Beruflich Dokumente

Kultur Dokumente

Brewing Industrz

Hochgeladen von

klokarteOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Brewing Industrz

Hochgeladen von

klokarteCopyright:

Verfügbare Formate

,Case Study One: GIobaI forces and the Western European brewing industry"

Question One: Using the data from the case, carry out for the Western European brewing

industry (i) a PESTEL anaIysis and (ii) a five forces anaIysis. What do you concIude?

AII references in this assignment to "the case" refer to the case study: "GIobaI forces and

the Western European brewing industry"

A Porter Five Forces analysis and a PESTEL analysis help analyzing the Western European

brewing industry's attractiveness and external changes.

The PESTEL analysis of the macro-environment identifies the main external factors influencing the

brewing industry as the following:

PESTEL anaIysis for the European brewing industry

ollLlcal urlnk drlvlng leglslaLlon nPS healLh campalgns agalnsL excesslve alcohol consumpLlon

more pressure on producers Lo be soclally responslble

Lconomlc

growLh of Aslan economles decllne of maLure Luropean markeL shlfL Lo offLrade

supermarkeLs offer low prlces and challenglng brewers

Cverall decrease ln Luropean beer consumpLlon

Soclal

lncrease of beer consumpLlon ln SouLhern Lurope changlng soclal Lrends ln Lurope

preference for subsLlLuLes wlne and exoLlc beers

awareness of healLh lssues and dangers of blnge drlnklng

1echnologlcal

advanced Lechnology and lnnovaLlon lmprove manufacLurlng processes and economles of

scale producLlon of speclallLles such as exLracold and Lrlple fllLered

lnLerneL presence lmproves brandlng and adverLlslng opporLunlLles

LnvlronmenLal

packaglng such as glass and cans are recycled Lo reduce wasLe growlng envlronmenLally

frlendly behavlour of large brewers

Legal

hlgher penalLles for drlnk drlvlng sLrlcLer llcenslng laws and closlng Llmes low resLrlcLlons

on mergers of Luropean brewers regulaLlons on prlce flxlng by Lu commlsslon

Porter's five forces model helps to identify the attractiveness of an industry and shows where

competitive power lies within an industry. n the following table the five forces and their main factors

are listed, while the "+ indicates the strength of each force.

Porter's Five Forces ModeI for the European brewing industry

uyers ++ reLallers lncreaslngly compeLlLlve and powerful wlLh own label beer

offerlng low prlces Lo aLLracL cusLomers offLrade shlfL has lncreased buyers power

Suppllers ++

hlghly consolldaLed ln packaglng lndusLry brewers maln purchaslng cosLs are

packaglng cosLs

becomlng more powerful as lnLernaLlonal companles domlnaLe Lhe lndusLry

SubsLlLuLes + no swlLchlng cosLs for consumers hlgh demand for exoLlc producLs and wlne ln Lurope

new LnLranLs + hlgh caplLal lnvesLmenL no legal enLry barrlers lncreased number of lmporLs

LhreaL of Chlnese brewerles lncreased lnLernaLlonallsaLlon Lhrough acqulslLlons

CompeLlLlve

8lvalry

decreaslng demand ln markeL wlLh many players lncreases rlvalry compeLlLlon Lakes

place ln prlclng hlsLory of prlce flxlng Large brewerles seek Lo Lake over compeLlLors

++

Discussion and analysis

ne of the main factors affecting the brewing industry negatively is the political campaigning against

drink driving and its legal implications. EU wide regulations have become tighter in terms of drink

driving and underage drinking and there are higher penalties for crimes influenced by alcohol. n the

UK regulations have been implemented that stop bars, pubs and restaurant from selling alcohol

after a certain time, depending on their license. Additionally the NHS campaigns against alcohol

abuse to raise awareness of health issues and alcohol consumption. This has led to a decrease of

beer consumption of 9000000 litres in the UK between 2003 and 2007 (Table 1). These political

restrictions have had negative effects on the industry. The results are an increase of beer sold in

supermarkets and a decrease of beer sold in pubs and bars. This shift from on-trade to off-trade

represents a challenge for European brewers as retailers have become very powerful. The case

argues that more than one fifth of beer volume is sold through retailers and these are offering their

"own label low-price beer.

As the market is at a mature, declining stage in Europe, there has been huge growth in markets like

China and South America. European brewers are trying to grow their market share by aggressive

takeovers, acquisition and mergers, which is a result of the economic changes taking place in the

brewing industry's environment. Although sales volumes are declining in Europe, sales values are

rising as companies introduce premium products and exotic products at higher prices. However, a

big share of these premium products is imported from non-European countries (Table 2). According

to the case, Heineken saw an 11% rise in packaging costs, which are the brewers' main purchasing

costs, in 2006, as the packaging industry raised their prices for cans and bottles.

The economic recession has affected the European market negatively, but beer is a relatively cheap

product, which makes the brewing industry quite stable during a recession. ther negative impacts

on brewers are caused by social trends. Political and economic changes, such as regulations on

licensing laws and the shift to off-trade have led to a rise in drinking at home, instead of in pubs and

bars. The shift to off-trade is supported by changing lifestyles, more focus on health and fitness, and

an overall tendency to prefer wine and exotic premium products, such as flavoured beers (Table 1).

This trend is dominant in Westerns and Northern Europe, whereas in Southern Europe where the

consumption of beer is steadily growing. This factor can be related to the growing middle class in

Europe and could explain the growing demand in emerging economies, such as China and Brazil.

Technological innovations have positively affected the brewing industry. Production and efficiency

have been improved and le to economies of scale. Advanced technology enabled brewers to be

innovative, develop new products, such as ice cold, and triple filtered beers. The internet offers new

opportunities for brand building and advertising the brand globally.

Brewing companies are increasingly acting environmentally friendly and many have CSR

programmes in place. Energy use, C2 emissions, recycling and water use are important factors,

breweries are considering to protect the environment. AB-nBev (2011) is aiming to reduce 99% of

its waste by 2012.

Legal changes have both broadened and restricted trading opportunities for the brewing industry.

n a global level, trade barriers have been removed to enable free trade with the EU and other

nations, such as the US and China. n the UK however, government regulations have tightened

licensing laws and reduced the alcohol limit for drink driving. EU wide there have been problems

with price fixing arrangements between large brewers, which is because of competitive pressure,

mergers, acquisitions, and growing consolidation in the European market.

The analysis of Porter's Five Forces Model shows that there are many threats to the European

brewing industry. The threat of new entrants is medium due to increasing acquisition and

consolidation and the high capital investment required to enter the market. However, there are no

legal entry barriers and there is a growing market for imported beers (Table 2) which allowed

Chinese brewers to enter the European market.

n addition, the bargaining power of suppliers is very high. There are only a few large, international

suppliers in the industry that can increase prices anytime and there is no substitute available for the

brewers, which could be seen in the 11% hike in packaging costs Heineken experienced in 2006.

Another equally powerful threat are the buyers, which includes retailers and individual customers.

For customers the switching costs are very low, but for individual sales, this does not severely affect

the industry. The retailers, such as supermarkets represent strong competition as around one fifth of

beer is sold through supermarkets and "own label beer is sold at the supermarkets' profit. n

industrialised economies, this challenges brewers even more to be innovative and to develop new

products and advertising strategies.

The threat of substitutes to the brewing industry is medium, with wine, exotic beers and cider being

the main threats. There are no switching costs for consumers and the change of consumer

consumption indicates a strong interest towards substitutes in Western Europe. However,

consumers who like beer and a brand will stick to their favourite as beer is not as differentiated.

Competitive Rivalry is very high as there are a few strong players in a consolidated market with not

much differentiation. So competition takes place in pricing which has let to price-fixing cartels and

high penalties imposed by the EU commission. This can be solved by product innovation and

differentiation, such as the introduction of premium products. The overall decrease of beer

consumption in Western Europe has led to more competition and aggressive acquisitions to

increase market shares.

The PESTEL analysis has shown there are negative political, legal, economic and social impacts on

the brewing industry, but also positive technological and environmental, which increase the

industry's innovation and productivity.

The European brewing industry is at a mature stage, with decreasing demand and slow growth

where bargaining power of suppliers and buyers is high. Threat of new entrants is medium as the

market is very consolidated and has strong players which makes it more difficult to enter. Demand is

decreasing not only due to economic changes but also social changes and the availability of

substitutes. Therefore, the European market is not attractive to enter. Brewers will instead look into

Asian and Eastern European markets to increase growth rates as the European brewing industry

will continue to consolidate. Aggressive marketing strategies and premium products will support the

growth of market shares in emerging economies, where the market for beer is steadily growing.

Question two

For the three breweries outIined above, expIain:

(a) How these trends wiII impact differentIy on these different companies; and

(b) The reIative strengths and weaknesses of each company

Answer to part (a)

A-B nBev

A-B nBev is the largest Brewer worldwide after the acquisition of nBev in 2008. t has followed an

aggressive strategy of acquisitions and mergers and is therefore highly competitive. t is the

strongest player in the market and has bargaining power over suppliers and buyers, which makes it

relatively resilient to the Porter's Five Forces and external factors. However, after the expensive

acquisition in 2008, the company withdrew from the Chinese market. n the future, the company will

see less organic growth as it already took over the biggest rivals.

Greene King

Greene King is specialized in running pubs and brewing in the UK and is the largest British brewer.

Applying the Five Forces Model, Greene King is in high rivalry with international brewers entering

the UK market. The company successfully managed to reduce competition in the domestic market

by acquisitions. The shift to off-trade could affect the company negatively in the future as they are

heavily depending on their over 2000 pubs in the UK. The case indicates that around 50 pubs per

week were closed during the recession in 2009.

Tsing Tao

Tsing Tao profits from the economic and social changes in Europe. The company has taken

advantage of the demand for exotic beers and has increased its exports that account for 50% of

China's beer exports and is Chinese brand leader in the US according to the case. The company

aims to build an international brand in the home and Western market. The low exchange rate allows

cheaper exports.

Answer to part (b)

A-B nBev

As the largest brewer worldwide, A-B nBev owns over 300 brands, including Stella Artois, Heineken

and Becks, which are top selling beers bringing high margins. Another strength is the company's

high efficiency due to it owning a large network of breweries which allows them to achieve

economies of scale and adds value. Advanced technology and expertise in different plants allows

for innovation that gave the company the advantage to enter the soft drink market in South America

and lower the threat of substitutes.

Weaknesses are that the company followed a costly and aggressive strategy of acquisitions and let

them no choice but to pull out of the Chinese market and sell Eastern and Central European

operations in order to afford the acquisition.

Greene King

Greene King is a strong player in the UK market but only in the UK market. t is small compared to

global players such as A-B nBev and takeovers are a possible threat. t has no presence

internationally and is dependent on the UK market. Sales volume has been decreasing in the UK

and is negatively affected by the governement changes and restrictions in the UK, which affect the

company's ontrade sales.

Strengths are that Greene King also sells to supermarkets directly and owns UK brands, such as

ld Speckled Hen. t strategy of operating in on- and off-trade gave the company a competitive

advantage in its domestic market. wning its own breweries and only focusing on a few brands

results in lower production costs and higher margins. verall they are in a strong position in the UK

market but not able to compete with global players which can result in possible takeovers if no

change of strategy is being implemented.

Tsing Tao

The analysis shows great potential for growth in the Western market, where exotic beer is in high

demand. The company is present in 62 countries and has experienced steady growth. n Europe it

is still in a niche market and mostly only available in supermarkets and Chinese retailers but it has

potential for growth if branded and marketed properly. ts Chinese heritage could be seen as a

disadvantage as Chinese products are not associated with high quality. The company could have

better opportunities if it put more emphasis on its German roots to differentiate itself in the

international market. Weaknesses are that the company is dependent on exports and focuses less

on the domestic market. n the Chinese market, it faces less competition and less foreign

competitors due to legal restrictions on imports.

A reason for the inability to establish the brand in the global market could be its lack of marketing

strategy. f branded properly the company can make use of the growth potential in Western

markets, such as USA, South America, Eastern and Western Europe.

References:

Anheuser-Busch-nBev, 2011. (pdf) Available at: http://www.ab-

inbev.com/pdf/AB_CSR10_Environment.pdf [Accessed 19 ctober 2011]

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Tailoring Strategy To Fit Specific Industry and Company SituationsDokument30 SeitenTailoring Strategy To Fit Specific Industry and Company SituationsOkkinNoissacNoch keine Bewertungen

- Promotional Competitions: A Winning Tool For Tourism MarketingDokument10 SeitenPromotional Competitions: A Winning Tool For Tourism MarketingkutukankutuNoch keine Bewertungen

- Real 2010: Protecting The BrandDokument22 SeitenReal 2010: Protecting The BrandKatie O'BrienNoch keine Bewertungen

- Case Study 4 Sprite - Soft Drink CBDokument4 SeitenCase Study 4 Sprite - Soft Drink CBAakriti Pateria50% (2)

- TOEIC - English Reading PracticeDokument4 SeitenTOEIC - English Reading PracticekhuelvNoch keine Bewertungen

- Marketing Plan ATTDokument17 SeitenMarketing Plan ATTDora Wan100% (1)

- Loans and AdvancesDokument64 SeitenLoans and AdvancesShams SNoch keine Bewertungen

- Case 1 We've Got Rhythm!Dokument25 SeitenCase 1 We've Got Rhythm!Sujith Johnson67% (3)

- Advanced Competitive Position AssignmentDokument7 SeitenAdvanced Competitive Position AssignmentGeraldine Aguilar100% (1)

- PVR Marketing PDFDokument32 SeitenPVR Marketing PDFRudro Mukherjee100% (1)

- PCC Module 3Dokument3 SeitenPCC Module 3Aries MatibagNoch keine Bewertungen

- Dove Assignment 2 PDFDokument10 SeitenDove Assignment 2 PDFsimranjit kaur100% (1)

- Truecolor A Range of Cosmetics: Consumer Behavior AssignmentDokument9 SeitenTruecolor A Range of Cosmetics: Consumer Behavior AssignmentLam ZoulianNoch keine Bewertungen

- A8 BRM Stage 0Dokument2 SeitenA8 BRM Stage 0Puneet MishraNoch keine Bewertungen

- Asq - Design FmeaDokument35 SeitenAsq - Design Fmeasa_arunkumarNoch keine Bewertungen

- Marine 2Dokument9 SeitenMarine 2Neesa AsriNoch keine Bewertungen

- Vayam Pahad (SIP) (HORECA)Dokument13 SeitenVayam Pahad (SIP) (HORECA)Rupam YadavNoch keine Bewertungen

- Swot AnalysisDokument4 SeitenSwot AnalysisAshirbad NayakNoch keine Bewertungen

- Task 3: Applications of Customer DataDokument1 SeiteTask 3: Applications of Customer DatasivaniNoch keine Bewertungen

- PEST AnalysisDokument5 SeitenPEST Analysislokesh_bhatiyaNoch keine Bewertungen

- Diagnose The Underlying Cause of The Difficulties That The JITD Program Was Created To Solve. What Are The Benefits and Drawbacks of This Program?Dokument2 SeitenDiagnose The Underlying Cause of The Difficulties That The JITD Program Was Created To Solve. What Are The Benefits and Drawbacks of This Program?SARTHAK NAVALAKHA100% (1)

- Cost Terminology and Cost BehaviorsDokument8 SeitenCost Terminology and Cost BehaviorsHunson Abadeer100% (2)

- ANE BooksDokument2 SeitenANE BooksMurali Medudula0% (1)

- About The Industry: Spanish Exports by SegmentDokument2 SeitenAbout The Industry: Spanish Exports by SegmentSamay KafulNoch keine Bewertungen

- Hilton HonorsDokument21 SeitenHilton Honorsursnew2385100% (1)

- Chapter 4 - StuDokument28 SeitenChapter 4 - StuGiang GiangNoch keine Bewertungen

- Manage Human Resource Strategic Planning MyerDokument10 SeitenManage Human Resource Strategic Planning MyershumaiylNoch keine Bewertungen

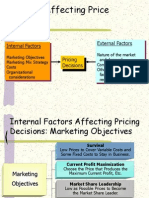

- Internal Factors External Factors Pricing DecisionsDokument17 SeitenInternal Factors External Factors Pricing DecisionssaurabhsaggiNoch keine Bewertungen

- Organizational StructureDokument18 SeitenOrganizational StructureAzeem AhmadNoch keine Bewertungen

- Consumption FunctionDokument15 SeitenConsumption FunctionRifaz ShakilNoch keine Bewertungen