Beruflich Dokumente

Kultur Dokumente

Guidelines For Valuation of Equity Shares of Companies Andthe Business and Net Assets of Branches Part I

Hochgeladen von

Dhanasekaran RamanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Guidelines For Valuation of Equity Shares of Companies Andthe Business and Net Assets of Branches Part I

Hochgeladen von

Dhanasekaran RamanCopyright:

Verfügbare Formate

GUIDELINES FOR VALUATION OF EQUITY SHARES OF COMPANIES ANDTHE BUSINESS AND NET ASSETS OF BRANCHESPART I 1.

These are operating guidelines for valuation of equity shares of companies. Briefly, theywill be referred to as valuation guidelines.2.These are purely administrative instructions for internal official use and are, therefore, notto be quoted, cited or published as the official guidelines of the Government.3. They will be effective from the date 1 of their issue and will be applicable to all pendingand future cases arising for consideration in the Department of Economic Affairs,Ministry of Finance.4. Specially, these guidelines will be applicable to the valuation of (a) equity shares of companies, private and public limited(b) Indian business/net assets of the sterling tea companies; and(c) Indian business/net assets of the branches of foreign companies. PART II Principles and method of valuation 5. The objective of the valuation process is to make a best reasonable judgment of the valueof the equity shares of a company or of the business and net assets of a branch in casesarising for valuation under the Foreign Exchange Regulation Act, 1973, and the CapitalIssues (Control) Act, 1947; The best reasonable judgment of the value will be referred toas the fair value (FV) and it will be arrived at on the basis of the following in the mannerdescribed in the subsequent paragraphs:(1) Net asset value (NAV);(2) Profit-earning capacity value (PECV);(3) Market value (MV) in the case of listed shares.6.1 Net asset value (NAV).--The net asset value, as at the latest audited balance-sheet date,will be calculated starting from the total assets of the company or of the branch anddeducting there from all debts, dues, borrowings and liabilities, including current andlikely contingent liabilities and preference capital, if any. In other words, it shouldrepresent the true net worth of the business after providing for all outside present and potential liabilities. In the case of companies, the net asset value as calculated from the assets side of the balance-sheet in the above manner will be cross checkedwith equity share capital plus free reserves and surplus, less the likely contingentliabilities.6.2. In calculating the net asset value, the following points shall particularly be kept inview:(i) If a new bonus issue or a fresh issue of equity capital is proposed, it shall betaken into account. The face value of the fresh issue of equity capital will be added to the existing net worth as at the latest balance -sheet date and the resulting net worth Will be divided by the enlarged equity capital base, including the fresh issue as well as the new bonus issue.(ii)

Intangible assets like goodwill, patents, trade marks, copyrights, etc., will notbe taken into account in calculating the assets.(iii) Revaluation of fixed assets, if any, will ordinarily not be taken into accountBut if the revaluation had taken place long ago, say nearly 15 years ago, it maynot be reasonable to deduct it from the total assets. (iv) Any reserve which has not been created out of genuine profits or outof cash will not be taken into account, e.g., amalgamation reserve orreserve created by changing the method of depreciation or reservecreated by revaluation of fixed assets, etc.(v) Provision for gratuity based on actuarial valuation, but not for taxes,as well as provision for any other terminal benefits due to theemployees will be provided for and deducted as liabilities.(vi) Liabilities like arrears of preference dividend, unclaimed dividends,dividends not provided for separately but proposed to be paid out of reserves, miscellaneous expenditure to the extent not written off, debitbalance on profit and loss account, arrears of depreciation, etc., willbe provided for and deducted from the total assets. So also, adequateprovision will be made for bad and doubtful debts.(vii) In the case of contingent liabilities, a judgment must be made of theliabilities that are likely to impair the net worth of the company and itshould be provided for on the liabilities side. In order to do so, theclarifications necessary may be obtained from the company and theirauditors.(viii) In the matter of provision for depreciation, the following approachwill be adopted: (a) if the company has consistently been following the straight linemethod of depreciation, the depreciation as provided for in theaccounts may be accepted in calculating the net asset value andit is not necessary to reckon depreciation according to thewritten down value method as claimed by the company forincome-tax purposes.

(b) If, however, within the preceding five years, the company has switched over from the written down value method to thestraight line method, then the provision for depreciation will bereckoned according to the written down value method as if thecompany has not made the switch over. For this purpose, thecompany should be asked to furnish the necessary information,especially the depreciation claimed for income-tax purposes.Where, however, a company follows right from the beginningthe straight line method for depreciation of new fixed assets,although it might be following the written down value methodof valuation for the older assets, the depreciation as providedfor in the accounts of the company will be accepted both for theold and new assets because this cannot be regarded as a switchover in the method of depreciation. The criterion fordetermining whether there has been a switch over or not is thuswhether there has been a change in the method of depreciationin respect of the same fixed assets within the preceding fiveyears. (c)

In the case of valuation of branches, the provision fordepreciation will always be reckoned according to the writtendown value method. If the accounts are based on the straightline method, then the company must be asked to furnish thedepreciation provision according to the written down valuemethod. 6.3 The calculation of the net asset value will be recorded, with the necessarydetails, in the pro forma shown in Annexure I. 7.1 Profit-earning capacity value (PECV) -The profit-earning capacityvalue will be calculated by capitalising the average of the after-tax profits atthe following rates:(i) 15% in the case of manufacturing companies. (ii) 20% in the case of trading companies. (iii) I 7% in the case of intermediate companies, that is to say, companies whose turnover from trading activity is more than 40%,but less than 60% of their total turnover.7.2 While ordinarily, the capitalisation rate for a manufacturing companywill be 15% there may be exceptional cases where the capitalisation ratemay have to be liberalised in order to ensure fair and equitable valuation.Such cases, where discretion may need to be exercised, are illustrated below:(i) Where, in the case of a listed share, the average of the net assetvalue and the profit-earning capacity value based on 15%capitalisation rate is less than the average market price by asubstantial margin, say by over 20%. In such cases, the company

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Uses and Limitations of Profitability Ratio Analysis in Managerial PracticeDokument6 SeitenUses and Limitations of Profitability Ratio Analysis in Managerial PracticeAlexandra AxNoch keine Bewertungen

- WWW - Capitalwaters.nl: Capital Waters Convertible Loan Agreement A.1.0 Page 1 of 9Dokument9 SeitenWWW - Capitalwaters.nl: Capital Waters Convertible Loan Agreement A.1.0 Page 1 of 9Anouar El HajiNoch keine Bewertungen

- Updates (Company Update)Dokument1 SeiteUpdates (Company Update)Shyam SunderNoch keine Bewertungen

- Dissolution of PartnershipDokument17 SeitenDissolution of PartnershipJASKARANNoch keine Bewertungen

- 2 Ceng 6108Dokument49 Seiten2 Ceng 6108addisu SissayNoch keine Bewertungen

- Loan Applicatinaniagsloauwvjwon FormDokument6 SeitenLoan Applicatinaniagsloauwvjwon FormSantosh Kumar GuptaNoch keine Bewertungen

- Introduction To Accounting: Pg. 1 Compiled By: Abdul Ahad ButtDokument38 SeitenIntroduction To Accounting: Pg. 1 Compiled By: Abdul Ahad ButtMuhammad FaisalNoch keine Bewertungen

- Commonwealth Bank StatementDokument5 SeitenCommonwealth Bank Statementsattazee1992100% (1)

- Social Entrepreneurship ManualDokument54 SeitenSocial Entrepreneurship ManualAndreea AcxinteNoch keine Bewertungen

- Indebtedness Assumed Exceeds Tax Basis of Property SoldDokument3 SeitenIndebtedness Assumed Exceeds Tax Basis of Property SoldJemalyn De Guzman TuringanNoch keine Bewertungen

- What If Gafa Replaced Traditional Banks?: Translation: Wency-Wenceslas MOUNDOUNGADokument10 SeitenWhat If Gafa Replaced Traditional Banks?: Translation: Wency-Wenceslas MOUNDOUNGAMike BurdickNoch keine Bewertungen

- Internship Report On Meezan Bank CompleteDokument86 SeitenInternship Report On Meezan Bank CompleteArslan96% (27)

- Chap 013Dokument30 SeitenChap 013sueernNoch keine Bewertungen

- UBS Investment Fund Account/Custody Account RegulationsDokument2 SeitenUBS Investment Fund Account/Custody Account RegulationsLeonardo RivasNoch keine Bewertungen

- Chapter 12 - Leverage - Text and End of Chapter Questions - 1Dokument39 SeitenChapter 12 - Leverage - Text and End of Chapter Questions - 1naimenimNoch keine Bewertungen

- For The Year Ended Year 1 Year 2 Year 3 Year 4: Income Statement ParticularsDokument5 SeitenFor The Year Ended Year 1 Year 2 Year 3 Year 4: Income Statement ParticularsTanya SinghNoch keine Bewertungen

- Drill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormDokument3 SeitenDrill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormKaye GonxalesNoch keine Bewertungen

- NBFC in IndiaDokument19 SeitenNBFC in IndiaBharath ReddyNoch keine Bewertungen

- Riding The South Sea Bubble (Peter Temin e Hans-Joachim Voth)Dokument52 SeitenRiding The South Sea Bubble (Peter Temin e Hans-Joachim Voth)João Henrique F. VieiraNoch keine Bewertungen

- Multiple Choice QuestionsDokument6 SeitenMultiple Choice QuestionsCandy DollNoch keine Bewertungen

- Credit Card ApplicationsDokument36 SeitenCredit Card Applicationsapi-333146577Noch keine Bewertungen

- FAR B41 Final Pre-Board Exam (Questions, Answers - Solutions)Dokument14 SeitenFAR B41 Final Pre-Board Exam (Questions, Answers - Solutions)Joanna MalubayNoch keine Bewertungen

- Rupee Max FormccbDokument2 SeitenRupee Max FormccbDesikanNoch keine Bewertungen

- Investment Risk Tolerance QuizDokument3 SeitenInvestment Risk Tolerance QuizPrabriti NeupaneNoch keine Bewertungen

- البنك الضامنDokument21 Seitenالبنك الضامنNada QiseerNoch keine Bewertungen

- Fundamental Analysis SeminarDokument18 SeitenFundamental Analysis SeminarAndrew WangNoch keine Bewertungen

- 02 2024 2 02446996 Fee VoucherDokument1 Seite02 2024 2 02446996 Fee Vouchersaeed123awan566Noch keine Bewertungen

- Questions Chapter 7Dokument22 SeitenQuestions Chapter 7SA 10Noch keine Bewertungen

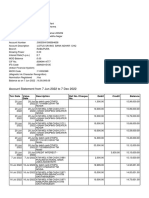

- Account Statement From 7 Jun 2022 To 7 Dec 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument3 SeitenAccount Statement From 7 Jun 2022 To 7 Dec 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRdb TalkNoch keine Bewertungen

- Arslan Rahim Financial and Risk ManagementDokument21 SeitenArslan Rahim Financial and Risk ManagementTehreem ZafarNoch keine Bewertungen