Beruflich Dokumente

Kultur Dokumente

Marsha J Pechman Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Marsha J Pechman Financial Disclosure Report For 2010

Hochgeladen von

Judicial Watch, Inc.Copyright:

Verfügbare Formate

I

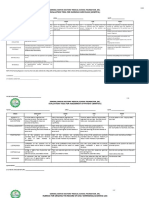

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization U.S. District Court 5a. Report Type (check appropriate type) [-"-] Nomination, Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) Pechman, Marsha J.

4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/10/2011 6. Reporting Period 01/01/2010 to 12/31/2010

Article III judge - active

[] Initial

5b. [] Amended Report

7. Chambers or Office Address 700 Stewart Street, Room 14229 Seattle, WA 98101

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPOR TANT NOTES: The instructions accompanying this form must be followed. Complete all parts, checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. (Re~,oning iuaiviauot o.ty; se~ pp. 9-13 of filing instructions.)

~] NONE (No reportable positions.) POSITION

NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. aeponing inai~iau.t onty; see pp. 14-16 of filing instructions.)

~]

NONE (No reportable agreements.)

DATE

1.1/1/99 2. 3.

PARTIES AND TERMS

Public Employees Retirement System, State of Washington (retirement benefit plan)

Pechman, Marsha J.

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporting Pechman, Marsha J.

Date of Report 05/10/2011

IlL NON-INVESTMENT INCOME. (Reporting individual andsp ....

A. Filers Non-Investment Income ~] NONE (No reportable non-investment income.)

DATE

; see pp. 17-24 of filing instructions.)

SOURCE AND TYPE

INCOME (yours, not spouses)

2. 3. 4.

B. Spouses Non-Investment Income - lf you were married during anyportion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.)

DATE

1.2010 2. 3. 4.

SOURCE AND TYPE Preg ODonnel & Gillett

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children," see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE

1. 2. 3. 4. 5.

DA~TES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 8

Name of Person Reporting Pechman, Marsha J.

Date of Report 05/10/2011

V. GIFTS. a.cl.des those to spouse and dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. (Includes those of spouse and dependent children; see pp. 32-33 of filing instruction~)

D NONE (No reportable liabilities.)

CREDITOR Visa

2. 3. 4. 5.

DESCRIPTION Credit card Periodic payment contract~~

VALUE CODE

J K

~~ college tuition

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting Pechman, Marsha J.

Date of Report 05/10/2011

VII. INVESTMENTS and TRUSTS - i .... e, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 o/filing instructions.)

[~ NONE (No reportable income, assets, or transactions.)

1. 2. 3. 4. 5. 6. 7. 8. 9. I0. 11. 12. 13. 14. 15.

Advanta Bank Corp CD Bank Dep Sweep Opt (money market acct) Cisco Systems Columbus Bank & Trust Co. CD Comerica Bank CD Davis New York Venture Fund Inc. D1. Y Dodge & Cox Income Dodge & Cox International Duke Energy Corp. Emerson Electric EuroPacific Growth Fund Exxon/Mobil Corp. Fairholme Funds Inc. Federated Money Mkt/Tr Gov Obligs Fd Instl A A A A A A A A A

None Interest None None None Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend None J J J J J J K K K T T T T T T T T T J J T T

Sold

04/15/10

Sold Sold

08/09/10 04/29/10

K L

A A

Buy (addl)

09/14/10

Buy Buy (addl)

01/07/10 K 07/01 / 10 J

16. General Electric 17. Harbor Bond Fund

A A

Dividend Dividend

J J

T T

1. Income Gain Codes: (See Columns B I and I34) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes ISee Column C2)

A =$] ,000 or less F =$50.001 - $100,000 J =$15.000 or less N =$250.001 - $500.000 P3 =$25.000.001 - $50.000.000 Q =Appraisal U =Book Value

B =$I.001 - $2,500 G =$100,~01 - $I,000,000 K -$15.001 - $50,000 O =$500.001 - $1,000.000 R =Cosl (Real Estate Only) V =Other

C =$2,501 - $5.000 HI =$1,000,001 - $5,000;000 L =$5C.001 - $100,000 PI =$1 000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$100.001 - $250,000 P2 =$5 000 001 -$25 000 000 T =Cash Market

E =$15,001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting Pechman, Marsha J.

Date of Report 05/10/2011

VII. INVESTMENTS and TRUSTS -i .... e, value, transactions (Includes those of sp ...... d dependent children; seepp. 34-60 of f!llng lnstructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets)

Place "(X)" after each asset exempt from prior disclosure B. Income during ~eporting period (l) Amount Code 1 (A-H) C. Gross value at end of reporting period ..... (2) Value Method . 3 (Q-W) (1) Type (e.g.; buy, sell, redemption): D. Transactions during reporting period (2) (3) I (4) Value Date mm/dd/yy Code 2 (J-P) (5) Identity of buyer/seller (if private transaction)

(2) (1) Type (e.g., Value Code 2 div., rent, or int.) .... ~... O-P)

Gain Code 1 (A-H)

18. 19.

Harris Assoc Inv Tr - Oakmark Eq&Inc Fund

None

Buy Buy (addl)

04/29/10 K 09/14/10 J

20. Johnson & Johnson 21. 22. Oppenheimer Main Str Fund Pioneer Cullen Value Fund C1 A

A A A

Dividend Dividend Dividend None

T Sold 01/07/10 J J J A (see VII1. notes) A (see VII1. notes) (see VIII. notes)

Merged 06/07/10 (with line 23) T K J J J J

J L

23. Pioneer Cullen Value Fund C1 Y 24. 25. 26. 27. 28.

29. 30. 31. 32. 33. 34. Vanguard Fixed Income - Sh Term Inv Growth D.

Open

06/07/10

Professionally Mngd Fund Portfolio Ostweis Funds Spectra Energy Corp. Target Touchtone Instl Funds T Rowe Price Growth Stock Fund Inc.

T Rowe Price Pers Strategy Funds Inc. Vanguard Bond Index Fund Sh Term Port Fund CI - Inv

A A A

Dividend Dividend Dividend None

T T T T T

T T Buy Sold (part) 04/30/10 07/01/10 04/30/10 07/01/10 09/14/10 K L K L K

A

A B

Dividend

Dividend Dividend

(see VIII. notes) B

Dividend

Buy (addl) Buy (addl) Buy (addl)

1. lncome Gain Codes:

A =$1,000 0r less

B--$1;001 - $2,500 : ~ ~]~!~0i ~ ~ii0~0i~00 K =$!5;001 - $50,000 O ~$500,001 - $1;000,000 R =Cost (Real Estate Only) V =Other

C =$2;501 - $5,000 Ill =$1,000,001- $5,000;000 L =$50,001 ~ $100,000 PI =$1;000;001 ~ $5i000;000 P4 =MOre than $50,000,000 S =Assessment W =Estimated

(See C0iurnns Bi ~nd I)4) ....... ~ ~$50100i ~ $:i6~i00~ 2. Value Codes J =$15,000 or less (See Columns C1 and D3) N =$250,001 -$500;000 P3 =$25,000 001 - $50 000 000 3. Value Method Codes Q =Appraisal (See Colunm C2) U =Book Value

D =$5,00t - $15,000 H2 =More than $5,000;000 M =$i00,001 - $250,000 P2 =$5,000~001 -$25;000,000 T --Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 6 of 8 VII. INVESTMENTS and TRU S TS -i ....

Name of Person Reporting Pechman, Marsha J.

Date of Report 05/10/2011

e, value, t ...... tions (Includes those of sp ......d dependent children; see pp. 34-60 of.filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. B. C. D. Transactions during reporting period

Place !r(X)~ after each asset

Amount

Type (e.g.,

Value

Value Method Code 3 (Q-W)

Type (e.g., buy, sell; redemption)

Value Date mm/dd/yy Code 2 (J-P)

Gain Code 1 (A-H)

Identity of buyer/seller (if private transaction)

35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47.

Vanguard Inflation-Protected Securities Vanguard Prime Money Mkt Fund Vanguard Short Term - Treas Admiral Vanguard Strategic Equity Fund Vanguard Total Bond Mkt Index - Inv

B A A A A

Dividend Dividend Dividend Dividend Dividend

K K M K

T T T T

Buy 01/07/10 J

(part)

Sold (part)

Sold

01/07/10 07/01/10

J L

Merged

10/19/10

(see VIII. notes) (see VIII. notes)

(with line 41) Vanguard Total Bond Mkt Index - Adm Vanguard Total International Stock Index Fund Vanguard Total Stock Market Index Fund Inv Vanguard Total Stock Market Index Fund Adm Vanguard Wellesley Income Fund Vanguard Wellington Fund Wells Fargo & Co. A A A A A B A Dividend Dividend Dividend Dividend Dividend Dividend Dividend L J K J

T

J K

Open

i 10119/10

Merged

10/19/10 L

(see VIII. notes) (see VIII. notes)

(with line 44) Open

10/19/10 L

(See Columns B I and D4) 2. Value C~xtes (See Columns C1 and D3) 3. Value Method Codes (See Column C2)

F =$50,001 - $100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25;000,001 - $50,000,000 Q =Appraisal U =Book Value

G =$100~001 - $1;000;000 K =$15~001 - $50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H 1 =$1;000,001 - $5;000,000 L =$50,001 - $I 00,000 P I =$ 1,000,001 - $5,000,000 P4 -More than $50,000,000 S =Assessment W =Estimated

D =$5,00 t - $15,000 H2 =More than $5~000,000 M =$ 100,001 - $250;000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting Pechman, Marsha J.

Date of Report 05/10/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicate part of report.)

VII. 21. A dividend o4 shares was declared on this holding on 12/3/09; it was sold on 01/07/09 VII. 22. Converted to Pioneer Cullen Value Fund Class Y on 06/07/10 VII. 23. Converted from Pioneer Cullen Value Fund Class A on 06/07/10 VII. 30. Vanguard Bond Index Fund Sh Term Port Fund CI - Inv has been listed as "Vanguard Bond Index" in the 2008 and 2009 FDRs -- they are the same fund. VII. 40. Converted to Vanguard Total Bond Mkt Index - Adm VII. 41. Converted from Vanguard Total Bond Mkt Index - Inv VII. 43. Converted to Vanguard Total Stock Market Index Fund - Adm VII. 44. Converted from Vanguard Total Stock Market Index Fund - Inv

FINANCIAL DISCLOSURE REPORT Page 8 of 8

Name of Person Reporting Pechman, Marsha J.

Date of Report 05/10/2011

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Marsha J. Pechman

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Das könnte Ihnen auch gefallen

- 1488 09032013Dokument262 Seiten1488 09032013Judicial Watch, Inc.100% (1)

- 2161 DocsDokument133 Seiten2161 DocsJudicial Watch, Inc.83% (12)

- Construction Agreement SimpleDokument3 SeitenConstruction Agreement Simpleben_23100% (4)

- 1878 001Dokument17 Seiten1878 001Judicial Watch, Inc.100% (5)

- Jon O Newman Financial Disclosure Report For 2010Dokument26 SeitenJon O Newman Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Harvey E Schlesinger Financial Disclosure Report For 2010Dokument8 SeitenHarvey E Schlesinger Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert P Patterson JR Financial Disclosure Report For 2010Dokument9 SeitenRobert P Patterson JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard Owen Financial Disclosure Report For 2010Dokument8 SeitenRichard Owen Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James E Gritzner Financial Disclosure Report For 2010Dokument10 SeitenJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Nina Gershon Financial Disclosure Report For 2010Dokument16 SeitenNina Gershon Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- John H McBryde Financial Disclosure Report For 2010Dokument9 SeitenJohn H McBryde Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Lynn N Hughes Financial Disclosure Report For 2010Dokument10 SeitenLynn N Hughes Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- H J Wilkinson III Financial Disclosure Report For 2010Dokument10 SeitenH J Wilkinson III Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James C Hill Financial Disclosure Report For 2010Dokument9 SeitenJames C Hill Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert L Jordan Financial Disclosure Report For 2010Dokument11 SeitenRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William F Nielson Financial Disclosure Report For 2010Dokument13 SeitenWilliam F Nielson Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Stanley Marcus Financial Disclosure Report For 2010Dokument8 SeitenStanley Marcus Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William C Bryson Financial Disclosure Report For 2010Dokument8 SeitenWilliam C Bryson Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- John A Woodcock JR Financial Disclosure Report For 2010Dokument12 SeitenJohn A Woodcock JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- John Antoon Financial Disclosure Report For 2010Dokument8 SeitenJohn Antoon Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert G Doumar Financial Disclosure Report For 2010Dokument19 SeitenRobert G Doumar Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Donald E Walter Financial Disclosure Report For 2010Dokument16 SeitenDonald E Walter Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Morris S Arnold Financial Disclosure Report For 2010Dokument10 SeitenMorris S Arnold Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Procter R Hug JR Financial Disclosure Report For 2010Dokument8 SeitenProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Roger Vinson Financial Disclosure Report For 2010Dokument20 SeitenRoger Vinson Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Robert L Hinkle Financial Disclosure Report For 2010Dokument8 SeitenRobert L Hinkle Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James Knoll Gardner Financial Disclosure Report For 2010Dokument11 SeitenJames Knoll Gardner Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Thad Heartfield Financial Disclosure Report For 2010Dokument18 SeitenThad Heartfield Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Jackson L Kiser Financial Disclosure Report For 2010Dokument8 SeitenJackson L Kiser Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Virginia E Hopkins Financial Disclosure Report For 2010Dokument16 SeitenVirginia E Hopkins Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- George Z Singal Financial Disclosure Report For 2010Dokument10 SeitenGeorge Z Singal Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William D Stiehl Financial Disclosure Report For 2010Dokument16 SeitenWilliam D Stiehl Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard J Holwell Financial Disclosure Report For 2010Dokument9 SeitenRichard J Holwell Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Leonard I Garth Financial Disclosure Report For 2010Dokument8 SeitenLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Lynn S Adelman Financial Disclosure Report For 2010Dokument9 SeitenLynn S Adelman Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Gerard E Lynch Financial Disclosure Report For 2010Dokument9 SeitenGerard E Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Walter T McGovern Financial Disclosure Report For 2010Dokument7 SeitenWalter T McGovern Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William M Hoeveler Financial Disclosure Report For 2010Dokument10 SeitenWilliam M Hoeveler Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Stephen M McNamee Financial Disclosure Report For 2010Dokument12 SeitenStephen M McNamee Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James B Loken Financial Disclosure Report For 2010Dokument10 SeitenJames B Loken Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Marcia M Howard Financial Disclosure Report For 2010Dokument9 SeitenMarcia M Howard Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Dennis F Saylor IV Financial Disclosure Report For 2010Dokument9 SeitenDennis F Saylor IV Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Ellen B Burns Financial Disclosure Report For 2010Dokument18 SeitenEllen B Burns Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- JR Ewing Werlein Financial Disclosure Report For 2010Dokument20 SeitenJR Ewing Werlein Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William T Hart Financial Disclosure Report For 2010Dokument8 SeitenWilliam T Hart Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Phyllis A Kravitch Financial Disclosure Report For 2010Dokument8 SeitenPhyllis A Kravitch Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Alfred V Covello Financial Disclosure Report For 2010Dokument30 SeitenAlfred V Covello Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Stanley R Chesler Financial Disclosure Report For 2010Dokument9 SeitenStanley R Chesler Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Christopher C Conner Financial Disclosure Report For 2010Dokument14 SeitenChristopher C Conner Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Barbara M Lynn Financial Disclosure Report For 2010Dokument30 SeitenBarbara M Lynn Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Bernard A Friedman Financial Disclosure Report For 2010Dokument15 SeitenBernard A Friedman Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- James L Dennis Financial Disclosure Report For 2010Dokument8 SeitenJames L Dennis Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Daniel L Hovland Financial Disclosure Report For 2010Dokument7 SeitenDaniel L Hovland Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- William H Albritton Financial Disclosure Report For 2010Dokument22 SeitenWilliam H Albritton Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard M Gergel Financial Disclosure Report For Gergel, Richard MDokument16 SeitenRichard M Gergel Financial Disclosure Report For Gergel, Richard MJudicial Watch, Inc.Noch keine Bewertungen

- Simeon T Lake Financial Disclosure Report For 2010Dokument9 SeitenSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard A Posner Financial Disclosure Report For 2010Dokument10 SeitenRichard A Posner Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Marilyn L Huff Financial Disclosure Report For 2010Dokument14 SeitenMarilyn L Huff Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Loretta A Preska Financial Disclosure Report For 2010Dokument14 SeitenLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Richard G Seeborg Financial Disclosure Report For 2010Dokument10 SeitenRichard G Seeborg Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Stephanie K Seymour Financial Disclosure Report For 2010Dokument8 SeitenStephanie K Seymour Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Joseph F Anderson JR Financial Disclosure Report For 2010Dokument7 SeitenJoseph F Anderson JR Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- The Continental Dollar: How the American Revolution Was Financed with Paper MoneyVon EverandThe Continental Dollar: How the American Revolution Was Financed with Paper MoneyNoch keine Bewertungen

- CC 081213 Dept 14 Lapp LDokument38 SeitenCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Noch keine Bewertungen

- State Dept 13-951Dokument4 SeitenState Dept 13-951Judicial Watch, Inc.Noch keine Bewertungen

- Stamped Complaint 2Dokument5 SeitenStamped Complaint 2Judicial Watch, Inc.Noch keine Bewertungen

- 11 1271 1451347Dokument29 Seiten11 1271 1451347david_stephens_29Noch keine Bewertungen

- SouthCom Water Safety ProductionDokument30 SeitenSouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Stamped ComplaintDokument4 SeitenStamped ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- CVR LTR SouthCom Water Safety ProductionDokument2 SeitenCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Noch keine Bewertungen

- Cover Letter To Requester Re Response Documents130715 - 305994Dokument2 SeitenCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- Gitmo Freezer Inspection ReportsDokument4 SeitenGitmo Freezer Inspection ReportsJudicial Watch, Inc.Noch keine Bewertungen

- JTF GTMO Water Safety App W ExhDokument13 SeitenJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Noch keine Bewertungen

- June 2004Dokument17 SeitenJune 2004Judicial Watch, Inc.Noch keine Bewertungen

- Model UNDokument2 SeitenModel UNJudicial Watch, Inc.Noch keine Bewertungen

- LAUSD Semillas AckDokument1 SeiteLAUSD Semillas AckJudicial Watch, Inc.Noch keine Bewertungen

- July 2007 BulletinDokument23 SeitenJuly 2007 BulletinJudicial Watch, Inc.Noch keine Bewertungen

- July 2006Dokument24 SeitenJuly 2006Judicial Watch, Inc.Noch keine Bewertungen

- December 2005Dokument7 SeitenDecember 2005Judicial Watch, Inc.Noch keine Bewertungen

- STAMPED ComplaintDokument4 SeitenSTAMPED ComplaintJudicial Watch, Inc.Noch keine Bewertungen

- September 2004Dokument24 SeitenSeptember 2004Judicial Watch, Inc.Noch keine Bewertungen

- Atlanta IntraregionalDokument4 SeitenAtlanta IntraregionalJudicial Watch, Inc.Noch keine Bewertungen

- 13-1150 Responsive Records 2 - RedactedDokument29 Seiten13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Noch keine Bewertungen

- 13-1150 Response Re Judicial WatchDokument1 Seite13-1150 Response Re Judicial WatchJudicial Watch, Inc.Noch keine Bewertungen

- December 2005 Bulletin 2Dokument14 SeitenDecember 2005 Bulletin 2Judicial Watch, Inc.Noch keine Bewertungen

- Budget ProposalDokument1 SeiteBudget ProposalXean miNoch keine Bewertungen

- PEDIA OPD RubricsDokument11 SeitenPEDIA OPD RubricsKylle AlimosaNoch keine Bewertungen

- Novi Hervianti Putri - A1E015047Dokument2 SeitenNovi Hervianti Putri - A1E015047Novi Hervianti PutriNoch keine Bewertungen

- Divorced Women RightsDokument41 SeitenDivorced Women RightsAnindita HajraNoch keine Bewertungen

- ReportDokument8 SeitenReportTrust Asia Cargo in OfficeNoch keine Bewertungen

- Google Chrome OSDokument47 SeitenGoogle Chrome OSnitin07sharmaNoch keine Bewertungen

- Acitve and Passive VoiceDokument3 SeitenAcitve and Passive VoiceRave LegoNoch keine Bewertungen

- Signal&Systems - Lab Manual - 2021-1Dokument121 SeitenSignal&Systems - Lab Manual - 2021-1telecom_numl8233Noch keine Bewertungen

- Channels of CommunicationDokument3 SeitenChannels of CommunicationIrin ChhinchaniNoch keine Bewertungen

- Mbtruck Accessories BrochureDokument69 SeitenMbtruck Accessories BrochureJoel AgbekponouNoch keine Bewertungen

- Peacekeepers: First Term ExamDokument2 SeitenPeacekeepers: First Term ExamNoOry foOT DZ & iNT100% (1)

- Use Reuse and Salvage Guidelines For Measurements of Crankshafts (1202)Dokument7 SeitenUse Reuse and Salvage Guidelines For Measurements of Crankshafts (1202)TASHKEELNoch keine Bewertungen

- College PrepDokument2 SeitenCollege Prepapi-322377992Noch keine Bewertungen

- Highway Capacity ManualDokument13 SeitenHighway Capacity Manualgabriel eduardo carmona joly estudianteNoch keine Bewertungen

- 03-Volume II-A The MIPS64 Instruction Set (MD00087)Dokument793 Seiten03-Volume II-A The MIPS64 Instruction Set (MD00087)miguel gonzalezNoch keine Bewertungen

- Contoh Rancangan Pengajaran Harian (RPH)Dokument7 SeitenContoh Rancangan Pengajaran Harian (RPH)Farees Ashraf Bin ZahriNoch keine Bewertungen

- Send Me An AngelDokument3 SeitenSend Me An AngeldeezersamNoch keine Bewertungen

- Linux Command Enigma2Dokument3 SeitenLinux Command Enigma2Hassan Mody TotaNoch keine Bewertungen

- Reflective Learning Journal (Teacher Guide) PDFDokument21 SeitenReflective Learning Journal (Teacher Guide) PDFGary ZhaiNoch keine Bewertungen

- Hirarc Form: 1. Hazard Identification 2. Risk Analysis 3. Risk ControlDokument2 SeitenHirarc Form: 1. Hazard Identification 2. Risk Analysis 3. Risk ControlQurratulain Syarifuddinzaini100% (1)

- Adrenal Cortical TumorsDokument8 SeitenAdrenal Cortical TumorsSabrina whtNoch keine Bewertungen

- ANTH 222 Syllabus 2012Dokument6 SeitenANTH 222 Syllabus 2012Maythe S. HanNoch keine Bewertungen

- Analysis of Pipe FlowDokument14 SeitenAnalysis of Pipe FlowRizwan FaridNoch keine Bewertungen

- ReproTech, LLC Welcomes New President & CEO, William BraunDokument3 SeitenReproTech, LLC Welcomes New President & CEO, William BraunPR.comNoch keine Bewertungen

- Cui Et Al. 2017Dokument10 SeitenCui Et Al. 2017Manaswini VadlamaniNoch keine Bewertungen

- Baybay - Quiz 1 Code of EthicsDokument2 SeitenBaybay - Quiz 1 Code of EthicsBAYBAY, Avin Dave D.Noch keine Bewertungen

- Surge Protectionfor ACMachineryDokument8 SeitenSurge Protectionfor ACMachineryvyroreiNoch keine Bewertungen

- FFT SlidesDokument11 SeitenFFT Slidessafu_117Noch keine Bewertungen

- Succession CasesDokument17 SeitenSuccession CasesAmbisyosa PormanesNoch keine Bewertungen