Beruflich Dokumente

Kultur Dokumente

E Boy

Hochgeladen von

Biorigha Grace Yousuo0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten9 SeitenKFC (Kentucky Fried Chicken) Holdings Berhad is a Malaysia-based investment holding corporation which operates in the eating places sector. It has its headquarters in Kuala Lumpur, Malaysia. Some of its products are; popcorn chicken, Zinger XXL burger, fresh buns, cakes, snacks, sauces, chicken rice.

Originalbeschreibung:

Originaltitel

E-BOY

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenKFC (Kentucky Fried Chicken) Holdings Berhad is a Malaysia-based investment holding corporation which operates in the eating places sector. It has its headquarters in Kuala Lumpur, Malaysia. Some of its products are; popcorn chicken, Zinger XXL burger, fresh buns, cakes, snacks, sauces, chicken rice.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten9 SeitenE Boy

Hochgeladen von

Biorigha Grace YousuoKFC (Kentucky Fried Chicken) Holdings Berhad is a Malaysia-based investment holding corporation which operates in the eating places sector. It has its headquarters in Kuala Lumpur, Malaysia. Some of its products are; popcorn chicken, Zinger XXL burger, fresh buns, cakes, snacks, sauces, chicken rice.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

A CASE STUDY ON THE ANNUAL REPORT OF KFC HOLDINGS (MALAYSIA) BERHAD, A MALAYSIA PUBLIC LIMITED COMPANY Component 1 submitted in partial fulfillment of the requirements for Accounting & its Regulatory Framework (FE1010).

Prepared for: Mr. Alfred Pang

Prepared by: UXXXXXX UXXXXXX UXXXXXX

School Of Business and Management (SOBM) Linton University College 17th October, 2011

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

(i) ABSTRACT

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

(ii) CONTENTS PAGE 1.0: Introduction 1.1: Background of KFC 1.1.1: The economic environment surrounding KFC Holdings 2.1: Analysis of the financial ratios 3.1: Evaluation of the cash and working capital management of KFC Holdings 4.1: The concepts used in the preparation of KFC Holdings annual report 4.2: The contents and significance of the directors and auditors reports and the chairmans statement 5.1: Qualitative and quantitative views about KFC Holdings.. 6.1: Conclusion. Word count. 7.1: Bibliography. 8.1: Appendices.

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

1.0: INTRODUCTION Finance is the backbone of every organization. So, for KFC to compete favorably in the global world of business characterized with hyper-competition, it must have financial managers who have the skills of financial analysis to diagnose the companys ills, prescribe useful remedies and anticipate the financial consequences of their actions (Gitman, 2005). It is in view of this fact that, we shall carry out a financial analysis of KFC Holdings Berhad from 2006 to 2010. 1.1: BACKGROUND OF KFC KFC (Kentucky Fried Chicken) Holdings Berhad is a Malaysia-based investment holding corporation which operates in the eating places sector. It was incorporated on the 22nd of December, 1980 and listed on Bursa Malaysia. It has its headquarters in Kuala Lumpur, Malaysia. Some of its products are; Popcorn Chicken, Zinger XXL burger, fresh buns, cakes, snacks, sauces, chicken rice meals and others. It operates in three main segments through its subsidiaries which are; restaurants, poultry and ancillary. By December 31, 2010, the firm had operated 515 KFC Restaurants across Malaysia, 77 stores in Singapore, nine in Brunei and seven in India with over 13,217 employees. Some of its subsidiaries are; Ayamas Food Corporation Sdn Bhd, Ayamas Integrated Poultry Industry Sdn Bhd, Cilik Bistari Sdn Bhd, KFC. India Holdings Sdn Bhd and Paramount Management Sdn Bhd. While its competitors are; McDonald, Chicken Rice Shop, Marrybrown and others. It has over 44% market share (KFC, 2011). KFC has received various awards owing to its quality products some of which are; Trusted Brand in 2010 - Gold Award, Putra Brand Award 2010 (Silver), Brand Excellence in Product Branding for Fast Food Chicken Category, 2008 and others (KFC, 2011). The vision of KFC Malaysia is to be the most prominent chain of food service provider in the Asia Pacific region by being customer oriented and providing high quality goods. While the mission is to optimize profitability, thus enhancing owners value and provide constant growth (KFC, 2011). 1.1.1: THE ECONOMIC ENVIRONMENT The global economic recession that affected all ASEAN countries gave KFC some challenges. The recession caused low exports, high produce prices, jobs losses, and overall market

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

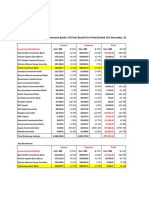

instability. Consequently, Malaysia had a GDP growth of -1.7% in 2009 as against the 4.6% growth of 2008. However, the economy grew by 4.5% in the final quarter of the year due to governments instigation of incentive packages. Again, continued growth in private consumption and improved public segment spending led to increased domestic demand and great exports. Therefore, the economy grows by 7.2% in 2010, thus improving the overall revenue of KFC. Other economic sectors that record growth are the services and production segments that achieve principally great growth of 6.8% and 11.4% correspondingly (KFC, 2011). 2.0: ANALYSIS OF THE FINANCIAL RATIOS This section examines the financial affairs of KFC through ratios. Five ends of year financial statements were examined starting from 2006 to 2010 using liquidity. Liquidity is used to ascertain a firm's ability to pay off its short-terms debts obligations. Three ratios were calculated under liquidity-current, quick and cash ratios. 2.1: CURRENT RATIO Current ratio consists of current assets and current liabilities. The ratio of current assets to current liabilities is the ratio of cash flowing in to cash flowing out of the company. KFCs current ratios for 2006 to 2010 are 1.15, 1.27, 1.15, 1.22 and 1.17 respectively. This shows that for every RM1 paid out, RM1.15cent, RM1.27cent, RM1.15cent, RM1.22cent and RM1.17cent was received respectively. However, the ratios are low. So, to have a margin of safety and a profit margin, KFCs current ratios must be greater than RM2 (Owen, 2003). This can be achieved by reducing current liabilities while increasing current assets. 2.1.1: QUICK RATIO This is similar to current ratio except the omission of stock. It is omitted because stock takes long time to turn into cash, thereby becoming questionable whether current assets represent cash the company is to receive. KFCs quick ratios from 2006 to 2010 are 0.10, 0.98, 0.70, 0.75 and 0.68 respectively. The ratios indicate that for each RM1 paid out, excluding stock, RM0.10cent, RM0.98cent, RM0.70cent, RM0.75cent and RM0.68cent was received respectively. However, the ratios are quite low showing that more money goes out of the company than coming in

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

(Gitman, 2005). Hence, KFC should reduce unnecessary liabilities while improving current assets through good marketing strategies. 2.1.1.1: CASH RATIO This ratio measures the ability of a company to utilize its cash and cash equivalents to pay its current financial obligations. KFCs cash ratios from 2006 to 2010 are; RM0.53, RM0.55, RM0.28, RM0.34 and 0.32 respectively. The ratios indicate that for every RM1 cash paid out, only 53cent, 55cent, 28cent, 34cent and 32cent was received respectively, suggesting negative net cash flow (Owen, 2003). Therefore, the company should improve on its cash generation by reducing debtors days because prolong negative net cash flow will cause bankruptcy. After examining the financial statements of KFC from 2006 to 2010, it was discovered that 2007 marked the ever best financial performance year. It was gathered that the feat was achieved because of what the chairman, board of directors called Customer Mania which serve as the guiding principle helping them to render quality products and services. Again, 2007 witnessed the expansion of its restaurants and the creation of enticing range of new products. Besides, KFC enhances its operational processes, reduce costs and improve its governance (KFC, 2011). However, 2008 and 2009 financial years had some challenges owing to the global recession which reduced exports, led to losses of jobs and low spending. But, the last quarter of 2009 and 2010 witnessed some improvement. Hence, the liquidity ratios improved (KFC, 2011). 3.1: EVALUATION OF THE CASH AND WORKING CAPITAL MANAGEMENT OF KFC HOLDINGS BASED ON THE FYE 2009 AND FYE 2010 Cash and working capital management entails a managerial accounting tactic that focuses on maintaining efficient levels of both components of working capital-current assets and current liabilities, in respect to each other. It ensures that a firm has enough cash flow to meet its shortterm debt obligations with operating expenses (Dyson, 2004). Looking at KFCs 2009 and 2010 cash flow statements, it shows that it has positive working capital. This means the company was able to pay off its short-term liabilities and still has enough for daily operations. The cash and cash equivalents for 2009 and 2010 are 123,449, 000 and

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

131,712,000 respectively. The latter working capital is better than the former. This is due to more expansion of business following the recovery of the global recession (KFC, 2011). However, KFC should improve on its working capital management by collecting money due from debtors more quickly, reducing inventory levels relative to sales, and negotiate for longer credit days from suppliers so as to provide a margin of safety and a profit of margin (Gitman, 2005). 4.0: THE CONCEPTS USED IN THE PREPARATION OF KFC HOLDINGS ANNUAL REPORT The financial statements of KFC are prepared based on various concepts. Hence, this section will examine some of such. 4.1: Historical cost concept Historical cost concept records assets at the original purchase cost (Holmes, and Gee, 2011). The notes to the financial statements declared that the reports are prepared on the historical cost basis except for assets like: Property, plant and equipment and Investment properties. 4.1.1: Consistency concept This concept shows the provision of meaningful trend comparison over long period of times. For example, when 31 December is chosen as the end of a financial year, such will be maintained over a period of time (Holmes, and Gee, 2011). And going by KFCs annual reports, this trend is maintained. 4.1.1.1: Periodicity This concept examines the period of time chosen to present the results of the financial statements. Some companies choose March as the end of a financial year while others choose December just like KFC. This means the accounting period is twelve years (Holmes, and Gee, 2011). 4.1.2: Marching concept This concept states that the expenses incurred by a company to produce that periods revenue must be subtracted from returns earned (Holmes, and Gee, 2011). And, KFC implements this

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

concept in the preparation of its income statements. The periods cost of sales is subtracted from the sales. Similarly, the concept is applied in the cash flow statements. 4.1.2.1: Objectivity This concept stipulates that reports must be prepared with no bias (Holmes, and Gee, 2011). And KFCs financial statements bear this in mind while preparing it. Hence, the auditors declared that the reports are true and fair showing that there are no mistakes. 4.1.2.2: Going concern concept This concept assumes that the firm will keep on functioning. This concept can be seen in the cash and working capital management through the cash flow statements. The aim of the cash flow is to ensure that the company pays off its short-term liabilities, thus ensuring the continuity of the company (Holmes, and Gee, 2011). 4.1.2.3: Accrual concept Accrual concept recognizes revenue when sales is made and expenses when incurred even when the cash is not paid yet (Holmes, and Gee, 2011). KFC implements this concept in its balance sheets where it has accounts receivables and payables. Similarly, accounts receivables and payables are recorded in the cash flow statements though cash has not been paid yet. 4.2: THE CONTENTS AND SIGNIFICANCE OF THE DIRECTORS AND AUDITORS REPORTS AND THE CHAIRMANS STATEMENT This section takes a critical look at the directors report, auditors report and the chairmans statement. It will start with the directors report followed by the auditors. Subsequently, the chairmans statement will be examined. The directors report is classified into various parts such as; principal business activities, financial performance, reserves and provisions, dividends policy, 5.1: QUALITATIVE AND QUANTITATIVE VIEWS ABOUT KFC HOLDINGS CONCLUSION

UXXXXXXXXXXX, UXXXXXXXX AND UXXXXXXXX

WORD COUNT2100 BIBLIOGRAPHY Dyson (2004) Accounting for Non-Accounting Students, 6th ed. Prentice Hall Holmes, G., Sugden, A., Gee. P (2011) Interpreting Company Reports and Accounts 10th ed. Prentice Hall KFC (2011) About the Company Online, Available from:

http://www.kfcholdings.com.my/English/FlashSite/AboutCompany/AboutCompany.asp Accessed on: 29th September, 2011 Owen, A.S. (2003) Accounting for Business Studies Burlington: Butterworth-Heinemann

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Mini project analysis of top 50 companies in Nifty 50 indexDokument19 SeitenMini project analysis of top 50 companies in Nifty 50 indexcharan tejaNoch keine Bewertungen

- ULAB Midterm Exam Business Communication CourseDokument5 SeitenULAB Midterm Exam Business Communication CourseKh SwononNoch keine Bewertungen

- Effects of Declaration of NullityDokument3 SeitenEffects of Declaration of NullityJacqueline PaulinoNoch keine Bewertungen

- E-Ticket: Travel InformationDokument2 SeitenE-Ticket: Travel InformationAli BajwaNoch keine Bewertungen

- IMUX 2000s Reference Manual 12-12-13Dokument70 SeitenIMUX 2000s Reference Manual 12-12-13Glauco TorresNoch keine Bewertungen

- Amigable vs. Cuenca DigestDokument2 SeitenAmigable vs. Cuenca Digestunbeatable38100% (5)

- Future Forms ExplainedDokument2 SeitenFuture Forms Explainednata_makarNoch keine Bewertungen

- Padua Vs PeopleDokument1 SeitePadua Vs PeopleKlaire EsdenNoch keine Bewertungen

- Art 36 FC (G.R. No. 196359. May 11, 2021)Dokument183 SeitenArt 36 FC (G.R. No. 196359. May 11, 2021)tin_m_sNoch keine Bewertungen

- Serban Nichifor: Happy New Year, Michele ! - For Clarinet in B-Flat and Piano (Score & Part)Dokument6 SeitenSerban Nichifor: Happy New Year, Michele ! - For Clarinet in B-Flat and Piano (Score & Part)Serban NichiforNoch keine Bewertungen

- Trade and Investment PoliciesDokument24 SeitenTrade and Investment PoliciesSarsal6067Noch keine Bewertungen

- STOCKL - Community After TotalitarianismDokument178 SeitenSTOCKL - Community After TotalitarianismMmarimmarNoch keine Bewertungen

- How To Talk in An Arranged Marriage Meeting - 22 StepsDokument3 SeitenHow To Talk in An Arranged Marriage Meeting - 22 StepsqwertyasdfgNoch keine Bewertungen

- CH04 Interest RatesDokument30 SeitenCH04 Interest RatesJessie DengNoch keine Bewertungen

- Kenyan Brokerage & Investment Banking Financial Results 2009Dokument83 SeitenKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNoch keine Bewertungen

- Application Form Registration of Job, Service Contractor, Sub ContractorDokument1 SeiteApplication Form Registration of Job, Service Contractor, Sub ContractorJane PerezNoch keine Bewertungen

- Bulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaDokument4 SeitenBulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaSsd IndiaNoch keine Bewertungen

- Criminal Law Case Digest CompilationDokument4 SeitenCriminal Law Case Digest CompilationJohnson YaplinNoch keine Bewertungen

- Public Administration in South Asia India, Bangladesh and Pakistan PDFDokument513 SeitenPublic Administration in South Asia India, Bangladesh and Pakistan PDFZahra ZubairNoch keine Bewertungen

- Gramsci Hegemony Separation PowersDokument2 SeitenGramsci Hegemony Separation PowersPrem VijayanNoch keine Bewertungen

- Kotak Mahindra Bank Limited FY 2020 21Dokument148 SeitenKotak Mahindra Bank Limited FY 2020 21Harshvardhan PatilNoch keine Bewertungen

- Letter Writing - Useful PhrasesDokument3 SeitenLetter Writing - Useful PhrasesLewis Enim100% (4)

- Test Question For Exam Chapter 1 To 6Dokument4 SeitenTest Question For Exam Chapter 1 To 6Cherryl ValmoresNoch keine Bewertungen

- Ralph M. Lepiscopo v. George E. Sullivan, Warden, 943 F.2d 57, 10th Cir. (1991)Dokument2 SeitenRalph M. Lepiscopo v. George E. Sullivan, Warden, 943 F.2d 57, 10th Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- Damodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaDokument15 SeitenDamodaram Sanjivayya National Law University Visakhapatnam, A.P., Indiaamit dipankarNoch keine Bewertungen

- MID-TERM EXAM ANSWER SHEETDokument11 SeitenMID-TERM EXAM ANSWER SHEETbLaXe AssassinNoch keine Bewertungen

- Dunns Info On AttorneysDokument5 SeitenDunns Info On Attorneyscynthiadear06100% (1)

- Heirs of Malabanan Vs RepublicDokument9 SeitenHeirs of Malabanan Vs RepublicAnisah AquilaNoch keine Bewertungen

- SPPTChap 006Dokument16 SeitenSPPTChap 006iqraNoch keine Bewertungen

- RB Baker-Miron Charter Revenue PDFDokument56 SeitenRB Baker-Miron Charter Revenue PDFNational Education Policy CenterNoch keine Bewertungen