Beruflich Dokumente

Kultur Dokumente

Bobby R Baldock Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bobby R Baldock Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

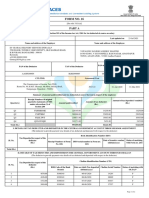

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

1. Person Reporting (last nam% first, middle initial) BALDOCK, Bobby R.

4. Title (Article lIl judges indicate active or senior status; magistrate judges indicate full- or part-time)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. ~q 101-111)

2. Court or Organization U.S. Court ofAppeals-10th Cir

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

3. Date of Report 5/02/2011

6. Reporting Period 01/01/2010 to 12/31/2010

U.S. Circuit Judge - Senior

5b. [] AmendedReport 7. Chambers or Office Address P.O. Box 2388 Roswell, New Mexico 88202-2388 8. On the basis of the information contained in this Report and any modifications pertaining thereto~ it is, in my opinion, in compliance with applicable laws and regulations.

Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. ~Reporting individual only; seepp. 9-13 of filing instructions.)

~-~ NONE (No reportable positions.)

POSITION

1. 2. 3. 4. 5. Trustee Trust

NAME OF ORGANIZATION/ENTITY

II. AGREEMENTS. meportl.g individual only; seepp. 14-16 of filing instructions.)

~] NONE (No reportable agreements.)

DATE PARTIES AND TERMS

Baldock, Bobby R.

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporting BALDOCK, Bobby R.

Date of Report 5/02/2011

III. NON-INVESTMENT INCOME. (Reporting individual and spouse; seepp. 17-24 of filing instructions.)

A. Filers Non-Investment Income ~] NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

INCOME (yonrs, not spouses)

2. 3. 4.

B. Spouses Non-Investment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.)

DATE

1. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 off!ling instructions.)

NONE (No reportable reimbursements.)

SOURCE

Moot Court Competition - University of Alabama School of Law 2. George Mason Law & Economics Center Alliance Defense Fund - The Blackstone Legal Fellowship Moot Court Competition Washington & Lee University School of Law

DATES

March 23-25, 2010

LOCATION

Tuscaloosa, AL

PURPOSE

Assist with Moot Court Competition

ITEMS PAID OR PROVIDED Transportation, meals, lodging

April 23-28, 2010

Tucson, AZ

Attend Program for Judges

Transportation, meals, lodging

3.

August 4-5, 2010

Phoenix, AZ

Legal Fellowship - Speaker

Transportation, meals, lodging

4.

October 29, 2010

Lexington, Virginia

Assist with Moot Court Competition

Transportation, meals, lodging

5.

FINANCIAL DISCLOSURE REPORT Page 3 of 8

Name of Person Reporting BALDOCK, Bobby R.

Date of Report 5/02/2011

V. GIFTS. andudes ,hose to spouse und dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.)

SOURCE 1. 2. 3. 4. 5. DESCRIPTION

VALUE

VI. LIABILITIES. ancludes those of spouse and dependent children; see pp. 32-33 of f!ling instructions.)

~ NONE (No reportable liabilities.) CREDITOR

1. 2. 3. 4. 5. Pioneer Savings

DESCRIPTION

Rental Property #2, Chaves County, NM

VALUECODE

L

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting BALDOCK, Bobby R.

Date of Report 5/02/2011

VII. INVESTMENTS and TRUSTS -- income, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets)

B. Income during reporting period (D Amount Code 1 (A-H) (2) Type (e:g., div., rent, or int.)

Place "(X)" after each asset exempt from prior disclosure

C. Gross value at end of reporting period (1) (2) Value Value Method Code 2 (J-P) Code 3 (Q-W)

D. Transact ons during reporting period (1) Type (e.g., buy, sell, redemption) (2) Date mm/dd/yy (3) (4) Value Gain Code2 Code 1 (J-P) (A-H) (5) Identity:of buyer/seller (if private transaction)

1. 2. 3. 4. 5. 6.

Merrill Lynch IRA -XCEL -Aim Weingarten Mutual Fund -Lord Abbett (Mutual R Fund) -1NG Small Cap (Mutual Fund) -Franklin Inves. Sec. TR Equity Income (Mutual Fund)

Dividend

7. -Merrill Lynch Retirement Reserves -Merrill Lynch Cash Equivalent Accounts 9. 10. 11. 12. 13. 14. 15.

16.

Hunker Commune (El Paso, Navajo, Western, Adventure) Lot in South Spring Acres, Roswell, NM Stock in South Spring Acres, Roswell, NM Minerals, Washita County, OK (BBX Oil Corp.) Silver and silver coins Gold coins Navajo, Hockley County, qX

Pioneer Savings Bank

Royalty None

J J K J J J

W W W W T

D C

Dividend Rent None None

B

A

Royalty

Interest L T

17.

Working interest in Hodges - Hockley County, TX

Royalty

1. Income Gain Codcs: (See Columns B 1 and D4) 2. Value Codes (See Columns C I and D3) 3. Value Mcthod Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J -$15,000 or less N -$250,001 - $500,000 P3 -$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$!,001 - $2,500 G =$100~001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $I,000,000 R -Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H 1 =$1,000,001 - $5,000,000 L -$50i001 - $ 100,000 PI =$I,000,001 - $5;000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$100,001 : $250,000 ~2 =$5,000;001 = $25,000;000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting BALDOCK, Bobby R.

Date of Report 5/02/2011

VII. INVESTMENTS and TRUSTS -income, value~ transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets)

Place "(X)" after each asset exempt from prior disclosure Income during reporting period (2) (I t Amount Type (e.g., Code 1 div., rent, (A-H) or int.)

Gross value at end of reporting period (1) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W)

(1) Type (e.g., : buy, sell, redemption)

(2) (3) (4) Value Gain Date mm/dd/yy Code 2 [ Code 1 (J-p) (A=H)

(5) Identity of buyer/seller (ifprivate transaction)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32.

Working interest in Jeffers-Hockley County, TX Working interest in Pair- Hockley County, TX Working interest in Reed-Hockley County, TX Working interest in White-Hockley County, TX Working interest in Terry-Hockley County, TX Cash Value Life Insurance, AXA Equitable(Money Market Acct)* Oil &Gas Items: XTO Energy Production BP Am Production Company Conoco Phillips Sunco Oil & Gas Production Great Western Drillling Company E1 Paso Production Company Working interest in Mewbourn Oil, Eddy County, NM Property #2, Chaves County, NM

A A A A A A

Royalty Royalty Royalty Royalty Royalty Interest

A E E A C C B A D

Royalty Royalty Royalty Royalty Royalty Royalty Royalty Rent Dividend

J K K J K K J L O

W W W W W W W W T

33. Trust #1

34. -Citigroup

1. Income Gair~ Codes: (See Columgs BI and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$L000 or less F =$50,001 - $100,000 J =$15,000 or tess N =$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$I,001 -$2,500 G =$100,00 l - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $ 1,000,000 R =Cost (Real Estate Only) V -Other

C =$2,501- $5,000 HI =si~000,00i ~ $51000,000 L =$50 001, $ 00000 PI =$1,000,001 -- $5,000,000 P4 =More thao $50 000 000 S =Assessment .... W =Estimated

D =$5,001 - $15,000 H2 M =$100 001 ~ $250;000 P2=$5 000 001 ~ $25,000,000 T =Cash M~k~t

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 6 of 8

Name of Person Reporting BALDOCK, Bobby R.

Date of Report 5/02/2011

VII. INVESTMENTS and TRU STS --inco,,e, value, transuctions anciudes those o/spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (1) (2) Amount Type (e.g.. Code I div:, rent, (A-H) or int.) C. Gross value at end 0f reporting period (1) Value Code2 (J-P) (2) Value Method Code 3 (1) . Type(e.g., buy, sell, redemption) D. Transact ons during reporting period (2) (3) (4) Date Value mrrddd/yy Code 2 (J-P) (5)

Gain Code 1 (A-H)

(Q-W)

35, 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. -Computer Sciences -Halliburton Co. -Innsuites Hospitality Trust SBI -KB Home -Kimberly Clark Corp. -Meadwestvaco Corp. -3M Co. -Walgreen -Wells Fargo & Co. -Columbia Tax Exempt Fund A -FT Franklin AZ T/F Inc. A -Oppenheimer Global Fund Class A -Invesco Van Kampen Muni Income Fd CL A* -Glendale Ariz Uni High -Pima Cnty Ariz Str & Hwy Rev -Arizona St Univ Revs Cpn -Merrill Lynch Bank Deposit Program*

Identity of buyer/seller (if private transaction)

1. lnc0me Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1 ;000 or ie~s F =$50,001 - $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B=$1;ool - $2 500 G Z$i00,00 i ~ $i,000,0~0 K =$15,001 - $50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

c =$2,51 - $5,

Hi =$1,0001001 : $5;0~0;000 L =$50,001 v $i00~000 PI ---$1;000;001 - $5,000,000 P4 ~-More ihan $50,000;000 S =Assessment W =Estimated H2 =More tha $5,000,000 M ~$100~001 - $250~000 P2 =$5,000;001 - $25,000,000 T ~aSh Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting BALDOCK, Bobby R.

Date of Report 5/02/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicate part of report.)

Part VII, page 5, line 23- Inserted name of life insurance company. Part VII, page 6, line 47- This asset was formerly known as "Van Kampen Muni Income Fd CL A" Part VII, page 6, line 5 l- This asset was formerly known as "Reserve Management Account Money Market"

FINANCIAL DISCLOSURE REPORT Page 8 of 8 IX. CERTIFICATION.

Name of Person Reporting BALDOCK, Bobby R.

Date of Report 5/02/201 !

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.SoC. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Bobby R. BALDOCK

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Opinion - JW V NavyDokument7 SeitenOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- Holder Travel Records CombinedDokument854 SeitenHolder Travel Records CombinedJudicial Watch, Inc.Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Gitmo Water Test ReportDokument2 SeitenGitmo Water Test ReportJudicial Watch, Inc.Noch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- JW Cross Motion v. NavyDokument10 SeitenJW Cross Motion v. NavyJudicial Watch, Inc.Noch keine Bewertungen

- Visitor Tent DescriptionDokument3 SeitenVisitor Tent DescriptionJudicial Watch, Inc.Noch keine Bewertungen

- Navy Water Safety ProductionDokument114 SeitenNavy Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- May 2007 BulletinDokument7 SeitenMay 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- LAUSD Semillas AckDokument1 SeiteLAUSD Semillas AckJudicial Watch, Inc.Noch keine Bewertungen

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- Fin 254 Final ProjectDokument36 SeitenFin 254 Final ProjectDpn BzNoch keine Bewertungen

- Leadership of Woman President in The Philippine State Universities and CollegesDokument14 SeitenLeadership of Woman President in The Philippine State Universities and CollegesAPJAET JournalNoch keine Bewertungen

- Criteria For Supplier Selection: A Literature Review: ArticleDokument6 SeitenCriteria For Supplier Selection: A Literature Review: ArticleMohammed ShahinNoch keine Bewertungen

- ChackaoDokument13 SeitenChackaoChackaNoch keine Bewertungen

- Fastag E-Statement: Customer Details Bank DetailsDokument2 SeitenFastag E-Statement: Customer Details Bank DetailsSawariya PaintsNoch keine Bewertungen

- Commercial Lease Jan 2022Dokument12 SeitenCommercial Lease Jan 2022Aniella94Noch keine Bewertungen

- EnrollmentDokument4 SeitenEnrollmentJet Boclaras100% (1)

- The Role of Power in LeadershipDokument4 SeitenThe Role of Power in LeadershipVahanNoch keine Bewertungen

- Customer Persona and Value PropositionDokument24 SeitenCustomer Persona and Value PropositionVishnu KompellaNoch keine Bewertungen

- Form No. 16: Part ADokument6 SeitenForm No. 16: Part AVinuthna ChinnapaNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Full Download Operations Management Sustainability and Supply Chain Management Canadian 2nd Edition Heizer Solutions Manual PDF Full ChapterDokument23 SeitenFull Download Operations Management Sustainability and Supply Chain Management Canadian 2nd Edition Heizer Solutions Manual PDF Full Chapterrengtressful5ysnt100% (20)

- RE: POLICY #: A13267806PLA NAME OF INSURED: Ossilien ThimotDokument1 SeiteRE: POLICY #: A13267806PLA NAME OF INSURED: Ossilien ThimotAndre SenabNoch keine Bewertungen

- Commerce Syllabus FullDokument48 SeitenCommerce Syllabus FullTapasNoch keine Bewertungen

- Economic, Social Impacts and Operation of Smart Factories in Industry 4.0 Focusing On Simulation and Artificial Intelligence of Collaborating RobotsDokument20 SeitenEconomic, Social Impacts and Operation of Smart Factories in Industry 4.0 Focusing On Simulation and Artificial Intelligence of Collaborating RobotsDrakzNoch keine Bewertungen

- Assignment Banking, Insurance and Financial Services BASEL Norms Analysis of Union BankDokument2 SeitenAssignment Banking, Insurance and Financial Services BASEL Norms Analysis of Union Banksomya mathurNoch keine Bewertungen

- ALUMNI MEET 2023-24 SampleDokument16 SeitenALUMNI MEET 2023-24 SampleTamil SelvanNoch keine Bewertungen

- Class 13 PDFDokument26 SeitenClass 13 PDFNilufar Yasmin AhmedNoch keine Bewertungen

- Week 3 - Lecture #1 Foundational Concepts of AISDokument25 SeitenWeek 3 - Lecture #1 Foundational Concepts of AISChand DivneshNoch keine Bewertungen

- CHPT 1...... The Foundations of EntrepreneurshipDokument62 SeitenCHPT 1...... The Foundations of EntrepreneurshipHashim MalikNoch keine Bewertungen

- Oral Transfer of Property Under The Transfer of Property ActDokument14 SeitenOral Transfer of Property Under The Transfer of Property ActRohanNoch keine Bewertungen

- Fin AcctgDokument9 SeitenFin AcctgCarl Angelo0% (1)

- 2023 Mock Paper 1 BRD HL IB Business Management Copy 2Dokument4 Seiten2023 Mock Paper 1 BRD HL IB Business Management Copy 2pandasniper567Noch keine Bewertungen

- Plantilla - Seguimiento de DevolucionesDokument15 SeitenPlantilla - Seguimiento de DevolucionesAaron ChávezNoch keine Bewertungen

- 2.3 Planeacion de Requirimientos de RecursosDokument22 Seiten2.3 Planeacion de Requirimientos de RecursosYenifer PerezNoch keine Bewertungen

- Budgeting: Accounting: A Malaysian Perspective, 5e (Adapted From Accounting 26e: Warren, Reeve & Duchac)Dokument58 SeitenBudgeting: Accounting: A Malaysian Perspective, 5e (Adapted From Accounting 26e: Warren, Reeve & Duchac)Asyikin OsmanNoch keine Bewertungen

- Sushma Industries: The Gordian Knot of Compensation DesignDokument7 SeitenSushma Industries: The Gordian Knot of Compensation DesignBCom Hons100% (1)

- Personal Finance 11th Edition Kapoor Solutions ManualDokument43 SeitenPersonal Finance 11th Edition Kapoor Solutions Manualcuclex61100% (28)

- Copyright in ChinaDokument237 SeitenCopyright in ChinaccoamamaniNoch keine Bewertungen

- How To Identify Winning Mutual Funds Safal Niveshak 2013Dokument23 SeitenHow To Identify Winning Mutual Funds Safal Niveshak 2013easytrainticketsNoch keine Bewertungen

- SMU V500R003C10SPC018T Upgrade GuideDokument9 SeitenSMU V500R003C10SPC018T Upgrade GuideDmitry PodkovyrkinNoch keine Bewertungen

- Seven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)Von EverandSeven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)Noch keine Bewertungen

- Living Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)Von EverandLiving Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)Bewertung: 5 von 5 Sternen5/5 (3)

- How I Made $10 Million From Internet Affiliate MarketingVon EverandHow I Made $10 Million From Internet Affiliate MarketingBewertung: 4.5 von 5 Sternen4.5/5 (22)

- 8 Living Trust Forms: Legal Self-Help GuideVon Everand8 Living Trust Forms: Legal Self-Help GuideBewertung: 5 von 5 Sternen5/5 (7)

- Passive Income: Top 7 Ways to Make Money Online While Quitting Your 9-5 Job and Enjoy Freedom In Your Life: Passive IncomeVon EverandPassive Income: Top 7 Ways to Make Money Online While Quitting Your 9-5 Job and Enjoy Freedom In Your Life: Passive IncomeNoch keine Bewertungen

- The Everything Executor and Trustee Book: A Step-by-Step Guide to Estate and Trust AdministrationVon EverandThe Everything Executor and Trustee Book: A Step-by-Step Guide to Estate and Trust AdministrationBewertung: 3 von 5 Sternen3/5 (3)

- Asset Protection for Business Owners and High-Income Earners: How to Protect What You Own from Lawsuits and CreditorsVon EverandAsset Protection for Business Owners and High-Income Earners: How to Protect What You Own from Lawsuits and CreditorsNoch keine Bewertungen