Beruflich Dokumente

Kultur Dokumente

Ratio Analysis

Hochgeladen von

bilalaabiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ratio Analysis

Hochgeladen von

bilalaabiCopyright:

Verfügbare Formate

Ratio Analysis

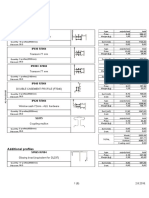

NISHAT CHUNIAN LIMITED Ratio Analysis

2009 Rupees LIQUIDITY RATIOS: CURRENT RATIO = 0.81 0.77 2008 Rupees

The current of the company in 2009 is higher than 2008 due to excess of asset. Generally the higher current ratio the more liquid the firm is considered to be.

Quick Ratio

= = 0.37 0.28

The portion of inventory in 2009 is more than the 2008.therefore the Quick ratio is higher than the previous year.

Ratio Analysis ACTIVITY RATIOS:

Inventory turnover = 3.21 time

The resulting turnover is meaningful only when it is compared with that of the firms past inventory turn over. In this period the inventory should be convert in 3 time almost.

Avg collection period

365 =

365

365

56days

52days

The average collection only in relation to the firms credit terms. And average 52 days may indicate a poorly managed credit or collection deptt.

Payment period =

365

365

365

= 32Days

20days

The figure is meaningful only in relation to the average credit term extended to the firm.the performance of payment period is better than the 2008.

Ratio Analysis

DEBT RATIOS:

Debt Ratio = 0.74 0.76

The value indicate that company has financed close half or its with that the higher this ratio the greate the firm degree of indebtedness and the the more leverage it has..so the asset will be increase as compare to 2008.

Long term to capitalization= 10.25 0.994

The firms equity participation in long term debt in current year is maximum than the previous. Because the firm equity is more than its long term debts. there 2009 equity less than 2008

Cash flow to L.T debt = 4.82 0.014

The firms cash flow to meet its long term obligation in current year is higher than the previous year .

Ratio Analysis

COVERAGE RATIOS:

Interest coverage = 0.15 0.10

The firms cash flows ability to cover its interest in 2009 is higher than 2008.

PRFITABILITY RATIOS:

Net profit margin =

100

1.03%

0.19 %

The firms net profit ratio is maximum in 2009 than the 2008.becouse his expenses decrease this year as compare to previous.

Operating profit to sale =

100

1.25%

8.55%

There profit ratio will be decrease in 2009 compare to 2008 becouse the cost of good is increase in current year.

Ratio Analysis G.P ratio =

100

14.89%

11.3%

The firms cost of good sold is maximum and the sale will be increase in 2009 as compare to 2008. And its less cost incurred in 2008

Return On Asset

= 0.8% 0.16%

Utilization of assets in 2009 is more efficient as compare to 2008. In profit the asset will be increase in 2009 than the 2008.

Asset turnover ratio= 0.829 0.843

The asset turnover ratio shows that in 2009 assets are converted and generate sale 0.829 times which is less than 2008 turnover ratio

MARTEK VALUE RATIOS:

Price Earning Ratio =

8.4

45.45

Ratio Analysis

The price earning ratio of the firms in 2009 is lower than 2008. Means firm seen to be less efficient in 2009.

CONCLUSION: The overall company performance is no better as compare to the previous year so its not good for a overall company performance.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Reaction PaperDokument3 SeitenReaction PaperPatrick Ramos80% (15)

- In Holland V Hodgson The ObjectDokument5 SeitenIn Holland V Hodgson The ObjectSuvigya TripathiNoch keine Bewertungen

- Dedication Table and AcknlgmentDokument13 SeitenDedication Table and AcknlgmentbilalaabiNoch keine Bewertungen

- Income ElasticityDokument5 SeitenIncome ElasticitybilalaabiNoch keine Bewertungen

- Fund PolicyDokument4 SeitenFund PolicybilalaabiNoch keine Bewertungen

- Landmarks in TheDokument9 SeitenLandmarks in ThebilalaabiNoch keine Bewertungen

- Instructional Supervisory Plan BITDokument7 SeitenInstructional Supervisory Plan BITjeo nalugon100% (2)

- MKTG How Analytics Can Drive Growth in Consumer Packaged Goods Trade PromotionsDokument5 SeitenMKTG How Analytics Can Drive Growth in Consumer Packaged Goods Trade PromotionsCultura AnimiNoch keine Bewertungen

- Geoland InProcessingCenterDokument50 SeitenGeoland InProcessingCenterjrtnNoch keine Bewertungen

- SANCHEZ V DEMETRIOUDokument3 SeitenSANCHEZ V DEMETRIOUShenna SunicoNoch keine Bewertungen

- People Vs GonaDokument2 SeitenPeople Vs GonaM Azeneth JJ100% (1)

- LRL Rudy Acuna On Neftali DeLeon - I Am Proud To Be The Grandson Son and Husband of Immigrants.Dokument9 SeitenLRL Rudy Acuna On Neftali DeLeon - I Am Proud To Be The Grandson Son and Husband of Immigrants.EditorNoch keine Bewertungen

- Experiment No 5 ZenerDokument3 SeitenExperiment No 5 ZenerEugene Christina EuniceNoch keine Bewertungen

- Associate-Shopping in Hyderabad, Telangana Careers at HyderabadDokument1 SeiteAssociate-Shopping in Hyderabad, Telangana Careers at HyderabadpavanNoch keine Bewertungen

- Ansys Flu - BatDokument30 SeitenAnsys Flu - BatNikola BoskovicNoch keine Bewertungen

- Dances in LuzonDokument13 SeitenDances in LuzonDenise Michelle AntivoNoch keine Bewertungen

- Spoken KashmiriDokument120 SeitenSpoken KashmiriGourav AroraNoch keine Bewertungen

- Managing Individual Differences and BehaviorDokument40 SeitenManaging Individual Differences and BehaviorDyg Norjuliani100% (1)

- Introducing Identity - SummaryDokument4 SeitenIntroducing Identity - SummarylkuasNoch keine Bewertungen

- Project Report: Eveplus Web PortalDokument47 SeitenProject Report: Eveplus Web Portaljas121Noch keine Bewertungen

- Final Draft Investment Proposal For ReviewDokument7 SeitenFinal Draft Investment Proposal For ReviewMerwinNoch keine Bewertungen

- Ulf Hannerz - Being There and ThereDokument17 SeitenUlf Hannerz - Being There and ThereThomás MeiraNoch keine Bewertungen

- Food Corporation of India Zonal Office (N) A-2A, 2B, SECTOR-24, NOIDADokument34 SeitenFood Corporation of India Zonal Office (N) A-2A, 2B, SECTOR-24, NOIDAEpaper awaazNoch keine Bewertungen

- Cayman Islands National Youth Policy September 2000Dokument111 SeitenCayman Islands National Youth Policy September 2000Kyler GreenwayNoch keine Bewertungen

- City Living: Centro de Lenguas ExtranjerasDokument2 SeitenCity Living: Centro de Lenguas Extranjerascolombia RodriguezNoch keine Bewertungen

- What Is ForexDokument8 SeitenWhat Is ForexnurzuriatyNoch keine Bewertungen

- A Palace in TimeDokument6 SeitenA Palace in TimeSonkheNoch keine Bewertungen

- Investigative Project Group 8Dokument7 SeitenInvestigative Project Group 8Riordan MoraldeNoch keine Bewertungen

- Lista Materijala WordDokument8 SeitenLista Materijala WordAdis MacanovicNoch keine Bewertungen

- 2.2 Push and Pull Sources of InnovationDokument16 Seiten2.2 Push and Pull Sources of Innovationbclarke113Noch keine Bewertungen

- Ebook PDF The Irony of Democracy An Uncommon Introduction To American Politics 17th Edition PDFDokument42 SeitenEbook PDF The Irony of Democracy An Uncommon Introduction To American Politics 17th Edition PDFscott.stokley449100% (39)

- Comparative Analysis Betwee Fast Restaurats & Five Star Hotels RestaurantsDokument54 SeitenComparative Analysis Betwee Fast Restaurats & Five Star Hotels RestaurantsAman RajputNoch keine Bewertungen

- A Triumph of Surgery EnglishDokument13 SeitenA Triumph of Surgery EnglishRiya KumariNoch keine Bewertungen

- Jurnal Upload DR Selvi PDFDokument8 SeitenJurnal Upload DR Selvi PDFRudi ChyprutNoch keine Bewertungen