Beruflich Dokumente

Kultur Dokumente

John F Motz Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

John F Motz Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

AO 10 Rev.

1/2011: :

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization United States District Court For the District of Maryland

5a. Report Type (check appropriate type) ] Nomination, Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) MOTZ, JOHN F.

4. Title (Article I11 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/20/2011

6. Reporting Period 01/01/2010 to 12/31/2010

Senior status

[] Initial

5b. [] Amended Report 7. Chambers or Office Address 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

U.S. Courthouse 101 W. Lombard St., 5th FI. Baltimore, Maryland 21201

IMPORTANT NOTES: The instructions accompanying this form must be followetL Complete all parts,

checking the NONE box for each part where yott have no reportable information. Sign on last page.

I. POSITIONS. (Rcpor, i.g individual only; see pp. 9-13 of filing instructions.)

D

1. 2. 3. 4. 5.

NONE (No reportable positions.)

POSITION

Trustee Trustee Custodian

NAME OF ORGANIZATION/ENTITY

Sheppard & Enoch Pratt Health System Generation Skipping Trust~, ~, ~ College Savings Plan ~

II. AGREEMENTS. me, o,i.g i.aiviaual o.ly; se~ pp. 14-16 of filing instructions.)

~] NONE (No reportable agreements.) DATE PARTIES AND TERMS

Motz, John F.

FINANCIAL DISCLOSURE REPORT Page 2 of 10

Name of Person Reporting MOTZ, JOHN F.

Date of Report 05/20/2011

IlL NON-INVESTMENT INCOME. (Reporting individual and spouse; see pp. 17-24 of filing instructions.)

A. Filers Non-Investment Income ~

NONE (No reportable non=investment income.)

DATE SOURCE AND TYPE INCOME (yours, not spouses)

2. 3. 4.

B. Spouses Non-Investment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment.income.) DATE

1. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children," see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.)

SOURCE DATES

4/23110-4/27/10

LOCATION

Phoenix, AZ

PURPOSE

Educational Seminar

ITEMS PAID OR PROVIDED lodging and transportation

I. 2.

3.

Arizona State University

4. 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 10

Name of Person Reporting

Date of Report 05/20/20! !

[ ~OTZ, ~On~ ~. V. GIFTS. a,~l,des ,ho,e to spouse and dependent children; seepp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. a.cl,,des those o/ wouse and de~,e.den, children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.) CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 10

Name of Person Reporting MOTZ, JOHN F.

Date of Report 05/20/201 I

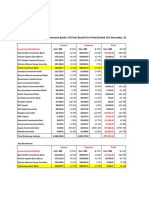

VII. INVESTMENTS and TRUSTS - i.eo,., ~o~e, t .....

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "iX)" after each asset exempt from prior disclosure Income during reporting period

ctlons (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

Gross value at end of reporting period (1) (2) Value Value Code 2 (J-P) Method Code 3 (Q-W)

Transactions during reporting period

(1)

Amount Code 1 (A-H)

(2)

Type (e.g., div., rent, or int.)

(l) Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code 1 (J-P) (A-H)

(5) Identity of buyer/seller (if private transaction

1. 2. 3. 4.

5.

Exxon Mobil IBM TRP - Tax Exempt T. Rowe Price

Sara Lee

D C A C

A

Div Div Int Div

Div

6.

Nicholas Fund

Div

7.

TRP Equity Income Fund

Dividend

8.

Chevron/Texaco

Dividend

9.

Campbell Soup

MD. Bond lnvesco Constellation (IRA)

Div

10.

Interest

11.

Div

note 1

12.

Genl Elec

Div

13.

DuPont DeNemour & Co.

Div

14.

ExxonMobil Corp. (IRA)

Div

15,

Apple Computer

Div

16.

TRP-New ERA

Dividend

17.

TRP- Value

Dividend

see note 1

I. Income Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes iSce Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25,000,O01 o $50,000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI =$1,000.001 - $5.000.000 L =$50,001 - $100,000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 tt2 =More than $5,000,000 M -$100,001 - $250,000 P2 =$5,000,001 - $25,000.000 T =Cash Market

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 10

Name of Person Reporting MOTZ, JOHN F.

Date of Report 05/20/2011

VII. INVE STMENTS and TRUS TS -income, valae, transactions (Includes those of spouse and dependent children; seepp. 34-60 of.filing instractlon&)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (1) Amount Code 1 (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (1) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) (I) Type (e.g., buy, sell, redemption) D. Transactions during reporting period (2) (3) (4) Date Value mm/dd/yy Code 2 (J-P) (5) Identity of buyer/seller (if private transaction)

Gain Code l (A-H)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34.

TRP - Capital Opp. (IRA) TRP - Health Sciences (IRA) TRP - New Asia (IRA) TRP - Small - Cap Value (IRA) TRP - Value Fund (IRA) TRP - Prime Reserve (IRA) Merck CVS Pepsico U.S. Treasury Bonds (IRA) Baltimore County Bond Montgomery County Bond Charles County Bond

Altria Kraft Yum Brands AIG

A A A A A

Dividend Dividend Dividend Dividend Dividend

K L L L K

T T T T T see note 2

B A B A A A A

A A A A

Dividend Dividend Dividend Interest Interest Interest Dividend

Dividend Dividend Dividend Dividend

K K L K J K J

J J K J

T T T T T T T

T T T T

I. Income Gain Codes: (See Colunms B 1 and 134) 2. Value Codes (See Columns 121 and D3) 3. Value Method Codes (See Column C2)

A=$1,000 orless F =$50,001- $100,000 J =$15,000 orless N=$250,001 o $500,000 P3 -$25,000,001 -$50.000,000 Q=Appraisal U =Book Value

B =$1,001- $2,500 G =$100.001 -$1,000,000 K=$15,001 -$50,000 O=$500,001 - $1,000,000 R =Cost(Real Estale Only) V =Other

C =$2,501- $5,000 H1 =$1.000.001- $5,000,000 L ~$50,001- $100,000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001- $15,000 H2 =More Man $5,000.000 M=$100,001 -$250,000 P2 =$5,000,001- $25,000,000 T =Cash Market

E =$15,001- $50.000

FINANCIAL DISCLOSURE REPORT Page 6 of 10

Name of Person Reporting MOTZ, JOHN F.

Date of Report 05/20/2011

VII. INVESTMENTS and TRUSTS - income, volue, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

NONE(No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (l) (2) Amount Type (e.g., Code 1 div., rent, (A-H) or int.) C. Gross value at end of reporting period (1) (2) Value Value Code 2 Method Code 3 (J-P) (Q-W) L L M K M M K K M L L L K K K M K T T T T T T T T T T T T T T T T T

Transactions during reporting period

" (1) Type (e.g., buy, sell, redemption)

(2) Date mm/dd/yy

(3) (4) Value Gain Code2 Code 1 (J-P) (A-H)

(5)

Identity of buyer/seller (if private transaction)

35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51.

Stanley Black & Decker Constellation Energy PNC TRP New Horizons Fund TRP Md. Tax-Free Bond Fund TRP Blue Chip Growth (GST) TRP InternationalBond (GST) TRP International Stock (GST) TRP Prime Reserve (GST) TRP Equity Income (GST) TRP Growth Stock (GST) TRP Spectrum Growth (GST) TRP Equity Income (IRA) TRP Growth Stock (IRA) TRP Spectrum Growth (IRA) TRP Prime Reserve (IRA) Exxon Mobil (IRA)

A B A A D A A A A B B B A A A A A

Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend

Redeemed 02/24/I 0 (part)

see note 3

1. Income Gain Codes: ( See Colurrms B 1 and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50.001 - $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25.000,001 - $50,000.000 Q =Appraisal U =Book Value

B =$1,001 : $2,500 G =$100,001 - $1,000,000 K =$15,001 - $ 50,000 O =$500,001 - $1,000,000 R =Cost (Real Estale Only) V =Other

C =$2,501 - $5,000 H 1 =$ 1,000,001 - $5,000,000 L =$50,001 - $100,000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H 2 =More than $ 5,000,000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000.000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of .10

Name of Person Reporting MOTZ, JOHN F.

Date of Report 05/20/201 I

VII. INVES TMENTS and TRU S TS - i.co,.e, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (i) Amount Code 1 (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (1) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) T T T T T T T T T T T T T T T T T Redeemed (paN)

(1) Type (e.g., Transactions during reporting period

buy, sell, redemption)

(3) (4) Value Gain mm/dd/yy Code 2 Code 1 (J-P) (A-H)

(2) Date

(5)

Identity of

buyer/seller (if private transaction)

52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68.

TRP Growth Stock TRP Spectrum Growth Summit Cash Reserve AES Corp Direct TV Duke Realty Macys Praxair Union Pacific Wash. Real Estate Inv. Trust Standard & Poors Depository Receipts TRP Prime Reserve TRP Global TRP Global (IRA) TRP Global (GST) TRP New Em (GST) Pothash Corp

A A A A A A A B B D B C A A A A A

Dividend Dividend Interest Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Interest Dividend Dividend Dividend Dividend Dividend

J L L K K J L M L M L PI L L L K L

03/19/10 M

1. Income Gain Codes: (See Columns B 1 and D4) 2. Vatue Codes (See Columns (21 and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N ~$250,001 - $500,000 P3 =$25,000,001 o $50.000,000 Q =Appraisal U =Book Value

B =$ 1,001 - $2,500 G =$100.001 - $1,000,000 K =$15,001 - $50.000 O =$500,001 - $1,000,000 R =Cost (Real Estale Only) V =Other

C :$2,501 - $5,000 H 1 =$1,000.001 - $ 5,000,000 L $50,001 - $100.000 P I =$1,000,001 - $5,000,000 P4 =More than $50,000.000 S =Asscssmcnt W =Eslimatcd

D =$5,001 - $15,000 H2 =M ore than $5,000,000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 8 of 10

Name of Person Reporting MOTZ, JOHN F.

Date of Report 05/20/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

NOI~IE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (1) Amount Code l (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (l) (2) Value Code 2 (J-P) Value Method Code 3 (Q-W) (l) Type (e.g., buy, sell, redemption) (2) (3) (4) Date Value mm/dd/yy Code 2 (J-P) Gain Code l (A-H) (5) Identity of buyer/seller (if private transaction) D. Transactions during reporting period

69. 70. 71. 72. 73.

Philip Morris Intl, Inc. TRP New Asia TRP Global CSP (Custodian) CSP (Custodian)

B A A A A

Dividend Dividend Dividend Dividend Dividend

K K L K K

T T T T T Buy Buy 12/28/10 12/28/I 0 J J see note 3

1. Income Gain Codes: (See Columns B I and 1)4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U ~Book Value

B =$1,001 - $2.500 G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $1,000.000 R =Cost (Real Estate Only) V =Other

C =$2,501 o $5,000 HI =$1,000,001 - $5,000,000 L =$50,001 - $100,000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000.000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 9 of 10

Name of Person Reporting MOTZ, JOHN F.

Date of Report 05/20/201 l

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicate part of report.)

Note 1 - The Fund changed its name Note 2 - Now reported in Item 63 Note 3 - Now reported in Item 64

FINANCIAL DISCLOSURE REPORT Page 10 of 10

Name of Person Reporting MOTZ, JOHN F.

Date of Report 05/20/201 I

IX. CERTIFICATION.

l certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/JOHN F. MOTZ

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- Opinion - JW V NavyDokument7 SeitenOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Welding Quality ControlDokument7 SeitenWelding Quality ControlPRAMOD KUMAR SETHI S100% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Meku Parameshwari Durga Nagalakshmi Reliance JioDokument7 SeitenMeku Parameshwari Durga Nagalakshmi Reliance Jiompd nagalakshmiNoch keine Bewertungen

- A Brief History of Human RightsDokument7 SeitenA Brief History of Human RightsBo Dist100% (1)

- Meralco Vs Jan Carlo Gala March 7Dokument3 SeitenMeralco Vs Jan Carlo Gala March 7Chezca MargretNoch keine Bewertungen

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- P290037 TAHSIN M A Osmani UWEBIC Offer Letter PDFDokument5 SeitenP290037 TAHSIN M A Osmani UWEBIC Offer Letter PDFM A Osmani TahsinNoch keine Bewertungen

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Holder Travel Records CombinedDokument854 SeitenHolder Travel Records CombinedJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- Visitor Tent DescriptionDokument3 SeitenVisitor Tent DescriptionJudicial Watch, Inc.Noch keine Bewertungen

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Water Test ReportDokument2 SeitenGitmo Water Test ReportJudicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- Navy Water Safety ProductionDokument114 SeitenNavy Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- JW Cross Motion v. NavyDokument10 SeitenJW Cross Motion v. NavyJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- May 2007 BulletinDokument7 SeitenMay 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- LAUSD Semillas AckDokument1 SeiteLAUSD Semillas AckJudicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- MID-TERM EXAM ANSWER SHEETDokument11 SeitenMID-TERM EXAM ANSWER SHEETbLaXe AssassinNoch keine Bewertungen

- Red Cross Youth and Sinior CouncilDokument9 SeitenRed Cross Youth and Sinior CouncilJay-Ar ValenzuelaNoch keine Bewertungen

- Kenyan Brokerage & Investment Banking Financial Results 2009Dokument83 SeitenKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNoch keine Bewertungen

- Georgian Economy: Every Cloud Has A Silver LiningDokument7 SeitenGeorgian Economy: Every Cloud Has A Silver LiningGiorgiKaralashviliNoch keine Bewertungen

- India S People S WarDokument77 SeitenIndia S People S WarSidhartha SamtaniNoch keine Bewertungen

- Effective Advocacy For School Leaders: Ohio School Boards AssociationDokument14 SeitenEffective Advocacy For School Leaders: Ohio School Boards AssociationJosua BeronganNoch keine Bewertungen

- Ralph M. Lepiscopo v. George E. Sullivan, Warden, 943 F.2d 57, 10th Cir. (1991)Dokument2 SeitenRalph M. Lepiscopo v. George E. Sullivan, Warden, 943 F.2d 57, 10th Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- Joseph Resler - Vice President - First American Bank - LinkedInDokument5 SeitenJoseph Resler - Vice President - First American Bank - LinkedInlarry-612445Noch keine Bewertungen

- Cheat Sheet StaticsDokument7 SeitenCheat Sheet StaticsDiri SendiriNoch keine Bewertungen

- Basf Masterseal Traffic 1500 TdsDokument6 SeitenBasf Masterseal Traffic 1500 Tdsjuli_radNoch keine Bewertungen

- How To Talk in An Arranged Marriage Meeting - 22 StepsDokument3 SeitenHow To Talk in An Arranged Marriage Meeting - 22 StepsqwertyasdfgNoch keine Bewertungen

- Eddie BurksDokument11 SeitenEddie BurksDave van BladelNoch keine Bewertungen

- ENTITYDokument4 SeitenENTITYGejhin ZeeKiahNoch keine Bewertungen

- GNS430W Pilots Guide and ReferenceDokument218 SeitenGNS430W Pilots Guide and Referenceniben16Noch keine Bewertungen

- CH04 Interest RatesDokument30 SeitenCH04 Interest RatesJessie DengNoch keine Bewertungen

- Conditionals and Wish Clauses Advanced TestDokument5 SeitenConditionals and Wish Clauses Advanced TestVan Do100% (1)

- FO-R23-001 - R2 Subcontractor Registration FormDokument6 SeitenFO-R23-001 - R2 Subcontractor Registration FormKeneth Del CarmenNoch keine Bewertungen

- ME 569 Stress and Strain RelationshipsDokument52 SeitenME 569 Stress and Strain RelationshipsعلىالمهندسNoch keine Bewertungen

- Gramsci Hegemony Separation PowersDokument2 SeitenGramsci Hegemony Separation PowersPrem VijayanNoch keine Bewertungen

- Instant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full ChapterDokument32 SeitenInstant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full Chapterrappelpotherueo100% (7)

- Chinese in The PHDokument15 SeitenChinese in The PHMandalihan GepersonNoch keine Bewertungen

- Principles of Cost Accounting 16th Edition Vanderbeck Solution ManualDokument47 SeitenPrinciples of Cost Accounting 16th Edition Vanderbeck Solution Manualcorey100% (30)

- Ex Parte Motion To Release Bail SAMPLEDokument2 SeitenEx Parte Motion To Release Bail SAMPLEweddanever.cornelNoch keine Bewertungen

- Government of India Directorate General of Civil Aviation Central Examination OrganisationDokument1 SeiteGovernment of India Directorate General of Civil Aviation Central Examination OrganisationsubharansuNoch keine Bewertungen

- BHM 657 Principles of Accounting IDokument182 SeitenBHM 657 Principles of Accounting Itaola100% (1)