Beruflich Dokumente

Kultur Dokumente

Technical Report 22nd November 2011

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Technical Report 22nd November 2011

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Technical Research | November 22, 2011

Daily Technical Report

Sensex (15952) / NIFTY (4778)

Yesterday, after a gap down opening, we witnessed yet another session with extreme pessimism. A massive selling pressure led indices to close well below 4800 after nearly seven weeks. On the sectoral front, the Metal, Banking and Realty corrected sharply in yesterdays session. There was no sector in the positive territory. The advance decline ratio was strongly in favor of declining counters (A=781 D=1971). (Source www.bseindia.com)

Exhibit 1: Nifty Daily Chart

Formation

There is no specific formation seen on the chart.

Trading strategy:

As mentioned in our earlier report, we witnessed a sharp correction after violating low of the bullish hammer and indices closed well below 4800 mark. Indices are now nearing crucial support level of 15745 / 4718. We may witness a minor bounce back up to 16297 16397 / 4874 4916, mainly due to oversold condition of daily oscillators. However, a close below 15745 / 4718, may attract massive selling pressure, which may drag indices lower to test 15650 15330 / 4675 4540 levels in coming trading sessions. Therefore, we reiterate our view that traders should stay light on positions and follow strict stop losses . View Resistance levels Support level Neutral 4874 - 4916 4764 4718

Source: Falcon

Actionable points:

For Private Circulation Only |

Technical Research | November 22, 2011

Bank Nifty Outlook - (8554)

Bank nifty opened on a flat note and traded with negative bias throughout the day to close near the lowest point of the day. We witnessed strong selling pressure on the violation of the low of the Dragon Fly Doji pattern formed on Friday and close below the low (8706) has negated the bullish probability of this pattern. Therefore, if Bank Nifty sustains below yesterdays low of 8522, then it is likely to test 8430 8300 levels. On the upside, 8650 - 8730 levels may act as resistance levels for the day. Actionable points: View

Resistance Levels Support Levels Neutral 8650 8730 8522 8430

Exhibit 2: Bank Nifty Daily Chart

Source: Falcon

For Private Circulation Only |

Technical Research | November 22, 2011

Positive Bias: Stock Name Dabur India 5 Day EMA 97.5 20 Day EMA 98.6 Expected Target 102 Remarks View will change below 95.5

Negative Bias:

Stock Name Cipla Techm

5 Day EMA 308 596.6

20 Day EMA 297.6 598.4

Expected Target 297 570

Remarks View will change above 314 View will change above 605

For Private Circulation Only |

Technical Research | November 22, 2011

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM AXISBANK BAJAJ-AUTO BHARTIARTL BHEL BPCL CAIRN CIPLA DLF DRREDDY GAIL HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RCOM RELCAPITAL RELIANCE RELINFRA RPOWER SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA SUZLON TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO S2 15,651 4,697 8,343 1,116 146 926 1,562 376 249 479 272 301 185 1,472 362 385 603 431 2,133 116 385 701 103 2,569 196 499 58 449 1,193 693 911 151 244 852 97 432 67 277 771 389 87 84 1,614 161 702 99 490 19 155 94 368 1,044 361 S1 15,799 4,738 8,449 1,125 148 936 1,593 382 255 492 281 305 190 1,501 367 390 613 438 2,152 118 388 716 105 2,619 198 508 59 455 1,210 706 927 154 248 860 98 440 69 285 779 395 88 86 1,643 166 712 101 494 20 158 95 374 1,055 366 PIVOT 16,048 4,806 8,628 1,137 150 954 1,646 389 266 510 296 312 199 1,535 376 395 628 447 2,175 120 390 741 108 2,677 200 523 62 464 1,237 725 947 158 255 868 99 449 71 294 789 406 90 90 1,684 175 726 104 498 22 164 97 383 1,072 370 R1 16,195 4,847 8,733 1,147 152 964 1,676 395 273 523 305 316 204 1,564 382 400 639 454 2,194 122 393 756 110 2,728 202 532 63 470 1,254 738 963 161 259 876 101 457 72 301 797 413 92 92 1,713 180 735 106 502 24 167 97 388 1,084 375 R2 16,445 4,915 8,912 1,159 154 982 1,729 402 284 541 319 322 212 1,597 390 405 654 463 2,217 125 396 781 113 2,786 204 546 65 479 1,281 758 983 165 266 884 102 466 75 311 808 424 94 96 1,754 189 749 109 506 26 173 99 397 1,100 379

Technical Research Team

For Private Circulation Only |

Technical Research | November 22, 2011 Technical Report

RESEARCH TEAM

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head - Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com Research Team: 022-3952 6600 Website: www.angelbroking.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past.

Sebi Registration No: INB 010996539

For Private Circulation Only |

Das könnte Ihnen auch gefallen

- ETAMAG - The Lost OrderDokument6 SeitenETAMAG - The Lost OrderSalekin Mahamood Chowdhury100% (1)

- Bar Review Material No. 3 PDFDokument2 SeitenBar Review Material No. 3 PDFScri Bid100% (1)

- Daily Technical Report: Sensex (16372) / NIFTY (4906)Dokument5 SeitenDaily Technical Report: Sensex (16372) / NIFTY (4906)Angel BrokingNoch keine Bewertungen

- Technical Report 29th December 2011Dokument5 SeitenTechnical Report 29th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 25th November 2011Dokument5 SeitenTechnical Report 25th November 2011Angel BrokingNoch keine Bewertungen

- Technical Report 30th November 2011Dokument5 SeitenTechnical Report 30th November 2011Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16462) / NIFTY (4935)Dokument5 SeitenDaily Technical Report: Sensex (16462) / NIFTY (4935)Angel BrokingNoch keine Bewertungen

- Technical Report 23rd November 2011Dokument5 SeitenTechnical Report 23rd November 2011Angel BrokingNoch keine Bewertungen

- Technical Report 11th January 2012Dokument5 SeitenTechnical Report 11th January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 19th December 2011Dokument5 SeitenTechnical Report 19th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 23rd December 2011Dokument5 SeitenTechnical Report 23rd December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 27th December 2011Dokument5 SeitenTechnical Report 27th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 30th December 2011Dokument5 SeitenTechnical Report 30th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 5th December 2011Dokument5 SeitenTechnical Report 5th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 12th January 2012Dokument5 SeitenTechnical Report 12th January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 26th December 2011Dokument5 SeitenTechnical Report 26th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 2nd November 2011Dokument5 SeitenTechnical Report 2nd November 2011Angel BrokingNoch keine Bewertungen

- Technical Report 29th August 2011Dokument3 SeitenTechnical Report 29th August 2011Angel BrokingNoch keine Bewertungen

- Technical Report 9th December 2011Dokument5 SeitenTechnical Report 9th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 6th January 2012Dokument5 SeitenTechnical Report 6th January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 22nd August 2011Dokument3 SeitenTechnical Report 22nd August 2011Angel BrokingNoch keine Bewertungen

- Technical Report 20th December 2011Dokument5 SeitenTechnical Report 20th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 16th February 2012Dokument5 SeitenTechnical Report 16th February 2012Angel BrokingNoch keine Bewertungen

- Technical Report 31st January 2012Dokument5 SeitenTechnical Report 31st January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 3rd November 2011Dokument5 SeitenTechnical Report 3rd November 2011Angel BrokingNoch keine Bewertungen

- Technical Report 29th November 2011Dokument5 SeitenTechnical Report 29th November 2011Angel BrokingNoch keine Bewertungen

- Technical Report 8th December 2011Dokument5 SeitenTechnical Report 8th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 20th October 2011Dokument5 SeitenTechnical Report 20th October 2011Angel BrokingNoch keine Bewertungen

- Technical Report 14th December 2011Dokument5 SeitenTechnical Report 14th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 13th January 2012Dokument5 SeitenTechnical Report 13th January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 2nd September 2011Dokument3 SeitenTechnical Report 2nd September 2011Angel BrokingNoch keine Bewertungen

- Technical Report 24th August 2011Dokument3 SeitenTechnical Report 24th August 2011Angel BrokingNoch keine Bewertungen

- Technical Report 26th August 2011Dokument3 SeitenTechnical Report 26th August 2011Angel BrokingNoch keine Bewertungen

- Technical Report 9th November 2011Dokument5 SeitenTechnical Report 9th November 2011Angel BrokingNoch keine Bewertungen

- Technical Report 16th December 2011Dokument5 SeitenTechnical Report 16th December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 14th October 2011Dokument5 SeitenTechnical Report 14th October 2011Angel BrokingNoch keine Bewertungen

- Technical Report 2nd January 2012Dokument5 SeitenTechnical Report 2nd January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 8th August 2011Dokument3 SeitenTechnical Report 8th August 2011Angel BrokingNoch keine Bewertungen

- Technical Report 27th September 2011Dokument3 SeitenTechnical Report 27th September 2011Angel BrokingNoch keine Bewertungen

- Technical Report 11th November 2011Dokument5 SeitenTechnical Report 11th November 2011Angel BrokingNoch keine Bewertungen

- Technical Report 19th March 2012Dokument5 SeitenTechnical Report 19th March 2012Angel BrokingNoch keine Bewertungen

- Technical Report 17th August 2011Dokument3 SeitenTechnical Report 17th August 2011Angel BrokingNoch keine Bewertungen

- Technical Report 11th October 2011Dokument4 SeitenTechnical Report 11th October 2011Angel BrokingNoch keine Bewertungen

- Technical Report 9th September 2011Dokument3 SeitenTechnical Report 9th September 2011Angel BrokingNoch keine Bewertungen

- Technical Report 17th January 2012Dokument5 SeitenTechnical Report 17th January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 26th April 2012Dokument5 SeitenTechnical Report 26th April 2012Angel BrokingNoch keine Bewertungen

- Technical Report 27th January 2012Dokument5 SeitenTechnical Report 27th January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 18th October 2011Dokument5 SeitenTechnical Report 18th October 2011Angel BrokingNoch keine Bewertungen

- Technical Report 5th October 2011Dokument3 SeitenTechnical Report 5th October 2011Angel BrokingNoch keine Bewertungen

- Technical Report 6th September 2011Dokument3 SeitenTechnical Report 6th September 2011Angel BrokingNoch keine Bewertungen

- Technical Report 18th August 2011Dokument3 SeitenTechnical Report 18th August 2011Angel BrokingNoch keine Bewertungen

- Technical Report 19th August 2011Dokument3 SeitenTechnical Report 19th August 2011Angel BrokingNoch keine Bewertungen

- Technical Report 26th September 2011Dokument3 SeitenTechnical Report 26th September 2011Angel BrokingNoch keine Bewertungen

- Technical Report 21st December 2011Dokument5 SeitenTechnical Report 21st December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 23rd September 2011Dokument3 SeitenTechnical Report 23rd September 2011Angel BrokingNoch keine Bewertungen

- Technical Report 4th October 2011Dokument3 SeitenTechnical Report 4th October 2011Angel BrokingNoch keine Bewertungen

- Technical Report 7th February 2012Dokument5 SeitenTechnical Report 7th February 2012Angel BrokingNoch keine Bewertungen

- Technical Report 2nd December 2011Dokument5 SeitenTechnical Report 2nd December 2011Angel BrokingNoch keine Bewertungen

- Technical Report 16th January 2012Dokument5 SeitenTechnical Report 16th January 2012Angel BrokingNoch keine Bewertungen

- Technical Report 5th January 2012Dokument5 SeitenTechnical Report 5th January 2012Angel BrokingNoch keine Bewertungen

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingVon EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingNoch keine Bewertungen

- A simple approach to fundamental analysis of financial markets: An introductory guide to fundamental analysis techniques and strategies for anticipating the events that move marketsVon EverandA simple approach to fundamental analysis of financial markets: An introductory guide to fundamental analysis techniques and strategies for anticipating the events that move marketsNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Forward ContractsDokument20 SeitenForward ContractsNeha ShahNoch keine Bewertungen

- Corporate Governance JournalDokument17 SeitenCorporate Governance JournalJoseph LimbongNoch keine Bewertungen

- Commerce Commerce Commerce Commerce: A A A ADokument40 SeitenCommerce Commerce Commerce Commerce: A A A ABharat SoniNoch keine Bewertungen

- Template For Loan AgreementDokument3 SeitenTemplate For Loan AgreementlegallyhungryblueNoch keine Bewertungen

- Problem 1-1: Problem 1-2 Cash and Cash EquivalentsDokument14 SeitenProblem 1-1: Problem 1-2 Cash and Cash EquivalentsAcissejNoch keine Bewertungen

- Accounting Rate of ReturnDokument7 SeitenAccounting Rate of ReturnMahesh RaoNoch keine Bewertungen

- Shrimp Farming in EcuadorDokument4 SeitenShrimp Farming in EcuadorsrexrodtNoch keine Bewertungen

- Ministry of Education: Teaching Syllabus For Financial Accounting (SHS 1 - 3)Dokument79 SeitenMinistry of Education: Teaching Syllabus For Financial Accounting (SHS 1 - 3)Kingsford DampsonNoch keine Bewertungen

- Sseagt 1 Aw Final Low en (2) Tcm78-355169 SCANIADokument17 SeitenSseagt 1 Aw Final Low en (2) Tcm78-355169 SCANIAVinay TigerNoch keine Bewertungen

- Comprehensive Exam BDokument14 SeitenComprehensive Exam Bjdiaz_646247Noch keine Bewertungen

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDokument4 SeitenForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNoch keine Bewertungen

- 5 6332319680358777015Dokument6 Seiten5 6332319680358777015Hitin100% (1)

- Composition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxDokument6 SeitenComposition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxKatie PxNoch keine Bewertungen

- IFIC Aamar Trade Enrolment Form-Change (002) - E-FormDokument6 SeitenIFIC Aamar Trade Enrolment Form-Change (002) - E-FormASIF AHMEDNoch keine Bewertungen

- Your Sister Operates Budget Parts Company An Online Boat Parts PDFDokument1 SeiteYour Sister Operates Budget Parts Company An Online Boat Parts PDFAnbu jaromiaNoch keine Bewertungen

- Financial LiteracyDokument22 SeitenFinancial LiteracyRio Albarico100% (1)

- AFAR 3 AnswersDokument5 SeitenAFAR 3 AnswersTyrelle Dela CruzNoch keine Bewertungen

- Unipe-NPF Initiative To Make Education Affordable and Thus AccessibleDokument1 SeiteUnipe-NPF Initiative To Make Education Affordable and Thus Accessiblemsarma7037Noch keine Bewertungen

- DrVijayMalik Company Analyses Vol 5Dokument349 SeitenDrVijayMalik Company Analyses Vol 5THE SCALPERNoch keine Bewertungen

- Toaz - Info Acc 557 Week 2 Chapter 3 E3 6e3 7e3 11p3 2a 100 Scored PRDokument26 SeitenToaz - Info Acc 557 Week 2 Chapter 3 E3 6e3 7e3 11p3 2a 100 Scored PRDandy KrisnaNoch keine Bewertungen

- Financial and Managerial Accounting PDFDokument1 SeiteFinancial and Managerial Accounting PDFcons theNoch keine Bewertungen

- Annotated 3.1 Q3 PPT Adjusting Entries Accruals and DeferralsDokument36 SeitenAnnotated 3.1 Q3 PPT Adjusting Entries Accruals and DeferralsenzobarnaoNoch keine Bewertungen

- Dundee City Council Policy & Resources Committee 26 November 2012Dokument93 SeitenDundee City Council Policy & Resources Committee 26 November 2012Richard McCreadyNoch keine Bewertungen

- DCM Shriram BS 2022Dokument202 SeitenDCM Shriram BS 2022Puneet367Noch keine Bewertungen

- Chapter 2 Problem SolutionsDokument14 SeitenChapter 2 Problem SolutionsAdelia DivandaNoch keine Bewertungen

- Axitrader Product ScheduleDokument12 SeitenAxitrader Product Schedulesiaufa hahaNoch keine Bewertungen

- Mock Test Cases BS PL 2023 15.9.23Dokument7 SeitenMock Test Cases BS PL 2023 15.9.23200100175Noch keine Bewertungen

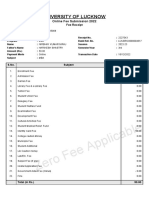

- Fee Receipt - Lucknow UniversityDokument3 SeitenFee Receipt - Lucknow UniversityNirbhay NirajNoch keine Bewertungen