Beruflich Dokumente

Kultur Dokumente

Lucky

Hochgeladen von

hello_krishOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lucky

Hochgeladen von

hello_krishCopyright:

Verfügbare Formate

DEFINITION OF CO-OPERATIVE BANKS A co-operative bank is a financial entity which belongs to its members, who are at the sometime

the owners and the customers of their bank. Co-operative banks are often created by persons belonging to the same local or professional community or sharing a common interest. Co-operative banks generally provide their members with a wide range of banking and financial services (loans, deposits, banking accounts -operative banks differ from stockholder banks by their organization, their goals, their values and their governance. In most countries, they are supervised and controlled by banking authorities and have to respect prudential banking regulations, which put them at a level playing field with stockholder banks. Depending on countries, this control and supervision can be implemented directly by state entities or delegated to a co-operative federation or central body. All the cooperative banks share common features : Customer-owned entities : In a co-operative bank, the needs of the customers meet the needs of the owners, as co-operative bank members are both. As a consequence, the first aim of a co-operative bank is not to maximize profit but to provide the best possible products and services to its members. Some co-operative banks only operate with their members but most of them also admit non-member clients to benefit from their banking and financial services. Democratic member control : Co-operative banks are owned and controlled by their members, who democratically elect the board of directors. Members usually have equal voting rights, according to the co-operative principle of person, one vote Profit allocation : In a co-operative bank, a significant part of the yearly profit, benefits or surplus is usually allocated to constitute reserves. A part of this profit can also be distributed tithe co-operative members, with legal or statutory limitations in most cases. Profit is usually allocated to members either through a patronage dividend, which is related to the use of theco-operative cts and services by each member, or through an interest or a dividend, which is related to the number of shares subscribed by each member. Y Co-operative Banks are organized and managed on the principal of co-operation, self-help, and mutual help. They function with the rule of t, no loss operative banks, as a principle, do not pursue the goalof profit maximization. Co-operative bank performs all the main banking functions of deposit mobilization, supply of credit and provision of remittance facilities. Co-operativeBanks provide limited banking products and are functionally specialists in agriculturerelated products. However, co-operative banks now provide housing loans also.

Y Co-operative Banks belong to the money market as well as to the capital market.

Primary agricultural credit societies provide short term and medium term loans. LandDevelopment Banks (LDBs) provide long-term loans. SCBs and CCBs also provide bothshort term and term loans. Cooperative banks are financial intermediaries onlypartially. The sources of their funds (resources) are (a) central and state government, (b)the Reserve Bank of India and NABARD, (c) other co-operative institutions, (d)ownership funds and, (e) deposits or debenture issues. It is interesting to note thatintra-sectoral flows of funds are much greater in co-operative banking than incommercial banking. Inter-bank deposits, borrowings, and credit from a significant partof assets and liabilities of co-operative banks. This means that intra-sectoral competitionis absent and intra-sectoral integration is high for co-operative bank

HISTORY The Bank was formed in 1872 as the Loan and Deposit Department of Manchester's Co-operative Wholesale Society, becoming the CWS Bank four years later. However, the bank didnot become a registered company until 1971. In 1975, the bank became the first new memberof the Committee of London Clearing Banks for 40 years, and thus able to issue its owncheques. Since 1974 the Cooperative Bank has consistently offered free banking for personalcustomers who remain in credit. It was also the first Clearing Bank to offer an interest bearingcheque account called Cheque & Save, in 1982. In 1991 the Bank shook the credit card marketwhen it introduced a guaranteed "free for life" Gold Visa card.The Co-operative banks in INDIA have a history of almost 100 years. The Cooperativebanks are an important constituent of the Indian Financial System, judging by the role assignedto them, the expectations they are supposed to fulfil, their number, and the number of officesthey operate. The co-operative movement originated in the West, but the importance that suchbanks have assumed in India is rarely paralleled anywhere else in the world. Their role in ruralfinancing continues to be important even today, and their business in the urban areas also hasincreased phenomenally in recent years mainly due to the sharp increase in the number of primary co-operative banks. Co operative Banks in India are registered under the Co-operativeSocieties Act. The cooperative bank is also regulated by the RBI. They are governed by theBanking Regulations Act 1949 and Banking Laws (Co-operative Societies) Act, 1965. Establishment of Cooperative Banks in India

INTRODUCTION Co-operative movement is quite well established in India. The first legislation on co-operation was passed in 1904. In 1914 the Maclagen committee envisaged a three tierstructure for co-operative banking viz. Primary Agricultural Credit Societies (PACs) at the grassroot level, Central Co-operative Banks at the district level and State Co-operative Banks at statelevel or Apex Level. The first urban cooperative bank in India was formed nearly 100 years backin Baroda.The co-operative banks arrived in India in the beginning of 20th Century as an officialeffort to create a new type of institution based on the principles of co-operative organisationand management, suitable for problems peculiar to Indian conditions. These banks wereconceived as substitutes for money lenders, to provide timely and adequate short-term andlong-term institutional credit at reasonable rates of interest.In the formative stage Co-operative Banks were Urban Co-operative Societies run oncommunity basis and their lending activities were restricted to meeting the credit requirementsof their members. The concept of Urban Co-operative Bank was first spelt out by MehtaBhansali Committee in 1939 which defined on Urban Co-operative Bank. Provisions of Section 5(CCV) of Banking Regulation Act, 1949 (as applicable to Cooperative Societies) defined anUrban Co-operative Bank as a Primary Co-operative Bank other than a Primary Co-operativeSociety was made applicable in 1966. MAIN FUNCTIONS OF CO-OPERATIVE BANKS

1.Co-operative Banks are organised and managed on the principal of co-operation, self-help,and mutual help. They function with the rule of "one member, one vote" function on "noprofit, no loss" basis. Co-operative banks, as a principle, do not pursue the goal of profitmaximisation. Co-operative bank performs all the main banking functions of depositmobilisation, supply of credit and provision of remittance facilities. Co-operative Banksprovide limited banking products and are functionally specialists in agriculture relatedproducts. However, co-operative banks now provide housing loans also. UCBs provideworking capital loans and term loan as well. 2. Co-operative bank do banking business mainly in the agriculture and rural sector. However,UCBs, SCBs, and CCBs operate in semi urban, urban, and metropolitan areas also. The urbanand nonagricultural business of these banks has grown over the years. The co-operativebanks demonstrate a shift from rural to urban, while the commercial banks, from urban torural. Co-operative Banks belong to the money market as well as to the capital market.Primary agricultural credit societies provide short term and medium term loans. 3. Cooperative banks in India finance rural areas under: Farming Cattle Milk Hatchery

Personal finance

4. Cooperative banks in India finance urban areas under: Self-employment Industries Small scale units Home finance Consumer finance Co-operative Banks Types

There are two types of co-operative banks in INDIA. 1. The first is the short term lending oriented Co-operative Banks. In this category there areagain three sub categories of banks which are the State Co-operative banks, District Co-operative banks and the Primary Agricultural Co-operative societies. 2. The second is the long term lending oriented Co-operative banks. In this second categorythere are land developments banks which are at three levels. First is the state level, thesecond is district level, and the third is the village level. Again the Co-operative banking structure in India is divided into five main categories and these categories are: 1. Primary Co-operative Credit Society .2. Central Co-operative Banks. 3. State Co-operative Banks. 4. Land Development Banks. 5.Urban Co-operative Banks.

It is very much clear that co-operative banks have very much importance in nationaldevelopment. Without the help of co-operative banks, millions of people in INDIA would belacking the much needed financial support.

Y Primary Co-operative Credit Society : The primary co-operative credit society is an association of borrowers and non-borrowersresiding in a particular locality. The funds of the society are derived from the share capital anddeposits of members and loans from central co-operative banks. The borrowing powers of themembers as well as of the society are fixed. The loans are given to members for the purchase of cattle, fodder, fertilizers, pesticides, etc.

Y Central co-operative banks: These are the federations of primary credit societies in a district and are of two types- those having a membership of primary societies only and those having a membership of societies aswell as individuals. The funds of the bank consist of share capital, deposits, loans and overdraftsfrom state co-operative banks and joint stocks. These banks provide finance to membersocieties within the limits of the borrowing capacity of societies. They also conduct all thebusiness of a joint stock bank. Y State co-operative banks : The state co-operative bank is a federation of central co-operative bank and acts as a watchdogof the co-operative banking structure in the state. Its funds are obtained from share capital,deposits, loans and overdrafts from the Reserve Bank of India. The state cooperative banks lendmoney to central cooperative banks and primary societies and not directly to the farmer. Y Land development banks : The Land development banks are organized in 3 tiers namely; state, central, and primary leveland they meet the long term credit requirements of the farmers for developmental purposes.The state land development banks oversee, the primary land development banks situated inthe districts and tehsil areas in the state. They are governed both by thestate government and Reserve Bank of India. Recently, the supervision of land developmentbanks has been assumed by National Bank for Agriculture and Rural development (NABARD).The sources of funds for these banks are the debentures 42subscribed by both central and stategovernment. These banks do not accept deposits from the general public. Y Urban Co-operative Banks : The term Urban Co-operative Banks (UCBs), though not formally defined, refers to primary cooperative banks located in urban and semi-urban areas. These banks, till 1996, were allowed tolend money only for non-agricultural purposes. This distinction does not hold today. Thesebanks were traditionally centered on communities, localities, work place groups. Theyessentially lend to small borrowers and businesses. Today, their scope of operations haswidened considerably. The origins of the urban co-operative banking movement in India can betraced to the close of nineteenth

century. Inspired by the success of the experiments relatedto the cooperative movement in Britain and the co-operative credit movement in Germany,such societies were set up in India. Co-operative societies are based on the principles of cooperation, mutual help, democratic decision making, and open membership. Cooperativesrepresented a new and alternative approach to organization as against proprietary firms,partnership firms, and joint stock companies which represent the dominant form of commercial organization. They mainly rely upon deposits from members and non-members andin case of need, they get finance from either the district central co-operative bank to whichthey are affiliated or from the apex co-operative bank if they work in big cities where the apexbank has its Head Office. They provide credit to small scale industrialists, salaried employees,and other urban and semi-urban residents.

CLASSIFICATION OF CO-OPERATIVE BANKS Some co-operative banks are scheduled banks, while others are non-scheduled banks. Forinstance, SCBs and some UCBs are scheduled banks but other co-operative banks are non-scheduled banks. At present, 28 SCBs and 11 UCBs with Demand and Time Liabilities over Rs 50crore each included in the Second Schedule of the Reserve Bank of India Act.Co-operative Banks are subject to CRR and liquidity requirements as other scheduled and non-scheduled banks are. However, their requirements are less than commercial banks.Sr.No. Category of bank Minimum SLR holding in Government and other approvedsecurities as percentage of Net Demand and Time Liabilities(NDTL)1. Scheduled banks 25%2. Non-Scheduled banks a) with NDTL of Rs.25crore & aboveb) with NDTL of lessthan Rs.25 crore15%10% Recent Developments. Over the years, primary (urban) cooperative banks have registered a significant growth innumber, size and volume of business handled. As on 31st March, 2003 there were 2,104 UCBsof which 56 were scheduled banks. About 79 percent of these are located in five states, -Andhra Pradesh, Gujarat, Karnataka, Maharashtra and Tamil Nadu. Recently the problems facedby a few large UCBs have highlighted some of the difficulties these banks face and policyendeavours are geared to consolidating and strengthening this sector and improvinggovernance. y

The cooperative banks/credit institutions constitutes the second segment

of Indian banking system, comprising of about 14% of the total banking

sector asset (March 2007). y

Bulk of the cooperative banks operate in the rural regions with rural coop y

banks accounting for 67% of the total asset and 67% of the total branches y

of all cooperative banks. y

Share of rural cooperatives in total institutional credit was 62% in 1992-93, y

34% in 2002-03 and 53% in 2006-07. y

Cooperative banks have an impressive network of outlets for institutional India,particularly in rural India.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Chapter 1 - Indian Financial System - IntroductionDokument26 SeitenChapter 1 - Indian Financial System - IntroductionsejalNoch keine Bewertungen

- NCERT Solutions For Class 11 Accountancy Financial Accounting Part-1 Chapter 4Dokument29 SeitenNCERT Solutions For Class 11 Accountancy Financial Accounting Part-1 Chapter 4Ioanna Maria MonopoliNoch keine Bewertungen

- Axis Bank - Final.Dokument55 SeitenAxis Bank - Final.TEJASHVINI PATELNoch keine Bewertungen

- 4s-Logistics 2011-11 12Dokument8 Seiten4s-Logistics 2011-11 12rickreddiNoch keine Bewertungen

- MDokument19 SeitenMJoannah SalamatNoch keine Bewertungen

- Manduleli Victor Bikitsha Nsualwkq ArchivedDokument10 SeitenManduleli Victor Bikitsha Nsualwkq ArchivedManduleli BikitshaNoch keine Bewertungen

- Deposit of Title Deeds Uco BankDokument3 SeitenDeposit of Title Deeds Uco Banksreenivas_miryalaNoch keine Bewertungen

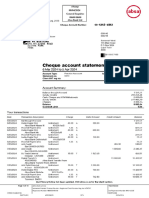

- Chase Bank Statement PDF Financial Technology Finance & Money ManagementDokument1 SeiteChase Bank Statement PDF Financial Technology Finance & Money Managementalexberry638464Noch keine Bewertungen

- EUR Statement: Account SummaryDokument2 SeitenEUR Statement: Account SummarySW ProjectNoch keine Bewertungen

- 1 - Renewal Application - Application For Continuance of Federal Kisan Credit Card Scheme - Modified V 2Dokument6 Seiten1 - Renewal Application - Application For Continuance of Federal Kisan Credit Card Scheme - Modified V 2AsifayiroorNoch keine Bewertungen

- Unit 22 Lesson 2: Discussing Banking: Talking About MoneyDokument32 SeitenUnit 22 Lesson 2: Discussing Banking: Talking About MoneyJorge FrancoNoch keine Bewertungen

- Sitxfin003 Learner Workbook v1.3 AcotDokument41 SeitenSitxfin003 Learner Workbook v1.3 Acotpooja sainiNoch keine Bewertungen

- Presentation On NBFC Crisis and Its Domino Effect On Indian EconomyDokument9 SeitenPresentation On NBFC Crisis and Its Domino Effect On Indian EconomySharath M SathyanarayanaNoch keine Bewertungen

- Uti ScamDokument7 SeitenUti ScamAbhishek ChadhaNoch keine Bewertungen

- RTM Full ExampleDokument9 SeitenRTM Full Examplemy nNoch keine Bewertungen

- Banking AwarenessDokument258 SeitenBanking AwarenessDhanrajDarsenaNoch keine Bewertungen

- Updated Prospectus Summary - CCB Principal Selected Growth Mixed Asset Fund.Dokument65 SeitenUpdated Prospectus Summary - CCB Principal Selected Growth Mixed Asset Fund.hasanNoch keine Bewertungen

- World Bank Support To Education Since 2001Dokument133 SeitenWorld Bank Support To Education Since 2001Independent Evaluation GroupNoch keine Bewertungen

- FIM Exercise AnsDokument6 SeitenFIM Exercise AnsSam MNoch keine Bewertungen

- Mortgage 06 12Dokument36 SeitenMortgage 06 12NewYorkObserverNoch keine Bewertungen

- Banking and Negotiable Instrument Notes2009-2010 Second SemesterDokument35 SeitenBanking and Negotiable Instrument Notes2009-2010 Second SemesterRow- Da- Vitzky75% (4)

- Project On NBFCDokument25 SeitenProject On NBFCAditya JagtapNoch keine Bewertungen

- Teller Duties ResumeDokument7 SeitenTeller Duties Resumeafllxjwyf100% (1)

- Credit Transaction CasesDokument7 SeitenCredit Transaction CasesSamKris Guerrero MalasagaNoch keine Bewertungen

- Adoption of E-Payment Systems A Review ofDokument10 SeitenAdoption of E-Payment Systems A Review ofFery Febriansyah100% (1)

- Accounting at Interactive Questions1Dokument32 SeitenAccounting at Interactive Questions1IQBALNoch keine Bewertungen

- Kalon Salon Talon Malon CelonDokument13 SeitenKalon Salon Talon Malon Celonਰੁਪਿੰਦਰ ਸਿੰਘNoch keine Bewertungen

- By: Vinit Mishra Sir: Ca IntermediateDokument128 SeitenBy: Vinit Mishra Sir: Ca IntermediategimNoch keine Bewertungen

- GTM Guidebook Analytical CRMDokument7 SeitenGTM Guidebook Analytical CRMKirsonNoch keine Bewertungen

- Report NICOM-2017 PDFDokument27 SeitenReport NICOM-2017 PDFAasaanHaiNoch keine Bewertungen