Beruflich Dokumente

Kultur Dokumente

Richard M Gergel Financial Disclosure Report For Gergel, Richard M

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Richard M Gergel Financial Disclosure Report For Gergel, Richard M

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

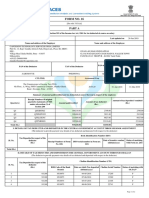

,4010 Rev.

1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization District of South Carolina

5a. Report T.~pe (check appropriate type)

Report Req,dred by the Ethics in Government Act ofl978 (5 U.S.C. app. 5 101-111)

I. Person Reporling (last name, first, middle initial) Gergel, Richard M.

4. Title (Article I11 judges indicate active or senior status; magistrate judges indicate full- or part-time) ] United States District Judge- Active

3. Date of Report 07/12/201 I 6. Reporting Period 01/01/2010 to 12/31/2010

Nomination, [] Initial

Date [] Annual [] Final

5b. [] Amended Report

7. Chambe~ or Office Address 85 Broad Street Charleston, SC 29401

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Revie~Jng Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed Complete ali parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. m,por,ing individuul o,ty; see pp. 9-13 of filing instructions.)

~1 NONE (No reportable positions.)

POSITION

NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. (Reporting individual only; see pp. 14-16 of filing instructions0

~] NONE (No reportable agreements.)

DATE

PARTIES AND TERMS

Ger_qel, Richard M.

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporting Gergel, Richard M.

Date of Repor~ 07/12/2011

II1. NON-INVESTMENT 1 NCOME. mepo~ing individual and spouse; see pp. 17-24 of filing instructions.)

A. Filers Non-Investment Income [~ NONE

(No reportable non-investment income.)

DATE SOURCE AND TYPE

Gergel, Nickles and Solomon, P.A.

INCOME

(yours, not spouses)

I. 2010 2. 3. 4.

$1,704,251.00

B. Spouses Non-Investment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

[-~

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

Columbia City Council Salary

I. 2010 2. 3. 4.

IV. REIMBURSEMENTS - transportation, lodging, food, entertainmen~

(Includes those to spouse and dependent children," see pp. 25-27 off!ling instructions.)

NONE (No reportable reimbursements.)

SOURCE DATES

I I/I I - 12/2010

LOCATION

Pinehurst, NC

PURPOSE

Presentation

ITEMS PAID OR PROVIDED Hotel and Meals

1. 2. 3. 4. 5.

SC Defense Trial Attorneys

FINANCIAL DISCLOSURE REPORT Page 3 of 8

Name of Person Reporting Gergel, Richard M.

Date of Report 07/12/2011

V. GIFTS. ancl,d~s ,hos, ,o 5po,se and d~,end~n, children; scc pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

I. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. anclad,, ,ho,o of ,po,se .,d depcnden, children; see pp. 32-33 of filing instructions.)

D NONE (No reportable liabilities.) CREDITOR

Bank of America 2. 3. 4. 5. Bank of America

DESCRIPTION

Mortgage on Investment Property: Edisto Beach, South Carolina Mortgage on Investment Properly: Charleston, South Carolina

VALUECODE

N N

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting Gergel, R~chard 51.

Date of Report 07/12/201 I

VII. INVESTM ENTS and TRUSTS - income, value, transactions (Includes those of spouse and dcptndent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Descriplinn of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (I) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (I) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) (I) Typ~ (e.g., buy, sell, redemption)

Transactions during reporting period

(2) (3) Date Value mm/dd/yy Code 2 0-P) (4) Gain Code I (A-H) (5) Identity of buyer/seller {if private transaction)

I. 2. 3. 4. 5. 6. 7. 8. 9. I0. I I. 12. 13. 14. 15. 16. 17.

Investment Property, Edisto Beach, SC Investment Property, Charleston, SC 1519 Richland LLP, Columbia, SC Prudential Life Insurance Columbia Cash Reserves Alliance Balance Wealth Strategies Class A Am. U.S. Government Securities Class B Am. Balanced Class A Am. Balanced Class B Am. High Income Trust Class A Columbia Marsico Focused Eq. Class A AM. Europacific Growth Class A Goldman Sachs Strategic Fund Hartford Advisors Class A Putnam International Equity Class A Am. Washington Mutual Inv. Class B Ship Financial International Com LSD A A A B A A D A B A A D

None None Rent None Int./Div. lnt./Div. Int./Div. Int./Div. Int./Div. Int./Div. Int./Div. Int./Div. None Int./Div. None lntJDiv. Int./Div.

PI N M K J K K M J K K J J J J J

W W W T T T T T T T T T T T T T Sold 08/03/10 J A

I. Income Gain Codes: (See Columns B I and IM) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See CoIumn C2)

A =$ 1,000 or less F -$50,091 - $ 100,000 J =$15.000 or less N =$250.001 - $500.090 P3 $25.0~0.001 - $50.00~.000 Q =Appraisal U =Book Value

B =$ 1,001 - $2,500 G = $ I 0~.0~ I - $1,00~.000 K =$15.001 - $ 50.000 O -$500,091 - $1,0~0,000 R =Co~t (Real Eslale Only) V =Other

C =$2,501 - $5,000 H I =$ 1,000,001 - $5,0~,000 L =$50.001 - $ 100.000 PI =$1,000,001 - $5,00~,0~0 P4 =More than $50,000.0(KI S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5 M =$100.001 - $250.000 P2 =$5.000.001 - $25.00~,090 T =Cash Markcl

E =$15,091 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting Gergel, Richard M.

Date of Report 07/12/201 I

VII. INVESTMENTS and TRUSTS - income, value, transactions a.ctuaes those of spouse a.a aepe.~e.t children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(x)" after each asset exempt from prior disclosure B. Income during reporting period 0) (2) Amount Type (e.g., Code I div., rent, (A-H) or int.) C. Gross value at end of reporting period 0) (2) Value Value Code 2 Method (J-P) Code 3 Transactions during reporting period 0) Type (e.g.,

buy, sell,

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code I

(J-P) (A-H)

redemption)

(5) Identity of buyer/seller (if private transaction)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34.

AllianceBer Large Cap Growth Class A Morgan Slanley Divident Growth Class B Morgan Stanley European Equity Class B Morgan Stanley Liquid Asset Fund Morgan Stanley Strategist Fund A Bank MeridianNA First NationaIBankshareslnc Tidelands Baneshares Inc VistaBank South Carolina Bank of America TIAA-CREF Exxon Mobil Columbia Tax Exempt Reserves Wachovia Certificates of Deposit Morgan Stanley Global Div. Growth/ Section A Am. Short Term Bond/Class A Lord Abbott Short Duration Tax Free Fund

A A A A A

Int./Div. Interest Int./Div. Int./Div. Int./Div. None None None None

J J J J J K

T T T T T T Sold Sold 08/03/t 0 J 08/03/I0 J A A

K K M

T T T Sold 08/03/I 0 J A

A D

lnt./Div. Int./Div. None

A A A A B

Int./Div. Int./Div. Int./Div. Int./Div. Int./Div.

J J J K L

T T T T Buy 06/22/10 L

I. Income Gain Codes: (S~e Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Mcthed Codes (see Column C2)

A =$1,000 or less F =$50.001 - $10~.00~ J =$15,000 or less N =$250.001 - $500,000 P3 -$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1.000.0~0 K :$15,001 - $50.000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI =SI.0~.001 - $5.00~.090 L =$50.001 - $ 100.000 PI =$1,000,001 - $5,090,000 P4 =More Ihan $50,000,000 S =Asscssmcnl W =Estimated

D =$5,001 - $15,000 H2 =More than $5.000,000 M -$ 100,001 - $250.000 P2 =$5,000.001 - $25,000.000 T =Cash Market

E =$15.001 - $50.1~90

FINANCIAL DISCLOSURE REPORT Page 6 of 8

Name of Person Reporting Gergel, Richard M.

Date of Report 07/12/201 I

VII. INVESTMENTS and TRUSTS -inc~me~~alue~transacti~ns(~nc~udesth~se~fsp~useanddependentchildren;seepp~34~6~f~inginstructi~n~

[~ NONE (No reportable income, assets, or transactions.)

A. Description of Assats (including trust assets) Place "(X)" after each asset

exempt from prior disclosure

B. Income during reporting period

C. Gross value at end of reporting period

Transactions during reporting period (2) (3) (4) Date Value [ Gain mm/dd/yy Code 2 i Code l (J-P) i (A-H) [

O)

Amount

Code I (A-H)

(2)

Type (e.g.,

div., rent, or int.)

0)

Value

Code 2 (J-P)

(2)

Value

Method Code 3 (Q-W)

Type (e.g., buy, sell, redemption)

(5) Identity of buyer/seller (if private transaction)

35. 36.

Blackrock GlobalAllocation Fund Templeton Global Bond Fund

B B

Int./Div. Int./Div.

L L

Buy Buy

06/22/10 L 06/22/10 L

I. Income Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes ~Scc Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N ~$250,001 - $500,000 P3 =$25,000,001 - $50.000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100.001 - $1.000.0OO K =$15,001 - $50,000 O -$500,001 - $1,000.000 R =Cosl (Real Estate Only) V Olhcr

C =$2,501 - $5,000 HI =$1.000.001 - $5.000.000 L =$50,001 - $ 100.000 PI =$1,0~XL00I - $5,000.000 P4 More than $50,000.000 S Asscssmcnl W =Estimated

D =$5.001 - $15,000 H2 =More than $5,000,000 M = $ 100.001 - $250.000 P2 =$5.000,001 - $25.000,000 T Cash Markcl

E =$15.001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting Gergel, Richard 51.

Date of Report 07/12/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (Inaicate part of report.)

FINANCIAL DISCLOSURE REPORT Page 8 of 8

Name of Person Reporting Gergel, Richard 51.

Date of Report 07/12/2011

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported svas withheld because it met applicable statutory pros~isions permitting non-disclosure.

1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Richard M. Gergel

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

AO IO Rev. 1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization District of South Carolina

5a. Report Type (check appropriate type) Nomination, ] [] Initial Date [] Annual ] Final

Report Required by the Ethics in Govermnent Act of 1978 (5 U.S.C. app..~sq 101-111)

1. Person Reporting (last name, first, middle initial) Gergel, Richard M. 4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/04/201 I 6. Reporting Period 01/01/2010 to 12/31/2010

United States District Judge- Active

5b. [] Amended Report

7. Chambers or Office Address 85 Broad Street Charleston, SC 29401

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance vdth applicable laws and regulations.

Reviewing Officer

Date

IMPORTANT NOTES: The instructions accompanying this form must be followe,! Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. (Reporting individual only; seepp. 9-13 of filing instructions.)

~

NONE (No reportablepositions.)

POSITION

NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. tRe~,orting indivldual o,ly; see pp. 14-16 of filing instructions.)

~

NONE (No reportable agreements.)

DATE

PARTIES AND TERMS

Ger_clel, Richard M. A

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporting Gergel, Richard M.

Date of Report 05/04/2011

III. NON-INVESTMENT INCOME. (Repo,~i,g i, dividual a,d,pouse; seepp. 17-24 of filing instructions.)

A. Filers Non-Investment Income ~-] NONE (No reportable non-investment income.) DATE

1. 2010 2. 3. 4.

SOURCE AND TYPE

Gergel, Nickles and Solomon, P.A.

INCOME (yours, not spouses) $1,704,251.00

B. Spouses Non-lnvestment Income - If you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

Columbia City Council Salary

I. 2010 2. 3. 4.

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment

(Includes those to spouse and dependent children," see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE

DATES I I / l I - 12/2010 LOCATION Pinehurst, NC PURPOSE Presentation

ITEMS PAID OR PROVIDED Hotel and Meals

I. 2. 3. 4. 5.

SC Defense Trial Attorneys

FINANCIAL DISCLOSURE REPORT Page 3 of 8

Name of Person Reporting Gergel, Richard M.

Date of Report 05/04/201 I

V. GIFTS. a.ct.d.~ ,ho~e ,o ~,ou~o u.d do,,.do., chitdre.: ~ee pp. ZS-Jt of filing inxtructions.)

NONE (No reportable g~s.)

SOURCE

I. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. ancl~des ,hose of spouse ~nd ~epe.de~t children; see pp. 32-33 of filing instructions.)

D NONE (No reportable liabilities.) CREDITOR

I. 2. Bank of America Bank of America DESCRIPTION Mortgage on Investment Property: Edisto Beach, South Carolina Mortgage on Investment Property: Charleston, South Carolina

VALUECODE

N N

3.

4. 5.

FINANCIAL DISCLOSURE REPORT Page 4 of 8 VII. INVESTMENTS and TRU STS - income, ,alu, ira ....

Name of Person Reporting Gergel, Richard 51.

Date of Report 0J/04/2011

tions (Includes those of spouse and dependent children; see pp. 34-60 of filing instruction~)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period O) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.) Gross value at end of reporting period (I) (2) Value Value Code 2 Method Code 3 (J-P) (Q-W) PI N M K J K K M J K K J J J J J T T T T T T T Sold 08/03/10

T T T

Transactions during reporting period

(2) (3) (4) Date Value Gain mm/dd!yy Code 2 Code I (J-P) (A-H)

Type (e.g., buy, sell, redemption)

(5) Identity of buyer/seller (if private transaction)

I. ! 2. 3. 4. 5. 6. 7. 8. 9. 10. I 1. 12. 13. 14. 15. 16. 17.

Investment Properly, Edisto Beach, SC Investment Property, Charleston, SC 1519 Richland LLP, Columbia, SC Prudential Life Insurance Columbia Cash Reserves Alliance Balance Wealth Strategies Class A Am. U.S. Government Securities Class B Am. Balanced Class A Am. Balanced Class B Am. High Income Trust Class A Columbia Marsico Focused Eq. Class A AM. Europacific Growth Class A Goldman Sachs Strategic Fund Hartford Advisors Class A Putnam International Equity Class A Am. Washington Mutual Inv. Class B Ship Financial International Com LSD

A A

None None D Rent None B A A D A B A A Int./Div. Int./Div. Int./Div. Int./Div. Int./Div. Int.tDiv. lnt./Div. Int./Div. None A lnt./Div. None lnt./Div. Int./Div.

w w w

I. Income Gain Codes: (See Columns BI and I)4) 2. Value Codes [See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$50.001 - $100.1~0 l =$15.0130 or less N =$250.001 - $500.000 P3 =$25.000.001 - $50.000.000 Q =Appraisal U =Book Value

B $1.001 - $2.500 G =$100.001 - $1.000.000 K =$15.001 - $50.000 O =$500.001 - $1,000,000 R =Cosl [Real Estate Only) V =Other

C =$2.501 - $5,000 HI =$1.000.001 - $5.000.000 L -$50,001 - $100,000 PI =$1,000,001 - $5,000,000 P4 =More Ihan $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5.000.000 M -$100,001 - $250.000 P2 =$5.000,001 - $25.000,000 T =Cash Market

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting Gergel, Richard 51.

Date of Report 05/04/201 I

VII. INVESTMENTS and TRUSTS - i.come, ,,ol.e, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Descriplion of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (I) (2) Amount Type (e.g., Code I div,, rent, (A-H) or int.) C. Gross value at end of reporting period O) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) Type (e.g., buy, sell, redemption) Transactions during reporting period

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code I (J-P) (A-H)

(5)

Identity of buyer/seller

(if private transaction)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29.

30.

AllianceBer Large Cap Growth Class A Morgan Stanley Divident Growth Class B Morgan Stanley European Equity Class B Morgan Stanley Liquid Asset Fund Morgan Stanley Strategist Fund A Bank MeridianNA First National Bankshares Inc Tidelands Baneshares Inc VistaBank South Carolina Bank of America TIAA-CREF Exxon Mobil

Columbia Tax Exempt Reserves

A A A A A

Int./Div. Interest Int./Div. Int./Div. Int./Div. None None None None

J J J J J K

T T T T T W Sold Sold 08/03/10 J 08/03/10 J A A

K K M

W T T Sold 08/03/10 J A

A D

Int./Div. Int./Div. None

Int./Div.

3t.

Wachovia Certificates of Deposit

Int./Div.

32. 33.

34.

Morgan Stanley Global Div. Growth/ Section A Am. Short Term Bond/Class A

Lord Abbott Short Duration Tax Free Fund

A A

B

lnt./Div. Int./Div.

Int./Div,

J K

L

T T

T

Buy

06/22/10 L

|. Income Gain Codes: (See Columns BI and [M) 2. Value Codes ISecColumns CI and D3) 3. Value Method Codes (See Colunm C2)

A =$1 ,O00 or less F =$50.001 - S 100.000 J =$15.000 or less N =$250.001 - $500,000 P3 $25.000,001 - $ 50.000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100.001 - $1.000.000 K =$15.001 - $50.000 O $500,001 - $1,000,000 R =Cosl (Real Estate Only) V -Other

C =$2,501 - $5,000 HI =$1.000.001 - $5.000.000 L =$50.001 - $100.000 PI -$1.000,001 - $5,000.000 P4 = M ore than $50.000,000 S =As~s_~mcnt W =Estimated

D =$5,001 - $| 5,000 H2 =More than $5.0~.000 M =$100.0~1 - $250.000 P2-$5,000,001 - $25,000,000 T =Cash Market

E =$|5,00| -

FINANCIAL DISCLOSURE REPORT Page 6 of 8

Name of Person Reporting Gergel, Richard 51.

Date of Repor~ 05/04/201 I

VII. INVESTMENTS and TRUSTS - inco,,o, ,,,I,,o. transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (I) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (1) Value Code 2 O-P) (2) Value Method Code 3 (Q-W) (1) Type (e.g., buy, sell, redemption) D. Transactions during reporting period (2) (3) (4) Date Value Gain mm/dd/yy Code 2 i Code I (A-H) U-P) , (5) Identity of buyer/seller (if private transaction)

135.

Blackrock Global Allocation Fund

B B

Int./Div. Int./Div.

L L

T T

Buy Buy

06/22/10 06/22/I 0

L L

36. TempletonGlobal Bond Fund

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (.See Column C2)

A =$ 1,000 or less F =$50,D01 - $100,000 J =$15,000 or less N =$250.001 - $50~.0~0 P3 =$25.000.001 - $ 50.000.000 Q =Apprai~l U =Book Value

B -$1,001 - $2,500 G =$100.001 - $1,000,000 K =$15,001 - $50,000 O =$50~.001 - $1,000,0~ R Cost (Real Estalc Onlyl V =Other

C =$2,501 - $5,000 HI =$1,000,001 - $5,000,000 L =$50,001 - $10~.00~ Pl =$1,000,001 - $5,000,0~ P4 More than $50,000.000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than M =5100.001 - $250,1)09 P2 =$5,000,0~1 - $25,0~9,000 T =Cash Markcl

E =$15,001 - $50,00~

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting Gergel, Richard 51.

Dale of Report 05/04/201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (ln,tica,e part of report.)

FINANCIAL DISCLOSURE REPORT Page 8 of 8 IX. CERTIFICATION.

Name of Person Reporting Gergel, Richard M.

Date of Report 05/04/2011

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure.

I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Richard M. Gergel

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- HSBC in A Nut ShellDokument190 SeitenHSBC in A Nut Shelllanpham19842003Noch keine Bewertungen

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- CA Inter Group 1 Book November 2021Dokument251 SeitenCA Inter Group 1 Book November 2021VISHAL100% (2)

- Fake PDFDokument2 SeitenFake PDFJessicaNoch keine Bewertungen

- Procter R Hug JR Financial Disclosure Report For 2010Dokument8 SeitenProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Neal B Biggers Financial Disclosure Report For 2010Dokument7 SeitenNeal B Biggers Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Thad Heartfield Financial Disclosure Report For 2010Dokument18 SeitenThad Heartfield Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard D Cudahy Financial Disclosure Report For 2010Dokument16 SeitenRichard D Cudahy Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Raymond W Gruender Financial Disclosure Report For 2010Dokument8 SeitenRaymond W Gruender Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Ment Ira de Financial Disclosure Report For 2010Dokument12 SeitenMent Ira de Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard L Voorhees Financial Disclosure Report For 2010Dokument8 SeitenRichard L Voorhees Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Dolly M Gee Financial Disclosure Report For Gee, Dolly MDokument9 SeitenDolly M Gee Financial Disclosure Report For Gee, Dolly MJudicial Watch, Inc.Noch keine Bewertungen

- James Knoll Gardner Financial Disclosure Report For 2010Dokument11 SeitenJames Knoll Gardner Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert S Lasnik Financial Disclosure Report For 2010Dokument7 SeitenRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Simeon T Lake Financial Disclosure Report For 2010Dokument9 SeitenSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Steven J McAuliffe Financial Disclosure Report For 2010Dokument15 SeitenSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Alan D Lourie Financial Disclosure Report For 2010Dokument7 SeitenAlan D Lourie Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Loretta A Preska Financial Disclosure Report For 2010Dokument14 SeitenLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Bernard A Friedman Financial Disclosure Report For 2010Dokument15 SeitenBernard A Friedman Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Stephen M McNamee Financial Disclosure Report For 2010Dokument12 SeitenStephen M McNamee Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Marilyn L Huff Financial Disclosure Report For 2010Dokument14 SeitenMarilyn L Huff Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James P Jones Financial Disclosure Report For 2010Dokument13 SeitenJames P Jones Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert P Patterson JR Financial Disclosure Report For 2010Dokument9 SeitenRobert P Patterson JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Peter J Messitte Financial Disclosure Report For 2010Dokument9 SeitenPeter J Messitte Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Thomas L Ambro Financial Disclosure Report For 2010Dokument21 SeitenThomas L Ambro Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William Keith Watkins Financial Disclosure Report For 2010Dokument8 SeitenWilliam Keith Watkins Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert R Beezer Financial Disclosure Report For 2010Dokument9 SeitenRobert R Beezer Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William Eugene Davis Financial Disclosure Report For 2010Dokument8 SeitenWilliam Eugene Davis Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Rudi M Brewster Financial Disclosure Report For 2010Dokument7 SeitenRudi M Brewster Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Gerard E Lynch Financial Disclosure Report For 2010Dokument9 SeitenGerard E Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Irma E Gonzalez Financial Disclosure Report For 2010Dokument8 SeitenIrma E Gonzalez Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Walter T McGovern Financial Disclosure Report For 2010Dokument7 SeitenWalter T McGovern Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William L Garwood Financial Disclosure Report For 2010Dokument15 SeitenWilliam L Garwood Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard J Holwell Financial Disclosure Report For 2010Dokument9 SeitenRichard J Holwell Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Joan B Gottschall Financial Disclosure Report For 2010Dokument10 SeitenJoan B Gottschall Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Sarah S Vance Financial Disclosure Report For 2010Dokument12 SeitenSarah S Vance Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Stephen F Williams Financial Disclosure Report For 2010Dokument9 SeitenStephen F Williams Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Brian M Cogan Financial Disclosure Report For 2010Dokument15 SeitenBrian M Cogan Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert G Doumar Financial Disclosure Report For 2010Dokument19 SeitenRobert G Doumar Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- David G Campbell Financial Disclosure Report For 2010Dokument11 SeitenDavid G Campbell Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Roger Vinson Financial Disclosure Report For 2010Dokument20 SeitenRoger Vinson Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James E Gritzner Financial Disclosure Report For 2010Dokument10 SeitenJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Roger J Miner Financial Disclosure Report For 2010Dokument8 SeitenRoger J Miner Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Samuel Conti Financial Disclosure Report For 2010Dokument7 SeitenSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard G Seeborg Financial Disclosure Report For 2010Dokument10 SeitenRichard G Seeborg Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Howard A Matz Financial Disclosure Report For 2010Dokument12 SeitenHoward A Matz Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Leonard I Garth Financial Disclosure Report For 2010Dokument8 SeitenLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Harold R DeMoss JR Financial Disclosure Report For 2010Dokument9 SeitenHarold R DeMoss JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Harvey E Schlesinger Financial Disclosure Report For 2010Dokument8 SeitenHarvey E Schlesinger Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Sandra S Beckwith Financial Disclosure Report For 2010Dokument20 SeitenSandra S Beckwith Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Mark A Goldsmith Financial Disclosure Report For Goldsmith, Mark ADokument7 SeitenMark A Goldsmith Financial Disclosure Report For Goldsmith, Mark AJudicial Watch, Inc.Noch keine Bewertungen

- John H McBryde Financial Disclosure Report For 2010Dokument9 SeitenJohn H McBryde Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert L Jordan Financial Disclosure Report For 2010Dokument11 SeitenRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William T Moore JR Financial Disclosure Report For 2010Dokument20 SeitenWilliam T Moore JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James A Beaty JR Financial Disclosure Report For 2010Dokument8 SeitenJames A Beaty JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Merrick B Garland Financial Disclosure Report For 2010Dokument10 SeitenMerrick B Garland Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Daniel L Hovland Financial Disclosure Report For 2010Dokument7 SeitenDaniel L Hovland Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Terrence L OBrien Financial Disclosure Report For 2010Dokument8 SeitenTerrence L OBrien Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Russel H Holland Financial Disclosure Report For 2010Dokument20 SeitenRussel H Holland Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert J Kelleher Financial Disclosure Report For 2010Dokument16 SeitenRobert J Kelleher Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Carl J Barbier Financial Disclosure Report For 2010Dokument12 SeitenCarl J Barbier Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James B Loken Financial Disclosure Report For 2010Dokument10 SeitenJames B Loken Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Charles J Siragusa Financial Disclosure Report For 2010Dokument27 SeitenCharles J Siragusa Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceVon EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNoch keine Bewertungen

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- September 2004Dokument24 SeitenSeptember 2004Judicial Watch, Inc.Noch keine Bewertungen

- LAUSD Semillas AckDokument1 SeiteLAUSD Semillas AckJudicial Watch, Inc.Noch keine Bewertungen

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- June 2004Dokument17 SeitenJune 2004Judicial Watch, Inc.Noch keine Bewertungen

- 13-1150 Responsive Records 2 - RedactedDokument29 Seiten13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Noch keine Bewertungen

- July 2006Dokument24 SeitenJuly 2006Judicial Watch, Inc.Noch keine Bewertungen

- December 2005 Bulletin 2Dokument14 SeitenDecember 2005 Bulletin 2Judicial Watch, Inc.Noch keine Bewertungen

- Atlanta IntraregionalDokument4 SeitenAtlanta IntraregionalJudicial Watch, Inc.Noch keine Bewertungen

- 13-1150 Response Re Judicial WatchDokument1 Seite13-1150 Response Re Judicial WatchJudicial Watch, Inc.Noch keine Bewertungen

- STAMPED ComplaintDokument4 SeitenSTAMPED ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- Daraman vs. DENRDokument2 SeitenDaraman vs. DENRJeng GacalNoch keine Bewertungen

- Activity Description Predecessor Time (Days) Activity Description Predecessor ADokument4 SeitenActivity Description Predecessor Time (Days) Activity Description Predecessor AAlvin LuisaNoch keine Bewertungen

- Web Technology PDFDokument3 SeitenWeb Technology PDFRahul Sachdeva100% (1)

- Elastic Modulus SFRCDokument9 SeitenElastic Modulus SFRCRatul ChopraNoch keine Bewertungen

- Catalogo AWSDokument46 SeitenCatalogo AWScesarNoch keine Bewertungen

- Doterra Enrollment Kits 2016 NewDokument3 SeitenDoterra Enrollment Kits 2016 Newapi-261515449Noch keine Bewertungen

- Zelio Control RM35UA13MWDokument3 SeitenZelio Control RM35UA13MWSerban NicolaeNoch keine Bewertungen

- Feasibility Study of Diethyl Sulfate ProductionDokument3 SeitenFeasibility Study of Diethyl Sulfate ProductionIntratec SolutionsNoch keine Bewertungen

- Oem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Dokument43 SeitenOem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Farhad FarajyanNoch keine Bewertungen

- Recommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityDokument49 SeitenRecommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityJohn DavisonNoch keine Bewertungen

- ICSI-Admit-Card (1) - 230531 - 163936Dokument17 SeitenICSI-Admit-Card (1) - 230531 - 163936SanjayNoch keine Bewertungen

- Wendi C. Lassiter, Raleigh NC ResumeDokument2 SeitenWendi C. Lassiter, Raleigh NC ResumewendilassiterNoch keine Bewertungen

- Urun Katalogu 4Dokument112 SeitenUrun Katalogu 4Jose Luis AcevedoNoch keine Bewertungen

- Catalog Celule Siemens 8DJHDokument80 SeitenCatalog Celule Siemens 8DJHAlexandru HalauNoch keine Bewertungen

- Cam Action: Series: Inch StandardDokument6 SeitenCam Action: Series: Inch StandardVishwa NNoch keine Bewertungen

- Lockbox Br100 v1.22Dokument36 SeitenLockbox Br100 v1.22Manoj BhogaleNoch keine Bewertungen

- SBL - The Event - QuestionDokument9 SeitenSBL - The Event - QuestionLucio Indiana WalazaNoch keine Bewertungen

- Material Safety Data Sheet (According To 91/155 EC)Dokument4 SeitenMaterial Safety Data Sheet (According To 91/155 EC)Jaymit PatelNoch keine Bewertungen

- Historical Development of AccountingDokument25 SeitenHistorical Development of AccountingstrifehartNoch keine Bewertungen

- 48 Volt Battery ChargerDokument5 Seiten48 Volt Battery ChargerpradeeepgargNoch keine Bewertungen

- Linux For Beginners - Shane BlackDokument165 SeitenLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- 1SXP210003C0201Dokument122 Seiten1SXP210003C0201Ferenc SzabóNoch keine Bewertungen

- MRT Mrte MRTFDokument24 SeitenMRT Mrte MRTFJonathan MoraNoch keine Bewertungen

- Form16 2018 2019Dokument10 SeitenForm16 2018 2019LogeshwaranNoch keine Bewertungen

- An RambTel Monopole Presentation 280111Dokument29 SeitenAn RambTel Monopole Presentation 280111Timmy SurarsoNoch keine Bewertungen

- 7 TariffDokument22 Seiten7 TariffParvathy SureshNoch keine Bewertungen

- Pneumatic Fly Ash Conveying0 PDFDokument1 SeitePneumatic Fly Ash Conveying0 PDFnjc6151Noch keine Bewertungen