Beruflich Dokumente

Kultur Dokumente

Project On Insurance Sector

Hochgeladen von

Ana Ryuuzaki Gjorgieva0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

29 Ansichten26 SeitenThe insurance industry has always recorded growth vis-a-vis other Indian industries. The General Insurance Business was nationalised aIter the promulgation oI the General Insurance Business (Nationalisation) Act, 1972. The industry has presented promising prospects Ior the coming Iuture.

Originalbeschreibung:

Originaltitel

Project on Insurance Sector

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe insurance industry has always recorded growth vis-a-vis other Indian industries. The General Insurance Business was nationalised aIter the promulgation oI the General Insurance Business (Nationalisation) Act, 1972. The industry has presented promising prospects Ior the coming Iuture.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

29 Ansichten26 SeitenProject On Insurance Sector

Hochgeladen von

Ana Ryuuzaki GjorgievaThe insurance industry has always recorded growth vis-a-vis other Indian industries. The General Insurance Business was nationalised aIter the promulgation oI the General Insurance Business (Nationalisation) Act, 1972. The industry has presented promising prospects Ior the coming Iuture.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 26

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

SECTION I: KNOWLEDGE OF THE INSURANCE INDUSTRY

INTRODUCTION

Insurance industry has always been a growth-oriented industry globally. On the Indian scene too,

the insurance industry has always recorded noticeable growth vis-a-vis other Indian industries.

The Triton General Insurance Co. Ltd. was the Iirst general insurance company to be established

in India in 1850, which was a wholly British-owned company. The Iirst general insurance

company to be set up by an Indian was Indian Mercantile Insurance Co. Ltd., which was

established in 1907. There emerged many a player on the Indian scene thereaIter.

The general insurance business was nationalised aIter the promulgation oI General Insurance

Business (Nationalisation) Act, 1972. The post-nationalisation general insurance business was

undertaken by the General Insurance Corporation oI India (GIC) and its 4 subsidiaries:

1. Oriental Insurance Company Limited;

2. New India Assurance Company Limited;

3. National Insurance Company Limited; and

4. United India Insurance Company Limited.

Towards the end oI 2000, the relation ceased to exist and the Iour companies are, at present,

operating as independent companies.

The LiIe Insurance Corporation (LIC) was established on 01.09.1956 and had been the sole

corporation to write the liIe insurance business in India.

The Indian insurance industry saw a new sun when the Insurance Regulatory & Development

Authority (IRDA) invited the applications Ior registration as insurers in August, 2000. With the

liberalisation and opening up oI the sector to private players, the industry has presented promising

prospects Ior the coming Iuture. The transition has also resulted into introduction oI ample

opportunities Ior the proIessionals including Chartered Accountants.

The Indian Insurance industry is Ieatured by the attributes:

Low market penetration;

Ever-growing middle class component in population.

Growth oI consumer movement with an increasing demand Ior better insurance products;

Inadequate application oI inIormation technology Ior business.

Adequate Iillip Irom the Government in the Iorm oI tax incentives to the insured, etc.

The industry Iormations need to keep vigil on these characteristics oI the Indian market and

Iormulate their strategies to entail maximum contribution to the output oI the sector.

The Indian liIe and non-liIe insurance business accounted Ior merely 0.42 percent oI the world's

liIe and non-liIe business in 1997. The Iigures oI the basic parameters oI the industry's

perIormance viz. Insurance Density and Insurance Penetration also are evident oI the hitherto

existing low-yield Indian market conditions.

The term "Insurance Penetration" broadly measures the contribution oI the insurance industry in

relation to a nation's entire economic productivity. The Iigure oI premium vis-a-vis the GDP oI

1999 stood at 0.54 percent Ior non-liIe insurance business and 1.39 percent Ior the liIe insurance

business. The term "Insurance Density" reIlects the Insurance purchasing power. The premium per

capita in India amounted to US $ 2.40 Ior non-liIe insurance and US $ 6.10 Ior liIe insurance in

1999 but with the deregulation oI the sector, a sea change in the scene is most likely.

The insurance sector in India has come a Iull circle Irom being an open competitive market to

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

nationalisation and back to a liberalized market again. Tracing the developments in the Indian

insurance sector reveals the 360-degree turn witnessed over a period oI almost two centuries.

A BRIEF HISTORY OF THE INSURANCE SECTOR

The business oI liIe insurance in India in its existing Iorm started in India in the year 1818 with

the establishment oI the Oriental LiIe Insurance Company in Calcutta. Some of the important

milestones in the life insurance business in India are:

1912: The Indian LiIe Assurance Companies Act enacted as the Iirst statute to regulate the liIe

insurance business.

1928: The Indian Insurance Companies Act enacted to enable the government to collect statistical

inIormation about both liIe and non-liIe insurance businesses.

1938: Earlier legislation consolidated and amended to by the Insurance Act with the objective oI

protecting the interests oI the insuring public.

1956: 245 Indian and Ioreign insurers and provident societies taken over by the central

government and nationalised. LIC Iormed by an Act oI Parliament, viz. LIC Act, 1956, with a

capital contribution oI Rs. 5 crore Irom the Government oI India. The General insurance business

in India, on the other hand, can trace its roots to the Triton Insurance Company Ltd., the Iirst

general insurance company established in the year 1850 in Calcutta by the British.

Some of the important milestones in the general insurance business in India are:

1907: The Indian Mercantile Insurance Ltd. set up, the Iirst company to transact all classes oI

general insurance business.

1957: General Insurance Council, a wing oI the Insurance Association oI India, Irames a code oI

conduct Ior ensuring Iair conduct and sound business practices.

1968: The Insurance Act amended to regulate investments and set minimum solvency margins and

the TariII Advisory Committee set up.

1972: The General Insurance Business (Nationalisation) Act, 1972 nationalised the general

insurance business in India with eIIect Irom 1 st January 1973. 107 insurers amalgamated and

grouped into Iour companies viz. the National Insurance Company Ltd., the New India Assurance

Company Ltd., the Oriental Insurance Company Ltd. and the United India Insurance Company

Ltd. GIC incorporated as a company.

STRUCTURE OF THE INSURANCE INDUSTRY

The structure oI the insurance industry comprises oI the Operating department, Administrative

department and the Iinance department. The Operating Department generally perIorms the basic

Iunctions pertaining to the designing oI products, marketing thereoI, servicing the insured, the the

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

the insured, management oI portIolio, etc. The Administrative Department looks aIter the day-to-

day aIIairs oI the company. The Finance Department backs the operations and administration oI

the company by accounting Ior the transactions, streamlining the Ilow oI Iunds, materializing the

management decisions, etc.

The Administration Department as well as the Finance Department, usually, Iunctions through in-

house setup. The Finance Department Iunctions in the areas oI accounting, Iinancial and

management reporting, budgeting and controlling, etc. and thus renders enormous scope Ior

Iinance proIessionals. The new entrants in the insurance sector are likely to call Ior the services oI

the Chartered Accountants Ior their Iinancial setup requirements. The Chartered Accountants have

engaged themselves in the audit oI Insurance Companies since long. With the transition in the

insurance sector, the horizons Ior their contribution have broadened. There has, emerged a king-

size pool oI opportunities that the Chartered Accountants can explore and apply their proIessional

wisdom and experience to.

BASIC FUNCTIONS OF THE INSURANCE INDUSTRY

1. Risk Perception and Evaluation:

The Iundamental Iunction oI an insurer is to provide a cover against the detriment caused to the

insured due to the happening oI certain speciIied and agreed events. Thus, prior to providing such

umbrella through a product, the insurer has to assess the risk involved in the transaction. The

insurer has to identiIy the element oI risk prevalent in the concerned industry or a particular unit.

The perception oI risk requires the study oI variables through various methods including the

application oI scientiIic and statistical techniques and correlation thereoI with the industry or unit

under study in light oI their basic environmental and inIra-structural characteristics. AIter the

identiIication and categorisation oI the risks perceived, the probability oI happening oI the loss-

causing events and the severity oI the loss has to be assessed.

2. Designing the Insurance Product:

On the basis oI the risks perceived, the insurer develops a product to cover the stipulated risks.

While designing an insurance product, an insurer decides its cost to be charged Irom the insured in

the Iorm oI premium, reduction thereoI in certain cases like not lodging any claim during the

previous covered period(s), suggesting the implementation oI risk-mitigating measures, etc. The

Ieatures oI a product should be Ilexible enough to provide Ior the determination oI premiums,

rebates, additional premiums, etc. depending upon the risk benchmarks as determined.

3. arketing of the Product:

The core Iunction oI the marketing Iorce oI an insurance company is to generate

awareness about the insurance products among the target market. But in the Indian

scenario, where the insurance penetration is too low as compared to the other nations, the

marketing Iorce needs to perIorm the pro-active role in developing an insurance culture.

It is through the eIIiciency oI the sales Iorce oI an insurance company that the

desirability and the success oI a product are determined.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

In Indian insurance market, the Iunction is, basically perIormed by the agents. The persons

desiring to Iunction as insurance agents have to obtain license to act as such Irom the IRDA or an

oIIicer authorised by the Authority in this behalI. The agents approach the prospective buyers and

apprise them oI the basic Ieatures oI the products. In order to dispense with the Iunctions, the

agents need to possess adequate knowledge oI the insurance industry, products and the modalities

attached therewith. Further, the marketing personnels should be adequately backed by the back-

oIIice setup.

. Selling of the Products:

The term selling in the context oI insurance industry connotes the issuance oI policies to the

applicant proposer. The non-liIe insurance policy basically embodies the covenant between the

insurer and the insured wherein the Iormer agrees to indemniIy the latter Ior the loss caused to him

on the happening oI the certain agreed events up to a speciIied limit. The liIe insurance policy

generally contains the agreement whereby the insurer agrees to pay to the insured or the

beneIiciary oI the policy an agreed amount on the expiry oI the term oI the policy or in the event

oI the death oI the insured respectively. The additional beneIits in the shape oI Riders viz.

Accidental Death BeneIit, Double Sum Assured, Critical Illness beneIits, Waiver oI Premiums,

etc. can also be appended with the policy on the payment oI an additional premium.

In Indian industry, the Iunction is, generally perIormed by the insurer. In addition, the insurance

companies depute their Direct Selling Representatives to look aIter the Iunction. They receive the

proposal documents, vet them and issue policies to the proposers.

5. anagement of Portfolio:

The management oI the portIolio includes the assessment oI requirement oI Iunds, identiIication

oI various sources oI Iinance, the evaluation oI the sources in the light oI their cost, availability,

timing, etc., reconciling the Ieatures oI various sources with the needs oI the company and the

selection oI appropriate conjunction oI sources. The insurer possesses huge amount oI Iunds,

which need proper management. The management oI the portIolio oI an insurance company

requires the identiIication oI investment avenues, evaluation thereoI and the selection oI the most

appropriate mix oI alternatives where the Iunds oI the company can be invested. The selection

requires the knowledge oI Iinance related Iunctions and techniques apart Irom the in-depth know

oI the patterns oI requirement oI Iunds in the company as well as in the industry as a whole.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

INSURANCE INDUSTRY: CLASSIFICATION

Fire Insurance Marine Insurance Mediclaim Motor Vehicle

SOE PLAYERS IN THE INDUSTRY:

Life Insurance General Insurance

Life Insurance Corporation of India. General Insurance Corporation of India.

1. Oriental Insurance Company Ltd.

2. New India Assurance Company Ltd.

3. National Insurance Company Ltd.

4. United India Insurance Company Ltd.

New Entrants

ICICI Prudential LiIe Insurance Ltd. Bajaj Alliaz General Insurance Company Ltd.

Tata AIG LiIe Insurance Corporation Ltd. Reliance General Insurance Company Ltd.

ING Vysya LiIe Insurance Corporation Ltd. Tata AIG General Insurance Company Ltd.

Om Kotak Mahindra LiIe Insurance

Corporation Ltd.

Royal Sundaram Alliance Insurance Company

Ltd.

INSURANCE

LIFE INSURANCE GENERAL INSURANCE

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

INSURANCE SERVICE: ITS USERS

The Iormulation oI creative marketing decisions is not possible unless the diIIerent categories oI

users using the services oI insurance industry are known. The general users assign due

weightage to their own interest whereas the industrial users assign an overriding priority to the

interests oI their organizations. The emerging changes in the socio-economic conditions and

governmental regulations inIluence the interests oI both the category oI users. It is against this

background that an in-depth study oI users is Iound signiIicant to the insurance industry.

An individual or an institution, a person or a group oI people availing the services is termed to

be the actual users oI the insurance industry. On the other hand both the categories oI prospects

having the potentials, bearing the willingness but not using the service right now are termed as

'potential users/prospects. The services are made available by the LiIe Insurance Corporation

oI India and the General Insurance Corporation and other private insurance companies are used

by both categories oI users.

The need and requirement can`t remain static. The business environmental conditions inIluence

the process oI change. The proIessionals engaged in servicing the insurance organizations bear

the responsibility oI understanding the changing level oI expectations oI the diIIerent categories.

USERS OF INSURANCE SERIVCE

INDIVIDUAL INSTITUTIONAL

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

SECTION II

INSURANCE POLICY: THE TOTAL PRODUCT CONCEPT

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

Theodore Levitt propounded the Total Product Concept (TPC), which implied that a product had

three levels oI Ieatures and the consumption was in totality.

LEVEL 1:

Core Product:

In the Insurance Industry the core product is the policy that provides protection to the consumers

against the risks. This is the main reason Ior which the Insurance Company is in existence. It

provides protection by way oI various riders viz. Accidental Death BeneIit, Double Sum Assured,

Critical Illness beneIits, Waiver oI Premiums, etc.

On the basis oI the risks perceived, the insurer develops a product to cover the stipulated risks.

While designing an insurance product, an insurer decides its cost to be charged Irom the insured in

the Iorm oI premium, reduction thereoI in certain cases like not lodging any claim during the

previous covered period(s), suggesting the implementation oI risk-mitigating measures, etc. The

Ieatures oI a product should be Ilexible enough to provide Ior the determination oI premiums,

rebates, additional premiums, etc. depending upon the risk benchmarks as determined.

LEVEL 2:

Formal Product:

When the customers expectations grows synchronized with increased competition the marketer

oIIers some tangibility to the existing core product to diIIerentiate itselI Irom the competitors.

1. Brand:

In order to distinguish itselI Irom the competitors, the Insurance Company gives a brand name to

its policy. This brand name gives an identity to the product (policy) oIIered by the insurance

company.

Thus ICICI Prudential LiIe Insurance has brands viz ICICI Pru Smart Kid, ICICI Pru Save n`

Protect, ICICI Pru LiIeLink, etc.

2. Attributes:

Just giving a brand name to the policy may not be enough Ior the insurance company to distinguish

its oIIerings. The product oIIering must also have attributes that will attract the consumers to take

the policy. The attributes must suit and satisIy the needs wants and desires oI the various types oI

consumers that the company is targeting at.

Thus ICICI`s investment plans suit the consumers who want to secure their Iamily through

insurance or invest money Ior growth. And its retirement plans suit the ones who want to enjoy

their Iruits oI labor aIter retirement or want to go Ior a dream vacation.

3. Instruction anual:

To make the service consumption easier Ior the consumers, the instruction manual with the policy

becomes very important. The instruction manual gives an overview to the consumers as to how to

go on with the Iilling oI the application Iorm. It also gives inIormation about the various

Iormalities that have to be adhered to at the time oI submission oI the application Iorm.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

LEVEL 3:

Augmented product:

With Iurther expectation oI the consumer again synchronized with intense competition

marketers oIIer more and more intangible Ieatures.

1. Post-sales service:

The insurance company must not consider it as the end oI the service providing the consumer

has taken once the policy. The Iunctions oI an insurance company include the provision oI

the Post-sales services to the consumer. Among the services rendered by the insurance

company is the service oI processing and release oI claims. The insurance company needs to

veriIy the accuracy oI the Iacts presented in relation to the insurance claim and the

documents produced in support thereoI.

2. Delivery points:

The delivery points can be the branches that the insurance company has at the discretion oI

the oI the consumers` location. The delivery points can also be mobilized with the presence

oI the insurance agents. The agents can cover a wide area and get in contact with the

consumers to provide the service to him.

3. Customer education and training:

The customer education and training is very important Ior the insurance company. The

agents play a vital role in this context. The customer can be educated on various beneIits that

can be accrued in his Iuture liIe by taking a policy. This is where the agents` communication

skills come into the picture. The insurance company has to play an active role in enabling the

agents to impart the best customer education through appropriate training given to the agents.

. Customer complaint management:

Customer complaints management with regards to delay in discharge oI claims must be

eIIectively handled by the insurance company to have competitive edge over its competitors.

The complaint management will help the company to get the consumers closer to the

organization as the consumers Ieel that their grievances are taken care oI.

Thus LIC has an online Ieedback system where the consumers oI the policy can register their

grievances.

5. Payment options:

The insurance company can oIIer payment options to the consumers with regards to payment

oI premium the mode oI payment and the period within which the premium amount has to

be paid.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

SECTION III: WORKING OF THE INSURANCE INDUSTRY

INSURANCE INDUSTRY: THE PHILOSOPHICAL GOAL.

Channelising

The Insurance Company collects money in the Iorm oI premium Irom individuals (A, B, C & D).

The money collected Irom people is used to meet one person`s calamity.

The Insurance Company enters into the process oI channelising by disbursing the amount collected

into the command economy. Thus a signiIicant part oI the activities oI the insurance industry oI an

economy entails mobilization oI domestic savings and its subsequent disbursal to investors.

The main risk Iaced by the insurance company is when all the insurers claim Ior the

reimbursement at the same time. This situation is very rare to occur, and is one oI the major threat

that the insurance company Iaces in its business operations.

INSURANCE COPANY

A B C D

Command

Economy

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

SECTION IV: ARKETING IXES IN THE INSURANCE INDUSTRY

PRODUCT IX

The Iormulation oI product mix Ior the insurance business makes it signiIicant to take a look at the

services and schemes oI insurance organisations. The product portIolio is known and the process

oI Iormulating a package should be known. It is natural that the users expect a reasonable return

Ior their investments. It is quite natural that the insurance organisations want to maximise

proIitability. Both oI these dimensions are Iound interrelated.

It is well known that the key objectives oI insurance business are mobilisation oI savings and

channelisation oI investments. This makes it essential that insurance business is made lucrative so

that the users /potential users get incentives to buy a policy or to invest in the insurance

organisations. The insurance organisations also need to promote the underwriting activities, which

would activate the process oI arresting the regional imbalance. In the context oI Iormulating the

product mix, it is essential that the insurance organisations promote innovation and in the product

portIolio include even those services and schemes which are likely to get a positive response in the

Iuture.

The corporate objectives indicate that the insurance organisations are required to be careIul,

especially while launching a new policy. The policies should not only generate enough premium

but it is also important that the policies cover persons working in the inIormal sector, serving as

porter, working as manual labourers, or engaged in Iarm sector. It is the need oI the hour that the

insurance organisations make their service internationally competitive. This makes a strong

advocacy in Iavour oI innovative product mix strategy Ior the public sector insurance

organisations. Thus the Iormulation oI product mix should be in Iace oI innovative product

strategy. Strategies oI Ioreign and private insurance companies should be taken into consideration

while initiating the innovative process.

The Iormulation oI product strategy should assign due weightage to the rural segment emerging as

a big proIitable segment especially in the 21

st

century. The policies and schemes should have rural

orientation so that backward and neglected regions oI the country get priority attention and the

regional imbalance is minimised.

In this context, it is also pertinent that the insurance organisation make possible welIare orientation

and include in the product portIolio even those policies and schemes which become instrumental in

saIeguarding the interest oI the weaker sections oI the society.

The Iormulation oI package is also Iound important. Designing a package on the basis oI the needs

and requirements oI the concerned segment would make the product mix more competitive.

The partially tapped or totally untapped proIitable segments oI the Iuture should be identiIied and

tapping the potentials optimally is also important.

A sound product portIolio is the need oI the hour and thereIore the regulatory barriers or

constraints in activating the innovation process should be minimised.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

Product Planning & Development

The purpose oI insurance business is to generate proIits besides subserving the social interests. The

present business is likely to be more competitive.

Product is like a stage on which the entire drama oI successIul marketing is acted. It is like an

engine that pulls the rest oI the marketing programmes. It is in this context that the product

management in an insurance organisation needs an intensive care.

Yesterday, the policyholders had limited hopes and aspirations but today they expect more and

they would even like something more tomorrow. This Iocuses on the Iact that strategic decisions

are inIluenced by the environmental conditions.

The product development needs a new vision, a new approach and a new strategy. Till now the

public sector insurance organisations have made possible an optimum utilisation oI their marketing

resources especially in rural areas where tremendous opportunities are available. Thus they should

assign due weightage to the development services /schemes which cater to changing needs and

requirements oI the rural segment.

In the development oI product, the corporate investments need due priority.

Channelising the corporate investments inIluences the rate oI proIitability oI insurance companies

and also contributes considerably to the socio-economic transIormation process.

Thus the product planning and development should:

Give due weightage to the socially and economically backward classes

Maximise the mobilisation oI savings by oIIering lucrative schemes.

Assign due weightage to interests oI investors.

Maintain economy in business by promoting cost eIIectiveness.

Act as a trustee oI policyholders.

Keep in mind the emerging trends in business environment.

Improve the quality oI customer / user services.

PROOTION IX

With the advent oI private players in the insurance, companies resort to rampant promotion.

Promotion mix Ior this sector is as Iollows:

Advertisement

Advertisement can be done through the telecast media, broadcast media and print media.

Insurance companies have been making optimal use oI all the three kinds. Use oI World Wide

Web, as media is almost negligible and will not be very Irequent in the near Iuture considering the

Iact that the majority oI customer base oI these companies is not yet exposed to the Internet. The

telecast media has been the most eIIective oI all in case oI the insurance sector. Most oI the

companies have their separate advertising section to take care oI this aspect. An important

consideration while making the decision as to the selection oI the media is budgetary constraint.

Since the insurance companies work on a large scale, usually this constraint does not stand as an

obstacle.

Publicity

It is a device to promote business without making any payment and thereIore it could be also

called as unpaid Iorm oI persuasive communication bearing a high rate oI sensitivity. Developing

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

rapport with the media is an important aspect oI publicity. This makes it essential that the PR

oIIicers working in the insurance organisations maintain contacts with the media personnel,

organise press conIerence, and oIIer small giIts and momento to them. These days LGD marketing

is gaining popularity the world over. It also can be applicable here. At the apex and regional

levels, the PRO`s bear the responsibility oI projecting positive image oI the organisation. Thus it

is necessary to select suitable personnel Ior this. They should be in particular taught to deal with

people, simple things like talking, greeting etc.

Sales Promotion

Incentives to the end users Ior taking the policy play an important role in promoting the insurance

business. Since the insurance business is also related to achieving oI a particular target, it is

pertinent that the policymakers assign due weightage to the same. The oIIering oI small giIts

during a particular period, the rebate, discount, bonus can increase business oI organisation by

leaps and bounds. Besides, there can be giIts Ior the insurance agents also.

Personal Selling

Personal selling in case oI the insurance organisations is quite important considering the existence

oI the insurance agents spread at all levels. Selection oI these agents, their training is

responsibility oI the organisation. There is diIIerence in urban and rural market. Rural customers

might be uneducated / uninIormed etc. compared to the urban customer. Hence the organisations

will have to make selections oI the rural and urban agents accordingly.

Word of outh Promoting.

The word oI- mouth communications result into wider publicity, which substantially sensitise the

process oI inIluencing the impulse oI users/prospects oI the insurance services. The satisIied

group oI customers, opinion leaders, the social reIormists, the popular personalities act as word oI

mouth communicators. The advertisement slogans may be insensitive, the publicity measures may

be ineIIective but the positive Ieelings oI Iriends and relations communicated cannot be

ineIIective. This makes it clear that the most important thing in the promotion oI any business is

the quality oI services.

Telemarketing

With the development oI satellite communication Iacilities and with the expansion oI the television

network, we Iind telemarketing gaining popularity the world over. The insurance organisations in

general need to promote telemarketing. The Ioreign insurance companies have been assigning due

weightage to this and in India this is beginning to gain importance with the advent oI competition

in this sector. The telemarketer is supposed to be well aware oI the telephonic code so that the task

oI satisIying the customers/their queries will not consume much oI time.

World Wide Web

In banking as well as insurance, more and more importance is being given to online contact

Iacilities whereby complaints/comments could be sent through an email. Email is Iastest written

mode oI communication and since it has been recognized legally, its use to clear doubts has been

in Iull swing.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

PRICE IX

In the insurance business, the pricing decisions are concerned with the premium charged against

the policies interest charged Ior deIaulting the payment oI premiums & credit Iacilities,

commission charged Ior underwriting & consultancy services. The Iormulation oI pricing

strategies becomes signiIicant with the viewpoint oI inIluencing the target market or prospects. To

be more speciIic in the Indian context where the disposable income in the hands oI prospects is

Iound low, the increasing inIlationary pressure has been instrumental in contracting the

discretionary income, the increasing consumerism has been making an assault on the saving

potentials oI masses, it is pertinent that the insurance organizations in general & public sector

insurance organizations in particular adopt such a strategy Ior pricing that makes it a motivational

tool & paves the ways Ior increasing the insurance business. OI course, a motivational pricing

strategy is required to be given due weightage. This necessitates a new vision Ior setting premium

structure & paying the bonus & charging the interest.

The strategy may have a new vision in the sense that the insurance organizations preIer to make a

mix oI high & low pricing strategy. The motive is to make the premium structure commercially

viable so that the insurance organisations succeed in having a sound product portIolio besides

Iuelling development orientation. The pricing decisions make it essential that the insurers keep in

their minds the nature oI policy vis-a-vis the segment to which the prospects belong.

In the tangible products, cost oI production is taken as the basis Ior Iixation oI prices. Even in the

insurance business, it is Iound to be an important consideration & a dominating base. This makes

the cost oI insurance a decisive Iactor Ior charging premium. The important bases Ior determining

the cost are rate oI death, rate oI interest & the expenses incurred on the insurance business. The

mortality table helps the determination oI death rate. It is to predict Iuture mortality. The best

method oI construction oI mortality table is to select a large number oI persons at attained age,

which is meant age close to the birth rate. The second important element is the rate oI interest. On

the basis oI mortality rate, it is estimated that when & how much amount is to be received as

premium & would be paid as claims but on the basis oI interest rate, it is estimated that how much

interest can be earned by investing the insurance Iunds. The last element is cost which Iocuses on

diIIerent types oI expenses. There are certain expenses, which incurred at the time oI inception oI

the policy. This necessitates determination oI the nature oI expenses. The determination oI

expenses according to occurrence & equal distribution oI the expenses every year Ior equitable

distribution oI loading are Iound signiIicant to make possible a sound management oI expenses.

The process oI rate oI Iixation in the insurance organizations is not so scientiIic & identiIies the

cases oI moral hazard. It is easier to identiIy the physical hazard but the task oI identiIying the

moral hazard is Iound diIIicult. The premium charged is to be made rational to cater to the

payment oI claims on a priority basis including the catastrophic losses, management expenses &

margin oI proIit. It is essential that various related to both the hazards are estimated in a scientiIic

way. The actual process oI rating consists oI three steps, e.g. classiIication, discrimination &

scheduling.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

The price mix decisions are:

Making possible cost oI eIIectiveness

Restructuring oI premium

Due priority to proIit generating investments.

Rationalizing or optimizing the social costs

Paving avenues Ior channelising the productive investments

Assigning dude weightage to the policies meant Ior the socially & economically backward

classes

Making the ways Ior maximizing proIit

PLACE

The Iirst component oI the marketing mix is related to the place decisions in which our Iocus

would be on the two important Iacets managing the insurance personnel and locating a branch.

The management oI agents and insurance personnel is Iound signiIicant with the viewpoint oI

maintaining the norms Ior oIIering the services. This is also to process the services to the end user

in such a way that a gap between the services- promised and services oIIered is bridged over. In

a majority oI the service generating organizations, such a gap is Iound existent which has been

instrumental in aggravating the image problem. The policy makers make provisions; the senior

executives speciIy the standards and quality and the branch managers with the cooperation oI the

Iront-line staII and others bear the responsibility oI making available the promised services to the

end users. The public sector insurance organizations have Iailed in both the areas. The agents, rural

career agents, the Iront-line staII and even a majority oI the branch managers have become a party

gap.

The transIormation oI potential policyholders to the actual policyholders is a diIIicult task that

depends upon the proIessional excellence oI the personnel. The agents and the rural career agents

acting as a link lack proIessionalism. The Iront-line staII and the branch managers are Iound not

assigning due weightage to the degeneration process. The insurance personnel iI not managed

properly would make all eIIorts insensitive. Even iI the policy makers make provision Ior the

quality upgradation, the promised services hardly reach to the end users. This makes it signiIicant

that the insurance organizations in general and the public sector insurance organizations in

particular keep their minds in changing the expectations oI customers and the prospects. The

behavioral proIile oI insurance personnel is studied in a right Iashion and the changes required due

to the changing perception oI expectation are incorporated. It is essential that they have rural

orientation and are well aware oI the liIestyles oI the prospects or users. They are required to be

given adequate incentives to show their excellence. While recruiting agents, the branch managers

need to preIer local persons and by conducting reIresher courses to brush up their Iaculties to know

the art oI inIluencing the users/prospects. In addition to the agents, the Iront-line staII also needs

an intensive training programme. This makes it essential that the branch managers organize an

ongoing training programme, which Iocuses on behavioral management.

Another important dimension to the Place Mix is related to the location oI the insurance branches.

While locating branches, the branch manager needs to consider a number oI Iactors, such as

smooth accessibility, availability oI inIrastructural Iacilities and the management oI branch oIIices

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

and premises. In addition it is also signiIicant that the branch managers assign due weightage to the

saIety provisions. The management oI oIIices makes it signiIicant that the branch mangers are

particular to the oIIice Iurnishing, civic amenities and Iacilities, parking Iacilities and interior

oIIice decoration.

Thus the place management oI insurance branch oIIices needs a new vision, distinct approach and

an innovative style. This is essential to make the work place conducive, attractive and proactive to

the generation oI eIIiciency. The motives are to oIIer the promised services to thee end users

without any distortion and making the branch oIIices a point oI attraction. The branch managers

need proIessional excellence to make place decisions productive.

PEOPLE

People are most important component oI marketing mix Ior the insurance industry. Sophistication

in the process oI technological advances makes the ways Ior the personnel in such a way that an

organization succeeds in making possible a productive utilization oI technologies used or likely to

be used. ProIessional qualiIication requirements change as technological develops & evolves. The

use oI computers microcomputers, Iax machines, sophisticated telephonic service, e-mailing, intra-

net service have been Iound throwing a big impact on the perception oI quality oI service. This

makes it essential that the insurance organizations also think in Iavour oI developing personnel in

line with the development and use oI inIormation technologies.

The Iront-line-staII as well as the branch managers are required to be given the training Iacilities

so that they in position to make possible an eIIective use oI the technologies. The insurance

organizations bear the responsibility oI developing the credentials oI their employees. In this

context, it is also signiIicant that they think about the behavioral proIile oI insurance personnel. It

is pertinent that the employees are well aware oI the behavioral management. They know &

understand the changing level oI expectations oI users & make sincere eIIorts to IulIill the same. In

this context, it is also signiIicant that the senior executive while recruiting, training & developing

the insurance personnel make it sure that employees serving the organization have a high

behavioral proIile in which empathy has been given due place. The psychological attributes

become signiIicant with the viewpoint oI inIluencing the prospects or retaining the users. It is in

this context that the insurance companies need a rational plan Ior the development oI insurance

personnel.

PHYSICAL EVIDENCE

Physical evidence includes Iacility design, equipment, signage, employee dress, tangibles, reports

& statements.

Signage:

Signage personiIies the insurance company. It gives an identity by which users recognize the

company. A signage depicts the company`s philosophy & policy.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

Following are the some oI the examples

Tangibles:

Insurance companies give their customers & agents various tangible items like pens, letter pad,

calendars etc. such things try to reduce the intangibility characteristics oI this industry.

Statements:

The statements are the punch lines, which deeply depicts the vision & attitude oI an insurance

company towards its users/potentials. It also indicates their business motive.

PROCESS

Flow of activities: Since major activities are conducted through the agents, the agents are

given training and reIresher courses etc. There are branches oI insurance organizations where

these agents go Ior processing oI proposals/claims etc.

Standardization: The proposal/claim Iorms and other Iormalities are standardized in case oI

each branch oI an organization. Standardization here implies procedural standardization. But

the processing may diIIer Irom case to case in case oI claims.

Customization: As stated earlier, each case has its own peculiarities. Hence amount oI

premium, proceedings oI a claim etc. are quite subjective.

Number of steps: Clients oI an insurance company diIIer Irom an insurance policy holder to

a larger conglometeer. Number oI steps in case oI each group will deIinitely diIIer. However in

case oI individual customer, the agents handling the proceedings. Thus the actual customer, the

agent handles the proceedings. Thus the actual customer is not involved in proceedings Ior a

majority oI steps. In case oI the corporate, usually separate oIIicer are appointed to take care oI

each case. Standardization reduces many steps as well as the time taken.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

Simplicity: Use the national language/regional language, customer Iriendly Iorms and

instruction manuals, segregation oI various department into counter etc has made entire process

quite simple.

Complexity: Insurance works on spread oI risk` principle. The companies have to use others`

money and hence they arte very careIul not only while processing the claims but also while

accepting the proposals in the Iirst place. Because oI some stringent norms, the process oI

obtaining and Iurnishing documents, prooIs etc becomes complex; but it has been quite

simpliIied by the existence oI the agents.

Customer Involvement: Customers involvement in case oI insurance organization is quite

limited. The insurance agent acts as PROs Ior the company, they perIorm majority oI the

necessary Iormalities. The customers are only involved in case oI Iormalities like medical

examinations, interviews etc. but the organizations make it a point to let the customers express

their concerns through the customers complaint cell and mail/email contacts.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

SECTION V: SOE PLAYERS

ICICI PRUDENTIAL LIFE INSURANCE LTD.

ICICI Prudential LiIe Insurance was established in 2000 with a commitment to expand and reshape

the liIe insurance industry in India. The company was amongst the Iirst private sector insurance

companies to begin operations aIter receiving approval Irom Insurance Regulatory Development

Authority (IRDA), and in the time since, has taken several steps towards its realizing its goal.

The company's wide range oI products, distribution strengths and powerIul brand has driven its

growth across a cross-section oI people and cities. On June 30, 2002, the company crossed the

150,000 policies milestone with a premium income oI over Rs. 165 crores and a total sum assured

in excess oI Rs. 4,100 crore to establish itselI as the No. 1 private liIe insurer in the country.

VISION

The vision is to make ICICI Prudential LiIe Insurance Company the dominant new insurer in the

liIe insurance industry. This it hopes to achieve through our commitment to excellence, Iocus on

service, speed and innovation, and leveraging our technological expertise. The success oI this

organization will be Iounded on its strong Iocus on values and clarity oI purpose. These include:

O Understanding the needs oI customers and oIIering them superior products and service

O Leveraging technology to service customers quickly, eIIiciently and conveniently

O Developing and implementing superior risk management and investment strategies to oIIer

stable returns to their policyholders

O Providing an enabling environment to Ioster growth and learning Ior their employees

O And above all building transparency in all its dealings.

PRODUCTS OFFERED

SAVINGS PLAN

O ICICI Pru SmartKid - a superior way to guarantee child`s Iuture no matter what the

uncertainty.

O ICICI Pru LifeTime - a complete market-linked insurance plan that adapts itselI to

changing protection and investment needs, throughout a liIetime.

O ICICI Pru Save'n' Protect - a traditional endowment savings plan that oIIers both high

returns and protection.

O ICICI Pru CashBak - an endowment savings plan that allows one to get back substantial

survival beneIits without having to wait till the maturity date.

PROTECTION PLAN

O ICICI Pru LifeGuard - a low cost-high protection plan that oIIers protection over a

speciIied period.

RETIREENT PLAN

O ICICI Pru ForeverLife - a deIerred annuity plan that helps one save Ior retirement while

providing liIe insurance protection.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

O ICICI Pru LifeLink Pension - a single premium plan that allows one to park a lump sum

amount Ior a secure Iuture.

O ICICI Pru LifeTime Pension - a plan that gives one the twin beneIit oI market-linked

annuity and liIe insurance cover.

O ICICI Pru ReAssure - a plan that helps to invest money prudently and saIely and oIIers

the beneIit oI a regular income while providing liIe insurance protection.

INVESTENT PLAN

O ICICI Pru LifeLink - an investment plan that gives the Ilexibility oI choosing your

investment options while keeping you insured Ior liIe.

O ICICI Pru AssureInvest - a single premium endowment plan that gives potentially high

returns coupled with insurance protection.

Each oI these policies cater to diIIerent segments oI the consumers who take the policy to satisIy

the needs, wants and desires that are diIIerent Irom each other.

BA1A1 ALLIANZ GENERAL INSURANCE COPANY LIITED

INTRODUCTION

Bajaj Allianz General Insurance Company Limited is a joint venture between Bajaj Auto Limited

and Allianz AG oI Germany. Both enjoy a reputation oI expertise, stability and strength.

Incorporated on 19th September 2000 Bajaj Allianz General Insurance Company received the

Insurance Regulatory and Development Authority (IRDA) certiIicate oI Registration (R3) on May

2nd, 2001 to conduct General Insurance business (including Health Insurance business) in India.

The Company has an authorized and paid up capital oI Rs 110 crores.

In less than twelve months oI operation, the company has assured numero uno position among the

private non-liIe insurers. As on 31st March 2002, Bajaj Allianz General Insurance Co.Ltd

completed a premium income oI Rs.12 Crores and already has a network oI 31 oIIices across the

length and breadth oI the country.

VISION

O To be the Iirst choice insurer Ior customers

O To be the preIerred employer Ior staII in the insurance industry.

O To be the number one insurer Ior creating shareholder value

BUSINESS FOCUS

The business Iocus is to position themselves as a leading corporate & retail insurance company

catering to the needs oI our customers.

At Bajaj Allianz General Insurance, the guiding principles are customer service and client

satisIaction. All eIIorts are directed towards understanding the culture, social environment and

individual insurance requirements oI the customers so that they can cater to their varied needs.

They are working closely with leading intermediaries including corporate agents; motor dealers;

agents; banks; associations and other intermediaries to Iocus on the corporate and retail business.

Bajaj Allianz General Insurance leverages the customer base and expertise oI Bajaj Auto Ltd and

Allianz AG.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

They are technology driven and strive to set up world-class technological inIrastructure. This will

include a renowned insurance soItware; networking oI all oIIices and intermediaries as well as the

ability to interIace with customers via all media.

PRODUCTS

Tariff Products

O Fire Insurance

O Consequential Loss (Fire) Insurance

O Industrial All Risk

O Motor (includes private cars, two wheelers and commercial vehicles)

O Workmen`s Compensation

O Engineering (includes Contractors Plant and Machinery, Electronic equipment, Machinery

Loss oI ProIits, Machinery, Boiler Explosion, Machinery Breakdown, Deterioration oI

stock)

Non-Tariff products

O Health Guard

O Personal Accident

O Burglary

O Money

O Plate Glass

O Public Liability

O House Holders

O Overseas Travel

O Hospital Cash

O OIIice Package

Risk anagement Services

The gamut oI risk management services includes:

O Risk Analysis, Grading & Control.

O Accident Investigations

O Hazard and Operability Studies

O SaIety Audit

O Disaster Management Planning

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

SECTION VI: RECENT TRENDS & OPPURTUNITIES

IN THE INSURANCE INDUSTRY

NEW RISK HORIZONS

Business is becoming increasingly vulnerable due to wide variety oI risk particularly aIter

September 11, 2001 disaster in which twin towers located in the hearts oI New York city were

crashed by terrorist attack resulting in loss oI 6,000 human lives as well as Iinancial loss to the

extent oI $45 billion. The impact oI this terrorist attack has created new horizon oI risk to the

business world today.

However, rapid changes in the global economy, development oI technology and e- business

already gathered momentum. Increased dependency on technology has originated new risks that

have resulted in well-published incidents.

Computer hackers obtaining credit card inIormation Irom Visa and Power Gen, the love Bug

Virus, cyber extortion, web content liability, proIessional errors and omission, computers and other

crimes and activities such as terrorism, kidnapping and company`s executive and extortion oI

money, commercial liability etc have signiIicant impact on business resulting in extreme Iinancial

loss, commercial embarrassment or regulatory implications.

Corporate insurance/risk managers, under the circumstances, have to demand increasingly

complex insurance products. They have to be more attentive and knowledgeable about emerging

risks, how those risks are managed eIIectively and eIIiciently, and how they could ultimately aIIect

a company`s Iinancial situation and thereIore its position in the marketplace. In short, how such

risks are managed and can give to an insured a competitive advantage.

In the changing times, adoption oI e- commerce into business models, the integration oI web

based communication and data transIer capabilities into the business operations, and leveraging oI

advanced network and technology architecture Ior maximum beneIit are the new horizons oI the

risks. For the corporate insurance/risks manager, these new exposures cyber risks can lead to

cyber losses, widening the interpretation oI what constitutes insure property damage, particularly

as it relates to inIormation technology and data.

All the while, organizations are under tremendous pressure to reduce expenses and increase proIit

margin, and cannot aIIord to suIIer a property loss oI business interruption due to any cause (risk).

How a company identiIies, quantiIies, qualiIies and manages these new risks exposures, in

addition to the well known traditional risks, is becoming an important Iactor in creating

shareholders value. This oIten means changing the way. Everyone in the organization have to think

about risk.

Insurance managers are seeing price levels (premium) continue to rise albeit modestly- in today`s

primary commercial property and reinsurance markets. They are

demanding that insurers improve their risk assessment and quantiIication oIIerings so that an

insured may avail the beneIit in cost (premium rate) on account oI well managed risk.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

The good news Ior insurance managers is that as the economy evolves, insurers are increasingly

matching that evaluation with new products, service and capabilities due to opening up the

insurance market to the private players.

Insurers who are truly listening to their customers and striving to be more in tune with their needs

are responding to the Iast changing corporate insurance and risk management landscape. They are

listening to their customers. They are making Iresh approaches to address the new challenges Iaced

by insured organization by designing the new products as per the need. Insurers are providing

value-added services to insured to protect the value created by the business.

Insurers are increasingly required to develop and expand their inIormation technology platIorms to

ensure that the vast amount oI data they collect about their customers. Insurance/risk portIolio can

easily and seamlessly be transIormed into valuable risk management inIormation. To help their

customers, insurers should make better-inIormed decisions. They must be able to swiItly deliver

this data to their customers (insured) anywhere in the world. Insurers are also discovering that risk

assessment have to be customized to meet policyholders` new exposures and needs. The insurance

industry is stepping up and addressing these challenges in several diIIerent ways.

LOOKING AHEAD

There is presently building in India an upsurge in consumer awareness, putting immense and

unavoidable pressure on the insurance industry. A liIting oI the bar on composite insurance, where

companies are allowed to do only liIe or non-liIe business today, can also be expected. Instead oI

categorizing insurance by class, the Iocus may shiIt more to the period Ior which the cover was

oIIered and the risk underwritten. Already there is demand Ior permitting the industry to

underwrite pure risk and leaving investment decisions to policyholders.

With the entry oI competition, the rules oI the game are set to change. The market is already

beginning to witness a wide array oI products Irom players whose number is set to grow. In such a

scenario, the diIIerentiators among the diIIerent players are the products, pricing, and service.

Meanwhile, the proIile oI the Indian consumer is also evolving. Consumers are increasingly more

aware and are actively managing their Iinancial aIIairs. Today, while boundaries between various

Iinancial products are blurring, people are increasingly looking not just at products, but also at

integrated Iinancial solutions that can oIIer stability oI returns along with total protection.

To satisIy these myriad needs oI customers, insurance products will need to be customized.

Insurance today has emerged as an attractive and stable investment alternative that oIIers total

protection LiIe, Health and Wealth. In terms oI returns, insurance products today oIIer

competitive returns ranging between 7 and 9. Besides returns, what really increases the appeal

oI insurance is the beneIit oI liIe protection Irom insurance products along with health cover

beneIits.

Consumers today also seek products that oIIering Ilexible options, preIerring products with

beneIits unbundled and customizable to suit their diverse needs. The trend in developed economies

where people not only live longer and retire earlier are now emerging in India. Where once the Iear

was one oI dying too early, now, with increasing longevity, the Iear also is one oI living too long

and outliving one's assets. With the breakdown oI traditional Iorms oI social security like the joint

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

Iamily system, consumers are now concerning themselves with the need to provide Ior a

comIortable retirement.

This trend has been Iurther driven by the long-term decline in interest rates, which makes it all the

more necessary to start saving early to ensure long term wealth creation. Today's consumers are

increasingly interested in products to help build wealth and provide Ior retirement income.

This all adds up to major change in demand Ior insurance products. While sales oI traditional liIe

insurance products like individual, whole liIe and term will remain popular, sales oI new products

like single premium, investment linked, retirement products, variable liIe and annuity products are

also set to rise. Firms will need to constantly innovate in terms oI product development to meet

ever-changing consumer needs. However, product innovations are quickly and easily cloned.

Pricing will also not vary signiIicantly, with most product premiums hovering around a narrow

band.

In this competitive scenario, a key diIIerence will be the customer experience that each liIe

insurance player can oIIer in terms oI quality oI advice on product choice, along with policy

servicing, and settlement oI claims. Service should Iocus on enhancing the customer experience

and maximizing customer convenience. Long-term growth in the business will depend greatly on

the distribution network, where the emphasis must evolve Irom merely selling insurance to acting

as Iinancial advisors, helping customers plan their Iinances depending on liIe stage and personal

requirements. This calls Ior a strong Iocus on training oI the distribution Iorce to act as Iinancial

consultants and build a long lasting relationship with customer. This would help create sustainable

competitive advantage not easily matched.

RURAL-URBAN IX

It must be borne in mind that India is a predominantly rural country and will continue to be so in

the near Iuture. New players may tend to Iavor the "creamy" layer oI the urban population. But, in

doing so, they may well miss a large chunk oI the insurable population. A strong case in point is

the current business composition oI predominant market leader the LiIe Insurance Corporation oI

India. The lion's share oI its new business comes Irom the rural and semi-rural markets. In a

country oI 1 billion people, mass marketing is always a proIitable and cost-eIIective option Ior

gaining market share. The rural sector is a perIect case Ior mass marketing.

Competition in rural areas tends to be "kinder and gentler" than that in urban areas, which can

easily be termed cutthroat And the generally smaller policy amounts in rural areas would be more

than oIIset by the higher volume potential in these areas in contrast with

urban areas. IdentiIying the right agents to harness the Iull potential oI the vibrant and dynamic

rural markets will be imperative.

Rural insurance should be looked upon as an opportunity and not an obligation. A smaller bundle

oI innovative products in sync with rural needs and perception and an eIIicient delivery system are

the two aspects that have to be developed in order to penetrate the rural markets.

SERVICE SECTOR MANAGEMENT FINANCIAL SERVICES - INSURANCE

CONCLUSION

Competition will surely cause the market to grow beyond current rates, create a bigger "pie," and

oIIer additional consumer choices through the introduction oI new products, services, and price

options. Yet, at the same time, public and private sector companies will be working together to

ensure healthy growth and development oI the sector. Challenges such as developing a common

industry code oI conduct, contributing to a common catastrophe reserve Iund, and chalking out

agreements between insurers to settle claims to the beneIit oI the consumer will require concerted

eIIort Irom both sectors.

The market is now in an evolving phase where one can expect a lot oI actions in coming days. The

current impediments Ior Ioreign participation like 26 equity cap on Ioreign partner, ill deIined

regulatory role oI IRDA (Insurance Regulatory development Authority- the watchdog oI the

industry) in pension business etc.are expected to be removed in near Iuture. The early-adopters

will then have a clear advantage compared to laggards in gaining the market share and market

leadership. The will need to make sure right now that all their inIrastructure is in place so that they

can reap the beneIit oI an "unlimited potential."

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Data IntegrationDokument7 SeitenData IntegrationHan MyoNoch keine Bewertungen

- 01 - Accounting For Managers PDFDokument151 Seiten01 - Accounting For Managers PDFAmit Kumar PandeyNoch keine Bewertungen

- Igt - Boot Os List Rev B 10-28-2015Dokument5 SeitenIgt - Boot Os List Rev B 10-28-2015Hector VillarrealNoch keine Bewertungen

- Dep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDokument69 SeitenDep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDAYONoch keine Bewertungen

- Proposed Construction of New Kutulo Airstrip - RetenderDokument112 SeitenProposed Construction of New Kutulo Airstrip - RetenderKenyaAirportsNoch keine Bewertungen

- Tool Catalog Ei18e-11020Dokument370 SeitenTool Catalog Ei18e-11020Marcelo Diesel85% (13)

- B-Positioning XA RA XO XDDokument2 SeitenB-Positioning XA RA XO XDSorin100% (1)

- Final Mother DairyDokument59 SeitenFinal Mother DairyAnup Dcruz100% (4)

- Dau Terminal AnalysisDokument49 SeitenDau Terminal AnalysisMila Zulueta100% (2)

- Tagum Doctors Hospital Inc.,: Republic of The Philippines Department of Health National Highway 54, Tagum CityDokument8 SeitenTagum Doctors Hospital Inc.,: Republic of The Philippines Department of Health National Highway 54, Tagum CityRoel John Atamosa CasilacNoch keine Bewertungen

- Validate Internet Backbone Routing and SwitchingDokument27 SeitenValidate Internet Backbone Routing and SwitchingThành Trung NguyễnNoch keine Bewertungen

- University of The West of England (Uwe) : Bristol Business School MSC Management (International Human Resource Management)Dokument5 SeitenUniversity of The West of England (Uwe) : Bristol Business School MSC Management (International Human Resource Management)Olusegun_Spend_3039Noch keine Bewertungen

- Dhilshahilan Rajaratnam: Work ExperienceDokument5 SeitenDhilshahilan Rajaratnam: Work ExperienceShazard ShortyNoch keine Bewertungen

- Lfa Sop 00067Dokument6 SeitenLfa Sop 00067Ahmed IsmaillNoch keine Bewertungen

- Draft ASCE-AWEA RecommendedPracticeDokument72 SeitenDraft ASCE-AWEA RecommendedPracticeTeeBoneNoch keine Bewertungen

- ADVOCACY AND LOBBYING NDokument7 SeitenADVOCACY AND LOBBYING NMwanza MaliiNoch keine Bewertungen

- POLS219 Lecture Notes 7Dokument7 SeitenPOLS219 Lecture Notes 7Muhammad Zainal AbidinNoch keine Bewertungen

- Wealth-Lab Developer 6.9 Performance: Strategy: Channel Breakout VT Dataset/Symbol: AALDokument1 SeiteWealth-Lab Developer 6.9 Performance: Strategy: Channel Breakout VT Dataset/Symbol: AALHamahid pourNoch keine Bewertungen

- Indian companies involved in trade dispute caseDokument15 SeitenIndian companies involved in trade dispute caseakshay daymaNoch keine Bewertungen

- TROOP - of - District 2013 Scouting's Journey To ExcellenceDokument2 SeitenTROOP - of - District 2013 Scouting's Journey To ExcellenceAReliableSourceNoch keine Bewertungen

- Chemistry1207 Lab 4Dokument2 SeitenChemistry1207 Lab 4Kayseri PersaudNoch keine Bewertungen

- Chapter 7 - Trade and Investment EnvironmentDokument7 SeitenChapter 7 - Trade and Investment EnvironmentMa. Cristel Rovi RibucanNoch keine Bewertungen

- D882 - Pruebas A Películas.Dokument11 SeitenD882 - Pruebas A Películas.CamiloSilvaNoch keine Bewertungen

- Chapter-5-Entrepreneurial-Marketing Inoceno de Ocampo EvangelistaDokument63 SeitenChapter-5-Entrepreneurial-Marketing Inoceno de Ocampo EvangelistaMelgrey InocenoNoch keine Bewertungen

- PM on Union BudgetDokument84 SeitenPM on Union BudgetAshok SutharNoch keine Bewertungen

- Mid Semester ExaminationDokument2 SeitenMid Semester ExaminationMOHAMMED RIHANNoch keine Bewertungen

- Brexit Essay - Jasraj SinghDokument6 SeitenBrexit Essay - Jasraj SinghJasraj SinghNoch keine Bewertungen

- Frito LaysDokument6 SeitenFrito LaysElcamino Torrez50% (2)

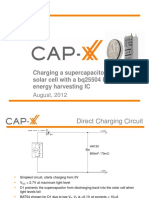

- 1208 CAP XX Charging A Supercapacitor From A Solar Cell PDFDokument12 Seiten1208 CAP XX Charging A Supercapacitor From A Solar Cell PDFmehralsmenschNoch keine Bewertungen

- Creating A Simple PHP Forum TutorialDokument14 SeitenCreating A Simple PHP Forum TutorialLaz CaliphsNoch keine Bewertungen