Beruflich Dokumente

Kultur Dokumente

Regression Analysis Games

Hochgeladen von

IRIZREENOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Regression Analysis Games

Hochgeladen von

IRIZREENCopyright:

Verfügbare Formate

ECO740: ECONOMIC ANALYSIS

INDIVIDUAL REGRESSION ASSIGNMENT

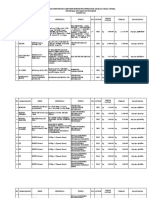

Data Ior 'Fantastic Frieda video game is given in the Iollowing table.

Year Q

F

P

F

($) P

C

($) Y

a

($) A ($)

1993 50000 18 20 24580 7500

1994 60000 16 20 26433 10500

1995 55000 16 18 27735 10500

1996 61000 17 20 29458 11500

1997 63000 17 21 30970 12000

1998 65000 18 22 32191 12400

1999 75000 16 21 34213 13000

2000 70000 20 24 35353 12500

2001 75000 20 24 35939 14000

490 Q

F

is the quantity demanded per year oI the games, P

F

is the price oI the game,

P

C

is the price oI competing games, Y

a

is the median annual Iamily income, and A is

the monthly advertising expenditures.

QUESTIONS

&sing any oI the standard multiple regression computer packages and the data:

1. stimate the demand Iunction Ior the video game.

2. Based on your regression estimates, would you be able to convince the video

game company to accept the model that you estimated? Why or why not?

3. Find the elasticity estimates.

4. Write a report on how the company may beneIit Irom your demand estimation

in its decision-making.

ANSWERS

Question 1:

Data transIormation:

Year logQ

F

logP

F

($) log P

C

($)

logY

a

($) log A ($)

1993 4.6990 1.2553 1.3010 4.3906 3.8751

1994 4.7782 1.2041 1.3010 4.4221 4.0212

1995 4.7404 1.2041 1.2553 4.4430 4.0212

1996 4.7853 1.2304 1.3010 4.4692 4.0607

1997 4.7993 1.2304 1.3222 4.4909 4.0792

1998 4.8129 1.2553 1.3424 4.5077 4.0934

1999 4.8751 1.2041 1.3222 4.5342 4.1139

2000 4.8451 1.3010 1.3802 4.5484 4.0969

2001 4.8751 1.3010 1.3802 4.5556 4.1461

For this data, the dependant variable is quantity demanded per year oI the games, Q

with 4 independent variables which are price oI the game, P

F

, price oI competing

games, P

C

, median annual Iamily income, Y

a

, and monthly advertising expenditures,

A. Thus, the data will be analyzed using a multiple linear regression model in a

multiplicative exponential Iorm. So, the demand Iunction Ior 'Fantastic Frieda video

game will be in the Iorm oI:

Q o

P

[

1

C

[

2

u

[

3

[

4

q. 1.1

Or, in the Iorm oI simple linear relationship, the equation will be:

log Q = log o +

1

log P

F

+

2

log P

C

+

3

log Y

a

+

4

log A +c q. 1.2

where, log o ,

1

,

2

,

3

is the coeIIicient (parameter) oI independent variable and c is

an error term.

Assumptions:

(i.)Assuming that the change oI quantity demanded oI the games per year, Q

depended on price oI the game, P

F

, price oI competing games, P

C

, median

annual Iamily income, Y

a

, and monthly advertising expenditures, A and/or

other Iactors.

(ii.)ultiplicative exponential model is chosen due to its easiness in estimating

elasticity as it gives constant elasticities over the range oI data.

From the regression output in Appendix 1, demand Iunction Ior the video

game with t-statistic in parentheses is:

log Q = . - .98 log P

F

+ .99 log P

C

+ . log Y

a

+ . log A

(2.356) (-2.504) (2.513) (1.689) (0.533)

Or

Q .9 P

F

0.798

P

C

0.949

Y

a

0.574

A

0.112

Question 2

Based on the regression output using SPSS 17.0 attached in Appendix 1:

(i.) Durbin-Watson

Since the data is in terms oI time, t, the value oI Durbin Watson should be

analyzed Iirst to determine whether autocorrelation existed. The value oI

Durbin-Watson is 1.824 which closes to 2. This value indicates possible

presence oI positive autocorrelation but since the value is close to 2, the data is

acceptable. So, the value oI t-statistics, r

2

and F is considered reliable.

(ii.) T-Test:

This test was done to test whether each oI the independent variables oI price oI

games, P

F

, price oI complementary games, P

C

, median annually Iamily income,

Y

a

, monthly advertising expenditures, A has a signiIicant relationship with

quantity oI games demanded per year ,Q by testing:

The null-hypotheses : H

0

:

i

0 (not signiIicant) against

alternative hypothesis: Ha: i 0 (signiIicant)

Decision rule: Reject H

0

iI , t , ~ critical t (t*), then it is signiIicant.

For 95 conIidence level or a 0.05 signiIicant level, t critical can assumed to

be:

t* 2

From the regression output, the independent variable(s) that is deemed

signiIicant by t-test is P

F

, P

C

and constant with value oI ,-2.504, ~ 2, 2.513 ~ 2,

and 2.356 ~ 2 respectively. We can say that the PF, PC and constant (other

Iactors) are important in estimating the demand Ior 'Fantastic Frieda video

games. However Ior annual Iamily income, Y

a

and monthly advertising

expenditures, A exhibits a t-statistics less than t-critical with each t-statistics

valued at 1.689 and 0.533 respectively, so they are not signiIicant to inIluence

quantity demanded per year oI games, Q.

(iii.) Correlation coeIIicient, r:

Based on the regression output, the correlation coeIIicient oI the model is 0.984

which is very close to 1 (almost perIect correlation) which shows a high

strength oI association between independent variable and dependent variable. In

other words, high value oI one variable is associated with a high value oI

another variable.

(iv.) Analysis oI variance:

CoeIIicient oI determinant, r

2

can be used to measure whether the regression

model Iit` to the samples oI observation oI the video game data.

The value oI r

2

oI 0.968 (96.8) is very close to 1(100) that shows the

regression model is almost perIectly Iit to the samples oI observation. This

value also explains that 96.8 oI the data variation can be explained by the

model while only 3.2 oI the data could not be explained by the regression

model.

F-statistics oI the regression model will show whether r

2

is signiIicant or

not.

(v.) F-statistics:

This model shows F-statistics oI 30.10. The value oI F-distribution Ior this

particular data is F

0.05, 4, 25

2.76. Since F-statistic ~ F-distribution table, 30.10

~ 2.76, thereIore, this shows that the r2 is signiIicant. Overall, the model is able

to explain a signiIicant proportion oI variation in Q caused by change oI all

independent variables.

(vi.) ames sales Iorecasting

The standard error oI estimate, J

can be used to predict the range or the

intervals oI sales oI games, Q. This value will show the interval at which the

actual value oI Q lies in. For a 95 conIidence level, the prediction Q range can

be calculated as:

Actual Q = Q _ J

In this case, Irom the regression model output, s

e

is 0.015, so the predicted range

oI Q will be: Actual Q = Q_ (.)

Question 3:

From the coeIIicient oI the independent variable, elasticity can be estimated as

Iollows:

(i.) ame price elasticity oI demand,

D

1

- 0.798

The market demand Ior game price was price inelastic where 0 ,-0.798, 1,

which explains that a percentage change in P

F

will result in a smaller

percentage oI change in Q. For example a 20 percent increase in P

F

will lead

to a 15.96 percent decrease in demand oI Q.

Calculation:

(0.2)(-0.798) 0.1596 15.96 (decrease)

(ii.) Cross price elasticity oI demand,

2

0.949

A competitors` price elasticity oI demand oI 0.949 shows P

C

is inelastic, as

20 percent increase in competitors` price, P

C

will lead to 18.98 percent

increase in quantity oI video games demanded, Q.

Calculation:

(0.2)(0.949) 0.1898 18.98 (increase)

Since the elasticity measured is highly positive, then both products are

substitute products. The high degree oI substitute relationship between

'Fantastic Frieda and other video game competitors shows a high

competition between them in a market.

(iii.) Income elasticity oI demand,

3

0. 574

The income elasticity oI 0.574 suggests that the income is inelastic which

means that iI there is 6 percent increase in the annual Iamily income then, the

quantity demanded Ior video games will increase 3.44 percent.

Calculation:

(0.06)(0.574) 0.0344 3.44 (increase)

(iv.) Advertising expenditure elasticity oI demand,

A

4

0.112

As advertising expenditure shows inelastic demand oI 0.112, Ior a 20 percent

increase in the ads expenditures, the demand will increase in 2.24 percent.

Calculation:

(0.2)(0.112) 0.0224 2.24 (increase)

(v.) Combined eIIect oI demand elasticity,

The demand oI 'Fantastic Frieda video games can also be estimated Ior

increasing change oI two Iactors (independent variable) simultaneously. For

this case, iI the price oI the video games and the Iamily income changes

simultaneously with other Iactors (competitor`s price and advertising

expenditures were assumed independent and additive respectively) remains

the same, the eIIect on the quantity demanded can be estimated using the

equation below:

Q

2

= Q

1

| +

(%AP

F

) +

(%AY

a

)] q. 1.3

Previously,

D

- 0.798;

0. 574; %AP

F

= %; %AY

a

= %;

For year 2001, Q

2001

75000;

So, substituting relevant data into eq. 1.3 yields the Iorecasting demand Ior

year 2002 which are as Iollows:

2002

= | + (- .98)(.) +. (.)] = units

Question 4:

Overall, this model shows a good Iit Ior the data as it explained 96.8 oI the

variations oI quantity demanded sales per year. Based on the regression model Ior

'Fantastic Frieda video games, it can be seen that Ior this particular product i.e.

'Fantastic Frieda video game, the price oI the video games and price oI competitors

is a signiIicant variable to be considered in estimating the demand oI the product.

(i). As the price oI the video game increases, the quantity demanded decreases.

(ii). As the price oI video game competitor increases, the quantity demanded also

increases.

It can be stipulated that the price oI the product is important in inIluencing the

demand oI the 'Fantastic Frieda. Based on these Iacts, the company should Iocus

more on coming up with a competitive price to compete with the other video games

competitor.

As the annual Iamily income and monthly advertising expenditures were less

inIluencing than the other two variables, the company may in order to reduce the total

cost oI product, adopt less cost advertising strategy such as through social networking

and through the internet.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Anthony Robbins - Time of Your Life - Summary CardsDokument23 SeitenAnthony Robbins - Time of Your Life - Summary CardsWineZen97% (58)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Parts Manual: Generator SetDokument118 SeitenParts Manual: Generator SetAhmed Kamal100% (2)

- Uh 60 ManualDokument241 SeitenUh 60 ManualAnonymous ddjwf1dqpNoch keine Bewertungen

- Wins Salvacion Es 2021Dokument16 SeitenWins Salvacion Es 2021MURILLO, FRANK JOMARI C.Noch keine Bewertungen

- Functions PW DPPDokument4 SeitenFunctions PW DPPDebmalyaNoch keine Bewertungen

- The History of Music in Portugal - Owen ReesDokument4 SeitenThe History of Music in Portugal - Owen ReeseugenioamorimNoch keine Bewertungen

- Rab Sikda Optima 2016Dokument20 SeitenRab Sikda Optima 2016Julius Chatry UniwalyNoch keine Bewertungen

- BSDDokument26 SeitenBSDEunnicePanaliganNoch keine Bewertungen

- Micro - Systemic Bacteriology Questions PDFDokument79 SeitenMicro - Systemic Bacteriology Questions PDFShashipriya AgressNoch keine Bewertungen

- 2432 - Test Solutions - Tsol - 2432 - 21702Dokument5 Seiten2432 - Test Solutions - Tsol - 2432 - 21702Anmol PanchalNoch keine Bewertungen

- Parker HPD Product Bulletin (HY28-2673-01)Dokument162 SeitenParker HPD Product Bulletin (HY28-2673-01)helden50229881Noch keine Bewertungen

- Nyamango Site Meeting 9 ReportDokument18 SeitenNyamango Site Meeting 9 ReportMbayo David GodfreyNoch keine Bewertungen

- Donnan Membrane EquilibriaDokument37 SeitenDonnan Membrane EquilibriamukeshNoch keine Bewertungen

- Corporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalDokument76 SeitenCorporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalNidhi LathNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument5 SeitenNew Microsoft Office Word DocumentSukanya SinghNoch keine Bewertungen

- A Brief Tutorial On Interval Type-2 Fuzzy Sets and SystemsDokument10 SeitenA Brief Tutorial On Interval Type-2 Fuzzy Sets and SystemstarekeeeNoch keine Bewertungen

- Work Site Inspection Checklist 1Dokument13 SeitenWork Site Inspection Checklist 1syed hassanNoch keine Bewertungen

- Route Clearence TeamDokument41 SeitenRoute Clearence Teamctenar2Noch keine Bewertungen

- Rocker ScientificDokument10 SeitenRocker ScientificRody JHNoch keine Bewertungen

- Smart Plug Installation GuideDokument9 SeitenSmart Plug Installation GuideFrancisco GuerreroNoch keine Bewertungen

- Windows System Shortcut CommandsDokument2 SeitenWindows System Shortcut CommandsVenkatesh YerraNoch keine Bewertungen

- VerificationManual en PDFDokument621 SeitenVerificationManual en PDFurdanetanpNoch keine Bewertungen

- Participatory EvaluationDokument4 SeitenParticipatory EvaluationEvaluación Participativa100% (1)

- Design and Optimization of A Medium Altitude Long Endurance UAV Wingbox StructureDokument8 SeitenDesign and Optimization of A Medium Altitude Long Endurance UAV Wingbox StructureamirNoch keine Bewertungen

- FKTDokument32 SeitenFKTNeeraj SharmaNoch keine Bewertungen

- A2 UNIT 5 Culture Teacher's NotesDokument1 SeiteA2 UNIT 5 Culture Teacher's NotesCarolinaNoch keine Bewertungen

- Carpentry Grade 8 Week 1 2Dokument20 SeitenCarpentry Grade 8 Week 1 2SANTIAGO ALVISNoch keine Bewertungen

- MN Rules Chapter 5208 DLIDokument24 SeitenMN Rules Chapter 5208 DLIMichael DoyleNoch keine Bewertungen

- Module 2Dokument7 SeitenModule 2karthik karti100% (1)

- O'Dell v. Medallia, Inc. Et Al, 1 - 21-cv-07475, No. 1 (S.D.N.Y. Sep. 7, 2021)Dokument15 SeitenO'Dell v. Medallia, Inc. Et Al, 1 - 21-cv-07475, No. 1 (S.D.N.Y. Sep. 7, 2021)yehuditgoldbergNoch keine Bewertungen