Beruflich Dokumente

Kultur Dokumente

William H Steele Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

William H Steele Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

AO I0 Rev.

1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization US District-So. Dist. Of AL

Report Required by the Ethics in Government Act ofl978 (5 U.S.C. app. ,~.~ 101-111)

!. Person Reporling (last name, first, middle initial) Steele, William H. 4. Title (Article !11 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/12/201 I 6. Reporting Period Ol/OI/2010 to 12/31/2010

5a. Report Type (cheek appropriate type) ] Nomination, Date

[] Annual [] Final

US District Judge-Active

[] Initial

5b. [] Amended Report

7. Chambers or Office Address 113 St. Joseph Street Mobile AL 36602

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. m~,o,~,,g i.sivu~,: o,ty: s~ pp. 9-13 o/fillng instructiong)

~ NONE (No reportablepositions.) POSITION NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. (eepo.,.g individualonly; see pp. 14-16 of fillng insttuctlons.)

~] NONE (No reportable agreements.) DATE PARTIES AND TERMS

Steele, William H.

FINANCIAL DISCLOSURE REPORT Page 2 of 9

Name of Person Reporting Steele, William H.

Date of Report 05/12/201 I

1 II. NON-I NVESTMENT INCOME. (Repo+.g individuo~ ondspo.se: +eepp. 17-24 of~lin~ ins,~.ctio~)

A. Filers Non-Investment Income

[]

NONE (No reportable non-investment income.)

DATE

I. 12-31-10 2. 12-31-10 3. 4. Church Reader Fees Musician Fees

SOURCE AND TYPE

INCOME (yours, not spouses)

$1,380.00 $480.00

B. Spouses Non-Investment Income - If you were matried durlng any portlon of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE ~o reportable non-investment income.)

DATE SOURCE AND TYPE

Self-employed (accounting consultant) Retirement income from Retirement Systems of Alabama Deferred Compensation distribution from Public Nationwide Retirement Solutions

I. 12-31-10 2.12-31-10 3. 12-31-10 4.

IV. REIMBURSEMENTS - transportation, Iodglng, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

~]

NONE (No reportable reimbursements.)

SOURCE DATES LOCATION PURPOSE ITEMS PAID OR PROVIDED

2. 3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 9

Name of Person Reporting Sleele, William H.

Date of Report 05/12/2011

V. GIFTS. anctud,~ those to spouse and dependent children; see pp. 28-31 of fillng instructiong)

NONE (No reportable girls.) SOURCE I. 2. 3. 4. 5. DESCRIPTION

VALUE

VI. LIABILITIES. ancludes those oy ~,ou~e und depend, nt chUdren; ,ee p~,. ~ 2- 3 3 of filing instructions.) [] NONE (No reportable liabilities.)

CREDITOR 1. 2. 3. 4. 5. Wachovia Mortgage Corporation Wells Fargo Advisors DESCRIPTION Mortgage on rental property, Orange Beach, AL (Pt VII, line 59) Margin balance

VALUECODE

M M

FINANCIAL DISCLOSURE REPORT Page 4 of 9

Name of Person Reporting Steele, William H.

Date of Report 05/12/201 I

VII. INVESTMENTS and TRUSTS - i ....... .aluo, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) ! (l) Place "(X)" after each asset exempt from prior disclosure i Amount Code I : (A-H) B. Income during reporting period (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (I) (2) Value Value Method Code 2 Code 3 (J-P) (Q-W) (I) Type (e.g., buy, sell, redemption) D. Transactions during reporting period (2) (3) (4) Date Value mm]dd]yy Code 2 (J-P) (5) Identity of buycr/seller (ifprivate transaction)

Gain Code I (A-H)

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17.

AmSouth Bank Account Fidelity Puritan *Nationwide Retirement Solutions (457b) - Nationwide Fixed Account - Fid Equity Income Fund - FID Contrafund - Janus Fund - Am Cent Value IC - Am Cent Vista Fd IC *Wells Fargo Advisors- (IRA) -Centennial Money Market - SunAmedca Blue Chip Fund Class B - Centerstaging Corp. - Putnam IntemationalGrowth Fund -Precision Drilling *Wells Fargo Advisors (IRA) - Alliance Bernstein Large-Cap Growth Class A

A A E

Interest Dividend Distribution

M J M

T T T

Dividend

Dividend

1. Income Gain Codes: (Scc Columns BI and D4) 2. Value Codes (Sc Columns CI and D3) 3. Value Method Codes {See Cohlmn C2)

A =$1,000 or less F =$50.001 - $100,000 J =SI5.000 or less N =$250.001 - $500.000 P3 =$25.000.001 - $50.000.000 Q -Appraisal U Book Value

B =$1.001 - $2.500 G =$100.001 - $1.000.000 K -$i 5.~OI - $50.000 O =$500.001 - SI,000.000 R =Cost tRcal Estate Only) V =O~hcr

C =$2.501 - $5,000 Ill =$1.000,001 - $5.000.000 L =$50,001 - $100.000 PI =$1.000.001 - $5.000,000 P4 =F.to~e than $50.000.000 S =Asscssmcm W =Estimated

D =$5.O01 - $15,000 112 =More than $5.000.000 M =$100.001 - $250.(~0 P2 =$5.000.001 - $25.000.000 T =Cash Market

E =$15.001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 5 of 9

Name of Person Reporting Steele, Wi liam H.

Date of Report 05/12/201 I

V I I. I N V E S T M E N T S a n d T R U S T S - i,,c ome. ,,,,t,,e. ,,,,~,,c,lo~ a ,,ct,,,m a, ose o.f ,,~,o,,s,, ,,,d ,,pe,ae,t c h Udro,: see ,,,~,..~ 4-,SO o~.mi,,g i,,s~,,,aio,,~..~

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period i (I) (2) i Amount i Code I I (A-H) ! Type (e.g., div,, rent, or int.) C. Gross value at end of reporting period (I) (2) Value Code 2 (J-P) Value Method Code 3 (Q-W) (I) Type (e.g., buy, sell, redemption) D. Transactions during reporting period (2) (3) (4) Date Value mm!dd/yy Code 2 (J-P) (5) Identity of buyer/seller (if private transaction)

Gain Code I (A-H)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34.

- Alliance Bemstein Global Thematic Growth Fund - John Hancock Regional Bank - Alliance Real Estate Investment Fund - Jennison Blend Fund Class A *Morgan Stanley Smith Barney LLC -Alliance Large CapitalGrowth -John Hancock Financial Industries *Wells Fargo Advisors -Centennial Money Market -AMCAP Fund (American Funds) -Putnam Voyager -Templeton Foreign -Mutual Shares (TESIX) -Putnam Allstate Advisor (Annuity) -Putnam FD for Growth & Income -Putnam Invt Fds Multi-Cap Value Fund -Fidelity Adv Emerging Markets Income Fund A A B A A A A None Dividend Dividend Dividend Dividend None Dividend Dividend Dividend K K N K K J T T T T T T J T Sold Sold 05112/10 L 05/12/10 K A None Dividend J J T T

I. Income Gain Codes: (Scc Columns BI and D4) 2. Value Codes (See Columns CI and D31 3. Value Method Codes (See Cohm~n C2)

A =$1.000 or less F =$50.0(11 - $100,000 J -$15.0OO or Ices N =$250,001 - $500.000 P3 =$25.000.0OI - $50.0OO,000 Q Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1.000,000 K =$15.0OI - $50.000 O =$500.001 - $1,000.O00 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 II I =$1,000.001 - $5.000.000 L =$50.0OI - $100.000 PI =$1.000.001 - $5.000.000 P4 =More than $50.000.000 S =Assessment W =Eslimated

D =$5.001 - $15,000 112 =More than $5.000.000 Is! ~$100.0OI - $250.000 P2 =$5.000.001 - $25,000.(X)O T ~a.sh Market

E =$15.1)01 - $50.0(~O

FINANCIAL DISCLOSURE REPORT Page 6 of 9

Name of Person Reporting Steele, William H.

Date of Report 05/12/2011

V I I. I N V E S T M E N T S a n d T R U S T S - i.com., ,.alu., ~ra.suc,io.~ a"~"d~ ,hose o/spa.s. ~.d d.p..d.., chiIdr..: s. ~. 34-60 of filing instructions.)

[-~ NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Income during reporting period (I) (2) Amount Typ~ (e.g., Code I div., rent, (A-H) or int.) Gross value at end of reporting period (I) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W) (I) Type (e.g., buy, sell, ~demption) Transactions during reporting period (2) (3) (4) Date Value mm/dd,~cy Code 2 (J-P) (5) Identity of buyer/seller (if private transaction)

Place "(X)" after each asset exempt from prior disclosure

Gain Code I (A-H)

35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51.

-Campbell Strategic Allocation Fund -Europacific Growth Fund (American Funds) -Fundamental Investors Inc. (American Funds) -Growth Fund of America (American Funds -New Economy Fund (American Funds) -Washington Mutual (American Funds) *Wells Fargo Advisors - IRA (FBO) -Invesco Constellation Fund -Invesco Charter Fund -Putnam Intl. Growth Fund -Putnam Invt Fds Multi-Cap Value Fund -Putnam Vista Fund -Putnam Voyager Fund -Euro Pacific Growth (American Funds) -Growth Fund of America (American Funds -Nuveen Diversified Commodity Fund Steele Enterprises LLC A B A A B B

None Dividend Dividend Dividend Dividend Dividend Dividend

M L L M K K N

T T T T T T T Sold Sold 09/16/10 09/16/10 J J A A Buy (addl)

11/16/10

Merged (with line 45)

09/28/10

Sold (part) Buy

None M U

11/16/10 09/27/10

J J

I. Income Gain Codes: (Scc Columns B I and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$ 50.0~ I - $ 100,000 J =$15,000 or less N =$250.001 - $500.000 P3 =$25,00<).O01 - $50.000,000 Q =Appraisal U =Book Value

B =$1,001 - $2.500 G =$100.091 - $ 1.000.000 K =$15.001 - $50.000 O =$500.0OI - $1,0~O.0OO R =Cost tRcal Es~a~c Only) V -Other

C =$2.501 - $5,000 I t I =$ 1.000,001 - $ 5.000.000 L =$50.001 - $100.000 PI -$1.000.001 - $5.000,C~) P4 =More Ihan $50.000.000 S =Asscssmc~l W =Estimaled

D =$5,001 - $15.000 112 =M ore Ihan $5,000.0OO M =$100.001 - $250.000 P2 =$5.000.0OI - $25,000.000 T =C~h Market

E =$15.001- $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 9

Name of Person Reporting Steele, \Villiam H.

Date of Report 05/12/201 I

VI 1. I NVESTMENTS a n d TRU STS - incor~e, volue, t,o,~ucao,~ anel~des those o/spouse ona ,~epenaent children; see pp. 34-60 of filing instructions.)

D NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Income during reporling period (1) (2) Gross value at end of ~:porting period (I) (2) Transactions during reporting period

Place "(X)" after each asset exempt from prior disclosure

Amount

Code I (A-H)

Type (e.g.,

div., rent, or int.)

Value

Code 2 (J-P)

Value

Method Code 3

(I) Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value mm/dd/yy Code 2 (J-P)

Gain Code I (A-H)

(5) Identity of buyer/seller (if private transaction)

(Q-W) 52. 53. Sun Life Assurance Co. of Canada (annuity- F Distribution no controlI Rental properly,Orange Beach,AL E Rent K M W

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$50.001 - $100,000 J =$15.000 or less N =$250.0OI - $5CO.000 P3 =$25.000.001 - $50,000.000 Q =Appraisal U =[look Value

B =$1,001 - $2.500 G =$ 100,001 - $ 1.000.000 K =$15.001 - $50.ODO 0 =$500.001 - $1,000,000 R =Cost (Real E~tate Only) V =C~hcr

C =$2.501 - $5,000 I I I =$ 1.000.001 - $5.000,000 L =$50.0OI - $100.000 PI =$1.000.001 - $5.000.COO P4 =More than $50.000.000 S = Ass,essnvznt W =Estimated

D =$5,001 - $15,000 112 =More Ihan $5.0~0.000 M =$100.001 - $250.000 P2 =$5.000.001 - $25,000.000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 8 of 9

Name of Person Reporting Steele, William H.

Date of Report 05/12/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

VII.16 - change of Broker from Legg Mason to Wells Fargo Advisors. VII.22 - name change for Broker from Legg Mason to Morgan Stanley Smith Barney LLC. V11.33 - name change for investment from Putnam Mid Cap to Putnam Invt. Fds. Multi-Cap Value Fund. VII.42 - name change for investment from AIM Funds Group-Constellation Fund to Invesco Constellation Fund. VII.43 - name change for investment from AIM Funds Group-Charter Fund to Invesco Char~er Fund. VII.45 - name change for investment from Putnum New Opportunities to Putnam Invt. Fds. Multi-Cap Value Fund. VII.51 - It is not anticipated that any income will be derived from the LLC. All income will be realized by the manager. VII.various - * denotes header information.

FINANCIAL DISCLOSURE REPORT Page 9 of 9 IX. CERTIFICATION.

Name of Person Reporting Steele, William H.

Dale of Report 05/12/201 I

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure.

! further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S[ William H. Steele

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- September 2004Dokument24 SeitenSeptember 2004Judicial Watch, Inc.Noch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- June 2004Dokument17 SeitenJune 2004Judicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 13-1150 Responsive Records 2 - RedactedDokument29 Seiten13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Noch keine Bewertungen

- July 2006Dokument24 SeitenJuly 2006Judicial Watch, Inc.Noch keine Bewertungen

- LAUSD Semillas AckDokument1 SeiteLAUSD Semillas AckJudicial Watch, Inc.Noch keine Bewertungen

- Atlanta IntraregionalDokument4 SeitenAtlanta IntraregionalJudicial Watch, Inc.Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- 13-1150 Response Re Judicial WatchDokument1 Seite13-1150 Response Re Judicial WatchJudicial Watch, Inc.Noch keine Bewertungen

- December 2005 Bulletin 2Dokument14 SeitenDecember 2005 Bulletin 2Judicial Watch, Inc.Noch keine Bewertungen

- STAMPED ComplaintDokument4 SeitenSTAMPED ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Disposal of Subsidiary PDFDokument9 SeitenDisposal of Subsidiary PDFStavri Makri SmirilliNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Family Id FormDokument2 SeitenFamily Id FormkiranNoch keine Bewertungen

- Corporate FinanceDokument66 SeitenCorporate FinanceRobin SrivastavaNoch keine Bewertungen

- Evaluation of Financial Performance Analysis of Commercial Bank of EthiopiaDokument8 SeitenEvaluation of Financial Performance Analysis of Commercial Bank of EthiopiaInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- 43 Indian - Capital - MarketDokument40 Seiten43 Indian - Capital - MarketNiladri MondalNoch keine Bewertungen

- Price Discovery Process For IPO PriceDokument30 SeitenPrice Discovery Process For IPO PriceAntora HoqueNoch keine Bewertungen

- FM-Imp QuestionsDokument2 SeitenFM-Imp QuestionsPau GajjarNoch keine Bewertungen

- Financial Management Project BbaDokument54 SeitenFinancial Management Project BbaMukul Somgade100% (6)

- ChartDokument39 SeitenChartNazrul Islam100% (2)

- Rule 68 Rules of CourtDokument4 SeitenRule 68 Rules of CourtElla Qui0% (1)

- Nike's Calculation For Cost of CapitalDokument2 SeitenNike's Calculation For Cost of CapitalDiandra Aditya Kusumawardhani100% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

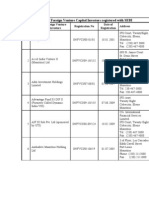

- A-List of Foreign Venture Capital Investors Registered With SEBIDokument24 SeitenA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNoch keine Bewertungen

- Mine River Clarification LetterDokument2 SeitenMine River Clarification LetterInvest StockNoch keine Bewertungen

- Implications of High-Frequency Trading For Security Markets: Annual Review of EconomicsDokument25 SeitenImplications of High-Frequency Trading For Security Markets: Annual Review of EconomicsVijay KumarNoch keine Bewertungen

- Power Grid Corporation of India LTD (Pgcil) (Pgcil) : AnalystDokument14 SeitenPower Grid Corporation of India LTD (Pgcil) (Pgcil) : AnalystRajiv BharatiNoch keine Bewertungen

- Financial Reporting IIDokument478 SeitenFinancial Reporting IIIrfan100% (3)

- SAP Reports Record Third Quarter 2011 Software RevenueDokument18 SeitenSAP Reports Record Third Quarter 2011 Software RevenueVersion2dkNoch keine Bewertungen

- 25 Simple ETF PortfoliosDokument10 Seiten25 Simple ETF PortfoliosdabuttiNoch keine Bewertungen

- Topic G ExercisesDokument8 SeitenTopic G ExercisesAustin Joseph100% (1)

- Investments: Solutions ManualDokument54 SeitenInvestments: Solutions ManualZayed Mohammad JohnyNoch keine Bewertungen

- Building Blocks of FinanceDokument38 SeitenBuilding Blocks of FinanceArdi Gunardi60% (10)

- ch-3 Analysis of MFDokument18 Seitench-3 Analysis of MFrgkusumbaNoch keine Bewertungen

- Capital Market IciciDokument35 SeitenCapital Market IciciNagireddy KalluriNoch keine Bewertungen

- Problem Risk Return CAPMDokument12 SeitenProblem Risk Return CAPMbajujuNoch keine Bewertungen

- ComprehensiveDokument9 SeitenComprehensiveChristopher RogersNoch keine Bewertungen

- Ratio Analysis of Fauji FertilizerDokument6 SeitenRatio Analysis of Fauji FertilizersharonulyssesNoch keine Bewertungen

- Paper14 SolutionDokument21 SeitenPaper14 SolutionJabir AghadiNoch keine Bewertungen

- New Kyc FormDokument3 SeitenNew Kyc Formvikas9saraswatNoch keine Bewertungen

- Astra Agro Lestari TBK Aali: Company History Dividend AnnouncementDokument3 SeitenAstra Agro Lestari TBK Aali: Company History Dividend AnnouncementJandri Zhen TomasoaNoch keine Bewertungen

- Term SheetDokument9 SeitenTerm SheetDongare RahulNoch keine Bewertungen

- Passive Income: Step By Step Guide On How To Create Passive Income And Live Your Dreams (Make Money Online)Von EverandPassive Income: Step By Step Guide On How To Create Passive Income And Live Your Dreams (Make Money Online)Bewertung: 4.5 von 5 Sternen4.5/5 (2)

- Patents, Copyrights and Trademarks For DummiesVon EverandPatents, Copyrights and Trademarks For DummiesBewertung: 4 von 5 Sternen4/5 (9)

- How I Made $10 Million From Internet Affiliate MarketingVon EverandHow I Made $10 Million From Internet Affiliate MarketingBewertung: 4.5 von 5 Sternen4.5/5 (22)

- The Complete Guide to Your First Rental Property A Step-by-Step Plan from the Experts Who Do It Every DayVon EverandThe Complete Guide to Your First Rental Property A Step-by-Step Plan from the Experts Who Do It Every DayNoch keine Bewertungen