Beruflich Dokumente

Kultur Dokumente

Registering A Limited Liability Company in U1

Hochgeladen von

anon_27251164Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Registering A Limited Liability Company in U1

Hochgeladen von

anon_27251164Copyright:

Verfügbare Formate

REGISTERING A LIMITED LIABILITY COMPANY IN U.

S Abhishek Kumar 4TH semester School of law, Christ University, Bangalore A limited liability company (LLC) is an accepted business form in all U.S. states; it is an independent legal structure separate from their owners. And it separates ones personal assets with the business debts. It is taxed similarly to a sole proprietorship (if one owner) or a partnership (if multiple owner).it is governed by the LLC statutes, formation document and LLC operating agreements. The owners of an LLC are called members rather than partners or shareholders, the members are drawn upon an operating agreement. And there is no limit to no. owners. And there is no requirement to hold annual meetings or record minutes. There are certain demerits as well in having a LLC, as it cannot engage in corporate income splitting to lower tax liability and it cannot issue stocks as well. Certain steps should be followed in order to register a LLC Draft a business plan A business plan serves as a blueprint to all aspects of the business, including strengths, weaknesses, opportunities and threats. Also, it will help to understand market analysis, organization and management, and the funding required.

Choose a name for the business There can be variations in the name of LL.C but it is wise enough to add LLC in the name of the firm to send an indication as to the firm is registered and doesnt violate any trademark. Determine the members of the LLC It should be decided whether the company is a member managed or manager managed determining the members will heip in understanding their duties and liabilities. Submit the articles of organization form to the Secretary of State along with the appropriate filing fee. The articles contain such information as the name of the LLC, the names of the managers or members, and the name and address of the registered agent. There may be an annual, biennial, or other renewal fee thereafter as well as franchise taxes depending on the state you are forming your LLC in . In some states you will file a certificate of organization currently states like Iowa and Idaho require a Certificate of Organization to be filed, instead of Articles of Organization. Have a separate bank account Get an employer id for the LLC, even if you do not plan on hiring any employees, you should still obtain an Employer ID (Tax ID) for the LLC. Create an operating agreement for the LLC An operating agreements sets out all of the decisions about the business, including member responsibilities and duties, how profits and losses are distributed to the members, and the effect on the LLC if a member dies, leaves, or is asked to leave .And this is not filed with the state, instead it is kept in the office.

File form 8832 entity classification election to be taxed as a corporation If you plan to file the LLC taxes as a sole proprietorship (one member) or partnership (more than one member), you do not need to file this form. If you want to file LLC taxes as a corporation, you will need to complete this form. A foreign person can form a corporation or LLC in the United States of America. In many states, one person can hold all corporate positions and titles, including director, president, secretary and treasurer. That person or persons need not be residents of the United States and can conduct business from outside of the United States. In some states, you may need to provide certain information about your company's owners prior to incorporating or forming your business.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Topic 5 - Chapter 7 ClassDokument39 SeitenTopic 5 - Chapter 7 ClassNoluthando MbathaNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Example - Recovery AmountDokument11 SeitenExample - Recovery AmountAAKANKSHA BHATIANoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- ScotiaBank AUG 09 Daily FX UpdateDokument3 SeitenScotiaBank AUG 09 Daily FX UpdateMiir ViirNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Overview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallDokument20 SeitenOverview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallCharles MK ChanNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- 20 Important Uses of PLR Rights Material PDFDokument21 Seiten20 Important Uses of PLR Rights Material PDFRavitNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- As and Guidance NotesDokument94 SeitenAs and Guidance NotesSivasankariNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- ReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDokument21 SeitenReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Strengths of The Alkaline Water Company IncDokument7 SeitenStrengths of The Alkaline Water Company IncIshan BavejaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Bio Pharma Case StudyDokument2 SeitenBio Pharma Case StudyAshish Shadija100% (2)

- Alliancing Best Practice PDFDokument48 SeitenAlliancing Best Practice PDFgimasaviNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Company Registration in EthiopiaDokument121 SeitenCompany Registration in Ethiopiadegu kassaNoch keine Bewertungen

- FFCDokument17 SeitenFFCAmna KhanNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Human Resource Management: Unit - IDokument6 SeitenHuman Resource Management: Unit - IpavanstvpgNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- SBR Open TuitionDokument162 SeitenSBR Open TuitionpatrikosNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Chatto Management 4n Activity 6Dokument2 SeitenChatto Management 4n Activity 6LabLab ChattoNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Taxation Reviewer - SAN BEDADokument128 SeitenTaxation Reviewer - SAN BEDAMark Lawrence Guzman93% (28)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Overview of Franchising Activities in VietnamDokument5 SeitenOverview of Franchising Activities in VietnamNo NameNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Digital - Marketing Notes On Bosch and Grainger Strategy Plan Final Problem Statement - CourseraDokument1 SeiteDigital - Marketing Notes On Bosch and Grainger Strategy Plan Final Problem Statement - CourseraSserunkuma MosesNoch keine Bewertungen

- HDFC Life Guaranteed Wealth Plus BrochureDokument23 SeitenHDFC Life Guaranteed Wealth Plus BrochureMichael GloverNoch keine Bewertungen

- Emkay LEAD PMS - JULY 2019Dokument17 SeitenEmkay LEAD PMS - JULY 2019speedenquiryNoch keine Bewertungen

- McKinsey On Marketing Organizing For CRMDokument7 SeitenMcKinsey On Marketing Organizing For CRML'HassaniNoch keine Bewertungen

- Politicas Publicas EnergeticasDokument38 SeitenPoliticas Publicas EnergeticasRodrigo Arce RojasNoch keine Bewertungen

- Accounting Cycle of A Service Business-Step 3-Posting To LedgerDokument40 SeitenAccounting Cycle of A Service Business-Step 3-Posting To LedgerdelgadojudithNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Answer Sheet - Docx ABC PARTNERSHIPDokument14 SeitenAnswer Sheet - Docx ABC PARTNERSHIPCathy AluadenNoch keine Bewertungen

- mgmt09 Tif08Dokument30 Seitenmgmt09 Tif08Sishi WangNoch keine Bewertungen

- The Economic ProblemDokument22 SeitenThe Economic ProblemPeterNoch keine Bewertungen

- Lkas 27Dokument15 SeitenLkas 27nithyNoch keine Bewertungen

- Order in The Matter of M/s Kinetic Capital Services Limited & M/s Shubh International LimitedDokument8 SeitenOrder in The Matter of M/s Kinetic Capital Services Limited & M/s Shubh International LimitedShyam SunderNoch keine Bewertungen

- Market StructureDokument14 SeitenMarket StructurevmktptNoch keine Bewertungen

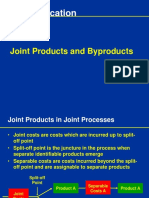

- Joint Cost Allocation Methods for Multiple ProductsDokument17 SeitenJoint Cost Allocation Methods for Multiple ProductsATLASNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)