Beruflich Dokumente

Kultur Dokumente

Bangladesh Lamps Limited

Hochgeladen von

Nazmul Hossain NisadCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bangladesh Lamps Limited

Hochgeladen von

Nazmul Hossain NisadCopyright:

Verfügbare Formate

Nisad Md.

Nazmul Hossain 09-14123-2(AIUB)

Bangladesh Lamps Limited Liquidity Ratio: Current Ratio = Current Assets/ Current Liabilities For 2010, Current Ratio is = 579397159/324269196 = 1.78 / 1.8:1 For 2009, Current Ratio was = 501760314/265583582 = 1.88 / 1.9:1 Quick /Acid Ratio = Current Assets less Inventory/ Current Liabilities For 2010, Quick Ratio is = 579397159-128611091/324269196 = 1.4 For 2009, Quick Ratio was = 501760314-127990769/265583582 = 1.4 Gearing/Debt to Equity Ratio: Debt to Equity Ratio = Total Debt / Total Equity For 2010, Debt to Equity Ratio is = 404816479/1120738844 = 0.3612 For 2009, Debt to Equity Ratio was = 343491784/732932874 = 0.4686

Total Debt to Total Asset = Total Debt / Total Asset For 2010, Total Debt to Total Asset is = 404816479/1525555323 = 0.2653 For 2009, Total Debt to Total Asset was = 343491784/1076424658 = 0.31910 Debt Equity Ratio = long Term Debt / Stockholder Equity For 2010, Debt Equity Ratio is = 80547283/1120738844 = 0.07186 For 2009, Debt Equity Ratio was =77908202/732932874 = 0.1062

Efficiency Ratio: Total Asset Turnover = Sales / Total Assets For 2010, Total Asset Turnover is = 622571342/1525555323 = 0.4080 For 2009, Total Asset Turnover was = 615330715/1076424658 = 0.5716 Fixed Asset Turnover = Sales / Net Fixed Assets For 2010, Fixed Asset Turnover is = 622571342/946158164 =0.6579

For 2009, Fixed Asset Turnover was = 615330715/574664344 = 1.0707 Profitability Ratio: Return on equity (ROE) =Net income/ Shareholders equity For 2010, Return on equity (ROE) is =61749642/1120738844 =0.05509 For 2009, Return on equity (ROE) was =58508890/732932874 =0.07982 Return on Assets (ROA) = Net income /Total Assets For 2010, Return on Assets (ROA) is=61749642/1525555323 =0.0404 For 2009, Return on Assets (ROA) was= 58508890/1076424658 =0.054354

During the year under review, the net sale of the company was tk 622.57 million as compared to tk 615.33 million in 2009. The net profit after tax for the year 2010 was tk 61.75 million. The growth in profitability has been due to more efficient supply chain management. Some of the performance highlights for the year are as follows: Increase in shareholders equity Increase in net current assets Increase in net profit after tax 52.91% 8.02% 5.54%

In view of growing business opportunities in the lighting sector, the Board of Directors at its meeting

Audit Committee The Audit Committee comprises of three Directors. The committee is headed by the independent Director , Mr.Ahmed Shafi Choudury. The objective of Audit Committee is to ensure and improve the proper and adequate internal control to facilitate the smooth functioning of the Companys operations and assist the Board in discharging its responsibilities. The Audit committee also reviews the interim and annual financial statements before submission to the Board.

Bangladesh Lamps Ltd. announced unedited earnings results for third quarter and nine months ended September 30, 2010. For the quarter, the company reported profit after tax of BDT 7.33 million with earnings per share (EPS) of BDT 10.17 against BDT 8.94 million and BDT 12.40 respectively for the same period of the previous year. Profit after tax was BDT 30.48 million with EPS of BDT 42.29 for the period of nine months to September 30 against BDT 26.97 million and BDT 37.42 respectively for the same ayear-ago period.

Bangladesh Lamps Ltd. has declared 35% cash dividend for 2009. The official licensee of Philips Electronics NV Holland (for lighting products) in Bangladesh made the declaration at its 49th annual general meeting at Emmanuelle's Banquet Hall in Gulshan, Dhaka.

Das könnte Ihnen auch gefallen

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawVon EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Singer BangladeshDokument16 SeitenSinger BangladeshMahbubur RahmanNoch keine Bewertungen

- Name: Bilal Ahmed ID: Mc090200863 Degree: MBA Specialization: FinanceDokument46 SeitenName: Bilal Ahmed ID: Mc090200863 Degree: MBA Specialization: FinanceEngr MahaNoch keine Bewertungen

- NBP PresentationDokument39 SeitenNBP PresentationFarazNaseerNoch keine Bewertungen

- Delta Life Insurance 2009Dokument65 SeitenDelta Life Insurance 2009OliviaDuchessNoch keine Bewertungen

- Assignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementDokument10 SeitenAssignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementIshu AroraNoch keine Bewertungen

- Financial Statement Analysis of Lucky CementDokument27 SeitenFinancial Statement Analysis of Lucky CementRaja UmairNoch keine Bewertungen

- Financially Yours AssignmentDokument6 SeitenFinancially Yours AssignmentSiddhant SinghNoch keine Bewertungen

- Managing Finincial Principles & Techniques Ms - SafinaDokument22 SeitenManaging Finincial Principles & Techniques Ms - SafinajojirajaNoch keine Bewertungen

- Fa ProjectDokument16 SeitenFa Projecttapas_kbNoch keine Bewertungen

- Amity University, Uttar PradeshDokument10 SeitenAmity University, Uttar Pradeshdiksha1912Noch keine Bewertungen

- Group Project On Corporate Finance BSRM Xtreme & GPH Ispat LTDDokument16 SeitenGroup Project On Corporate Finance BSRM Xtreme & GPH Ispat LTDTamim ChowdhuryNoch keine Bewertungen

- Financial Analysis of Indigo Airlines From Lender's PerspectiveDokument12 SeitenFinancial Analysis of Indigo Airlines From Lender's PerspectiveAnil Kumar Reddy100% (1)

- Investor Presentation (Company Update)Dokument34 SeitenInvestor Presentation (Company Update)Shyam SunderNoch keine Bewertungen

- Hero Motocorp: Previous YearsDokument11 SeitenHero Motocorp: Previous YearssalimsidNoch keine Bewertungen

- Ratio Analysis of Dutch Bangla Bank LimitedDokument6 SeitenRatio Analysis of Dutch Bangla Bank LimitedSafiur_AIUBNoch keine Bewertungen

- Blackberry Financial StatementsDokument12 SeitenBlackberry Financial StatementsSelmir V KlicicNoch keine Bewertungen

- Asyad Financial AnalysisDokument9 SeitenAsyad Financial AnalysisshawktNoch keine Bewertungen

- Pak Tobacco CompanyDokument16 SeitenPak Tobacco CompanySana KhanNoch keine Bewertungen

- Accounting KFC Holdings Financial Ratio Analysis of Year 2009Dokument16 SeitenAccounting KFC Holdings Financial Ratio Analysis of Year 2009Malathi Sundrasaigaran100% (6)

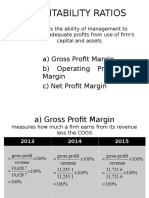

- Profitability Ratios: A) Gross Profit Margin B) Operating Profit Margin C) Net Profit MarginDokument7 SeitenProfitability Ratios: A) Gross Profit Margin B) Operating Profit Margin C) Net Profit MarginnwlNoch keine Bewertungen

- ACCA F6 Revision Mock June 2013 QUESTIONS Version 2 FINAL at 25 March 2013Dokument15 SeitenACCA F6 Revision Mock June 2013 QUESTIONS Version 2 FINAL at 25 March 2013syedtahaali100% (1)

- Case Study On AutomobileDokument8 SeitenCase Study On AutomobileDipock MondalNoch keine Bewertungen

- Basic Account AssignmentDokument21 SeitenBasic Account AssignmentLeeJianRuNoch keine Bewertungen

- Financial Management AssignmentDokument16 SeitenFinancial Management AssignmentNishant goyalNoch keine Bewertungen

- RatiosDokument12 SeitenRatiosstuck00123Noch keine Bewertungen

- Consolidated Profit and Loss Account For The Year Ended December 31, 2008Dokument16 SeitenConsolidated Profit and Loss Account For The Year Ended December 31, 2008madihaijazNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Ratio Analysis: Income Ratio: The Formula For Income Ratio Is-Gross Margin/Net SalesDokument4 SeitenRatio Analysis: Income Ratio: The Formula For Income Ratio Is-Gross Margin/Net Saleszafar71Noch keine Bewertungen

- Capital Structure Analysis: TVS Motor CompanyDokument11 SeitenCapital Structure Analysis: TVS Motor CompanyPankaj GargNoch keine Bewertungen

- Session 16 - FA&ADokument21 SeitenSession 16 - FA&AYASH BATRANoch keine Bewertungen

- Ratio Analysis of Company Report (2012/13) : Short Term Solvency Ratios/liquidity RatiosDokument8 SeitenRatio Analysis of Company Report (2012/13) : Short Term Solvency Ratios/liquidity RatiosRehan AbdullahNoch keine Bewertungen

- Tata Steel 1Dokument12 SeitenTata Steel 1Dhwani ShahNoch keine Bewertungen

- TSL Audited Results For FY Ended 31 Oct 13Dokument2 SeitenTSL Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNoch keine Bewertungen

- PPTDokument35 SeitenPPTShivam ChauhanNoch keine Bewertungen

- FishboneDokument5 SeitenFishboneGhibran MaulanaNoch keine Bewertungen

- United Bank Limited (Ubl) Complete Ratio Analysis For Internship Report YEAR 2008, 2009, 2010Dokument0 SeitenUnited Bank Limited (Ubl) Complete Ratio Analysis For Internship Report YEAR 2008, 2009, 2010Elegant EmeraldNoch keine Bewertungen

- Unconsolidated Condensed Interim Financial Statements of Allied Bank LimitedDokument44 SeitenUnconsolidated Condensed Interim Financial Statements of Allied Bank LimitedenkashmiriNoch keine Bewertungen

- Taxation (United Kingdom) : Tuesday 4 June 2013Dokument22 SeitenTaxation (United Kingdom) : Tuesday 4 June 2013Eric MugaNoch keine Bewertungen

- 3rd Quarterly Report 2011Dokument44 Seiten3rd Quarterly Report 2011Muhammad Salman ShahNoch keine Bewertungen

- Student Name: Student ID MBA FinanceDokument27 SeitenStudent Name: Student ID MBA FinanceAhsan RaoNoch keine Bewertungen

- Letter To Shareholders and Financial Results September 2012Dokument5 SeitenLetter To Shareholders and Financial Results September 2012SwamiNoch keine Bewertungen

- Financial Performance Analysis of Jamuna Bank LimitedDokument9 SeitenFinancial Performance Analysis of Jamuna Bank LimitedMonirNoch keine Bewertungen

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Dokument4 SeitenNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNoch keine Bewertungen

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Dokument6 SeitenAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Andhra Bank 2009-2010Dokument7 SeitenAndhra Bank 2009-2010Don Iz BackNoch keine Bewertungen

- FIN440 FFA ReportDokument11 SeitenFIN440 FFA ReportImrul Farhan Pritom 1620326630Noch keine Bewertungen

- Project On Corporate Finance: Comprehensive AnalysisDokument24 SeitenProject On Corporate Finance: Comprehensive AnalysisAli RazaNoch keine Bewertungen

- Balance-Sheet - PWC& Deloitte-Summary & AnalysisDokument7 SeitenBalance-Sheet - PWC& Deloitte-Summary & AnalysisAjit AgarwalNoch keine Bewertungen

- Results Press Release For December 31, 2015 (Result)Dokument4 SeitenResults Press Release For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Auto & Metal (PVT) LTDDokument25 SeitenAuto & Metal (PVT) LTDNatala De LemisNoch keine Bewertungen

- Hrtex 2012-2013 AnnualDokument43 SeitenHrtex 2012-2013 AnnualObydulRanaNoch keine Bewertungen

- 1st Quarter ReportDokument9 Seiten1st Quarter ReportammarpkrNoch keine Bewertungen

- Zarfarie Binti Aron 195645 London Biscuits BHDDokument16 SeitenZarfarie Binti Aron 195645 London Biscuits BHDzarfarie aronNoch keine Bewertungen

- 56 PDFDokument80 Seiten56 PDFHarpreet ShergillNoch keine Bewertungen

- Complete Task - Buderim GingerDokument9 SeitenComplete Task - Buderim GingerOne OrgNoch keine Bewertungen

- Installment Sales & Long-Term ConsDokument6 SeitenInstallment Sales & Long-Term ConsSirr JeyNoch keine Bewertungen

- Consolidated Financial StatementsDokument40 SeitenConsolidated Financial StatementsSandeep GunjanNoch keine Bewertungen

- Makalah Return On Invested Capital and Profitability Analysis Pada PT Gudang Garam Tbk.Dokument11 SeitenMakalah Return On Invested Capital and Profitability Analysis Pada PT Gudang Garam Tbk.Megawati MediyaniNoch keine Bewertungen

- The International Financial Environment: Multinational Corporation (MNC)Dokument46 SeitenThe International Financial Environment: Multinational Corporation (MNC)Navkiran KinniNoch keine Bewertungen

- TVM TableDokument5 SeitenTVM Tablesarf_88Noch keine Bewertungen

- PVAFDokument3 SeitenPVAFVishal BasettiNoch keine Bewertungen

- PVAFDokument3 SeitenPVAFVishal BasettiNoch keine Bewertungen

- TVM TableDokument5 SeitenTVM Tablesarf_88Noch keine Bewertungen

- Principles of Marketing: PresentationDokument18 SeitenPrinciples of Marketing: PresentationNazmul Hossain NisadNoch keine Bewertungen

- Presentation NNDokument23 SeitenPresentation NNNazmul Hossain NisadNoch keine Bewertungen

- Akij Group of IndustriesDokument36 SeitenAkij Group of IndustriesNazmul Hossain NisadNoch keine Bewertungen

- BD SlideDokument29 SeitenBD SlideNazmul Hossain Nisad0% (1)

- Walton Hi-Tech Industries LTDDokument22 SeitenWalton Hi-Tech Industries LTDNazmul Hossain NisadNoch keine Bewertungen

- Final Marketing AssaginmentDokument15 SeitenFinal Marketing AssaginmentNazmul Hossain NisadNoch keine Bewertungen

- Marketimg Pran GroupDokument11 SeitenMarketimg Pran GroupNazmul Hossain Nisad100% (1)

- Marketimg Pran GroupDokument11 SeitenMarketimg Pran GroupNazmul Hossain Nisad100% (1)

- Commodities Outlook, LBBWDokument25 SeitenCommodities Outlook, LBBWClaudeNoch keine Bewertungen

- Estados Financieros ComcastDokument90 SeitenEstados Financieros ComcastGustavo Florez100% (1)

- Stocks 142-146Dokument5 SeitenStocks 142-146Rej Patnaan100% (1)

- Gillan, 2006 Recent JCFDokument22 SeitenGillan, 2006 Recent JCFMila Minkhatul Maula MingmilaNoch keine Bewertungen

- Capital StructuringDokument6 SeitenCapital StructuringLourene Jauod- GuanzonNoch keine Bewertungen

- Makor Capital - Technical Summary European UtilitiesDokument13 SeitenMakor Capital - Technical Summary European UtilitiesH3NPHLONoch keine Bewertungen

- Comparative Analysis of Indian Stock Market WithDokument15 SeitenComparative Analysis of Indian Stock Market WithVinoth Pillay100% (1)

- 24 The Elusive Cash BalanceDokument13 Seiten24 The Elusive Cash Balancehaqicohir100% (2)

- RV InvestmentDokument11 SeitenRV Investmentdipak_pandey_007Noch keine Bewertungen

- Divergence System by Oleg A. ButDokument0 SeitenDivergence System by Oleg A. ButGeorge Akrivos100% (2)

- Capital Market and Role of SebiDokument20 SeitenCapital Market and Role of SebiSameeksha KashyapNoch keine Bewertungen

- Assignment 1Dokument20 SeitenAssignment 1SarthakAryaNoch keine Bewertungen

- Assignment Next PLCDokument16 SeitenAssignment Next PLCJames Jane50% (2)

- Investor CurriculumDokument22 SeitenInvestor CurriculumR. SinghNoch keine Bewertungen

- USDC Doc# 45-1 Through 45-15 Declaration of Paolo Bruckner ISO Request For Entry of Default W-ExhibitsDokument157 SeitenUSDC Doc# 45-1 Through 45-15 Declaration of Paolo Bruckner ISO Request For Entry of Default W-ExhibitsSYCR ServiceNoch keine Bewertungen

- Cost of Capital of ITCDokument24 SeitenCost of Capital of ITCMadhusudan PartaniNoch keine Bewertungen

- LAPORAN KEUANGAN 2020 TrioDokument3 SeitenLAPORAN KEUANGAN 2020 TrioMT Project EnokNoch keine Bewertungen

- Harvard BlackscholesDokument8 SeitenHarvard BlackscholesGuilherme Ozores PiresNoch keine Bewertungen

- Allegations Denied! Ron Nechemia The Chairman of The Board of Governors of The EurOrient Financial Group To Contest Claims Alleged in California Department of CorporationDokument4 SeitenAllegations Denied! Ron Nechemia The Chairman of The Board of Governors of The EurOrient Financial Group To Contest Claims Alleged in California Department of CorporationRon NechemiaNoch keine Bewertungen

- Scheme of Arrangement Between Just Dial Limited and Just Dial Global Private Limited and Their Respective Shareholders and Creditors (Corp. Action)Dokument3 SeitenScheme of Arrangement Between Just Dial Limited and Just Dial Global Private Limited and Their Respective Shareholders and Creditors (Corp. Action)Shyam SunderNoch keine Bewertungen

- ICAU Investment Clubs CurriculumDokument2 SeitenICAU Investment Clubs CurriculumTumwine Kahweza ProsperNoch keine Bewertungen

- Bhel Financial AnalysisDokument10 SeitenBhel Financial Analysisashish_verma_22Noch keine Bewertungen

- Case Study Mki - BladesDokument3 SeitenCase Study Mki - Bladeslily kusumawati100% (1)

- El Alamein - Emaar Misr - Final OM PDFDokument383 SeitenEl Alamein - Emaar Misr - Final OM PDFAbdellah EssonniNoch keine Bewertungen

- Cheat Sheet BashidDokument76 SeitenCheat Sheet BashidbashideNoch keine Bewertungen

- Investment Banking OverviewDokument77 SeitenInvestment Banking OverviewEmerson De Mello100% (26)

- bsDSIJ3409 PDFDokument84 SeitenbsDSIJ3409 PDFSheikh AbdullahNoch keine Bewertungen

- Accounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Dokument12 SeitenAccounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Badiuz FaruquiNoch keine Bewertungen

- Valuation of GoodwillDokument34 SeitenValuation of GoodwillGamming Evolves100% (1)

- Finm7401 L1Dokument69 SeitenFinm7401 L1Mohammad Waffy FazilNoch keine Bewertungen

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetVon EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetBewertung: 5 von 5 Sternen5/5 (2)

- Joy of Agility: How to Solve Problems and Succeed SoonerVon EverandJoy of Agility: How to Solve Problems and Succeed SoonerBewertung: 4 von 5 Sternen4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Financial Risk Management: A Simple IntroductionVon EverandFinancial Risk Management: A Simple IntroductionBewertung: 4.5 von 5 Sternen4.5/5 (7)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNoch keine Bewertungen

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursVon EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursBewertung: 4.5 von 5 Sternen4.5/5 (8)

- How to Measure Anything: Finding the Value of Intangibles in BusinessVon EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityVon EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Creating Shareholder Value: A Guide For Managers And InvestorsVon EverandCreating Shareholder Value: A Guide For Managers And InvestorsBewertung: 4.5 von 5 Sternen4.5/5 (8)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsVon EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNoch keine Bewertungen

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Von EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 5 von 5 Sternen5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionVon EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionBewertung: 5 von 5 Sternen5/5 (1)