Beruflich Dokumente

Kultur Dokumente

Real Property Gain Tax

Hochgeladen von

lcs1234678Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Real Property Gain Tax

Hochgeladen von

lcs1234678Copyright:

Verfügbare Formate

Chek Sern Intellectual property rights reserved

Real Property Gain Tax (RPGT)

INTRODUCTION The first legislation to tax gains from the disposal of real property being introduced on 06 December 1973 though Land Speculation Tax Act (LSTA)[Act 126]. This Act provided a single tax rate of 50% on chargeable gains in respect of properties take place within two year from the date of acquisition and the disposal consideration was greater than RM 200,000. However, the legislation has been repealed by Real Property Gain Tax Act 1976 (RPGTA) effective from 7 November 1975. RPGTA provided only mechanism for taxing chargeable gains from real property or shares in a real property company. Whereby, property been disposed after 1 January 2007 has been grated to be weaving by The Minister of Finance [P.U. (A) 146/2007]. This means that, any property been disposed within the period 1 January 2007 to 31 December 2009 was excluded from the scope of charge by RPGTA. In addition, RPGTA been reactivated by new rules applied as enacted by [P.U. (A) 486/2009] starting from 1 January 2010. This means that the [P.U. (A) 146/2007] has been revoked by [P.U. (A) 486/2009].

Real Property Gain Tax Act 1976 [Act 169]:http://www.agc.gov.my/Akta/Vol.%204/Act%20169.pdf [P.U. (A) 146/2007](revoked) :http://synergymanagement.com.my/main/Act/RPGT/2007/REAL%20PROPERTY%20G AINS%20TAX%20%28EXEMPTION%29%20%28NO.%202%29%20ORDER%20200 7.pdf [P.U. (A) 486/2009]:http://www.adventconsulting.com.my/admin/Upload/99A46_Real_Property_Gains_Tax_ %28Exemption%29_%28No._2%29_Order_2009.pdf

Chek Sern Intellectual property rights reserved

DEFINATIONS Section 2 of RPGTA 1976 chargeable gain has the meaning assigned by section 7; Sec.7 (1) Where a chargeable asset is disposed of, then (a) if the disposal price exceeds the acquisition price, there is a chargeable gain; (b) if the disposal price is less than the acquisition price, there is an allowable loss; and (c) if the disposal price is equal to the acquisition price, there is neither a chargeable gain nor an allowable loss. real property means any land situated in Malaysia and any interest, option or other right in or over such land; land includes (a) the surface of the earth and all substances forming that surface; (b) the earth below the surface and substances therein; (c) buildings on land and anything attached to land or permanently fastened to any thing attached to land (whether on or below the surface); (d) standing timber, trees, crops and other vegetation growing on land; and (e) land covered by water; shares means all or any of the following: (a) stock and shares in a company; (b) loan stock and debentures issued by a company or any other corporate body, wherever incorporated; (c) a members interest in a company not limited by shares whether or not it has a share capital; (d) any option or other right in, over or relating to shares as defined in paragraphs (a) to (c);

Chek Sern Intellectual property rights reserved

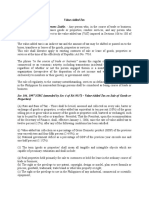

EXAMPTION The Minister exempts any person from the application of Schedule 5 of the Act on the payment of tax on the chargeable gain in respect of any disposal of asset on or after 1 January 2010 where the disposal is made after 5 years of the subject propertys acquisition. FORMULAR APPLICATION The Minister exempts any person from the application of Schedule 5 of the Act on the payment of tax on the chargeable gain in respect of any disposal of asset on or after 1 January 2010 subject to the condition that the amount of chargeable gain shall be determined in accordance with the following formula: A B Where:A : is the amount of tax charged on the chargeable gain on the person at the appropriate tax rate reduced by the amount of tax charged on such chargeable gain at the rate of 5%. B : is the amount of tax charged on such chargeable gain at the appropriate tax rate. C : is the amount of such chargeable gain. xC

Chek Sern Intellectual property rights reserved

RPGT Effective Tax Rate:Lets: Gain on chargeable property = Applicable tax rate = Where = ============== ============== Exemption formula:- 5% = (- 5%) - 5% x

Effective chargeable gain:(Chargeable Gain Exemption Allowance ) x Applicable Tax Rate

=( - 5% - 5% -5% - 5% -5% 5% x)x

= ( 1-

)xx

)xx

)xx

= =

)x

Note : =5% is not applicable

Das könnte Ihnen auch gefallen

- Republic Act No. 10752 Road Right of Way ActDokument9 SeitenRepublic Act No. 10752 Road Right of Way ActAppraiser PhilippinesNoch keine Bewertungen

- Act 53 - Income Tax Act 1967 (Malaysia Tax)Dokument601 SeitenAct 53 - Income Tax Act 1967 (Malaysia Tax)lcs1234678100% (1)

- The Secret of Being HappyDokument282 SeitenThe Secret of Being Happylcs1234678100% (3)

- Chap014 Solution Manual Financial Institutions Management A Risk Management ApproachDokument19 SeitenChap014 Solution Manual Financial Institutions Management A Risk Management ApproachFami FamzNoch keine Bewertungen

- The System of Government Budgeting Bangladesh: Motahar HussainDokument9 SeitenThe System of Government Budgeting Bangladesh: Motahar HussainManjare Hassin RaadNoch keine Bewertungen

- Income Tax Act, 1961Dokument13 SeitenIncome Tax Act, 1961Sanketh_Surey_6489Noch keine Bewertungen

- Topic 6 RPGTDokument41 SeitenTopic 6 RPGTMuhammadSajeNoch keine Bewertungen

- 90-17 Cpar - Local Government TaxesDokument37 Seiten90-17 Cpar - Local Government TaxesJellah NavarroNoch keine Bewertungen

- 01 Law1993Dokument17 Seiten01 Law1993GgoudNoch keine Bewertungen

- LGC RPTDokument19 SeitenLGC RPTMelissa MarinduqueNoch keine Bewertungen

- Real Estate - TaxationDokument13 SeitenReal Estate - TaxationVinay SharmaNoch keine Bewertungen

- Property Taxation Real Property Gain Tax CEA 1043Dokument57 SeitenProperty Taxation Real Property Gain Tax CEA 1043Afiq AfhamNoch keine Bewertungen

- VAT Codal and RegulationsDokument6 SeitenVAT Codal and RegulationsVictor LimNoch keine Bewertungen

- Ra 9480Dokument6 SeitenRa 9480cmv mendozaNoch keine Bewertungen

- Ra 9480 PDFDokument9 SeitenRa 9480 PDFMïë Jüŕ EťhNoch keine Bewertungen

- Income From Property IIUI Spring Semester 22Dokument13 SeitenIncome From Property IIUI Spring Semester 22Wahaj AhmedNoch keine Bewertungen

- VAT ActDokument16 SeitenVAT ActcasarokarNoch keine Bewertungen

- Chapter - I Computation of Total IncomeDokument24 SeitenChapter - I Computation of Total IncomeFardeen KhanNoch keine Bewertungen

- Amendment To The NIRCDokument14 SeitenAmendment To The NIRCDan DoligonNoch keine Bewertungen

- National Power Corp VS City of CabanatuanDokument3 SeitenNational Power Corp VS City of CabanatuanEmpty CupNoch keine Bewertungen

- Income Tax Act 1993 Updated Up To 1 April 2012Dokument127 SeitenIncome Tax Act 1993 Updated Up To 1 April 2012auriciveyNoch keine Bewertungen

- Sikkim Collection of Taxes and Prevention of Evasion of Payment ofDokument4 SeitenSikkim Collection of Taxes and Prevention of Evasion of Payment ofLatest Laws TeamNoch keine Bewertungen

- Codal-Local Power of TaxationDokument7 SeitenCodal-Local Power of TaxationKim DyNoch keine Bewertungen

- RA10752 - Acquisition of Right of Way-Rule67 On ExproprationDokument13 SeitenRA10752 - Acquisition of Right of Way-Rule67 On Exproprationkreistil weeNoch keine Bewertungen

- Saving On Real Estate Related TaxationDokument40 SeitenSaving On Real Estate Related TaxationLou SuyangNoch keine Bewertungen

- Property Tax Punjab 1958Dokument9 SeitenProperty Tax Punjab 1958Muhammad AliNoch keine Bewertungen

- ReviewerDokument4 SeitenReviewerroseyNoch keine Bewertungen

- Amendments in Finance Act, 2023Dokument3 SeitenAmendments in Finance Act, 2023Imran AlamNoch keine Bewertungen

- Taxation Reviewer 1Dokument110 SeitenTaxation Reviewer 1bigbully23Noch keine Bewertungen

- Right of WayDokument8 SeitenRight of WayChelle Rico Fernandez BONoch keine Bewertungen

- Howto Computeyour Capital GainsDokument55 SeitenHowto Computeyour Capital GainsAccounting & TaxationNoch keine Bewertungen

- Highlights of The CREATE LawDokument3 SeitenHighlights of The CREATE LawChristine Rufher FajotaNoch keine Bewertungen

- Section 11 BankingDokument6 SeitenSection 11 BankingMay TanNoch keine Bewertungen

- Gidc P.C.C. Additional Notified Area Consolidated Tax Rules, 1998Dokument6 SeitenGidc P.C.C. Additional Notified Area Consolidated Tax Rules, 1998Anita NautiyalNoch keine Bewertungen

- Republic Act No. 10752 An Act Facilitating The Acquisition of Right-Of-way Site or Location For National Government Infrastructure ProjectsDokument6 SeitenRepublic Act No. 10752 An Act Facilitating The Acquisition of Right-Of-way Site or Location For National Government Infrastructure ProjectsMilio MilioNoch keine Bewertungen

- Notes - Tax I - Create Law - Nov 24Dokument9 SeitenNotes - Tax I - Create Law - Nov 240506sheltonNoch keine Bewertungen

- G.R. No. 172087Dokument12 SeitenG.R. No. 172087monica may ramosNoch keine Bewertungen

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDokument9 SeitenBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJoy OrenaNoch keine Bewertungen

- Allowable Deductions SEC. 86. Computation of Net Estate. - For The Purpose of The Tax Imposed in ThisDokument5 SeitenAllowable Deductions SEC. 86. Computation of Net Estate. - For The Purpose of The Tax Imposed in ThisJenny Rose Castro FernandezNoch keine Bewertungen

- Immovable PropertyDokument24 SeitenImmovable PropertyAsif ShaikhNoch keine Bewertungen

- Fiscal Incentives To TEZ Operators and Registered Tourism Enterprises Within The TEZDokument2 SeitenFiscal Incentives To TEZ Operators and Registered Tourism Enterprises Within The TEZjerson_xx6816Noch keine Bewertungen

- BIR Ruling DA-229-06 (PAGCOR) PDFDokument4 SeitenBIR Ruling DA-229-06 (PAGCOR) PDFJonNoch keine Bewertungen

- Estate Tax CodalDokument10 SeitenEstate Tax CodalDeneb DoydoraNoch keine Bewertungen

- LegataxpptDokument25 SeitenLegataxpptDeepak R GoradNoch keine Bewertungen

- Withholding Tax: Bar Examination Questions and Answers in TaxationDokument14 SeitenWithholding Tax: Bar Examination Questions and Answers in TaxationSophia OñateNoch keine Bewertungen

- VAT ActDokument42 SeitenVAT ActJamie ReyesNoch keine Bewertungen

- RMC No 45-2015Dokument4 SeitenRMC No 45-2015GoogleNoch keine Bewertungen

- 15 Withholding TaxDokument14 Seiten15 Withholding TaxHaRry PeregrinoNoch keine Bewertungen

- Tax Law ReviewDokument8 SeitenTax Law ReviewIon FashNoch keine Bewertungen

- Begun and Held in Metro Manila, On Monday, The Twenty-Seventh Day of July, Two Thousand FifteenDokument7 SeitenBegun and Held in Metro Manila, On Monday, The Twenty-Seventh Day of July, Two Thousand FifteenDebra BraciaNoch keine Bewertungen

- Chapter 4 Legal IssuesDokument8 SeitenChapter 4 Legal IssuesNada AlhenyNoch keine Bewertungen

- Sources of Tax Laws Page 8Dokument16 SeitenSources of Tax Laws Page 8nazhNoch keine Bewertungen

- C CCC C: C C C C C C C C CDokument60 SeitenC CCC C: C C C C C C C C CAmit KhanNoch keine Bewertungen

- Bir Ruling No. 313-15Dokument4 SeitenBir Ruling No. 313-15Stacy Lyn LiongNoch keine Bewertungen

- Using Relevant Examples Discuss The Importance of Board of Governors in An Institution of LearningDokument10 SeitenUsing Relevant Examples Discuss The Importance of Board of Governors in An Institution of Learningivanongia2000Noch keine Bewertungen

- 2007 Taxation Law Q&ADokument6 Seiten2007 Taxation Law Q&AJose Maria Jude DuremdesNoch keine Bewertungen

- Inland Revenue Act 2006 oDokument207 SeitenInland Revenue Act 2006 osham777678678Noch keine Bewertungen

- Local Taxation UpdatedDokument71 SeitenLocal Taxation UpdatedEmille Llorente100% (1)

- Capital Gains TaxDokument3 SeitenCapital Gains TaxJeilo FactorNoch keine Bewertungen

- RR 2-98Dokument41 SeitenRR 2-98matinikki100% (2)

- AFC NotesDokument28 SeitenAFC NotesFaisal Islam ButtNoch keine Bewertungen

- Income From Other Sources PDFDokument22 SeitenIncome From Other Sources PDFRajendra PatelNoch keine Bewertungen

- The PEZA IssueDokument29 SeitenThe PEZA IssueArne TanNoch keine Bewertungen

- Turning Around Bad Fortune - Joey Yap's QiMen TribeDokument3 SeitenTurning Around Bad Fortune - Joey Yap's QiMen Tribelcs1234678100% (1)

- Outrunning Your Rival With Proper GST GuideDokument1 SeiteOutrunning Your Rival With Proper GST Guidelcs1234678Noch keine Bewertungen

- GST Brochure: Your Incredible Business PartnerDokument1 SeiteGST Brochure: Your Incredible Business Partnerlcs1234678Noch keine Bewertungen

- 1fta Forex Trading Course PDFDokument58 Seiten1fta Forex Trading Course PDFlcs1234678Noch keine Bewertungen

- Electronic Day Trading To Win PDFDokument161 SeitenElectronic Day Trading To Win PDFlcs1234678Noch keine Bewertungen

- Forex SimplifiedDokument154 SeitenForex Simplifiedlysakowski89% (9)

- Water Recycling PurposesDokument14 SeitenWater Recycling PurposesSiti Shahirah Binti SuhailiNoch keine Bewertungen

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperDokument15 SeitenThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoNoch keine Bewertungen

- KaleeswariDokument14 SeitenKaleeswariRocks KiranNoch keine Bewertungen

- Presentation On " ": Human Resource Practices OF BRAC BANKDokument14 SeitenPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziNoch keine Bewertungen

- Part 1Dokument122 SeitenPart 1Astha MalikNoch keine Bewertungen

- Fiscal Deficit UPSCDokument3 SeitenFiscal Deficit UPSCSubbareddyNoch keine Bewertungen

- (Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayDokument3 Seiten(Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayYuri VillanuevaNoch keine Bewertungen

- Financial Literacy PDFDokument44 SeitenFinancial Literacy PDFGilbert MendozaNoch keine Bewertungen

- Indian Contract ActDokument8 SeitenIndian Contract ActManish SinghNoch keine Bewertungen

- A View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)Dokument17 SeitenA View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)(FPTU HCM) Phạm Anh Thiện TùngNoch keine Bewertungen

- Quijano ST., San Juan, San Ildefonso, BulacanDokument2 SeitenQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzNoch keine Bewertungen

- Nissan Leaf - The Bulletin, March 2011Dokument2 SeitenNissan Leaf - The Bulletin, March 2011belgianwafflingNoch keine Bewertungen

- Pembayaran PoltekkesDokument12 SeitenPembayaran PoltekkesteffiNoch keine Bewertungen

- Percentage and Its ApplicationsDokument6 SeitenPercentage and Its ApplicationsSahil KalaNoch keine Bewertungen

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesDokument14 SeitenLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaNoch keine Bewertungen

- Bill CertificateDokument3 SeitenBill CertificateRohith ReddyNoch keine Bewertungen

- QQy 5 N OKBej DP 2 U 8 MDokument4 SeitenQQy 5 N OKBej DP 2 U 8 MAaditi yadavNoch keine Bewertungen

- Forex Fluctuations On Imports and ExportsDokument33 SeitenForex Fluctuations On Imports and Exportskushaal subramonyNoch keine Bewertungen

- Introduction - IEC Standards and Their Application V1 PDFDokument11 SeitenIntroduction - IEC Standards and Their Application V1 PDFdavidjovisNoch keine Bewertungen

- Business Cycle Indicators HandbookDokument158 SeitenBusiness Cycle Indicators HandbookAnna Kasimatis100% (1)

- PaySlip 05 201911 5552Dokument1 SeitePaySlip 05 201911 5552KumarNoch keine Bewertungen

- Modified Jominy Test For Determining The Critical Cooling Rate For Intercritically Annealed Dual Phase SteelsDokument18 SeitenModified Jominy Test For Determining The Critical Cooling Rate For Intercritically Annealed Dual Phase Steelsbmcpitt0% (1)

- Final - APP Project Report Script 2017Dokument9 SeitenFinal - APP Project Report Script 2017Jhe LoNoch keine Bewertungen

- Year 2016Dokument15 SeitenYear 2016fahadullahNoch keine Bewertungen

- Exim BankDokument79 SeitenExim Banklaxmi sambre0% (1)

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaDokument12 SeitenReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryNoch keine Bewertungen

- Use CaseDokument4 SeitenUse CasemeriiNoch keine Bewertungen

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesDokument19 SeitenIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64Noch keine Bewertungen