Beruflich Dokumente

Kultur Dokumente

2008SRO549

Hochgeladen von

Aakash RoyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2008SRO549

Hochgeladen von

Aakash RoyCopyright:

Verfügbare Formate

GOVERNMENT OF PAKSITAN MINISTRY OF FINANCE, ECONOMIC AFFAIRS, STATISTICS AND REVENUE (REVENUE DIVISION) **** Islamabad, the 11th

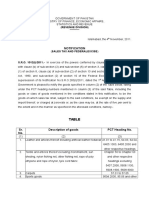

June, 2008 NOTIFICAITON (SALES TAX) S.R.O. 549(I)/2008: In exercise of the powers conferred by clause (c) of section 4 of the Sales Tax Act, 1990, the Federal Government is pleased to direct that the goods mentioned in column (2) of the table below shall be charged to tax at the rate of zero per cent subject to the conditions and restrictions specified in column (3) of that table, namely:-

TABLE S.No. (1) 1. Description of goods (2) Goods exempted under section 13. Conditions and restrictions (3) If exported by the manufacturer who makes local supplies of both taxable and exempt goods.

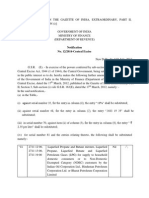

2.

(i) Cotton seeds (PCT Heading 1207.2000); Supplies thereof. and (ii) Oil cake and other solid residues, whether or not ground or in the form of pellets (PCT Heading 2306.1000)

3.

(i)

Plant, machinery and equipment (i) (whether or not manufactured locally), including parts thereof.

Import thereof.

(ii)

Plant, machinery and equipment, whether locally manufactured or (ii) Supplies thereof; imported. Provided that the expressions plant, machinery

and equipment mentioned in this serial number do not include consumer durables and office machines. 4. (i). Uncooked poultry Heading 02.07); meat (PCT Import and supplies thereof.

(ii). Milk (PCT Heading 04.01); (iii). Flavored Milk (PCT (0402.9900 and 22.02); Headings

(iv). Cream (PCT Heading 04.01 and 04.02); (v). Milk and cream, concentrated or containing added sugar or other sweetening matter (PCT Headings 0402.1000, 0402.2100, 0402.2900, 0402.9100 and 0402.9900) (vi). Yogurt (PCT Heading 0403.1000); (vii). Whey (PCT Heading 04.04); and (viii). Butter (PCT Heading 0405.1000); (ix). Desi ghee 0405.9000); (PCT Heading

(x). Cheese (PCT Heading 0406.1010); (xi). Processed cheese not grated or powdered (PCT Heading 0406.3000) (xii). Frozen, prepared or preserved sausages and similar products of poultry meat or meat offal (PCT Heading 1601.0000); (xiii). Meat and similar products of prepared frozen or preserved meat or meat offal of all types including poultry meat and fish (PCT Headings 1602.3200, 1602.3900, 1602.5000, 1604.1100, 1604.1200, 1604.1300, 1604.1400, 1604.1500, 1604.1600, 1604.1900, 1604.2010, 1604.2020, 1604.2090, 1604.3000); (xiv). Preparations for infant use, put up for retail sale (PCT Heading 1901.1000) (xv). Fat filled milk (PCT Heading

1901.9090); (xvi). Soyabean meal 2304.0000); (PCT Heading

(xvii). Petroleum crude oil (PCT Heading 2709.0000); (xviii). Colours in sets (Poster colours) (PCT Heading 3213.1000) (xix). Writing, drawing and marking inks (PCT Headings 3215.9010 and 3215.9090); (xx). Erasers (PCT Headings 4016.9210 and 4016.9290) (xxi). Exercise books 4820.2000); (PCT Heading

(xxii). Remeltable scrap (PCT Heading 72.04); (xxiii). Pencil sharpeners (PCT Heading 8214.1000) (xxiv). Sewing machines of the household type (PCT Headings 8452.1010 and 8452.1090); (xxv). Dedicated CNG buses and all other buses meant for transportation of forty or more passengers whether in CBU or CKD condition (PCT Heading 87.02); (xxvi). Trucks and dumpers with g.v.w. exceeding 5 tonnes (PCT Heading (87.04); (xxvii). Bicycles (PCT Heading 87.12); (xxviii). Trailers and semi-trailers for the transport of goods having specifications duly approved by the Engineering Development Board (PCT Heading 87.16); (xxix). Road tractors for semi-trailers, prime movers and road tractors for trailers whether in CBU condition or in kit form (PCT Headings 8701.2010, 8701.2020, 8701.2030, 8701.2090, 8710.9030, 8701.9040, 8701.9050 and 8701.9060);

(xxx). Purpose built taxis, whether in CBU or CKD condition (PCT Headings 8703.3226 and 8703.3227) which are built on girder chassis and having following features, namely:(xxxi). Attack resistance central division along with payment tray; (xxxii). Wheelchair compartment folding ramp; and (xxxiii). Taximeter system; and two-way with radio

(xxxiv). Vessels for breaking Heading 89.08);

up

(PCT

(xxxv). Other drawing, marking out or mathematical calculating instruments (geometry box) (PCT Heading 9017.2000) (xxxvi). Pens and ball pens (PCT Heading 96.08) and (xxxvii). Pencils including colour (PCT Heading 96.09); pencils

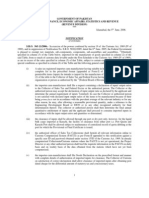

5. 6.

Compost (non-chemical fertilizer) Raw materials, components, components and parts.

If produced and supplied locally. sub- If purchased from authorized vendors by a recognized manufacturer of tractors (PCT Heading 8701.9020) for use in the manufacturing of such tractors subject to the following conditions, namely:(a) the manufacturer shall sell tractors against a proper zero-rate sales tax invoice without charging any sales tax. the vendors shall be entitled to input tax adjustment, or as the

(b)

case maybe, refund in respect of zero-rated supply of the components, subcomponents and parts supplied to recognized manufacturers of tractors: Provided that the electricity and gas consumed in the plant where tractors are manufactured shall also be zero-rated for the purposes of sales tax levy.

7.

Raw materials, components, components and parts.

sub- If imported or purchased locally for use in the manufacturing of such plant and machinery as is chargeable to sales tax at the rate of zero percent subject to the condition that the importer or the purchaser of the raw materials, components, subcomponents and parts holds a valid sales tax registration showing his registration category as manufacturer.

[C.No. 4(8) STJ/2008]

(Abdul Wadood Khan) Additional Secretary

Das könnte Ihnen auch gefallen

- Section-XXI Chapter-98Dokument10 SeitenSection-XXI Chapter-98శ్రీనివాసకిరణ్కుమార్చతుర్వేదులNoch keine Bewertungen

- Sro 967 (I) 2022Dokument3 SeitenSro 967 (I) 2022Hassan MujtabaNoch keine Bewertungen

- Fifth Schedule PDFDokument56 SeitenFifth Schedule PDFAkber LakhaniNoch keine Bewertungen

- An Import Is Any Good or Service Brought Into One Country From Another Country in A Legitimate FashionDokument21 SeitenAn Import Is Any Good or Service Brought Into One Country From Another Country in A Legitimate FashionsolankikavitaNoch keine Bewertungen

- Cex0606 PDFDokument19 SeitenCex0606 PDFbravoswagatNoch keine Bewertungen

- Second Schedule (Fifth Schedule)Dokument95 SeitenSecond Schedule (Fifth Schedule)Adnan KhanNoch keine Bewertungen

- Circular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedDokument10 SeitenCircular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedNitesh RawatNoch keine Bewertungen

- Duty Drawback Feb 2020Dokument192 SeitenDuty Drawback Feb 2020AkashAgarwalNoch keine Bewertungen

- Input Tax Credit Under GST Law FinalDokument7 SeitenInput Tax Credit Under GST Law FinalBiswaRanjanPandaNoch keine Bewertungen

- Rates of DepreciationDokument22 SeitenRates of DepreciationBalaKumar MurugadossNoch keine Bewertungen

- Circular 52 2018 Customs NewDokument2 SeitenCircular 52 2018 Customs NewSteve MclarenNoch keine Bewertungen

- SRO693 (I) 200629oct2013Dokument42 SeitenSRO693 (I) 200629oct2013Naveed AhmedNoch keine Bewertungen

- Cost Rules Modified 18-11-13 On Discussion of CAB Officers 2Dokument8 SeitenCost Rules Modified 18-11-13 On Discussion of CAB Officers 2bhuban020383Noch keine Bewertungen

- Noti. No. 04-2014 C.E.Dokument4 SeitenNoti. No. 04-2014 C.E.Ashutosh GargNoch keine Bewertungen

- Income Tax Department Depreciation RateDokument16 SeitenIncome Tax Department Depreciation RatejiviNoch keine Bewertungen

- DBK Rate 2018 PDFDokument176 SeitenDBK Rate 2018 PDFmahen aryaNoch keine Bewertungen

- 5th ScheduleDokument5 Seiten5th ScheduleWaseem ParchaNoch keine Bewertungen

- Notification: S.R.O. 1012 (I) /2011.-In Exercise of The Powers Conferred by Clause (C) of Section 4 ReadDokument7 SeitenNotification: S.R.O. 1012 (I) /2011.-In Exercise of The Powers Conferred by Clause (C) of Section 4 ReadYasir MasoodNoch keine Bewertungen

- 0775 31072006 Ipo PDFDokument80 Seiten0775 31072006 Ipo PDFsadafNoch keine Bewertungen

- Central Excise Tariff Notification No.12/2014 Dated 11th July, 2014Dokument6 SeitenCentral Excise Tariff Notification No.12/2014 Dated 11th July, 2014stephin k jNoch keine Bewertungen

- Notification No. 95 of 2018 CUSTOMS N.T PDFDokument176 SeitenNotification No. 95 of 2018 CUSTOMS N.T PDFARJUNNoch keine Bewertungen

- New Microsoft Word DocumentDokument2 SeitenNew Microsoft Word DocumentKrishna Kumar VermaNoch keine Bewertungen

- IV. Job Work Notifications General Exemption No. 23Dokument6 SeitenIV. Job Work Notifications General Exemption No. 23Samy JainNoch keine Bewertungen

- Block of Assets: I. BuildingsDokument8 SeitenBlock of Assets: I. BuildingsspandanNoch keine Bewertungen

- Sro 575 Updated 200313Dokument40 SeitenSro 575 Updated 200313Asaad ZahirNoch keine Bewertungen

- Sro 487Dokument4 SeitenSro 487Rana SaimNoch keine Bewertungen

- Sro 567i2022Dokument13 SeitenSro 567i2022Hassan MujtabaNoch keine Bewertungen

- Hs Final 2017Dokument506 SeitenHs Final 2017samerkalmoniNoch keine Bewertungen

- Fifth ScheduleDokument50 SeitenFifth ScheduleZameer HussainNoch keine Bewertungen

- Companies CRAR 2019Dokument53 SeitenCompanies CRAR 2019trijya.cma20Noch keine Bewertungen

- csnt77-2023 - Applicable 30-Oct-23Dokument159 Seitencsnt77-2023 - Applicable 30-Oct-23Sumit ChhuganiNoch keine Bewertungen

- Sro 154Dokument5 SeitenSro 154msadhanani3922Noch keine Bewertungen

- Government of Chhattisgarh Finance and Planning Department (Commercial Tax Department) Mantralaya Dau Kalyan Singh Bhawan, Raipur NotificationDokument3 SeitenGovernment of Chhattisgarh Finance and Planning Department (Commercial Tax Department) Mantralaya Dau Kalyan Singh Bhawan, Raipur Notificationjdhamdeep07Noch keine Bewertungen

- Sale Tax SchedulesDokument17 SeitenSale Tax Schedulesسید رض وانNoch keine Bewertungen

- HighLights ST FEDokument34 SeitenHighLights ST FEShakir MuhammadNoch keine Bewertungen

- The Sixth Schedule - Sales Tax ActDokument9 SeitenThe Sixth Schedule - Sales Tax Actfzl17100% (1)

- Fifth Schedule To The Customs ActDokument66 SeitenFifth Schedule To The Customs Actharis iqbalNoch keine Bewertungen

- Pakistan Custom Tariff - Fifth Schedule To The Customs Act, 1969 (2019-20) (Updated Upto 30-06-2019)Dokument66 SeitenPakistan Custom Tariff - Fifth Schedule To The Customs Act, 1969 (2019-20) (Updated Upto 30-06-2019)zacybernautNoch keine Bewertungen

- The Second Schedule: "Fifth Schedule To The Customs Act 1969 (Iv of 1969)Dokument67 SeitenThe Second Schedule: "Fifth Schedule To The Customs Act 1969 (Iv of 1969)Ameer BhattiNoch keine Bewertungen

- Sro 565-2006Dokument44 SeitenSro 565-2006Abdullah Jathol100% (1)

- SCH 2 3Dokument16 SeitenSCH 2 3mahabalu123456789Noch keine Bewertungen

- Personal DutyDokument13 SeitenPersonal DutyEarwineNoch keine Bewertungen

- Cenvat Credit Rules, 2004Dokument21 SeitenCenvat Credit Rules, 2004Himanshu SawNoch keine Bewertungen

- Ix. Exemption To Certain Goods and IndustriesDokument7 SeitenIx. Exemption To Certain Goods and IndustriesManish GautamNoch keine Bewertungen

- DBK and DeecDokument3 SeitenDBK and DeecManik RajNoch keine Bewertungen

- Taxation - Digest RR PDFDokument41 SeitenTaxation - Digest RR PDFNiño Navarez RosalNoch keine Bewertungen

- Export Oriented Units (Eous), Electronics Hardware Technology Parks (Ehtps), Software Technology Parks (STPS) and Bio-Technology Parks (BTPS)Dokument21 SeitenExport Oriented Units (Eous), Electronics Hardware Technology Parks (Ehtps), Software Technology Parks (STPS) and Bio-Technology Parks (BTPS)Bharat JainNoch keine Bewertungen

- KOREA USA Trade AgreementDokument105 SeitenKOREA USA Trade AgreementJorge Gregorio SeguraNoch keine Bewertungen

- Scoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018Dokument4 SeitenScoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018DRI HQ CINoch keine Bewertungen

- Collection and Deduction of Tax at SourceDokument64 SeitenCollection and Deduction of Tax at SourceMohammad SaadNoch keine Bewertungen

- Annex III.2 Exceptions To Articles III.2 and III.7 Section I - Canadian MeasuresDokument2 SeitenAnnex III.2 Exceptions To Articles III.2 and III.7 Section I - Canadian Measurescfts94Noch keine Bewertungen

- Government of Pakistan Ministry of Finance, Revenue and Economic Affairs (Revenue Division) Notification (Customs/Sales Tax)Dokument5 SeitenGovernment of Pakistan Ministry of Finance, Revenue and Economic Affairs (Revenue Division) Notification (Customs/Sales Tax)MOHSINNoch keine Bewertungen

- 3 Excise & DSTDokument11 Seiten3 Excise & DSTAnonymous fqPzSjkNoch keine Bewertungen

- Iii. Trade Policies and Practices by Measure (1) M D A I (I) Customs ProceduresDokument31 SeitenIii. Trade Policies and Practices by Measure (1) M D A I (I) Customs ProceduresTri Putra Agro HarmonisNoch keine Bewertungen

- 2001sro450 - Customs RulesDokument217 Seiten2001sro450 - Customs RulesAazam Shahzad CasanovaNoch keine Bewertungen

- file CENVAT CREDIT RULES, 2004Dokument26 Seitenfile CENVAT CREDIT RULES, 2004vvalliraoNoch keine Bewertungen

- Industrial Trucks, Tractors, Trailers & Stackers World Summary: Market Values & Financials by CountryVon EverandIndustrial Trucks, Tractors, Trailers & Stackers World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryVon EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Industrial Trucks, Tractors & Mobile Straddle Carriers & Cranes World Summary: Market Sector Values & Financials by CountryVon EverandIndustrial Trucks, Tractors & Mobile Straddle Carriers & Cranes World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryVon EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Ajay Kumar Tyagi Parth Engineering Works 357, D.D.A. Flat, Khirki, Malviya Nagar,, New Delhi, DelhiDokument2 SeitenAjay Kumar Tyagi Parth Engineering Works 357, D.D.A. Flat, Khirki, Malviya Nagar,, New Delhi, DelhiShankar BanrwalNoch keine Bewertungen

- Walmart Case StudyDokument15 SeitenWalmart Case StudyChiragNoch keine Bewertungen

- B5 - 9.5 XP Replacement Parts ListDokument2 SeitenB5 - 9.5 XP Replacement Parts ListGeo MoralesNoch keine Bewertungen

- Sop p180 Avanti IIDokument92 SeitenSop p180 Avanti IIcougarfly100% (2)

- A Shock AbsorberDokument5 SeitenA Shock Absorberriz2010Noch keine Bewertungen

- RFD Daily Incident Report 7/18/21Dokument2 SeitenRFD Daily Incident Report 7/18/21inforumdocsNoch keine Bewertungen

- DOT Hazmat Training For Nuclear Medicine Technologists - Rules of The RoadDokument50 SeitenDOT Hazmat Training For Nuclear Medicine Technologists - Rules of The RoadAdji Achmad J BramantyaNoch keine Bewertungen

- Forklift Policy ManualDokument8 SeitenForklift Policy ManualJuan Carlos SerppNoch keine Bewertungen

- Thank You For Your Application To Rishworth Aviation!: Candidate Questionnaire & DeclarationDokument7 SeitenThank You For Your Application To Rishworth Aviation!: Candidate Questionnaire & DeclarationGustavo RamirezNoch keine Bewertungen

- Parkview FRONT REAR Rev 3 - 13 Da Vers 28 - 85Dokument2 SeitenParkview FRONT REAR Rev 3 - 13 Da Vers 28 - 85zdenev389Noch keine Bewertungen

- Suspension Bridge ReportDokument36 SeitenSuspension Bridge ReportRam Pathak50% (6)

- Pantaloon ReportDokument16 SeitenPantaloon ReportHimanshu Rastogi100% (1)

- CHUYÊN ĐỀ 2- SUBJECT AND VERB AGREEMENTDokument5 SeitenCHUYÊN ĐỀ 2- SUBJECT AND VERB AGREEMENTNguyễn Hà LinhNoch keine Bewertungen

- Emea Cat Mo Wheel Bearings Catmo1802 2018-2019 en HQDokument1.164 SeitenEmea Cat Mo Wheel Bearings Catmo1802 2018-2019 en HQJharomar BatacNoch keine Bewertungen

- ZGTMB Z Driver Takaful e Hailing Flyer Eng BM Ho 220819Dokument2 SeitenZGTMB Z Driver Takaful e Hailing Flyer Eng BM Ho 220819fadzli_ismailNoch keine Bewertungen

- Diagnostic Manual (EMS) : Cruise ControlDokument4 SeitenDiagnostic Manual (EMS) : Cruise ControlZacklift Para Gruas Y CamionesNoch keine Bewertungen

- Case Studies in Fracture MechanicsDokument475 SeitenCase Studies in Fracture MechanicsBenjamin Rohit100% (1)

- Abdurehman MuletaDokument124 SeitenAbdurehman MuletaHundee Hundumaa100% (1)

- Cesna 172Dokument7 SeitenCesna 172eng13Noch keine Bewertungen

- eSUP 2015 02Dokument2 SeiteneSUP 2015 02Phyo ThantNoch keine Bewertungen

- Sea Ports - Exports & Imports by INDIRA SARKARDokument3 SeitenSea Ports - Exports & Imports by INDIRA SARKARShambhavi RaiNoch keine Bewertungen

- Jora RaiseDokument11 SeitenJora RaiseAyush tiwari100% (1)

- VW Transporter T6 Current Flow DiagramDokument1.505 SeitenVW Transporter T6 Current Flow DiagramRuican AlexandruNoch keine Bewertungen

- Madrid: Facts and FiguresDokument6 SeitenMadrid: Facts and FiguresPromoMadridNoch keine Bewertungen

- U&M ARM550 E01Dokument165 SeitenU&M ARM550 E01Augusto Oliveira100% (2)

- Padernal-BSA-1A-SW-Accounts ReceivableDokument4 SeitenPadernal-BSA-1A-SW-Accounts ReceivableFly ThoughtsNoch keine Bewertungen

- AboutDokument3 SeitenAboutTushar SharmaNoch keine Bewertungen

- Ibau-Hamburg 1Dokument10 SeitenIbau-Hamburg 1belleblackNoch keine Bewertungen

- Caterpillar Performance Handbook 49 62020 Partie3Dokument4 SeitenCaterpillar Performance Handbook 49 62020 Partie3ali alilouNoch keine Bewertungen

- BMBS For Freight Stock-SKDokument25 SeitenBMBS For Freight Stock-SKSoumen BhattaNoch keine Bewertungen