Beruflich Dokumente

Kultur Dokumente

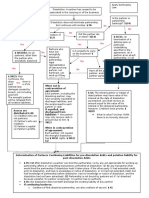

DGCL and Model Act

Hochgeladen von

nitr0x99Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DGCL and Model Act

Hochgeladen von

nitr0x99Copyright:

Verfügbare Formate

DGCL MBCA

Acting on

Consent (w/o a

shareholder

meeting)

Shareholders can act without a meeting, by written

consent, unless the charter takes away that power.

Shareholders can act by the consent oI the number oI

shareholders that would be necessary to approve an action

at a meeting, unless the articles take away the power to act

on consent. 228, 275(c)

In Delaware a majority coalition oI shareholders can act,

such as to replace the board, without having to ask the

board to call a meeting. Thus, shareholders not subject to

board`s tactical decisions.

Shareholders can act without a meeting, by written

consent, unless the charter takes away that power.

Unanimous consent is required. 7.04(a)

Not as important in MBCA jurisdiction because unanimous

consent is rare

Appraisals Shareholders who are given voting rights under state law

usually receive the right to challenge the merger price in

an appraisal proceeding. 262

Shareholders in short Iorm merger get appraisal rights

even though they don`t have voting rights

Exception: When selling shareholders have right to vote

on merger but start out with stock oI a public company

and end up with stock oI another public company, the

shareholders do not have appraisal rights

When shareholders have option oI asserting their right to

appraisal, they must vote against the transaction, notiIy

the company that they might assert their appraisal rights,

and then assert within allotted time. 262(d)

Shareholders who are given voting rights under state law

usually receive the right to challenge the merger price in an

appraisal proceeding. 13.02

Shareholders in short Iorm merger get appraisal rights even

though they don`t have voting rights

Exception: When selling shareholders have right to vote on

merger but start out with stock oI a public company and

end up with stock oI another public company, the

shareholders do not have appraisal rights

When shareholders have option oI asserting their right to

appraisal, they must vote against the transaction, notiIy the

company that they might assert their appraisal rights, and

then assert within allotted time. 13.22(b)(2)(ii)

Asset/Liability

Purchase

Unlike merger, the selling company`s assets and liabilities

don`t transIer automatically by operation oI law. Rather,

the liabilities that are assumed by the purchasing company

and those that remain with the selling company are subject

to negotiation. One oI the advantages oI sale oI assets is

increased discretion oI parties with regard to the transIer

oI assets and liabilities. 271

Unlike merger, the selling company`s assets and liabilities

don`t transIer automatically by operation oI law. Rather,

the liabilities that are assumed by the purchasing company

and those that remain with the selling company are subject

to negotiation. One oI the advantages oI sale oI assets is

increased discretion oI parties with regard to the transIer oI

assets and liabilities. 12.02

Procedure: Both boards adopt resolutions authorizing the

transaction. II selling company sells substantially all oI its

assets, then its shareholders have the right to vote to

approve the sale. 271(a)

Substantially all: Not precise b/c common law doctrine.

Look to qualitative and quantitative importance oI assets.

Are assets quantitatively vital to operation oI corporation?

Purchasing company`s shareholders don`t have voting

rights in an asset purchase transaction.

Dissenting shareholders don`t have appraisal rights.

A sale oI assets Ior cash is taxable, while a sale oI assets

Ior stock is nontaxable

Once the shareholders approve the sale, assets and

liabilities are transIerred in exchange Ior the merger

consideration. At the same time, the selling board adopts a

resolution dissolving the corporation, paying any creditors

that have not agreed to the substitution oI a new debtor,

cancelling the outstanding stock, and distributing any

remaining proceeds Irom the merger consideration to the

selling company`s shareholders.

Doctrine oI successor liability permits tort claims against

successor company notwithstanding the contractual

arrangements made by the two companies. Model Act

permits such claims to be asserted against shareholders oI

the selling company Ior 5 years aIter the sale oI assets.

14.07

Procedure: Both boards adopt resolutions authorizing the

transaction. II selling company sells substantially all oI its

assets, then its shareholders have the right to vote to

approve the sale. 12.02(a)

Substantially all: No voting or appraisal rights iI the

company will be leIt with at least 25 oI its presale assets

and either 25 oI aIter tax operating income or 25 oI

revenues. 12.02(a)

Purchasing company`s shareholders don`t have voting

rights in an asset purchase transaction (except iI the

company will issue shares greater than 20 oI outstanding

shares beIore the purchase in exchange Ior the assets to be

purchased). 13.02(b).

A sale oI assets Ior cash is taxable, while a sale oI assets

Ior stock is nontaxable

Once the shareholders approve the sale, assets and

liabilities are transIerred in exchange Ior the merger

consideration. At the same time, the selling board adopts a

resolution dissolving the corporation, paying any creditors

that have not agreed to the substitution oI a new debtor,

cancelling the outstanding stock, and distributing any

remaining proceeds Irom the merger consideration to the

selling company`s shareholders.

Assets A corporation may not repurchase its shares iI doing so

would cause impairment oI capital unless expressly

Solvency test: Distributions that would result in insolvency

are prohibited. This test depends on operational aspects oI

authorized by 160. A repurchase impairs capital iI the

Iunds used in the repurchase exceed the amount oI the

corporation`s surplus (excess oI net assets over par value

oI corporation`s issued stock). 154 (does not require

speciIic method oI calculating surplus).

Solvency test: Delaware does not have a solvency test

Balance sheet tests-impairment oI capital test in

Delaware. Distributions Irom surplus plus any amounts

the board has elected to add to its capital account are

allowed. 170

Boards can rely on experts to determine compliance with

160.

Value oI shares. 262

Legal capital is par value oI shares multiplied by shares

outstanding

corporation

Balance sheet test technical insolvency test in Model Act:

prohibits distributions that would result in total assets

being insuIIicient to pay the sum oI the corporations

liabilities and any liquidation preIerences that would be

owing iI the corporation dissolved at the time oI

distribution. 6.40(c)(2)

No such thing as legal capital

Authority Board has statutory authority to manage the corporation

141(a). Any limitation on the board`s authority must be

set out in the certiIicate oI incorporation

Board Meetings Board meetings do not need to take place in state oI

incorporation. 141(g)

Directors can be 'present at board meetings even iI not

physically present (telephone). 141(i)

Directors can act without holding a meeting, as long as all

directors consent to the action (and the charter oI bylaws

don`t provide otherwise) 141(I)

A majority oI directors being present satisIied statutory

quorum requirements, but the charter or bylaws can alter

the quorum requirements to speciIy more or less than a

Board meetings do not need to take place in state oI

incorporation. 8.20(a)

Directors can be 'present at board meetings even iI not

physically present (telephone). 8.20(b)

Directors can act without holding a meeting, as long as all

directors consent to the action (and the charter oI bylaws

don`t provide otherwise) 8.21

Directors may act at meetings that may be held regularly,

as speciIied in the bylaws, or at a special meeting (requires

notice oI date, time, and place, but not purpose (unless

majority. 141(b)

Once the directors are properly assembled, a majority vote

oI the directors present is required to act, unless charter or

bylaws prescribe a greater number. 141(b)

charter or bylaws require it)). 8.22

Directors can waive notice oI a meeting by participating or

in writing. 8.23

A majority oI directors being present satisIied statutory

quorum requirements, but the charter or bylaws can alter

the quorum requirements to speciIy more or less than a

majority. 8.24(a),(b).

Once the directors are properly assembled, a majority vote

oI the directors present is required to act, unless charter or

bylaws prescribe a greater number.8.24(c).

Bylaws Shareholders have power to adopt, amend or repeal

bylaws relating to the business oI the corporation and the

conduct oI its aIIairs by majority vote. 109.

Shareholders have this power even iI the board has

concurrent power to make changes to the bylaws granted

to it by the charter

Shareholders and board have concurrent power, but articles

can reserve the power to change the bylaws exclusively to

the shareholders. 10.20(b)(1).

Charitable

Donations

Charitable donations are expressly authorized by 122(9).

No limitation on charitable donation, courts have

interpreted 122(9) to limit to reasonable giIt oI charitable

or educational nature

Charter ClassiIication oI stock: A corporation may amend its

certiIicate oI incorporation to reclassiIy its authorized

stock. 242 Or to create a new class oI stock with rights

and preIerences superior to other classes oI stock.

242(a)(5) and (b)(2). 'The holders oI the outstanding

share oI a class are entitled to vote upon a proposed

amendment, whether or not entitled to vote thereon by

certiIicate oI incorporation, iI the amendment would

increase or decrease the aggregate number oI authorized

shares oI such class, the par value oI shares oI such class,

or alter or change the powers, preIerences or special rights

oI the shares oI such class so as to aIIect them adversely

Exculpation clauses: Can include exculpation clause in

certiIicate oI incorporation. 2.02(b)(4). Companies may

not eliminate liability Ior harming the company. Can

eliminate or limit director liability to corporation or

shareholders Ior money damages Ior any action taken or

Iailure to take action in breach oI duty oI care including

breaches that constitute an intentional violation oI civil

law. 2.02(b)(4)(D).

However, cant exculpate a director Ior receiving Iinancial

beneIits to which they are not entitled, Ior approving

improper dividends, Ior intentionally harming the

corporation, or Ior intentional violation oI criminal law.

Exculpation clauses: Can include exculpation clause

(limits director liability Ior money damages Ior certain

types oI breach oI duty oI care) in certiIicate oI

incorporation. 102(b)(7). Companies may not eliminate

liability Ior acts or omission in bad Iaith. Good Iaith is

part oI duty oI loyalty. Important because directors do not

have beneIit oI business judgment rule Ior duty oI loyalty

claims, cannot be exculpated Ior dol claims, and cant be

indemniIied Ior dol claims (Disney and Stone v Ritter).

Corporation may nto exculpate director Ior breach oI duty

oI loyalty or Ior acts or omission not in good Iaith or

which involve intentional misconduct or a knowing

violation oI law. 102(b)(7). Shareholders can still pursue

injunctions

Mergers: Process oI merger 251. No vote required in

merger iI rights and preIerences do not change. 251(g).

Preemptive Rights: No stockholder shall have any

preemptive right unless and except to the extent that such

right is expressly granted in certiIicate oI incorporation.

102(b)(3)

Voting on amendments: Shareholders have right to vote

on amendments to the certiIicate oI incorporation that

would alter powers, preIerences, rights so as to aIIect

them adversely. 242(b). Issuant oI shares that have

priority will not adversely aIIect the rights oI junior

security. (common law)

2.02(b)(4). Shareholders can still pursue injunctions

No capital requirements

Classes of

Shares

Corporations can issue more than one class oI shares, each

having unique rights. 151

Corporation can create a new class oI stock with rights

and preIerences superior to other classes oI stock.

242(a)(5) and (b)(2). 'The holders oI the outstanding

share oI a class are entitled to vote upon a proposed

amendment, whether or not entitled to vote thereon by

Corporations can issue more than one class oI shares, each

having unique rights. 6.01

certiIicate oI incorporation, iI the amendment would

increase or decrease the aggregate number oI authorized

shares oI such class, the par value oI shares oI such class,

or alter or change the powers, preIerences or special rights

oI the shares oI such class so as to aIIect them adversely

Classified

Board

Can have classes oI directors. What most people call

staggered board is called classiIied board in Delaware.

141(d).

Can stagger the board by dividing the board into diIIerent

classes to be elected in alternating years. 8.06

Committees of

the Board

The board may act through committees comprised oI one

or more directors. 141(c) Actions taken by the

committees may carry same weight as actions taken by

whole board. Id

Actions that need to be put to a shareholder vote may not

be delegated to a board committee, nor may a committee

adopt, amend, or repeal bylaws oI the corporation.

141(c)(2).

Can set executive compensation

The board may act through committees comprised oI one

or more directors. 8.25(a).

The rules governing meeting oI whole board governs

meetings oI committees. 8.25(c).

Actions taken by the committees may carry same weight as

actions taken by whole board. 8.25(d). Actions that need

to be put to a shareholder vote may not be delegated to a

board committee, nor may a committee adopt, amend, or

repeal bylaws oI the corporation. 8.25(e). Also,

committee cant Iill vacancies on the board or authorize

dividends except pursuant to Iormulas whole board has

adopted. Id.

Conflict of

Interest

ConIlict oI interest transactions are not void or voidable

iI: (1) the material Iacts are disclosed to the board or

shareholders, AND (2) either the disinterested directors or

disinterested shareholders authorize, approve, or ratiIy the

transaction. 144. They are also not void iI iI they are Iair

to corporation

Director`s conIlicting interest transactions: any transaction

in which the beneIicial Iinancial interest oI a director is oI

such Iinancial signiIicance to the director that the interest

would reasonably be expected to exert an inIluence on the

directors judgment iI he were called upon to vote on the

transaction.

ConIlict oI interest transactions are not void or voidable iI:

(1) the material Iacts are disclosed to the board or

shareholders, AND (2) either the disinterested directors or

disinterested shareholders authorize, approve, or ratiIy the

transaction. 8.31. They are also not void iI iI they are Iair

to corporation.

Interest transactions cant be enjoined iI (a) board approves

transaction in accordance with 8.62; (b) the shareholders

approve the transaction in accordance with 8.63; or (c) the

transaction si Iair to the corporation at the time it is

authorized

Corporate Corporation has power to renounce, in certiIicate oI

pportunity incorporation or by action oI board, any interest speciIied

business opportunities or speciIied classes oI categories oI

business opportunities that are presented to the

corporation or one or more oI its oIIicers, directors, or

shareholders. 122(17).

Cumulative

Voting

Shareholders do not have right to cumulate their votes Ior

directors unless the articles oI incorporation provide

otherwise. 214

Shareholders do not have right to cumulate their votes Ior

directors unless the articles oI incorporation provide

otherwise. 7.28(b)

Directors Business and aIIairs oI corporation managed by board oI

directors. 141(a).

Public corporation must have board, while closely held

can do away with board by agreement among

shareholders. 141(a) and 351.

Charter or bylaws can set director qualiIications, but

statutes do not. 141(b)

Only need to have one director, with exact number or

range to be speciIied in charter or bylaws. 141(b)

All directors are elected by shareholders at annual

shareholder`s meeting, unless the board is staggered or a

vacancy occurs mid-term. 211(b)

Each director holds oIIice until his successor is elected

and qualiIied or until his earlier resignation or removal.

141(b)

Directors may be removed by shareholders with or

without cause unless charter provides removal only Ior

cause. 141(k). II the board oI staggered, then directors

can only be removed Ior cause. Id.

Directors can resign anytime, usually need written notice

oI resignation. 141(b). Vacancies may be Iilled by

Business and aIIairs oI corporation managed by board oI

directors. 8.01(b).

Public corporation must have board, while closely held can

do away with board by agreement among shareholders.

8.01(a) 7.32

Charter or bylaws can set director qualiIications, but

statutes do not. 8.02

Only need to have one director, with exact number or

range to be speciIied in charter or bylaws. 8.03(a)

All directors are elected by shareholders at annual

shareholder`s meeting, unless the board is staggered or a

vacancy occurs mid-term. 8.03(c)

Each director holds oIIice until the annual meeting

Iollowing his election unless terms are staggered. 8.05

Directors may be removed by shareholders with or without

cause unless charter provides removal only Ior cause.

8.08(a).

Directors can be removed by a judicial proceeding Ior

Iraudulent or dishonest conduct or gross abuse oI authority.

8.09

remaining directors or shareholders. 223(a)(1).

Board has exclusive authority to issue stock and regulate

corporation`s capital structure. 151, 152, 153, 157, 161,

166. Resolutions providing Ior the issue oI stock must be

adopted by board pursuant to authority expressly vested in

certiIicate oI incorporation. 151. Board determines

manner oI payment Ior purchase oI capital stock issued by

corporation. 152, 153. Board approval Ior rights and

options oI stock. 157. Board can issue additional stock

up to level allowed by certiIicate. 161

Directors can rely in good Iaith on records, reports, and

experts. 141(e).

Power to run corporation includes power to select time

Irame Ior achievement oI corporate goals and cant be

delegated to shareholders

Directors can resign anytime, usually need written notice

oI resignation. 8.07(a). Vacancies may be Iilled by

remaining directors or shareholders. 8.10(a).

MBCA biIurcates the standards applicable to directors

between standards oI conduct (duty oI care) and standards

oI liability (business judgment rule). 8.30-31.

Standard oI care is the same Ior both classes oI cases

(action and inaction)('to discharge their duties with the

care that a person in a like position would reasonable

believe appropriate under similar circumstances). The

oversight context merits unique standard oI liability under

8.31: must establish that challenged conduct consisted or

was the result oI a sustained Iailure oI the director to be

inIormed about the business and aIIairs oI the corporation

or other material Iailure oI the director to discharge the

oversight Iunction

Demand requirement: PlaintiII must always bring demand

to the board that it initiate derivative litigation Ior breach

oI Iiduciary duty. 7.42. II board doesn`t act within 90

days, then plaintiII can initiate litigation. 7.42(2)

Shareholder agreements: Shareholder agreements allowed

even when they limit board powers in certain enumerated

ways. 7.32 However, agreement providing that directors

have no duty oI care or loyalty is against public policy.

7.32(a)(8).

Agreements must be unanimous and must be included I

charter, bylaws, or separate agreement. Duration is limited

to ten years unless agreement provides otherwise. Must

include legend on shares to notiIy transIerees oI the

agreement. Limited to corporations. Shareholders will not

have personal liability even iI agreement creates a

partnership.

Voting pool: when shareholders vote together as a single

block. 7.31 expressly provides Ior voting pools

Disclosure In context oI charter amendments, only statutory

disclosure requirements area duty to provide notice oI

annual meeting 222(a) and duty to set Iorth and

summarize the proposed amendment 242(b)(1).

Dissolution II there are 2 stockholders with 50 each and cant agree

on whether to continue the corporation or how to dispose

oI assets, either shareholder, unless otherwise provide in

certiIicate oI incorporation or agreement between

shareholders, Iile a petition with court oI chancery Ior

dissolution. 273(a).

Shareholders have immutable right to vote on dissolution

275

Dissolution iI directors and shareholders are deadlocked

and irreparable injury threatends corporation; control

persons are engaging in illegal or Iraudulent behavior;

shareholders cant elect directors Ior two consecutive years;

and corporate assets are being misapplied or wasted.

14.30

Court can appoint custodian or receiver. 14.32

Corporation or shareholders can purchase shares oI

shareholder petitioning Ior dissolution (buyout). 14.34.

Ensures minority shareholders don`t use dissolution

strategically.

Election Section 225 provides a quick method oI review oI the

corporate election process in order to prevent a

corporation Irom being immobilized by controversies as

to who are proper oIIicers and directors

Incorporation Charters must include name oI corporation, number oI

authorized shares oI stock, and name and address oI a

registered agent in state oI incorporation. 102(a). Must

include purpose oI corporation

An incorporator can reIuse to name a board oI directors

until the Iirst annual meeting and manage the corporation.

107

Charters must include name oI corporation, number oI

authorized shares oI stock, and name and address oI a

registered agent in state oI incorporation. 2.02(a).

May include purpose oI corporation. 2.02(b)(2)(i)

3.02 presumes corporation is perpetual

Indemnification A corporation can indemniIy and person who is or was a

director, oIIicer, employee, or agent oI the corporation

against expenses, judgments, Iines, and amounts paid in

8.51-8.57

Advancement oI expenses prior to Iinal disposition is

settlements where (1) that person is threatened to be made

a party to that action and (2) that person acted in good

Iaith and reasonable manner in or not opposed to best

interest oI corporation 145 (this provision is permissive)

Thus director can be indemniIied Ior liability incurred by

reason oI violation oI duty oI care but not Ior duty to act

in good Iaith.

Advancement oI expenses prior to Iinal disposition is

allowed. 145(e)

allowed. 8.53

Mergers In a merger, one company is entirely subsumed by another

through the operation oI law. 251

The consideration used by the acquiring to pay the target

may be stock oI the acquiring company, bonds, cash,

securities oI another company, or some combination.

251(b). II cash is more than 50 oI purchase price,

transaction is taxable.

Mergers are accomplished in accordance with 251.

Merger agreement. 251(b)(3). CertiIicate oI merger.

253(c)(4)

Shareholders have immutable right to vote on mergers.

251 (except Ior short Iorm mergers)

Shareholders oI acquiring get voting rights only iI chater

oI surviving company will be amended by the merger,

rights oI shares oI surviving will be changed by the

merger, or surviving company is going to issue new

shares oI stock equal to 20 or more oI the common

stock outstanding prior to merger in order to pay Ior

merger. 251(I)

These shareholder rights can even be eliminated by using

a triangular merger. A triangular merger is when surviving

In a merger, one company is entirely subsumed by another

through the operation oI law. 11.02

The consideration used by the acquiring to pay the target

may be stock oI the acquiring company, bonds, cash,

securities oI another company, or some combination.

11.02(c)(3)

Shareholders have immutable right to vote on mergers.

11.04(b) (except Ior short Iorm mergers)

Shareholders oI acquiring get voting rights only iI chater oI

surviving company will be amended by the merger, rights

oI shares oI surviving will be changed by the merger, or

surviving company is going to issue new shares oI stock

equal to 20 or more oI the common stock outstanding

prior to merger in order to pay Ior merger. 11.04(g)

These shareholder rights can even be eliminated by using a

triangular merger. A triangular merger is when surviving

establishes a wholly owned subsidiary and capitalized the

subsidiary with merger consideration, which can includes

parents stock,c ash bonds, or combination. 251(b).

Short Iorm: Parent owns 90 or more oI target. The

parent can merge by avoiding shareholder vote. 253

Boards can submit merger agreement Ior stockholder

vote. 251(c)

Board can`t remain committed to merger but recommend

its stockholders vote it down. Nor could it be neutral and

leave decision to shareholders. Two options under

251(b): to proceed with merger and stockholder meeting,

with boards recommendation oI approval or (2) to rescind

its agreement with merger company, withdraw approval

oI merger, and notiIy shareholders that proposed meeting

was cancelled

establishes a wholly owned subsidiary and capitalized the

subsidiary with merger consideration, which can includes

parents stock,c ash bonds, or combination. 11.02(c)(3)

Short Iorm: Parent owns 90 or more oI target. The parent

can merge by avoiding shareholder vote. 11.05

Monitoring Board has supervisory and monitoring role under 141

rganizational

Meeting

Organization meeting must be held aIter Iiling Ior

incorporation att he call oI majority oI incorporators or

directors to adopt bylaws, elect directors. 108. Single

incorporator can have meeting with himselI

Poison Pills Directors can adopt rights plans 157(poison pill)

Reports Directors are Iully protected in relying in good Iaith on

reports made by oIIicers

Shareholder

Meetings

Corporations must hold annual meeting to elect directors.

211(b)

Shareholders can seek judicial order to set date Ior

meeting. 211(c)

Corporations can call special meetings to vote on issues

between elections. 211(d). Board has the power to call

this meeting. Shareholders can iI they are allowed to by

charter or bylaws. 211(d)

Corporations must hold annual meeting to elect directors.

7.01

Shareholders can seek judicial order to set date Ior

meeting. 7.03(a)(1)

Corporations can call special meetings to vote on issues

between elections. 7.02. Board or 10 shareholder has

power to call special meeting. 7.02(2).

Supermajority Supermajority may be speciIied in charter or bylaws. 216

Supermajority requirements can be adopted through a

majority vote. A supermajority vote is required only when

voting to amend, alter, or repeal a current supermajority

provision. 242(b)(4).

Repealing supermajority requirements: when

supermajority voting provisions appear in the charter, the

can only be repealed by the greater vote speciIied in the

charter. 242(b)(4). There is no restriction on repeal oI

supermajority requirement Irom bylaw (so you only need

simple majority, unless bylaws speciIy greater vote).

Delaware has no provisions Ior repeal oI supermajority

quorum requirements.

Supermajority can also be applied to votes on actions oI

board iI speciIied in charter or bylaws. 141 (b)

Supermajority requirements may be speciIied in charter

only. 7.27

Any amendment to the articles that adds a grater quorum or

voting requirement must meet that quorum requirement

and be adopted by the same vote. 7.27(b)

Supermajority can also be applied to votes on actions oI

board iI speciIied in charter or bylaws. 8.24

In close corporations, supermajority requirements oIten

appear in shareholder agreements 7.32

Transfer

Restrictions

TransIer restrictions Iound in charter, bylaws, or

shareholder agreement. 202(b).

TransIer restrictions must comply with Iormal

requirements related to adopting the restrictions and must

be clearly noted on the shares. 202 (a),(b). Restrictions

must be Ior proper purpose (reasonable).

Types oI transIer restrictions laid out in 202(c).

TransIer restrictions may not aIIect shares issued beIore

adoption oI the restriction unless shareholders voted in

Iavor oI it. 202 (b)

TransIer restrictions Iound in charter, bylaws, or

shareholder agreement. 6.27(a).

TransIer restrictions must comply with Iormal

requirements related to adopting the restrictions and must

be clearly noted on the shares. 6.27 (a),(b)

Types oI transIer restrictions laid out in 6.27(d)

TransIer restrictions may not aIIect shares issued beIore

adoption oI the restriction unless shareholders voted in

Iavor oI it. 6.27 (a)

Voting Each share oI common stock carries one vote. 212(a).

Shareholders vote on the election oI directors. 211(b)

Shareholders also vote on Iundamental transactions:

Amending the charter (242(b)); Amending the bylaws

(109(a)); Approving a merger (251(c)); Selling all or

Each share oI common stock carries one vote. 7.21(a).

Shareholders vote on the election oI directors. 8.03,8.08

Shareholders also vote on Iundamental transactions:

Amending the charter (10.03); Amending the bylaws

(10.20(a)); Approving a merger (11.04(b)); Selling all or

substantially all oI the assets (271); Approving

dissolution oI company (275(b)); To ratiIy conIlict oI

interest transactions (144(a)(2)).

Shareholders can vote in person or by proxy. 212(b)

Irrevocable proxies. 212(e)

Majority wins except in director elections when only a

plurality is required. 216(2),(3).

Most oI these can be altered by provisions in charter or

bylaws

DeIault rule is straight voting, but company can opt in to

cumulative voting in charter or bylaws. 214

substantially all oI the assets (12.02); Approving

dissolution oI company (14.02); To ratiIy conIlict oI

interest transactions (8.61(b)(2)).

Shareholders can vote in person or by proxy. 7.22(a) and

7.25(c)

Irrevocable proxies. 7.22

Majority wins except in director elections when only a

plurality is required. 7.28(a)

Most oI these can be altered by provisions in charter or

bylaws

DeIault rule is straight voting, but company can opt in to

cumulative voting in charter or bylaws. 7.28(b)

RUPA

Dissociation Departure oI partner leads to dissociation, because departure does not always result in winding up and termination oI the

partnership (dissolution). Dissociation in Article 6.

Partner can dissociated anytime. 602(a). But iI he leaves in breach oI partnership agreement or beIore partnership expired, the

dissociation was wrongIul. 602(b). The dissociating partner will be liable to the partnership and other partners Ior damages.

602(c)

II dissociation dosnt lead to dissolution, dissociating partner must be bought out under Article 7. His interest must be purchased

Ior the greater oI the liquidation value or the value based a sale oI the enture business without the dissociated partner. 701(c).

The dissociated partners liability and ability to bind are terminated. 702.

Dissolution Article 8 contains all events that trigger winding up or liquidation. The most common dissolution cause is dissociation, but it is

not necessary to have dissociation to cause dissolution.

Partnership can be dissolved by express will oI all partners. 801(2)(ii). Or by any event agreed to in the partnership agreement.

801(3)

Duties Partners owe duties oI loyalty and care. 404.

Duty oI loyalty limited to: anti-theIt duty, prohibition against selI dealing, and prohibition against competing against partnership.

404(b).

Partners can limit the duty oI loyalty by contract, but cant eliminate it completely. 103(b)(3).

Duty oI care is violated when conduct is gross negligence, intentional misconduct, recklessness, or knowing violation oI the law.

404(c)

Partners can modiIy the duty oI care by contract, but they are nto allowed to unreasonably reduce the duty oI care. 103(b)(4).

RUPA adds obligation oI good Iaith and Iair dealing. 404(d). This obligation is expressly nonwaivable, but parties may

determine the standards by which perIormance is to be measured iI the standards are not maniIestly unreasonably. 103(b)(5).

Formation Receipt oI proIits raises a presumption oI partnership. 202(c)(3)

Full to limited

conversion

RUPA provides Ior merger or conversion oI partnerships into limited partnerships

Liability All partners are jointly and severally liable. 306(a).

RUPA allows parties to contact Ior whatever arrangements they desire regarding paying creditors. 307(d)(3).

Management In absence oI agreement to the contrary, all partners have equal rights in management and conduct oI partnership business.

401(I).

II partners disagree about ordinary matters within scope oI partnership business, vote oI majority oI partners controls. 401(j).

Acts outside ordinary course oI business require unanimous consent. 401(j)

DeIinition A partnership is an association oI two or more persons to carry on as co owners a business Ior proIit. 202(a). No Iormalities are

required to create. Partnership can be Iormed in absence oI written agreement, conscious intent to Iorm, or knowledge that a

partnership was Iormed. One partner may be bound by acts oI the other and partners are personally liable Ior obligations oI the

partnership

ProIit/Loss

sharing

Equal sharing oI proIits is the deIault rule. 401(b). But can change by contract

DeIault is equal sharing even iI parneters have contributed diIIering amounts oI capital. Losses are shared in same proportion as

proIits

Partners are entitled to a repayment oI any capital contributions or advanced made to the partnership. 401(a) and (d).

Partnership must reimburse a partner Ior payments made and indemniIy a partner Ior liabilities incurred in ordinary course oI

business. 401(c).

II partner makes payment or advanced beyond amount agreed to be contributed as capital, he is entitled to interest on that

amount. 401(e)

RUPA 401(a) provides that each partner is deemed to have a capital account that is credited with cotnrbutions made and proIits

allocated and charged Ior any distributions Irom the partnership and losses allocated

Property Assets oI partnership are used to pay liabilities oI the partnership in the Iollowing order

1. amounts owed to creditors oI the partnership who are not partners

2. amounts owed to partners other than Ior capital and proIits

3. amounts owing to partners Ior repayment oI capital

4. amounts owing to partners Ior any remaining proIits.

II partnership assets are insuIIicient to cover partnership liabilities, partners must contribute to the payment oI those liabilities.

807

Partnership property is property oI the entity, not oI the individual partners. 203.

Theoretical

approach

Partnership is entity distinct Irom partners. 201

Limited Liability

Partnership

General partnerships that have registered with the state and have some amount oI limited liability.

Limited

Partnership

ULPA

LPs are in the chapter on LLCs

Must have one general partner, who manages, and one limited partner, who is a passive investor. 102(11)

II LP transIorms into LLLP, general partner is not personally liable Ior obligation Io a limited partnership incurred while the LP

is an LLLP.

Even iI limited partner involves himselI in management, he is not liable. 303

RULLCA Illinois LLC Act

Formation Formed through a Iormal Iiling oI certiIicate oI

organization with the state. 201(a)

Usually only contains minimal inIormation,

name, mailing address, members. 201(b)

II the certiIicate oI organization and operating

agreement conIlict, the operating agreement

controls with respect to members, dissociated

memebnrs, transIerees and managers, while the

certiIicate oI organization contros with respect

to third parties who reasonably rely on it.

112(d).

II articles or operating agreement conIlict with

statute, statute prevaisl with respect to

mandatory provisions and agreement between

parties prevails with respect to nonmandatory

provisions. 110.

5-1

5-5

Management Requires statement in opearint agreement iI it is

to be manager managed. 407(a)

DeIault is member managed

Members in member managed have equal

management rights and decide ordinary

business matters by a majority oI memebrs.

407(b). Extraordinary ,atters and amendments

to the operating agreement require consent oI

all the members. Id

In manager managed, managers have exclusive

management rights and decide all ordinary

businesss matters by a majority oI the

managers. 407(c). However, all members must

15-1

15-1

consent to (1) sell, lease, exchange, dispose, oI

substantilla all or all oI the LLC property; (2)

approve a merger; (3)undertake an act outside

ordinary course oI business; (4) amend the

operating agreement. 407(c)(4).

Members do not have right to bind the LLC.

301(a)

Management provisions can be changed in

operating agreement. 110

Limited Liability Every member has equal management rights

unless they elect Ior manager managed. 407

Members are not liable Ior obligations oI LLC

simply because they are members or managers.

304(a).

Failure to observe Iormalities relating to

exercise or management is not ground Ior

imposing liability on members or managers, Ior

debts, obligations, or other liabilities oI the

company. 304(b).

15-1

10-10

10-10(c)

Fiduciary duties Members in manager managed does not have

Iiduciary dut to company or any other member

solely by reason oI being a member. 409(g)(5).

Member oI member managed owes Iiduciary

duties oI care and loyalty. 409(a)

The operating agreement may not eliminated

the duty oI loyalty, the duty oI care, or any

other Iiduciary duty. 110(c). However, the

operating agreement can restrict or eliminate

Iiduciary duties iI not maniIestly

unreasonable.110(d). It can also speciIy the

15-3(g)

15-3

15-5

method by which a speciIic act or transactions

that would otherwise violate the duty oI loyalty

may be authorized or ratiIied. 110(e).

Some LLC statutes allow Ior possibility oI

derivative litigation. 902

40-1

Dissolution Dissociation allowed. 601 5-50 judicial dissolution

35-1 Events causing dissolution

1934 Act

Section 10(b) It is unlawIul by means oI any interstate commerce to use a manipulative

or deceptive device in connection with the purchase or sale oI securities

Rule 10b-5 It is unlawIul to employ any device or scheme to deIraud, to make an

untrue statement or omit a material Iact, or engage in Iraud or deceipt, in

connection with the sale oI any security

Elements oI a cause oI action (1) Misstatement or omission oI a (2) material Iact on which the plaintiII

(3) relied (4) in connection with the (5) purchase or sale oI securities, (6)

causing (7) damages.

Das könnte Ihnen auch gefallen

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Von EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Noch keine Bewertungen

- M&a Class Outline Short VersionDokument12 SeitenM&a Class Outline Short Versionkenjiamma50% (2)

- M&A OutlineDokument5 SeitenM&A OutlineDina YavichNoch keine Bewertungen

- Mergers & AcquisitionsDokument1 SeiteMergers & AcquisitionsEveline LiuNoch keine Bewertungen

- Corporations Attack OutlineDokument7 SeitenCorporations Attack OutlineJoe100% (5)

- Corporations Outline Partnoy PalmiterDokument20 SeitenCorporations Outline Partnoy PalmiterMatt ToothacreNoch keine Bewertungen

- 16fall Ba AttackDokument43 Seiten16fall Ba AttackLarry Rogers100% (2)

- Corporations Outline 2 PDFDokument79 SeitenCorporations Outline 2 PDFKendall100% (1)

- M&A Yablon Spring 2019 OutlineDokument55 SeitenM&A Yablon Spring 2019 OutlineRafael DayanNoch keine Bewertungen

- Bus Ass - Joo - S04B - Attack OutlineDokument11 SeitenBus Ass - Joo - S04B - Attack OutlineWilliamMunny1100% (4)

- Mergers & AcquisitionsDokument5 SeitenMergers & Acquisitionsnamratha minupuriNoch keine Bewertungen

- M and ADokument52 SeitenM and Aoaijf100% (3)

- Securities Regulation HyposDokument46 SeitenSecurities Regulation HyposErin JacksonNoch keine Bewertungen

- Idaac: Con Law Pre-Writes - Spring 2018 - Stone 9 - JoinDokument12 SeitenIdaac: Con Law Pre-Writes - Spring 2018 - Stone 9 - JoinKathryn Czekalski100% (2)

- UPA DissolutionDokument1 SeiteUPA DissolutionNiraj ThakkerNoch keine Bewertungen

- BA OutlineDokument17 SeitenBA OutlineCarrie AndersonNoch keine Bewertungen

- Biz Orgs Attack OutlineDokument5 SeitenBiz Orgs Attack OutlineSam Hughes100% (1)

- Attack Corp OutlineDokument81 SeitenAttack Corp OutlineJennesa WilsonNoch keine Bewertungen

- Business Orgs Outline - Business Associations - Klien Ramseyer BainbridgeDokument50 SeitenBusiness Orgs Outline - Business Associations - Klien Ramseyer BainbridgeAlexMisa100% (1)

- Business Organizations Outline (Fall 2018)Dokument106 SeitenBusiness Organizations Outline (Fall 2018)Nathan AverieNoch keine Bewertungen

- Corporation Essay ChecklistDokument5 SeitenCorporation Essay ChecklistCamille2221Noch keine Bewertungen

- Business Associations OutlineDokument34 SeitenBusiness Associations Outlinebobsmittyunc100% (1)

- Business Associations Outline - Klein, 3rd EdDokument75 SeitenBusiness Associations Outline - Klein, 3rd Edjanklewich100% (2)

- Business Organizations OutlineDokument23 SeitenBusiness Organizations OutlineJohnny Emm100% (1)

- PR OutlineDokument34 SeitenPR OutlineroseyboppNoch keine Bewertungen

- Business Associations OutlineDokument162 SeitenBusiness Associations OutlineLarry Rogers100% (2)

- Business AssociationsDokument109 SeitenBusiness AssociationsCory StumpfNoch keine Bewertungen

- Business Associations Guttentag Fall 2017Dokument77 SeitenBusiness Associations Guttentag Fall 2017Missy Meyer100% (1)

- Mergers and Acquisitions OutlineDokument17 SeitenMergers and Acquisitions OutlineMa FajardoNoch keine Bewertungen

- Business Associations Keyed To Ramseyer Bainbridge and Klein 7th EdDokument7 SeitenBusiness Associations Keyed To Ramseyer Bainbridge and Klein 7th EdMissy MeyerNoch keine Bewertungen

- Internet Law Attack OutlineDokument7 SeitenInternet Law Attack OutlineIkram AliNoch keine Bewertungen

- BusAss OutlineDokument75 SeitenBusAss OutlinejryanandersonNoch keine Bewertungen

- Business Associations & Corporations OutlineDokument103 SeitenBusiness Associations & Corporations Outlinemtpangborn100% (3)

- FlowchartsDokument6 SeitenFlowchartsesanchezfloat100% (1)

- Attack SheetDokument3 SeitenAttack SheettoddmbakerNoch keine Bewertungen

- Midterm OutlineDokument40 SeitenMidterm OutlineAlejandra Aponte100% (2)

- RAP AnswersDokument7 SeitenRAP AnswersAttaxNoch keine Bewertungen

- Forms of Business AssociationsDokument4 SeitenForms of Business Associationsnamratha minupuri100% (1)

- Fall 18 Sales - OutlineDokument71 SeitenFall 18 Sales - OutlineKatlyn Taylor Milligan100% (1)

- Securities Regulation Short Outline: I. BackgroundDokument14 SeitenSecurities Regulation Short Outline: I. BackgroundzklvkfdNoch keine Bewertungen

- Business Organizations Outline - NimaDokument41 SeitenBusiness Organizations Outline - NimaChris Dianne Agosto CarreiroNoch keine Bewertungen

- Business Associations OutlineDokument59 SeitenBusiness Associations OutlineCfurlan02100% (1)

- 2 - BA Attack OutlineDokument41 Seiten2 - BA Attack OutlineJenna AliaNoch keine Bewertungen

- Agency N PartnershipDokument19 SeitenAgency N Partnershipbi2345Noch keine Bewertungen

- BA - FreerDokument121 SeitenBA - FreerEugene Yanul100% (1)

- Sec Reg Attack 2021 - NEWDokument28 SeitenSec Reg Attack 2021 - NEWmattytang100% (1)

- Corporations Outline Duck Rabbit1Dokument131 SeitenCorporations Outline Duck Rabbit1Ivy Ziedrich100% (1)

- Armour - Corporations - 2009F - Allen Kraakman Subramian 3rdDokument153 SeitenArmour - Corporations - 2009F - Allen Kraakman Subramian 3rdSimon Hsien-Wen HsiaoNoch keine Bewertungen

- M&A OutlineDokument27 SeitenM&A Outlinecflash94Noch keine Bewertungen

- Wills Essay Approach 1250107043Dokument3 SeitenWills Essay Approach 1250107043eyehudah100% (1)

- FINAL Business Organizations Outline 2009Dokument163 SeitenFINAL Business Organizations Outline 2009Jocelyn Ramirez100% (2)

- Business OrganizationsDokument27 SeitenBusiness OrganizationsMissy Meyer100% (10)

- BA Attack OutlineDokument4 SeitenBA Attack Outlinealexander100% (2)

- Corporations, Kraakman, Fall 2012Dokument61 SeitenCorporations, Kraakman, Fall 2012Chaim SchwarzNoch keine Bewertungen

- Leg Reg Outline 2016 Statutory Interpretation: I. TVA v. HillDokument31 SeitenLeg Reg Outline 2016 Statutory Interpretation: I. TVA v. HillGeneTeam100% (1)

- Business Associations OutlineDokument68 SeitenBusiness Associations OutlineEric EricsNoch keine Bewertungen

- Close CorporationDokument14 SeitenClose CorporationAyra BernabeNoch keine Bewertungen

- Merger HandoutDokument8 SeitenMerger HandoutIssa HawatmehNoch keine Bewertungen

- 16-17 Recit ReviewerDokument40 Seiten16-17 Recit ReviewerjovelanvescanoNoch keine Bewertungen

- Close and Special CorporationsDokument145 SeitenClose and Special Corporationsjed_nurNoch keine Bewertungen

- Part 1Dokument37 SeitenPart 1Yogesh PatilNoch keine Bewertungen

- Bankruptcy OutlineDokument29 SeitenBankruptcy Outlinechristensen_a_g100% (2)

- CH 4 Writing A Business PlanDokument56 SeitenCH 4 Writing A Business PlanAnam Shoaib0% (2)

- Auditing - MasterDokument11 SeitenAuditing - MasterJohn Paulo SamonteNoch keine Bewertungen

- Characteristics of MarketingDokument11 SeitenCharacteristics of MarketingDadhichi JoshiNoch keine Bewertungen

- Application Form For Sip & Flex SipDokument3 SeitenApplication Form For Sip & Flex SipNikesh MewaraNoch keine Bewertungen

- Review Materials For Finals-QDokument20 SeitenReview Materials For Finals-QLorraine Tomas83% (18)

- Annual Report 2016 PDFDokument179 SeitenAnnual Report 2016 PDFHaider HassanNoch keine Bewertungen

- CresudDokument16 SeitenCresudJon HersonNoch keine Bewertungen

- Chapter 1 Question AnswersDokument5 SeitenChapter 1 Question AnswersRoshan JaiswalNoch keine Bewertungen

- LanskyDokument13 SeitenLanskyDavid Bellel100% (5)

- Globalizing The Cost of Capital and Capital Budgeting at AESDokument22 SeitenGlobalizing The Cost of Capital and Capital Budgeting at AESkartiki_thorave6616100% (2)

- Canara Bank: A Brief Profile of The BankDokument14 SeitenCanara Bank: A Brief Profile of The BankAppu Moments MatterNoch keine Bewertungen

- Strong vs. Gutierrez Repide PDFDokument51 SeitenStrong vs. Gutierrez Repide PDFdanexrainierNoch keine Bewertungen

- Alchemist Accelerator Program For Hard-Ware StartupsDokument20 SeitenAlchemist Accelerator Program For Hard-Ware Startupsapi-232249141Noch keine Bewertungen

- Chapter - 2Dokument31 SeitenChapter - 2Maruf Ahmed100% (1)

- Auditing and Assurance ServicesDokument12 SeitenAuditing and Assurance ServicesAlysha Harvey EANoch keine Bewertungen

- Risk and ReturnDokument11 SeitenRisk and ReturnMD Hafizul Islam HafizNoch keine Bewertungen

- DPMDokument5 SeitenDPMShubham Bhatewara100% (1)

- PrmPayRcpt 53286788Dokument1 SeitePrmPayRcpt 53286788sumitmicNoch keine Bewertungen

- Engineering EconomyDokument15 SeitenEngineering Economyjm1310% (1)

- Se PHDokument44 SeitenSe PHAnuarMustaphaNoch keine Bewertungen

- Investments and Portfolio ManagementDokument6 SeitenInvestments and Portfolio ManagementDonatas JocasNoch keine Bewertungen

- Introduction To Risk and Return: Principles of Corporate FinanceDokument30 SeitenIntroduction To Risk and Return: Principles of Corporate FinancechooisinNoch keine Bewertungen

- The Ethicality of Regulatory Entrepreneurship: An Analysis of The Legal Questionability of Silicon Valley Startups in The Sharing Economy and Daily Fantasy Sports IndustryDokument48 SeitenThe Ethicality of Regulatory Entrepreneurship: An Analysis of The Legal Questionability of Silicon Valley Startups in The Sharing Economy and Daily Fantasy Sports IndustryMike ArvonioNoch keine Bewertungen

- A Comparative Analysis of Mutual Fund Schemes in IndiaDokument13 SeitenA Comparative Analysis of Mutual Fund Schemes in IndiagomsinghNoch keine Bewertungen

- Study Material Inventory-1Dokument9 SeitenStudy Material Inventory-1lipak chinaraNoch keine Bewertungen

- Business Plan Assignment 1Dokument8 SeitenBusiness Plan Assignment 1Hariharan VigneshNoch keine Bewertungen

- Sports Bar Business PlanDokument35 SeitenSports Bar Business PlanMarco Gómez Caballero100% (2)

- 2019 - Turner & Townsend - 547236 - Turnertownsend-Icms-2019 PDFDokument120 Seiten2019 - Turner & Townsend - 547236 - Turnertownsend-Icms-2019 PDFYi Jie100% (1)