Beruflich Dokumente

Kultur Dokumente

Victor Marrero Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Victor Marrero Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

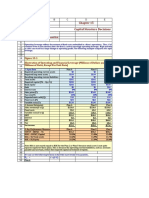

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

1. Person Reporting (last name, first, middle initial) Marreru, Victor

4. Title (Article III judges indicate active or senior status; magistrate judges indicate full- or part-time)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

2. Court or Organization U.S. District Court, S.D.N.Y.

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

3. Date of Report 08/23/2011

6. Reporting Period 01/01/2010 to 12/31/2010

U.S. District Judge - Active

5b. [] Amended Report 7. Chambers or Office Address 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compfianee with applicable laws and regulations. Reviewing Officer Date

U.S. District Court, SDNY 500 Pearl Street New York, New York 10007

IMPORTANT NOTES: The instructions accompanying this form must be followecL Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. aepo,~ing indiviauat onty ; see pp. 9-13 of filing instructions.)

~

1. 2. 3. 4. 5.

NONE (No reportable positions.) POSITION

Trustee

NAME OF ORGANIZATION/ENTITY

New York Public Library

II. AGREEMENTS. (Reponing indiviau,t only; s~ ,p. 14-16 of filing instructions.)

~] NONE (No reportable agreements.)

DATE

PARTIES AND TERMS

Marrero, Victor

FINANCIAL DISCLOSURE REPORT Page 2 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

Ill. NON-INVESTMENT INCOME. (Reporting individual and spouse; seepp. 17-24 offillng instructions.)

A. Filers Non-Investment Income

~ NONE(No reportable non-investment income.) DATE SOURCE AND TYPE

INCOME (yours, not spouses)

2. 3. 4.

B, Spouses Non-Investment Income - if you were married during anyportion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE(No reportable non-investment income.) DATE SOURCE AND TYPE

municipal government official

1.2010 2. 3. 4.

IV. REIMBURSEMENTS - transportation, lodglng, food, entertainmenL

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE DATES LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

2. 3. 4. 5.

DISCLOSURE REPORT PageFINANCIAL3 of 22

I

[

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

V. GIFTS. anciudes those to spouse and dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. ancludes those o/spouse und dependent children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.) CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUECODE

FINANCIAL DISCLOSURE REPORT Page 4 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRUSTS --income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of f!ling instructions.)

NONE (No reportable income, assets, or transactions.)

1. 2.

CITIBANK KEOGH ACCOUNT: (see lines 2 and 3) CDs A A Interest Dividend L T Sold 10/27/10 K C

3. Annuity-Transamerica

5. 6.

PUTNAM RETIREMENT IRA: (see line 6) Balanced Retirement C1-A B Dividend Sold 10/25/10 K C

8. 9. 10. 11.

SUN AMERICA IRA: (see lines 9 and 10) SunAmerica Balanced SunAmerica Goldman Sachs A A Dividend Dividend Sold Sold 10/18/10 K 10/18/10 K C C

12. ~ PUTNAM IRA: (see line 13) 13. Balanced Retirement C1-A 14. 15. 16. 17. DREYFUS (see line 16) N Tax Exempt Fund D Dividend N T A Dividend J T

~ ~$50i00i- $100,000 2 valU~:~odel J --$15,000 or tess (See Columns C land D3)N =$250.001 - $500,000 .... P3 ~$25,000,001 - $50,000,000 32 value Method Codes Q =Appraisal (See Column C2) U =Book Value

G =$100~00i 2 $ii000~000 K ~$151001 - $50~000 O =$500.001 - $ 1.000,000 R =Cost (Real Estate Only) V =Other

H I =$i;000;001 ~ $5.000,000 L =$50;001 - $100,000 PI =$1,000,001 - $5;000,000 P4 =More than $50,000,000 S =Asscssracnt W =Estimatcd

M =$100~001 ~ $250~000 P2 =$5,000;00] -$25.000,000 T =Cash Market

FINANCIAL DISCLOSURE REPORT Page 5 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRU STS -income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

18. 19. 20. 21. 22. 23. 24.

SCHWAB (see line 19) ConEd - common stock B Dividend Sold 07/26/10 K D

NY STATE TUITION SAVINGS PLAN

Dividend

JPMORGAN CHASE MONEY MARKET

Interest

25. ~ NYC DEFERRED COMP. IRA 26. 27. 28. 29. 30. 31. 32. 33. :34. FIDELITY ROLLOVER IRA: (see lines 35 through 170) CHASE TRADITIONAL IRA (see lines 28-32) JPMorgan High Yield Bd Fund JPMorgan Core Plus Bond Class A JPMorgan Emerg. Mkts Debt C1 A MFS Emerg. Mkts Debt C1 A Principal Global Diversified Inc. A

Dividend

A A A A A

Dividend Dividend Dividend Dividend Dividend

K J K K K

T T T T T

Buy Buy Buy Buy Buy

10/29/10 10/29/10 10/29/10 10/29/10 10/29/10

K K K K K

I. Income Gain Codes: (See Columns B 1 and D4) 2, Value Codes (See Columns (21 and D3) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$50.001 - $100.000 J =$15.000 or less N =$250,001 - $500.000 P3 =$25.000.001 - $50.000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100.001 - $1.000.000 K =$I 5.001 - $50.000 O =$500.001 - $1.000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H 1 =$1.000,001 - $5~000.000 L =$50,001 - $106.000 PI =$1,000,001 - $5,000,000 P4 =More than $50.000.000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5.000,000 M =$100.00| - $250.000 P2 =$5,000,001 -$25,000,000 T =Cash Markel

E =$! 5.001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 6 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRU S TS -income, value, transactions (lndudes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45.

46.

Fidelity Strategic Advs. Value Fund (name change on line 40)

Dividend

Buy Buy Buy Buy Buy

01/21/10 03/30/10 03/31/I 0 05/12110 06/25/10 06/25/10

K J J J J J J K

J

Strategic Advs. Value Fund (name change from line 35)

Dividend

T Buy Buy

08/04/10 10/06/10 10/07/10 I 0/14/10 12/15/10

03/30/10

Buy Buy Sold

Buy

J

J

(part)

Fidelity Pas Small Cap Fund of Fds (name change on line 47) Strategic Advs Pas Small Mid-Cap Fd (name change from In 46) A Dividend

J

J

47.

Dividend

08/20/10

48.

Buy

10/14/10

J

J

49.

Buy

12/15/10

50. 51. FidelityPas lntl Fund of Funds (name change on line 54) A

Buy Dividend Buy

12/16/10 03/30/10

J J

1. Income Gain Codes: (See Columns B 1 and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

=$~5,ooo o~ ~ess

=$250,001- $500,000 P3 =$25,000,001 - $50:000,000 =Appraisal =Book Value

~$50,001 - $100;000

K --$~5;oo~ - $~oi000

O--~00~001- $i 1000iD06 R =Cost (Real Estate Only) V =Other

L ~$~0100i : $1001000 ~ =$i00;00i = ~0100~

PI L$1i000100i - $5~000,000 P4 =M0r~ than *50,000,000 S =Assessment W =Estimated P2 =$5i000~00i ~ $2510001000 T =Cash Mfirk~t i

FINANCIAL DISCLOSURE REPORT Page 7 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRU STS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

[] NONE (No reportable income, assets, or transactions.)

52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. Strategic Advs. Growth Fund A Dividend L T Fidelity Pas US Oppor Fund of Funds (name change on In 58) Strategic Advs Pas US Opp Fd of Fds (name change from In 57) Strategic Advs Core Fund A A A Dividend Dividend Dividend K M T T Strategic Advs. Pas Intl Fd of Fds (name change from In 51) B Dividend M T

Buy Buy

05/12/10 08/04/10 08/20/10

J J J J J J J K J J K J J J J J K A

Buy Buy Buy

10/06/10 10/14/10 06/25/10 08/20/10

Buy Buy Buy Buy Buy Sold Buy Buy Buy Buy

01/21/10 01/22/10 06/22/10 08/04/10 I 0/06/10 11/15/10 12/15/10 06/25/10 08/04/10 10/06/10

(part)

1. lnc0me ~ain C~d~: : : A=$ i;000 or i~s (See Co!umns B I and D4)F =$50;001: $100;000 2. ValUe Codes J =$15 000 or less N =$250;001 - $500,000 (See Columns C I and D3) P3 =$25,000;00] - $50,000,000 3. Value Method Codes Q =Appraisal (Sce Column C2) U =Book Value

~ =$15,o0~ ~o~0oo :

0 =$500~001 ~ $1 ;000,000 R =Cost (Real Estate Only) V =Other P I ~$1~000~001 ~ $5i000;000:P2 =$5i000;001 ~ $25i000i000 S =Asscssmc~i W =Eslirn~ted

FINANCIAL DISCLOSURE REPORT Page 8 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRU STS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of f!ling instructions.)

NONE (No reportable income, assets, or transactions.)

69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79.

80. Fidelity Select Gold B Dividend K T

Buy Buy Buy Buy Strategic Advs. Emerg. Mkts. A Dividend K T Buy Buy Buy Fidelity Dividend Growth A Dividend J T Buy Sold

12/09/10 11/15/10 12/10/10 12/15/10 10/14/10 10/15/10 11/15/10 01/21/10 06/25/10 08/04/10 10/06/10

06/25/10

J J J J K J J J J

(p~)

Sold (part) Sold (part)

Buy

81.

Fidelity Capital & Income

Dividend

Sold

(paa)

Sold

01/21/10

A A A A A

82.

10/14/10

(part)

83.

84. Fidelity Investment Grade B Dividend K T

Sold

(part)

Sold

12/15/10

06/25/10

J

J

(part)

Sold (part)

85.

10/06/10

! Income Gain Codes: (See Colunms BI and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Cedes tSce Column C22

A =$1.000 or tess F =$50.001 - $100.000 J =$15.000 or less N =$250.001 - $500.000 P3 =$25,000.001 - $50.000,000 Q =Appraisal U =Book Value

B =$1,00t -$2,500 G =$t 00,001 - $I ,000,000 K =$15.001 - $50,000 O =$500,001 - $1,000,000 R =Cosl (Real Estate Only) V =Other

C =$2.501 * $5,000 H 1 =$1,000,00t - $5,000,000 L =$,50.001 - $100.000 PI =$1,000.00t - $5.000.000 P4-More than $50.000.000 S =Assessment W =Estimated

D =$5,001 -$15.000 H2 =More than $5,000,000 M =$ 100,001 - $250.000 P2 =$5.000,001 - $25,000,000 T =Cash Markct

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 9 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

D NONE (No reportable income, assets, or transactions.)

86. 87. 88. 89. ] 90. 91. 92. I 93. 94. 95. 96. ]97. 98. 99. Fidelity Pas Income Opp Fd of Fds (name change on line 99) Strategic Advs Pas Inc Core Opp Fd (name change from In 98) C A A Dividend Dividend Dividend K J T T Strategic Advs Pas Core Inc. Fd (name change from line 90) B Dividend M T Fidelity Total Bond FidelityPas Core Income Fd of Fds (name change on line 93) B C Dividend Dividend L T Fidelity Short Term Bond A Dividend K T

Sold (part) Buy Buy Buy Buy Buy Sold

10/29/10 06/25/10 10/14/10 12/09/10 01/21/10 03/30/10 06/25/10 08/20/10

K J J J J J J L K K J J J K J J J

(part)

Buy Buy Buy Buy Sold (part)

10/06/10 11/15/10 11/16/10 12/15/10 01/21/10 08/20/10

100. FIMM MNIKT Port Inst. C1 101. 102. Fidelity Money Market

Buy Sold (part)

11/15/10 12/28/10 01/21/10

Dividend

Buy

2. Val~ ~ (SeeC0!umnsCl and D3) 3. Value Method Codes (See ColUmn C2)

N =$250;001 ~ $500;000 P3 ~$25 000 001- $50 000;000 Q --Appraisal U =Book Value

: K =$151001, $50;000 O =$500;001 ~ $1i000;000 R =Cost (Real Estate Only) V =Other

L =$50i001 ~ $i00,000 M =$100,00i - $250,000 PI --$t;000,001 .-$5,000,000 P2 =$5,000;001 - $25;000~000 P4 --M0~e tha~ $50;000;000 T =Cash Market S =Assessm6dt W =Estimated

FINANCIAL DISCLOSURE REPORT Page 10 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMEN TS and TRU S TS - income, vutue, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

D NONE (No reportable income, assets, or transactions.)

103.

(part)

104. Sold (part)

Sold

02/17/10

05/25/10

105.

Buy

Sold

06/25/10

106.

(part)

107. Buy

08/31/10

10/t4/10

108.

Sold

(part)

109. Allianz NFJ Divident Value Sold (part) Sold

I1/15/10

01/21/10

A B B A A A A A A A A

110.

03/30/10

111. Dreyfus Appreciation Fund

Sold

01/2 l/10

112. Goldman Sachs Large Cap Value

Sold (part) Sold

03/30/10

113.

05/12/10

(part)

114. Sold (part) Sold 06/25/10 J

ll5.

lO/06/lO

(part)

116. Sold (part) Sold 10/14/10 J

117.

11/15/10

118. Hartford Growth Opp Class A

Sold

03/30/10

119. Hartford Capital Appreciation Class A

Sold (part)

01/21/10

1. Income GainCodes: (See Columns BI and D4"~ 2. Value Codes (See Colurmas CI and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $I00.000 J =$15.000 ar less N =$250.001 - $500.000 P3 =$25,000,001 - $50.000.000 Q =Appraisal U =Book Value

B =$1.001 - $2.500 G =$100,001 - $I.000.000 K =$15.001 - $50.000 O =$500.001 - $1.000.000 R =Cost (Real Estale Only) V =Other

C =$2.501 - $5,000 HI =$1.000.001 - $5.000.000 L =$50.001 - $100.000 PI =$ 1.000.001 - $5.000,000 P4 =More than $50.000.000 S =Asscssmcnt w =Esumatcd

=$5,001 - $15,000 H2 =More than $5,000,000 M =$ 100,001 - $250.000 P2 =$5.000.001 - $25,000,000 =Cash Markel

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 11 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

120.

121.

Sold

(part) Sold (part) Sold

06/25/10

08/04/10

J

J

A A A A A A A A A A A A A A A A

122.

10/06/10

(part)

123.

124.

(part)

Sold

Sold

10/14/10

l 1/15/lO

J

J

125. Hotchkis & Wiley Large Cap Value Class A 126. 127. 128. 129. 130. Perkins Mid Cap Value Fund CI J 131. 132. JPMorgan US Lg Cap Core Plus 133. Lazard Emerging Mkts Open C1

134. Legg Mason CBA Lg Cap Growth A 135. 136. A Dividend

Sold

01/21/10 05/12/10 10/06/10 10/14/10 11/15/10 01/21/10 10/06/10

J J J J J J J

(part)

(part)

Sold

Sold

(part) (part)

Sold Sold Sold

(part)

Sold Sold

Sold Sold (part) Sold (part) Sold

01/21/10 K

10/14/10 K 06/25/10 08/04/10 10/06/10

J J J

1. Income Gain Codes: (See Columns B 1 and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes {See Column C2)

A =$1.000 or less F =550.001 - $100.000 J =515.000 or less N =$250.001 - $500.000 P3 =$25.000.001 - $50,000.000 Q =Appraisal U =Book Value

B =$1.001 - $2.500 G =$] 00.001 - 51.000.000 K =$15.001 - $50.000 O =$500.001 - $1.000.000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H 1 =$1,000,001 - 55,000,000 L =$ 50.001 - $ 100.000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =Mere than $5,000,000 M =5100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 12 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVES TMENTS and TRU S TS --i.eome, vutue, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

[~ NO~E (No reportable income, assets, or transactions.)

137. MFS Intl Value Fund Cl A 138. 139. MFS Research Intl Class A 140. 141. Mainstay Lg Cap Growth Fund CI A 142.

Sold (part) Sold Sold

10/06/10 10/14/10 10/06/10 10/14/10 06/25/10 08/04/10 lO/06/lO 11/15/lO ! 12/09/10 06/25/10 08/04/10 lO/06/lO 10/06/10 10/14/10 03/30/10 J

J J J J J J J J J J J J J J

A A A A A A A A A A A A A A A

(part)

Sold Sold

(part) (part)

143. 144. 145. 146. Marsico Focus 147. 148. 149. Masters Select Intl Invest 150. 151. Merger Fund 152. Morgan Stanley Mid Cap Gr Port C1 P 153. A Dividend

Sold Sold Sold

(part) (part)

Sold Sold (part) Sold (part) Sold Sold (part) Sold Sold

Sold (part) Sold (part)

06/25/10 08/04/10

J J

A A

1. Income Gain Codes: (See Columm B 1 and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

N =$250 001 -$500,000: :

P3 =$25,000,001 - $50,000;000 Q =Appraisal

O =$500;001 ;$1;000 000

R =Cost (Reai Estate Only)

P1 =$ii000,00i ~ S5,000,000 : : P2 =S5;000,001 +$25100011?06

P4 =M0r~ iha~ ~5o;o00,000

S =Assessmcnt T --Cash Market i

U =Book Value

V =Other

W =Estimated

FINANCIAL DISCLOSURE REPORT Page 13 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

[~ NOblE (No reportable income, assets, or transactions.)

154. 155. 156. 157. Pimco Total Return Adm Shs

158.

Sold (part) Sold (part) Sold C Dividend L T Sold (part)

10/06/10 11/15/10 12/15/10 06/25/10

11/15/10

J J J J

K

A A A A B

(part)

A A B Dividend Dividend Dividend K J K T T T Sold (part) Sold Sold (part) Sold (part) Sold Buy Sold

Sold

159. Pimco Short Term Adm Shs 160. Pimco Comm Real Ret Strat Adm 161. T Rowe Price High Yield Adv C1 162. Royce Penn Mut Fund 163. 164. Selected American Shs CI S 165. 166. 167. 168. Templeton Global Bond C1 A 169. Westport Select Cap C1 R 170. Fidelity Cash Reserves

10/14/10

(part)

06/25/10 i J

10114/10 12/15/10 01/21/10 06/25/10 08/04/10 10/06/10

J J

J J J J

A A A

(part)

Sold Dividend K Sold (part) Interest

A A

10/06/t 0 J

1. Income Gain Codes: (See Columns B 1 and D4-, 2. Value Codes {See Columns C 1 and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N =$250.001 - $500.000 P3 =$25.000,001 - $50.000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$I 00,001 - $1,000,000 K =$15.001 - $50.000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2.501 - $5,000 H l =$1,000,001 - $5~000,000 L =$50,001 - $100,000 P1 =$1,000,001 - $5,000,000 P4 =More than $50.000.000 S =Assessment W =Estimated

D =$5,001 - $I 5,000 H2 =More than $5.000.000 M =$100.001 - $250,000 P2 =$5.000.001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 14 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVES TMENTS and TRU STS -- i.eome, volue, trunsactio.s (lndudes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

~-~ NONE (No reportable income, assets, or transactions.)

171, 172. (S) FIDELITY ROLLOVER IRA: (see lines 173 through 220) 173. Fidelity Strategic Advs. Value Fund (name change on In 175)

174.

Buy Buy A Dividend J T Buy Sold

02/10/10 06/16/10 06/25/10 09/21/10 10/27/10 08/20/10

J J J J

175. Strategic Advs. Value Fund (name change from line 173) 176. 177. 178. Fidelity Pas Small-Mid Cap Fd of Fds (name change on In 179) 179. Strategic Advs Pas Small-Mid Cap Fd (name change froln ln178) 180. Fidelity Pas Intl Fund of Funds (name change on line 181) 181. Strategic Advs Pas Intl Fd of Fds (name change from In 180) 182. Fidelity Pas US Opp Fd of Fds (name change on line 183) 183. Strategic Advs Pas US Opp Fd (name change from In 182) 184. Fidelity Strategic Advs. Core Fund 185. 186. Strategic Advs. Growth Fund 187. Strategic Advs. Emerg. Mkts

(part)

Dividend

08/20/10 08/20/10

J J J

J

A A A A

Dividend Dividend Dividend Dividend J J

T Sold (part) T T Buy Buy

08/20/10 03/30/10 08/20/10 03/30/10 06/16/10 06/16/10 10/27/10

J J J J J

A A

Dividend Dividend

J J

T T

Buy Buy

2. Val~ COdes : :: (See Columns C ! andD3) 3: Value Method Codes (See C01unm C2)

.1 =$15,000 0r i~S~ N =$250,001 ~ $500,000 P3 =$25,000,001 ~ $50;000;000 Q =AppraiSal U =Book Value

~ Z~i06i i $i00;000 P]--$l~000~001 ~ $5;000,000 ~ ~MO~ than $50,000i000 S _-AsSeSsment R ~C9~t (Rea! Estat~ On!y)i V =Other W--Estimated O =$500;001 ~ $1,000~000 :

M =$1001001 ~ $250i000 P2 =$5,0001001 - $25;000,000 T =Cash Market

FINANCIAL DISCLOSURE REPORT Page 15 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRU STS -income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

[] NONE (No reportable income, assets, or transactions.)

188. Fidelity Real Estate Inc. 189. Fidelity Select Gold 190. Fidelity Capital & Income 191. Fidelity Invest Grade 192. Fidelity Total Bond 193. Fidelity Pas Core Inc Fd of Fds (name change on line 194) 194. Strategic Advs Pas Core Inc Fd (name change from In 193) 195. Fidelity Pas Income Opp Fd of Fds (name change on In 196) 196. Strategic Advs Pas Income Opp Fd (name change from In 195) 197. Fidelity Money Market 198. 199. AQR Diversified Arb. Class 1 200. American Beacon Lg Cap Invest 201. Credit Suisse Commd Rtrn Strtgy Sh 202. Goldman Sachs Lg Cap Val Instl 203. 204. Janus Fund CI J Shs

A A A A A A A A A A

Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend

J J

T T Sold 10/27/10 J A

J J

T T 08/20/10

J

K J K J

T T T T Sold (part) Sold (part)

08/20/10 08/20/10 08/20/10 10/27/10 11/02/10 09/21/10

J

J

J

J

J J

Dividend

Buy Sold

06/16/10 J

Dividend

T

Sold (part) Sold Sold 02/10/10 03/30/10 J J A A

06/16/10 J

1. Income Gain Codes: ISee Columns BI and IM) 2: Value C~des (See Columns C1 and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J -$15.000 or tess N =$250,001 - $500,000 P3 =$25.000.001 - $50.000.000 Q =Appraisal U =Book Value

B =$1.001 - $2,500 G =$100.001 - $1.000.000 K =$15,001 - $50,000 O =$500.001 - $1.000.000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI =$t,000,00t - $5,000.000 L =$50.001 - $100,000 PI =$1,000,001 - $5.000.000 P4 =More than $50.000.000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$I00.001 - $250.000 P2 =$5.000.001 - $25.000.000 T =Cash Market

E =$15.001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 16 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRUSTS -income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE(No reportable income, assets, or transactions.)

205. Perkins Mid Cap Val Fd Inv Shs 206. LazardEmerging Mkts Open C1 207. Mainstay Lg Cap Gr Fd CI A 208. Merger Fund 209. 210. Metropolitan West Low Duration M 211. Pimco Total Return Adm Shs 212. Pimco Short Term Adm Shs 213. 214. T Rowe Price High Yld Adv C1 215. T Rowe Price Short Term Bd Fund 216. T Rowe Price Mid Cap. Value 217. Templeton Global Bd CI A 218. FIMM MMKT Port Inst CL 219. 220. Fidelity Cash Reserves 221. A

Interest

Sold A Dividend Sold Sold A Dividend Buy Sold A A A Dividend Dividend Dividend J J J

T T T

03/30/10 10/27/10 06/16/10 03/30/10 09/21/10

J J J J J

Buy Buy

02/10/10 09/21/10

J J

A A

Dividend Dividend

J J

T T Buy Buy 10/27/10 03/30/t 0 J J

A A

Dividend Dividend

J J

T T Buy Buy T 10/27/10 11/02/10 J J

1. Income Gain Codes: (See Columns BI and D41 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2/

A =$1.000 or less F =$50,001 - $100.000 J =$15.000 or less N =$250.001 - $500,000 P3 =$25.000,001 - $50.000.000 Q =Appraisal U =Book Value

B =$1.001 - $2,500 G=$100.001 - $1.000.000 K $15,001 -$50.000 O-$500.001 -$1.000.000 R =Cost(Real Estate Only) V =Othcr

C =$2.501- $5,000 HI =$1.000.001-$5.000.000 L =$50,001 -$100.000 PI =$1.000.001 -$5.000.000 P4 =Mo~than $50,000,000 S -Assessment W=Estimated

D=$5,001 -$15,000 H2 =More than $5.000.000 M=$100.001 -$250.000 P2=$5,000,001 -$25,000,000 T =Cash Market

E =$15,001- $50.000

FINANCIAL DISCLOSURE REPORT Page 17 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRU S TS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of f!ling instructions.)

~] NO~IE (No reportable income, assets, or transactions.)

222. ~ FIDELITY SEP IRA: (see lines 223 through 286) 223. Fidelity Strategic Advs Value Fund (name change on line 226) 224. 225. 226. Strategic Advs Value Fund (name change from line 223) 227. 228. 229. Fidelity Pas Small-Mid Cap Fd (name change on In 230) 230. Strategic Advs Pas Small-Mid Cap Fd (name change from ln229) 231. Fidelity Pas 1ntl Fd of Fds (name change on line 233) 232. 233. Strategic Advs Pas Intl Fd of Fds (name change from In 231) 234. 235. Fidelity Pas US Oppor Fd of Fds (name change on line 236) 236. Strategic Advs Pas US Opp Fd (name change from In 235)

237. Fidelity Strategic Advs. Core Fund A A A Dividend Dividend Dividend J J T T

Buy Buy Buy A Dividend J T Buy Sold (part) A A Dividend Dividend J T

02/10/10 03/30/10 03/31/10

06/25/10 J

J J J

09/21/10 J 10/27/10 08/20/10 08/20/10 J J J J J

J J J J J

102/lO/lO

Buy A Dividend J T Sold (part) Sold 06/16/10 08/20/10 10/27/10 03/30/10 08/20/10 Buy Buy 03/30/10 06/16/10

(part)

238.

i. lnc0me Gain c0des: (See Columns B! and D4) 2. Value codes (See c61umns Cl and D3) 3. Value Method Codes (See Column C2)

A =$1;000 or less F =$501001 ~ $100,000 J =$15;000 or less

K--$i~;ool-$50;000

O--$500,001 ~ $1,000~000 PI =$1 000~001 ; $5i000,000

P4 =Mor~ than $50i000;000

N =$~5o,oo~ - $500,000 P3 =$2s,ooo,ool - $50,000,000

Q =Appraisal U =Book Value

P2--$5;000;001- $25 000;000 Y =Cash Market

R :Cost (Real Estate Only)S--Assessment v =Other W =Estimated

FINANCIAL DISCLOSURE REPORT Page 18 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVE S TMEN TS and TRU S TS - income, v, lue, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructlon~)

D NONE (No reportable income, assets, or transactions.)

239. 240. 241. Strategic Advs. Growth Fund

242. Strategic Advs. Emerg. Mkts

Buy Buy A A A Dividend Dividend Dividend J J J T T T Buy Buy Sold (part) Sold (part) A A Dividend Dividend J T Sold

06/17/10 09/21/10 06/16/I 0

J J J

10/27/10 J 02/10/10 10/27/10 J J

243. Fidelity Real Estate Income 244. 245. Fidelity Select Gold 246. Fidelity Capital & Income 247. 248. 249. Fidelity Invest Grade 250. Fidelity Total Bond 251. Fidelity Pas Core Inc Fd of Fds (name change on line 252) 252. Strategic Advs Pas Core Inc. Fd (name change from In 251) 253. Fidelity Pas lnc Oppor Fd (name change on In 254) 254. Strategic Advs Pas Inc Opp Fd (name change from In 253) 255.

(part)

Sold (part) Sold

02/10/10 03/30/10 10/27/10

J J J

A A

A B A B A A

Dividend Dividend Dividend Dividend Dividend Dividend

K K

T T Sold (part) 06/16/10 08/20/10 08/20/10 J K K K J A

T Buy

08/20/10 10/27/10

1. Income Gain Codes: (See Columns B 1 and D41 2. Value Codes ~Sce Columns C l and D3) 3. Value Method Codes /See Column C2)

A =$1,000 or less F=$50.001-$100.000 J =$15.000 or less N =$250,001 - $500,000 P3 =$25.000.001 - $50,000,000 Q =Appraisal U =Book Value

B =$1.00t : $2:500 G=$100,001-$1,000~000 K -$15.001 - $50.000 0 =$500~001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI=S1.000.001 -$5.000.000 L =$50.001 - $100.000 Pl =$1,000,001 - $5,000,000 P4 -More than $50.000.000 S -Assessmenl W =Estimated

D =$5,001 :- $t5.00~3 : H2 =More than $5,000,000 M =$100,001 - $250,000 P2 =$5,000,001 - $25.000,000 T =Cash Market

E =$15,001- $50.000

FINANCIAL DISCLOSURE REPORT Page 19 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVES TMENTS and TRU S TS - i.co,.e, val.e, tra.soetio.s a.ciudes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

~-] NONE (No reportable income, assets, or transactions.)

256. FIMM MMRT Port Inst. CL 257. 258. ~59. 260. Fidelity Money Market 261. 262. 263. 264. 265. AQR Diver. Arb. Class 1 266. 267. American Beacon Lg Cap Invest 268. Credit Suisse Commd Remm Strtgy Shs 269. 270. Goldman Sachs Lg Cap Val Instl 271. 272. Janus Fund CI J Shs

Dividend

Buy Buy Buy Buy

10/27/10 10/28/10 11/02/10 : 11/03/10 02/10/10 06/16/10 09/21/10 10/27/10 11/02/10 09/21/10 09/22/10

J J J J J J J J J J J

Dividend

Buy Buy Buy Sold (part) Sold (part)

Dividend

Buy Buy Sold

06/16/10 J 02/10/10 06/16/10 02/10/10 03/30/10 06/16/10

J J J J A A A

Dividend

Sold

(part)

Sold (part) Sold (part) Sold Sold

(see co!umns c! and D3) 3: Value Mrthod 0dds (See Column C2)

N =$250;00155500;000

O =$500;001 ~ $1;000i000 :

Pt --$1~000~001 ; $5i000i000

V3 =$25;o0o;o01 L $50,oo0;ooo

Q =Apwaisal U =Book value

~ ~g~ ina~ $50;0661033 .....

P2 ~$5~000~00] ~$25;000~000 ~ ~Cash Market

R =Cost (Reai E~taie oniy)~ ~A~ V =Other W ~E~tim~md

FINANCIAL DISCLOSURE REPORT Page 20 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VII. INVESTMENTS and TRU S TS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

--] NONE (No reportable income, assets, or transactions.)

273. Perkins Mid Cap Value Fd CI T 274. Lazard Emerging Mkts Open CL 275. Mainstay Lg Cap Gr Fd C1 A 276. Merger Fund 277. 278. Metropolitan West Low Dur M 279. Pimco Total Retrn Adm Shs 280. Pimco Short Term Adm Shs 281. 282. T Rowe Price High Yld Adv CI 283. T Rowe Price Short Term Bd Fund Adv C1 284. T Rowe Price Mid Cap Value 285. 286. Templeton Global Bd C1 A A Dividend A A Dividend Dividend J J T T A B A Dividend Dividend Dividend J K K T T T A Dividend

Sold Sold Sold Buy Sold

103/30/10 10/27/10 06/16/10 03/30/t 0 09/21/10

J J J J J

Buy Buy Sold (part) Buy Buy Sold

02/10/10 09/21/10 02/10/10 10/27/l 0 03/30/10 09/21/10

J

J

J J

J

2. Vai~codes (see c0lumns c! and DJ) 3. Value Method Codes (See Column C2)

J~$isi0000ri~ : K ~]~i~0i~$~riO0~ L~5~i~i ~i001o00 --$10~i001 ~$250,000 N =$2~0;00i ~ $~00~0~ ~ ~$~00 ~1 ~ $~1~00~00:0 Pi ~$i~000~0~1, $5~000~000 P~ ~3r~ ih~n Sgo~dbo;ooo P3 ~$25~000~001 - ~50~000~006 :: R =C~i (~1 ~state o~ii)s ~e~g~ni Q =Appraisal V =Oiher U =Book Value W &Estimated

P2 =$5,000,001- $25,000,000 T =Cash Market

FINANCIAL DISCLOSURE REPORT Page 21 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (Indlcatepart of report.)

In part VII, several transactions are recorded with respect to specified Fidelity Investments funds the names of which as reported in the 2009 Report were changed by Fidelity on June 25, 2010 and August 20, 2010. As to each transaction, the fund is reflected on the line with the original name on the first transaction of the year and on the line with the new name on the date of the change.

FINANCIAL DISCLOSURE REPORT Page 22 of 22

Name of Person Reporting Marrero, Victor

Date of Report 08/23/2011

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Victor

Marrero

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- June 2004Dokument17 SeitenJune 2004Judicial Watch, Inc.Noch keine Bewertungen

- September 2004Dokument24 SeitenSeptember 2004Judicial Watch, Inc.Noch keine Bewertungen

- LAUSD Semillas AckDokument1 SeiteLAUSD Semillas AckJudicial Watch, Inc.Noch keine Bewertungen

- 13-1150 Response Re Judicial WatchDokument1 Seite13-1150 Response Re Judicial WatchJudicial Watch, Inc.Noch keine Bewertungen

- Atlanta IntraregionalDokument4 SeitenAtlanta IntraregionalJudicial Watch, Inc.Noch keine Bewertungen

- July 2006Dokument24 SeitenJuly 2006Judicial Watch, Inc.Noch keine Bewertungen

- 13-1150 Responsive Records 2 - RedactedDokument29 Seiten13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Noch keine Bewertungen

- December 2005 Bulletin 2Dokument14 SeitenDecember 2005 Bulletin 2Judicial Watch, Inc.Noch keine Bewertungen

- STAMPED ComplaintDokument4 SeitenSTAMPED ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CHAPTER 7 - MATHEMATICS of FINANCE, Seventh Edition by Robert L. Brown, Steve Kopp and Petr Zima (Z-Lib - Org) - 261-289Dokument29 SeitenCHAPTER 7 - MATHEMATICS of FINANCE, Seventh Edition by Robert L. Brown, Steve Kopp and Petr Zima (Z-Lib - Org) - 261-289Tisha YatolNoch keine Bewertungen

- Literature Review On Financial InstrumentsDokument9 SeitenLiterature Review On Financial Instrumentshnpawevkg100% (1)

- Investment Has Different Meanings in Finance and EconomicsDokument15 SeitenInvestment Has Different Meanings in Finance and EconomicsArun IssacNoch keine Bewertungen

- Jade FactsheetDokument11 SeitenJade FactsheetNelly HNoch keine Bewertungen

- Long-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorDokument49 SeitenLong-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorJH_CarrNoch keine Bewertungen

- Green Finance For Developing CountriesDokument52 SeitenGreen Finance For Developing CountriesInhee ChungNoch keine Bewertungen

- D2C Marketing Manager - Job DescriptionDokument1 SeiteD2C Marketing Manager - Job DescriptionHakim DjerrariNoch keine Bewertungen

- Advanced Corporate Finance - Assignment 1Dokument4 SeitenAdvanced Corporate Finance - Assignment 1Arush SinhalNoch keine Bewertungen

- Cash Flow AnalysisDokument75 SeitenCash Flow AnalysisBalasingam PrahalathanNoch keine Bewertungen

- CFPB Mortgage Complaint DatabaseDokument718 SeitenCFPB Mortgage Complaint DatabaseSP BiloxiNoch keine Bewertungen

- Creating Job Opportunities For UnemployedDokument4 SeitenCreating Job Opportunities For UnemployedhadncsNoch keine Bewertungen

- Black Book Chit FundDokument63 SeitenBlack Book Chit FundLalit MakwanaNoch keine Bewertungen

- Role of Capital Market in IndiaDokument6 SeitenRole of Capital Market in Indiajyoti verma100% (1)

- Private Credit - Time To Consider Special Situations - (J.P. Morgan Asset Management)Dokument4 SeitenPrivate Credit - Time To Consider Special Situations - (J.P. Morgan Asset Management)QuantDev-MNoch keine Bewertungen

- Tma Aug 2022Dokument124 SeitenTma Aug 2022Nivan MultiplesNoch keine Bewertungen

- Stock Code: 500265 Stock Code: MAHSEAMLES: Nid AlDokument1 SeiteStock Code: 500265 Stock Code: MAHSEAMLES: Nid AlLalitNoch keine Bewertungen

- 04 Chapter 1Dokument26 Seiten04 Chapter 1Motiram paudelNoch keine Bewertungen

- Ch15 Tool KitDokument20 SeitenCh15 Tool KitNino Natradze100% (1)

- Principles of Investments 1st Edition Bodie Solutions ManualDokument35 SeitenPrinciples of Investments 1st Edition Bodie Solutions Manualdesight.xantho1q28100% (27)

- Assignment On SebiDokument17 SeitenAssignment On SebiSUFIYAN SIDDIQUINoch keine Bewertungen

- Week 2 TUTE Chapter 1 QuestionsDokument2 SeitenWeek 2 TUTE Chapter 1 QuestionsDylan AdrianNoch keine Bewertungen

- Intermediate Group I Test Papers FOR 2014 DECDokument88 SeitenIntermediate Group I Test Papers FOR 2014 DECwaterloveNoch keine Bewertungen

- Bhel Financial AnalysisDokument10 SeitenBhel Financial Analysisashish_verma_22Noch keine Bewertungen

- Research in International Business and Finance: David Moreno, Marcos Antoli, David QuintanaDokument14 SeitenResearch in International Business and Finance: David Moreno, Marcos Antoli, David QuintanaEnrica Des DoridesNoch keine Bewertungen

- Massey Questions 1, 2, 5Dokument3 SeitenMassey Questions 1, 2, 5Samir IsmailNoch keine Bewertungen

- BRESDokument6 SeitenBRESUday KiranNoch keine Bewertungen

- AC Hotels PrepDokument2 SeitenAC Hotels PrepYevgeniy SydorenkoNoch keine Bewertungen

- Banking Sector in AngolaDokument2 SeitenBanking Sector in AngolaMuyeedulIslamNoch keine Bewertungen

- Stray Reflections Full April Issue 2015 Emerging Markets The Great Unravell - 7'45'Dokument24 SeitenStray Reflections Full April Issue 2015 Emerging Markets The Great Unravell - 7'45'sajithsankarNoch keine Bewertungen

- Project ReportDokument86 SeitenProject ReportavnishNoch keine Bewertungen