Beruflich Dokumente

Kultur Dokumente

IFRS News - November 2010

Hochgeladen von

Umair SheikhOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IFRS News - November 2010

Hochgeladen von

Umair SheikhCopyright:

Verfügbare Formate

www.pwc.

com/ifrs

IFRS news November 2010

IFRS news IASB Trustees go for Noahs ark approach

In this issue: 1 IASB appoints chairman and vice-chairman 2 Financial instruments Project update 3 Cannon Street Press Transition and effective dates 4 Contacts Hans Hoogervorst

To be IASB chairman from 1 July 2011

Ian Mackintosh

To be IASB vice-chairman from 1 July 2011

The Trustees of IASCF have taken a ground-breaking step in appointing a successor to current chairman Sir David Tweedie, following a Noahs ark, two-by-two approach. Hans Hoogervorst a Dutch politician with financial regulatory experience will become the next chairman of the IASB. He will be joined by a vice-chairman, Ian Mackintosh, current chairman of the Accounting Standards Board in the UK. Mr Hoogervorst will succeed Sir David Tweedie on his retirement as chairman of the IASB at the end of June 2011. He is currently chairman of the Netherlands Authority for the Financial Markets (AFM), the Dutch securities and market regulator he will resign this position before joining the IASB. He is also chairman of the Technical Committee of the International Organization of Securities Commissions (IOSCO), stepping down from this role in April. He was also until recently the co-chair of the Financial Crisis Advisory

Group (FCAG), an independent body of senior leaders formed to advise accounting standard-setters on their response to the global financial crisis. Mr Mackintosh, a former chief accountant of the Australian Securities and Investment Commission, has more than 30 years experience of national and international accounting standard-setting. He is currently chairman of the UK Accounting Standards Board and chairman of the group of national accounting standard-setters, a body in which more than 20 national and regional accounting standard-setting organisations participate. Sam Di Piazza, Trustee of the IFRS Foundation and former global CEO of PwC, called the appointment of Hans and Ian an outstanding choice. I have known Hans for several years. His background as Minister of Finance in The Netherlands gives him unique policy

CONTINUED

HOME

www.pwc.com/ifrs

experience of the issues faced by the IASB in its service to the public interest. On the crucial issue of independence, Hans has been absolutely clear. He is committed to investor protection and believes the independence of the IASB is primary. Having worked with him in his role as chairman of the Monitoring Board, his actions have confirmed his views. It has long been my view that the successor of Sir David Tweedie would

require a keen sense of business and finance, said Sam, but more importantly a skill in public policy not often found in the accounting profession. The IASB has made tremendous progress in its first decade, but the next 10 years will require both technical and public policy experience. I believe we have the perfect combination in Hans. Sam said of Ian MackIntosh, His deep experience in the profession and in

standard setting will serve him well in this new role. He has served in an outstanding manner as chair of the National Standard Setters since 2004, which gives him great perspectives of the global issues we face at the IASB. His diverse background, including his roots in New Zealand, his service in Australia and the UK, his work at the World Bank and the Australian Securities and Investment Commission will also aid in his service to the IASB.

Financial instruments project moves forward

The IASB has put in place several more building blocks of the financial instruments project. It has updated IFRS 9, Financial instruments, to include guidance on financial liabilities and derecognition of financial instruments, and has amended IFRS 7 to include disclosures around transferred financial assets. The accounting and presentation for financial liabilities and for derecognising financial instruments has been relocated from IAS 39, Financial instruments: Recognition and measurement, to IFRS 9. The guidance is unchanged with one exception: the accounting for financial liabilities that are designated at fair value through profit or loss (FVTPL), as explained below. IFRS 9 is applicable for accounting periods beginning on or after 1 January 2013. The IFRS 7 amendments are applicable for annual accounting periods beginning on or after 1 July 2011. including the related application and implementation guidance. The two existing measurement categories for financial liabilities remain unchanged: FVTPL and amortised cost. The criteria for designating a financial liability at FVTPL also remain unchanged. Entities are still required to separate derivatives embedded in financial liabilities where they are not closely related to the host contract. The separated derivative continues to be measured at FVTPL, and the residual debt host continues to be measured at amortised cost. The existing application guidance relating to embedded derivatives has been included in IFRS 9; it will continue to apply to derivatives embedded in non-financial items for example, foreign currency derivatives embedded in purchase and sales contracts. The requirements in IAS 39 for determining when financial instruments are derecognised from the balance sheet have also been relocated to IFRS 9 without any change. New measurement guidance Entities with financial liabilities designated at FVTPL recognise changes in the fair value due to changes in the liabilitys credit risk directly in other comprehensive income (OCI). There is no subsequent recycling of the amounts in OCI to profit or loss, but accumulated gains or losses may be transferred within equity. However, all fair value movements are recognised in profit or loss if presenting the change in fair value attributable to the credit risk of the liability in OCI would create an accounting mismatch in profit or loss. Determination of the accounting mismatch is at initial recognition of the financial liability and the determination is not reassessed. The mismatch must arise from an economic relationship between the financial liability and a financial asset that results in the liabilitys credit risk being offset by a change in the fair value of the asset. All fair value movements will be recognised in profit and loss for financial liabilities that are required to be measured at FVTPL (as distinct from those that the entity has designated at FVTPL), including financial guarantees and loan

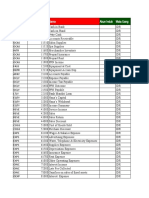

Key provisions

Items unchanged The requirements in IAS 39 regarding the classification and measurement of financial liabilities have been retained,

2 IFRS news November 2010

CONTINUED

HOME

www.pwc.com/ifrs

commitments measured at FVTPL. All derivatives and a banks own liabilities that it holds in its trading portfolio are in this category. Effective date and transition IFRS 9 amendments The effective date and transition requirements are consistent with IFRS 9 issued in November 2009 for the classification and measurement of financial assets. That is, IFRS 9 is mandatory for annual periods beginning on or after 1 January 2013. Early adoption is possible, but the rules are complex. There are three possible choices for adoption of the standard: The financial asset accounting provisions of IFRS 9 can be early adopted without adopting the financial liability requirements; All of the requirements (financial assets and financial liabilities) can be early adopted; or An entity can wait and adopt the standard at the mandatory adoption date, for a calendar year entity that would be 2013 and restatement of comparatives would be required.

An entity that chooses either of the early adoption options prior to 1 January 2012 would not be required to restate comparatives. There is additional transition guidance for the designation of financial liabilities or financial assets at FVTPL on initial application of IFRS 9. Entities that are affected should be aware of the requirements, as they are specific and detailed. Effective date and transition IFRS 7 amendments The additional disclosure requirements will be required for annual periods beginning on or after 1 July 2011, with earlier application permitted. Disclosures are not required for any period presented that is before the date the amendments are adopted; in other words, there is no requirement for comparatives in the year of adoption.

designated liabilities at FVTPL to eliminate an accounting mismatch or to avoid separating an embedded derivative. The additional disclosure requirements will impact any entity that sells, factors, securitises, lends or otherwise transfers financial assets.

What do I need to do?

Management of entities that currently designate (or in future may wish to designate) financial liabilities at fair value through profit or loss should familiarise themselves with the updated requirements of IFRS 9. Management should also consider carefully the planned timing of their adoption of IFRS 9. However, the financial instruments project is still evolving, and additional changes are expected for the impairment and hedging phases. The IASB has recently requested views on the effective date and transition requirements for the entire group of standards in the US GAAP convergence programme. This may well impact the transition dates and requirements set out above.

Impact

The changes to IFRS 9 will impact entities that have designated financial liabilities at FVTPL. For example, it impacts financial institutions that have

Request for views on effective dates and transition methods

A number of major projects are scheduled for completion in 2011, so the IASB and FASB are seeking views on how to sequence the effective dates of new standards in order to reduce the burden on preparers. The IASB will consider the needs of jurisdictions already using IFRSs and those planning to do so. The projects covered by the request for views are: all phases of the financial instruments project; revenue from contracts with customers;

insurance contracts and leases; pensions; other comprehensive income; consolidation; and joint arrangements.

Some of the new standards that are the subject of this request for views are being developed by the IASB and the FASB. The FASB has published a discussion paper inviting comments on the same issues. The IASB has asked for views on four

broad issues: preparing for transition to the new requirements; the implementation approach and timetable (effective dates for the new requirements and early adoption); international convergence considerations; and considerations for first-time adopters of IFRS. Comments are requested by 31 January 2011.

3 IFRS news November 2010

CONTINUED

HOME

www.pwc.com/ifrs

For further help on IFRS technical issues contact:

Business Combinations and Adoption of IFRS

mary.dolson@uk.pwc.com: Tel: + 44 (0)20 7804 2930 caroline.woodward@uk.pwc.com: Tel: +44 (0)20 7804 7392

Liabilities, Revenue Recognition and Other Areas

tony.m.debell@uk.pwc.com: Tel: +44 (0)20 7213 5336 mark.lohmann@uk.pwc.com: Tel: +44 (0)20 7212 4482

IFRS news editor

Financial Instruments and Financial Services

john.althoff@uk.pwc.com: Tel: + 44 (0)20 7213 1175 jessica.taurae@uk.pwc.com: Tel: + 44 (0)20 7212 5700 elizabeth.m.lynn@uk.pwc.com: Tel: + 44 (0)20 7804 0306

joanna.c.malvern@uk.pwc.com: Tel: +44 (0)20 7804 9377

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. It does not take into account any objectives, financial situation or needs of any recipient; any recipient should not act upon the information contained in this publication without obtaining independent professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers LLP, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. 2010 PricewaterhouseCoopers. All rights reserved. PricewaterhouseCoopers refers to the network of member firms of PricewaterhouseCoopers International Limited, each of which is a separate and independent legal entity.

4 IFRS news November 2010

CONTINUED

HOME

Das könnte Ihnen auch gefallen

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsVon EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsBewertung: 4 von 5 Sternen4/5 (11)

- Practical Guide To IFRS - Edition 1 18 June 2010 Practical Guide To IFRS 18 June 2010Dokument5 SeitenPractical Guide To IFRS - Edition 1 18 June 2010 Practical Guide To IFRS 18 June 2010valay82Noch keine Bewertungen

- ch6 IFRSDokument56 Seitench6 IFRSAnonymous 6aW7sZWdILNoch keine Bewertungen

- Investor Perspective Financial Instruments July 2014Dokument6 SeitenInvestor Perspective Financial Instruments July 2014Bheki TshimedziNoch keine Bewertungen

- Impact of IFRS139 On SectorsDokument19 SeitenImpact of IFRS139 On SectorsdarionxNoch keine Bewertungen

- Apc 316Dokument6 SeitenApc 316Md Jonayed HossainNoch keine Bewertungen

- 2012 Model Financial StatementsDokument140 Seiten2012 Model Financial StatementsBhava Nath Dahal100% (1)

- Ifrs Updates August 2019Dokument9 SeitenIfrs Updates August 2019obedNoch keine Bewertungen

- Thesis Ifrs 9Dokument8 SeitenThesis Ifrs 9bkx89b3r100% (2)

- Amendments On Financial Reporting Standards Part 1Dokument5 SeitenAmendments On Financial Reporting Standards Part 1Mon RamNoch keine Bewertungen

- Sa Aug11 Ifrs9Dokument7 SeitenSa Aug11 Ifrs9Parwez KurmallyNoch keine Bewertungen

- EY PBGuide April 2014Dokument26 SeitenEY PBGuide April 2014Pankaj GourNoch keine Bewertungen

- MBC Audited FS 2017 PARENTDokument57 SeitenMBC Audited FS 2017 PARENTMikx LeeNoch keine Bewertungen

- The Path To IFRS: Considerations For The Shipping IndustryDokument0 SeitenThe Path To IFRS: Considerations For The Shipping IndustryNam Duy VuNoch keine Bewertungen

- What Is IFRSDokument5 SeitenWhat Is IFRSRR Triani ANoch keine Bewertungen

- Applying FI Mar2016Dokument53 SeitenApplying FI Mar2016Vikas Arora100% (1)

- IFRS NotesDokument4 SeitenIFRS Notes05550100% (2)

- IFRSDokument26 SeitenIFRSSuchetana Anthony50% (2)

- Final Version of IFRS 9Dokument17 SeitenFinal Version of IFRS 9Sunil GNoch keine Bewertungen

- IFRS Illustrative Financial Statements (Dec 2019) FINALDokument290 SeitenIFRS Illustrative Financial Statements (Dec 2019) FINALPaddireddySatyamNoch keine Bewertungen

- IFRS Illustrative Financial StatementsDokument306 SeitenIFRS Illustrative Financial Statementsjohnthorrr100% (1)

- Adamay International Co., Inc.: Note 1 - General InformationDokument36 SeitenAdamay International Co., Inc.: Note 1 - General Informationgrecelyn bianesNoch keine Bewertungen

- Diff Betn Us Gaap - IfrsDokument9 SeitenDiff Betn Us Gaap - IfrsVimal SoniNoch keine Bewertungen

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Dokument10 SeitenIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNoch keine Bewertungen

- IFRSDokument2 SeitenIFRSparikshitshivNoch keine Bewertungen

- C C C CC CCCCC CC CCCCCCCCC CCC C ËDokument8 SeitenC C C CC CCCCC CC CCCCCCCCC CCC C ËAshu AshwiniNoch keine Bewertungen

- Tax Faculty - Seminar On Tax Impl of IFRS - Taiwo OyedeleDokument58 SeitenTax Faculty - Seminar On Tax Impl of IFRS - Taiwo OyedeleLegogie Moses AnoghenaNoch keine Bewertungen

- IfrsDokument23 SeitenIfrsdefactosnipeNoch keine Bewertungen

- Personal Details Name: Purvesh Jobanputra MFM: Sem 5, Div: B Roll No: 220 Project:On IFRS Submitted To: Professor Hemant JunarkarDokument12 SeitenPersonal Details Name: Purvesh Jobanputra MFM: Sem 5, Div: B Roll No: 220 Project:On IFRS Submitted To: Professor Hemant JunarkarKhwahish ArmanNoch keine Bewertungen

- SABS - Impending IFRS Convergence - Vinayak PaiDokument7 SeitenSABS - Impending IFRS Convergence - Vinayak PaiBasappaSarkarNoch keine Bewertungen

- ABA - Annual Report 2018Dokument146 SeitenABA - Annual Report 2018Ivan ChiuNoch keine Bewertungen

- Introduction To IFRSDokument13 SeitenIntroduction To IFRSgovindsekharNoch keine Bewertungen

- 1478-8225-Aftermaths of IFRS CCCDokument25 Seiten1478-8225-Aftermaths of IFRS CCCsincereboy5Noch keine Bewertungen

- Financial Instruments Accounting For Asset Management PDFDokument39 SeitenFinancial Instruments Accounting For Asset Management PDFNikitaNoch keine Bewertungen

- NG Ifrs9 ImplementationDokument1 SeiteNG Ifrs9 ImplementationDritaNoch keine Bewertungen

- Convergence With IFRS in IndiaDokument32 SeitenConvergence With IFRS in IndiaVimal GogriNoch keine Bewertungen

- Nfrs BanksDokument62 SeitenNfrs BanksArtha sarokarNoch keine Bewertungen

- FA Assignment 2 MarkupDokument2 SeitenFA Assignment 2 MarkupKomal RehmanNoch keine Bewertungen

- Current Applicable International Accounting Standard (IAS) Under IASBDokument11 SeitenCurrent Applicable International Accounting Standard (IAS) Under IASBEZEKIEL100% (1)

- Subsedaries Working ProcessDokument5 SeitenSubsedaries Working ProcessKaiumNoch keine Bewertungen

- IFRS BasicsDokument8 SeitenIFRS BasicsgeorgebabycNoch keine Bewertungen

- Accounting Standard IndiaDokument114 SeitenAccounting Standard IndiakprakashmmNoch keine Bewertungen

- 29 September: Accounting Developments NewsletterDokument4 Seiten29 September: Accounting Developments Newslettershaharhr1Noch keine Bewertungen

- Comparison of Ind As and IFRSDokument10 SeitenComparison of Ind As and IFRSAman SinghNoch keine Bewertungen

- Csa 20090717 33-314 Ifrs-RegDokument2 SeitenCsa 20090717 33-314 Ifrs-RegzelcomeiaukNoch keine Bewertungen

- Illustrative Ifrs Hkfrs Dec2014Dokument317 SeitenIllustrative Ifrs Hkfrs Dec2014petitfm100% (1)

- Ifrs ProjectDokument5 SeitenIfrs ProjectAlexandra CavcaNoch keine Bewertungen

- IFRS1Dokument33 SeitenIFRS1Ejiemen OkunegaNoch keine Bewertungen

- Ch01 SMDokument33 SeitenCh01 SMcalz_ccccssssdddd_550% (1)

- AfmDokument15 SeitenAfmabcd dcbaNoch keine Bewertungen

- Coa Circular No. 2024 - 007 - 0001Dokument21 SeitenCoa Circular No. 2024 - 007 - 0001nieves.averheaNoch keine Bewertungen

- PnA Accounting Alert: IASB Publishes IFRS For SMEsDokument8 SeitenPnA Accounting Alert: IASB Publishes IFRS For SMEsRodwin DeunaNoch keine Bewertungen

- Ifrs ProjectDokument12 SeitenIfrs Projectpurvesh_200180% (5)

- Preface To IFRS Preface To International Financial Reporting Standards Purpose of Issuing PrefaceDokument4 SeitenPreface To IFRS Preface To International Financial Reporting Standards Purpose of Issuing PrefaceJere Mae Bertuso TaganasNoch keine Bewertungen

- Kiranjot Kaur 2Dokument27 SeitenKiranjot Kaur 2Rupali MalhotraNoch keine Bewertungen

- International Financial Reporting StandardsDokument10 SeitenInternational Financial Reporting StandardsCrisostomo RayoNoch keine Bewertungen

- Deloitte IFRS 1 First Time Implementation GuideDokument84 SeitenDeloitte IFRS 1 First Time Implementation GuideRaymond M Reed100% (1)

- 25 Notes of Financial StatementsDokument35 Seiten25 Notes of Financial StatementsDustin ThompsonNoch keine Bewertungen

- PFRS or IFRS 9Dokument11 SeitenPFRS or IFRS 9安美仁Noch keine Bewertungen

- Daftar Akun Rumah Cantik HanaDokument4 SeitenDaftar Akun Rumah Cantik HanaLSP SMKN 1 BanjarmasinNoch keine Bewertungen

- Arguelles Medical ClinicDokument3 SeitenArguelles Medical ClinicPJ PoliranNoch keine Bewertungen

- Financial and Managerial Accounting 8Th Edition Wild Test Bank Full Chapter PDFDokument67 SeitenFinancial and Managerial Accounting 8Th Edition Wild Test Bank Full Chapter PDFClaudiaAdamsfowp100% (9)

- Ind AS 36Dokument37 SeitenInd AS 36rajan tiwariNoch keine Bewertungen

- Assignment Solutions Relationship Between Capital Structure and PerformanceDokument19 SeitenAssignment Solutions Relationship Between Capital Structure and PerformanceShoaib MuhammadNoch keine Bewertungen

- Cost of CapitalDokument16 SeitenCost of CapitalReiner NuludNoch keine Bewertungen

- Valuation Certificate Subject: Valuation of Fixed Assets: Dear Sir/madamDokument4 SeitenValuation Certificate Subject: Valuation of Fixed Assets: Dear Sir/madamArjun BaralNoch keine Bewertungen

- CEO COO General Counsel in Bermuda Resume William FawcettDokument3 SeitenCEO COO General Counsel in Bermuda Resume William FawcettWilliamFawcett100% (1)

- Investment Valuation SlideDokument231 SeitenInvestment Valuation Slidehung311aNoch keine Bewertungen

- ACC 311 Ass#2Dokument7 SeitenACC 311 Ass#2Justine Reine CornicoNoch keine Bewertungen

- Cost Benefit Analysis Is Done To Determine How WellDokument5 SeitenCost Benefit Analysis Is Done To Determine How WellShaikh JahirNoch keine Bewertungen

- Jaguar Land Rover PLC LX000000002046407490Dokument409 SeitenJaguar Land Rover PLC LX000000002046407490mehulssheth50% (2)

- Types of Audit AssignmentDokument21 SeitenTypes of Audit AssignmentKanika GoelNoch keine Bewertungen

- Ars International, Bill No. 880, DT., 17.12.2021Dokument1 SeiteArs International, Bill No. 880, DT., 17.12.2021Ars InternationalNoch keine Bewertungen

- Kinds of ProspectusDokument5 SeitenKinds of ProspectusPriya KumariNoch keine Bewertungen

- Sachin Tyagi Insurance PDFDokument4 SeitenSachin Tyagi Insurance PDFsachin tyagiNoch keine Bewertungen

- Gannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadDokument1 SeiteGannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadNaga GeeNoch keine Bewertungen

- Central Industries PLC: (Company Reg - No. PQ 121)Dokument10 SeitenCentral Industries PLC: (Company Reg - No. PQ 121)wasantha12Noch keine Bewertungen

- A Project Report On Taxation in IndiaDokument59 SeitenA Project Report On Taxation in IndiaYash Bhagat100% (1)

- m339w Sample ThreeDokument8 Seitenm339w Sample ThreeMerliza JusayanNoch keine Bewertungen

- Catchment Mapping BillaDokument12 SeitenCatchment Mapping Billa28-RPavan raj. BNoch keine Bewertungen

- Rajya Sabha Unstarred Question No-1832 Loans Written OffDokument6 SeitenRajya Sabha Unstarred Question No-1832 Loans Written Offnafa nuksanNoch keine Bewertungen

- NCFM Model Test PaperDokument8 SeitenNCFM Model Test PapersplfriendsNoch keine Bewertungen

- SEAT Ibiza Range BrochureDokument25 SeitenSEAT Ibiza Range BrochureJason SmithNoch keine Bewertungen

- Sample Resume - FinanceDokument2 SeitenSample Resume - FinanceNiraj DeobhankarNoch keine Bewertungen

- NG Cho Cio V NG Diong-Case DigestDokument2 SeitenNG Cho Cio V NG Diong-Case DigestAngelette BulacanNoch keine Bewertungen

- 2022-2023 Fillable ISFAADokument5 Seiten2022-2023 Fillable ISFAAKouassi Thimotée YaoNoch keine Bewertungen

- PWT 90Dokument1.315 SeitenPWT 90burcakkaplanNoch keine Bewertungen

- Olamic Healthcare GST Invoice: Sri Krishna PharmaDokument2 SeitenOlamic Healthcare GST Invoice: Sri Krishna PharmaYours PharmacyNoch keine Bewertungen