Beruflich Dokumente

Kultur Dokumente

Elaine E Bucklo Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Elaine E Bucklo Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

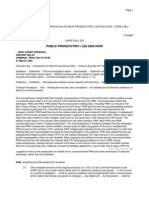

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

1. Person Reporting (last name, first, middle initial) BUCKLO, ELAINE E. 4. Title (Article llI judges indicate active or senior status; magistrate judges indicate full- or part-time) 2. Court or Organization UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF ILLINOIS 5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 3q 101-111)

3. Date of Report 04/19/2011 6. Reporting Period 01/01/2010 to 12/31/2010

SENIOR STATUS

5b. [] Amended Report 7. Chambers or Office Address 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer

Date

UNITED STATES DISTRICT COURT 219 SOUTH DEARBORN STREET SUITE 1446 CHICAGO, ILLINOIS 60604

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. mevoning inalvia..t only; see pp. 9-13 of filing instructions.)

~ NONE ~o reportablepositions.)

POSITION

NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. ~neVonlng inalvla.~t onty; see pv. 14-16 of fillng instructions.)

~] NONE (No reportable agreements.) DATE PARTIES AND TERMS

Bucklo, Elaine E.

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting BUCKLO, ELAINE E.

Date of Report 04/19/2011

IlL NON-INVESTMENT INCOME. (gepor,i.g individual andspouse; seepp. 17-24 of jTding instructions.)

A. Filers Non-Investment Income

~] NONE (No reportable DATE

non-investment

income.) SOURCE AND TYPE

INCOME

(yours, not spouses)

2. 3. 4.

B, Spouses Non-Investment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.)

DATE

1.2010 2. 3. 4.

SOURCE AND TYPE

SELF-EMPLOYED THERAPIST

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of f!ling instructions.)

NONE (No reportable reimbursements.)

SOURCE

1. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting BUCKLO, ELAINE E.

Date of Report 04/19/2011

V. GIFTS. aneludes those to spouse and dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.)

SOURCE 1. 2. 3. 4. 5. DESCRIPTION

VALUE

VI. LIABILITIES. anaudes those oZspouse and dependent children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.)

CREDITOR 1. 2. 3. 4. 5. DESCRIPTION

VALUECODE

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting BUCKLO, ELAINE E.

Date of Report 04/19/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Income during reporting period (1) (2) Gross value at end of reposing period (1) (2) (1) (2) ..... (3) Transactions during reporting period

Place "(X)" after each asset exempt from prior disclosure

Amount

Code 1 (A-H)

Type (e.g.,

div., rent, or int.)

Value

Code 2 (J-P)

Va ue

Method Code 3

Type (e.g.,

buy, sell, redemption)

Date .Value

m~dd/yy Code 2 (J~P)

(4) Gain Code t (A-H)

(Q-W)

Harris Trust & Savings Bank, Chicago, IL

2.

(5) Identity of buyer/seller (if private transaction)

A B

Interest Royalty

J J

T W

Mineral Interests,~

3.

4.

5.

6.

7.

8.

9.

17.

1. Income Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3.Value Method Codes (See Column C2)

--$1,000 or less =$~0100] - $100,000 .... =$15,000 or less =$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 =Appraisal =Book Value

B =$1,001 7 $2i500 O =$~00,001 : $1,000,000 K =$15,001 - $50,000 0 =$500,001 z $ 1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI =$11000,OOl - $5,000;000 L =$50,001 - $100.000 PI =$1,000,001 - $5,000,000 P4 =More than $50,0001000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 --More than $5;000,000 M =$100~001 = $250;000 12 =$5 000 6011 $25 000 000 T =Cash Ma~kei

E =$15,001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting BUCKLO, ELAINE E.

Date of Report 04/19/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. a,,,~ic,~tep,~r~ of report.)

PART VII, LIN]~ 2 PAYORS: NATIONAL COOPERATIVE P~FINI~RY ASSN.; PLAINS MARKETING, L.P.; and ]~AGL]~WING, L.P.

FINANCIAL DISCLOSURE REPORT Page 6 of 6 IX. CERTIFICATION.

Name of Person Reporting BUCKLO, ELAINE E.

Date of Report 04/19/2011

I certify that all information given above (including information pertaining to ]ny spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/ELAINE

E. BUCKLO

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- Opinion - JW V NavyDokument7 SeitenOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- CIVIL PROCEDURE CASES – Judgement on the PleadingsDokument14 SeitenCIVIL PROCEDURE CASES – Judgement on the PleadingsNikki D. ChavezNoch keine Bewertungen

- Vanessa D Gilmore Financial Disclosure Report For 2010Dokument6 SeitenVanessa D Gilmore Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Administrative Law: WritsDokument8 SeitenAdministrative Law: WritsZeesahnNoch keine Bewertungen

- Consti Notes - Fr. BernasDokument16 SeitenConsti Notes - Fr. BernasJosine Protasio100% (2)

- Aug 14 Cases - DigestsDokument11 SeitenAug 14 Cases - Digestsmaria_catapang_2100% (1)

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- Moldex Realty v HLURB - Payment of Streetlight Electricity CostDokument3 SeitenMoldex Realty v HLURB - Payment of Streetlight Electricity Costtrish bernardoNoch keine Bewertungen

- Jose Lagon Vs HoovenDokument1 SeiteJose Lagon Vs HoovenARNoch keine Bewertungen

- Supreme Court Rules on Military Reservation Land DisputeDokument13 SeitenSupreme Court Rules on Military Reservation Land Disputecarl dianneNoch keine Bewertungen

- Public Prosecutor V Lee Eng Kooi - (1993) 2Dokument13 SeitenPublic Prosecutor V Lee Eng Kooi - (1993) 2givamathanNoch keine Bewertungen

- Administrative Law Case Digests: Powers and Functions of Administrative AgenciesDokument8 SeitenAdministrative Law Case Digests: Powers and Functions of Administrative AgenciesAizaFerrerEbina100% (1)

- Josie Berin and Merly Alorro, Complainants, vs. Judge FELIXBERTO P. BARTE, Municipal Circuit Trial Court, Hamtic, Antique, RespondentDokument4 SeitenJosie Berin and Merly Alorro, Complainants, vs. Judge FELIXBERTO P. BARTE, Municipal Circuit Trial Court, Hamtic, Antique, RespondentnellafayericoNoch keine Bewertungen

- Carol E Jackson Financial Disclosure Report For 2010Dokument6 SeitenCarol E Jackson Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William J Hibbler Financial Disclosure Report For 2010Dokument6 SeitenWilliam J Hibbler Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Lee R West Financial Disclosure Report For 2010Dokument6 SeitenLee R West Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Samuel F Biery JR Financial Disclosure Report For 2010Dokument6 SeitenSamuel F Biery JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Lacey A Collier Financial Disclosure Report For 2010Dokument6 SeitenLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Malcom J Howard Financial Disclosure Report For 2010Dokument6 SeitenMalcom J Howard Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Sam A Lindsay Financial Disclosure Report For 2010Dokument6 SeitenSam A Lindsay Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Terry J Hatter JR Financial Disclosure Report For 2010Dokument6 SeitenTerry J Hatter JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Ronald E Longstaff Financial Disclosure Report For 2010Dokument6 SeitenRonald E Longstaff Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Garland E Burrell JR Financial Disclosure Report For 2010Dokument6 SeitenGarland E Burrell JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Jerome A Holmes Financial Disclosure Report For 2010Dokument6 SeitenJerome A Holmes Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Donetta W Ambrose Financial Disclosure Report For 2010Dokument7 SeitenDonetta W Ambrose Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- John F Keenan Financial Disclosure Report For 2010Dokument6 SeitenJohn F Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Ralph R Beistline Financial Disclosure Report For 2010Dokument6 SeitenRalph R Beistline Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Delwen L Jensen Financial Disclosure Report For 2010Dokument6 SeitenDelwen L Jensen Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Garland E Burrell JR Financial Disclosure Report For 2009Dokument6 SeitenGarland E Burrell JR Financial Disclosure Report For 2009Judicial Watch, Inc.Noch keine Bewertungen

- Roger L Hunt Financial Disclosure Report For 2010Dokument6 SeitenRoger L Hunt Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Thomas N ONeill JR Financial Disclosure Report For 2009Dokument6 SeitenThomas N ONeill JR Financial Disclosure Report For 2009Judicial Watch, Inc.Noch keine Bewertungen

- JR Louis Guirola Financial Disclosure Report For 2010Dokument6 SeitenJR Louis Guirola Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James R Hall Financial Disclosure Report For 2010Dokument6 SeitenJames R Hall Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert C Broomfield Financial Disclosure Report For 2010Dokument6 SeitenRobert C Broomfield Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William J Bauer Financial Disclosure Report For 2010Dokument6 SeitenWilliam J Bauer Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Michael A Chagares Financial Disclosure Report For 2010Dokument6 SeitenMichael A Chagares Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Dale A Kimball Financial Disclosure Report For 2010Dokument6 SeitenDale A Kimball Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Scott O Wright Financial Disclosure Report For 2010Dokument6 SeitenScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Charles N Clevert Financial Disclosure Report For 2010Dokument6 SeitenCharles N Clevert Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Eric F Melgren Financial Disclosure Report For 2010Dokument6 SeitenEric F Melgren Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Donald W Molloy Financial Disclosure Report For 2010Dokument6 SeitenDonald W Molloy Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William C Canby JR Financial Disclosure Report For 2010Dokument6 SeitenWilliam C Canby JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James L Edmondson Financial Disclosure Report For 2010Dokument6 SeitenJames L Edmondson Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William C Lee Financial Disclosure Report For 2010Dokument6 SeitenWilliam C Lee Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Philip M Pro Financial Disclosure Report For 2010Dokument6 SeitenPhilip M Pro Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Charles C Lovell Financial Disclosure Report For 2010Dokument6 SeitenCharles C Lovell Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Eugene E Siler Financial Disclosure Report For 2010Dokument7 SeitenEugene E Siler Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Glen H Davidson Financial Disclosure Report For 2010Dokument6 SeitenGlen H Davidson Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Christopher F Droney Financial Disclosure Report For 2010Dokument6 SeitenChristopher F Droney Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Edward Leavy Financial Disclosure Report For 2010Dokument6 SeitenEdward Leavy Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- George M Marovich Financial Disclosure Report For 2009Dokument6 SeitenGeorge M Marovich Financial Disclosure Report For 2009Judicial Watch, Inc.Noch keine Bewertungen

- Leonard D Wexler Financial Disclosure Report For 2010Dokument6 SeitenLeonard D Wexler Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Raymond J Dearie Financial Disclosure Report For 2010Dokument7 SeitenRaymond J Dearie Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Alicemarie Stotler Financial Disclosure Report For 2010Dokument6 SeitenAlicemarie Stotler Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Kenneth A Marra Financial Disclosure Report For 2010Dokument6 SeitenKenneth A Marra Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Stanley T Anderson Financial Disclosure Report For 2010Dokument6 SeitenStanley T Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Jon E DeGuilio Financial Disclosure Report For DeGuilio, Jon EDokument6 SeitenJon E DeGuilio Financial Disclosure Report For DeGuilio, Jon EJudicial Watch, Inc.Noch keine Bewertungen

- Janis L Sammartino Financial Disclosure Report For Sammartino, Janis LDokument6 SeitenJanis L Sammartino Financial Disclosure Report For Sammartino, Janis LJudicial Watch, Inc.Noch keine Bewertungen

- Damon J Keith Financial Disclosure Report For 2010Dokument6 SeitenDamon J Keith Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Rebecca F Doherty Financial Disclosure Report For 2010Dokument7 SeitenRebecca F Doherty Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Henry F Floyd Financial Disclosure Report For 2010Dokument6 SeitenHenry F Floyd Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William B Enright Financial Disclosure Report For 2010Dokument6 SeitenWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Clark Waddoups Financial Disclosure Report For 2010Dokument13 SeitenClark Waddoups Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Mary A McLaughlin Financial Disclosure Report For 2010Dokument12 SeitenMary A McLaughlin Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Michael R Murphy Financial Disclosure Report For 2010Dokument6 SeitenMichael R Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Royce C Lamberth Financial Disclosure Report For 2010Dokument6 SeitenRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Cynthia M Rufe Financial Disclosure Report For 2010Dokument6 SeitenCynthia M Rufe Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Jeffrey S Sutton Financial Disclosure Report For 2010Dokument8 SeitenJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Carolyn R Dimmick Financial Disclosure Report For 2010Dokument6 SeitenCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Warren K Urbom Financial Disclosure Report For 2010Dokument6 SeitenWarren K Urbom Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Roberto A Lange Financial Disclosure Report For Lange, Roberto ADokument7 SeitenRoberto A Lange Financial Disclosure Report For Lange, Roberto AJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- Visitor Tent DescriptionDokument3 SeitenVisitor Tent DescriptionJudicial Watch, Inc.Noch keine Bewertungen

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Holder Travel Records CombinedDokument854 SeitenHolder Travel Records CombinedJudicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Water Test ReportDokument2 SeitenGitmo Water Test ReportJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Navy Water Safety ProductionDokument114 SeitenNavy Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JW Cross Motion v. NavyDokument10 SeitenJW Cross Motion v. NavyJudicial Watch, Inc.Noch keine Bewertungen

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- May 2007 BulletinDokument7 SeitenMay 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- LAUSD Semillas AckDokument1 SeiteLAUSD Semillas AckJudicial Watch, Inc.Noch keine Bewertungen

- The Rule On The Writ of AmparoDokument21 SeitenThe Rule On The Writ of AmparoSage LingatongNoch keine Bewertungen

- University v. A.W. Chesterton, 1st Cir. (1993)Dokument81 SeitenUniversity v. A.W. Chesterton, 1st Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- Pagpapatunay NG Bilihang Lampasan NG Lupa,: First DivisionDokument1 SeitePagpapatunay NG Bilihang Lampasan NG Lupa,: First DivisionNivra Lyn EmpialesNoch keine Bewertungen

- Crownhart v. Suthers, 10th Cir. (2013)Dokument3 SeitenCrownhart v. Suthers, 10th Cir. (2013)Scribd Government DocsNoch keine Bewertungen

- 7037 - The Most UsedDokument46 Seiten7037 - The Most Usedpurinaresh85Noch keine Bewertungen

- W-E-P-M-, AXXX XXX 859 (BIA July 15, 2015)Dokument7 SeitenW-E-P-M-, AXXX XXX 859 (BIA July 15, 2015)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Craig v. ADVO, Inc. - Document No. 3Dokument4 SeitenCraig v. ADVO, Inc. - Document No. 3Justia.comNoch keine Bewertungen

- Agri Cases (1st Two)Dokument2 SeitenAgri Cases (1st Two)Angel Lou AguitongNoch keine Bewertungen

- Chapter 1: Business and Its Legal EnvironmentDokument4 SeitenChapter 1: Business and Its Legal EnvironmentkhaseNoch keine Bewertungen

- Cabador Vs PeopleDokument4 SeitenCabador Vs PeopleAnonymous himZBVQcoNoch keine Bewertungen

- Archer Daniels Midland v. Charter Intl Oil Co 60 B.R. 854 1986Dokument5 SeitenArcher Daniels Midland v. Charter Intl Oil Co 60 B.R. 854 1986Thalia SandersNoch keine Bewertungen

- Berenguer-Lander Vs FlorinDokument10 SeitenBerenguer-Lander Vs FlorinBaldovino VenturesNoch keine Bewertungen

- Viran Al Nagapan V Deepa AP Subramaniam (PDokument12 SeitenViran Al Nagapan V Deepa AP Subramaniam (PraihanazzNoch keine Bewertungen

- VIzconde vs. VeranoDokument5 SeitenVIzconde vs. VeranoAmiel Lyndon PeliasNoch keine Bewertungen

- Hilado Vs CADokument8 SeitenHilado Vs CAKevs De EgurrolaNoch keine Bewertungen

- Salabiaku V France (1988) 13 Ehrr 379 - EcthrDokument18 SeitenSalabiaku V France (1988) 13 Ehrr 379 - EcthrvalentinTDNoch keine Bewertungen

- Family Law Divorce Without ChildDokument33 SeitenFamily Law Divorce Without ChildDr LipseyNoch keine Bewertungen

- Dissertation Final!!!Dokument39 SeitenDissertation Final!!!Graeme PretoriusNoch keine Bewertungen

- State of Nebraska v. Paul Hansen On Ex Rel. Commission On Unauthorized Practice of LawDokument9 SeitenState of Nebraska v. Paul Hansen On Ex Rel. Commission On Unauthorized Practice of LawAlbertFrank55Noch keine Bewertungen

- People V GoDokument3 SeitenPeople V GoSophiaFrancescaEspinosaNoch keine Bewertungen