Buy BackteammrauNoch keine Bewertungen

- LN TBond FormDokument90 SeitenLN TBond FormboargzcrNoch keine Bewertungen

- IDFC Infrastructure Bond Tranche 3 Application Form 2012Dokument8 SeitenIDFC Infrastructure Bond Tranche 3 Application Form 2012Prajna CapitalNoch keine Bewertungen

- Muthoot Finance Limited: D D M M Y Y Y YDokument2 SeitenMuthoot Finance Limited: D D M M Y Y Y YShaji MathewNoch keine Bewertungen

- 23 7 Checklist For Various Products 15 09Dokument193 Seiten23 7 Checklist For Various Products 15 09RadhakrishnanNoch keine Bewertungen

- NHPC Application Form DetailsTNC PDFDokument47 SeitenNHPC Application Form DetailsTNC PDFHariprasad ManchiNoch keine Bewertungen

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDokument2 Seiten(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- REC Infra Bond Application FormDokument2 SeitenREC Infra Bond Application FormPrajna CapitalNoch keine Bewertungen

- FED Master Direction No. 5 External Commercial Borrowings, Trade Credit Dec 2021Dokument27 SeitenFED Master Direction No. 5 External Commercial Borrowings, Trade Credit Dec 2021Prabhat SinghNoch keine Bewertungen

- KB220502AIMCU - Sanction Letter PDFDokument3 SeitenKB220502AIMCU - Sanction Letter PDFRatnesh ShuklaNoch keine Bewertungen

- EDF L/C Master Circular by BB 2009Dokument6 SeitenEDF L/C Master Circular by BB 2009Mohammad Shafiqul Islam RoneeNoch keine Bewertungen

- 12 Quick Success Series Asset Products SmeDokument23 Seiten12 Quick Success Series Asset Products SmeShubham GoyalNoch keine Bewertungen

- ECB Trade CreditDokument27 SeitenECB Trade CreditSachin DakahaNoch keine Bewertungen

- Circular 25.01.2022Dokument6 SeitenCircular 25.01.2022riteshskcoNoch keine Bewertungen

- Sip Enrolment Cum Auto Debit/Ecs Mandate Form: (ARN Stamp Here)Dokument2 SeitenSip Enrolment Cum Auto Debit/Ecs Mandate Form: (ARN Stamp Here)ranverbsahuNoch keine Bewertungen

- IDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Dokument7 SeitenIDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Sarath KumarNoch keine Bewertungen

- Section 2 Inst To BiddersDokument16 SeitenSection 2 Inst To Bidderspavankumar001Noch keine Bewertungen

- RBI DocDokument36 SeitenRBI DocPritesh RoyNoch keine Bewertungen

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDokument4 SeitenFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaNoch keine Bewertungen

- ShriramTrsptFin Jun2011Dokument507 SeitenShriramTrsptFin Jun2011Chitra VenkatachalamNoch keine Bewertungen

- WLC LTRDokument6 SeitenWLC LTRraghu INoch keine Bewertungen

- MC01 Master Circular The Housing Finance Companies NHB Directions 2010Dokument92 SeitenMC01 Master Circular The Housing Finance Companies NHB Directions 2010AkhyaNoch keine Bewertungen

- FEMABudgetannoucements 06 03Dokument4 SeitenFEMABudgetannoucements 06 03Pawan KvsNoch keine Bewertungen

- 2023 24 Charities Guidelines - FinalDokument17 Seiten2023 24 Charities Guidelines - FinalGOLDA KrugerNoch keine Bewertungen

- Anant Raj V Yes BankDokument10 SeitenAnant Raj V Yes BankRishi SehgalNoch keine Bewertungen

- Small Cap Program, Chhorn Chhou 100m (12 June 20) - DraftDokument10 SeitenSmall Cap Program, Chhorn Chhou 100m (12 June 20) - DraftMamnyNoch keine Bewertungen

- SREI Infrastructure Bond Application FormDokument8 SeitenSREI Infrastructure Bond Application FormPrajna CapitalNoch keine Bewertungen

- 3 Bank ConfirmationDokument3 Seiten3 Bank Confirmationzura aidaNoch keine Bewertungen

- SGB Circular Tranche2Dokument4 SeitenSGB Circular Tranche2ishan619Noch keine Bewertungen

- KotakDokument2 SeitenKotakRandhir RanaNoch keine Bewertungen

- IRDAI Master Circular Unclaimed Amounts of Policyholders Full Text CIRMisc282 Dated 18-11-2020Dokument12 SeitenIRDAI Master Circular Unclaimed Amounts of Policyholders Full Text CIRMisc282 Dated 18-11-2020Puran Singh LabanaNoch keine Bewertungen

- Takeover - Credit ReportDokument8 SeitenTakeover - Credit ReportShantanuMogalNoch keine Bewertungen

- Welcome Letter 162032006Dokument6 SeitenWelcome Letter 162032006faizalkapadia737Noch keine Bewertungen

- MSME Policy Ver1Dokument5 SeitenMSME Policy Ver1dibyenduNoch keine Bewertungen

- Reserve Bank of India Financial Markets Regulation Department Central Office Mumbai - 400 001Dokument94 SeitenReserve Bank of India Financial Markets Regulation Department Central Office Mumbai - 400 001kaustubh_dec17Noch keine Bewertungen

- Policy 2Dokument5 SeitenPolicy 2RinkeshNoch keine Bewertungen

- Acctstmt HDokument8 SeitenAcctstmt HDaniel MartinezNoch keine Bewertungen

- Most Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Dokument2 SeitenMost Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Venkatesh W0% (1)

- Disbursement Letter - Houche0116263650Dokument4 SeitenDisbursement Letter - Houche0116263650Sasikumar RamarajNoch keine Bewertungen

- Circular For Interest PaymentDokument3 SeitenCircular For Interest PaymentVibhu SinghNoch keine Bewertungen

- DHLF - Loan Sanction LetterDokument2 SeitenDHLF - Loan Sanction LetterRaju BhaiNoch keine Bewertungen

- Financial InstrumentDokument12 SeitenFinancial InstrumentYoga PeryogaNoch keine Bewertungen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Class 7 ClimateDokument8 SeitenClass 7 ClimateShashikant KumarNoch keine Bewertungen

- Como CatalystDokument254 SeitenComo CatalystShashikant KumarNoch keine Bewertungen

- Ejercicios Inglés PrimariaDokument40 SeitenEjercicios Inglés Primariaamayaberroya4474100% (3)

- 5.energy Audit of CW SystemDokument39 Seiten5.energy Audit of CW Systembharadwaj037Noch keine Bewertungen

- 72-EA-1D LeakDokument3 Seiten72-EA-1D LeakShashikant KumarNoch keine Bewertungen

- Rigorous HTR SimDokument6 SeitenRigorous HTR SimShashikant KumarNoch keine Bewertungen

- Security Administration GuideDokument416 SeitenSecurity Administration GuideCauã VinhasNoch keine Bewertungen

- 3.1 Geographical Extent of The Foreign Exchange MarketDokument8 Seiten3.1 Geographical Extent of The Foreign Exchange MarketSharad BhorNoch keine Bewertungen

- Motor Insurance - Proposal Form Cum Transcript Letter For Miscellaneous Carrying ComprehensiveDokument2 SeitenMotor Insurance - Proposal Form Cum Transcript Letter For Miscellaneous Carrying ComprehensiveSantosh JaiswalNoch keine Bewertungen

- QCP Installation of Ahu FahuDokument7 SeitenQCP Installation of Ahu FahuThulani DlaminiNoch keine Bewertungen

- Dasa SandhiDokument1 SeiteDasa SandhishivasudhakarNoch keine Bewertungen

- Merger, Akuisisi Dan Konsolidasi Compile 14.00 NisaDokument18 SeitenMerger, Akuisisi Dan Konsolidasi Compile 14.00 Nisaalfan halifa100% (1)

- Imm5786 2-V1V20ZRDokument1 SeiteImm5786 2-V1V20ZRmichel fogueNoch keine Bewertungen

- Chapter 20 Mutual Fund IndustryDokument55 SeitenChapter 20 Mutual Fund IndustryrohangonNoch keine Bewertungen

- Accounting SyllabiDokument2 SeitenAccounting SyllabiJyotirmaya MaharanaNoch keine Bewertungen

- The English School of ThoughtDokument2 SeitenThe English School of ThoughtSetyo Aji PambudiNoch keine Bewertungen

- Arthur Andersen Case PDFDokument12 SeitenArthur Andersen Case PDFwindow805Noch keine Bewertungen

- JF 2 7 ProjectSolution Functions 8pDokument8 SeitenJF 2 7 ProjectSolution Functions 8pNikos Papadoulopoulos0% (1)

- HW1Dokument4 SeitenHW1hung hoangNoch keine Bewertungen

- Iso 5167 2 PDFDokument54 SeitenIso 5167 2 PDFSree288Noch keine Bewertungen

- Villareal vs. PeopleDokument11 SeitenVillareal vs. PeopleJan Carlo SanchezNoch keine Bewertungen

- Week 4, 5, 6 Adjustments and Financial Statement Prep - ClosingDokument61 SeitenWeek 4, 5, 6 Adjustments and Financial Statement Prep - ClosingAarya SharmaNoch keine Bewertungen

- Parts of A DecisionDokument3 SeitenParts of A DecisionChristine-Thine Malaga CuliliNoch keine Bewertungen

- About Alok Industries: Insolvency FilingDokument4 SeitenAbout Alok Industries: Insolvency FilingHarshit GuptaNoch keine Bewertungen

- Notes On Qawaid FiqhiyaDokument2 SeitenNotes On Qawaid FiqhiyatariqsoasNoch keine Bewertungen

- CFS Session 1 Choosing The Firm Financial StructureDokument41 SeitenCFS Session 1 Choosing The Firm Financial Structureaudrey gadayNoch keine Bewertungen

- MCQ ISC 2023 Retirement and DeathDokument15 SeitenMCQ ISC 2023 Retirement and DeathArnab NaskarNoch keine Bewertungen

- Lucknow Pact - WikipediaDokument8 SeitenLucknow Pact - WikipediaHamza AfzalNoch keine Bewertungen

- K-8 March 2014 Lunch MenuDokument1 SeiteK-8 March 2014 Lunch MenuMedford Public Schools and City of Medford, MANoch keine Bewertungen

- Chapter 8Dokument74 SeitenChapter 8Liyana AzizNoch keine Bewertungen

- GodsBag Invoice PDFDokument1 SeiteGodsBag Invoice PDFambarsinghNoch keine Bewertungen

- John Lewis Snead v. W. Frank Smyth, JR., Superintendent of The Virginia State Penitentiary, 273 F.2d 838, 4th Cir. (1959)Dokument6 SeitenJohn Lewis Snead v. W. Frank Smyth, JR., Superintendent of The Virginia State Penitentiary, 273 F.2d 838, 4th Cir. (1959)Scribd Government DocsNoch keine Bewertungen

- Demand Letter WiwiDokument1 SeiteDemand Letter WiwiflippinturtleNoch keine Bewertungen

- Beso v. DagumanDokument3 SeitenBeso v. DagumanMarie TitularNoch keine Bewertungen

- Fundamentals of Drilling Operations: ContractsDokument15 SeitenFundamentals of Drilling Operations: ContractsSAKNoch keine Bewertungen

- Physical Education ProjectDokument7 SeitenPhysical Education ProjectToshan KaushikNoch keine Bewertungen