Beruflich Dokumente

Kultur Dokumente

New Microsoft Office Word Document

Hochgeladen von

Bhagvan KarnavatOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

New Microsoft Office Word Document

Hochgeladen von

Bhagvan KarnavatCopyright:

Verfügbare Formate

RESIDENTIAL STATUS AND TAX INCIDENCE

Taxation (T.Y.BBA)

INTRODUCTION

Tax incidence of an assessee depends on his residential status. For instance, whether an income, accrued to an individual outside India, is taxable in India depends upon the residential status of the individual in India. Similarly, whether an income earned by a foreign national in India (or outside India) is taxable in India depends on the residential status of the individual, rather than on his citizenship. Therefore, the determination of the residential status of a person is very significant in order to find out his tax liability.

CONCEPT OF RESIDENTIAL STATUS

The following norms one has to keep in mind while deciding the residential status of an assessee:

1. Different taxable entities - All taxable entities are divided in the following categories for the purpose of determining residential status: a. An individual; b. A Hindu undivided family; c. A firm or an association of persons; d. A joint stock company; and e. Every other person.

2. Different residential status - An assessee is either: (a) resident in India, or (b) non-resident in India.

However, a resident individual or a Hindu undivided family has to be (a) resident and ordinarily resident, or (b) resident but not ordinarily resident. Therefore, an individual and a Hindu undivided family can either be: a. resident and ordinarily resident in India; or b. resident but not ordinarily resident in India; or c. non-resident in India Prepared by: Mr. Bhagvan M. Karnavat A.S.B.Patel college of Business Administration, Unjha.

RESIDENTIAL STATUS AND TAX INCIDENCE

Taxation (T.Y.BBA)

All other assessees (viz., a firm, an association of persons, a joint stock company and every other person) can either be: a. resident in India; or b. non-resident in India.

3. Residential status for each previous year - Residential status of an assessee is to be determined in respect of each previous year as it may vary from previous year to previous year. 4. Different residential status for different assessment years - An assessee may enjoy different residential status for different assessment years. For instance, an individual who has been regularly assessed as resident and ordinarily resident has to be treated as non-resident in a particular assessment year if he satisfies none of the conditions of section 6(1).

5. Resident in India and abroad - It is not necessary that a person, who is resident in India, cannot become resident in any other country for the same assessment year. A person may be resident in two (or more) countries at the same time. It is, therefore, not necessary that a person who is resident in India will be non-resident in all other countries for the same assessment year.

RESIDENTIAL STATUS OF AN INDIVIDUAL

As per section 6, an individual may be (a) resident and ordinarily resident in India, (b) resident but not ordinarily resident in India, or (c) non-resident in India.

a. RESIDENT AND ORDINARILY RESIDENT As per section 6(1), in order to find out whether an individual is resident and ordinarily resident in India, one has to proceed as follows Step 1 Step 2 First find out whether such individual is resident in India. If such individual is resident in India, then find out whether he is ordinarily resident in India. However, if such individual is a non-resident in India, then no further investigation is necessary Prepared by: Mr. Bhagvan M. Karnavat A.S.B.Patel college of Business Administration, Unjha.

RESIDENTIAL STATUS AND TAX INCIDENCE

Taxation (T.Y.BBA)

BASIC CONDITIONS TO TEST AS TO WHEN AN INDIVIDUAL IS RESIDENT IN INDIA - Under section 6(1) an individual is said to be resident in India in any previous

year, if he satisfies at least one of the following two basic conditions 1. He is in India in the previous year for a period of 182 days or more OR 2. He is in India for a period of 60 days or more during the previous year and 365 days or more during 4 years immediately preceding the previous year. Exception for 2nd condition: In the following two cases, an individual needs to be present in India for a minimum of 182 days or more in order to become resident in India:

1. An Indian citizen who leaves India during the previous year for the purpose of taking employment outside India or an Indian citizen leaving India during the previous year as a member of the crew of an Indian ship.

2. An Indian citizen or a person of Indian origin who comes on visit to India during the previous year (a person is said to be of Indian origin if either he or any of his parents or any of his grand parents was born in undivided India).

ADDITIONAL CONDITIONS TO TEST AS TO WHEN A RESIDENT INDIVIDUAL IS ORDINARILY RESIDENT IN INDIA - Under section 6(6), a resident individual is treated as resident and ordinarily resident in India if he must satisfies the following two additional conditions 1. He has been resident in India at least 2 years out of 10 years immediately proceeding previous years. AND 2. He has been in India for a period of 730 days or more during 7 years immediately proceeding previous years.

b.

RESIDENT BUT NOT ORDINARILY RESIDENT

Prepared by: Mr. Bhagvan M. Karnavat A.S.B.Patel college of Business Administration, Unjha.

RESIDENTIAL STATUS AND TAX INCIDENCE

Taxation (T.Y.BBA)

As per section 6(1), an individual who satisfies at least one of the two basic conditions but does not satisfy the both the additional conditions, is treated as a resident but not ordinarily resident in India.

C. NON-RESIDENT

An Individual is a Non Resident of India if he/she satisfies none of the two basic conditions.

RESIDENTIAL STATUS AND INCIDENCE OF TAX

As per section 5, incidence of tax on a taxpayer depends on his residential status and also on the place and time of accrual or receipt of income. * In order to understand the relationship between residential status and tax liability, one must understand the meaning of Indian income and foreign income. INDIAN INCOME - Any of the following three is an Indian income 1. If income is received (or deemed to be received) in India during the previous year and at the same time it accrues (or arises or is deemed to accrue or arise) in India during the previous year. 2. If income is received (or deemed to be received) in India during the previous year but it accrues (or arises) outside India during the previous year. 3. If income is received outside India during the previous year but it accrues (or arises or is deemed to accrue or arise) in India during the previous year. FOREIGN INCOME - If the following two conditions are satisfied, then such income is foreign income a. Income is not received (or not deemed to be received) in India; and b. Income does not accrue or arise (or does not deemed to accrue or arise) in India.

Prepared by: Mr. Bhagvan M. Karnavat A.S.B.Patel college of Business Administration, Unjha.

RESIDENTIAL STATUS AND TAX INCIDENCE

Taxation (T.Y.BBA)

INCIDENCE OF TAX FOR DIFFERENT TAX PAYERS

Tax incidence of different taxpayers is as follows Individual and Hindu undivided family Resident and Resident but not Non-resident ordinarily resident Ordinarily of India in India resident in India Indian income Foreign income - If it is business income and business is controlled wholly or partly from India - If it is income from profession which is set up in India - If it is business income and business is controlled from outside India - If it is income from profession which is set up outside India - Any other foreign income (like salary, rent, interest, etc.) Taxable in India Taxable in India Taxable India Not taxable in India in

Taxable in India

Taxable in India

Taxable in India

Taxable in India

Not taxable in India Not taxable in India Not taxable in India Not taxable in India

Taxable in India

Not taxable in India Not taxable in India Not taxable in India

Taxable in India

Taxable in India

Any other taxpayer (like company, firm, co-operative society, association of persons, body of individual, etc Resident in India Indian income Foreign income Taxable in India Taxable in India Non-resident in India Taxable in India Not taxable in India

Prepared by: Mr. Bhagvan M. Karnavat A.S.B.Patel college of Business Administration, Unjha.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Pontenciano v. BarnesDokument3 SeitenPontenciano v. BarnesKevin HernandezNoch keine Bewertungen

- CNN and Acosta v. Trump - Motion For Temporary Restraining Order - Additional ExhibitsDokument171 SeitenCNN and Acosta v. Trump - Motion For Temporary Restraining Order - Additional ExhibitsLegal InsurrectionNoch keine Bewertungen

- Not GayDokument6 SeitenNot GayLawrence Del GradoNoch keine Bewertungen

- Country Risk AnalysisDokument19 SeitenCountry Risk Analysisamit1002001Noch keine Bewertungen

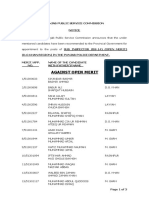

- SI (Open Merit) (D.G Khan) 43G2019Dokument3 SeitenSI (Open Merit) (D.G Khan) 43G2019AQEEL NIJADNoch keine Bewertungen

- ME Form 2 LYDP Monitoring FormDokument2 SeitenME Form 2 LYDP Monitoring FormLYDO San CarlosNoch keine Bewertungen

- Master of Deceit J. Edgar Hoover and America in The Age of Lies Chapter SamplerDokument15 SeitenMaster of Deceit J. Edgar Hoover and America in The Age of Lies Chapter SamplerCandlewick PressNoch keine Bewertungen

- Dalit Studies-1Dokument5 SeitenDalit Studies-1JennyRowenaNoch keine Bewertungen

- Saplot-Summary of Rizal-2ADokument3 SeitenSaplot-Summary of Rizal-2ANeszel Jean Japus SaplotNoch keine Bewertungen

- Election Law (Bautista - Pacris) Case DigestsDokument9 SeitenElection Law (Bautista - Pacris) Case Digestsanna beeNoch keine Bewertungen

- Reaching Across The Pacific: Latin America and Asia in The New CenturyDokument318 SeitenReaching Across The Pacific: Latin America and Asia in The New CenturyThe Wilson Center100% (2)

- Blank BOLDokument1 SeiteBlank BOLRaymond DavisNoch keine Bewertungen

- Copy - Deped Cebu Gi - Eb - 2019 - Reduced SlidesDokument50 SeitenCopy - Deped Cebu Gi - Eb - 2019 - Reduced Slidestiny aNoch keine Bewertungen

- GR No. 125469Dokument5 SeitenGR No. 125469Karen Gina DupraNoch keine Bewertungen

- Stalking Law of The PHDokument14 SeitenStalking Law of The PHJoey YusingcoNoch keine Bewertungen

- Newsletter - SEE Forum On Climate Change AdaptationDokument9 SeitenNewsletter - SEE Forum On Climate Change AdaptationlibertteNoch keine Bewertungen

- 2013 05 30 RMB 1st Ihl Lecture NotesDokument17 Seiten2013 05 30 RMB 1st Ihl Lecture NotesMussawer HasnainNoch keine Bewertungen

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDokument2 SeitenCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNoch keine Bewertungen

- The Right To Try IVF ActDokument2 SeitenThe Right To Try IVF ActAlanna VagianosNoch keine Bewertungen

- All House Committees Shall Be Chaired by Republicans and ShallDokument10 SeitenAll House Committees Shall Be Chaired by Republicans and ShallBrandon WaltensNoch keine Bewertungen

- Organizational Structure of The Department of Labor and Attached AgenciesDokument1 SeiteOrganizational Structure of The Department of Labor and Attached Agenciestepi7wepiNoch keine Bewertungen

- Organizational Politics and PowerDokument23 SeitenOrganizational Politics and PowerMichael Valdez100% (1)

- Case DigestDokument31 SeitenCase Digestmb_estanislaoNoch keine Bewertungen

- Hatta 1958Dokument12 SeitenHatta 1958Madelief WhiteNoch keine Bewertungen

- Couples Counseling and Domestic ViolenceDokument8 SeitenCouples Counseling and Domestic ViolenceLidiaMaciasNoch keine Bewertungen

- Mitsubishi CaseDokument8 SeitenMitsubishi CaseNugroho Atma HadiNoch keine Bewertungen

- Arabic Desert Sky Net Geog HTMLDokument9 SeitenArabic Desert Sky Net Geog HTMLAbdullah Ibn MubarakNoch keine Bewertungen

- Advantages of DecentralizationDokument2 SeitenAdvantages of DecentralizationsherlexisNoch keine Bewertungen

- Gilded Age - Viewing QuestionsDokument6 SeitenGilded Age - Viewing QuestionsAmy GibbonsNoch keine Bewertungen

- Republic, Lost: How Money Corrupts Congress - and A Plan To Stop ItDokument6 SeitenRepublic, Lost: How Money Corrupts Congress - and A Plan To Stop Itwamu885Noch keine Bewertungen