Beruflich Dokumente

Kultur Dokumente

Present Status of The Insurance Industry

Hochgeladen von

Ratish KakkadOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Present Status of The Insurance Industry

Hochgeladen von

Ratish KakkadCopyright:

Verfügbare Formate

Present status of the Insurance industry

Global overview

Insurance awareness has led people to save in policyholders` and pensioners`

Iunds in Iinancial markets, which thereby not only protect them, but also lead to

overall development oI the country. Countries with a robust insurance sector,

higher capital base and more diverse products deem to have generated long term

Iunds Ior investment in their debt and capital markets. Further, it has been

observed that these countries have also released resources Ior investment,

particularly Ior the inIrastructure sector.

With a relatively young and well educated population oI 1.1billion people, the

insurance market in India appears more than Iavorable and can generate suIIicient

long-term Iunds Ior the development. The domestic insurance industry has been

growing at a CAGR oI 28.1 during FY03-07 with the entry oI many new players

both domestic and Ioreign, Iormulation oI new regulations and the introduction

oI newer products.

The emergence oI segments such as health insurance and micro insurance has

opened new growth avenues Ior specialized services. But still there are gaps such

as concerns over product, distribution and penetration (India`s penetration was

only 0.6 oI GDP in FY07, as compared to 2.7 in Australia and 3.8 in South

Korea during the same period), which need to be addressed. Hence, there is an

unIinished agenda on the reIorms and industry compliance Iront, particularly in

terms oI exploring alternative ways to manage and oversee both risk and capital

management issues in the insurance industry in India.

Accordingly, in order to achieve exponential growth in various segments oI

insurance, the need to view the present state and Iuture course oI action has

becomes imperative. This will play a crucial role in setting the right expectations,

learning Irom the experience oI other countries as well as delineating strategies,

thereby positioning India as a regional insurance hub and an international Iinancial

center.

The global insurance industry is Iacing increasing competition, which has put

signiIicant pressure on companies to become more eIIicient, enhance their

technology-related processes and alter their business models.

Globally, most insurance companies are trying to enhance the eIIiciency oI their

underwriting process, cut their overheads and reduce claims leakage since returns

Irom investment are shrinking. Net operating gains in the insurance sector are

expected to increase globally in 2008. With high competition in the insurance

industry, companies will need to strengthen their product lines, investment

strategies and corporate inIrastructure.

%he following have been identified as challenges that may affect the global

insurance industry in 2008.

1. Climate change: Climatic changes due to global warming have increased

windstorms, Iloods and heat waves. These result in an increase in mortality and

health problems, the spread oI environment-related litigation and political risk

linked to conIlicts Ior control oI resources. Climate changes can aIIect an

insurance company`s pricing structure, solvency and corporate viability.

2. Demographic change: The proportion oI the population over the age oI 60 years

is expected to rise Irom 20 in 2005 to 33 in 2050 worldwide, increasing the

demand Ior Iinancial products to meet post-retirement needs. Moreover, estimates

suggest that around 10,000 people will become eligible Ior social security Indian

insurance industry: The task ahead 7 beneIits every day over the next two decades,

with 70 million baby boomers crossing the retirement threshold over the next 10

years. Hence, insurance companies are stepping in as social welIare providers.

3. Emerging markets: Most companies grow organically to meet their strategic

objective oI being global players, but insurers Iace a challenge in developing

cultural knowledge (Ior product design and sales) and eIIective distribution

channels. Russia, China and India are among the countries where local insurers

have been more successIul than in other countries.

. Regulatory intervention: The shiIt Irom rule-based to principal-based regulations

has increased regulatory scrutiny, the complexity oI rules and sophisticated

underlying methods oI insurance business. Regulatory changes include the

International Financial Reporting Standard, Sarbanes-Oxley, the proposed

adoption oI Solvency II norms in the UK, principal-based reserves in the US,

among others. These regulations are driven by political Iactors and can result in a

change in underwriting practices and the selection criteria.

5. Distribution channels: Technological advancements are edging out traditional

agent based distribution models. Today,insurance companies are reaching their

clients directly, either through phone or via the internet. However, insurance

brokers and intermediaries are still preIerred channels Ior selling commercial lines

and complex products. ThereIore, insurance companies need to look Ior innovative

distribution channels.

6. Legal risks: SigniIicant and unexpected changes in the legal environment can

result in serious implications Ior the insurance business. These changes can be

either through government legislations or case law decisions. To remain

competitive, insurance companies are concentrating on upgrading their products,

developing new ways to manage and oversee risk and capital management, and

Iormulate new regulations that may revolutionize the industry in the next decade.

The Iollowing section illustrates the insurance scenario oI the three most important

geographic regions oI the world.

merica

The insurance market in the US is currently in its best phase, since US

property/casualty insurers are expected to record net proIits Ior the third

consecutive year. The industry`s proIitability is related to a Iavorable insurance

pricing environment that began in 2002.

A Iavorable claims experience and comparatively benign catastrophe situations

have considerably improved accident and healthcare operational earnings.

Operating earnings also beneIited Irom the improved mortality experience in the

traditional liIe and reinsurance lines. However, sales oI Iixed income annuities

have been aIIected by diIIicult market conditions associated with uncertainty over

the regulatory environment. New business margins Ior some insurers Iell, partly

due to the eIIect oI rising interest yields, which resulted in a higher discounting oI

Iuture proIits. However, insurers with innovative product oIIerings within variable

annuities have showed a stronger perIormance.

Some challenges

Insurance companies Iace increasing complexity in the highly

regulated and reporting environment oI the US. Lawsuits,

regulations and quasi-regulatory issues are still a concern Ior

insurers/distributors as they increase uncertainty in the industry.

Some key regulatory issues include international supervision, US

regulation oI primary insurers, the implementation oI Sarbanes-

Oxley processes, and the extension oI the %errorism Risk

Insurance ct (%RI.

Most insurers now sell their products via unaIIiliated distributors,

including banks, broker/dealers, insurance brokers and independent

marketing organizations. To maintain their market position and sales

without resorting to aggressive pricing, liIe insurers need to manage

distribution relationships and compensation incentives. Hence,

product distribution continues to remain a challenge.

Lastly, the biggest challenges currently Iacing the insurance industry

are in the health coverage sector, where increasing costs and a

rapidly aging US population maket it extremely diIIicult Ior insurers

to Iorecast Iuture costs and appropriately price their products.

Europe

This region encompasses relatively mature insurance markets, including Germany

and the UK, as well as the emerging markets oI the Central Eastern European

(CEE) region. Many oI the top insurers have seen a strong perIormance in the UK

market in the liIe and pension sectors, which are expected to continue as high-

growth markets. The rise in the equity markets has also increased the sale oI bonds

and investments. Fiscal and regulatory changes in some Central European

countries have created diIIicult conditions Ior insurers. In Germany, investment

bond volumes have been aIIected by the Ilattening yield curve. In Belgium, sales

were generally lower aIter the introduction oI a 1.1 insurance tax levy on liIe

insurance premiums at the beginning oI 2006.

In Spain, there has been an overall decline in the sale oI savings products, which

were adversely aIIected by the tax changes announced Ior 2007. The Netherlands

has also been aIIected by competitive pricing and regulatory and Iiscal changes.

For example, new legislation adversely aIIected the sickness beneIits market.

Interest rate changes, however, had a positive impact on guarantee provisions and

related hedges, which helped to increase the operating earnings oI several insurers

in this area.

The Eastern European region has proved to be more promising. There has been

signiIicant growth in pensions in Eastern Europe, partly due to continuing

regulatory reIorms in several countries, including Poland, the Czech Republic and

Hungary. A change to the tax regime in Hungary in 2006 led to a Iall in the sales

oI the top insurers in the region. Several oI the top insurers have continued to build

the size oI their businesses within the CEE region during 2006, reIlecting growth

expectations.

Big insurance players in the UK are strongly capitalized and are under pressure

Irom investors to deliver Iurther growth. As the existing markets are generally

mature, companies have become more willing to explore acquisitions, particularly

in the emerging high-growth European and Asian markets. Overall, Iurther

consolidation seems likely, especially on a cross-border basis, as the industry still

has the scope Ior global consolidation.

Super specialization is the hallmark oI the US and UK markets. There are insurers

and re-insurers who specialize in a particular product and are regarded as the best

in their respective segments.

A recent initiative has been to oIIer incentives to customers Ior demonstrating a

healthy liIestyle. The Iirst oI its kind in the UK, Prudential`s private medical

insurer, PruHealth, has tied up with Sainsbury`s to oIIer rewards to people Ior

buying healthy Iood products. Under this scheme, a policyholder can collect what

are known as vitality points Ior buying Iresh Iruit and vegetables, which will be

used at the end oI the year to oIIset his/her Iuture premiums.

An interesting innovation in the Iield oI motor insurance has been in the Iorm oI

telematics motor policies. For instance, Norwich Union launched a Pay As You

Drive (PAYD) scheme in November 2006, under which premiums are calculated,

based on how, when and where the car is used. This is done through GPS

technology and a telematics box Iitted into the policyholder`s car.

%he sia-Pacific region

Rapid economic expansion and the rising aIIluence oI the middle classes in most

countries in the Asia-PaciIic region have driven the development oI this region`s

insurance industry. The relaxation oI regulatory controls in Asia has led insurers

worldwide to increase their reach into Asian countries that were once considered

impenetrable to outsiders. Continuing liberalization has made the Asia-PaciIic

region more attractive as an investment destination. Many Asian countries have

removed, or are in the process oI removing, the limits on Ioreign equity

participation in the insurance sector.

The domestic insurers in the region are Iacing increasing competition Irom global

players such as AIG, Allianz and ING, among others. This is particularly so in

India, where LIC`s market share reduced by 13 in three years Irom 95.3 in

FY04 to 81.9 in FY07.

Japan has the largest insurance market in the Asia-PaciIic region. However, it is

slowly losing its competitiveness to Asia`s two Iastest growing markets China

and India. With the speed at which China is liberalizing, it remains the most

preIerred investment destination in this region.

The insurance markets in Southeast Asia, as those in Singapore and Thailand, have

great potential to be among Asia`s insurance powerhouses. According to Swiss

Re, the agricultural insurance sector in Asia is at a very nascent stage with a very

low penetration rate. However, growing government participation and the level oI

commitment shown by private insurers is spurring the development oI this sector.

Due to a rise in shipping activities, marine insurance in Asia is gaining

momentum. Singapore, Hong Kong and Taiwan are currently the main marine

insurance markets in Asia, with China in the race as well.

For the purpose oI distribution, the use oI insurance brokers is becoming more

prevalent in Asia due to the lower costs involved. With the increase in the number

oI insurance companies and the rising demand Ior insurance products, more

insurance brokers are expected to enter this market.

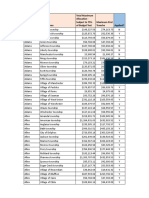

Indian general and liIe insurance premiums have been very low as compared to

other developing countries, including China and Taiwan. In addition, the insurance

penetration rate is low in India, primarily due to low premiums and higher GDP.

Per capita insurance premiums are also low, mainly due to a large population. The

Iollowing table shows insurance premiums in various countries in 2007.

India

India`s insurance industry recently underwent major structural changes. Both the

liIe and general insurance sectors, which were nationalized in the 1950s and

1960s, respectively, saw an across-the-board liberalization process in 2000. Since

then, the Indian insurance sector has enjoyed rapid growth. In terms oI total

premiums, the Indian insurance sector is the IiIth-largest insurance market in Asia

as oI FY07. The liIe insurance sector is slated to grow at 30 in FY08, as

compared to 95 in the last Iiscal. The total income Irom liIe premiums is

expected to exceed INR 2,000 billion (USD 50 billion) by the end oI FY08, as

against INR 1,500 billion (USD 40 billion) in the previous Iiscal. The general

insurance segment, on the other hand, is expected to grow at 15 to INR 290

billion by the end oI FY08 Irom INR 256 billion during the corresponding period

last year.

The current Ioreign shareholding limit in India is Iixed at 26 in the liIe and

general insurance sectors. There have been negotiations to increase this limit to

49, as Ioreign partners want to be more proactive in running their businesses

using diIIerentiated strategies. Indian regulators will however take some time to

take a decision on increasing the FDI limit as this will reduce the stake oI local

promoters.

The Government introduced reIorms in the insurance sector in 1990s, primarily to

encourage more domestic investments to increase insurance coverage and create

an eIIicient and competitive insurance industry. The Government`s monopoly

came to an end in 1991 when restrictions on the entry oI private and Ioreign

companies were liIted. The Iollowing table summarizes some oI the signiIicant

milestones in the introduction oI insurance reIorms in India.

The eIIect oI insurance reIorms has been positive on the insurance industry. There

has been positive growth in all the segments, with investments Ilowing in the right

direction. ReIorms have helped to achieve rapid growth in critical areas and

sustain them over a period oI time through channelized strategies.

Post reIorms, the number oI players have increased Irom Iour in liIe insurance and

eight in general insurance in 2000 to 21 liIe players and 20 general insurance

players, including one reinsurer, in 2008. The biIurcation oI players across

industry segments over the years is provided below:

The strong growth in recent years has increased penetration levels substantially,

but India is still scarcely penetrated as compared to other economies and global

standards. The premium income in the country as a percentage oI its GDP

increased Irom 3.3 in FY03 to 4.7 in FY07.

This remarkable increase has been a result oI the growing contribution oI the liIe

insurance sector as compared to the general insurance sector. The contribution oI

liIe insurance premiums to the GDP has increased Irom 2.7 to 4.1 during the

same period. However, the contribution oI the general insurance sector has

remained almost constant.

The growth oI the insurance sector in the last Iive years has made it one oI the

promising sectors in the economy. %he following graph depicts premium

income as a percentage of GDP (life and general:

On observing the premium per capita oI liIe and general insurance, and the total

premiums, it is clear that with the growth oI the population at a CAGR oI 1.4

during FY0307, premiums per capita have also increased substantially.

Number of poIicies soId in the Iife insurance sector

(first year premiums)

When we look at the Iirst year premium contribution by the private and public

sectors, LIC still holds a monopoly. However, the share oI premiums Irom private

companies has increased Irom a mere 6 in FY03 to approximately 36 in FY08.

LIC is losing market share to the private sector as private players are oIIering a

larger variety oI products. Additionally, these companies are pursuing aggressive

marketing and distribution growth strategies, thereby increasing their consumer

reach. On comparing the total premiums oI the private and public sectors, the

contribution oI the private sector has increased Irom 2 in FY03 to approximately

18 in FY07. The share oI the public sector, which was 82 in FY07, is on a

gradual decline.

Regulatory framework and need for a

conducive environment

In the near Iuture, the insurance industry is expected to grow both in stature

and strength. Insurers shall be less Iinancially vulnerable to the vagaries oI

the market because oI the adoption oI a prudential regulatory regime, which

has set very high solvency requirements and capital adequacy norms.

Domestic institutions both insurers and intermediaries are expected to

catch up with their international counterparts with respect to eIIiciency,

innovation and customer services. Productivity levels are expected to be as

per international best practices. The level oI market penetration is also

expected to improve substantially. Most regulations become obsolete

almost as soon as they are Iormulated.

With evolving industry dynamics, it is essential to step up regulations to

keep pace with the exponential growth in the industry. Regulators in

emerging markets should be in tandem with product innovations,

alternative distribution channels, electronically-linked payment systems, e-

commerce, investment avenues and alternative risk transIers etc. It has

become imperative not only to Iormulate or update regulations, but also Ior

the industry to adhere to these regulatory compliance policies and

procedures. A more sophisticated approach to risk management, Iinancial

reporting and corporate governance will be necessary Ior insurance

companies to meet these requirements. This would ensure sustenance in

growth, which augurs well Ior the insurance industry in India over the long

term.

The government regulation can either promote or hinder insurance

provisions. A conducive regulatory Iramework is essential Ior achieving

sustainability and at the same time needed Ior the expanding insurance

services (Ior instance, large-scale, cost-covering and long-term provision)

to all income segments oI the society. Regulations have proven vital Irom

the stage oI having a new player in the industry. It is necessary to gauge the

Iinancial strength, track record and reputation oI promoters, particularly

with regard to compliance with regulations and the strength oI internal

control systems. IRDA has also been keen to see the industry develop in

terms oI product innovation and the use oI alternative distribution channels.

Applicants with a strong record in these areas, or in specialist and niche

Iields, and those with experience in the health insurance business have

received Iavorable consideration. In addition to strict scrutiny at the point

oI entry, regulators also provide Ior constant monitoring oI the perIormance

oI the companies as a check against lax management practices, which may

result in loss to policyholders. Regulators protect policyholders against

excessive insolvency risk by requiring insurers to meet certain Iinancial

standards and act prudently in managing their aIIairs.

The statutes require insurers to meet minimum capital and surplus standards

and Iinancial reporting requirements and authorize regulators to take other

actions to protect policyholders` interest.

Das könnte Ihnen auch gefallen

- State Bank of Travancore Peon 18092013Dokument6 SeitenState Bank of Travancore Peon 18092013Ratish KakkadNoch keine Bewertungen

- Parents PerceptionDokument16 SeitenParents PerceptionRatish KakkadNoch keine Bewertungen

- Computer Fundamentals NotesDokument40 SeitenComputer Fundamentals NotesRatish KakkadNoch keine Bewertungen

- Teacher's Day Celebration at BJVMDokument7 SeitenTeacher's Day Celebration at BJVMRatish KakkadNoch keine Bewertungen

- State Level Conference - Management Around 2011Dokument2 SeitenState Level Conference - Management Around 2011Ratish KakkadNoch keine Bewertungen

- Final Portfolio ManagementDokument131 SeitenFinal Portfolio ManagementRatish KakkadNoch keine Bewertungen

- Hindu Fasts & FestivalsDokument92 SeitenHindu Fasts & FestivalsRatish KakkadNoch keine Bewertungen

- Ethical Consumer BehaviorDokument19 SeitenEthical Consumer BehaviorRatish KakkadNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Introduction To Organization StudyDokument50 SeitenIntroduction To Organization Studysimply_cooolNoch keine Bewertungen

- Ub Dialogue Book - FINALDokument172 SeitenUb Dialogue Book - FINALISSMongolia100% (1)

- 2019-108 PHLDokument4 Seiten2019-108 PHLJAGUAR GAMINGNoch keine Bewertungen

- Trope Paper - The Chiefs DaughterDokument8 SeitenTrope Paper - The Chiefs Daughterapi-319809743Noch keine Bewertungen

- APUSH Semester II: Gilded Age to Reagan EraDokument6 SeitenAPUSH Semester II: Gilded Age to Reagan EraJimmy HunNoch keine Bewertungen

- Reading Response 2Dokument3 SeitenReading Response 2api-460657824Noch keine Bewertungen

- Demand Letter To The Department of JusticeDokument4 SeitenDemand Letter To The Department of JusticeGordon Duff100% (1)

- Imperial Blues by Fiona I.B. NgôDokument48 SeitenImperial Blues by Fiona I.B. NgôDuke University Press100% (1)

- NHD Annotated BibliographyDokument7 SeitenNHD Annotated Bibliographyapi-597028165Noch keine Bewertungen

- Chang Et Al v. Virgin Mobile USA LLC Et Al - Document No. 32Dokument3 SeitenChang Et Al v. Virgin Mobile USA LLC Et Al - Document No. 32Justia.comNoch keine Bewertungen

- LitchiDokument11 SeitenLitchimapas_salemNoch keine Bewertungen

- From Melting Pot To Salad BowlDokument1 SeiteFrom Melting Pot To Salad BowlAntemie Razvan Geo100% (1)

- CETking MBA CET 2014 Question Paper With Solution PDFDokument37 SeitenCETking MBA CET 2014 Question Paper With Solution PDFmaheeNoch keine Bewertungen

- Bo SEO SpeechesDokument22 SeitenBo SEO Speechesdebate ddNoch keine Bewertungen

- Vocabulary 17: Key EventsDokument3 SeitenVocabulary 17: Key EventsAnthony Torres-RutherfordNoch keine Bewertungen

- Request Information Northeastern University AdmissionsDokument1 SeiteRequest Information Northeastern University AdmissionsArislenny TolentinoNoch keine Bewertungen

- Manpower Employment Outlook Survey: RomaniaDokument23 SeitenManpower Employment Outlook Survey: RomaniaMihai MaresNoch keine Bewertungen

- Pakistan's Ties with Central Asian States: Irritants and ChallengesDokument13 SeitenPakistan's Ties with Central Asian States: Irritants and ChallengesTariq IqbalNoch keine Bewertungen

- Status of Whether Ohio Municipalities Have Applied For Federal StimulusDokument54 SeitenStatus of Whether Ohio Municipalities Have Applied For Federal StimulusDougNoch keine Bewertungen

- Invest Namibia Journal (INJ) June 2019 EditionDokument60 SeitenInvest Namibia Journal (INJ) June 2019 EditionAndy Shivute AndjeneNoch keine Bewertungen

- Starbuck LifestyleDokument24 SeitenStarbuck LifestylefeminaNoch keine Bewertungen

- IELTS Writing Task 1 Sample - Pie - ZIMDokument25 SeitenIELTS Writing Task 1 Sample - Pie - ZIMĐặng Phương Thùy LinhNoch keine Bewertungen

- Foreign Status Letter 2015Dokument3 SeitenForeign Status Letter 2015Anonymous nYwWYS3ntV100% (10)

- Petrochemical Trends h1 2021Dokument14 SeitenPetrochemical Trends h1 2021sanjeev thadaniNoch keine Bewertungen

- The Republican CharterDokument9 SeitenThe Republican CharterJessada96Noch keine Bewertungen

- Us Food SystemDokument2 SeitenUs Food SystemJesse SchreierNoch keine Bewertungen

- Westward ExpansionDokument13 SeitenWestward ExpansionDeshi boy Shriyansh DubeyNoch keine Bewertungen

- Warof 1812 NewselaDokument4 SeitenWarof 1812 Newselaapi-445420983Noch keine Bewertungen

- Screenshot 2021-04-06 at 10.46.44 PMDokument16 SeitenScreenshot 2021-04-06 at 10.46.44 PMNadzmin HairuddinNoch keine Bewertungen

- Carrollton, Texas - 287 (G) FOIA DocumentsDokument2 SeitenCarrollton, Texas - 287 (G) FOIA DocumentsJ CoxNoch keine Bewertungen