Beruflich Dokumente

Kultur Dokumente

Jane E Magnus-Stinson Financial Disclosure Report For 2009

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jane E Magnus-Stinson Financial Disclosure Report For 2009

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

AO 10 Rev.

1/2008

FINANCIAL DISCLOSURE REPORT NOMINATION FILING

i 2. Court or Organization US District Court Southern District of Indiana 5a. Report Type (check appropriate type) ] Nomination, i [] Initial Date 01/20/2010 [] A .... 1 [] Final

Report Required by the Ethics in Government Act of 1978 (5 u.s.c, app. 101-111)

1. Person Reporting (last name, first, middle initial) Magnus-Stinson, Jane E. 4. Title (Article III judges indicate active or senior status; magistrate judges indicate full- or pan-time) District Judge- Nominee

3. Date of Report 0t/18/2010 6. Reporting Period 01/01/2009 to 12/31/2009

7. Chambers or Office Address Birch Bayh United States Courthouse 46 E. Ohio Street, Room 361 Indianapolis, IN 46204

] 5b. [] Amended Report 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NO TES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. (Reporting individual only; seepp. 9-13 of filing instructions.)

[~ NONE (No reportable positions.) POSITION

1. Chairperson, Board of Visitors 2. Trustee 3.

NAME OF ORGANIZATION/ENTITY

Indiana University School of Law, Indianapolis

5.

._r-. 3 __ _

~ ~.~

II. AG~EMENTS. (Reporting individual only; see pp. 14-16 of filing instructions.)

~ NONE ~o reportable agreements.) DATE

1. 1995

r,"l (2

~--

P~TIES A~ TE~S

Indiana Judges Retirement Fund, pension upon retirement age 62-65

ra

~o

Magnus-Stinson, Jane E.

FINANCIAL DISCLOSURE REPORT Page 2 of 7

~ ....

f Person Reporting

Date of Report

Magnus-Stinson, Jane E.

01/18/20!0

III. NON-INVESTMENT INCOME. (Reporting individualandsp ....

A. Filers Non-Investment Income

NONE (No reportable non-investment income.) DATE

t. 10/20/2009

; see pp. 17-24of filing instructions.)

SOURCE AND TYPE

National Institute for Trial Advocacy - teaching compensation

INCOME

(yours, not spouses) $1,650.00

2.

3.

4.

B. Spouses Non-lnvestment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

[~

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

Cripe Architects + Engineers - wages St Marys Guild - raffle winner St. Thomas Aquinas - raffle winner

1. 2009 2. 2009 3.2009

4.

IV. REIMBURSEMENTS --transportation, lodging, food, entertai ....

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

t.

[]

NONE (No reportable reimbursements.) SOURCE DAT__~_ES LOCATION PURPOSE ITEMS PAID OR PROVIDED

1. Exempt

2. 3. 4.

5.

FINANCIAL DISCLOSURE REPORT

Name of Person Reporting Magnus-Stinson, Jane E.

Date of Report 01/18/2010

Page 3 of 7

V. GIFTS. ancludes ,hose to spo ..... d dependent children; see pp. 28-31 of filing ir~tructions.)

[~ NONE (No reportable gifts.) SOURCE

1. Exempt 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. tinct.des those of ~p ...... ~ dependent children; seepp. 32-33 of filing instructions.)

NONE (No reportable liabilities.) CREDITOR

1. 2. 3.

4.

DESCRIPTION

VALUE CODE

5.

FINANCIAL DISCLOSURE REPORT

Nu,~e of Person Reporting

Date of Report

Page 4 of 7

Magnus-Stinson, Jane E.

01/!8/2010

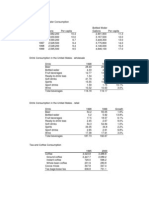

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of sp ...... # dependent children; seepp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period Amount ] Type(e.g., Code l I di ...... t, C. Gross value at end of reporting period Value Code 2 [ Value I Method D. Transactions during reporting period

Type(e.g., 1 Date Value ] Gain ] buy, sell, ] Month- [ Code 2 I Code l I

Identity of buyer/seller

1.

Defer:ed Compensation Acct. J 1

Exempt

2.

-Indiana Stable Value Fund

Interest

3.

Deferred Compensation Acct. J2

4.

-Indiana Stable Value Fund

Interest

5.

Vanguard 500 Index Fund

Dividend

6.

Settlers (formerly Key) Life IRA

Interest

7.

Regions Bank IRA

Interest

8.

Deferred Compensation Acct. - B1

9.

-Indiana Stable Value Fund Deferred Compensation Acct. - B2

Interest

10.

I 1.

-Indiana Stable Value Fund

Interest

12.

Ret. Fund BP

13.

-PERF Guaranteed Fund

Interest

14.

-North. Tr. lnvstmts., Inc. Lehman Bros. ( now Barclays) Agg Indiana Members Credit Union Accts.

lnt./Div.

15.

Int./Div.

i6.

Regions Bank Acct.

Interest

17.

Huntington National Bank Acct.

Interest

1. Income Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$ 1,000 or less F =$50,001 - $100,000 .I =$15,000 or less N =$250,001 - $500,000 P3 =$25,O00,0OI - $50,000,000 Q =Appraisal U =Book Value

13 =$1,001 - $2,500 G =$100,001 - $I,000,000 K =$15,001 - $50,000 O =$500,001 - $I,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI =$1,000,001 - $5,000,000 L =$50.001 - $100,000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$100,001 - $250,000 P2 =$5~000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 7

N~me of Person Reporting Magnus-Stinson, Jane E.

Date of Report 01/18/2010

VII. INVESTMENTS and TRUSTS - inco,~e, value,, ...... tions (Includes those of sp ...... d dependent children; see pp. 34-60 of Jiling instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Plaee"(X)" after each asset exempt from prior disclosure B. Income during , reporting period I (1) [ (2) iAmunt i Type (e.g., Code I [ div., rent, (A-H) ! or int.) C. Gross value at end of reporting period I (I) [ (2) Value Code 2 [ (J-P) Value Method Code3 (Q-W) T T (1) Type (e.g., buy, sell, redemption) D. Transactions during reporting period (2) (3) (4) Date [ Value [ Gain [ Month- I Code 2 I Code 1 Day ~ (J-P) (A-H) ~D~ .................. (5) Identity of buyer/seller (if private ?.[_a_~a _c t_io_ n_ )_ ..........

____ _L~._.___~ ...... 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. NationalCity Money Market Old National Bank Account Cripe Deferred Comp Alliance Benefit Gr oup -Rainier Balanced Portfolio -PIMCOTotal Return Fund Van Kampen Equity IRA (J) Van Kampen Equity IRA (B) J IN College Choice Black Rock Large Cap. C J IN College Choice PIMCO Total Return G IN College Choice Black Rock Large Cap C G IN CollegeChoice PIMCO Total Return ][ Real Property Trust A A A A A A A A A Interest Interest Interest Interest Interest Interest Interest Interest None Interest None J J J J J J J J J K J A A Interest Interest K J

T T T T T T T T T T T

CERES Cal Unified School Bond IN Fin. Auth. Bond Srs. St.Frances Health

I. Income Gain Codes: (See Columns B I and D4) 2 Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$50,001 - 51 O0,000 J =515.000 or less N =$250,001 - $500,000 P3 =$25,000,001 - S50,000,000 Q =Appraisal U =Book Value

B =$1,001 - 52,500 G =5100,001 - $1,000,000 K =515,001 - 550,000 O =5500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H I =$1,000,001 - $5.000,000 L =$50,001 - $100.000 PI =51,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$I 5,001 - $50.000

FINANCIAL DISCLOSURE REPORT

Name of Person Reporting Magnus-Stinson, Jane E.

Date of Report 01/18/2010

Page 6 of 7

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

Part I. ~ passed away I served as Trustee for a real estate trust that was established for the former home of February 13, 2008. ~ who.had been the trustee of the property n~"~--ff~ ich t eh y lived, determined after several months that Dcould not live alone and left Indianapolis to live with ~ Due to the distahce,~lasked me to serve as trusteee for the limited purpose of selling the house. The house was sold in September 2009, the trust procceeds distributed, and the trust dissolved. Part III A. - Filers Non-Investment Income: Additional income was received during the reporting period as salary from the U.S. Government as a United States Magistrate Judge.

FINANCIAL DISCLOSURE ~E e O~~ Page 7 of 7 IX. CERTIFICATION.

N;+me of Person Reporting

Daz~ of Report

01]~8+mo

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, If any) is accurate, true, and complete to the best of my knosvledge and belief, and that any information not reported was withheld because it met applicable stat~utory pro~,i+ions permitting non-disclosure. | further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

NOTE: ANY INDIVIDUAl+ WHO KNOWINGLY AND WI LFULLY FALSIFIES OR FAII.S TO FILE Tills REPORT MAY BE SUBJECT TO CI VII. AND CRIMINAL SANCFIONS (5 U.S.C. app. 104)

FILING INSTRUCTIONS Mail signed original and 3 additional copies to: Committee on Financial Disclosure Administt~ative Office of Ihc United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Opinion - JW V NavyDokument7 SeitenOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Holder Travel Records CombinedDokument854 SeitenHolder Travel Records CombinedJudicial Watch, Inc.Noch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- Visitor Tent DescriptionDokument3 SeitenVisitor Tent DescriptionJudicial Watch, Inc.Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Gitmo Water Test ReportDokument2 SeitenGitmo Water Test ReportJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Navy Water Safety ProductionDokument114 SeitenNavy Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- JW Cross Motion v. NavyDokument10 SeitenJW Cross Motion v. NavyJudicial Watch, Inc.Noch keine Bewertungen

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- May 2007 BulletinDokument7 SeitenMay 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- Schoolboard PowerpointDokument2 SeitenSchoolboard PowerpointJudicial Watch, Inc.Noch keine Bewertungen

- Analysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabraDokument59 SeitenAnalysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabravishalbehereNoch keine Bewertungen

- WZ Wealth Ideas November 11Dokument4 SeitenWZ Wealth Ideas November 11satish kumar0% (1)

- Si & CiDokument33 SeitenSi & CiAnonymous ZVbwfcNoch keine Bewertungen

- Professor Steve Markoff Preparation Assignment For Class #1: Fundamentals of AccountingDokument4 SeitenProfessor Steve Markoff Preparation Assignment For Class #1: Fundamentals of Accountinganon_733987828Noch keine Bewertungen

- Branding & Priority BankingDokument42 SeitenBranding & Priority BankingGAUTAM BUCHHANoch keine Bewertungen

- 09 Chapter 1Dokument113 Seiten09 Chapter 1Sami ZamaNoch keine Bewertungen

- Islamic Books Available To PurchaseDokument15 SeitenIslamic Books Available To PurchaseMirza Vejzagic0% (1)

- 52, 53 SMU MBA Assignment IV SemDokument119 Seiten52, 53 SMU MBA Assignment IV SemRanjan PalNoch keine Bewertungen

- Chapter 9Dokument34 SeitenChapter 9carlo knowsNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Honest Tea - Help SpreadsheetDokument12 SeitenHonest Tea - Help Spreadsheetvirgin51100% (1)

- Politik GlobalDokument12 SeitenPolitik GlobalAlvianZuhriZuhriNoch keine Bewertungen

- AB Bank Final ReportDokument72 SeitenAB Bank Final ReportShahjalal Sumon100% (1)

- Bankruptcy NotesDokument46 SeitenBankruptcy Notesblade1111Noch keine Bewertungen

- Factor's Affecting Firm PerformanceDokument15 SeitenFactor's Affecting Firm PerformanceDidier KraftNoch keine Bewertungen

- Shriram Finanace NewDokument43 SeitenShriram Finanace NewRavi GuptaNoch keine Bewertungen

- Curriculum Vitae For Zicai Cainde Dube Personal DetailsDokument4 SeitenCurriculum Vitae For Zicai Cainde Dube Personal DetailsMichelle DubeNoch keine Bewertungen

- Explanatory Notes Formct1Dokument15 SeitenExplanatory Notes Formct1lockon31Noch keine Bewertungen

- INTERNATIONAL FINANCE-Factors Affecting International InvestmentsDokument3 SeitenINTERNATIONAL FINANCE-Factors Affecting International InvestmentsRahul R Naik100% (1)

- WCM Toyota STDokument18 SeitenWCM Toyota STferoz khanNoch keine Bewertungen

- Eb5 Investor Visa Lawyer San JoseDokument3 SeitenEb5 Investor Visa Lawyer San JoseAlison YewNoch keine Bewertungen

- Sustainability 10 02144Dokument15 SeitenSustainability 10 02144Sachin ParasharNoch keine Bewertungen

- Inherited Iras Lose Bankruptcy ProtectionDokument1 SeiteInherited Iras Lose Bankruptcy ProtectionPhilColeNoch keine Bewertungen

- Buyback and Delisting of SharesDokument42 SeitenBuyback and Delisting of SharesSahil SinglaNoch keine Bewertungen

- Unit 4 Admission of New PartnerDokument5 SeitenUnit 4 Admission of New PartnerNeelabh KumarNoch keine Bewertungen

- HR Exit ProcedureDokument7 SeitenHR Exit ProcedureAditya YadavNoch keine Bewertungen

- Investor Digest: Equity Research - 28 March 2019Dokument9 SeitenInvestor Digest: Equity Research - 28 March 2019Rising PKN STANNoch keine Bewertungen

- Admin Cases Part III-gen Prin UNDER ATTY SALAODokument61 SeitenAdmin Cases Part III-gen Prin UNDER ATTY SALAOAnie Guiling-Hadji GaffarNoch keine Bewertungen

- Case 1.7 Crazy Eddy, IncDokument6 SeitenCase 1.7 Crazy Eddy, IncMutiara HapsariNoch keine Bewertungen

- The Laboratory BudgetDokument25 SeitenThe Laboratory Budgetmaria emailNoch keine Bewertungen

- Market Leader Answer Keys 2Dokument21 SeitenMarket Leader Answer Keys 2Ale GuzmÁn67% (6)

- Asset Protection for Business Owners and High-Income Earners: How to Protect What You Own from Lawsuits and CreditorsVon EverandAsset Protection for Business Owners and High-Income Earners: How to Protect What You Own from Lawsuits and CreditorsNoch keine Bewertungen

- 8 Living Trust Forms: Legal Self-Help GuideVon Everand8 Living Trust Forms: Legal Self-Help GuideBewertung: 5 von 5 Sternen5/5 (7)

- How I Made $10 Million From Internet Affiliate MarketingVon EverandHow I Made $10 Million From Internet Affiliate MarketingBewertung: 4.5 von 5 Sternen4.5/5 (22)

- Real Passive Income: 36 Passive Income Ideas For Creating Unending Income With Or Without Money (Online Or Offline)Von EverandReal Passive Income: 36 Passive Income Ideas For Creating Unending Income With Or Without Money (Online Or Offline)Bewertung: 4.5 von 5 Sternen4.5/5 (3)

- Living Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)Von EverandLiving Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)Bewertung: 5 von 5 Sternen5/5 (3)

- Seven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)Von EverandSeven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)Noch keine Bewertungen

- The Millionaire Maker: Act, Think, and Make Money the Way the Wealthy DoVon EverandThe Millionaire Maker: Act, Think, and Make Money the Way the Wealthy DoBewertung: 4.5 von 5 Sternen4.5/5 (5)

- Governance as Leadership: Reframing the Work of Nonprofit BoardsVon EverandGovernance as Leadership: Reframing the Work of Nonprofit BoardsBewertung: 3 von 5 Sternen3/5 (5)