Beruflich Dokumente

Kultur Dokumente

As Macroeconomics

Hochgeladen von

Vivek Prakash SuryaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

As Macroeconomics

Hochgeladen von

Vivek Prakash SuryaCopyright:

Verfügbare Formate

A S h a c r o e c o n o mI c s l I n t e r n a t I o n a I E c o n o m y

Aggregate Demand

Ths secton yves you c plct]orm ]or understcndny ssues such cs njlaton economc yrowth cnd

unemloyment. Ayyreycte demcnd (A0) cnd cyyreycte supply (AS) cnclyss provdes c wcy o]

llustrctny mccroeconomc relctonshps cnd the e]]ects o] yovernment polcy chcnyes.

Aggregate 0emand

The IdentIty for calculatIng aggregate demand (A0) Is as follows:

A0 = C + I + C + (X-h)

Where

C: Consumers' expendIture on goods and servIces: ThIs Includes demand for consumer durables

(e.g. washIng machInes, audIovIsual equIpment and motor vehIcles E nondurable goods such as

food and drInks whIch are "consumed" and must be repurchased). Household spendIng accounts

for over sIxty fIve per cent of aggregate demand In the UK.

I: CapItaI Investment - ThIs Is Investment spendIng by companIes on capItaI goods such as new

plant and equIpment and buIldIngs. nvestment also Includes spendIng on workIng capItaI such as

stocks of fInIshed goods and work In progress.

CapItal Investment spendIng In the UK typIcally accounts for between 1520 of C0P In any gIven

year. Df thIs Investment, 75 comes from prIvate sector busInesses such as Tesco, 8rItIsh AIrways

and 8rItIsh Petroleum and the remaInder Is spent by the publIc (government) sector - for example

Investment by the government In buIldIng new schools or Investment In ImprovIng the raIlway or

road networks. So a mobIle phone company such as D2 spendIng f100 mIllIon on extendIng Its

network capacIty and the government allocatIng f15 mIllIon of funds to buIld a new hospItal are

both counted as part of capItal Investment. nvestment has Important longterm effects on the s

suppIy-sIde of the economy as well as beIng an Important although volatIle component of

aggregate demand.

C: Covernment SpendIng - ThIs Is government spendIng on stateprovIded goods and servIces

IncludIng publIc and merIt goods. 0ecIsIons on how much the government wIll spend each year are

affected by developments In the economy and also the changIng polItIcal prIorItIes of the

government. n a normal year, government purchases of goods and servIces accounts for around

twenty per cent of aggregate demand. We wIll return to thIs agaIn when we look at how the

government runs Its fIscal polIcy.

Transfer payments In the form of welfare benefIts (e.g. state pensIons and the jobseekers

allowance) are not Included In general government spendIng because they are not a payment to a

factor of productIon for any output produced. They are sImply a transfer from one group wIthIn the

economy (I.e. people In work payIng Income taxes) to another group (I.e. pensIoners drawIng theIr

state pensIon havIng retIred from the labour force, or famIlIes on low Incomes).

The next two components of aggregate demand relate to InternatIonaI trade In goods and servIces

between the UK economy and the rest of the world.

X: Exports of goods and servIces Exports sold overseas are an InfIow of demand (an InjectIon)

Into our cIrcular flow of Income and therefore add to the demand for UK produced output.

h: Imports of goods and servIces. mports are a wIthdrawaI of demand (a leakage) from the

cIrcular flow of Income and spendIng. Coods and servIces come Into the economy for us to consume

and enjoy but there Is a flow of money out of the economy to pay for them.

Net exports (X-h) reflect the net effect of InternatIonal trade on the level of aggregate demand.

When net exports are posItIve, there Is a trade surpIus (addIng to A0); when net exports are

negatIve, there Is a trade defIcIt (reducIng A0). The UK economy has been runnIng a large trade

defIcIt for several years now as has the UnIted States.

Aggregate demand shocks

conomc events such cs chcnyes n nterest rctes cnd economc yrowth n the 0nted Stctes ccn

hcve c power]ul e]]ect on other countres ncludny the 0K. Ths s beccuse the 0SA s the world's

lcryest economy. 15 per cent o] our exports yo to the 0SA.

Lots of unexpected events can happen whIch cause changes In the level of demand, output and

employment In the economy. These unplanned events are called "shocks" Dne of the causes of

fluctuatIons In the level of economIc actIvIty Is the presence of demand-sIde shocks.

Some of the maIn causes of demandsIde shocks are as follows:

O A capItaI Investment boom e.g. a constructIon boom to Increase the supply of new houses

or to buIld new commercIal and IndustrIal buIldIngs.

O A rIse or faII In the exchange rate - affectIng net export demand and havIng followon

effects on output, employment, Incomes and profIts of busInesses lInked to export

IndustrIes.

O A consumer boom abroad In the country of one of our major tradIng partners whIch

affects the demand for our exports of goods and servIces.

O A large boom In the housIng market or a slump In share prIces.

O An unexpected cut or an unexpected rIse In Interest rates.

The Aggregate 0emand Curve

The A0 curve shows the relatIonshIp between the general prIce level and real C0P.

hy does the A0 curve sIope downwards!

There are several explanatIons for an Inverse relatIonshIp between aggregate demand and the prIce

level In an economy. These are summarIsed below:

O aIIIng reaI Incomes: As the prIce level rIses, so the real value of people's Incomes fall and

consumers are then less able to afford UK produced goods and servIces.

O The baIance of trade: As the prIce level rIses, foreIgnproduced goods and servIces become

more attractIve (cheaper) In prIce terms, causIng a fall In exports and a rIse In Imports.

ThIs wIll lead to a reductIon In trade (X|) and a contractIon In aggregate demand.

O Interest rate effect: If In the UK the prIce level rIses, thIs causes an Increase In the

demand for money and a consequentIal rIse In Interest rates wIth a deflatIonary effect on

the entIre economy. ThIs assumes that the central bank (In our case the 8ank of England) Is

settIng Interest rates In order to meet a specIfIed InflatIon target.

ShIfts In the A0 curve

A change In factors affectIng any one or more components of aggregate demand, households (C),

fIrms (), the government (C) or overseas consumers and busIness (X) changes planned aggregate

demand and results In a shIft In the A0 curve.

ConsIder the dIagram below whIch shows an Inward shIft of A0 from A01 to A0J and an outward

shIft of A0 from A01 to A02. The Increase In A0 mIght have been caused for example by a fall In

Interest rates or an Increase In consumers' wealth because of rIsIng house prIces.

actors causIng a shIft In A0

Changes In ExpectatIons

urrent spendny s c]]ected by

cntcpcted ]uture ncome pro]t

cnd n]lcton

The expectctons o] consumers cnd busnesses can have a powerful effect

on planned spendIng In the economy E.g. expected Increases In consumer

Incomes, wealth or company profIts encourage households and fIrms to

spend more - boostIng A0. SImIlarly, hIgher expected InflatIon encourages

spendIng now before prIce Increases come Into effect a short term boost

to A0.

When confIdence turns lower, we expect to see an Increase In savIng and

some companIes decIdIng to postpone capItal Investment projects because

of worrIes over a lack of demand and a fall In the expected rate of profIt on

Investments.

Changes In honetary PoIIcy - I.e. a

change In Interest rates

(Note there s more thcn one

nterest rcte n the economy

clthouyh borrowny cnd scvnys

rctes tend to move n the scme

drecton)

An expansIonary monetary polIcy wIll cause an outward shIft of the A0

curve. f Interest rates fall - thIs lowers the cost of borrowIng and the

IncentIve to save, thereby encouragIng consumptIon. Lower Interest rates

encourage fIrms to borrow and Invest.

There are tIme lags between changes In Interest rates and the changes on

the components of aggregate demand.

Changes In IscaI PoIIcy

sccl Polcy re]ers to chcnyes n

yovernment spendny wel]cre

bene]ts cnd tcxcton cnd the

cmount thct the yovernment

borrows

For example, the Covernment may Increase Its expendIture e.g. fInanced by

a hIgher budget defIcIt, thIs dIrectly Increases A0

ncome tax affects dIsposable Income e.g. lower rates of Income tax raIse

dIsposable Income and should boost consumptIon.

An Increase In transfer payments raIses A0 - partIcularly If welfare

recIpIents spend a hIgh of the benefIts they receIve.

EconomIc events In the

InternatIonaI economy

nternctoncl ]cctors such cs the

exchcnye rcte cnd ]oreyn ncome

(e.y. the economc cycle n other

countres)

A fall In the value of the pound (f) (a deprecIatIon) makes Imports dearer

and exports cheaper thereby dIscouragIng Imports and encouragIng exports -

the net result should be that UK A0 rIses - the Impact depends on the prIce

elastIcIty of demand for Imports and exports and also the elastIcIty of

supply of UK exporters In response to an exchange rate deprecIatIon.

An Increase In overseas Incomes raIses demand for exports and therefore UK

A0 rIses. n contrast a recessIon In a major export market wIll lead to a fall

In UK exports and an Inward shIft of aggregate demand.

The UK Is an open economy, meanIng that a large and rIsIng share of our

natIonal output Is lInked to exports of goods and servIces or Is open to

competItIon from Imports.

Changes In househoId weaIth

eclth re]ers to the vclue o] cssets

owned by consumers e.y. houses

cnd shcres

A rIse In house prIces or the value of shares Increases consumers' wealth

and allow an Increase In borrowIng to fInance consumptIon IncreasIng A0. n

contrast, a fall In the value of share prIces wIll lead to a declIne In

household fInancIal wealth and a fall In consumer demand.

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Research ProposalDokument3 SeitenResearch Proposaljan ray aribuaboNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Cost AnalysisDokument23 SeitenCost Analysisankit_kataryaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The MTEF Was Introduced in Ghana To Provide A Tool For Better DeficitDokument6 SeitenThe MTEF Was Introduced in Ghana To Provide A Tool For Better DeficitKaizer David-angeloNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Awareness On Budgeting: Dr. M.V.S. Kameshwar Rao Associate Professor, XIMR, MumbaiDokument36 SeitenAwareness On Budgeting: Dr. M.V.S. Kameshwar Rao Associate Professor, XIMR, MumbaiM.V.S.Kameshwar RaoNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Chapter 1Dokument16 SeitenChapter 1Sheila Mae BenedictoNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Public Administration Unit-82 Role of BureaucracyDokument11 SeitenPublic Administration Unit-82 Role of BureaucracyDeepika Sharma100% (1)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Activity/Training/Learning and Development (L & D) Proposal Title Name Position Division SchoolDokument3 SeitenActivity/Training/Learning and Development (L & D) Proposal Title Name Position Division SchoolCherry Rose SumalbagNoch keine Bewertungen

- Global Fraud-Global Hope by Paul HellyerDokument14 SeitenGlobal Fraud-Global Hope by Paul HellyerChristopher Porter100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

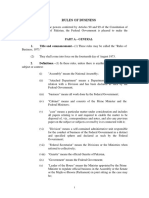

- Rules of Business 1973Dokument85 SeitenRules of Business 1973fahimkhan1986Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- MAS Preboard Ctdi May 2018 AnswersDokument30 SeitenMAS Preboard Ctdi May 2018 AnswersKrizza MaeNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- DTI2020 Management LetterDokument54 SeitenDTI2020 Management LetterAngel BacaniNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Making A BudgetDokument22 SeitenMaking A BudgetbuddysmbdNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Management Accounting - HariharanDokument2 SeitenManagement Accounting - HariharanHa Tran Hung0% (1)

- Management Accounting & Services: Topics/Subtopics Taken UP?Dokument10 SeitenManagement Accounting & Services: Topics/Subtopics Taken UP?Lance GallogoNoch keine Bewertungen

- Prelims Pretest 3Dokument4 SeitenPrelims Pretest 3Graal GasparNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Budget Planning and ControlDokument9 SeitenBudget Planning and ControlDominic Muli100% (6)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Day 1 Capital BudgetingDokument12 SeitenDay 1 Capital BudgetingJohn Carlo Aquino100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- May 31 2013Dokument16 SeitenMay 31 2013Anonymous KMKk9Msn5Noch keine Bewertungen

- Department of Budget and Management Public-Private Partnership Center Joint Memorandum Circular No. 2018-01 DateDokument16 SeitenDepartment of Budget and Management Public-Private Partnership Center Joint Memorandum Circular No. 2018-01 DatejoancuteverNoch keine Bewertungen

- 6Dokument459 Seiten6sunildubey02100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Sir KurtDokument2 SeitenSir KurtAngelica BautistaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Fiscal PolicyDokument13 SeitenFiscal PolicyAakash SaxenaNoch keine Bewertungen

- C34-The Influence of FP and MP On ADDokument15 SeitenC34-The Influence of FP and MP On ADhoangchuNoch keine Bewertungen

- Power Sector Financing Project ReportDokument57 SeitenPower Sector Financing Project ReportAnonymous hVrzfRSmT100% (1)

- Sandeep Project 22Dokument91 SeitenSandeep Project 22prashant mhatreNoch keine Bewertungen

- Director Finance Controller Accounting in Phoenix AZ Resume Michael FleuryDokument2 SeitenDirector Finance Controller Accounting in Phoenix AZ Resume Michael FleuryMichaelFleuryNoch keine Bewertungen

- Multiple Choice Answer On The Scantron Provided ONLYDokument10 SeitenMultiple Choice Answer On The Scantron Provided ONLYGiovana Marie Balasquide100% (1)

- The Little Book of PMODokument83 SeitenThe Little Book of PMOpnorbertoNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Horizontal and Vertical AnalysisDokument3 SeitenHorizontal and Vertical AnalysisJane Ericka Joy MayoNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)