Beruflich Dokumente

Kultur Dokumente

Joy Flowers Conti Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Joy Flowers Conti Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

I

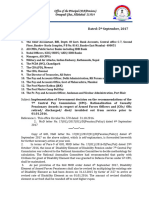

AO 10 Rev. 1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization U.S. District Court WDPA

5a. Report Type (check appropriate type)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) Conti, Joy Flowers 4. Title (Arlicle I!1 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/13/2011 6. Reporting Period 01/01/2010 to 12/31/2010

Nomination,

Date [] Annual [] Final

Active Article I11 Judge

[] Initial

5b. [] Amended Report

7. Chambers or Office Address 5250 US Courthouse 700 Grant Street Pittsburgh, PA 15219

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable informatiot~ Sign on last page.

I. POSITIONS. (Reporting individual only; see pp. 9-13 of filing instructions.)

D

I. 2. 3. 4. 5.

NONE (No reportable positions.)

POSITION

Board of Directors Counselor

NAME OF ORGANIZATION/ENTITY

Catholic Charities Free Health Care Center

W. Edward Sell American Inn of Court

II. AGREEMENTS. Reporting indiviaaat onty; see ~,~,. 14-16 of filing instructions.)

~

NONE (No reportable agreements.)

DATE PARTIES AND TERMS

Conti, Jov Flowers

FINANCIAL DISCLOSURE REPORT Page 2 of 8

rYame of Person Reporting Conti, Joy Flowers

Date of Report 0.5/13/2011

IIl. NON-INVESTMENT INCOME. (Reporting individual and spouse; seepp. 17-24 of filing instructions.)

A. Filers Non-lnvestment Income ~-] NONE (No reportable non-investment income.) DATE SOURCE AND TYPE INCOME (yours, not spouses)

2. 3. 4.

B. Spouses Non-Investment Income - If you were married during anyportion of the reportingyear, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.)

DATE

1.2010 2.2010 3. 4.

SOURCE AND TYPE

Ross, Sinclaire & Associates, LLC - Salary Commonwealth Securities and Investments, Inc - Final Commissions

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE

I. New York Intellectual Properly Law Association Allegheny County Bar Association Masters Conference Inc Academy of Trial Lawyers of Allegheny County National Conference of Bankruptcy Judges

DATES

March 26-28, 2010

LOCATION

New York, NY

PURPOSE

NYIPLA Annual Federal Judges Dinner Allegheny County Bench Bar Conference 2010 Masters Conference Annual Masters of Trial Advocacy Retreat Annual National Conference of Bankruptcy Judges

ITEMS PAID OR PROVIDED

Food, Lodging, Transportation

2.

June 17-18, 2010

Champion, PA

Food, Lodging, Conference Registration

3. 4.

October 4-5, 2010 October 6-8,2010

Washington, DC Fannington, PA

Food, Lodging, Transportation, Parking Food, Lodging

5.

October 12-16, 2010

New Orleans, LA

Food, Lodging. Transportation, Parking

FINANCIAL DISCLOSURE REPORT Page 3 of 8

Name of Person Reporting Conti, Joy Flowers

Date of Report 05/13/2011

V. GIFTS. anaudes ,hose ,o spouse und d~pcnden, children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.)

SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. a, clua~s those o/spous, und dep~n,~ent children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.) CREDITOR

1. 2.

DESCRIPTION

VALUECODE

3.

4. 5.

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting Conti, Joy Flowers

Date of Report 05/13/201 l

VII. INVESTMENTS and TRUSTS -income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

~] NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (2) (D Amount Type (e.g., Code 1 div., rent, (A-H) or int.) C. Gross value at end of reporting period (1) (2) Value Value Code 2 Method Code 3 (J-P) (Q-W)

Transactions during reporting period

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/ddIyy Code2 Code 1 (J-P) (A-H)

Identity of buyerlseller (if private transaction)

1. 2. 3. 4.

BROKERAGE ACCOUNT #1 (Part VIII) -Neoprobe Corp Stock -Pa Muni Cash Trust (Money Market) -Franklin Cnty Pa IDA Bond 5.25% due 7/1/14 A A None Dividend Interest J J T T Buy Redeemed 07/01/10 07/28/10 J J

6. 7.

ROTH IRA ROLLOVER ACCOUNT #1 (Part Vlll) -Pershing Government Money Market Fund -General Motors Accep Corp Smartnotes (7.125% due 8/15/12)

Int/Div

9.

10.

-General MotorsAccepCorpSmartnotes (7.25%due9/15/17) -GSMtg Secs Corp2005-7FMtgNotes (5% due 9/25/35) -GenemlMotorsAccepCorpMedTerm (8.4%due 4/15/10) Sold Matured 10/20/10 04/15/10 K K A

12.

-Deere & Co Stock -General Motors Accep Corp Smartnotes (7% due 1/15/13)

-General Motors Accep Corp Smartnotes (0% due 11/15/201 I) Buy Buy 07/06/10 I0/28/10 :

13. 14. 15. 16. 17.

K K

-Lee Street Investors LLC Class B Units RETIREMENT PLAN #2 -CREF Stock Fund C Interest N

I. Income Gain Codes: (See Columns BI and D4) 2. Value Codes ( See Columns C I and D3 ) 3. Value Method Codes IScc Colunm C2)

A =$1,000 or less F =$50,001 - $100.000 J =$15.000 or less N ~$250,001 - $500,000 P3 -$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $I.000.000 K = $15,001 - $50.000 O =$500,01) I - $ 1,000,000 R =Cost (Real Eslate Only) V =Other

C =$2,501 - $5,000 HI =$1,000,001 - $5,000,000 L =$50.001 - $ 100,000 P 1 -$ 1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5.001 - $15,000 H2 =More than $5,000,000 M =$ 100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E=$15,001- $50.000

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting Conti, Joy Flowers

Date of Report 05/I 3/2011

VII. INVESTMENTS and TRUSTS - i.co~.e, ~uc, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

---] NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (t) (2) Amount Type (e.g., Code 1 div., rent, (A-H) or int.) C. Gross value at end of reporting period (1) Value Code 2 (J-P) (2) Value Method Code 3 Transactions during reporting period

(1)

Type (e.g,

buy, sell,

(2)

Date

(3)

Value (J-P)

(4)

Gain Code I (A-H)

(5)

Identity of buyer/seller (if private transaction)

mm/dd/yy Code 2

redemption)

(Q-W)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. -Lee Street Investors LLC Class B Units IRA ROLLOVER ACCOUNT #6 -Gateway Bank Of Pennsylvania Stock IMMEDIUS, INC CONV PREFERRED STOCK IMMEDIUS, INC COMMON STOCK MELLON BANK: ACCOUNTS None None None J J K T T T None T -TIAA Traditional Annuities ROTH IRA ROLLOVER ACCOUNT #3 (Part VIII) -Pershing Government Money Market Fund -Neoprobe Corp Stock -Quanta Svcs, lnc - Stock -Genl Mtrs Accep Corp Smartnotes (7% due 01/15/13) -Goldman Sachs Group - Stock -lshares TR Dow Jones Select Div Fund -Standard & Poors Depositoff Receipts (SPDRs) -Knox Cnty, KY Hosp Bond (5.875% due 12/01/36) Sold Sold Sold Buy Buy (addl) Buy 04/26/10 I 02/05/10 02/05/10 06/09110 09/01/10 10/28/10 J K K J K B Sold (part) Sold 10/20/10 J D Int./Div. M T

10/19110 K

I. Income Gain C0dcs: (See Columns BI and D4) 2. Value Codes (See Columns CI and DJ) 3, Value Melhod Codes (See Column C2)

A =$1,000 or less F =$50.001 - $100,000 J = $15.000 or less N ~$250,001 - $500,000 P3 ~$25,000,001 - $50,000,0011 Q =Appraisal U =Book Value

B =$1.001 - $2,500 G =$ 100.O01 - $1.000.000 K = $15.001 - $ 50.000 o = $500.001 - $ I ,oo0,ooo R : Cost (Real Estate Only) V : t)thcr

C =$2,501 - $5.000 HI =$1,000,001 - $5,000,000 L =$50,001 - $100,000 P I =$ 1,000,001 - $5,000,000 P4 =More than $50,000.000 S :Assessment W :Estlmatcd

D =$5.001 -$15,000 H2 =More than $5,000,000 M=$100.001- $250,000 P2=$5,000,001 -$25,000,000 T =Cash Markct

E =$15,001- $50.000

FINANCIAL DISCLOSURE REPORT Page 6 of 8

Name of Person Reporting Confi, Joy Flowers

Date of Report 05/13/2011

VII. INVESTMEN TS and TRU STS -inrome, vatue, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

~] NO~NE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (l) (2) Amount Type (e.g., Code l div., rent, (A-H) or int.) C. Gross value at end of reporting period (1) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W)

Transactions during reporting period

(1)

Type (e.g., buy, sell, redemption)

(2)

(3)

(J-P)

(4)

Gain Code 1 (A-H)

(5)

Identity of buyer/seller (if private transaction)

Date Value mm/dd!yy Code2

35.

36. 37. 38. 39. 40. 41. 42. 43.

CITIZENS BANK:ACCOUNTS

MASSACHUSETTS MUTUAL: WHOLE LIFE POLICY MASSACHUSETTS MUTUAL: WHOLE LIFE POLICY NORTHWESTERN: WHOLE LIFE INS POLICY METROPOLITAN LIFE: WHOLE LIFE POLICY GENERAL AMERICAN: WHOLE LIFE POLICY MASSACHUSETTS MUTUAL: WHOLE LIFE POLICY METROPOLITAN LIFE: WHOLE LIFE POLICY NORTHWESTERN: WHOLE LIFE INS POLICY

None

None None None None None None None None

J

J J J J J J J J

T T T T T T T T

I. Income Gain Codes: ( See Column s B I a nd D4 ) 2. Value Codes (See Columns C I and D3 ) 3. Value Mclhod Codes (See Column C2)

A =$1.000 or less F = $ 50.001 - $ 100.000 J =$15,000 or less N ~ $250.001 - $500.000 P3 -$25.000d)01 - $51).0()0.000 Q =Appraisal U = Book Value

B =$1,001 . $2,500 G = $ 100.001 - $ 1,000,000 K =$15,001 - $50,000 O =$500,001 - $ 1.000,000 I~. = Cost (Real E~tale Only) V - Other

C =$2.501 - $5,000 H 1 =$ 1,000,001 - $5,000,000 L =$50,001 - $100,000 P I =$1,000.001 - $5,000,000 P4 -More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$ 100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporling Conti, Joy Flowers

Date of Report 05/13/201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicatepart of report.)

Additional Information for Part VII (Investments and Trusts): From prior years: On the 2009 report, the only brokerage accounts listed were #1 and #3 o In 2009, Brokerage Account #3 was no longer required to be reported. Accordingly, the only active brokerage account was Brokerage Account #1. There is no Retirement Plan # 1 There is no IRA/IRA Rollover Account # 2, 4 or 5

Current year:

Line 6: (former) IRA Rollover Account #1; Line 19: (former) IRA Rollover Account #3 Assets in each of these accounts were converted to Roth IRA accounts in October 2010. Since the accounts were transferred intact, reporting of information on these assets is shown on a combined basis for activity within the old/new accounts. The account titles have been changed to Roth IRA Rollover Accounts #1 and #3

FINANCIAL DISCLOSURE REPORT Page 8 of 8 IX. CERTIFICATION.

Name of Person Reporting Conti, Joy Flowers

Date of Report 05/13/2011

1 certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. l further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Joy Flowers Conti

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- Opinion - JW V NavyDokument7 SeitenOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Lecture Time Value of MoneyDokument44 SeitenLecture Time Value of MoneyAdina MaricaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Retirement Village For ExpatriatesDokument193 SeitenRetirement Village For ExpatriatesJoe Doromal Baldelovar100% (1)

- March 2022 Salary PayslipDokument3 SeitenMarch 2022 Salary PayslipParveen SainiNoch keine Bewertungen

- Payroll - Internal Audit Report: City of MarionDokument31 SeitenPayroll - Internal Audit Report: City of MarionMudassar NawazNoch keine Bewertungen

- Sample Paper 1Dokument24 SeitenSample Paper 1Aiyaz50% (4)

- Form 16 TDS certificate summaryDokument3 SeitenForm 16 TDS certificate summarykumar reddyNoch keine Bewertungen

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- Visitor Tent DescriptionDokument3 SeitenVisitor Tent DescriptionJudicial Watch, Inc.Noch keine Bewertungen

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Holder Travel Records CombinedDokument854 SeitenHolder Travel Records CombinedJudicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Water Test ReportDokument2 SeitenGitmo Water Test ReportJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Navy Water Safety ProductionDokument114 SeitenNavy Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- JW Cross Motion v. NavyDokument10 SeitenJW Cross Motion v. NavyJudicial Watch, Inc.Noch keine Bewertungen

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- May 2007 BulletinDokument7 SeitenMay 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- Schoolboard PowerpointDokument2 SeitenSchoolboard PowerpointJudicial Watch, Inc.Noch keine Bewertungen

- Circular 582Dokument5 SeitenCircular 582NainschoolNoch keine Bewertungen

- Calculating Internal Rate of ReturnDokument4 SeitenCalculating Internal Rate of ReturnJayna CrichlowNoch keine Bewertungen

- Serious Money Straight TalkDokument142 SeitenSerious Money Straight TalkAscaNoch keine Bewertungen

- Falling Interest Rates Impact on Jeevan Shanti Policy Returns vs Bank FDDokument27 SeitenFalling Interest Rates Impact on Jeevan Shanti Policy Returns vs Bank FDshahnawazNoch keine Bewertungen

- Employee Separation Types and BenefitsDokument15 SeitenEmployee Separation Types and BenefitsVatsal BanwariNoch keine Bewertungen

- Ko Tak Capital Multiplier PlanDokument2 SeitenKo Tak Capital Multiplier PlanemailtotesttestNoch keine Bewertungen

- Dabur Balance SheetDokument30 SeitenDabur Balance SheetKrishan TiwariNoch keine Bewertungen

- JRU College of Business Administration and Accountancy Income Tax SyllabusDokument10 SeitenJRU College of Business Administration and Accountancy Income Tax SyllabusValery Joy CerenadoNoch keine Bewertungen

- Income Tax PlainingDokument57 SeitenIncome Tax PlainingrohitNoch keine Bewertungen

- Personal Tax Planning BookDokument105 SeitenPersonal Tax Planning Bookcwlee7025100% (1)

- 4 Minimum Wages ActDokument11 Seiten4 Minimum Wages ActDeepakNoch keine Bewertungen

- Understanding Pay StubsDokument3 SeitenUnderstanding Pay StubsJacob OrrNoch keine Bewertungen

- Aee GS 21-08-2023Dokument134 SeitenAee GS 21-08-2023RaghuNoch keine Bewertungen

- TDokument3 SeitenTVijay RengaNoch keine Bewertungen

- Gross Income NotesDokument20 SeitenGross Income NotesCheng OlayvarNoch keine Bewertungen

- LIFEB305Dokument209 SeitenLIFEB305PriyalPatel0% (1)

- ch20 SolDokument10 Seitench20 SolJohn Nigz PayeeNoch keine Bewertungen

- Tax Deducted at Source (TDS) /withholding TaxDokument1 SeiteTax Deducted at Source (TDS) /withholding Taxसम्राट सुबेदीNoch keine Bewertungen

- Mid-Norfolk Times May 2010Dokument28 SeitenMid-Norfolk Times May 2010Julian HornNoch keine Bewertungen

- Project On Maxlife InsuranceDokument41 SeitenProject On Maxlife Insurancejigna kelaNoch keine Bewertungen

- Project Maths Sample - Leaving Cert Higher Level - 2014Dokument20 SeitenProject Maths Sample - Leaving Cert Higher Level - 2014maghmathsNoch keine Bewertungen

- Cayo G. Gamogamo, Petitioner, vs. Pnoc Shipping and TRANSPORT CORP., Respondent. DecisionDokument5 SeitenCayo G. Gamogamo, Petitioner, vs. Pnoc Shipping and TRANSPORT CORP., Respondent. DecisionJen DioknoNoch keine Bewertungen

- PLDT V Jeturian From Lawyerly - PHDokument7 SeitenPLDT V Jeturian From Lawyerly - PHDaryl YuNoch keine Bewertungen

- Executive Engineer, Nadia Electrical Division, P. W. Dte. Pay Slip Government of West BengalDokument1 SeiteExecutive Engineer, Nadia Electrical Division, P. W. Dte. Pay Slip Government of West BengalBharati DasNoch keine Bewertungen