Beruflich Dokumente

Kultur Dokumente

Constitutionality of School Choice in Pennsylvania

Hochgeladen von

Nathan BenefieldCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Constitutionality of School Choice in Pennsylvania

Hochgeladen von

Nathan BenefieldCopyright:

Verfügbare Formate

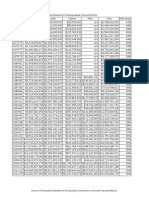

PENNSYLVANIA

Compelled Support Clause

VOUCHERS

TAX CREDITS

70

EXISTING SCHOOL CHOICE PROGRAMS Public School Choice:

[N]o man can of right be compelled to attend, erect or support any place of worship, or to maintain any ministry against his consent . PENNSYLVANIA CONST. Art. 1, 3.

Yes

24 Pennsylvania Code Section 13-1316 Charter Schools: Yes 24 Pennsylvania Code Sections 17-1701-A to 17-1751-A Private School Choice: Yes Education Improvement Tax Credits 24 Pennsylvania Code Sections 20-2001-B to 20-2008-B Pre-K Tax Credits 24 Pennsylvania Code Section 24-2003-B

Blaine Amendment

No money raised for the support of the public schools of the Commonwealth shall be appropriated to or used for the support of any sectarian school. PENNSYLVANIA CONST. Art. 3, 15.

Other Relevant Provisions

No appropriation shall be made for charitable, educational or benevolent purposes to any person or community nor to any denominational and sectarian institution, corporation or association: Provided, That appropriations may be made for loans for higher educational purposes to residents of the Commonwealth enrolled in institutions of higher learning except that no scholarship, grants or loans for higher educational purposes shall be given to persons enrolled in a theological seminary or school of theology. PENNSYLVANIA CONST. Art. 3, 29.

continued on next page

RELEVANT CASE LAW Christen G. v. Lower Merion School District, 919 F. Supp. 793 (E.D. Pa. 1996)

A federal district court held that in accordance with the IDEA a state could reimburse parents for private school tuition without violating either the U.S. or Pennsylvania constitutions because the payments do not advance religion.

Haller v. Department of Revenue, 728 A.2d 351 (Pa. 1999)

The Pennsylvania Supreme Court held that a tax exemption for the sale and use of religious publications sold by religious groups violates the First Amendments Establishment Clause because it shows a preference for religious communications without some overarching secular purpose. The exemptions narrow focus makes it unconstitutional.

Springeld School District v. Department of Education, 397 A.2d 1154 (Pa. 1979)

The Pennsylvania Supreme Court held that free school bus transportation provided to parochial school children does not violate the federal or state constitutions because any benet to a religious institution is indirect and incidental.

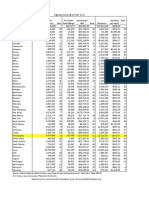

71

PENNSYLVANIA

VOUCHERS

TAX CREDITS

continued from previous page

Wiest v. Mt. Lebanon School District, 320 A.2d 362, 366-67 (Pa. 1974)

In holding that a religious invocation at the start of a public school graduation ceremony does not violate the First Amendment, the Pennsylvania Supreme Court also concluded that such an invocation would not offend Pennsylvanias Compelled Support Clause because it is coextensive with the First Amendment.

Rhoades v. School District, 226 A.2d 53 (Pa. 1967)

The Pennsylvania Supreme Court upheld the constitutionality of a statute authorizing transportation of private school students at public expense as a health and safety measure.

Both tax credit and voucher programs are school choice options for Pennsylvania. The Pennsylvania Constitution contains a Compelled Support Clause and a Blaine Amendment. The latter restricts the use of funds raised for the public schools but can be avoided entirely by funding vouchers from other government revenue. State case law demonstrates a strong adherence to federal Establishment Clause precedent and includes a distinction between appropriations and payments for services rendered, which should ensure voucher legislations compliance with the Blaine Amendment. Model Legislation: Parental Choice Scholarship Program (Universal Eligibility), Parental Choice Scholarship Program (Means-Tested Eligibility), Special Needs Scholarship Program, Foster Child Scholarship Program, Autism Scholarship, Great Schools Tax Credit Program, Family Education Tax Credit Program

Schade v. Allegheny County Institution District, 126 A.2d 911 (Pa. 1956)

The Pennsylvania Supreme Court held that paying public funds to religious orphanages did not violate Pennsylvanias Blaine Amendment because they were not appropriations, but rather payments for services rendered. Nothing in the Pennsylvania Constitution prevents the state from contracting with religious institutions and then paying its debts upon performance.

Collins v. Martin, 139 A. 122 (Pa. 1927)

In striking down a welfare appropriation in which public money would ow to private or religious hospitals, the Pennsylvania Supreme Court held that the Pennsylvania Constitution plainly stated that the peoples money should not be given for charity, benevolence or education to persons or communities, or for any purpose to sectarian and denominational institutions, corporations or associations.

Collins v. Kephart, 117 A. 440 (Pa. 1921)

Under an earlier version of Pennsylvanias Blaine Amendment, the Pennsylvania Supreme Court held that religious hospitals were barred from receiving state funds despite their status as worthy charities.

Giacomucci v. Southeast Delco School District, 742 A.2d 1165 (Pa. Commw. Ct. 1999)

The Pennsylvania Commonwealth Court held that a local school board lacked the statutory authority to institute a voucher program.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Benefield Testimony AttachmentsDokument18 SeitenBenefield Testimony AttachmentsNathan BenefieldNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- DPW Fact Sheet On Medicaid ExpansionDokument3 SeitenDPW Fact Sheet On Medicaid ExpansionNathan BenefieldNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Benefield Testimony AttachmentsDokument18 SeitenBenefield Testimony AttachmentsNathan BenefieldNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Gov. Wolf's Tax ProposalsDokument7 SeitenGov. Wolf's Tax ProposalsNathan BenefieldNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Charter Testimony (Benefield)Dokument5 SeitenCharter Testimony (Benefield)Nathan BenefieldNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Testimony To PA Funding Reform CommissionDokument8 SeitenTestimony To PA Funding Reform CommissionNathan BenefieldNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- PSEA Mailer For Tom WolfDokument2 SeitenPSEA Mailer For Tom WolfNathan BenefieldNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Bleeding GreenDokument1 SeiteBleeding GreenNathan BenefieldNoch keine Bewertungen

- PSEA Political MailerDokument2 SeitenPSEA Political MailerNathan BenefieldNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- PSEA Campaign Mailer 2012 PrimaryDokument2 SeitenPSEA Campaign Mailer 2012 PrimaryNathan BenefieldNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Pennsylvania Government Structural ReformsDokument5 SeitenPennsylvania Government Structural ReformsNathan BenefieldNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Pennsylvania State Union ContractsDokument2 SeitenPennsylvania State Union ContractsNathan BenefieldNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Fireproofing Pennsylvania'S Economy:: P L Isttbdt2012 Pennsylvania State Budget 2012Dokument25 SeitenFireproofing Pennsylvania'S Economy:: P L Isttbdt2012 Pennsylvania State Budget 2012Nathan BenefieldNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- 2011-12 PA Budget Deal SpreadsheetDokument17 Seiten2011-12 PA Budget Deal SpreadsheetNathan BenefieldNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shippensburg Prevailing Wage ResolutionDokument1 SeiteShippensburg Prevailing Wage ResolutionNathan BenefieldNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Trans $ by State 2010Dokument1 SeiteTrans $ by State 2010Nathan BenefieldNoch keine Bewertungen

- PLCB Wine Kiosk Cover UpDokument7 SeitenPLCB Wine Kiosk Cover UpNathan BenefieldNoch keine Bewertungen

- Letter To Pitt FamilyDokument2 SeitenLetter To Pitt FamilyNathan BenefieldNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- More Taxpayer Funded Lobbying Against School ChoiceDokument2 SeitenMore Taxpayer Funded Lobbying Against School ChoiceNathan BenefieldNoch keine Bewertungen

- Pennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationDokument22 SeitenPennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationNathan BenefieldNoch keine Bewertungen

- 2010 School Choice Poll - PADokument5 Seiten2010 School Choice Poll - PANathan BenefieldNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- PA Pension Reform PresentationDokument21 SeitenPA Pension Reform PresentationNathan BenefieldNoch keine Bewertungen

- Toomey Vs Sestak On JobsDokument1 SeiteToomey Vs Sestak On JobsNathan BenefieldNoch keine Bewertungen

- Cabot Oil and Gas Letter Sent To DEPDokument6 SeitenCabot Oil and Gas Letter Sent To DEPNathan BenefieldNoch keine Bewertungen

- Pennsylvania State Budget PresentationDokument20 SeitenPennsylvania State Budget PresentationNathan BenefieldNoch keine Bewertungen

- PA Transportation SpendingDokument1 SeitePA Transportation SpendingNathan BenefieldNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Memo On AEPS ReportDokument1 SeiteMemo On AEPS ReportNathan BenefieldNoch keine Bewertungen

- Comparing States Severance TaxDokument1 SeiteComparing States Severance TaxNathan BenefieldNoch keine Bewertungen

- Gasland DebunkedDokument2 SeitenGasland DebunkedNathan BenefieldNoch keine Bewertungen

- PGD Brochure 10th BatchDokument13 SeitenPGD Brochure 10th BatchSaiful Islam PatwaryNoch keine Bewertungen

- MMT Brochure - ENG PDFDokument24 SeitenMMT Brochure - ENG PDFbichojausenNoch keine Bewertungen

- 21st Century SkillsDokument4 Seiten21st Century SkillsKathrine MacapagalNoch keine Bewertungen

- Syllabus CPH 574: Public Health Policy & Management FALL 2012Dokument12 SeitenSyllabus CPH 574: Public Health Policy & Management FALL 2012Ala Abo RajabNoch keine Bewertungen

- Call For Admission 2020 Per Il WebDokument4 SeitenCall For Admission 2020 Per Il WebVic KeyNoch keine Bewertungen

- Pharmacy Student Handbook 2018-2019 FINALDokument205 SeitenPharmacy Student Handbook 2018-2019 FINALMaria Ingrid Lagdamen PistaNoch keine Bewertungen

- Chapter 2Dokument8 SeitenChapter 2Zyrome Jen HarderNoch keine Bewertungen

- Week 1 MTLBDokument7 SeitenWeek 1 MTLBHanni Jane CalibosoNoch keine Bewertungen

- SOP For Discharge Planning (Nursing)Dokument2 SeitenSOP For Discharge Planning (Nursing)enumula kumar100% (2)

- Nutrition Education For The Health Care ProfessionsDokument121 SeitenNutrition Education For The Health Care ProfessionsvishwassinghagraNoch keine Bewertungen

- Malcom Miles, Interruptions. Testing The Rhetoric of Culturally Led Urban DevelopmentDokument24 SeitenMalcom Miles, Interruptions. Testing The Rhetoric of Culturally Led Urban DevelopmentThiago FerreiraNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- MPS Item AnalysisDokument4 SeitenMPS Item AnalysisCharlie Ferrer EstradaNoch keine Bewertungen

- Cambridge O Level: Chemistry 5070/12 October/November 2020Dokument3 SeitenCambridge O Level: Chemistry 5070/12 October/November 2020Islamabad ALMA SchoolNoch keine Bewertungen

- Acp Module 5Dokument32 SeitenAcp Module 5Mechel Cabaltera87% (15)

- Leadership Essay QuestionsDokument10 SeitenLeadership Essay Questionsapi-337527210Noch keine Bewertungen

- Solution-Focused Counseling in Schools: Suggested APA Style ReferenceDokument8 SeitenSolution-Focused Counseling in Schools: Suggested APA Style ReferenceYoselin Urbina MezaNoch keine Bewertungen

- September 26 2023 1Dokument4 SeitenSeptember 26 2023 1Aubrey DacerNoch keine Bewertungen

- North South University: ID# 213 1035 642 DegreeDokument1 SeiteNorth South University: ID# 213 1035 642 DegreeTihum KabirNoch keine Bewertungen

- City College of Tagaytay: Republic of The PhilippinesDokument5 SeitenCity College of Tagaytay: Republic of The PhilippinesJeff Jeremiah PereaNoch keine Bewertungen

- Mechanical Engineering ResumeDokument2 SeitenMechanical Engineering ResumeShivaraj K YadavNoch keine Bewertungen

- Project Planning Putting It All TogetherDokument25 SeitenProject Planning Putting It All TogetherPedro Carranza Matamoros100% (1)

- Machine Learning (15Cs73) : Text Book Tom M. Mitchell, Machine Learning, India Edition 2013, Mcgraw HillDokument78 SeitenMachine Learning (15Cs73) : Text Book Tom M. Mitchell, Machine Learning, India Edition 2013, Mcgraw HillSamba Shiva Reddy.g ShivaNoch keine Bewertungen

- Hausa Literature 1Dokument10 SeitenHausa Literature 1Mubarak BichiNoch keine Bewertungen

- PISA2018 Results: PhilippinesDokument12 SeitenPISA2018 Results: PhilippinesRichie YapNoch keine Bewertungen

- Korean SourcesDokument6 SeitenKorean Sourcesgodoydelarosa2244Noch keine Bewertungen

- AchievementsDokument4 SeitenAchievementsapi-200331452Noch keine Bewertungen

- Resume Elizabeth PretzerDokument3 SeitenResume Elizabeth Pretzerapi-532076550Noch keine Bewertungen

- Chapter - Iv Data Analysis and InterpretationDokument20 SeitenChapter - Iv Data Analysis and InterpretationMubeenNoch keine Bewertungen

- Self-Diagnosis Table: Behavior Yes No X X X X X X X X X XDokument2 SeitenSelf-Diagnosis Table: Behavior Yes No X X X X X X X X X XCarmen Maria CordovaNoch keine Bewertungen

- BMI W HFA STA. CRUZ ES 2022 2023Dokument105 SeitenBMI W HFA STA. CRUZ ES 2022 2023Dang-dang QueNoch keine Bewertungen