Beruflich Dokumente

Kultur Dokumente

Policies

Hochgeladen von

ngmoradiya0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

10 Ansichten3 Seiten100deg FDI under the automatic route is now permitted in all segments oI power sector including trading. Customs duty on import oI capital goods Ior Mega Power Projects has been reduced to nil. Ten year tax holiday under section 80IA oI the Income Tax Act is available to enterprises engaged in development, operation and maintenance.

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden100deg FDI under the automatic route is now permitted in all segments oI power sector including trading. Customs duty on import oI capital goods Ior Mega Power Projects has been reduced to nil. Ten year tax holiday under section 80IA oI the Income Tax Act is available to enterprises engaged in development, operation and maintenance.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

10 Ansichten3 SeitenPolicies

Hochgeladen von

ngmoradiya100deg FDI under the automatic route is now permitted in all segments oI power sector including trading. Customs duty on import oI capital goods Ior Mega Power Projects has been reduced to nil. Ten year tax holiday under section 80IA oI the Income Tax Act is available to enterprises engaged in development, operation and maintenance.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

CERTAIN POLICIES RELATED TO POWER SECTOR

Liberalization of FDI Regulations:

i. 100 FDI under the automatic route is now permitted in all

segments oI power sector including trading;

ii. Equal participation opportunities have been extended to both domestic

and Ioreign investors.

Fiscal Incentives

i. Customs duty on import oI capital goods Ior Mega Power Projects has

been reduced to nil.

ii. Ten year tax holiday under section 80IA oI the Income Tax Act is

available to enterprises engaged in development, operation and

maintenance oI power generation projects, subject to compliance with

conditions prescribed therein.

Subsequent to ratiIying the Kyoto protocol, an institutional mechanism to

govern the setting up and operation oI a 'carbon emissions exchange is

in the process oI being established. Such a move is likely to result in

substantial investments in clean sources oI energy as the carbon credits that

would be earned through the same would serve as a signiIicant revenue

stream Ior the investor.

The success oI the above incentives can be gauged Irom the Iollowing Iacts:

The Power Sector has received US$ 2.73 billion in FDI between

April 2000 and July 2008

OI the total corporate investments announced between January - June 2008,

the power sector attracted the maximum amount, with announced

investment aggregating US$ 40.84 billion

40 GW oI generation capacity, at a cost oI US$ 44 billion is presently

under execution.

The private sector has already achieved Iinancial closure oI 4,400 MW oI

capacity generation.

Sector Specific Opportunities

Coal

At 51, Coal is the single-largest source oI energy at the disposal oI the

power sector. (KPMG Report, November 2007)

By 2011 12, demand Ior coal is expected to increase to 730 MMT p.a.,

creating a supply shortage oI over 50 MMT

.

India has the Iourth largest proven coal reserves in the world, pegged at

96 billion tones, creating an investment opportunity oI US$ 10 15 billion

over the next 5 years.

Oil

The demand Ior Oil which is currently the second most important source oI

energy - is expected to grow Irom 119 MTOE in 2004 to 250 MTOE in 2025

at an annual growth rate oI 3.6.

However, domestic production Ior the corresponding period is expected to

increase at approximately 2.6 only.

As a result, our reliance on oil imports is likely to increase Irom its present

level oI 72 to 90 by 2025.

To combat this issue, the government has opened up the domestic oil sector Ior

private participation under the New Exploration Licensing Policy (NELP).

Under the competitive bidding process prescribed under the NELP, investment

commitments oI US$ 8 billion towards oil exploration projects have already

been received. Bidding Ior more such projects is currently in progress and is

expected to result in Iurther investment inIlows into this sector.

Natural Gas

India has vast reserves oI natural gas. More than 700 billion cubic meters oI

natural gas have been discovered in the last decade alone.

Demand Ior Natural Gas is expected to grow at a CAGR oI 12 over the next

5 years to reach 279 MMSCMD by 2012.

The importance oI natural gas as an energy source has witnessed a signiIicant

increase over the past decade on account oI the Iollowing two reasons:

Rising popularity oI compressed natural gas (CNG) as an alternative source

oI automotive Iuel;

Increased penetration through availability oI 'piped gas at residences; and

Imminent depletion oI traditional energy sources such as coal and oil.

/ro Power

With it intricate network oI rivers, substantial opportunities Ior generation

oI hydro-power exist in India.

Only 22 oI the 150 GW hydroelectric potential in the country has

been harnessed so Iar.

Private participation will play a key role in meeting the target

requirement oI an additional 45 GW over the next 10 years.

Win/ Energ

India is the 4th largest country in the world in terms oI installed wind

energy.

India`s potential oI wind power is pegged at 45,000 MW while its current

capacity stands at only 7,660MW.

Tax incentives, including availability oI accelerated depreciation

80 under WDV method on cost incurred on setting up oI wind turbine

generators have resulted in signiIicant private investment in this area.

Solar Energ

Despite the prevalence oI an inherent advantage in the Iorm oI solar

insulation, the potential Ior solar energy is virtually untapped in India.

India`s installed solar based capacity stands at a mere 100MW

compared to its present potential oI 50,000MW.

Based on the substantial investment opportunities that exist in this

sector, it is estimated that by 2031 32, solar power would be the single

largest source oI energy, contributing 1,200 MTOE i.e. more than 30

oI our total expected requirements.

Nuclear Energ

By 2032, the government plans to raise the contribution oI nuclear energy

Irom the current level oI less than 3 to around 10 oI the country's

installed capacity.

The signing oI the Indo US nuclear deal has created signiIicant

opportunities Ior several players across the entire power supply chain, with

an estimated investment opportunity oI US$ 10 billion over the next Iive

years.

Further, India has among the world`s largest reserves oI alternative nuclear

Iuel thorium. Accordingly, substantial investment opportunities are also

likely to arise once commercial production based on thorium becomes

Ieasible.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Gorgon Emp Offshore Feed Gas Pipeline Installation Management PlanDokument364 SeitenGorgon Emp Offshore Feed Gas Pipeline Installation Management Planafasf100% (1)

- FFBLDokument44 SeitenFFBLismailbuttNoch keine Bewertungen

- Ethylene Recovery Through Dephlegmator TechnologyDokument9 SeitenEthylene Recovery Through Dephlegmator TechnologyMohamed Abushrida100% (1)

- Eneva SA: A Key Solution To Enhance Electricity Supply in Brazil: Initiate With BuyDokument58 SeitenEneva SA: A Key Solution To Enhance Electricity Supply in Brazil: Initiate With BuyBeto ParanaNoch keine Bewertungen

- A Commodity Report On Brent Crude OilDokument8 SeitenA Commodity Report On Brent Crude OilgauravmandawawalaNoch keine Bewertungen

- MWM TCG2020Dokument8 SeitenMWM TCG2020Md Iqbal HossainNoch keine Bewertungen

- June 24th Pages - Gowrie NewsDokument12 SeitenJune 24th Pages - Gowrie NewsTonya HarrisonNoch keine Bewertungen

- Calentadores Electricos ChromaloxDokument24 SeitenCalentadores Electricos ChromaloxelmerNoch keine Bewertungen

- Ferrum Energy Catalogo enDokument15 SeitenFerrum Energy Catalogo enMEHDINoch keine Bewertungen

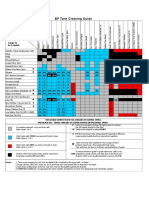

- BP Tank Cleaning Guide05Dokument1 SeiteBP Tank Cleaning Guide05CELESTIALNoch keine Bewertungen

- Méziane Boudellal - Power-To-Gas - Renewable Hydrogen Economy For The Energy Transition-De Gruyter (2018)Dokument227 SeitenMéziane Boudellal - Power-To-Gas - Renewable Hydrogen Economy For The Energy Transition-De Gruyter (2018)FabNoch keine Bewertungen

- BunkerDokument7 SeitenBunkerDhananjayan GopinathanNoch keine Bewertungen

- CEW Boiler BookDokument16 SeitenCEW Boiler Bookfauzi endraNoch keine Bewertungen

- GB50160 99Dokument45 SeitenGB50160 99Anonymous YjKZdJTNoch keine Bewertungen

- Outline:: Iii. ConclusionDokument9 SeitenOutline:: Iii. ConclusionFatah Hilman SetiawanNoch keine Bewertungen

- GHG ManualDokument162 SeitenGHG ManualLeonel Lumogdang100% (1)

- K Factor or Watson FactorDokument6 SeitenK Factor or Watson FactorZakyAlFatonyNoch keine Bewertungen

- CV Oil & Gas EngineerDokument5 SeitenCV Oil & Gas EngineerpoetoetNoch keine Bewertungen

- Role of Padma Bridge in boosting Bangladesh's economyDokument25 SeitenRole of Padma Bridge in boosting Bangladesh's economyMosiur Rahman100% (1)

- PSO Term Report .Dokument13 SeitenPSO Term Report .Sami MemonNoch keine Bewertungen

- DOE PC 91008 0374 OSTI - ID 3175 in Situ Combustion Handbook Hydroxi Aluminum 1Dokument424 SeitenDOE PC 91008 0374 OSTI - ID 3175 in Situ Combustion Handbook Hydroxi Aluminum 1Anonymous JMuM0E5YO100% (2)

- Válvulas de Alívio NaucoDokument12 SeitenVálvulas de Alívio NaucoBruno CoutoNoch keine Bewertungen

- Boilers PDFDokument11 SeitenBoilers PDFKevinNoch keine Bewertungen

- The Durgapur PR-WPS OfficeDokument33 SeitenThe Durgapur PR-WPS OfficeSuraj SharmaNoch keine Bewertungen

- What is a conventional source of energyDokument2 SeitenWhat is a conventional source of energyYogendra PatilNoch keine Bewertungen

- Medium speed generator sets for power solutionsDokument24 SeitenMedium speed generator sets for power solutionsthomas1313Noch keine Bewertungen

- Casale Advanced Ammonia TechnologiesDokument35 SeitenCasale Advanced Ammonia TechnologiesMaribel ParragaNoch keine Bewertungen

- Four Steps: To Recovering Heat Energy From WastewaterDokument3 SeitenFour Steps: To Recovering Heat Energy From WastewaterNicole FelicianoNoch keine Bewertungen

- Integrated Solutions For Oil & GasDokument52 SeitenIntegrated Solutions For Oil & Gasmehrzad1373Noch keine Bewertungen

- LNG Bunker SlidesDokument38 SeitenLNG Bunker SlidesChristopher Hoo100% (5)