Beruflich Dokumente

Kultur Dokumente

Rbi and Impossible Trinity

Hochgeladen von

mebugdaneOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rbi and Impossible Trinity

Hochgeladen von

mebugdaneCopyright:

Verfügbare Formate

RBI AND IMPOSSIBLE TRINITY Introduction The RBI pursues a policy called a managed float.

. The rupee is flexible within limits but the RBI will intervene to prevent excessive fluctuations At the same the RBI seems to keep inflation low This creates a fundamental conflict in an economy with open capital flows which is often described as the impossible trinity

Managed Float An exchange rate which is flexible but where the central bank intervenes occasionally is called a managed float Reasons for central bank intervention: a) smoothing excessive fluctuations in exchange rates b) Exchange rates affect trade and aggregate demand Two main methods of influencing exchange rates: a) Direct intervention in the forex markets b) Indirect intervention through regular monetary policy which will indirectly influence exchange rates Many central banks including the RBI pursue a managed float. One major problem with this policy is that it makes monetary policy less transparent since there are two goals: keeping low inflation and managing the exchange rate.

Real effective exchange rate (REER) The REER is a measure for whether a currency is undervalued or overvalued. The RBI has used it as guide to exchange rate management. Effective means that instead of looking at a single exchange rate, a composite is created of the exchange rates of various important trading partners NEER or nominal effective exchange rate is a composite of different exchange rates of a countrys various trading partners. Real means that the exchange rate is adjusted for inflation rates in both the home country and the trading partner. After adjusting the NEER for inflation you get the REER.

REER= NEER *(P(d)/P(f)) Where P(d) is domestic price level and P(f) is foreign price level For example if India has a higher inflation rate than its trading partners but its NEER remains constant then its REER will rise.

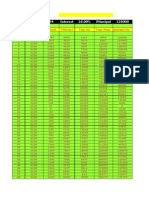

RBI and REER The RBI calculates a 36 country index which covers around 75% of Indias trade. The base year is1993-94 and the index uses three-year moving average trade statistics to assign weights to the different currencies. There are two sets of weights: one based on trade and one based on exports. In general the RBI has intervened in the market to keep the REER between 95 and 105.

Impossible Trinity The following three are impossible to sustain simultaneously: 1)A fixed exchange rate 2)Free capital flows 3)Independent monetary policy This creates a dilemma for policymakers since all these three are desirable for different reasons Policymakers have to choose which of the two are most important for the economy in question Either they give up completely on one of the three or they partially adjust between the three (relevant to India).

Independent Trinity

Why manage exchange rates? Flexible exchange rates too volatile and prone to overshoot. Rapidly rising exchange rates can damage export sector. No social safety net for unorganized export sector e.g. textiles. Rapidly falling exchange rates can spark inflation and damage investor confidence.

Why open capital flows? Capital flows can increase aggregate investment and raise growth rates FDI investment brings in new technology and raises technological progress and growth Foreign investment can improve institutional quality of financial markets and increase liquidity.

Why independent monetary policy? Monetary policy is the most effective tool for short-run macroeconomic stabilization Execution lag is much lower than fiscal policy. Effective monetary policy helps keep inflation low and improve investment climate as well as reduce volatility Conclusion: All three variables are desirable to an extent. Solution try to find optimal combination of 3 variables.

Hypothetical Example Think of the three legs of the impossible trinity and give them scores of 1-10: Independent monetary policy: 10 being a fully autonomous monetary policy Managed currency:10 being a fully fixed exchange rate Capital flows:10 being a fully open capital account. Then the impossible trinity says that a country can have at most a total score of around 20. One way of achieving this is to give one of the three legs completely and achieve close to full scores on the other two. Alternatively you can achieve a mix of the three: perhaps around 6 to 7 on each.

Policymakers may change the mix according to conditions: e.g. going from 7 to 6 on capital convertibility in order to move from 7 to 8 on managed currency. Restrictions on PNs in 2007 may be viewed as an example of this.

Impossible Trinity in 2007 In 2007 the RBI seemed to hit the constraints of the impossible trinity Huge FII inflows, rising rupee RBI intervention to prevent rupee from appreciating Losing control over inflation because of overheating economy and high commodity prices

Impossible trinity in 2008 At the height of the crisis in late 2008 the RBI faced the impossible trinity in the opposite direction. Huge capital outflows because of crisis led to downward pressure on the rupee RBI intervened to prevent rupee depreciation Such intervention was contractionary in nature which was inappropriate for domestic monetary policy Once again trade-off between exchange rate management and domestic macroeconomic management

Possible solutions Sterilization: combine forex intervention with offsetting bond transaction. Problem offsetting transaction may undercut initial intervention. In general sterilization often ineffective. Issuing government bonds and interest payments impose significant fiscal cost Another solution is capital controls: e.g. restrictions on participatory notes proposed in October 2007. However such proposals can be adhoc and increase market volatility

Tobin Tax? Tobin Tax proposed by economist James Tobin: a tax on short-term currency transactions in order to reduce exchange rate volatility

In the context of impossible trinity a similar tax would give the government a second tool to control capital inflows while still using monetary policy to focus on low inflation E.g. Brazil recently imposed a 2% tax on portfolio inflows to restrain capital inflows and prevent appreciation of its currency. Possible problems: Evasion, reduction of liquidity However this may be the best of available options.

Conclusion The impossible trinity is a fundamental constraint for monetary policy in an economy like India Using monetary policy to manage exchange rates and inflation is ineffective A second policy instrument is required to manage large capital flows. A quantitative measure like a transactions tax which can be adjusted according to circumstances is perhaps the best solution

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Chapter 2: Introducing Money EssayDokument1 SeiteChapter 2: Introducing Money EssayhsjhsNoch keine Bewertungen

- Topic 9 Foreign Exchange Exposure and Currency HedgingDokument32 SeitenTopic 9 Foreign Exchange Exposure and Currency HedgingAdam Mo AliNoch keine Bewertungen

- Fishers Debt Deflation TheoryDokument8 SeitenFishers Debt Deflation TheoryAliza ShahrinNoch keine Bewertungen

- Directory: Wholesale Lenders: OnlineDokument4 SeitenDirectory: Wholesale Lenders: OnlinedarylchambersNoch keine Bewertungen

- Asian CrisisDokument21 SeitenAsian CrisisShreshtha DasNoch keine Bewertungen

- Loan CalculatorDokument47 SeitenLoan CalculatorgoodthoughtsNoch keine Bewertungen

- TVM-Excel Function Solved ProblemDokument16 SeitenTVM-Excel Function Solved ProblemIdrisNoch keine Bewertungen

- Which of The Following Is Not The Feature of Business Cycle? (A) Business Cycle Follow Perfectly Timed CycleDokument5 SeitenWhich of The Following Is Not The Feature of Business Cycle? (A) Business Cycle Follow Perfectly Timed CycleMohammad Waris RahmanNoch keine Bewertungen

- Week 14 - Optimum Currency AreaDokument39 SeitenWeek 14 - Optimum Currency AreaSalsabilla RasyidinNoch keine Bewertungen

- Chapter 5 ReviewDokument7 SeitenChapter 5 ReviewZahaAliNoch keine Bewertungen

- SBI MaxGain Amortization ScheduleDokument27 SeitenSBI MaxGain Amortization ScheduleSwapneil TamhankarNoch keine Bewertungen

- Topic - 6 International Money MarketDokument2 SeitenTopic - 6 International Money MarketKainat TanveerNoch keine Bewertungen

- Lecture (Monetary Theory & Policy)Dokument12 SeitenLecture (Monetary Theory & Policy)simraNoch keine Bewertungen

- RBI Credit Control in IndiaDokument11 SeitenRBI Credit Control in IndiaDeepjyotiNoch keine Bewertungen

- The University of Sydney Macroeconomic Theory: ECON5002 Week Eight Practice QuestionsDokument2 SeitenThe University of Sydney Macroeconomic Theory: ECON5002 Week Eight Practice QuestionsJames AdofoNoch keine Bewertungen

- Predatory Lending What Is Predatory Lending?: EquityDokument5 SeitenPredatory Lending What Is Predatory Lending?: EquityNiño Rey LopezNoch keine Bewertungen

- 123Dokument5 Seiten123Bede Ramulfo Juntilla SedanoNoch keine Bewertungen

- My Student DataDokument25 SeitenMy Student DataAngelia Taylor-PattersonNoch keine Bewertungen

- Bretton Woods SystemDokument2 SeitenBretton Woods SystemRahul DesaiNoch keine Bewertungen

- Barter SystemDokument20 SeitenBarter SystemMichael NyaongoNoch keine Bewertungen

- The Open Economy Revisited & The Mundell-Fleming Model and The Exchange-Rate RegimeDokument45 SeitenThe Open Economy Revisited & The Mundell-Fleming Model and The Exchange-Rate RegimeAditya SinghNoch keine Bewertungen

- Subprime CrisisDokument5 SeitenSubprime CrisisMayank Jain100% (5)

- Bank Negara MalaysiaDokument17 SeitenBank Negara MalaysiaMohammad Fairuz100% (3)

- A Project On M.P of RbiDokument37 SeitenA Project On M.P of RbiUmesh Soni100% (1)

- Economics (Samuelson) CHAP21&23 SummaryDokument1 SeiteEconomics (Samuelson) CHAP21&23 SummaryP3 PowersNoch keine Bewertungen

- Chapter 7Dokument9 SeitenChapter 7Kc Saw100% (4)

- Name: Shariq Altaf ROLL NO: MBA-18-13 Q1. Fixed Exchange Rate Is The Rate Which Is Officially Fixed by The Government orDokument5 SeitenName: Shariq Altaf ROLL NO: MBA-18-13 Q1. Fixed Exchange Rate Is The Rate Which Is Officially Fixed by The Government orShariq AltafNoch keine Bewertungen

- Interest RateDokument32 SeitenInterest RateMayur N Malviya85% (13)

- What Is Mortgage Markets?Dokument8 SeitenWhat Is Mortgage Markets?Hades RiegoNoch keine Bewertungen

- Monetary Policy and The Federal ReserveDokument18 SeitenMonetary Policy and The Federal Reservesha ve3Noch keine Bewertungen