Beruflich Dokumente

Kultur Dokumente

4.1 Annual Report: 4. Corporate Analysis

Hochgeladen von

abhi_003Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

4.1 Annual Report: 4. Corporate Analysis

Hochgeladen von

abhi_003Copyright:

Verfügbare Formate

4.

Corporate analysis

4.1 Annual Report

Previous | Next Annual report is a document, every listed companies should present annual report in AGM (Annual General Meeting) every year as per SEBI (Security Exchange Board of India) guidelines. It is the duty of the management of the company to present its view on the company's previous year's performance and its future outlook to its shareholders. After all, the shareholders have funded the management's long-term objective. Through the annual report, the management conveys its views on the economy, on the sector that it represents the performance relative to the industry and the future growth prospects. Every shareholder is supposed to receive a copy of the annual report. Even if one is not a shareholder of a company, the latest annual reports, quarterly statements and other information filed by a company are available at www.sebiedifar.nic.in. Investor can make an assessment of the company's performance and strengths by comparing the following.

Current performance with the past performance. The performance of the company with the performance of competitors in the same industry. The performance of the company with the performance of companies in different industries.

Content of annual report

Each annual report contains reports and financial statements. The important reports are Chairman's speech, Director's report and Auditor's report. Balance sheet, Profit & Loss statement and Cash flow statement are financial statements.

Chairman's speech: The Chairman talks about the general direction of the

company and the industry, some times the economy. He usually makes his speech at the company's annual general meeting (AGM), which is often published as an advertisement in newspapers and magazines. The Chairman's speech of 73rd Annual General Meeting of the Associated Cement Companies (ACC) Limited is provided here for your reference.

Director's report: Like the chairman's speech, the directors' report is not legally

necessary. Directors report usually have justifications for a bad performance and

how the company plans to avoid this in future, as well as pats on the back for good results. Results: The performance of the company in the relevant year. Here, the directors are meant to read into the performance and address their concerns. Instead, many companies simply rehash elements of the profit-and-loss statement and the balance sheet without going into the merits of each item. Dividend: Dividend announcements are also part of the directors' report. Companies are declaring dividend on two ways. These are per share basis and percentage basis. Capacity utilisation: Although this is relevant only to manufacturing companies, it deserves a closer look. Investors have to find the reasons for increases or decreases in capacity utilisation. Segmental reporting: Here's where to look for the performance of the company's individual divisions. This is important because one segment may be dragging down the company's overall performance. It's also a must-see in evaluating any management move to hive off divisions to a separate company. Subsidiary companies: Details about the performance of the subsidiary companies.

Auditor's report: In most cases the auditor's report states that the profit and

loss account and balance sheet give a true and fair view. But it can also tell you if the management is up to any unacceptable or unethical accounting practices. The auditor's report also tells you if there has been a change in accounting policies, which make comparisons with prior performance less meaningful.

Financial summary: This includes the company's long-term past performance.

Again, while this is not compulsory, many companies have started revealing this. That a company is ready to give its shareholders this information is a good sign. Here, companies provide two kinds of data. Fundamental data: Most companies give 10-year data. Things covered under this include equity capital, net worth, sales, earnings per share (EPS), dividend, and book value per share. But some companies give data for fewer years. Technical data: Some companies even give share price data for the past year in the form of graph as well as high and low prices in BSE and NSE. It also gave the price range of its listed GDRs (converted to Indian rupee for comparison).

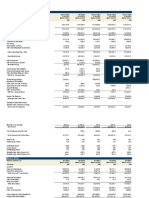

Balance sheet: The balance sheet is a statement of the company's financial

position at a specific date, which is normally the last day of the company's accounting year. It summarises the position of the assets and the liabilities of the

company as at that date. 'Assets' refer to what the company owns and various debts owing to it. 'Liabilities' refer to what the company owes to its shareholders and its creditors. Balance sheet is explained in chapter 4.2.

Profit & Loss statement: It's the first thing investors look at, and it certainly has

the most immediate impact on the stock price. The profit and loss (P&L) statement gives vital information on the operations, profitability and growth of the company. Quarterly and half-yearly results are abridged forms of the P&L statement. It summarises the financial year's operations of a business in the bottom line, which after accounting for every expenses could be either a profit or a loss. Profit and loss statement is explained in chapter 4.3.

Cash flow statement: Companies need to deal with various entities during the

course of their business, which may result in financial transactions. But, to do so, the company needs cash. Hence, it is essential for companies to improve their respective cash generating abilities. Better management of these cash inflows and outflows and its respective short and long-term obligations translate into an impressive cash flow statement. Cash flow statement is explained in chapter 4.4.

Miscellaneous information: Companies can also provide a host of other

information that can influence your investment decision. The only problem is that all of them do not provide this, making comparisons difficult. Number of employees: This helps you assess whether a company is an efficient manager of manpower as indicated by falling employee costs per unit of sales. Shareholding pattern: Annual report gives a detailed break-up of share holding pattern between individuals, corporate, Foreign Institutional Investors (FIIs), government and government-sponsored institutions, and the management. Risk management: Risk management is the another area on which most annual reports draw a blank. Each company has to give the perceived risks the company is facing and how the management plans to tackle them. Market information: Several other forms of information can also interest shareholders. These include stock exchange information such as book closure date, record date for dividend, price performance of shares listed outside India (like GDR and ADS). Annexure to the directors' report: Particularly the one that tells you the salaries your executives are being paid. Basically, it helps you decide whether the management at the top needs a change or is giving you value for money.

Diagnosing annual report

The investors should go through the annual report to understand different aspects like target vs achievement, consistency factor, peer comparison and auditor comments. Each one is explained below. Target Vs achievement: One factor that could enable investors to understand the management of the company is to try and match what the management expected at the start of the year and whether it materialized. If a company expected its revenues to grow by 40% in a year and landed up with a 20% growth at the end of the year, it is important to understand what is the reason for the same? Consistency factor: It is not only important to look at what the management is saying in one year but over a period of 2 to 3 years in the past. More than anything else, for long-term investors, it is pertinent to have a confidence in the management before investing in that stock. A two to three year reading of the management statement will enable investor to firm a view on whether the management is directing the company towards its long-term vision and how. Peer comparison: If you are planning to invest/stay invested in say, ICICI Bank and you have got the annual report, it will also be useful to understand what State Bank of India (the competitor) is saying about industry performance and future prospects. Auditor comments: It is important to read the auditors report of the company and understand whether auditors have qualified the financial statements. By qualified, we mean whether the auditors found the information disclosed by the company adequate to prepare the accounts and whether the accounting policies are appropriate. There are companies wherein the auditors have failed to qualify the financial statement. So investor has to be sure that the financial statements reflect the true picture. If an investor makes an effort to understand these aspects, it is possible to arrive a overall view of the company's position in that industry and the management's ability to steer the company through ups and downs. Finally the management's interest in shareholders return is reflected in the annual report.

(c) 2010 Value line investment corporation

Das könnte Ihnen auch gefallen

- Jalen SDN BHDDokument18 SeitenJalen SDN BHDsyakira kamarudinNoch keine Bewertungen

- Ratio Analysis Draft 1Dokument9 SeitenRatio Analysis Draft 1SuchitaSanghviNoch keine Bewertungen

- File: Chapter 03 - Consolidations - Subsequent To The Date of Acquisition Multiple ChoiceDokument58 SeitenFile: Chapter 03 - Consolidations - Subsequent To The Date of Acquisition Multiple Choicejana ayoubNoch keine Bewertungen

- Atom Bomb of CA Final Total Pages 763 PDFDokument763 SeitenAtom Bomb of CA Final Total Pages 763 PDFPrem Prakash Sinha33% (3)

- FI504 Case Study 1 - The Complete Accounting Cycle RevisedDokument16 SeitenFI504 Case Study 1 - The Complete Accounting Cycle RevisedBrittini Beyondcompare BridgesNoch keine Bewertungen

- Important Things To Analyse in An Annual Repor1Dokument5 SeitenImportant Things To Analyse in An Annual Repor1Rahul VangaNoch keine Bewertungen

- 10 Important Things To Analyse While Reading An Annual ReportDokument3 Seiten10 Important Things To Analyse While Reading An Annual ReportVaibhav RusiaNoch keine Bewertungen

- Corporate Annual Report As A Means of Comprehensive Communicatio1Dokument14 SeitenCorporate Annual Report As A Means of Comprehensive Communicatio1sonam swamiNoch keine Bewertungen

- Corporate Annual Report As A Means of Comprehensive CommunicationDokument13 SeitenCorporate Annual Report As A Means of Comprehensive Communicationsonam swamiNoch keine Bewertungen

- Tools For Fundamental AnalysisDokument20 SeitenTools For Fundamental AnalysisvkathorNoch keine Bewertungen

- MCO 7120 AssignmentDokument3 SeitenMCO 7120 AssignmentAnusree SasidharanNoch keine Bewertungen

- Topic The Annual Report: N.Nickita DeviDokument23 SeitenTopic The Annual Report: N.Nickita Deviप्रशांत कुमारNoch keine Bewertungen

- Fra Notes (Questions and Answers Format) : Financial Reporting: Meaning, Objectives and Importance UNIT-1Dokument74 SeitenFra Notes (Questions and Answers Format) : Financial Reporting: Meaning, Objectives and Importance UNIT-1paras pant100% (1)

- Chapter 4Dokument53 SeitenChapter 4tangliNoch keine Bewertungen

- What Is An Annual Report?Dokument4 SeitenWhat Is An Annual Report?Evanjo NuquiNoch keine Bewertungen

- Annual Report: These Are The Contents Need To Read in An AnnualDokument2 SeitenAnnual Report: These Are The Contents Need To Read in An Annualnikhil gayamNoch keine Bewertungen

- Sonu Kumar 221139 Sbi CardDokument23 SeitenSonu Kumar 221139 Sbi CardSonu KumarNoch keine Bewertungen

- Accounting ReportDokument26 SeitenAccounting ReportDương Ngọc TrânNoch keine Bewertungen

- Summative Assessment 2Dokument5 SeitenSummative Assessment 2Parvesh SahotraNoch keine Bewertungen

- How To Read Financial Statements of Indian Listed Companies?Dokument11 SeitenHow To Read Financial Statements of Indian Listed Companies?DrDhananjhay GangineniNoch keine Bewertungen

- Hero Moto Corp Financial AnalysisDokument16 SeitenHero Moto Corp Financial AnalysisUmeshchandu4a9Noch keine Bewertungen

- Ratio AnalysisDokument36 SeitenRatio AnalysisHARVENDRA9022 SINGHNoch keine Bewertungen

- Module 1 - Lesson 1Dokument6 SeitenModule 1 - Lesson 1Mai RuizNoch keine Bewertungen

- Annual ReportDokument7 SeitenAnnual ReportElfawizzyNoch keine Bewertungen

- Interpreting Financial StatementsDokument16 SeitenInterpreting Financial Statementsmucio.t.mattosNoch keine Bewertungen

- Final PrintDokument35 SeitenFinal PrintVipin KushwahaNoch keine Bewertungen

- Principles of Finance Chapter07 BlackDokument115 SeitenPrinciples of Finance Chapter07 BlackLim Mei Suok100% (1)

- Proj 3.0 2Dokument26 SeitenProj 3.0 2Shivam KharuleNoch keine Bewertungen

- Afs RatioDokument25 SeitenAfs Ratioansarimdfarhan100% (1)

- Every Limited Company Prepares An Annual Report On Its Accounts and State ofDokument4 SeitenEvery Limited Company Prepares An Annual Report On Its Accounts and State ofSuraj SharmaNoch keine Bewertungen

- Corporate Accounting ProjectDokument12 SeitenCorporate Accounting ProjectAarti SinghNoch keine Bewertungen

- Managerial Focus On Ratios & ImportanceDokument9 SeitenManagerial Focus On Ratios & ImportanceMahima BharathiNoch keine Bewertungen

- Assessing Financial Health (Part-A)Dokument17 SeitenAssessing Financial Health (Part-A)kohacNoch keine Bewertungen

- Financial Statement Analysis (Nov-20)Dokument51 SeitenFinancial Statement Analysis (Nov-20)Aminul Islam AmuNoch keine Bewertungen

- Financial Planning & Strategy ForDokument36 SeitenFinancial Planning & Strategy ForNageshwar SinghNoch keine Bewertungen

- Balangoda Plantations PLC and Madulsima Planrtations PLC (1193)Dokument21 SeitenBalangoda Plantations PLC and Madulsima Planrtations PLC (1193)Bajalock VirusNoch keine Bewertungen

- 1.01 Understanding Financial StatementDokument14 Seiten1.01 Understanding Financial StatementHardik MistryNoch keine Bewertungen

- Module 1 Interpretations of Financial StatementsDokument21 SeitenModule 1 Interpretations of Financial StatementsPushpaNoch keine Bewertungen

- 6370a - Sbi Icici BankDokument59 Seiten6370a - Sbi Icici BankRamachandran RajaramNoch keine Bewertungen

- Revised Chapter 2 Financial Statements and Corporate FinanceDokument17 SeitenRevised Chapter 2 Financial Statements and Corporate FinanceLegend Game100% (1)

- Analysis of Financial Statements - Ratio Analysis: Learning ObjectivesDokument56 SeitenAnalysis of Financial Statements - Ratio Analysis: Learning ObjectivesAnkit GargNoch keine Bewertungen

- 4 Financial ReportingDokument3 Seiten4 Financial ReportingCharlesNoch keine Bewertungen

- Definition and Explanation of Financial Statement AnalysisDokument7 SeitenDefinition and Explanation of Financial Statement Analysismedbest11Noch keine Bewertungen

- Financial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Dokument22 SeitenFinancial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Pasupuleti Balasubramaniyam100% (1)

- Both The CourseworksDokument7 SeitenBoth The CourseworksUnderstand_Islam10Noch keine Bewertungen

- 20BSP1623 - PRACHI DAS - Financial Statement Analysis AssignmentDokument2 Seiten20BSP1623 - PRACHI DAS - Financial Statement Analysis AssignmentASHUTOSH KUMAR SINGHNoch keine Bewertungen

- FinalDokument13 SeitenFinalNishuNoch keine Bewertungen

- Introduction To Financial Statement Analysis 1.1 Background of The TopicDokument70 SeitenIntroduction To Financial Statement Analysis 1.1 Background of The TopicThanuja BhaskarNoch keine Bewertungen

- Annual ReportDokument11 SeitenAnnual ReportbalqisNoch keine Bewertungen

- Finance AnalysisDokument11 SeitenFinance Analysissham_codeNoch keine Bewertungen

- Understanding Financial Statement FM 1Dokument5 SeitenUnderstanding Financial Statement FM 1ashleyNoch keine Bewertungen

- Finance Project For McomDokument40 SeitenFinance Project For McomSangeeta Rachkonda100% (1)

- Financial TrainingDokument15 SeitenFinancial TrainingGismon PereiraNoch keine Bewertungen

- Adithya RAj Ballal CIA-2Dokument9 SeitenAdithya RAj Ballal CIA-2Aditya .cNoch keine Bewertungen

- Financial Analysis of Reliance Industry LimitedDokument69 SeitenFinancial Analysis of Reliance Industry LimitedWebsoft Tech-Hyd100% (1)

- Equity Valuation.Dokument70 SeitenEquity Valuation.prashant1889Noch keine Bewertungen

- Introduction To Financial Statement Analysis 1.1 Background of The TopicDokument82 SeitenIntroduction To Financial Statement Analysis 1.1 Background of The TopicThanuja BhaskarNoch keine Bewertungen

- Assignment Weng 5Dokument1 SeiteAssignment Weng 5dampalit malabonNoch keine Bewertungen

- Accountancy Project TopicDokument14 SeitenAccountancy Project TopicIsha BhattacharjeeNoch keine Bewertungen

- Ratio Analysis Note Acc 321-2Dokument20 SeitenRatio Analysis Note Acc 321-2Adedeji MichaelNoch keine Bewertungen

- Week 4 5 FinmanDokument6 SeitenWeek 4 5 FinmanZavanna LaurentNoch keine Bewertungen

- Rs 203 BUY: Key Take AwayDokument6 SeitenRs 203 BUY: Key Take Awayabhi_003Noch keine Bewertungen

- Talent ForecastingDokument9 SeitenTalent Forecastingabhi_003Noch keine Bewertungen

- Ci Sept 01 p22-23lDokument2 SeitenCi Sept 01 p22-23labhi_003Noch keine Bewertungen

- Ishikawa DiagramsDokument2 SeitenIshikawa Diagramsabhi_003Noch keine Bewertungen

- ACN II - Home Assignment 1Dokument8 SeitenACN II - Home Assignment 1Mehrab Hussain ZainNoch keine Bewertungen

- Cost & Asset Accounting: Prof - Dr.G.M.MamoorDokument51 SeitenCost & Asset Accounting: Prof - Dr.G.M.MamoorPIRZADA TALHA ISMAIL100% (1)

- Performance Task 2Dokument1 SeitePerformance Task 2wivadaNoch keine Bewertungen

- Currency INR INR INR INR INR: Income StatementDokument26 SeitenCurrency INR INR INR INR INR: Income StatementNikhil BhatiaNoch keine Bewertungen

- Finacc 3 Empleo Sol ManDokument10 SeitenFinacc 3 Empleo Sol ManolafedNoch keine Bewertungen

- Ch13 Current Liabilities and Contingencies 2Dokument37 SeitenCh13 Current Liabilities and Contingencies 2Babi Dimaano NavarezNoch keine Bewertungen

- Partnership Liquidation ProblemsDokument20 SeitenPartnership Liquidation ProblemsBea Dela PeniaNoch keine Bewertungen

- PAS 1: Presentation of Financial StatementsDokument8 SeitenPAS 1: Presentation of Financial StatementsLeilalyn NicolasNoch keine Bewertungen

- ChapterDokument37 SeitenChaptershaannivasNoch keine Bewertungen

- 3Q 2021 TDPM Tridomain+Performance+MaterialsDokument128 Seiten3Q 2021 TDPM Tridomain+Performance+MaterialsHasriANoch keine Bewertungen

- BES 001 ReviewDokument3 SeitenBES 001 ReviewAC Joyce SaulNoch keine Bewertungen

- 5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A PlanDokument6 Seiten5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A Planapi-245262597100% (1)

- 6001q1specimen PaperDokument12 Seiten6001q1specimen Paperckjoshua819100% (1)

- Financial Analysis 105-115Dokument10 SeitenFinancial Analysis 105-115deshpandep33Noch keine Bewertungen

- Key Risk Managemen Issues (5) Liquidity Risk: Sakamaki Tsuzuri JICA Chief Advisor To The State Bank of VietnamDokument63 SeitenKey Risk Managemen Issues (5) Liquidity Risk: Sakamaki Tsuzuri JICA Chief Advisor To The State Bank of VietnamNGUYEN HUU THUNoch keine Bewertungen

- Adjustments For Final AccountsDokument48 SeitenAdjustments For Final AccountsArsalan QaziNoch keine Bewertungen

- Restructuring and ReschedulingDokument16 SeitenRestructuring and ReschedulingJeyashankar Ramakrishnan100% (1)

- Assignment QuestionsDokument12 SeitenAssignment QuestionsyogendradilwalaNoch keine Bewertungen

- Trade and Other Receivables p2Dokument51 SeitenTrade and Other Receivables p2Camille G.Noch keine Bewertungen

- Financial ReportingDokument133 SeitenFinancial ReportingClerry SamuelNoch keine Bewertungen

- Lecture 4 - Bank's Assets and Liability ManagementDokument16 SeitenLecture 4 - Bank's Assets and Liability ManagementLeyli MelikovaNoch keine Bewertungen

- Liquidation of Company PDFDokument10 SeitenLiquidation of Company PDFMehul SesodiyaNoch keine Bewertungen

- 2019 Quarter One Report: Presented by You ExecDokument42 Seiten2019 Quarter One Report: Presented by You ExeclkulacogluNoch keine Bewertungen

- Balance Sheet of Bandhan BankDokument4 SeitenBalance Sheet of Bandhan BankAditya Kumar SahNoch keine Bewertungen

- Hira Textile Mill Horizontal Analysis 2014-13 1Dokument8 SeitenHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqNoch keine Bewertungen

- MEDINA - Homework 1 (Midterm) No. 8Dokument3 SeitenMEDINA - Homework 1 (Midterm) No. 8Von Andrei MedinaNoch keine Bewertungen